Is ONDO the next big thing in tokenized finance?

"I want the SEC to rapidly approve the tokenization of bonds and stocks. This will save more money for more people and bring down the cost of ownership of stocks and bonds." - Larry Fink, CEO of BlackRock

Larry Fink has once again shaken up the financial world with his recent bold stance on the need for tokenization of Real World Assets. Traditional finance (TradFi) has had barriers to entry due to high fees, inefficient processes, and limited accessibility, locking millions of investors out of global markets.

There is a huge gap in the market and this needs to be filled. The ability to bring real-world assets (RWAs) on-chain could transform global finance and help push these barriers down. While governments and regulators scramble to catch up, one project is already ahead of the curve-Ondo Finance.

Their vision? What stablecoins did for dollars, Ondo GM will do for securities. But is Ondo the best horse to bet on in this Trillion-dollar race?

Let's dive in to find out!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Bringing the future of finance on-chain

The financial sector is evolving and the way we invest into assets is changing very fast. Traditional financial markets have had barriers that keep everyday retail investors locked out of opportunities available to larger players in the market. But what if everyone could access the same high-quality financial products as Wall Street?This is where Ondo steps in to take the charge. By bridging real-world assets on-chain, Ondo is creating more accessible, transparent and efficient financial systems. Whether you are an individual investor seeking low-risk returns or a hedge fund looking to optimize yields, Ondo provides a seamless bridge between TradeFi and Defi.

But how does it all work? Let's break it down.

What does Ondo offer?

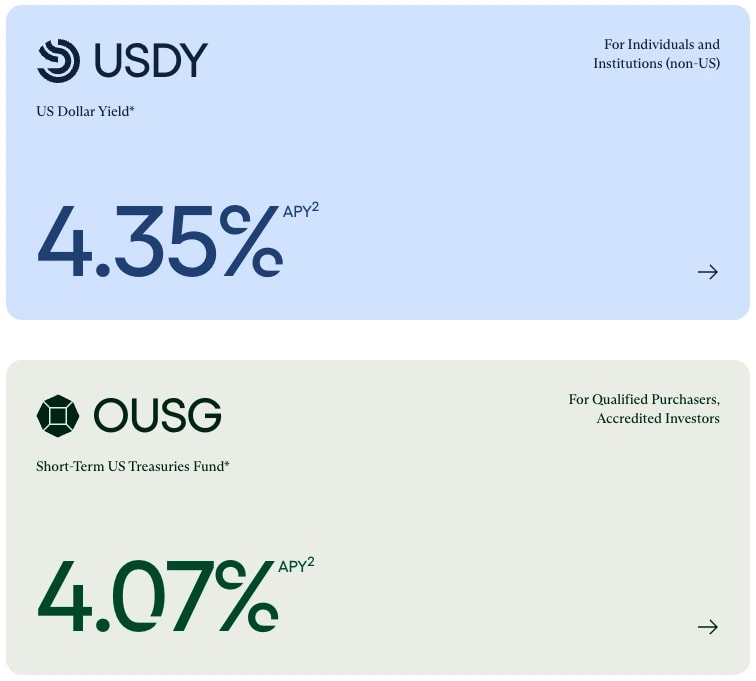

Ondo's success is built on an infrastructure that supports the seamless tokenization and management of RWAs. At its core, Ondo Finance tokenizes institutional-grade financial assets. Assets that were once restricted to traditional markets can now be easily traded, transferred, and used within Web3 applications. Here's how their core products work:1. USDY - Tokenized U.S. treasury bills

Ondo's USDY token is a yield-bearing, low-risk digital asset backed 1:1 by short-term U.S. Treasury bills. Unlike traditional stablecoins, which sit idle in wallets, USDY accrues interest over time, making it an attractive on-chain alternative to holding cash.- Stable yield - Earn a passive income from U.S. Treasury-backed returns.

- Seamless DeFi integration - Use USDY in lending, borrowing, and trading protocols.

- Backed by the safest financial asset - U.S. Treasuries are considered the gold standard of low-risk investments.

2. OUSG - Tokenized money market fund shares

OUSG represents tokenized shares in a money market fund that invests in U.S. Treasury bills and government-backed securities. This product is structured to give investors multiple ways to earn yield:- Accumulating OUSG - The token's value gradually increases over time as yield accrues.

- Rebasing OUSG (rOUSG) - Maintains a fixed $1.00 price, distributing interest as additional tokens.

