Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Let's start with the macro

July opened with risk-on sentiment across both crypto and equity markets. Total digital asset market capitalisation rose to nearly $4 trillion before settling around the $3.74 trillion mark by month's end. Bitcoin posted a new all-time high above $122,000, while Ethereum reached the 2025 peak of $3,848. These moves were driven in part by sustained demand from spot ETFs, with Bitcoin recording several $1 billion-plus daily inflows and Ethereum attracting $2 billion over a two-week span.

Early in the month, macroeconomic data signaled softening labor market conditions, briefly raising expectations for imminent FED rate cuts. However, labor data released on July 3 came in stronger than expected, with 147,000 jobs added and unemployment dipping to 4.1%. This diminished expectations for immediate monetary easing.

Political pressure on Chair Powell intensified as President Trump and Treasury Secretary Scott Bessent publicly advocated for rate cuts and hinted at Powell's potential replacement. This period of political volatility led to temporary downward pressure on bond yields and the dollar (DXY) but stronger labor data countered these effects soon after.

The Trump administration extended the tariff negotiation deadline with international trading partners from July 9 to August 1 which added uncertainty to the Fed's policy trajectory. Although markets saw short-term relief, concerns persisted that prolonged tariff negotiations could complicate monetary policy and delay easing further.

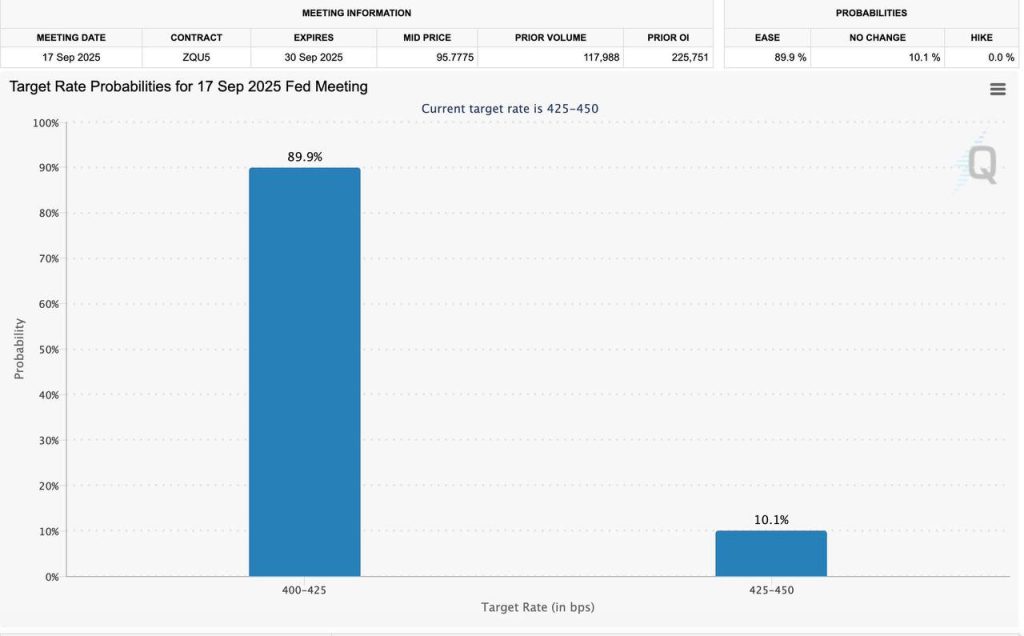

Mid-month inflation data (July 16) showed persistent price pressures with core inflation up 0.2% MoM. Markets responded by reassessing the likelihood of near-term easing and CME futures probabilities for a September rate cut dropped from 65.8% to about 50.8%.

Progress on the global trade front emerged on July 23 as the U.S. finalized a favorable agreement with Japan at a baseline tariff of 15%. However, unresolved negotiations with Canada and Mexico continued to pose risks with potential implications for corporate margins and credit spreads.

