The Englishman, not even aware that there are other dimensions, doesn't even hear what the Chinaman just said.

Even if he knew that Earth-321 existed, he doesn't speak Mandarin.

Now, the Chinaman could be Solana, and the Englishman could be Ethereum…You could try building a smart contract using Solidity on Solana, but you wouldn't get far. These two chains are so different that, from the perspective of Solana, Ethereum doesn't even exist - it might as well be in another dimension.

Replace Solana or Ethereum with any other random blockchain; the argument mostly stands. Now imagine a trans-dimensional being saying, "I'll pass along your message" - that's LayerZero.

Now that the ZRO token has launched, where do we stand?

Key questions

- Discover how this cross-chain communications protocol is breaking down barriers between different blockchains.

- Uncover the unique advantages that set LayerZero apart from other cross-chain solutions like Polkadot and Cosmos.

- Explore the inner workings of LayerZero's innovative messaging protocol that ensures seamless interoperability.

- Find out which major blockchain networks have integrated with LayerZero and the impact of these connections.

- Learn about the utility and governance of the ZRO token and how its distribution could affect its future value.

- What's the potential upside? Get insights into the market projections and valuation scenarios that could make ZRO a game-changer in the crypto world.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is LayerZero?

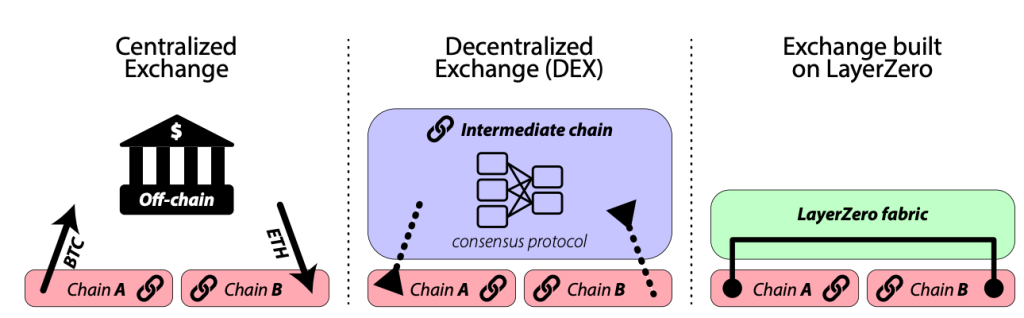

LayerZero is a cross-chain communications protocol, unlike other examples such as THORChain, Wormhole, or even Polkadot, the flagship Layer-0 protocol.A quick recap on cross-chain comms

To recap, a Layer-0 protocol (not to be confused with LayerZero) is a sidechain that runs underneath a Layer-1 chain (like Ethereum) to facilitate communication between another Layer-1 or even a Layer-2 chain.The reason behind this is that blockchains are constructed differently. They may use a different programming language, run at different speeds, have different wallet formats, etc. This means they are incompatible with virtually any other blockchain.

A Layer-0 protocol is a networking layer. It translates the information sent from one chain into information that is useable/readable on a second chain. However, older examples such as Cosmos and Polkadot are limited to their respective ecosystems.