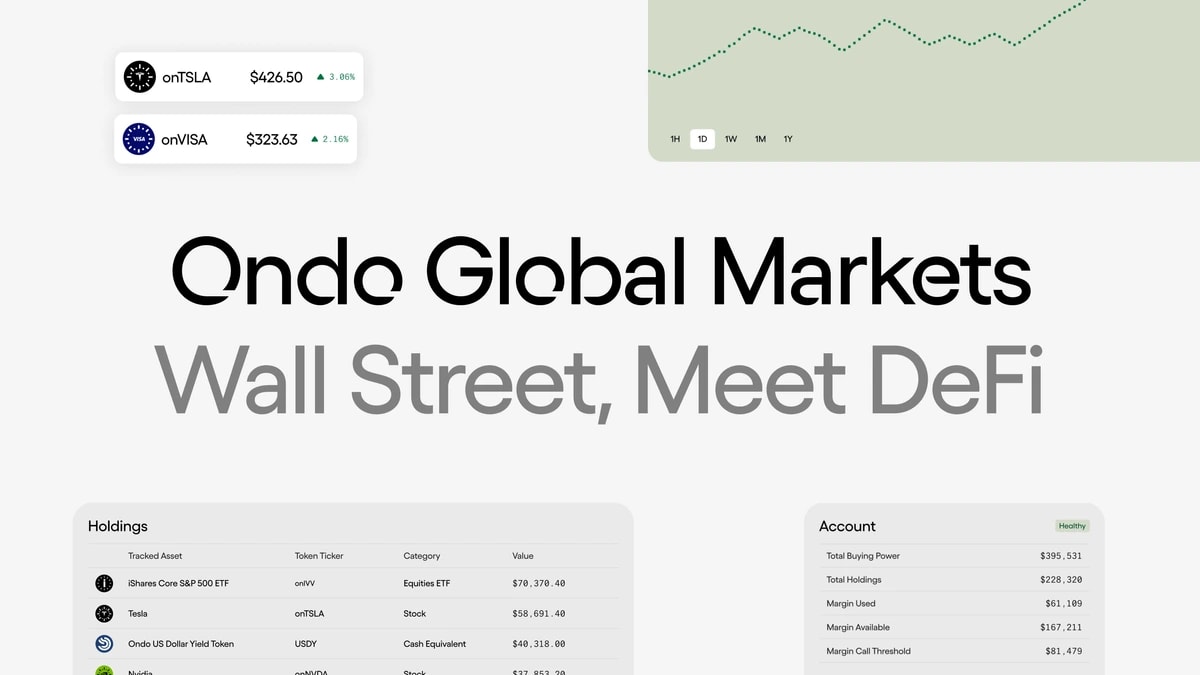

3. Ondo global markets (GM) - Tokenized public securities

Ondo GM enables investors outside the U.S. to access tokenized stocks, ETFs, and bonds, functioning similarly to stablecoins but backed by traditional financial assets.- 1:1 Asset-Backed - Each Ondo GM token represents a real, fully backed security.

- 24/7 Market Access - Unlike traditional stock markets, trade anytime, anywhere.

- Unlocking DeFi Potential - Use tokenized securities for on-chain lending, derivatives, and trading strategies.

4. Flux finance - Ondo's DeFi lending platform

Flux Finance is Ondo's decentralized lending protocol, allowing users to borrow against tokenized real-world assets. This provides a secure, transparent way to access liquidity while holding onto valuable assets.- Use RWAs as collateral - Borrow against tokenized securities and Treasuries.

- Lower borrowing costs - Institutional-grade rates available on-chain.

- Full transparency - No hidden fees, no centralized intermediaries.