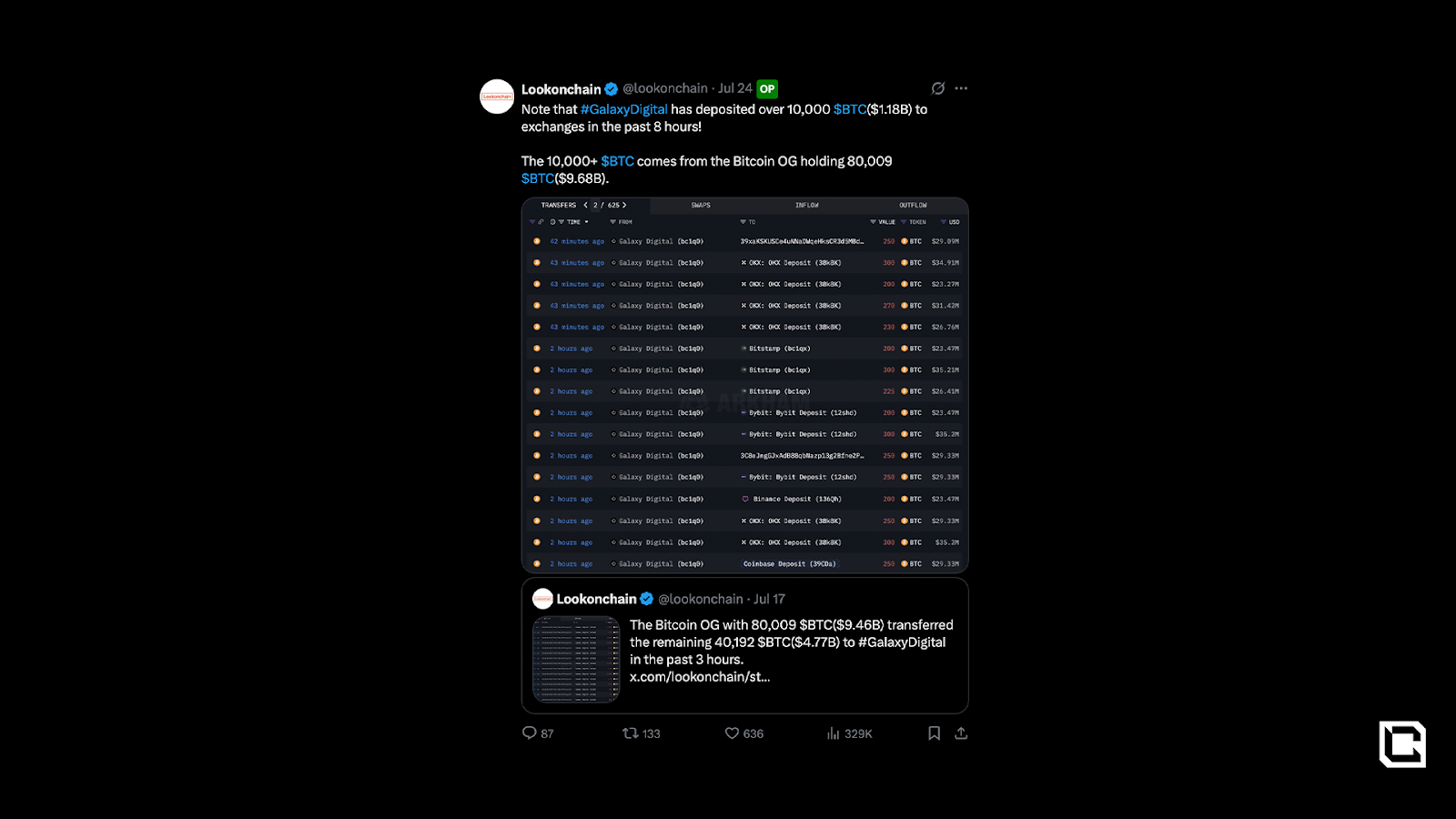

Later in the month (July 25th), Galaxy Digital executed a landmark sale of 80,000 BTC ($9 billion) on behalf of a Satoshi-era bitcoin investor. Initially the market pulled back, but buyers aggressively stepped in to absorb the sell pressure. As a result, Bitcoin ultimately held above $115,000 on the daily close for the remainder of the month. This sequence highlighted the growing maturity of the asset class and confirmed the strength of spot market liquidity under stress.

The policy landscape shifted yet again on July 28 with the announcement of a generational U.S.–EU trade agreement. The European Union committed to $750 billion in U.S. energy purchases and $600 billion in direct U.S. investments by 2028. A 15% baseline tariff on key industrial goods was also implemented. While presented as a growth catalyst, the agreement also introduced margin risks for U.S. manufacturers and added complexity to the inflation outlook.

By the final week of July, markets faced a packed macro calendar which included jobs data, PCE inflation, and a pivotal Fed meeting.

Ahead of the meeting, market participants projected a robust labor market (100K Non-Farm Payrolls; 4.2% unemployment). Powell's hawkish commentary on July 31 caused the implied probability of a September rate cut to fall sharply from 63.3% to 45.2%. Powell reiterated the Fed's data-dependent stance by emphasizing persistent inflation, labor market strength, and ongoing tariff uncertainty as key determinants.

Regulatory Milestones: U.S. Policy Breakthrough

Amid July's macro volatility, U.S. crypto regulation entered a new era. During "Crypto Week" (July 14–18), Congress passed two landmark bills with strong bipartisan support:- GENIUS Act: The first federal framework for stablecoins, setting clear requirements for issuers and reserves.

- CLARITY Act: Defined legal standards for custody, token classification, and on-chain issuance, eliminating much of the regulatory uncertainty that had kept major institutions on the sidelines.

The shift accelerated on July 31 when SEC Chair Paul Atkins announced Project Crypt; a modernisation initiative to bring tokenized assets, interoperable custodians, and decentralized market architecture under U.S. securities law. With this, the U.S. established a clear path for integrating blockchain-based finance with traditional markets.

Markets reacted positively. Regulatory clarity was broadly viewed as a structural tailwind for long-term adoption and innovation. The move particularly benefits well-capitalised and compliance-focused players ready to scale within the new framework.

Treasury Companies Drive Direct Crypto Exposure

July marked a structural turning point in the intersection between public equity and digital assets. A new class of publicly traded treasury companies emerged, each purpose-built to accumulate native crypto tokens as long-term corporate reserves.

At face value, the scale of capital deployment was staggering:

- StableCoinX raised $360 million to acquire ENA, with plans to list on Nasdaq under the ticker "USDE."

- CEA Industries completed a $500 million private placement to launch the first institutional BNB treasury vehicle.

