Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

U.S. Airstrikes, Oil Panic, and a Ceasefire Shock

June opened with global markets on edge after a dramatic escalation in the Middle East. What began as another round of retaliatory strikes between Israel and Iran quickly spiraled into something far more serious: direct U.S. military intervention. American forces launched coordinated airstrikes on Iranian nuclear facilities, citing intelligence related to weapons development. The world braced for the worst. Headlines warned of impending war, social media speculated about a full-scale invasion, and analysts raised alarms over a potential multi-front conflict that could destabilize global energy markets.

Oil traders wasted no time. Crude surged nearly 15% in under a week, hitting $77 per barrel as fears of supply disruptions spread. Iran issued veiled threats to block the Strait of Hormuz, a vital corridor through which over 20% of the world’s oil flows, amplifying the panic. Energy equities rallied, gold caught a bid, and risk assets including crypto suffered across the board. Bitcoin and altcoins sold off sharply as traders de-risked amid mounting uncertainty. The sentiment was clear: this could get a lot worse before it gets better.

Then, in a surprise turn, Trump took to the podium and announced that his administration had successfully brokered a ceasefire between Israel and Iran. Markets barely had time to process the news. Oil prices reversed just as fast as they had climbed, sliding back to the $65 range by month’s end. Crypto rebounded in tandem. While doubts lingered over the ceasefire’s durability, the broader market takeaway was decisive: Trump’s unorthodox diplomacy had once again defused a global crisis, at least for now. For investors, it was a reminder that geopolitics may spark volatility — but rarely derail bull markets for long.