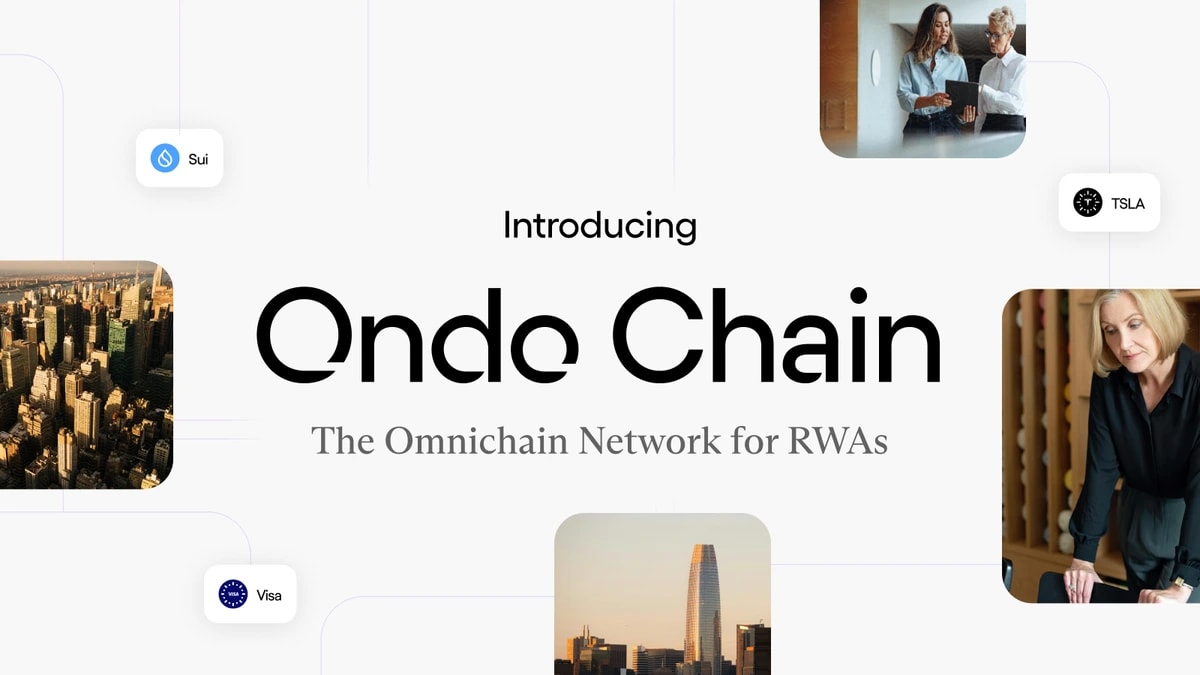

Ondo chain: A game-changing L1 for institutional RWAs

We are truly thrilled about Ondo's most recent news. Ondo Chain, a Layer 1 blockchain created especially for tokenized real-world assets (RWAs), was recently announced.

Ondo Chain is designed to access the billions of dollars that are trapped in traditional banking and bring these assets onchain, so it's not simply another generic L1 trying to get into the DeFi or gaming businesses. This action seems to have the potential to completely change how blockchain technology engages with actual markets.

What is notable is how Ondo has addressed some of the most significant challenges in tokenizing RWAs by adopting a reasonable, institution-first strategy. To begin with, it's a brilliant idea to use RWAs as staked collateral. Other chains haven't been able to do this right, but it enables the network to retain strong security while matching incentives with stability in the real world.

It serves as a bridge that allows developers, conventional financial institutions, and individual investors to easily communicate with RWAs; it is not only a platform for institutions. Developers have tools to create RWA-specific dApps, institutions receive the necessary compliance and trust, and individual investors have access to premium assets that were previously unattainable.

We believe this could be a huge step toward making on-chain capital markets a reality and driving mass adoption of tokenized assets. It's hard not to feel optimistic about the impact this could have.

The team behind Ondo

Considering the leadership of Ondo, we believe it is fair to say that the team is well-suited for the position. They have a combination of experience that is ideal for advancing the tokenization of physical assets, having strong roots in traditional banking and substantial exposure to digital assets.Let's discuss credentials. Former executives from some of the most notable financial and cryptocurrency institutions are among their leadership: Circle's Director of Business Development in Web3; BlackRock's VP of US iShares Institutional; Bridgewater's Senior Relations Manager; and Goldman Sachs' Accelerate Digital Asset Head, VP of Digital Assets, and Head of Digital Asset Markets.

This roster, in our opinion, is one of Ondo's strongest points. This group is capable of bridging the divide between decentralised and traditional finance.