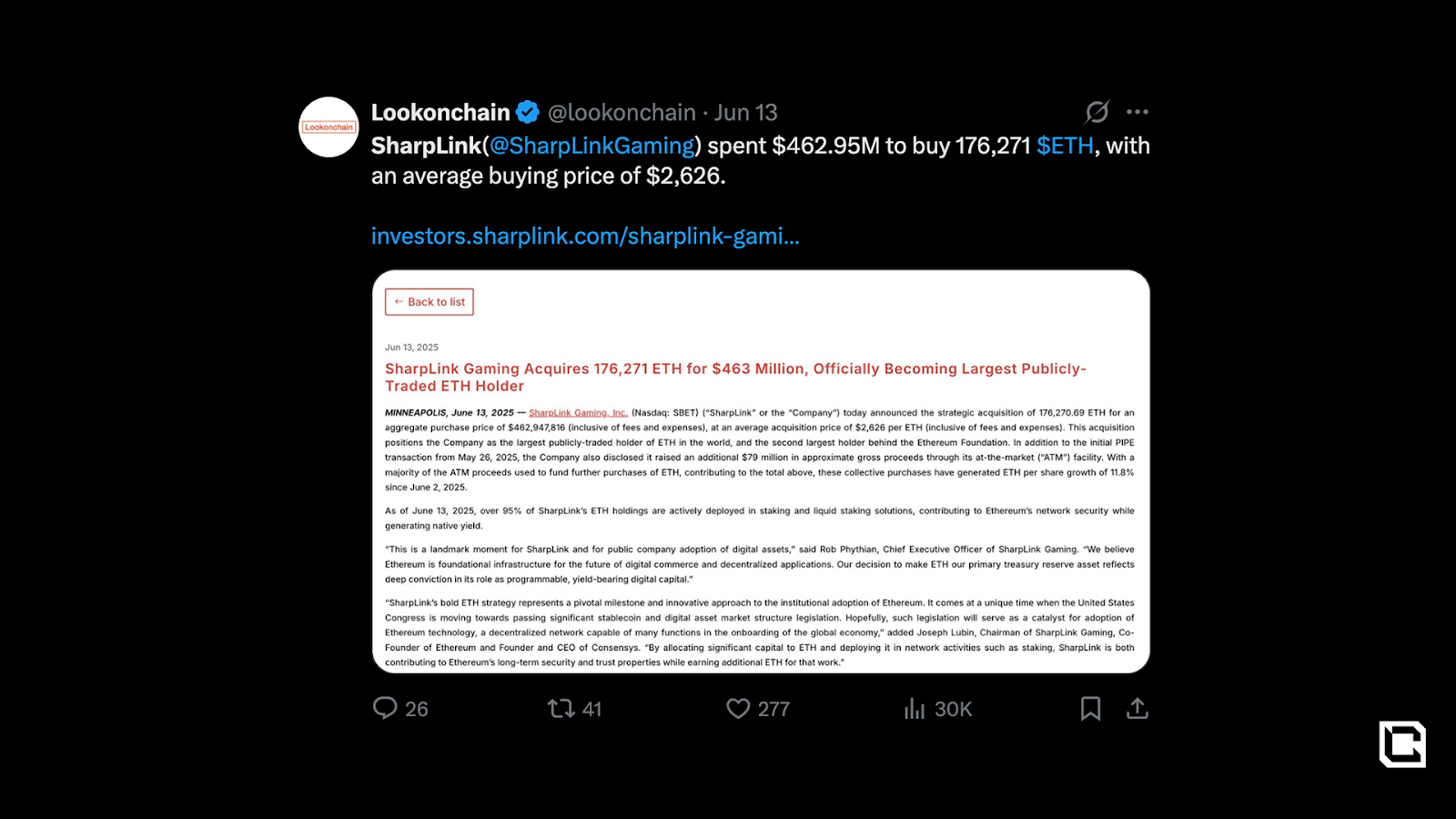

- SharpLink Gaming acquired 280,706 ETH, surpassing the Ethereum Foundation to become the largest corporate holder of Ethereum.

- Eyenovia expanded its HYPE position to over 1.3 million tokens, signaling long-term strategic alignment with the Hyperliquid ecosystem.

