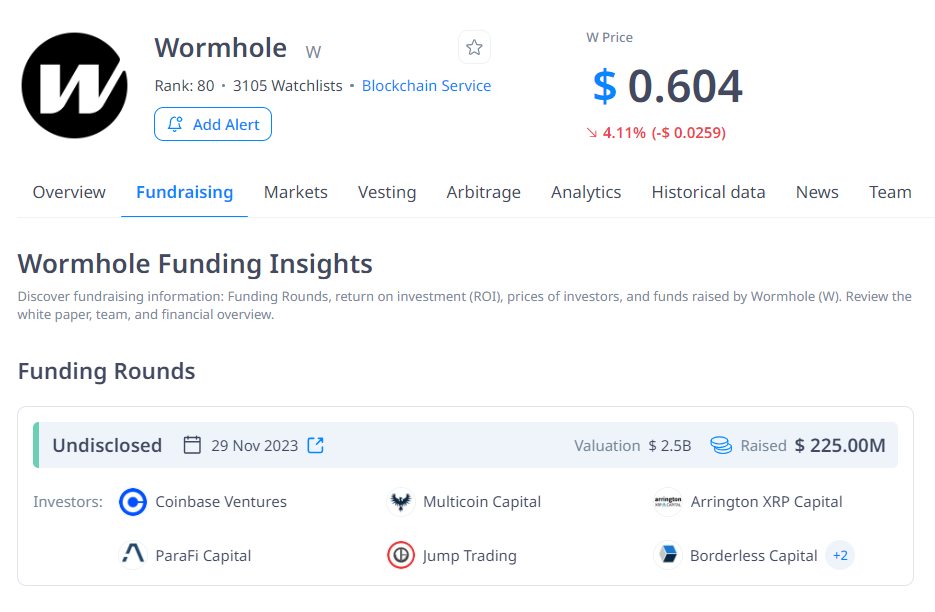

Wormhole is a pioneer cross-chain bridge that facilitates the transfer of messages and assets between chains. It raised a whopping $225m at a $2.5b valuation. However, the token performance has been disappointing so far.

Yes, the entire crypto market is in a sell-off, but is the general state of the market enough excuse for $ W's performance so far?

And more importantly, will $W be an underperformer, or is it a diamond in the rough?

Let's find out!

TLDR

- Wormhole is a pioneering cross-chain bridge protocol enabling asset transfers across multiple blockchains.

- It is at the heart of the Solana blockchain and is integrated into almost all popular dApps on Solana.

- It has huge funding, backers, and partnerships. However, the numbers don't look impressive yet.

- The big question: Can VC backing alone propel Wormhole to greater user embrace despite the lack of traction?

- We present our bull, base, best-case scenarios, and a short-term opportunity that may sweeten the deal.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Wormhole

Wormhole is a pioneering cross-chain bridge protocol facilitating communication and asset transfer across multiple blockchain networks. Launched in 2021, it has since grown to support a variety of blockchains, including Ethereum, Solana, Binance Smart Chain, and many more.

Wormhole's primary goal is to enable seamless interoperability between disparate blockchain ecosystems, thus expanding the possibilities for decentralised applications (dApps) and enhancing the overall user experience.

One of Wormhole's key components is its support for simple messages and arbitrary messaging bridges (AMBs). Simple messages allow for the transfer of basic data between blockchains, such as token transfers or simple state updates.

AMBs also enable the transfer of more complex data structures, including smart contract calls and cross-chain function invocations. This feature allows developers to create dApps that can leverage the strengths of multiple blockchain networks, enhancing their applications' functionality and scalability.

Wormhole also supports an NFT bridge, which enables the transfer of ERC721 and SPL NFTs between selected blockchains in the Wormhole ecosystem. This feature allows NFT creators and collectors to access a broader range of markets and platforms, further expanding the potential use cases for non-fungible tokens.

Security

Despite being hacked in 2022 for $325m, Wormhole's security and trust assumptions are central to its "design." The protocol ensures that no single entity controls the system by employing a decentralised network of validators. This approach reduces the risk of malicious activities and enhances the network's overall security.At the heart of Wormhole's design is the concept of a "Guardian Network," a set of 19 validator nodes that collectively maintain the system's security and integrity. These validators are chosen from a prestigious list of well-respected infrastructure providers (Proof-of-Authority), ensuring high trust and reliability.

The Guardian Network is responsible for observing and validating cross-chain messages. For a message to be considered valid, at least two-thirds of all validators must agree upon a particular state observation.