Ondo tokenomics

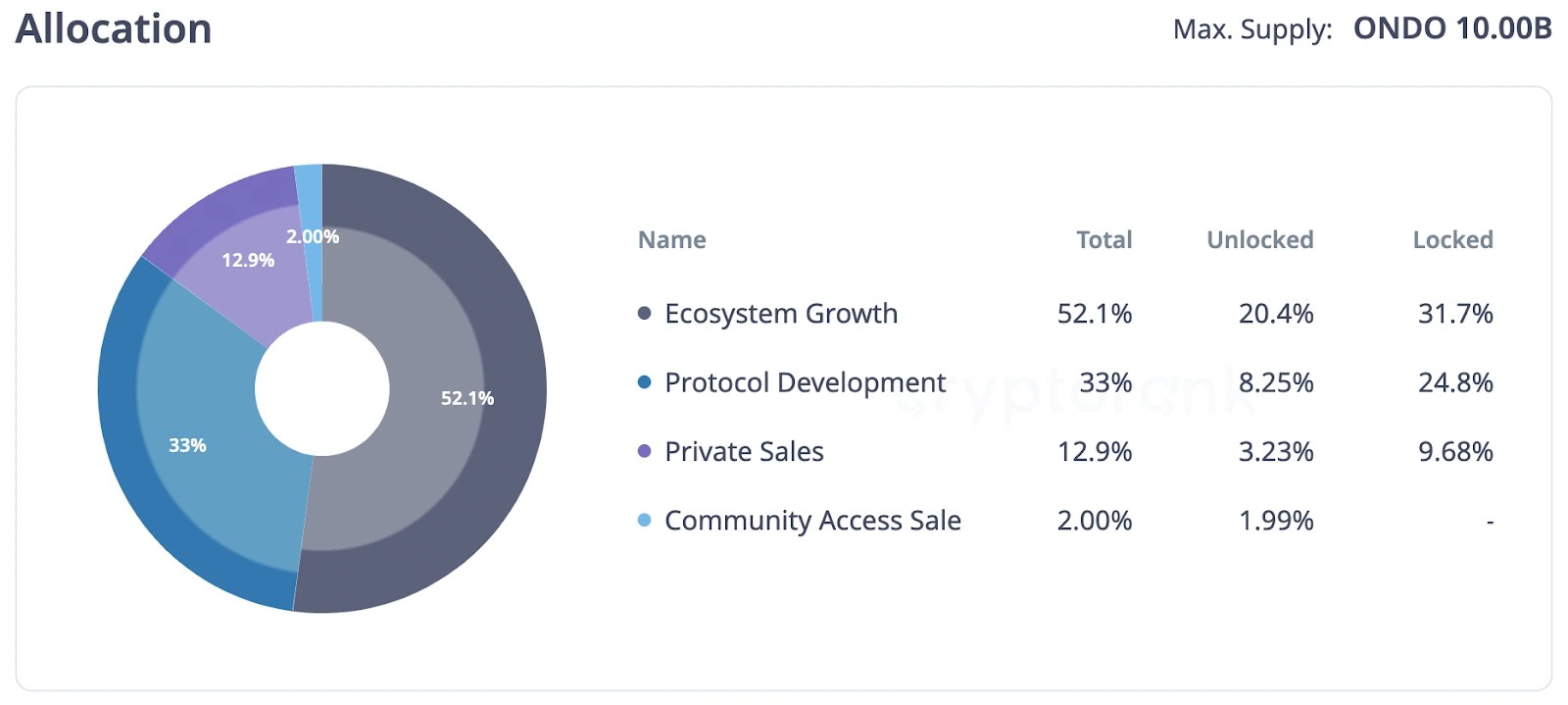

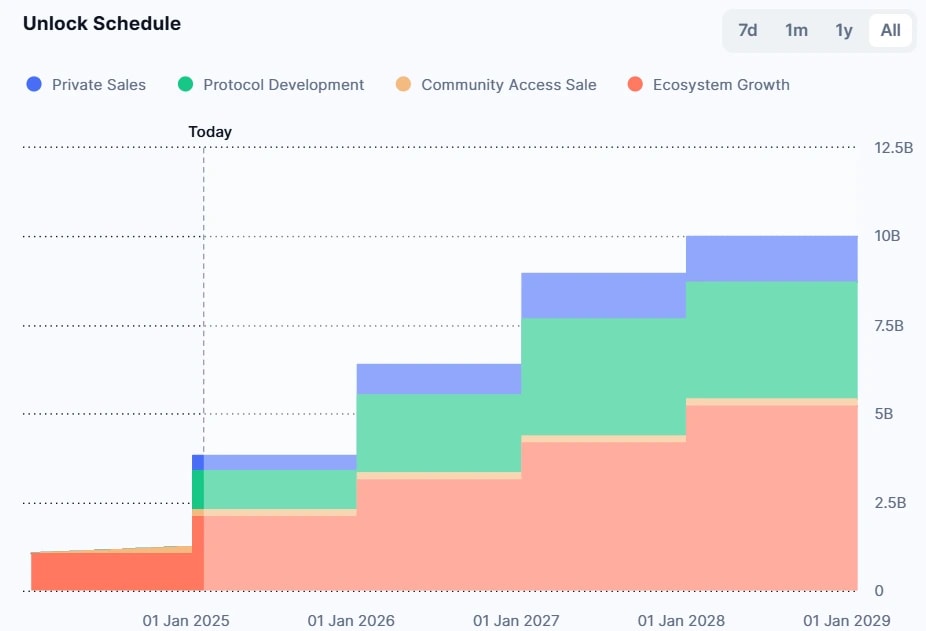

The ONDO token serves as the governance token as of now for both the Ondo DAO and Flux Finance. Launched on Ethereum in January 2024, ONDO gives its holders the ability to shape vault tactics, protocol updates, and the future course of the tokenized real-world asset (RWA) network running on Ondo.Ondo launched with a maximum supply of 10 billion tokens.

Token allocation breakdown

- Community access sale: 198.88M tokens (~2%) were distributed to early supporters via CoinList. Around 90% of these tokens were unlocked at launch, ensuring immediate liquidity for early backers.

- Ecosystem growth: 5.21B tokens (~52.1%) are dedicated to airdrops, incentives, and ecosystem expansion. While 24% of this allocation was unlocked at launch, the remainder is set to vest gradually over five years, ensuring long-term development support.