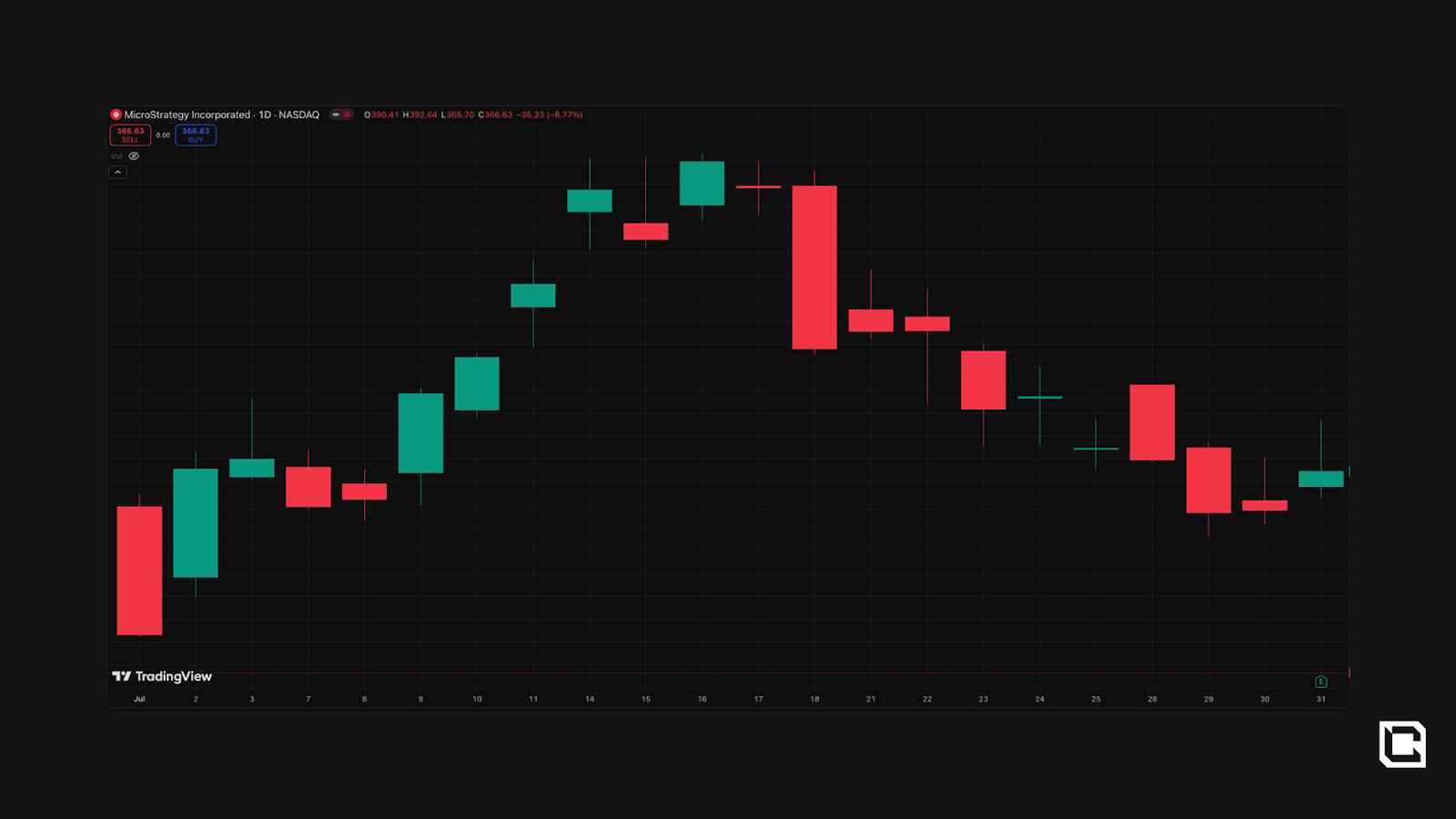

These moves signal a growing consensus within TradFi that direct token exposure is no longer experimental. It is being formalised as a long-term treasury strategy capable of generating shareholder value, yield, and protocol influence. The original blueprint was laid by Strategy's aggressive Bitcoin accumulation under Chairman Michael Saylor, which demonstrated that digital assets could serve as high-conviction corporate reserves. The current wave builds on that model by expanding into multi-asset exposure across ecosystems like Ethereum, BNB, Hyperliquid, and Ethena. With credible names like 10X Capital, Galaxy Digital alumni, and regulated public companies entering the fold, the barrier between traditional and on-chain finance continues to thin.

Still, there are clear risks. StableCoinX's $260 million ENA buyback is set to be executed in daily $5 million spot market tranches over a six-week window. In illiquid conditions, this type of mechanical buying may distort short-term price discovery and create localised euphoria, detaching market price from fundamental value.

This introduces a broader macro question: are these treasury vehicles a bridge to institutional legitimacy, or are they momentum buyers fueling a new bubble? The reflexivity is undeniable. Higher token prices raise the NAV of treasury companies, attracting equity inflows that fund even more token accumulation. The inverse is equally true. A breakdown in token price could trigger a feedback loop of NAV erosion, confidence loss, and impaired fundraising capacity.

There are also governance and exit risks. Projects like VAPE and StableCoinX claim they will never sell tokens, but that assumption remains untested at scale. Treasury dilution, forced selling during redemptions, or misaligned governance actions could become flashpoints in the next downturn.

In aggregate, the rise of crypto-native treasury companies marks a pivotal step forward for institutional involvement in digital assets. But the same dynamic that validates crypto as an investable asset class could also heighten fragility if not paired with proper risk management. These vehicles offer upside access for traditional investors, but they also introduce a new form of speculative reflexivity that must be monitored closely as the cycle matures.

PumpFun's Collapse: The Great Extraction followed by slow death

July marked a definitive shift for memecoins on Solana. Once hailed as a grassroots launchpad for internet-native culture, PumpFun has become a case study in extractive design and market disillusionment. From dominating fees and daily launches to bleeding out users, credibility, and market share, the $PUMP ICO and its aftermath crystallised the platform's fall from grace.

