TLDR

- Over $9m was extracted from one of the most hyped ICOs recently, leaving many participants shocked by how the sale played out.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What happened?

TroveMarkets ran an ICO marketed around a Hyperliquid-based perp DEX for assets like Pokémon cards, CS skins, watches and other exotic assets. It raised roughly $11.5M, despite a stated $2.5M target and $20M FDV pricing.The ICO was heavily hyped on social media, with multiple KOLs pushing it aggressively across timelines.

Even though we’ve participated in previous ICOs where there was a clear playbook to hedge risk and capture the spread, we passed on this one because we didn't see the play here.

Regardless, Trove raised around $11.5 million in an ICO/presale originally tied to building within the Hyperliquid ecosystem. The initial target was far smaller (around $2.5M), but demand pushed the raise dramatically higher because it was oversubscribed. However, the catch was that it was a commitment-based sale initially, which means people tend to over-commit intentionally because they assume allocations will get scaled down. That’s the standard playbook: you commit big, expecting you’ll be diluted, and you end up with a manageable fill.

But instead of sticking to the original cap, the team effectively just raised it, meaning people ended up risking way more than they meant to, and Trove could raise a lot more capital than the sale was originally framed around.

ICO ran from January 8 to January 11, and stayed relatively smooth… until the final minutes. Just before the sale was set to close, Trove amended the ICO contract to extend the sale, triggering immediate confusion.

Then came the reversal: the team walked the extension back shortly after, turning the end of the sale into a mess. And in the middle of that chaos, accusations started circulating that team members were placing TGE bets on Polymarket with information the market obviously didn’t have.

Undisclosed Promotions

Trove’s rapid fundraising was inseparable from its social media presence. A huge part of why Trove got as big as it did, that fast, was hype.Ahead of the ICO, Trove was everywhere: timelines, group chats, quote tweets. A lot of the hype didn’t feel organic either. And in hindsight, that matters, because it helped pull in a ton of retail size.

Multiple people in the crypto community shared screenshots alleging that Trove (or people close to the team) were offering paid promo deals to KOLs. Essentially: “post about this, we’ll pay you, easy deliverable.” Some even claimed they were offered meaningful amounts and chose to decline.

