It has suffered from delay after delay, issue after issue – but all of that is in the past; we now know definitively that the Merge will be happening later this month.

For those unaware, the Merge will be the point at which Ethereum will no longer be secured by a Proof-of-Work consensus and will move to a Proof-of-Stake model. Nothing will change in terms of the blockchain and its state, and no one has to do anything – no asset changes, etc. It will be as if nothing happened for the average user!

However, what does this mean for liquid staking protocols (and their tokens) post-Merge? What exactly is liquid staking? In this journal, we will briefly outline the fundamentals of liquid staking and the potential repercussions for protocols that provide this service going into the Merge.

TLDR

- Liquid staking has become a popular way of maintaining the usability of funds whilst also benefiting from staking rewards.

- Lido is by far the most popular provider of liquid staking for ETH, with over 90% dominance in the sector.

- We believe LDO will continue to attract users post-Merge - especially as ETH staking yields increase.

- For more details, continue reading!

Most people are aware of what staking is – the act of delegating tokens to a service (blockchain, protocol, or other decentralised entity) for a few purposes. The main reason for staking is that Proof-of-Stake (PoS) chains require tokens to be staked to secure the network. They act as a sort of collateral, ensuring validators behave. If they don’t behave, they get their stake slashed. If they do behave, they receive a portion of the block rewards/emissions as an incentive. Other reasons for staking include governance – where you stake tokens and get a say in the protocol.

For the most part, however, once these tokens are staked, they are taken out of circulation and cannot be used elsewhere. That liquidity is locked until the participant unstakes. Imagine that the US Government required $10 trillion USD to be locked for the government to function – there would be less liquidity for everyone else to use for things like buying houses, cars, construction, etc. Therein lies the issue – but what if there was a solution?

Liquid Staking

Staked assets are illiquid as they are locked with validators on Proof-of-Stake networks. This creates a conflict of interest for users wanting to secure the network (and earn for it) and utilize their assets in DeFi to generate yield. Liquid Staking solves this problem by allowing users to deposit PoS assets into a staking protocol that stakes the assets on their behalf. The protocol then issues users a 1:1 tokenized version of the staked asset, allowing them to earn staking rewards, secure the network, and deploy the liquid staking token in DeFi protocols for lending, collateral, or as an LP (liquidity provider).This unlocks another layer of yield for users. Liquid staking protocols allow users to unstake immediately for a nominal fee, a feature unavailable when staking directly with validators.

TLDR: You stake your tokens with a liquid staking protocol, and they give you a token representing your stake that is freely transferable and useable.

Lido DAO

Liquid staking has been a prime play for Ethereum coming up to the Merge. Lido has been a leading protocol offering liquid staking for “ETH2.0” with around 4.3 million ETH staked (image below is slightly dated) through the protocol – 90%+ market dominance.