- Protocol development: 3.3B tokens (~33%) are allocated to building infrastructure and products. These tokens have a 12-month lock period, followed by gradual unlocking over five years.

- Private sales: 1.29B tokens (~12.9%) were reserved for seed and Series A investors. Like the protocol development allocation, these tokens are locked for a minimum of 12 months and released incrementally over five years.

Circulation and unlock status

Currently, 66.11% of ONDO tokens are locked (6.61B tokens), while 33.89% are in circulation (3.39B tokens).Recent unlock: January 18, 2025

The most recent unlock brought a significant influx of tokens into circulation:- Protocol development: 825M ONDO tokens (~26.11% of circulating supply), worth $1.09B (24.85% of market cap).

- Ecosystem growth: 792.05M ONDO tokens (~25.07% of circulating supply), valued at $1.04B (23.86% of market cap).

- Private sales: 322.56M ONDO tokens (~10.21% of circulating supply), equating to $424.41M (9.72% of market cap).

Upcoming unlock: January 18, 2026

Looking ahead, the next major unlock is scheduled for January 18, 2026, featuring similar allocations:- Protocol development: 825M ONDO tokens (~26.11% of circulating supply), valued at $1.13B (25.88% of market cap).

- Ecosystem growth: 792.05M ONDO tokens (~25.07% of circulating supply), worth $1.09B.

- Private sales: 322.56M ONDO tokens (~10.21% of circulating supply), valued at $441.91M (10.12% of market cap).

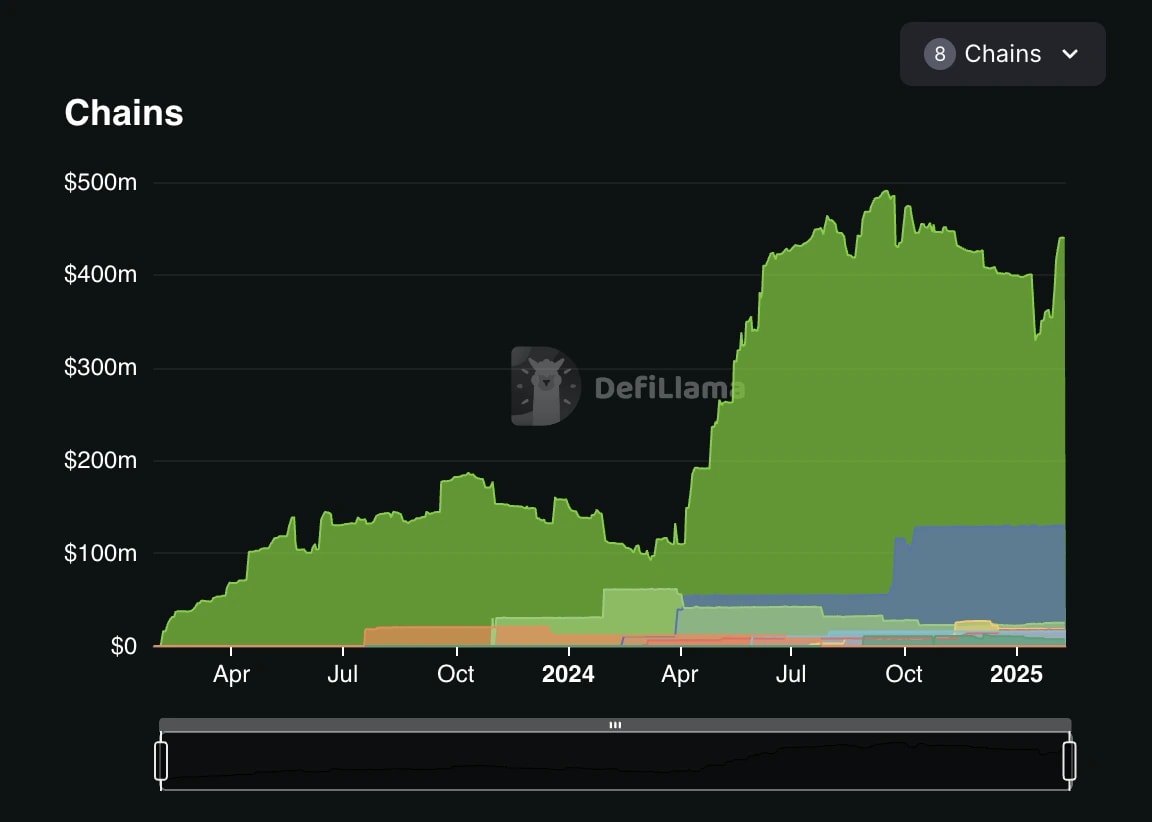

Ondo's TVL breakdown

Since its launch in January 2023, Ondo Protocol has had remarkable growth, with its Total Value Locked (TVL) now reaching $650 million. Let's break down the data.The lion's share of Ondo's TVL is on the Ethereum chain, which holds $440 million. This tells us about Ethereum's position as the go-to network for DeFi due to its liquidity and infrastructure. Solana takes the second spot, contributing $130 million with the remaining TVL spread across other emerging chains such as Mantle, Noble, Sui, and others.

