Is the Smart Money bearish? Q4 presents fresh opportunities

When trading, it's not really about whether you're right or wrong. The more important point is how much money you make when you're right and lose when you're wrong. This statement encapsulates the essence of smart crypto trading.

While no trader wins every bet, the "Smart Money" has cracked the code on how to maximise gains and minimise losses. They've developed strategies, tapped into narratives, and honed their timing to stay ahead of the pack.

In this report, we'll explore how some of the savviest traders are positioning themselves in the current market.

Are they turning bearish or gearing up to capitalise on emerging opportunities? By examining their portfolios, tracing past successes, and decoding approaches, we can glean valuable insights to inform our own investment decisions.

Join us as we get inside the minds of crypto's elite traders and uncover what the "Smart Money" is doing now.

TLDR

- There’s been a decline in the stablecoin holdings of Smart Money allets throughout the year. But a notable rebound in September potentially signals a shift towards a more risk-averse strategy.

- King Louie: Profited from MONG and HarryPotterObamaPacMan8Inu; prefers USDC; cautious stance.

- Baloo: Success with CHAD and BOBO; systematic approach; currently in stablecoins awaiting opportunities.

- Shere Khan: Impressive returns with METAL and PEPE, takes calculated risks, and is now betting big on RLB in the decentralised gambling sector.

- Han Solo Update: Sold GRAIL for a modest profit and invested in LODE on Arbitrum, looking for opportunities within the Arbitrum ecosystem.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Macro insights