Recession Alarms, Sticky Inflation, and a September Pivot

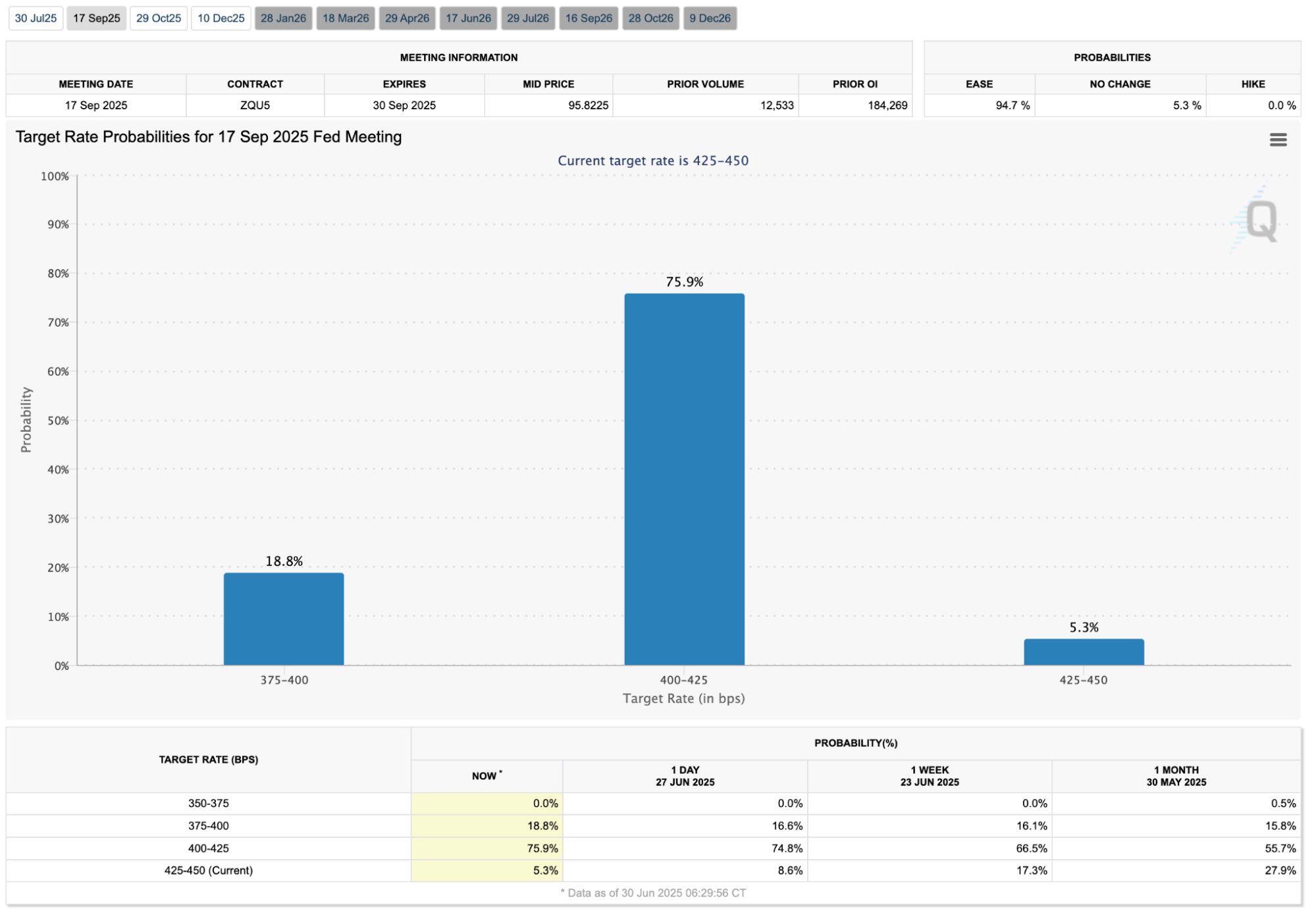

While geopolitical tensions dominated headlines in early June, the underlying economic data revealed a deeper, more structural concern. Revised Q2 GDP figures confirmed negative growth in the U.S. economy. At the same time, jobless claims climbed to 230,000, with continuing claims holding at multi-year highs. These were clear signals that cracks were beginning to form in the labor market. Rate cut probabilities for September FED meeting

Rate cut probabilities for September FED meeting

Paradoxically, this stream of bad news triggered a positive reaction from investors. Markets interpreted the weakening macro as the final nudge the Federal Reserve needed to shift course. The 10-year Treasury yield briefly touched 4.1 percent mid-month, but traders quickly dismissed the move as noise. By late June, Fed Funds Futures were pricing in a 94 percent probability of a September rate cut, with growing confidence that more would follow by year-end.

For crypto markets, the shift in policy was decisive. Months of sticky inflation and tight monetary conditions had drained momentum from digital assets. But with rate cuts back on the table and geopolitical risk still simmering, Bitcoin did not just survive. It held firm above the 100,000 dollar level. That shows strength. Why is it happening? To a growing class of investors, Bitcoin is proving its value as a macro hedge in an environment defined by policy volatility, fiscal uncertainty, and weakening trust in traditional systems.