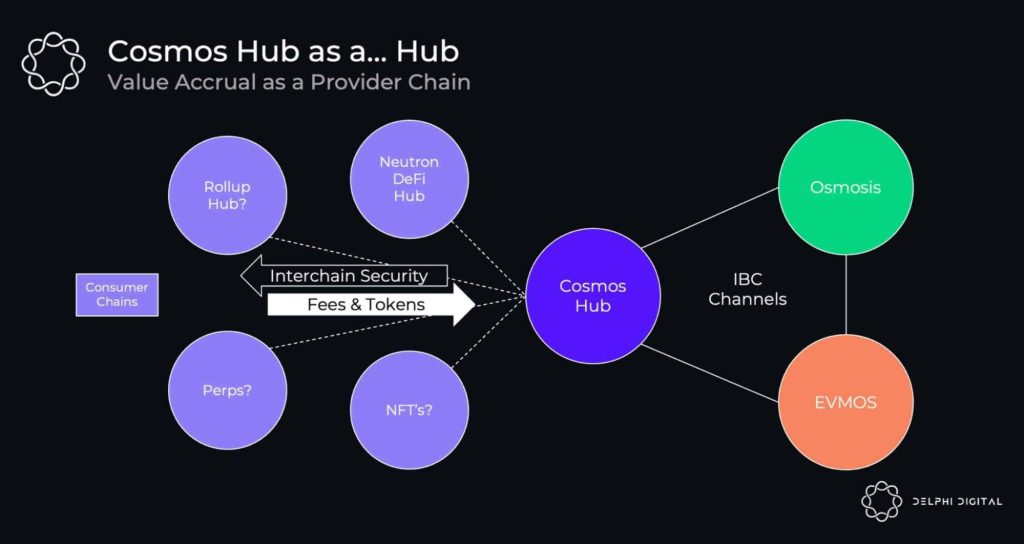

The Cosmos IBC (Inter-Blockchain Communications protocol), shown in the example above, utilises Cosmos' base layer as the groundwork for communications between any and all Cosmos chains. But it cannot (without modification) communicate with another chain like Solana.

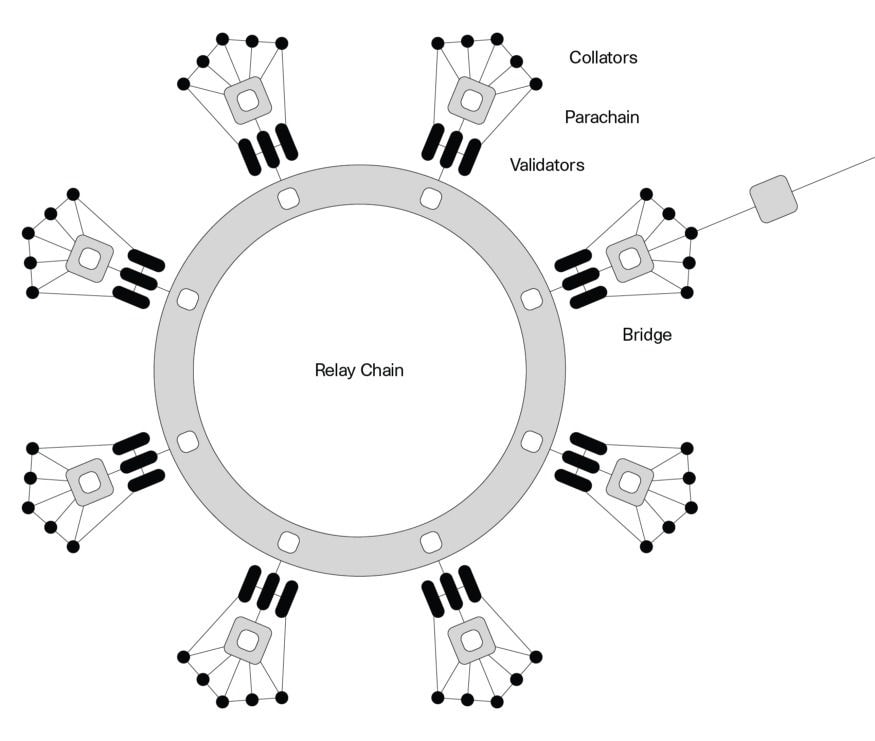

The story is the same for Polkadot, as shown above. The key issue is the transfer of wealth between completely unrelated chains.

It's like you were trying to move money between an HSBC and a Citibank account, but they could not process the request because the two banks used a different settlement system and were completely incompatible.

Sounds absurd, doesn't it?

Why LayerZero over other cross-chain comms?

LayerZero does the same as Polkadot and Cosmos but is not limited to related chains. Rather, it allows fluid communication between any connected chain. The winning property is that any chain can be integrated, and so LayerZero is considered an omni-chain.

Like a blockchain skeleton key, LayerZero unlocks previously unreachable liquidity for any chain it is integrated with.

To give another metaphor, LayerZero is the Internet protocol of crypto, connecting anything with everything: Macbooks with Windows systems, eBay with banking—it's the Swiss army knife of communications in the Web3 realm.

Here are a couple of examples of previously impossible utility that was made possible by LayerZero:

- Multi-chain DAOs/Omni-chain tokens: traditionally, most DAOs exist on a single chain, backed by a single token, with voting executed via transactions on that chain. With the cross-chain messaging service implemented by LayerZero, the vote can be carried out on any chain using a token that is not native to any one chain.

- Omni-chain NFT collections: similar to the token example above, NFT collections are no longer limited to a single chain and can be freely passed from chain to chain, whilst each individual token remains non-fungible.