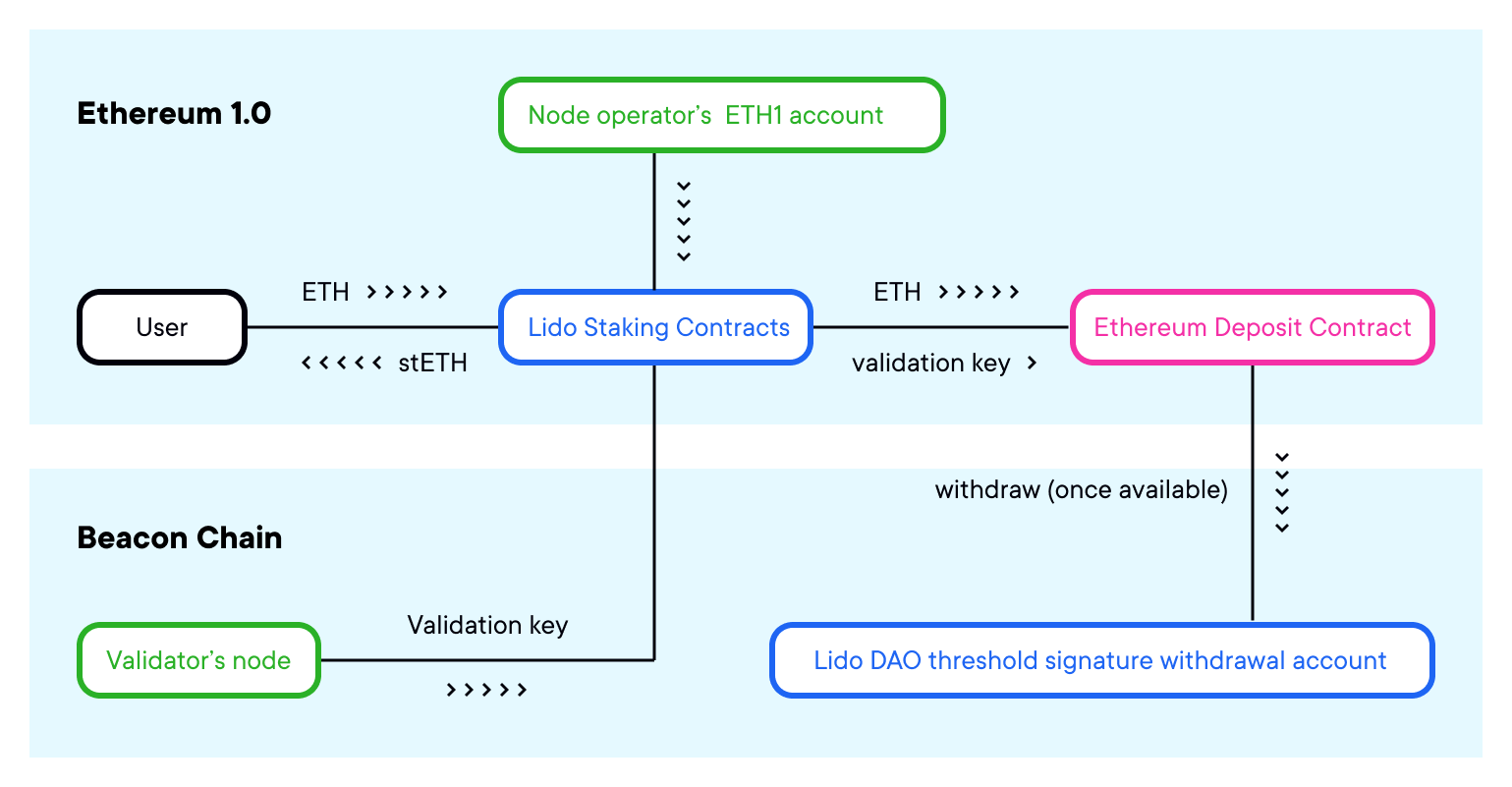

Lido was created just after the launch of the Beacon Chain (for more info, click the link) around December 2020. Its purpose was to provide liquid staking services to those who were interested in staking ETH in the ETH2.0 contract but did not want that liquidity to be locked up for potentially years. Lido provides this service through their stETH (Lido Staked Ether) derivative token, which is provided to users when they initially stake their ETH through Lido DAO. There are a few components to Lido:

- Staking Pool – the protocol that manages deposits, rewards, and withdrawals.

- stETH – the liquid staking token that maintains the 1:1 balance of Beacon Chain Ether to staked Ether.

- Aragon DAO – the Decentralised Autonomous Organisation that governs protocol parameters.

Staking Pool Contract

The Staking Pool Contract is the beating heart of Lido, responsible for all of the points outlined above, plus the minting and burning of stETH, delegating assets to node operators, applying fees to staking rewards, and accepting updates from the oracle contract (we’ll get into that later). Users send ETH to the contract, which mints and returns stETH to the user. The deposited ETH is distributed between node operators (in chunks of 32 ETH) to maintain an even distribution.