Even though Wormhole is designed to be "decentralised," having only 19 validators who are "chosen" by the team introduces heavy centralisation issues. The MultiChain bridge had a similar design with only around 20 validators, and it was hacked for $1.5b last summer.

However, the protocol is expected to become more decentralised and trustless once zero-knowledge proofs are more ubiquitous. Currently, the team is making a tradeoff based on the available technology.

Wormhole's core functionality revolves around its ability to send and receive messages between different blockchains. The process begins with a user initiating a transaction on the source chain, which the Guardian Network then observes. The validators establish a two-thirds majority for validation, and the message is publicly broadcast for access on a different chain.

This process enables the seamless transfer of assets and data across different blockchain networks, opening up a world of possibilities for developers and users alike.

So, in summary, Wormhole offers:

- Messaging (Transfer of data, tokens and NFTs)

- Data Queries

- Bridging widget (Integrate in 3 lines of code)

- NTT (Make any tokens natively multichain)

Ecosystem

The Wormhole has been adopted by many decentralised applications across 29 supported chains, showcasing its widespread acceptance and utility in the blockchain interoperability sector.

Ecosystem dApps

Wormhole is the main bridge in the Solana ecosystem. Almost all Solana dApps have integrated Wormhole to ensure the smooth onboarding of capital into their platforms.

Backing and partnerships

Wormhole raised a whopping $225m at a $2.5b valuation from industry giants like Coinbase Ventures and Multicoin Capital.It is well-capitalised and has support from big names in the crypto VC world.

Strong backers and good connections let Wormhole develop its ecosystem and close partnerships very quickly. Some of its partnerships include:

- AMD: Wormhole has a partnership with Advanced Micro Devices (AMD) to integrate AMD's enterprise-grade FPGA hardware accelerators into the Wormhole ecosystem.

- Aylabs: Aylabs has partnered with Wormhole to enhance its Traffic Loop with Wormhole Queries, aiming to transform web3 user acquisition.

- NFT communities (DeGods, Mad Lads, Yoots): Wormhole strategically distributed its $W token to the most popular Solana NFT communities.

- Monad: Wormhole airdropped to Monad community members as a sign of mutual collaboration and partnership.

Some stats

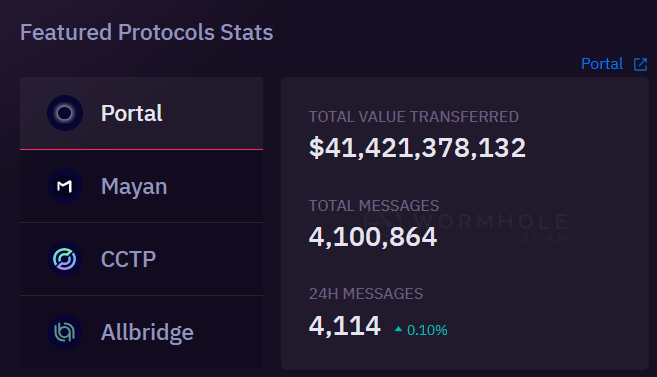

To date, Wormhole has processed over 1 billion messages and over $41 billion in volume. In comparison, Wormhole's direct competitor, LayerZero, has processed slightly over 127 million messages.

The most popular dApp on Wormhole is Portal (Wormhole's main bridge), followed by MayanSwap (a potential airdrop), CCTP and Allbridge.

