During this time, Solana has capitulated by 35%, dropping from a yearly high of $210 to $116 on April 13. While many people feel uneasy about the market's current state, we aren't particularly worried. Contrary to the prevailing sentiment, this slowdown actually presents an opportunity to buy potential winners at a discount.

Solana remains one of the most exciting ecosystems in this bull run, and Solchat (CHAT) has emerged as an exciting prospect in that ecosystem.

Now, the coin is down almost 70% to a $50m market cap and a trading price of $5.73

Today, we examine whether this project has any substance and whether the CHAT could be one of the top performers in this bull market.

TDLR

- Solchat is a Solana-based communications protocol that brings Web2 tools like texting and voice/video calls to a Web3 environment.

- The project has strong fundamentals - simplistic design, defined roadmap, and investor-friendly tokenomics

- On-chain data shows Solchat has relatively low token concentration and decentralised ownership, but liquidity is a concern.

- The CHAT token currently lacks clear utility, but the upcoming V2 upgrade is expected to introduce staking and other use cases.

- Solchat is a promising project, but the CHAT token is currently a high-risk investment, given the protocol's early stage and uncertain token economics.

- Prospects hinge on the forthcoming Solchat V2 upgrade and the introduction of a staking mechanism, alongside ongoing roadmap progress for price target assessment.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

What is Solchat?

Solchat is a communications protocol on Solana that brings Web2-format communication tools into a Web3 environment. Think about traditional forms of communication such as texting, voice calls, and video calls. All these functionalities are available on Solchat, but in contrast to conventional apps, they are secured and stored on-chain on the network.Solchat delivers this affordably on-chain because of Solana's low transaction fees. It is also privacy-focused because it operates without a centralised database. Audio and video calls are facilitated via WebRTC; each interaction is encrypted, and the data is distributed across many nodes in the network. Therefore, it is very difficult for unauthorised parties to access private data and messages.

Why do we like Solchat?

Understanding the objective or long-term use case can be tricky when analysing a project in the RWA, AI, or DePin sector. Many projects fill their whitepapers with buzzwords and fluff, making them look like they are carrying substance, but most of the time, it is all a smokescreen. However, Solchat has form and substance for the following reasons.- Simplicity

A simple protocol that works is always attractive to investors since its demand can be tangibly visualised. Solchat falls in that category for the time being.

- Defined Roadmap

A defined roadmap is a positive sign, and the fact that the team regularly checks off each phase shows intent and consistency.

- Tokenomics

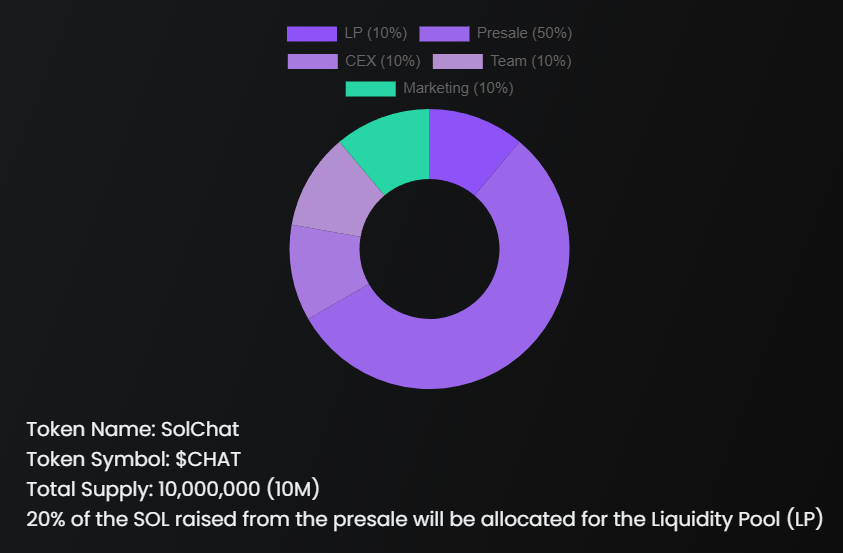

90% of the supply is in circulation, with no unlock or other events scheduled. The tokenomics are quite investor-friendly and simplified, just like the protocol.