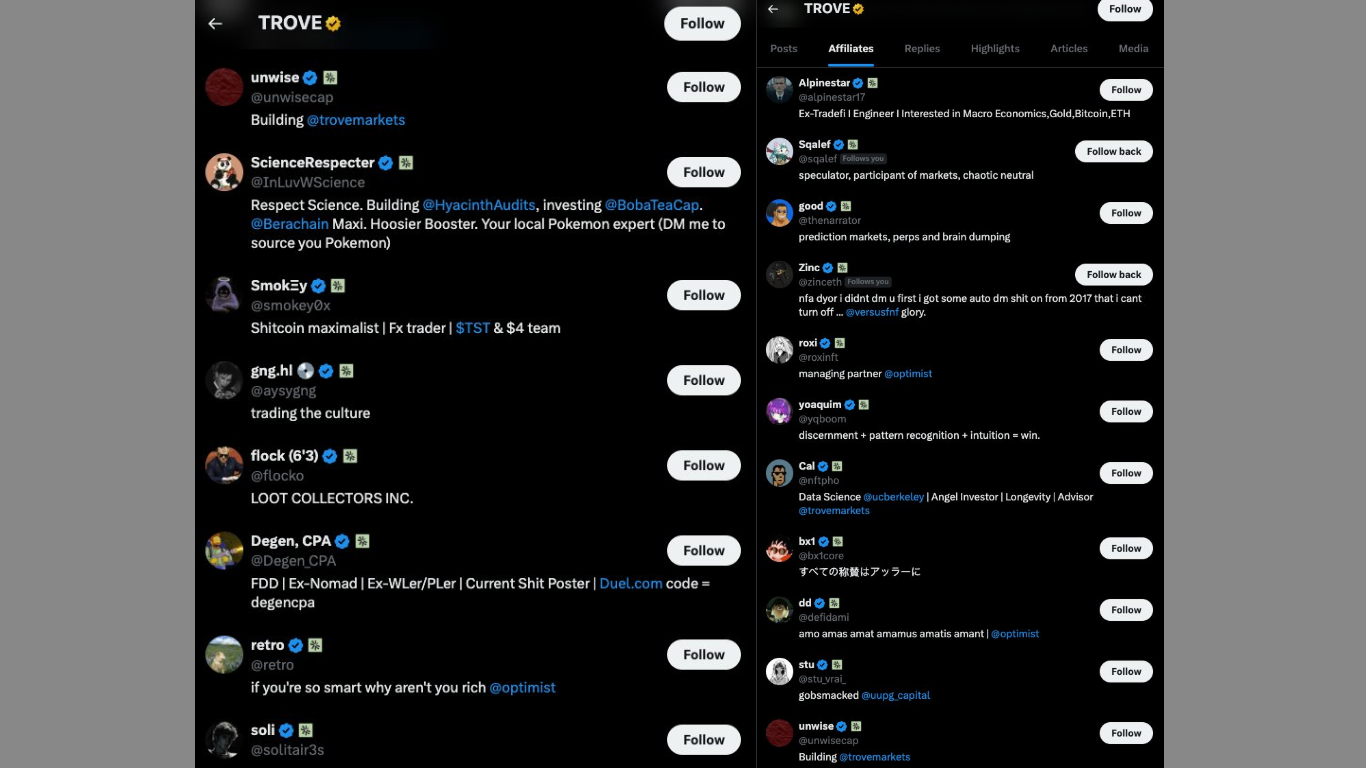

At the same time, we had a visible wave of KOLs suddenly wearing Trove badges, promoting and pushing the sale details aggressively.

Below is a list of the KOLs involved; it is quite extensive, which helps explain the level of hype generated. However, this type of coordinated promotion creates highly inorganic buzz, and whenever it occurs, it is important to remain sceptical. It may also be useful to keep the following account in mind for future reference.

List of KOLs who promoted Trove

Pivot to Solana and TGE

Then came the part that completely changed the nature of the deal. After raising the money around a Hyperliquid-based perp DEX narrative, Trove suddenly pivoted away from Hyperliquid and moved to Solana. It was a sudden rewrite of what people thought they were funding.Because it’s one thing to raise $11.5M and change timelines. It’s another to raise $11.5M on one premise, then pivot chains right after, leaving people feeling like they bought into a product that effectively no longer existed in the form it was marketed.

And it got worse.

ZachXBT pointed out that portions of the funds raised were routed into gambling/ casino-linked addresses, instead of staying parked transparently for product development and runway.

Even if you ignore everything that happened before, the TGE itself was a disaster.

The token listed at around ~$1m FDV with only ~$60k of liquidity behind it, meaning the market was paper-thin from the first second. This is not merely poor execution but a fundamentally irresponsible setup that predictably enabled extreme price manipulation. Given how obvious these dynamics are, it is difficult to view this as accidental to be honest…

And unsurprisingly, it didn’t take long for things to break.

Within hours, the FDV collapsed to roughly ~$500K, which tells you everything: there was no real depth, no real support, and no real plan for a clean open market.

Trove chart right after TGE

Under massive collective pushback, the Trove team published an update explaining what they were keeping (from raised funds) and why. Many hoped that they will get refunded…

Polymarket odds of Trove team refunding ICO participants

However, from the total raise, Trove said they would retain $9.3m to continue building (now framed as a Solana perp DEX), while only $100,000 would be automatically refunded back to ICO participants. It’s tough because most people who participated in this ICO have been simply rekt on this one.They also claimed they had already refunded $2,4m as part of “cleaning up participation and protecting distribution integrity”.

Lessons/ Red flag checklist

It is unlikely that people will be made whole here, however, there are some important lessons to learn from this incident:1. Heavy KOL push

One of the earliest warning signs is a heavy KOL push relative to substance. Heavy reliance on influencers, especially when they dominate discourse more than product related topics, often signals an attempt to manufacture demand rather than demonstrate value. While marketing is necessary, hype that precedes code, users, or verifiable milestones should be treated with skepticism. Anytime it feels inorganic, it likely is…

2. The team isn’t doxxed

Team transparency is another critical factor. Anonymous teams can build great products, but in fundraising events, it massively increases counterparty risk. If things go wrong, there’s no accountability. It is important to check the track record of the team before committing funds to them

3. Don’t oversubscribe

Commitment-based sales make people over-commit because they expect dilution. If the cap gets lifted or terms change, you can end up risking way more than intended. Risk management is key here, don’t let greed overtake basic risk management.

4. Team communication matters

Poor comms = poor project, especially in early stages. If they do sudden pivots, last-minute contract edits, or change ICO details mid-flight, treat that as a serious red flag. Get out asap.

Cryptonary’s take

The market is maturing, but incidents like this are a reminder that the old games haven’t gone away yet. What happened with Trove was a textbook extraction, executed using familiar mechanics that continue to work because the market allows them to.A lot of people got burned here, and that’s exactly why the crypto community must push back hard against this kind of behaviour. The only path forward is ruthless accountability and proper due diligence from participants.

At a time when institutional capital is increasingly moving on-chain, and adoption continues to rise, the market should not be rewarding this kind of behaviour.

Peace!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms