Sometimes, the crypto market can also be highly inefficient. In other words, assets can be misvalued, especially when focused on only specific sectors.

However, such inefficiency creates opportunities for smart investors to filter the signals from the noise and identify undervalued gems.

The first time we wrote about Kwenta, we said it would deliver 3x to 6x gains in 4 months; it did 3x in 20 days – don't fade our calls.

We were right about this coin once; can we be right again?

Let's find out…

Key questions

- Remember our Kwenta call from February? We had a price target of 3x to 6x in 4 months – it did 3x in 20 days. Don't fade our calls.

- Now, Kwenta is trading at a much lower price than our initial recommended entry price. Is Kwenta's current market cap telling the whole story? We dive into some surprising numbers.

- What major move is the Kwenta team planning that could shake up the token's value?

- And more importantly, is it time to get off the Kwenta train, or is another bullish wave about to begin?

- What's our long-term outlook for Kwenta, and how does it fit into the 24/25 cycle?

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

A quick primer

We covered Kwenta in February and presented it as a 3x-6x opportunity with a 4-month timeframe.For those who missed it, Kwenta is a decentralised derivatives trading platform built on top of Synthetix. It leverages Synthetix's debt pool and offers perpetual futures with up to 50x leverage.

Our thesis was based on Synthetix and Kwenta's expansion to Base with drastically improved tokenomics and potential revenue share.

As expected, Synthetix and Kwenta launched on Base, and we were early to catch the move.

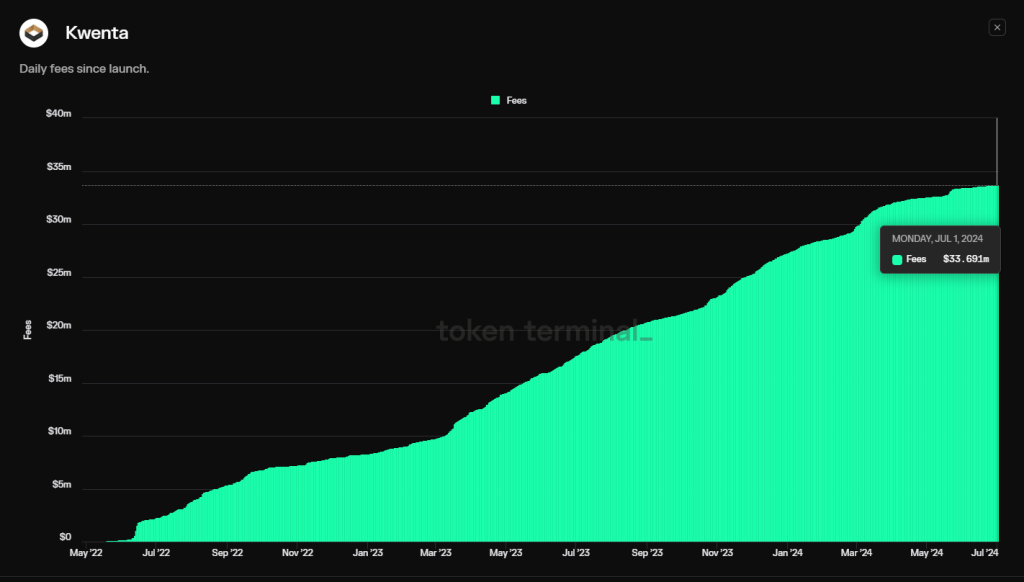

Further, we estimated that launch on Base would increase Kwenta's annual fees from $20m to $30m. In reality, Kwenta is generating around $33m in fees annually, slightly higher than our projection.

Following the expansion, the price of Kwenta has increased from our floor price of around $61 to $178 in just 19 days, resulting in 2.92x.

Even though the move missed our targets by 0.08x, our thesis played precisely as we expected, and if you followed us, the trade should have made you money.

However, Kwenta repeatedly tried to break the $178 resistance but failed twice, resulting in a pullback which was further exaggerated by the macro environment.

To make matters worse, a whale capitulated at around the $60 price point, accelerating a spiral to $35. Then, Kwenta touched the $24 level before bouncing back quickly to $30.

Currently, Kwenta is trading significantly lower from the price we recommended entering. It is down roughly 50% from our recommended entry prices in February.

What are your options if you haven't taken any profits and ended up holding a bag?

Should you cut your losses, or is it a bottom?