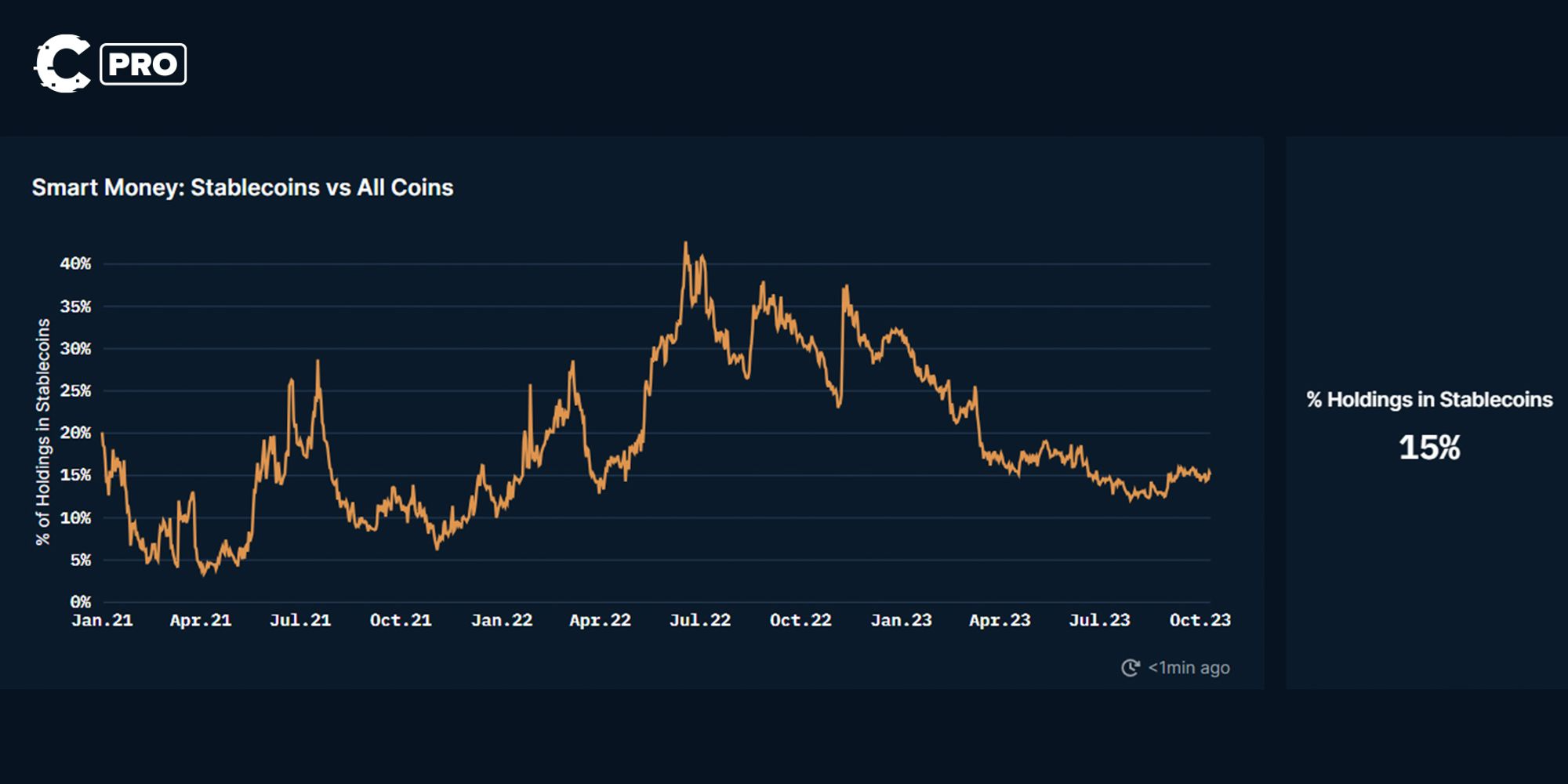

The holdings of stablecoins in Smart Money wallets had been decreasing since the beginning of the year, experiencing a rapid decline in January, followed by a slower grind down in Q2.

Notably, we began to notice a rise in stablecoin holdings in September. This shift marked a rebound from a low of 12.8% on August 29th, the same day Grayscale won its lawsuit against the SEC.

The increase to 15.4% suggests that Smart Money has become slightly less confident and opted for a more risk-averse strategy.

This change may be attributed to the SEC's delays in approving Spot Bitcoin ETFs and the underwhelming performance of ETH futures ETFs launched at the start of October.

While this is not a significant concern, it does highlight that we have yet to enter bull market territory. What appears to be occurring is positioning for the bull market following a challenging 2022, but with a degree of caution.