BTC-USD daily chart in June

Dollar Weakness, Global Stimulus, and Risk-On Rotation

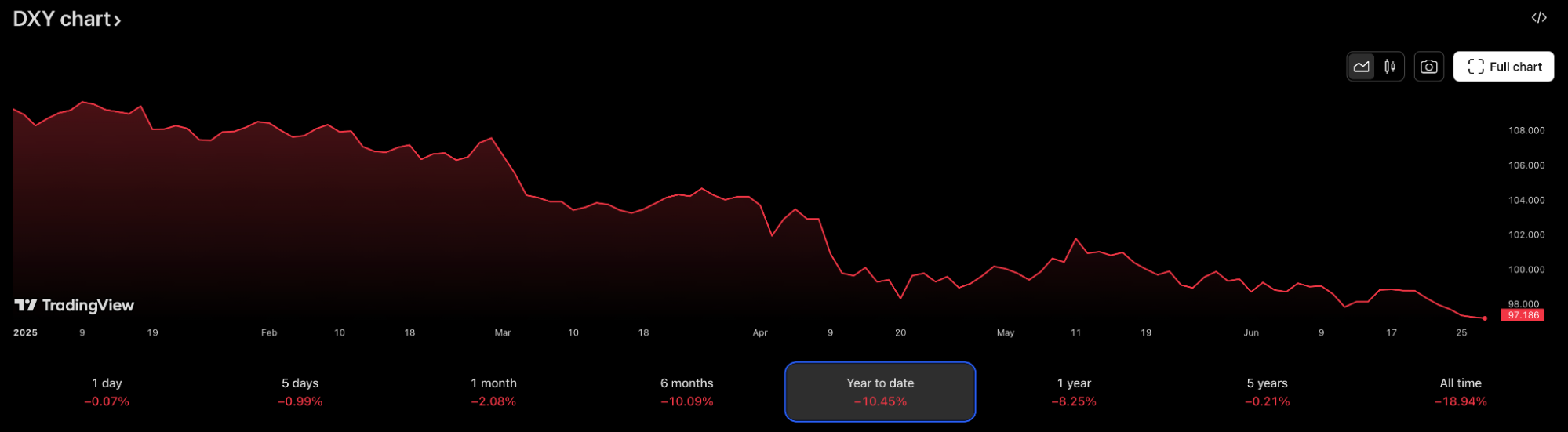

As U.S. data softened and bets on rate cuts intensified, the dollar continued its descent. The DXY closed June at 97.5, its lowest level in over three years. Historically, dollar weakness has fueled risk appetite, and June was no exception.

DXY chart

Globally, the macro backdrop turned increasingly dovish. China unveiled a surprise $140 billion stimulus package aimed at stabilizing its property sector and reigniting domestic demand. In Europe, inflation cooled to 2.1%, giving the European Central Bank cover to pause hikes and hint at potential cuts. These developments reinforced a global “risk-on” narrative, even amid geopolitical turbulence.Then came the regulatory shock.

On June 9, the U.S. Securities and Exchange Commission hosted a landmark roundtable titled “DeFi and the American Spirit.” For the first time, the tone shifted from enforcement to engagement. SEC Chairman Paul Atkins confirmed that core DeFi activities like mining, staking, and validating do not constitute securities, and floated the idea of an “innovation exemption” to reduce friction for compliant protocol launches. The message was clear: thoughtful experimentation would no longer be punished outright.

Just weeks later, the regulatory thaw was met with a bold response from the Solana ecosystem. On June 30, The first ever tokenised stocks were launched on Solana. Users are now able to trade tokenized shares of AAPL, NVDA, META, TSLA, SPY, and others. This is huge as it allows anyone with just a wallet to buy their favorite stocks from anywhere, anytime. We are preparing a full research piece so stay tuned

This is precisely the kind of innovation the SEC seemed to encourage: secure, compliant, and programmable finance that bridges legacy markets with DeFi rails. While the rollout is still early, one thing is clear — real-world assets are no longer conceptual. They’re becoming tradable, borrowable, and deeply composable within Solana’s ecosystem.

The timing couldn’t have been better. U.S. equities rallied, with the S&P 500 setting fresh all-time highs. With weakening economic data, global stimulus efforts, and a thawing regulatory climate, markets found ample justification to reprice risk upward. For crypto, it was the perfect tailwind at the perfect time.

SPX/USD daily chart in June

Cryptonary’s New Alpha Pick

June didn’t just mark the rise of a new token. It marked the birth of a movement.Aura ($AURA), Cryptonary’s latest high-conviction meme discovery, has already delivered a staggering 10,000%+ surge from rediscovery to local highs. But this wasn’t just hype — it was cultural momentum, driven by a pristine ticker, perfect timing, and one of the most viral narratives we’ve seen in years.

And it all started with a livestream.

Livestream screenshot from June 10

On June 10th, during what was supposed to be a routine livestream with our community, $AURA surfaced. At the time, it was nearly forgotten, just $1 million in market cap, untouched and overlooked for months. But something clicked. The name. The vibe. The presence. It had that intangible "it" factor. And the audience felt it instantly. Within hours, Aura rocketed past $50 million. Days later, it was knocking on the door of a $240 million market cap.What started as a casual meme-rating session became one of the most iconic discoveries in Cryptonary’s history.