- Trustless cross-chain swaps: rather than rely on a third party, IOU-wrapped token, LayerZero allows omni-chain tokens to be swapped 1:1 between chains, purchases/swaps to be made on one chain and executed on another and is safer than conventional bridges when it comes to moving wealth between chains as there is no reliance on multi-sig wallets (looking at you Wormhole).

Just today, the Pendle ecosystem lead, Anton, the ecosystem lead at Pendle, had this to say about Pendle's relationship with LayerZero:

"LayerZero has essentially enabled the Pendle protocol to deploy omni-chain vTokenomics, allowing users to synchronise their vPendle balances across all supported chains where Pendle is deployed. So, LayerZero helps enhance this accessibility and interoperability for those Pendles pools. What this basically means is that you just need to cast your vPendle votes in a single hub, which is on Ethereum, and Pendle leverages LayerZero's messaging protocol to broadcast the voting results across the different protocol deployments on different chains."This is just a basic selection of the utility that LayerZero provides, but really, anything that can be done and verified on one smart-contract-capable chain is just as valid on any other chain that the protocol has integrated.

How does it work?

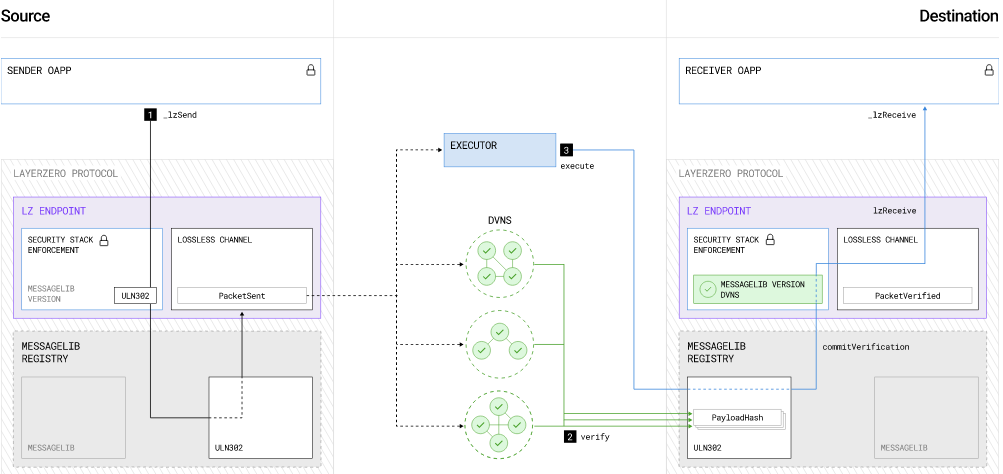

There are 3 important components that facilitate the transmission of messages - the endpoints, the Oracle, and the Relayer.

When a message is sent by an application (dApp):

- The message is transmitted through the first endpoint on Chain A, which tells the Oracle and the Relayer what the message is and its destination chain.

- The Oracle forwards the block header (basically an identification of the block on which the message was signed) to the endpoint on Chain B.

- The Relayer submits proof of the transaction to the endpoint on Chain B. This proof is validated on Chain B, and the message is sent to the relevant destination address.

Who's connected?

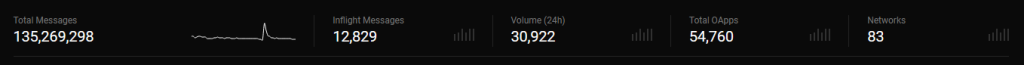

Since its launch, LayerZero has connected 83 networks, some of which are quite exciting. For instance, Pendle's ongoing innovation, including the development of Pendle v3, relies on the robust infrastructure provided by LayerZero.

ZRO tokenomics

ZRO is the utility and governance token for the LayerZero protocol. Its primary function is voting power in the bi-yearly on-chain referendum on whether or not to change/alter the fee structure for LayerZero. Fees accrued are burned, making the token deflationary and essentially distributing the value evenly to holders based on the proportion of the tokens they hold.