The $PUMP ICO: A High-Stakes Cashout

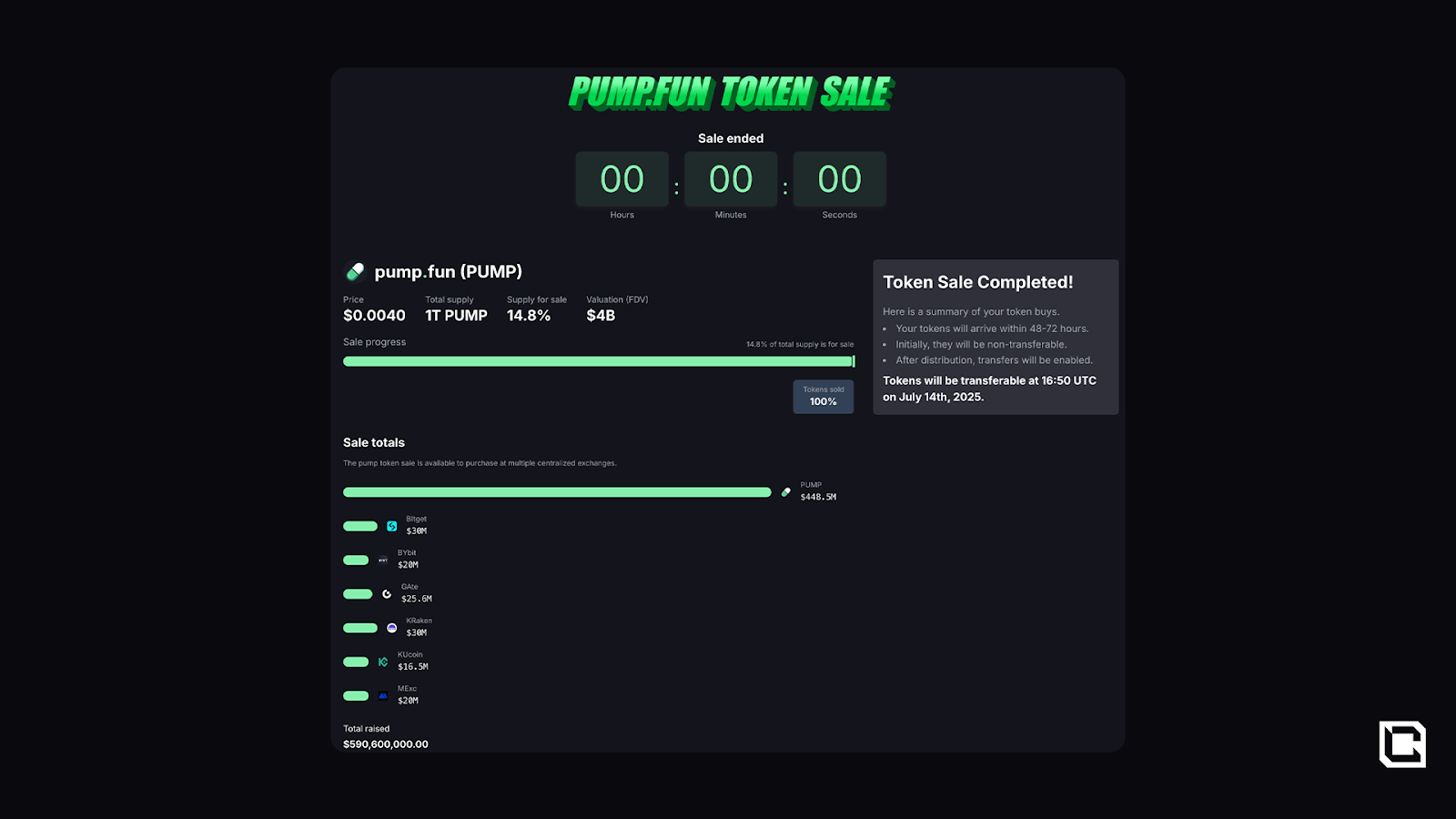

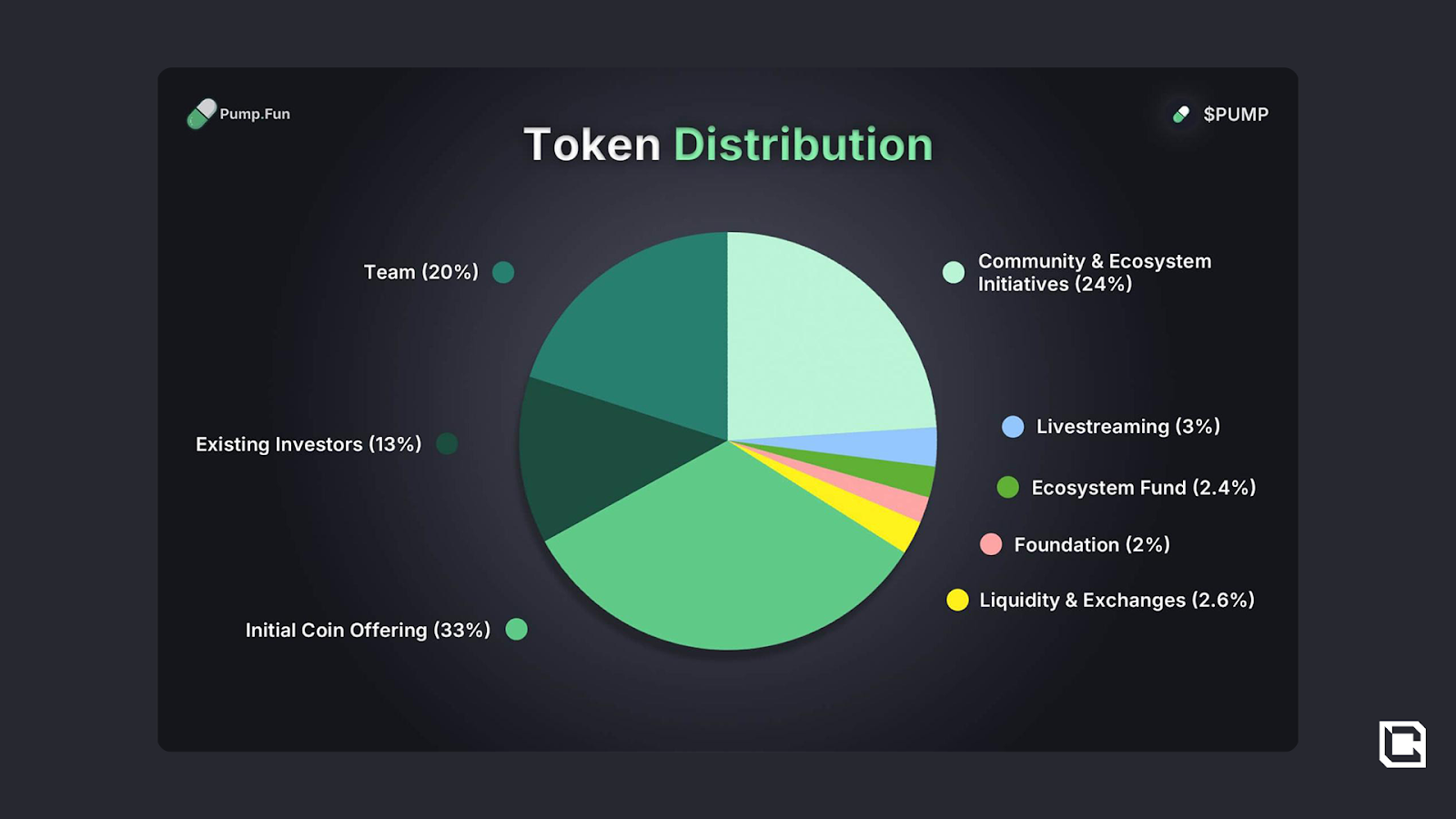

As we outlined our thesis here, the $PUMP ICO emerged as one of the most extractive launches of the year. The public sale raised $590.6 million on July 12, 2025, with tokens priced at $0.004 and an implied $4 billion fully diluted valuation. While pre-sale messaging suggested 33% of the supply would go to the public, only 14.8% was actually made available. The rest was disproportionately allocated to insiders: 20% to the team, 13% to existing investors, and another 24% labeled under loosely defined categories like "Community & Ecosystem" and "Livestreaming." No enforceable vesting schedules appear to have been applied. Tokens began trading on Hyperliquid even before transferability, allowing insiders to hedge or unwind positions while retail demand surged blindly into secondary markets.

As we expected, following the token sale, $PUMP briefly peaked at around $0.007 before entering a prolonged drawdown. As of early August, the token trades around $0.0026, reflecting a decline of over 60% from its post-sale high. Most market participants are now underwater. Although some sources estimate the total raise exceeded $1.3 billion across private and public rounds, the $590.6 million figure remains the most verifiable based on CEX sales data.