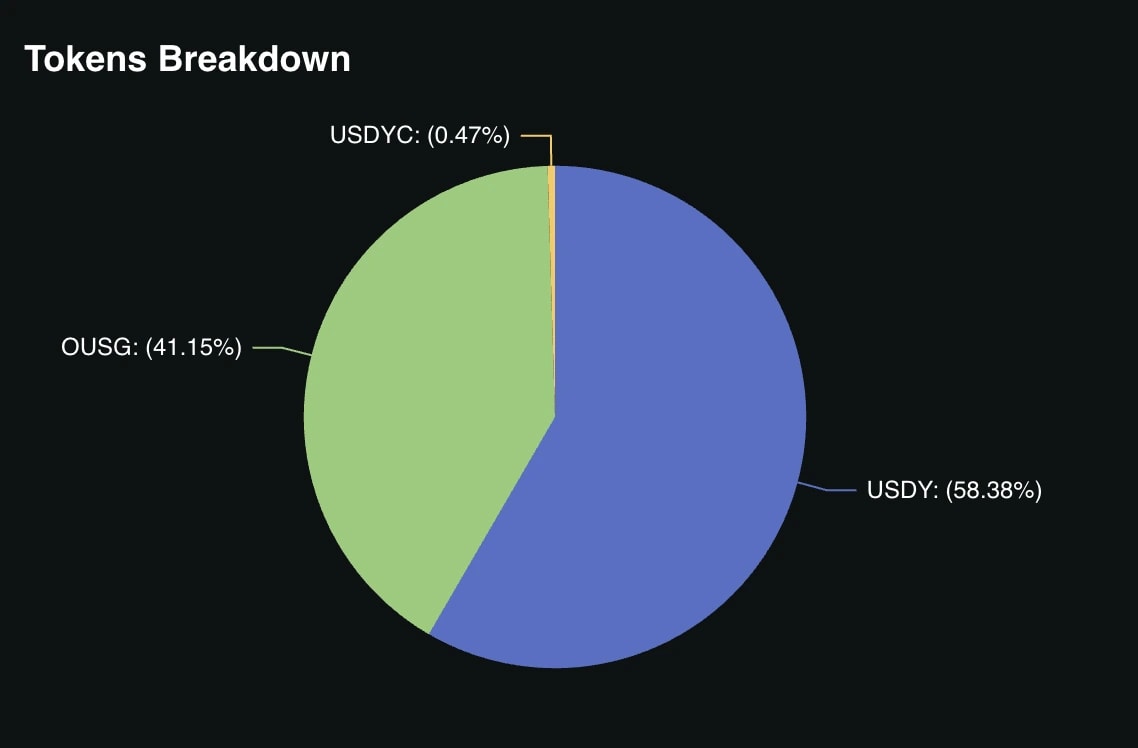

When we examine the allocation of funds within Ondo's products, the split is primarily between:

- USDY (58.38%): Ondo's tokenized representation of short-term US Treasury bills, offering low-risk, yield-bearing exposure on-chain.

- OUSG (41.15%): A tokenized money market product focused on government bonds and high-quality funds.

With Ondo GM adding tokenized stocks and ETFs to the mix, we anticipate significant inflows into the protocol, further solidifying its position as a potential leader in the RWA space.

Ondo's sentiment and mindshare

We're seeing a surge in sentiment and mindshare for Ondo Finance, and honestly, we're not surprised. With the recent announcement of Ondo Chain and their bold vision for a "Wall Street 2.0", Ondo is making moves that are hard to ignore.Their Summit on February 6th brought together some of the biggest names in blockchain-executives from Ripple, Chainlink, and Uniswap-as well as Eric Trump, whose appearance turned heads and added even more excitement to the summit. It's clear that the market is reacting strongly to their initiatives, and we think this momentum is well-deserved.