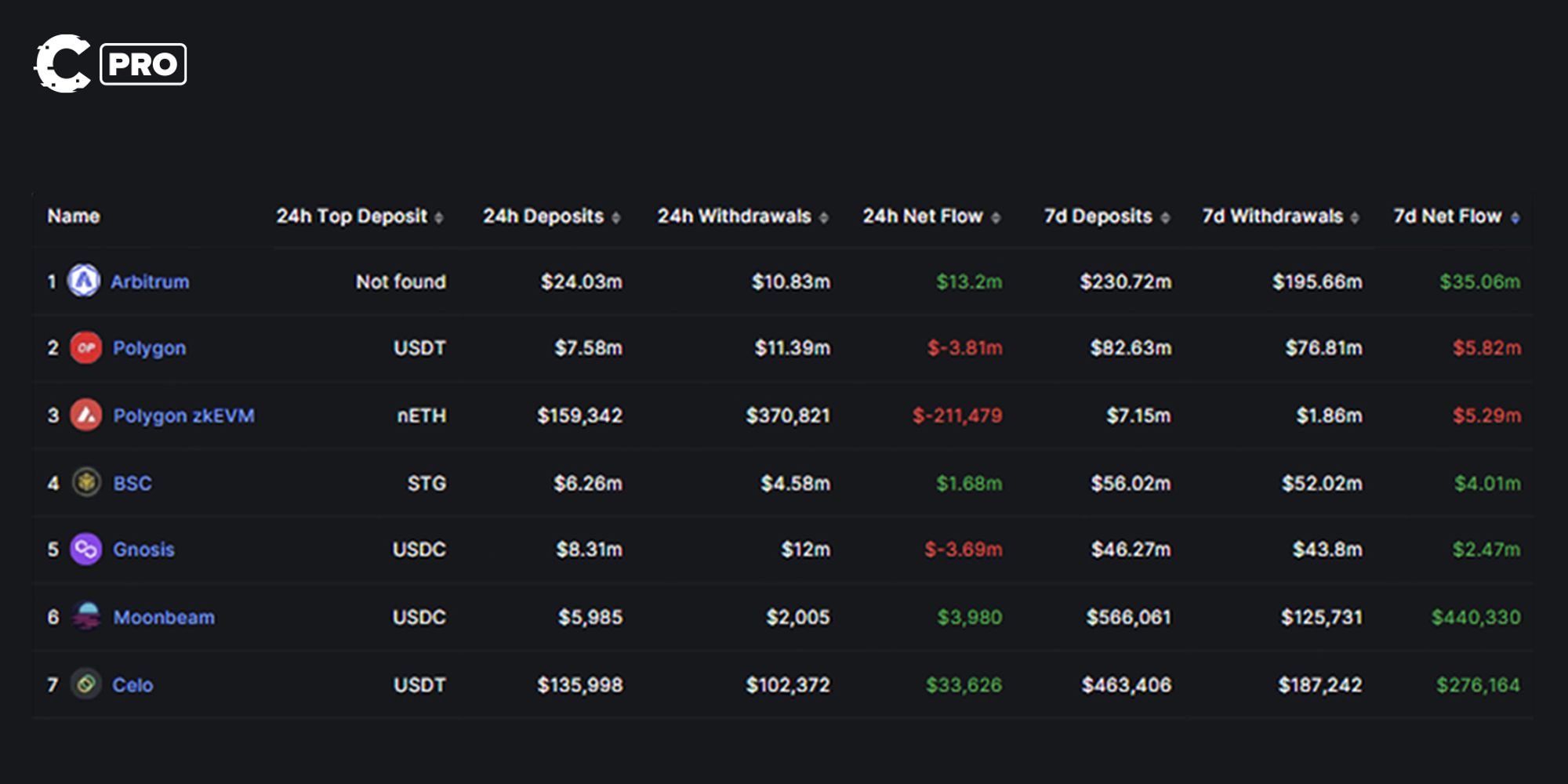

However, when we analyse the flow of funds by observing bridge volumes, it becomes evident that the favoured ecosystem is Arbitrum, with a $35 million inflow this week.

The attention on Arbitrum is primarily due to the introduction of its Short-Term Incentive Program (STIP) by the Arbitrum Foundation, which aims to distribute 50,000,000 ARB tokens valued at $41.2 million.

The first round of proposals for these incentives has already been voted on, and capital will likely continue to migrate to Arbitrum to seize a share of these incentives.

With this incentive program, Arbitrum has become an ecosystem worth watching.

Later in this article, we'll also introduce an intriguing play within this ecosystem from one of our smart money wallets👇

King Louie

King Louie is one of our standout traders, with a remarkable net worth of $171,696. In 2023, he achieved a realised Profit of $661,325, demonstrating his trading prowess.

He predominantly favours USDC in his trading strategy, showcasing a cautious approach to the market. However, his trading history reveals that he is open to calculated risk-taking when the timing is right.

- Net worth: $171,696

- Realised PnL 2023: $661,325

- Style: Memecoin trader

- Wallet address: 0xb835367ae1cafcea58a10a51b17fea25d16c3dab

- Top pick(s) USDC

Portfolio

Big wins

The trader invested $126,604.708 in MONG at an average buy price of $0.0188. Then, he sold his position for $843,117.203, realising a profit of $653,639, representing an ROI of 516.28%.The trader entered the HarryPotterObamaPacMan8Inu trade with an initial investment of $9,445.517 at an average buy price of $0.010. Upon exiting the position, they made $33,338.798 in sales, resulting in a profit of $24,267 and an impressive ROI of 256.92%.