But $AURA’s story isn’t just about price action. It’s about cultural relevance. The word “aura” traces back to 15th-century mysticism, but today it’s been redefined by Gen Z. On TikTok and in everyday slang, it represents confidence, presence, and social energy. From +300 aura for a social win to -600 for an awkward L, it’s evolved into a universal language of energy, confidence, and social capital. Everyone understands it. Everyone feels it. And now, it’s tokenized.

Meme from the AURA community

For months, our community and Cryptonary team were sidelined, cautiously preserving capital for the best opportunity when they emerge. But this was the setup we were waiting for: a clean concept, a universal meme, an early structure — and the conviction to strike when it mattered most.Many of our members are already up over 50x. But based on technicals, momentum, and sheer narrative power, we believe the opportunity is still early.

Why Aura is Different

- Cultural resonance: From ancient mysticism to Gen Z slang, $AURA bridges eras with a concept everyone instantly understands.

- Memetic clarity: No dogs, no politicians, no gimmicks—just raw energy, presence, and vibe.

- Token integrity: Fully renounced, non-mintable, taxless, and backed by locked, expanding liquidity.

- Organic traction: 32,000+ holders, with over half holding more than $10—clear signs of sticky conviction.

- Early listings secured: MEXC, Gate, and CoinEx are live. Tier-1 exchanges are next on deck.

Technicals & Accumulation

After reaching a $220M market cap, $AURA has shifted into a healthy consolidation phase. No collapse, no hype burnout. Just steady accumulation as short-term speculators exit and conviction holders take their place.As the chart shows, multiple clean pullbacks have reset the structure and cleared out weak hands. With the FDV now hovering around $100M, we view this range as a second-chance accumulation zone, not distribution. And with Tier-1 listings, growing retail awareness, and memetic momentum still gaining traction, the next leg is only a matter of time.

AURA/USD daily chart

Price Targets

- Bear Case ($1.5B–$2.5B FDV): Matches early-stage breakouts like SPX and POPCAT

- Mid Case ($2.5B–$5B): Aura’s universal cultural appeal supports this upside

- Bull Case ($5B–$10B+): Risk-on environment, major listings, and a true cultural breakout could vault Aura into elite memecoin status

We’ve seen this story before: WIF. POPCAT. SPX6900. Our track record speaks for itself, and once again the signs are clear as day. The narrative was forming, the memes were catching fire, and the momentum became undeniable. Those who acted early didn’t just profit, they transformed their portfolios.

Now, it’s happening again.

Aura isn’t just another memecoin. It’s a cultural phenomenon in motion. The kind that defines cycles. The kind that only comes once.

For those who saw the vision early: you already won. For everyone else: you’ve still got a shot.