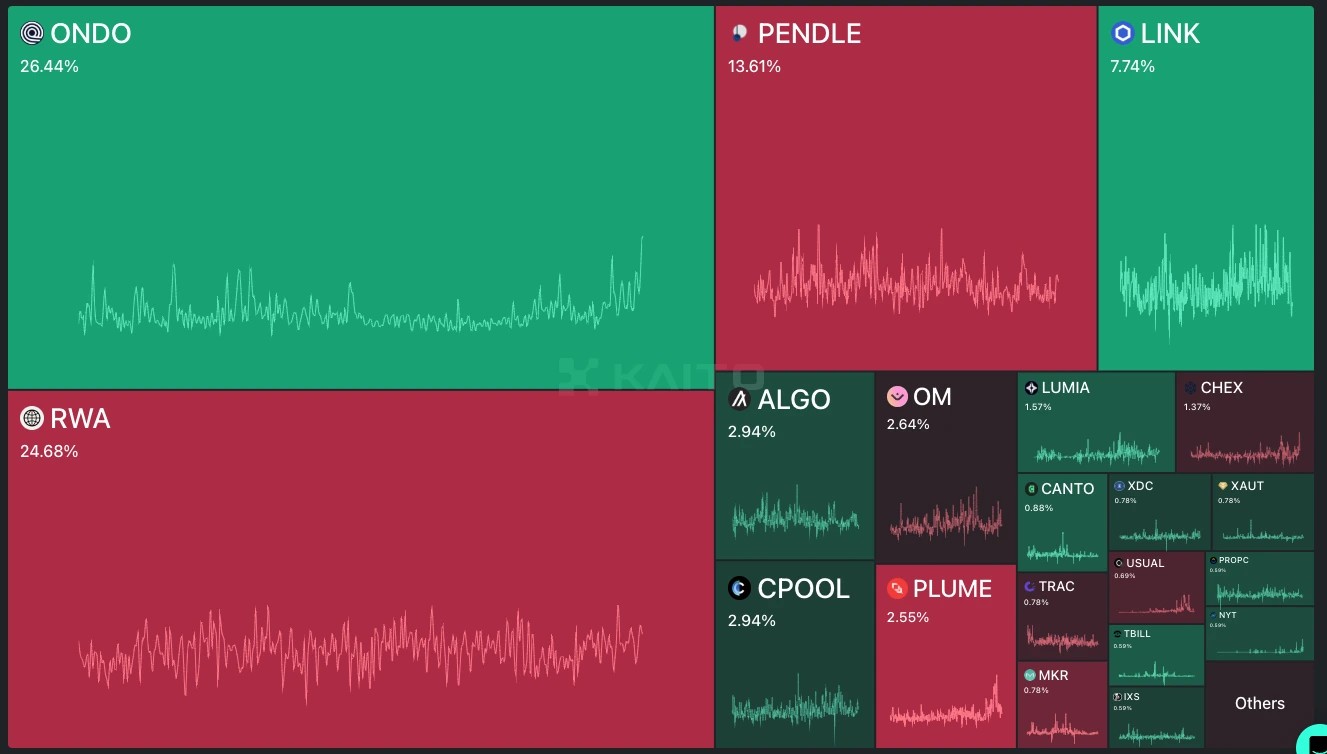

Ondo's positive sentiment is peaking to new highs, currently at 1.73 and mindshare at 0.68% showing growing enthusiasm and support from the community, which is exactly the kind of momentum they need to solidify their position in the market.

![]()

Ondo is leading the pack in the RWA mindshare data. Capturing 26.47% of the total sector's attention than a quarter-it's clear that Ondo has positioned itself as the go-to protocol for RWAs. Compared to other players like Pendle (13.61%) and Chainlink (7.74%), Ondo is dominating the conversation.

We believe that this is about providing tangible value and creating solutions that appeal to institutions and the cryptocurrency community, not just about hype. If this trajectory continues, we think Ondo is well on its way to becoming a cornerstone of the Web3 economy.

Latest snapshot of the RWA market

Although RWA tokenisation is advancing significantly, it still only accounts for a small portion of the blockchain markets. With private credit ($11.9 billion) and U.S. Treasury debt ($3.6 billion) controlling the market, RWAs now have an on-chain value of $17.19 billion. With only $16 million worth of tokenized equities accessible, tokenized stocks are still mostly unexplored, in sharp contrast to the trillions in global equity markets.Stablecoins, on the other hand, have grown to a $218.43 billion market, showing the enormous demand for tokenized financial goods. However, RWAs, which provide real-world assistance, are still far behind, accounting for less than 10% of the stablecoin market. The ecosystem is still in its early stages but is expanding gradually, with just 83,234 asset holders and 112 issuers.

With an emphasis on tokenized US Treasuries and other premium assets, we believe Ondo is stepping up to fill a critical gap in the market. In our view, Ondo is building the way for widespread adoption and positioning RWAs to become a fundamental pillar of the Web3 economy.

