Is Kujira still a “buy” after a 7x rally in 2023?

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

Kujira (KUJI) got a lot of attention back in Q4 2023 when we crossed from the bear market into the bull market. And the attention was well-deserved; Kujira has a unique DeFi ecosystem, and the price ended up following the hype.

KUJI token went up by as much as 722% at one point during the Q4 rally before ending the year with a 422% gain.

However, since then, the token has undergone a bit of correction. The market is split now – some investors believe that Kujira’s momentum might be over – and others think it still has more upside to provide.

In this report, we are analysing Kujira’s potential for 2024. The question remains: Is it time to shift focus to other projects, or will Kujira rise above expectations yet again?

Let's find out!

TDLR

- Kujira offers various DeFi products, catering to both retail and institutional investors.

- Its revenue model is based on real yield generation.

- KUJI token has a 0% inflation rate in 2024.

- Kujira TVL is up 375% since October 2023, and the number of holders is up 53% in 2024.

- KUJI’s 7x ROI can be followed by another 11x as the bull market continues.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

What is Kujira?

The Kujira network is an L1 blockchain based on the Cosmos ecosystem. It offers a host of DeFi applications for its users. We will briefly touch upon some of the key components of the Kujira ecosystem here and highlight how they complement one another.- GHOST: Kujira’s money market protocol allows users to mobilise assets for short or long-term lending or borrowing.

- ORCA: a marketplace that allows users to trade liquidate collateral. Users can place bids and buy at discounted prices across the Cosmos blockchains. ORCA is among the few platforms that allow retail investors to bid on liquidated collateral easily.

- FIN (DEX): An order-book style decentralised exchange with low transaction fees and high liquidity. Token swaps for makers and takers are 0.075% and 0.15%, respectively. For comparison, Uniswap charges 0.3% on average tier fees.

- BOW (Liquidity Engine): BOW is the liquidity solution linked with FIN DEX. Users can contribute funds to token pair pools on FIN to boost liquidity. Fees generated by Kujira are shared with these LPs for providing value.

- BLUE: Kujira’s central hub, where users can stake KUJI to earn a portion of revenue and carry out operations like voting on governance proposals, KUJI swaps, and cross-chain transfers.

- USK Stablecoin: USK is an overcollateralised stablecoin pegged to the U.S. dollar. Users can mint USK by providing collateral.

Kujira’s ecosystem synergy

One of the strengths of Kujira’s ecosystem is that each native dApp accelerates the growth of the others.Let us take the example of GHOST and ORCA.

When users borrow on GHOST, they need to deposit collateral. If borrowers cannot repay their loan in time, their collateral is liquidated through ORCA. This liquidated collateral is up for bids at 30% discounted rates and bought back within the network. In short, it boosts trading activity, improves liquidity and generates revenue.

Similarly, FIN and BOW are co-dependent, where traders utilise an exchange at low fees, and LPs are rewarded for generating liquidity. LP pairs also facilitate compelling APR rates.

Through its interconnected ecosystem, the revenue generated is sustainable, where users are attracting activity yield rather than extracting individualised value.

Tokenomics

Kujira’s economic model is based on generating revenue from products to ensure long-term adoption. The aim is to create a circular economy where participants accrue value from the platform’s success, which in turn may attract more users.$KUJI is the native token of the Kujira network, and it has excellent tokenomics.

The network has a total supply of 122.4 million tokens, which was originally 150 million. Currently, the entire total supply is in circulation, meaning KUJI carries zero inflation pressure. The emission schedule was concluded in November 2023, which was one of the catalysts for its previous price action.

On top of that, 53% of the total supply is currently staked, with only 38.39m tokens in liquid supply.

The KUJI token is used across the network for network and dApp fees, and the revenue is distributed to the KUJI stakers. The network retains only 2% of the profit.

The token is also used for governance – to participate in on-chain voting; users will need to stake KUJI.

How do we value Kujira?

Since we have a fair idea about the ecosystem and its economic model, let us dig into the network’s recent adoption rate and growth.More often than not, bullish price action is followed by rising on-chain activity. Active addresses improve, TVL picks up pace, and there is a substantial surge in volumes.

Kujira witnessed a similar trajectory at the end of 2023, where both price and market adoption of the network improved side by side.

In most cases, when the price action slows down, the activity or engagement also drops (a recent example is Dymension). KUJI token has declined nearly 40% from the top in 2024. However, Kujira has continued to improve in terms of adoption.