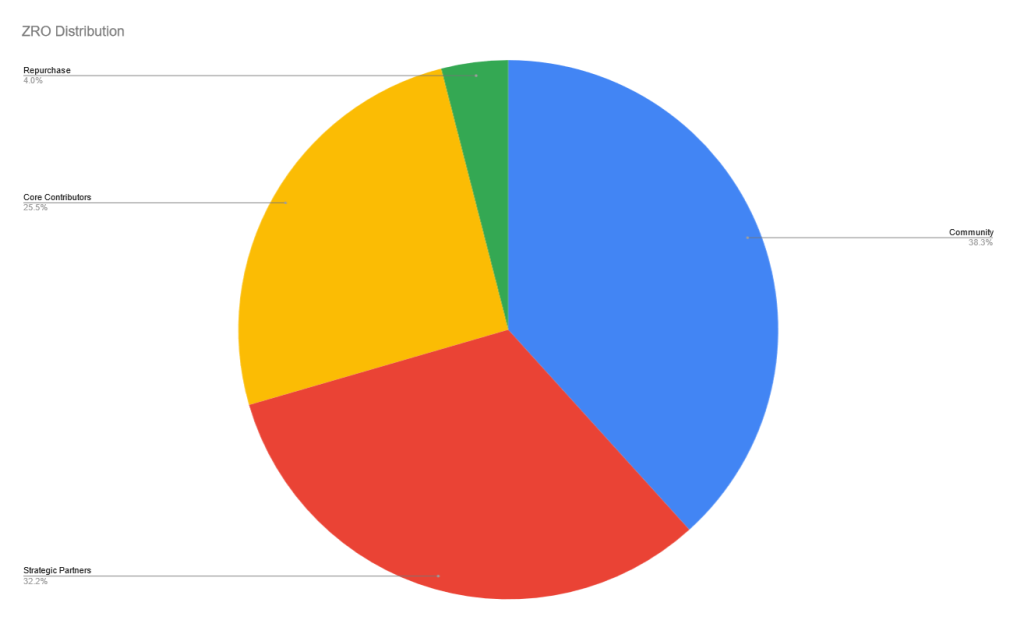

The ZRO distribution is as follows:

- 38.3% to LayerZero community - users (airdrop), developers, and others.

- 32.2% to partners (investors/advisors)

- 25.5% to the core team, including future members.

- 4% buyback for redistribution to the community.

The distribution (and lack of emissions 12 months after the initial drop) provides price stability that other airdropped tokens lack…

ZRO airdrop

The airdrop event occurred on the 20th of June 2024 and was (and continues to be) supported and listed by many centralised exchanges.1.3 million wallets were eligible for the ZRO airdrop.

This has been one of the most highly anticipated events in the cross-chain realm, potentially in the entire market.

Are you eligible? Find out here.

Technical analysis

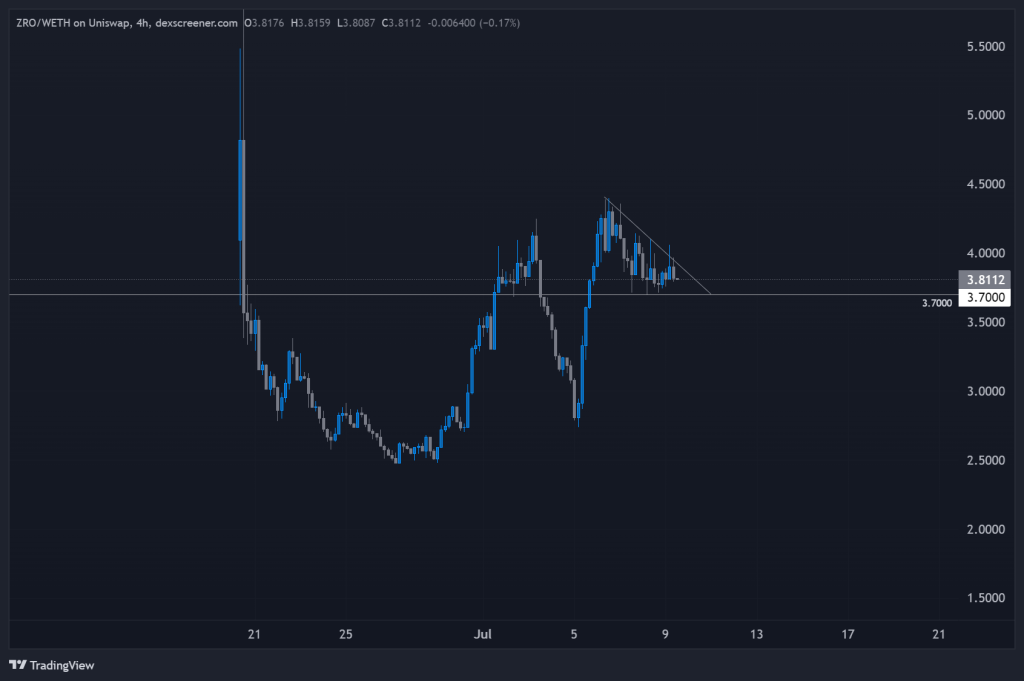

The airdrop was on June 20th, so we don't have much data to work with.