Strategy

When we examine King Louie's trading strategy, it becomes evident that he possesses a deep understanding of meme coins and has primarily earned his profits during the meme coin frenzy earlier in the year. He achieved this by entering these meme coins before they gained their initial hype, as exemplified by his investment in $MONG.Additionally, King Louie implemented another strategy by purchasing derivatives of meme coins. Instead of going for HarryPotterObamaSonicInu10, which he believed was a late entry, he opted for a fork named HarryPotterObamaPacMan8Inu, from which he could secure a profitable outcome.

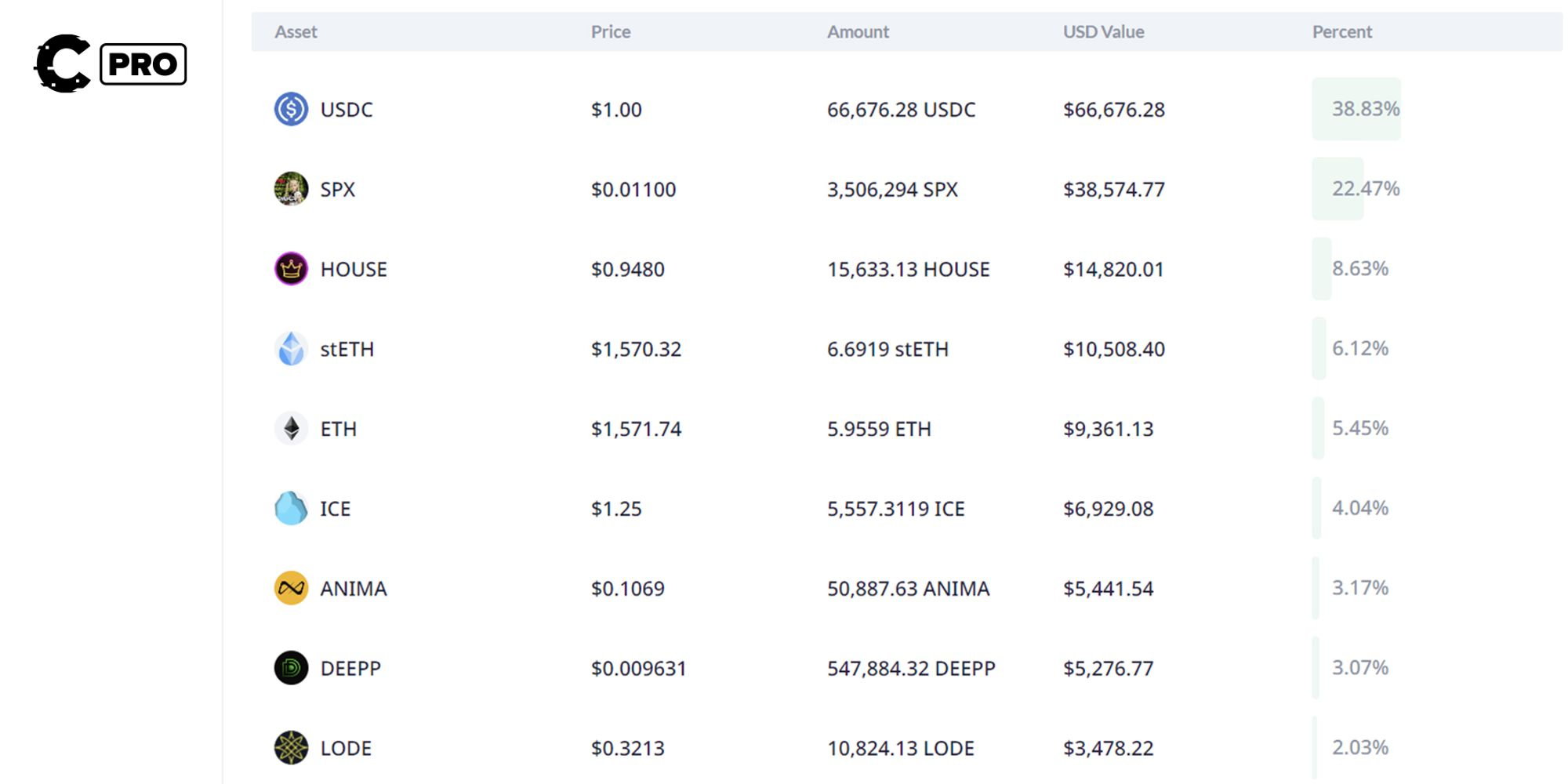

He appears to have adopted a more cautious position, possibly due to lower expectations for market excitement, as 38% of his portfolio is held in USDC. Nevertheless, he identifies two opportunities: SPX and HOUSE, with 22% of his portfolio allocated to SPX and 8% to HOUSE.

SPX is a meme coin with an unconventional and edgy approach, akin to HarryPotterObamaSonicInu10, almost parodying the essence of the crypto world. The project currently boasts a mere 1,400 followers on Twitter, signifying that it remains relatively under the radar. The trader's bet could be based on the belief that this token has the potential to amass a dedicated cult following, much like how $BITCOIN did in its early days.

In the case of $HOUSE, the thesis is more straightforward. This coin is directly associated with the HOUSEMONEY project, which is developing a sports betting Telegram bot. This aligns with the broader narrative of trading bots and decentralised casinos.

This development enables individuals to place bets on sports games directly through Telegram. The timing is particularly strategic, given the upcoming sports season in the United States, including the Super Bowl in Q1 of 2024. This trader appears to be banking on the idea that sports betting within the crypto realm will gain significant traction.