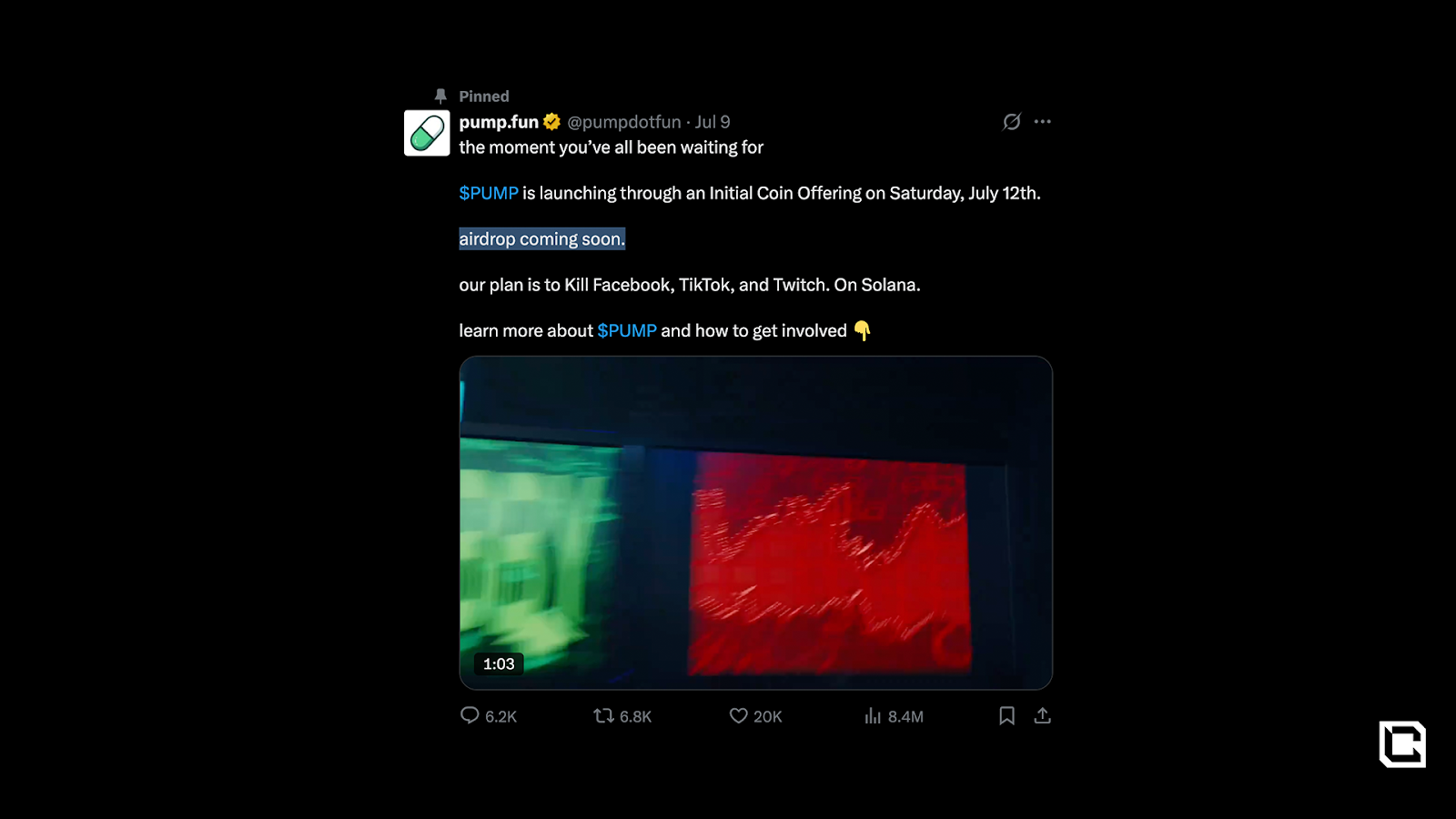

The Airdrop That Never Materialised

While not the sole driver of growth, the expectation of a $PUMP airdrop played a meaningful role in sustaining user engagement throughout Pump.fun's rise. No snapshot was ever confirmed, yet the narrative gained traction across social media, livestreams, and community channels. The possibility of retroactive rewards became an implicit incentive for continued participation, especially among users who missed early trading opportunities or leaderboard placements.

Over time, the airdrop evolved into a form of narrative scaffolding. Without formal commitments, vague references to future rewards were enough to keep users interacting with the platform. This ambiguity allowed the team to extract value from recurring activity while deflecting accountability. By encouraging belief in an undefined reward structure, Pump.fun effectively extended its lifecycle without delivering material benefits to its most active participants.

As of early August, no tokens have been distributed and no eligibility criteria have been released. The airdrop remains unconfirmed and unresolved. This absence has amplified existing frustrations, particularly among those who absorbed high transaction fees and slippage costs under the assumption that loyalty would eventually be compensated. The situation now serves as a case study as one of the most extractive platforms in the history of crypto.