Since January 1, its total value locked has improved by almost 32%, reaching a value of $141 million. Since October 2023, Kujira’s TVL has been up by 375%, making it the fastest-growing TVL for all L1 blockchains involved in the same period.

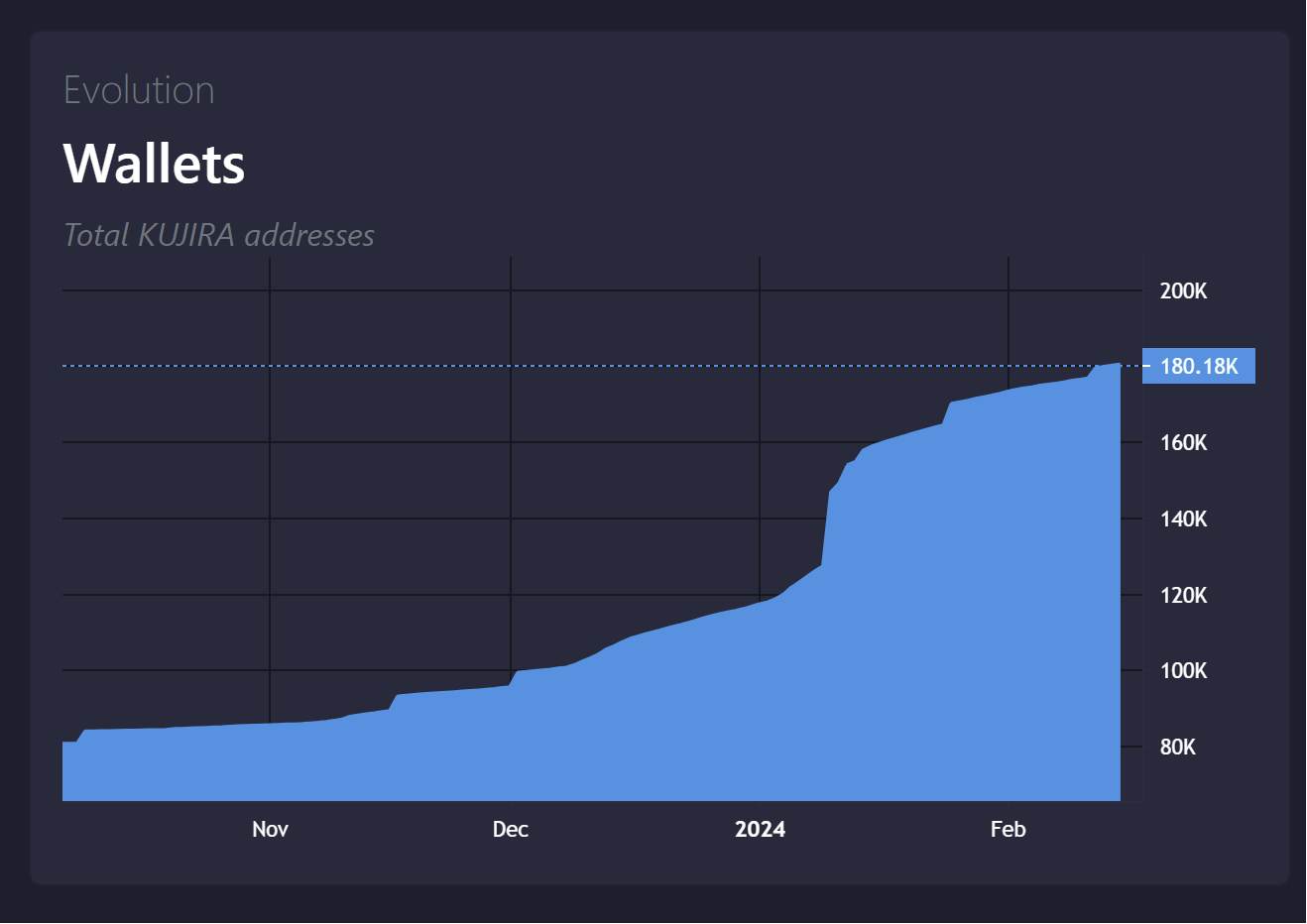

The number of Kujira holders also increased from 117K wallets to 180K, a 53% increase in 6 weeks. Meanwhile, the number of USK minted using collateral improved to 6.1 million, a 35% rise in 2024.