Baloo

Being part of smart money also involves knowing when to refrain from trading, and Baloo embodies this principle. Despite his currently unremarkable portfolio, this wallet is a valuable indicator comprising only 10% in ETH and the remaining funds in stablecoins.

Baloo has demonstrated exceptional trading acumen this year, consistently securing profits. However, his current hesitancy suggests uncertainty in the market.

- Net worth: $282,317

- Realised PnL 2023: $237,039.0

- Style: Day trader

- Wallet address: 0x8eb2283f696f2a130134d46e28d3528e19e16868

- Top pick(s) USDT

Portfolio

Big wins

The trader invested $188,477.582 in CHAD and sold his position for $236,332.126, realising a profit of $84,576, which represents an ROI of 44.87%He bought $16,484.365 worth of BOBO and then sold it for $69,310.190, netting himself a profit of $41,800, representing an ROI of 253.58%.

The trader entered the FTM trade with $304,373.005 at $0.270 and then sold this position at $0.336, worth $330,765.773, netting himself a profit of approximately 8.67%.

Strategy

Baloo is a true trader with a highly systematic approach to trading. For him, it's not primarily about which coins he buys and their fundamental value. Instead, he likely relies on technical analysis or other indicators to make trade entry decisions.Baloo has traded many tokens, from meme coins like CHAD to alternative layer 1s like Fantom (FTM). He typically maintains positions for a short period, aiming to capture profits within the 40-5% ROI range. While this might seem modest, consistently applying this strategy over time accumulates substantial rewards.

However, at present, Baloo appears to perceive fewer significant trading opportunities. As a result, he has moved all his profits into stablecoins and is patiently awaiting the right moment to reenter the market. This situation implies that monitoring Baloo's wallet can serve as an indicator for identifying future trading opportunities.