Projections for Ondo

Ondo's current market capitalization sits around $4.2 billion and a fully diluted valuation (FDV) of $13.2 billion. Since there won't be any token unlocks for the next 10-11 months, Ondo is well-positioned to gain traction without running the danger of dilution.Base case

If Ondo continues its current momentum, driven by its existing products and the broader adoption of RWAs, as shown by Larry Fink's most recent statements, we project Ondo's market capitalization could more than double to around $10 billion, almost 2.5x from here and placing the ONDO token at around $3.15. This assumes steady progress without any significant issues.Bull case

Things become much more exciting for the bull case. The protocol may develop rapidly if Ondo Chain debuts within the next two quarters and the Ondo Global Markets (GM) product goes live. By itself, these two drivers could push Ondo into the top 5-6 Layer 1 blockchains by market capitalisation. Competing with Cardano ($25 billion market cap, 5th position) and TRON ($20 billion market cap, 6th position), Ondo's market capitalization could reach the $20-25 billion range. This would translate to an ONDO token price of $6.20-$7.80, doubling the base case.Challenges for Ondo

Tokenized real-world assets (RWAs) are helping Ondo Finance bridge the gap between traditional and decentralised finance, but there are still some big obstacles to overcome. These challenges mostly centre on operational complexity, regulatory compliance, and the dynamic character of the cryptocurrency market.Regulatory compliance and restrictions

Navigating the international regulatory landscape is one of Ondo Finance's biggest concerns. For instance, neither the U.S. Securities Act nor the securities laws of other jurisdictions register Ondo's flagship product, USDY. Unless certain exemptions or exclusions are met, this lack of registration severely restricts its availability, preventing it from being offered, sold, or transferred within the United States and to U.S. persons.Ondo must constantly maintain compliance while adjusting to new regulations as the legal and regulatory landscape surrounding cryptocurrency assets changes. The accessibility and uptake of the product may be impacted by these factors.

Establishing trust and onboarding institutions

Ondo has to make sure that conventional financial institutions trust the underlying technology and are onboarded in order to fully realise its vision of tokenized capital markets. Institutional-grade security, transparency, and compliance are necessary for the integration of RWAs into decentralised finance; these are areas where conventional players remain sceptical. An important but difficult part of Ondo's purpose is establishing and preserving this confidence while adhering to institutional norms.Technical analysis

On the weekly chart, Ondo is showing a clear bullish structure, consistently forming higher highs and higher lows. When applying the Fibonacci retracement tool to the recent swing, Ondo is currently trading right at the 50% retracement level, which is a critical zone in technical analysis.The price dipped into the deeper discount zone, wicking down to the $0.92 area before showing strong bullish momentum and filling the entire wick. Now, it has retraced back to the 50% Fib level, signalling a healthy consolidation in an uptrend.

Switching to the daily chart, Ondo is trading within a range. The current price is trading between $1.324, with support at $1.287 and resistance at $1.485.

Resistance levels

- $1.485

- $1.643

- All-Time High (ATH) at $2.14

- $1.287

- 200 EMA at $1.131

- $1.04

- $0.839

ONDO/BTC analysis

This pair has been moving within a range for the past few months, oscillating between four key levels. It tested the range low (line 1) back in October and early November before gaining momentum and surging towards the range high (line 4). However, it failed to break above, facing strong rejection and falling back into the mid-range, consolidating between lines 2 and 3.Recently, the market-wide pullback forced ONDO/BTC below line 2 momentarily, but the weekly timeframe showed a strong recovery. A key demand zone, marked by a grey box, acted as support during the liquidation event, helping prices bounce back quickly. Now, ONDO/BTC is safely trading within the 2-3 range again, showing resilience in the face of volatility.

Looking ahead, the critical level to watch is line 3. If Ondo BTC breaks above it, line 4 will act as the next resistance. A successful breakout beyond that would put into price discovery, opening the door for significant upside momentum.

Buy boxes and DCA zones

For accumulation, we've identified two key DCA (Dollar-Cost Averaging) zones:- $1.18 - $1.06: A strong zone for gradual accumulation.

- If the market experiences a wider shakeout, the $0.95 - $0.85 region provides an excellent DCA opportunity.

Cryptonary's take

Ondo is making all the right moves at the right time. From a macro perspective, Ondo is riding a multi-trillion-dollar wave. The stablecoin market has already surpassed $200B, yet tokenized RWAs are still sitting at just $17.2B. The upside is clear.But let's talk about risk. Ondo is stepping into a highly regulated space where compliance is everything. If regulators push back hard, adoption could slow down. Additionally, competition is heating up. Other players in the RWA space are moving fast with Injective announcing that they are launching the first tokenized on-chain S&P 500 index very soon. Everyone wants a piece of the pie in this trillion-dollar market.

So where does that leave us? In our base case, Ondo reaches a $10B market cap- a 2x from here. But in the bull case, where Ondo Chain launches in the next two quarters and Ondo Global Markets captures serious volume, we're looking at a $20B+ market-cap putting it in direct competition with the top L1s. That's a 4-5x move from today's levels.

With that being said, we are closely monitoring the developments happening and awaiting the launch of Ondo's L1 and better macro backdrop. Stay tuned for more updates.

Cryptonary, OUT!