What does on-chain data tell us about Solchat?

Solchat is a fairly new project, so there isn't much data to conduct a strong assessment. Yet, a few things about the project are quite impressive.First, the token contract has its ownership renounced, and the contract creator balance is less than 0.01%. Also, the token concentration is fairly distributed and decentralised.

The total number of CHAT token holders is around 25,368, with the top 100 holders collectively owning 31.89%. That is relatively low compared to many popular projects, where the top 100 holders usually hold more than or close to 50% of the supply.

It is also worth noting that a Raydium pool is the top holder with 1.30%, which declines progressively in the list.

On the contrary, the CHAT token's value transfer and token DEX trading have reduced significantly since the beginning of March. This drop in activity coincides with the price drop, so this is an interesting metric to keep track of going forward.

Potential drawbacks

As highlighted in the previous section, Solchat has strong fundamentals for a newly minted project. However, a few things need to be considered. If not improved, these factors can be potential red flags in the future.One issue with Solchat is the low liquidity on the chain. The project has a market cap of $50 million, but the current liquidity is $1.3 million. The wide distribution of tokens is positive since a single address does not hold more than 1% of the total circulating supply. However, liquidity needs to be improved for trading volumes to last.

Secondly, the CHAT token does not have any credible utility right now. For example, the gas fees for user registration on the app are paid in SOL. Users also need to pay SOL as a gas fee to initiate a chat with another user rather than paying in CHAT.

So, for an investor, there's really not much incentive to hold CHAT currently other than believing in the project as a whole and hoping that other investors buy into the vision.

Price evaluation

In the last section, we discussed the CHAT token's lack of utility, which makes it tricky to assess its price. CHAT's all-time high is already $20, so the bullish expectation from current prices is that it will rebound to match that high.However, without token utility, how would it do that? And if it does, would it go higher and sustainably?

Well, Solchat V2 is the next major update, which is part of the current Phase 3. The V2 upgrade is expected to bring more use cases for $CHAT, as users can access premium features, including using SPL tokens for payments.

However, the Solchat staking mechanism is possibly the most important functionality that would interest investors holding CHAT tokens. Users can stake tokens in the SolRocket staking pool to earn 80% of the revenue share from the total pool.

We will conduct a price target evaluation after the V2 upgrade is released because we believe these features should play a major role in determining CHAT's long-term investment potential.

Technical analysis

As mentioned earlier, CHAT is down 68% since reaching an all-time high of $20 last month. It is hovering around the first zone of interest, which amassed a lot of trading activity in March. On the daily chart, it is currently displaying a bullish resurgence with an 11% rise.

A descending channel pattern is also forming, and CHAT is oscillating between the upper and lower trendline. An upside breakout from the pattern would bring a positive confirmation alongside a daily close above $6-$7.

However, with resistance forming at its current price point, it might be a while before CHAT breaks positively in the charts. A long-term orderblock was observed under $2, which has a low testing possibility at the moment, but further drawdown may increase the probability.

Cryptonary's take

The jury is out for Solchat as the protocol is still relatively new.The token has strong positives: sound tokenomics, an absence of whale concentration, and a clear market product utility. However, the CHAT token doesn't have a clear use case in the ecosystem yet, so that needs to become more evident going forward.

Solchat has potential, but it is a high-risk bet right now. The project has a market cap of $50 million and is still in beta. We can make a case for overvaluation, which is why we are probably witnessing such a strong price correction.

Its relationship with the Solana ecosystem is positive, but Solchat needs to keep pushing with its roadmap and incorporate more ways to use CHAT in the ecosystem. We will keep a close eye on Phase 3 and the Solchat V2 upgrade and will release a price target for CHAT soon.

Until then,

Cryptonary Out!