Shere Khan

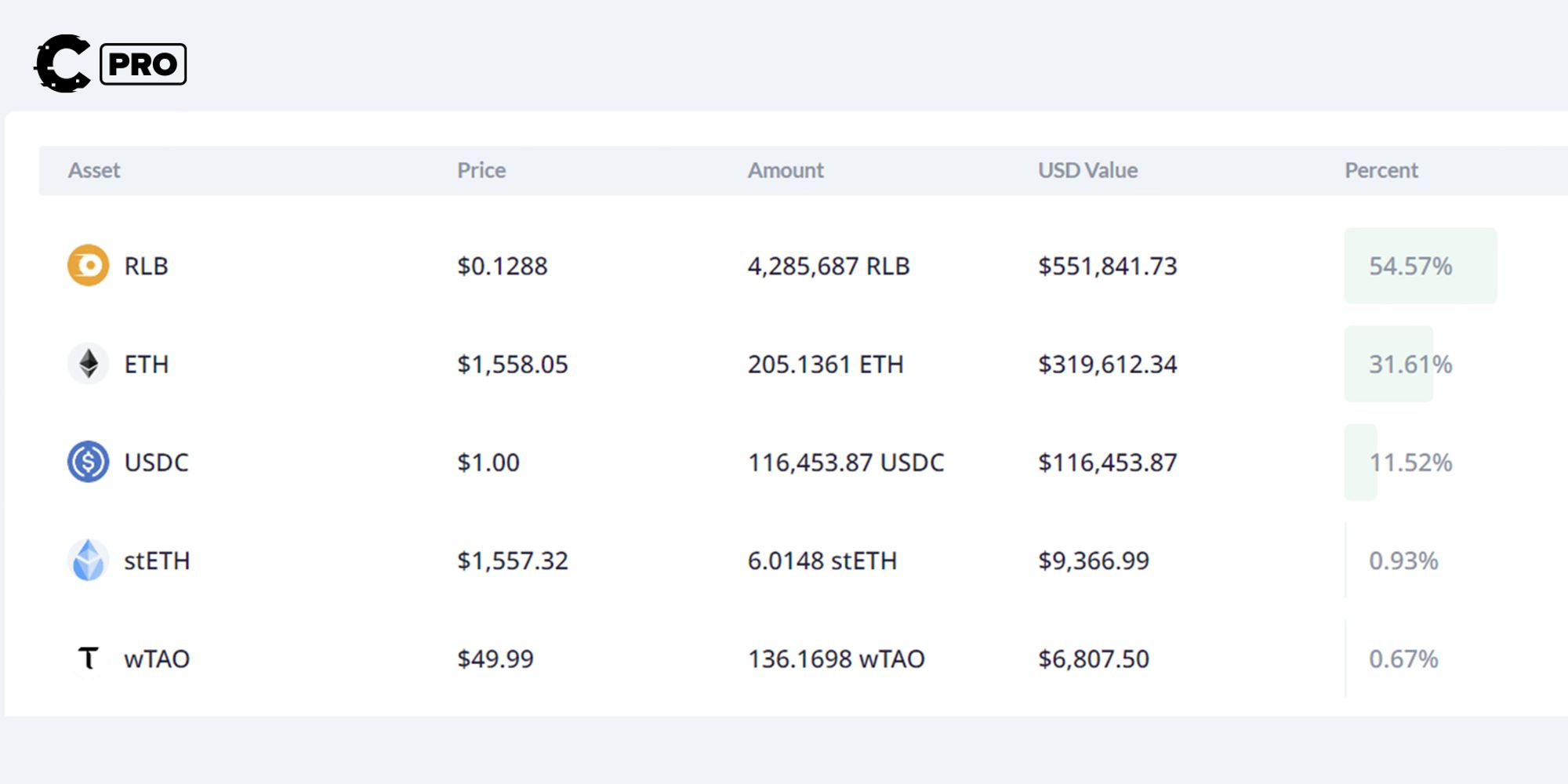

Shere Khan is a trader with an impressive net worth of $1,011,198 and a realised Profit of $332,935. His trading strategy stands out for its audacious approach, as he makes substantial bets in decentralised gambling, particularly with RLB. Shere Khan's willingness to dive into this niche market signifies his confidence in its potential and its opportunities.

- Net worth: $1,011,198

- Realised PnL: $332,935

- Style: Narrative trader

- Wallet address 0x0d7661a7b7a89b40b6db128900557e4f1d1b3789

- Top Pick(s): RLB

Portfolio

Big wins

The trader bought $9,835.016 worth of METAL and then sold this for $27,245.931 worth of METAL, realising a profit of $17,410.915. This profit corresponds to an ROI of approximately 177.06%.The trader bought $756,640.74 worth of PEPE and then sold it for $954,115.846 worth of PEPE, realising a profit of $197,475.106. This profit corresponds to an ROI of approximately 26.12%.