Investment thesis

If you have been holding Kwenta since the top, should you cut your losses or start DCAing? We believe selling at these prices would be a mistake.We believe it is essential to hold at these levels, or better still, to start DCAing slowly into the asset for the following reasons.

Fundamentals

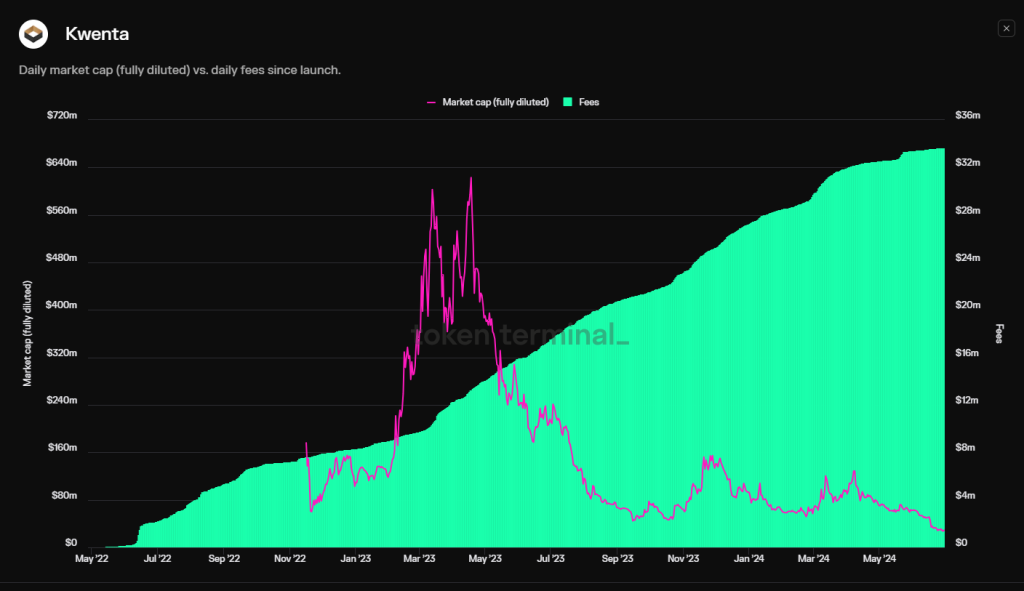

The token is at all-time lows, but protocol fees are at all-time highs. Over the last year, Kwenta has generated over $33m in fees.However, Kwenta's current circulating market cap is around $13m. That is an extremely low P/E ratio of less than 0.5.

From a business perspective, buying the whole platform would generate everything you paid for it in less than half a year. In our honest opinion, that is a really cheap valuation.

Kwenta's fundamentals and market cap are extremely divergent, and the market is ignoring this.

Kwenta buybacks

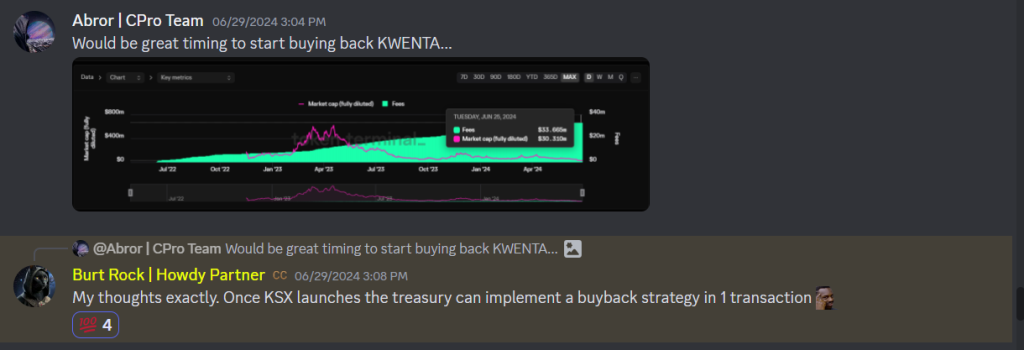

Fortunately, Kwenta's team acknowledges that the token is highly undervalued and plans to buy back the Kwenta tokens from the fees generated to its treasury.