These metrics imply that user growth has continued during a price correction phase. Kujira’s SONAR wallet is another tool which is still in beta development. A fully operational wallet is expected to improve adoption, allowing users to store, transfer and manage native cryptocurrencies on the Kujira blockchain and its dApps.

The ecosystem also has plans to launch perpetual trading in 2024. Futures trading would boost trading volumes, generating more fees.

From a development angle, Kujira has continued to build at a rapid pace, and it is progressively adding more value to its ecosystem.

Valuation exercise

Kujira’s valuation exercise was a little tricky. While there are multiple L1 blockchains in the industry, Kujira is a semi-permissioned chain built with interoperability functions that allow open access to DeFi protocols for builders and web3 users.From a market competition perspective, we have decided to analyse it against the Injective and Near protocols – both have similar market products. Kujira shares more similarities with Injective as both are built with Cosmos SDK.

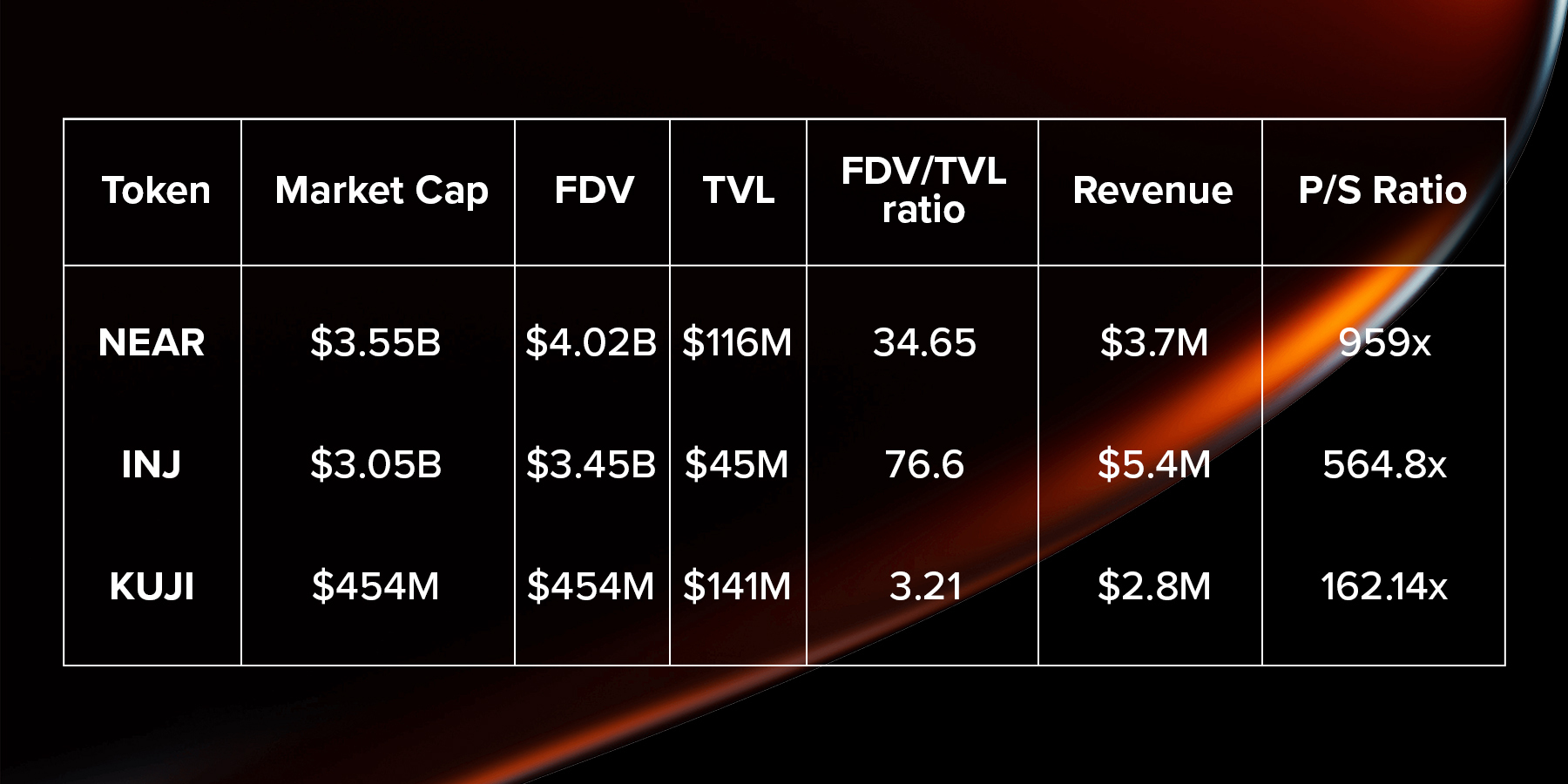

All three of the projects have more than 80% of the total supply in circulation, with Kujira having 100% of the tokens in the market. Let us tabulate some data for each token.