Strategy

Shere Khan has been navigating the crypto landscape like a seasoned tiger stalking its prey. When he spots an opportunity, he pounces with conviction, as he did with PEPE. While he recognised that the return might not be as substantial, he wagered a significant portion of his holdings, resulting in a substantial dollar-wise profit, even though the ROI was 26.12%.In other instances, Khan allocates a smaller portion of his portfolio to higher-risk assets, such as $METAL, where he realised an impressive ROI of 177.06%. This strategic allocation perfectly reflects his grasp of risk and reward dynamics within the crypto market.

Now, Shere Khan has set his sights on a new opportunity, boldly investing over 50% of his portfolio in Rollbit (RLB), effectively betting on the success of the emerging crypto casino.

His move into RLB showcases his confidence and conviction.

From a fundamental perspective, the trade makes sense because Rollbit has announced a buyback and burn program that operates transparently on the blockchain this month.This program uses their revenues to buy back their tokens, potentially acting as a catalyst for the token's value.

Update on a previous Smart Money wallet

Han Solo

In our previous report, we introduced a trader we've nicknamed Han Solo. He's an adventurous trader who thrives on riding market hype cycles for substantial gains.We'd like to update you on one position he has chosen to sell and one position he's decided to enter within the Arbitrum ecosystem.

- Net worth: $302,979

- Realised PnL: +$398,393

- Style: Narrative trader

- Wallet address: 0xf7b3e7e00f7b6d0e259ffb82f2d5a130dfd021f1

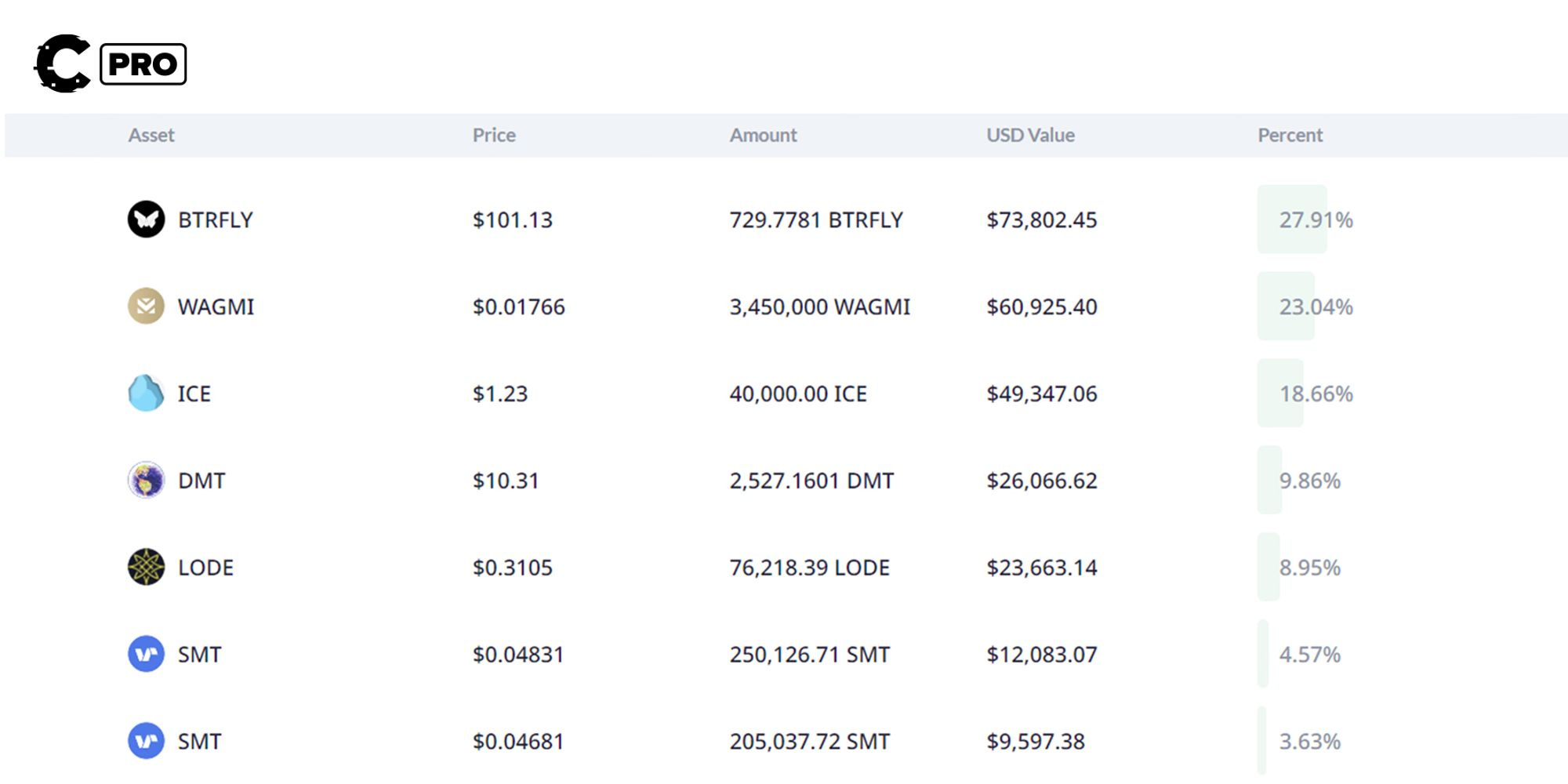

- Top pick(s): BTRFLY

Portfolio update

Han Solo has opted to sell his position in GRAIL, the token of Camelot, the largest DEX on Arbitrum. He sold $17,409.943 worth of it at a price of $799.326, which didn't yield a significant profit. He essentially broke even with a modest profit of $35.

It's apparent that he may have reassessed the value of this position and decided it was no longer worth holding.