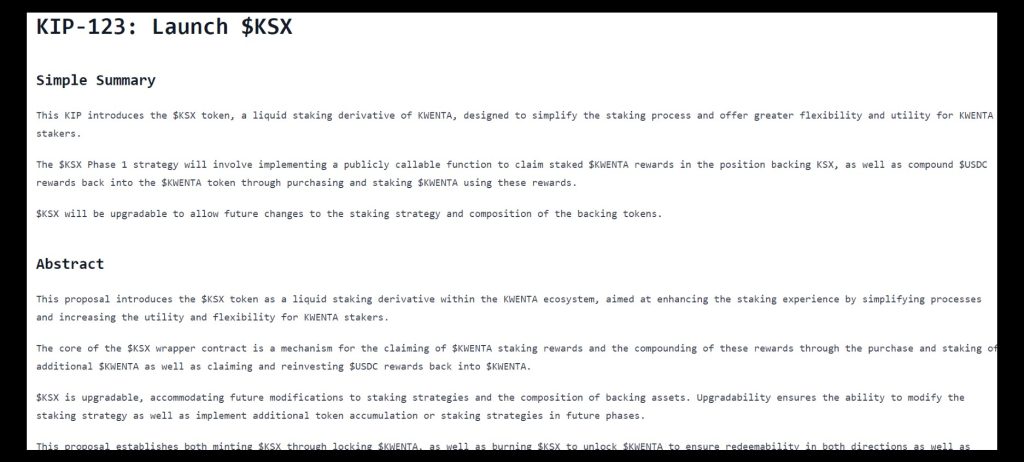

There is a proposal to launch a liquid-staked token for Kwenta called KSX. The fees generated on Base will be auto-compounded back into Kwenta by buying it back from an open market.

The launch is scheduled for the end of July or maybe the beginning of August. The timing is perfect; Kwenta is extremely undervalued right now, and the buyback will be very healthy for the price action.

There are also plans to launch on Arbitrum, which should lead to additional revenue and buying pressure on the token. Given the low valuation, the contributors seem willing to buy back the token as soon as possible.

Launch on Arbitrum

The Kwenta DAO approved Kwenta's expansion to Arbitrum following a proposal by Perennial Labs.This move is a strategic decision for Kwenta, as it positions the platform to tap into Arbitrum's growing ecosystem and user base.

The integration with Perennial Protocol on Arbitrum is expected to bring Kwenta users access to a broader range of assets, including cryptocurrencies, FX, commodities, NFTs, and more.

Camelot DEX, a decentralised exchange on Arbitrum, has welcomed Kwenta into its ecosystem, with trading for $KWENTA already live on the platform. Camelot DEX has also announced plans to introduce incentives for $KWENTA trading in the near future.

Expanding to Arbitrum is part of Kwenta's broader strategy to become an aggregator, making Arbitrum a logical choice for the platform's next step. The move is a significant development for Kwenta and its users, as it opens up new opportunities and markets for the platform.

Expansion is expected to bring an additional revenue stream, which will again be used to buy back Kwenta from the open market.

Price targets

Given all these upcoming catalysts, we believe Kwenta has hit its bottom or is very close to it. We still expect our previous targets to be hit. However, we expect them to be hit sometime during the 24/25 cycle.

In the meantime, we have middle price targets for the next 3-4 months.

Base case: We believe in the short term, Kwenta can reach a $60m market cap (roughly 4x from current prices)

Bull case: In a bull case, we believe Kwenta can reach a $100m market cap (roughly 7x)

Even though the price of Kwenta touched our previous targets, we expect the price to revisit those targets.

As a result, we can expect 7x - 14x medium to longer term (for 24/25 cycle).

Technical analysis

Kwenta has seen a minor bounce during the day, forming an intra-day support. Overall, there is a bearish trend line to consider, but during the formation of this trend line, we have seen some intense fighting back from the bulls.

The asset isn't trading unusually differently against the market; it is trading very similarly, and the price action is justified. Let's see how this newfound support holds up around this price level of $24.00.

Cryptonary's take

Our thesis on capitalising on Kwenta's expansion on Base and improved tokenomics has played exactly as we expected.However, the broader market has resulted in a reversal even though our targets were touched and our thesis played out.

Now, Kwenta is at a significant discount relative to the token's fundamentals. A P/E ratio of less than 0.5, with upcoming buybacks and further expansion to Arbitrum, makes it very compelling to hold or DCA into Kwenta to lower the average entry price.

Our previous thesis has played out, and we expect today's thesis to play out similarly. We expect 4x-7x in the coming 3-4 months and 7x—14x sometime during the 24/25 bull market.

We remain optimistic and believe Kwenta remains exceptionally undervalued.

Don't fumble the bag!

Cryptonary, OUT!