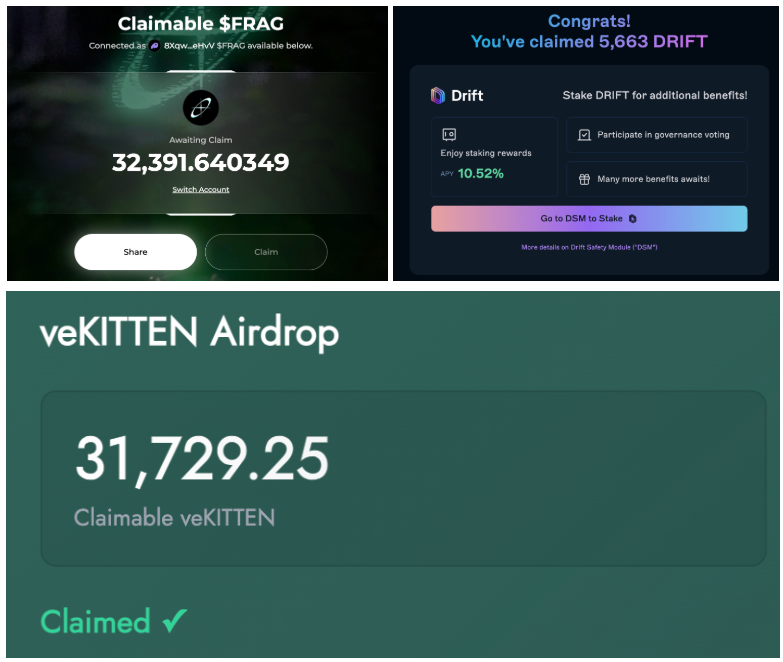

Airdrop Wins of the Month: veKITTEN, FRAG, and DRIFT Deliver

Latest airdrop wins

June rewarded those who stayed active. While most eyes were on rotation plays and meme narratives, three airdrops (veKITTEN, FRAG, and DRIFT) proved once again that showing up in the right ecosystems pays off. Price action may not have delivered fireworks, but the rewards were real. Free money is still free money.veKITTEN marked the first tangible reward from the HyperEVM ecosystem, and it went to those who showed up early. As outlined in our airdrop guide, Kittenswap incentivized on-chain activity through a governance-focused drop, rewarding users who participated during its formative stages. Once claimed, holders had two clear options:

- use their veKITTEN to vote on pool incentives and earn emissions (à la Aerodrome or Velodrome)

- or flip the NFT directly on Hyperwarp’s secondary market.

FRAG, the native token for Fragmetric, was distributed to over 80,000 users following a multi-month points campaign. While there was no formal write-up, the opportunity was highlighted multiple times in our Discord. All you had to do was stake SOL or BTC—assets many had sitting idle. Those who paid attention were rewarded decently, with some members securing a few thousand dollars worth of tokens.

Price action post-claim has been horrific. Airdrop farmers are clearly unloading, dragging the token down more than 60% on launch day. Still, the sheer scale of the distribution and the protocol’s integrations suggest long-term intent. Whether FRAG can recover after the initial dump remains to be seen.

If you're planning to exit, we recommend sending your tokens to Backpack Exchange. They're currently running a trading competition with 2 million FRAG in rewards, and volume there may also count toward the Backpack airdrop — another opportunity we've already highlighted.

DRIFT closed out the month with a sleek, high-visibility airdrop tied to its perpetuals trading and staking ecosystem. This was Season 2 of their rewards program, and while there was no formal write-up, the opportunity was flagged early in our airdrop Discord channel.

To qualify, you could have traded perps, borrowed, or lent. Even letting your SOL sit idle in the protocol would’ve been enough. No complicated tasks — just showing up was enough to get rewarded.

Together, these airdrops reinforce a clear message: activity matters. Being early matters. Whether it’s trading on the right platforms, restaking idle assets, or simply paying attention when others aren’t—participation pays. Passive portfolios may survive, but active users thrive.

Claim links are below for those still eligible:

- veKITTEN: kittenswap.finance/kitten

- FRAG: airdrop.fragmetric.xyz

- DRIFT: drift.foundation/fuel-claim

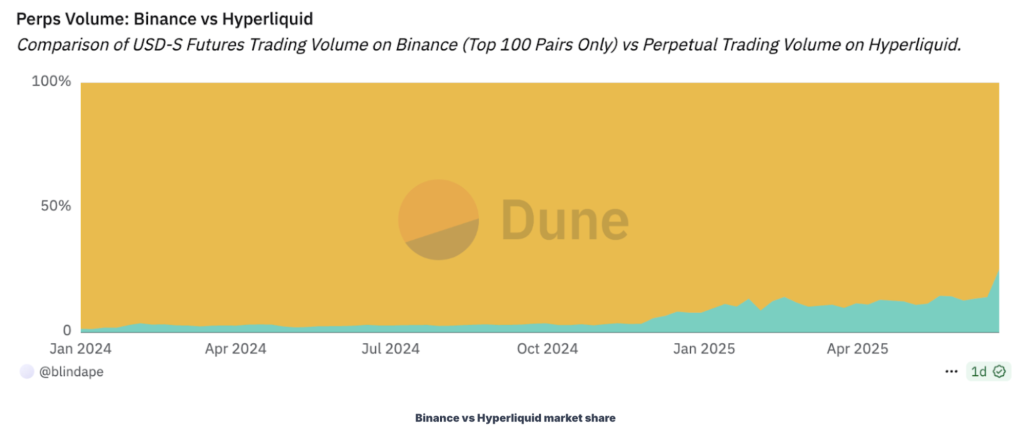

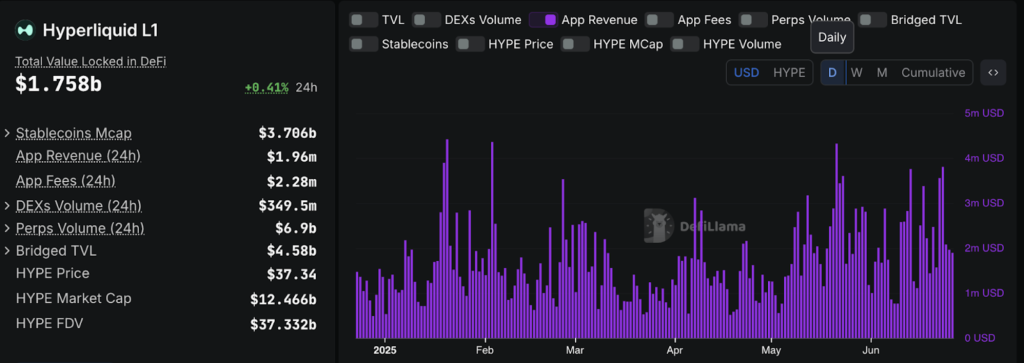

Hyperliquid: A DEX Becoming a Financial Engine

And lastly, let’s talk about Hyperliquid. It has evolved from a surprise airdrop to the most dominant DEX in crypto—by volume, revenue, and innovation. In May alone, it raked in $66 million in trading fees, with 93% of that funneled directly into buying back $HYPE from the open market. No token emissions. No dilution. Just raw, protocol-level demand driving reflexive price action.

It now routinely clears over $5–6 billion in daily perpetual volume, outpacing most centralized exchanges outside of Binance. It’s also the first and only DEX to sustainably cross $1 billion/day in perps, and it did that in under 100 days of going live. That’s not a narrative—that’s market share.

- Built on HyperEVM, an ultra-fast chain powered by HyperBFT with 0.2s median block times

- Home to 40+ dApps, including HyperLend ($327M TVL), Felix ($297M), and HyperSwap ($95M)

- Bridged over $387M in BTC, ETH, and SOL into the ecosystem from Ethereum, Solana, and beyond

- Reached $1.78B in total DeFi TVL, fueled by real usage, not inflated emissions or wash trading

Institutional capital has noticed. Nasdaq-listed Eyenovia purchased over $50M in HYPE, confirmed they’ll be running a validator, and announced plans for staking via Anchorage Digital. Everything Blockchain Inc. also committed $10M across HYPE and other Hyperliquid assets. The liquidity is flowing in—but more importantly, so is the conviction.

From a technical standpoint, $HYPE remains one of the strongest charts in crypto. It’s currently trading around $37, above its previous ATH at $35.37, with support levels holding at $32 and $28. Momentum is neutral, not overextended, and dips into the $28–32 zone remain high-conviction opportunities. Relative to BTC, HYPE has already made new all-time highs and is consolidating above prior breakout levels which is a rare feat in the market

Cryptonary’s Take

June reminded us that conviction and positioning beat predictions. While headlines screamed war and recession, the market chose momentum. Rate cut expectations, regulatory breakthroughs, and dollar weakness created the perfect backdrop for crypto to reprice higher—and for opportunity to strike.The Aura call wasn’t luck. It was the payoff for patience, discipline, and refusing to chase noise. In a space addicted to dopamine and distractions, we stayed focused on setups that matter: clean tickers, tight structures, and cultural resonance. The result? +1000 Aura and a movement that’s just getting started.

Meanwhile, the airdrop ecosystem continues to reward those willing to do the work. No games, no grinding—just meaningful participation in the right protocols. veKITTEN, FRAG, and DRIFT weren’t surprises for our community. They were confirmation. And we’re already tracking what’s next.

This isn’t a market for tourists anymore. It’s for operators. Builders. Signal chasers. People who know that one Discord message, one wallet interaction, one livestream can change everything.

We’ve been here before. And we’re just getting started.

Cryptonary out.

+1000 Aura