Instead, he has redirected his attention to a different opportunity within the Arbitrum ecosystem. He invested $22,034.37 in LODE, the token associated with the lending protocol Lodesetar on Arbitrum, purchasing it at a price of $0.30. This decision likely stems from the potential benefits that Lodestar can reap from the Arbitrum incentive program we mentioned earlier

If the project secures a grant, it could have a significant impact, especially considering its current market cap of only $1,285,362. Even a $600K grant would represent 50% of the project's total market cap. So, it has a high-potential project for substantial upside.

Cryptonary’s take

As we've seen, smart money traders have adopted varying stances reflective of the uncertain markets. While some, like King Louie, take risks on potential meme coin breakouts, others, like Baloo, have turned cautious, awaiting clearer signals.In most wallets, stablecoins continue to play a pivotal role, reflecting a conservative inclination and a prudent approach to the market. While these wallets are actively engaged in trading, it's evident that they anticipate a rather uneventful October as they maintain a notably risk-averse stance.

Yet conviction plays surface, too. Shere Khan's bold bet on the RLB casino token and Han Solo's targeting of obscured gems like LODE show opportunism can still thrive. Though approaches differ, combining hype sensitivity, fundamentals analysis, and impeccable timing remains a smart money hallmark.

Out of the opportunities highlighted, the one we agree with most is RLB. In fact, we will cover RLB in an upcoming in-depth report, as one of our researchers believes Rollbit is significantly undervalued.

What's also important to note is that we are diligently developing Smart Money V2 in the background. This will integrate real-time wallet updates, offering a more robust product. Every wallet featured will integrate into V2. We'll provide further updates on this in late Q4. Refer to our previous report for more details on what this entails.

Also, here's the link to the article we mentioned in the video about trading through market narratives.

And that’s all on this edition of Smart Money.

As always, thanks for reading.

Cryptonary, OUT!