However, ZRO has been recovering since the lows printed on the 27th of June.

A key level we have identified is 3.7000. On the 1st of July, the price broke and closed above this price region before breaking lower five days later. The price managed to reclaim this price region, and now we seem to be forming a bullish wedge pattern, which has strong underlying psychological reasons why this wedge forms for potential further upside.

Compared to other airdrops in recent memory, the ZRO launch has been exceptional. Many examples have jumped, then dumped, then DUMPED since they dropped.

ZRO is showing price stability here, especially considering current market conditions, which lends credibility to its viability as a viable investment.

Valuation exercise

ZRO represents voting power on the LayerZero network. Couple that with the fact that the airdrop has been a success, with prices relatively stable, we think ZRO has huge potential. The thesis goes something like this:- LayerZero has an ever-expanding ecosystem. With every chain integrated, hundreds/thousands of new applications and users will be able to communicate with previously unreachable liquidity and applications.

- Since these chains now have a new "port" for Web3 immigration/emigration, they will likely want a say in managing that port.

- ZRO is the way to do this—it's a multi-chain token, so users don't even have to leave their ecosystem; they can keep their holdings natively.

- The speculative factor here is huge, which will attract investors who have no vested interest in anything other than making money.

Would you buy it?

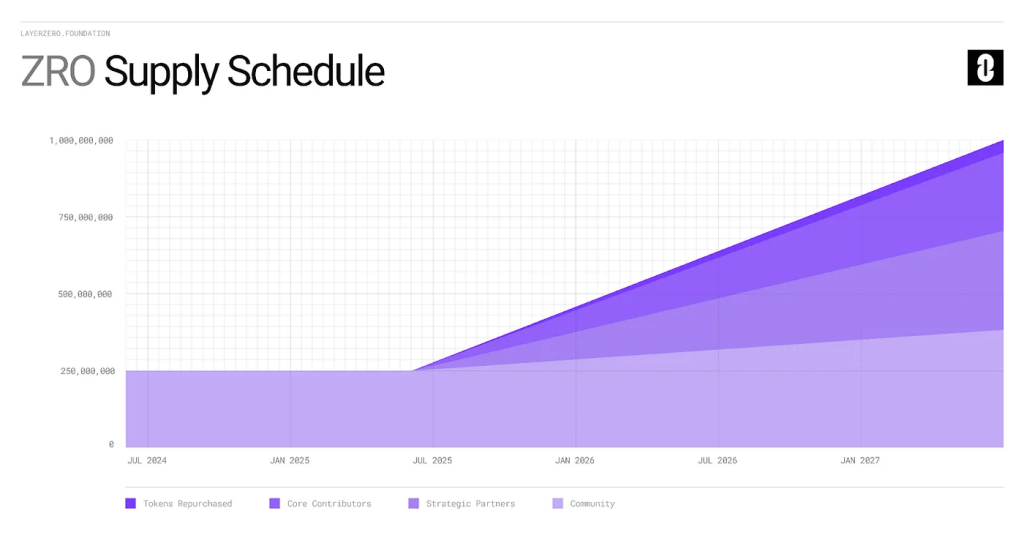

Based on that thesis, let's take a look at the current numbers:- Market cap: $420 million.

- FDV: $3.8 billion.

- Circulating supply: 110 million.

- Max supply: 1 billion.

We know that there are 83+ blockchains connected to LayerZero already, and ZRO is listed on a dozen centralised exchanges. Additionally, it is native to every single one of those chains - huge reach.

In terms of valuation, it is more based on potential reach to new investors - especially when the market takes an upswing again. Our timeframe (if applicable) for these targets is stated in brackets:

- Base case: $3 billion market cap, at $27.30 per token - a ~7x.

- Bull case (1-year): $7.5 billion market cap, at $68.20 per token - an ~18x.

- Best case (Q1-2026): $20 billion market cap, at $20b/(2*110m) = $90.90 per token, a ~24x.

Cryptonary's take

We've been monitoring LayerZero since 2022, and it's excellent to finally see the token launch—with success. Now, we're able to place some targets on it.The potential here really is huge - cross-chain messaging has always been our choice solution to the multi-chain problem.

LayerZero is the culmination of years of trial and error within the cross-chain space to find the best solution, and there is a chance that the protocol could become the dominant solution for most applications for years to come.