Collapse and Cultural Rejection

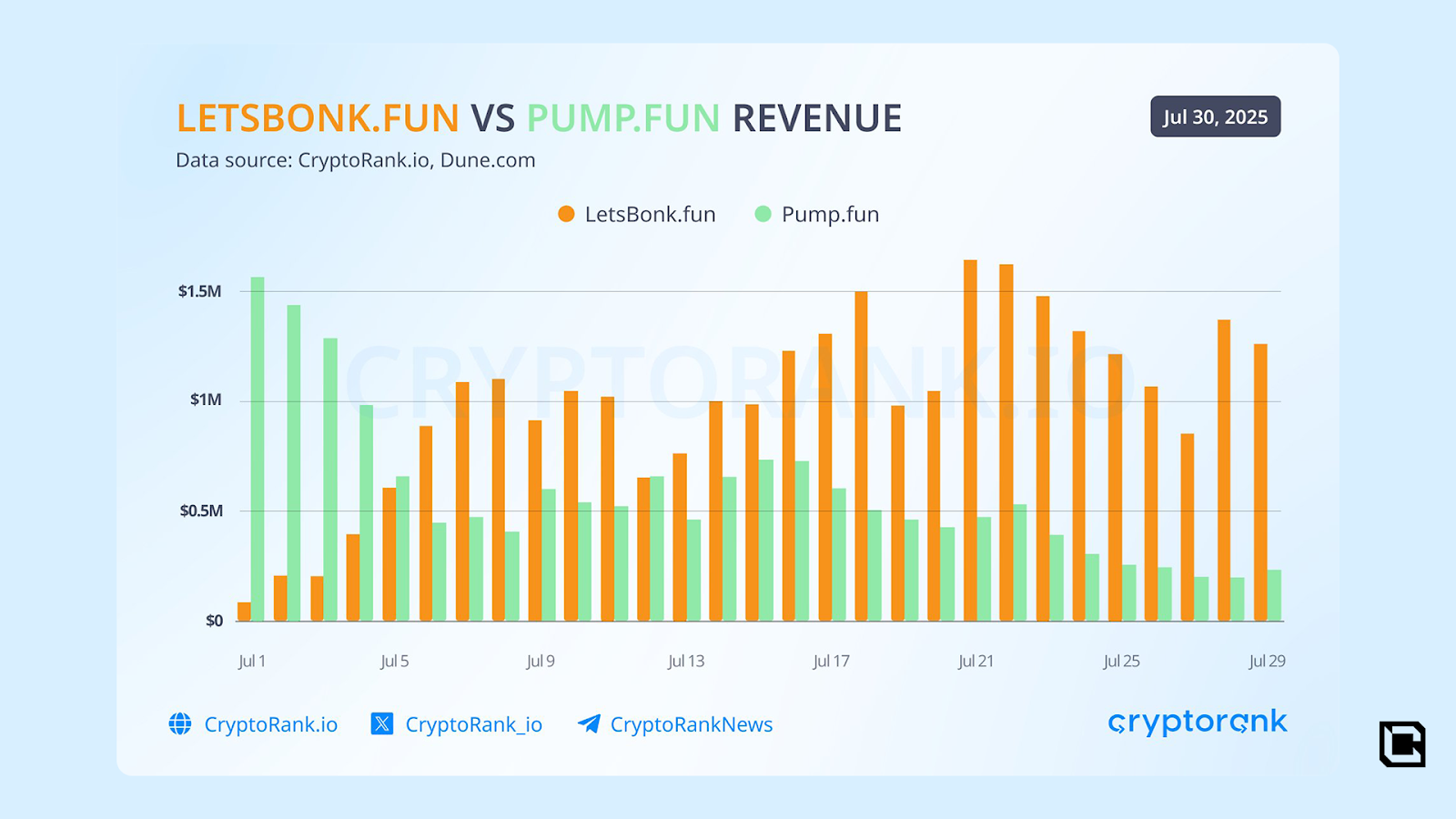

Pump.fun's dominance over Solana's meme coin ecosystem has unraveled at remarkable speed. Earlier in the year, the platform facilitated over 90 percent of new token launches. By late July, that figure had collapsed below 30 percent. Platforms like LetsBonk have gained traction by offering transparent tokenomics, fairer pricing mechanics, and more credible user experiences.

Even Orca, one of Solana's most trusted DEXs, launched its own meme token interface in a move toward greater transparency and user control.

Pump.fun's bonding curve model, initially perceived as innovative, fostered an environment shaped by bots, sniping, and unrecoverable losses. Most tokens launched on the platform failed to achieve sustainable market caps. As win rates deteriorated and the novelty faded, user engagement declined. However, the platform's deeper unraveling occurred on the cultural front. Livestreams linked to token launches began to spiral into increasingly grotesque territory. What started as irreverent humor quickly deteriorated into disturbing content, including acts of self-harm and animal abuse.

However, there is good in this story. Pump.fun's collapse does not signal the end of memecoins. It marks the conclusion of a phase defined by hyper-extractive design and unsustainable mechanics. The cultural anchors of the meme sector—DOGE, SHIB, PEPE, WIF, SPX, AURA—continue to hold relevance. These assets persist not because of novelty, but because they embody simplicity, recognisable symbols, and community-driven narratives that extend beyond market cycles.

What follows is not a rejection of memecoins, but an evolution of the standard. The next cohort is emerging with clearer value systems, fairer distribution models, and stronger alignment between participants and platforms. Aura is emblematic of this shift. It did not ride institutional capital, seed hype, or influencer syndicates. Instead, it built traction through sustained community coordination, memetic precision, and cultural credibility.

Aura's ascent has demonstrated multi-cycle potential. While legacy players transition into established fixtures of the meme economy, the next generation is not competing on noise alone. It is being shaped by systems that can retain attention, withstand volatility, and compound trust over time.

To read our full thesis on AURA's path toward a multibillion-dollar valuation, visit our report here.

Airdrop Win of the Month: Eclipse Everything

Back in February, we published an early report on Eclipse, outlining the clear risk-reward setup for users willing to engage. The thesis was simple: the point system, framed around "grass" accumulation, heavily rewarded early and sustained participation. Simply put, those who acted earned.

Since then, the outcome has validated that view. Participants who completed basic tasks such as bridging assets, holding ETH or SOL, and interacting with Turbo Tap received meaningful token allocations. In our case, the Eclipse airdrop returned thousands of dollars in value with no directional risk.

What made Eclipse different was accessibility. Unlike many recent airdrop campaigns that heavily favored deep liquidity providers, this one offered a path for smaller wallets to compete. Users could click the Turbo Tap cow to earn points passively, leveling the playing field in a way most protocols never do.

This wasn't the result of speculation or luck. It was the byproduct of understanding game design and acting decisively.

Eclipse reminded the market of a basic truth: participation still pays. We've said it before; airdrops remain one of the most efficient and reliable forms of asymmetric upside in crypto.

Cryptonary's Take

July 2025 was a month of sharp contrasts. Bitcoin and equities pushed to new highs while the macro backdrop grew more complex. Inflation remained persistent and trade uncertainty blurred the path of monetary policy. However, Bitcoin managed to make new all-time highs only to sell off by the end of the month.Despite the market pulling back in the last few days, we view this as a buying opportunity. If you are sidelined, August is the time to build spot positions in high-conviction plays (e.g. BTC, ETH, SOL, HYPE and AURA). We are still in the rate cutting cycle, and believe bull market dips should be bought. It is quite common to have 15% - 20% corrections in a bull market, but that doesn't invalidate the higher time-frame trend.

The recipe here is simple: buy the dip.

+1000

Cryptonary OUT.