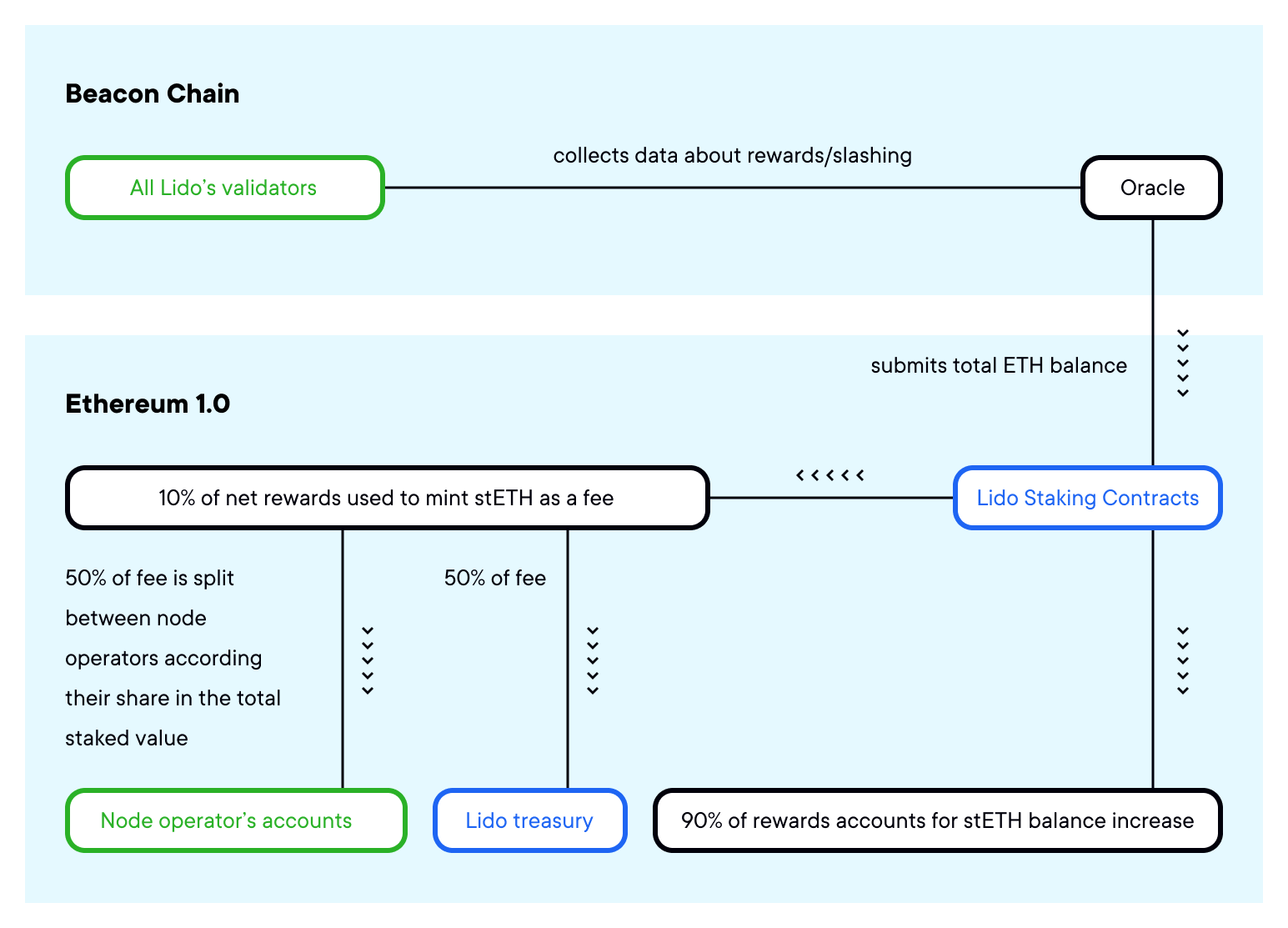

Oracle is the contract that keeps tabs on the balances of verified node operators on the Beacon Chain (node operators also validate transactions on Beacon). Balances increase as rewards are distributed or are slashed due to staking penalties.

stETH tokens equal to the ETH rewards accumulated for that day are minted and distributed to node operators and the DAOs insurance/operational fund (treasury). This fee is equal to 10% of the accumulated rewards for that day, split 50/50 between node operators and the Lido Treasury. The remaining 90% of rewards are distributed to users in the form of stETH.

stETH is an ERC-20 token representing Ether staked in Lido. Tokens are minted upon a deposit of ETH and are burned upon a withdrawal of ETH. stETH itself can be moved around and used at will – that’s the whole point of liquid staking!

LDO

LDO is the governance token for Lido DAO – governance is an important aspect of Lido as the DAO controls several important parameters relating to the operation outlined above:- Setting the fee structure.

- Selecting validators.

- Deciding incentive distribution.

- Managing insurance.

- Managing the Lido Treasury.

Although there is no direct relationship between the amount of ETH (or other assets) staked in Lido and the value of LDO, there is a significant interest in holding LDO from the perspective of those who have significant funds staked in the protocol. If you had hundreds of millions worth of a token staked in a protocol, would you not want a say in how its ran? This is the baseline thought process for LDO’s valuation being so high.

LDO powers the decentralized ownership and decision-making of Lido, with governance decisions made by the community conducted based on LDO. LDO holders cast their votes in any decision that will shape the future of the platform. This enables everyone to have their say, thereby maintaining decentralization.

Where’s the Value?

On the topic of what happens to Lido after the Merge, there are several factors we need to take into consideration:- How likely is it that users already staked will continue staking through Lido after the Merge rather than run their own nodes or use other platforms?

- What is the interest in Lido post-Merge as a liquid staking platform?

The current dominance of Lido as the key provider of Liquid Staking suggests that Lido will continue to have some form of dominance. However, the question then becomes; how secure will Ethereum be if 30%+ of the tokens securing the network are managed by a single protocol? Lido currently has a practical monopoly on the Ethereum liquid staking market. The main issue is that if pooled stake under one liquid staking protocol exceeds 50% of all ETH staked on Ethereum, this pooled staked gains the ability to censor blocks.

There is no question that Lido DAO is decentralised enough not to reduce the integrity of the Ethereum network. Additionally, there are proposals on the governance forum to introduce a “self-restraint” - a rule set by the DAO that the protocol should not manage more than 25% of the entire ETH staked on Ethereum. Although Lido does have a monopoly right now, we believe the current dominance will likely not continue forever.

CPRO Outlook

As stated above, the main reason for holding LDO is to have active participation in governance. If protocol revenues increase (by proxy of increased staking yield through transaction fees), then there would be more incentive for additional users to onboard to Lido to take advantage. This, in turn, should bring more speculative value to LDO and direct value through more DAO participation.

Lido offers one of the oldest, most robust, convenient, and decentralised ETH liquid staking services. In terms of value added to the Ethereum ecosystem, the unlocked liquidity is a huge factor in facilitating continued DeFi activity despite the vast quantities of otherwise locked ETH that will be required to secure the network after the Merge.

Although the Risk:Reward for purchasing LDO before the Merge is not there anymore, we believe that LDO will continue to be a valued asset post-Merge and beyond. Lido is one of the few protocols that has proven more popular than CEXs in its offering, and we expect that popularity to continue, especially with increased yields after the Merge.