On comparing the fully diluted valuation/total valued locked ratio, it can be implied that the KUJI token is undervalued when compared to INJ and NEAR.

For DeFi protocols, TVL is a key metric to identify potential with respect to market value. Right now, KUJI’s market growth is faster than its price rise. This metric is not a steadfast rule to a conclusion, but it portrays a similarity when comparing the Price-to-Sales ratio.

Now, the P/S ratio is calculated by dividing the market cap by the annualised revenue generated. A lower P/S ratio means that there is room for price appreciation.

KUJI currently has a lower P/S ratio than INJ and NEAR, but it is still quite high. This means the upside in the token could be limited or rise slower if revenue remains stagnant.Based on the current analysis, KUJI does present the possibility of further price appreciation in the market. Its on-chain growth has continued to rise, and its revenue is relatively close to that of its competitors, but its market cap is fairly low in comparison.

Yet, we must remember that KUJI is not on the brink of a bullish rally but a continuation. As highlighted earlier, the token had already recorded a 7x gain and kept 4x by the end of 2023.

So, in fairly bullish conditions, KUJI should match INJ and NEAR’s current $3 billion market cap, where we would consider taking profits.

Another case we need to consider is that hype and narrative go a long way in euphoric bull markets. Kujira is one of the tokens with hype, a trending market narrative and strong fundamentals.

Consider these factors; in peak market conditions, KUJI’s hyperbolic valuation might reach $5 billion.

The entire DeFi market is currently valued at $90 billion, which peaked at $173 billion in 2021. Assuming we double that valuation over the next bull market, we are looking at a $346 billion collective value in DeFi protocols. $5 billion is 1.44% of that total, which is a reasonable market share for Kujira.

Therefore,

- The base case for KUJI, at $3 billion, will be $24.5, i.e. 6.5X.

- The bull case for KUJI at $5 billion will be $41, i.e. 11X.

Areas of concern

We've listed below a few areas of concern that the Kujira team needs to address.- Currently, the APR has dropped to 1.47%. INJ’s APR is 15%. This can hinder adoption, and validator profitability over the long term might not make sense.

- 24-hour trading volume is 0.47% of the market cap, which is extremely low, so a major CEX listing is essential going forward – without this, KUJI may fail to live up to expectations.

- EVM integrations should be the next step forward. KUJI products are not available for Ethereum users, which is a massive market they have not tapped into yet.

Price analysis

KUJI has been undergoing a price correction in 2024, retesting support at $3 twice over the past few weeks. Its daily chart illustrates an early head-and-shoulder formation, but we will have to wait and see if the range at $4.10-$.4.40 (green box) is tested or breached.

Ideally, building a position around $3 is feasible since a couple of confluences are in that range. It is coinciding with a support range and Fibonacci level of 0.618.

However, if the market enters a prolonged correction period, the token can drop to $2.26. This would be an excellent range to buy and hold long-term.

Cryptonary’s take

When we speak about the potential of DeFi, it is fair to state that its potential remains fairly underutilised.One of the major reasons comes down to complexity and an overwhelming setup for retail investors. This is one part where Kujira shines as a protocol.

The platform has a very direct approach to this issue and has made significant strides in solving the problem. Kujira has found a product-market fit, and they are adding more value to the ecosystem, product by product.

Nevertheless, strong product narratives have fallen short, where the token fails to capture investors’ attention. KUJI makes sense right now because we have to consider how efficient its real-yield and economy model is. There is no inflation pressure, users generate profit by providing value, and all the apps are interconnected to accelerate growth.

Hence, we see it as a low-risk 10x bet right now.

If a buying opportunity presents itself around $3-$2.5, the ROI ranges between 14x-16x for an asset which is building with clear objectives.

While the project needs to grow further in adoption, Kujira is on the right path for now.

Cryptonary OUT!