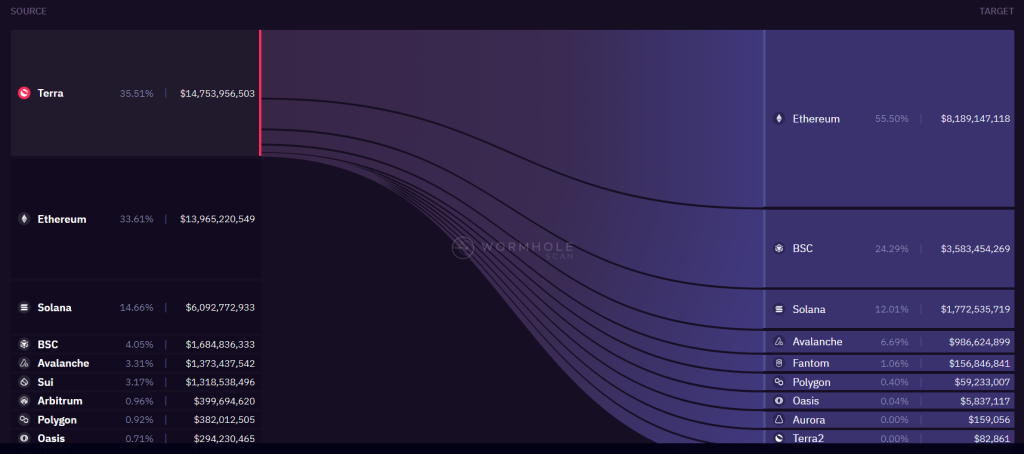

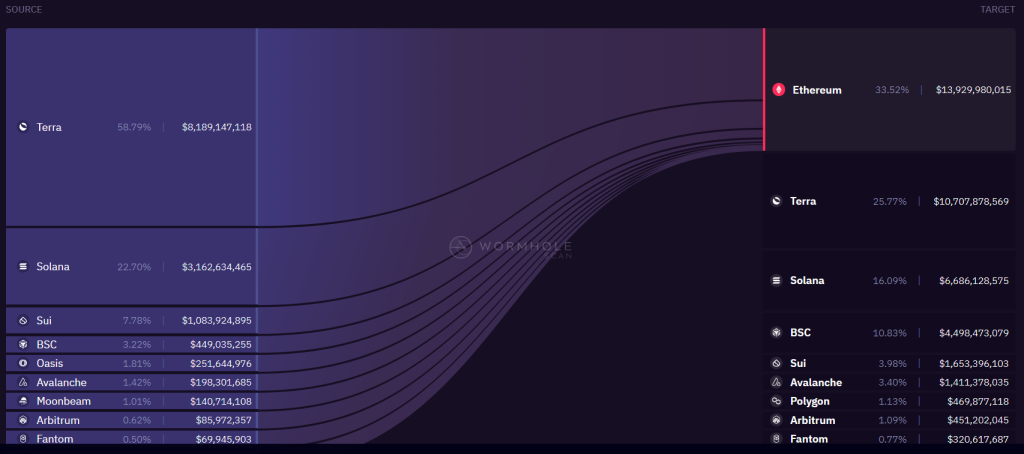

Looking at the most popular chains for bridging and messaging, we can see that most of the activity happened between Terra and Ethereum.

Frankly, this statistic doesn't look good. It's been almost two years since UST/Luna collapsed, but we can still see that Wormhole couldn't recover and gain any significant adoption on other chains.

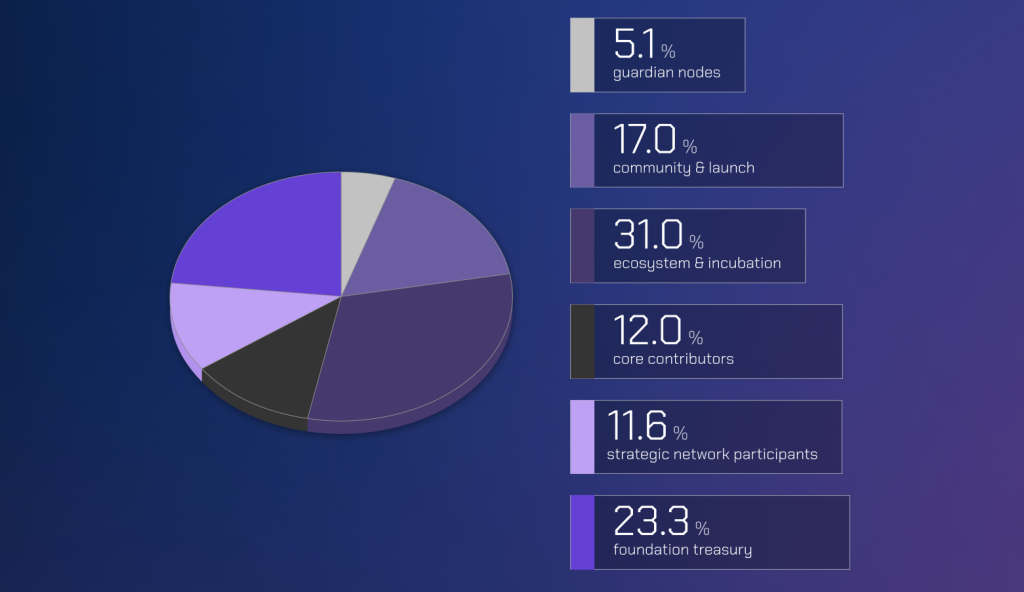

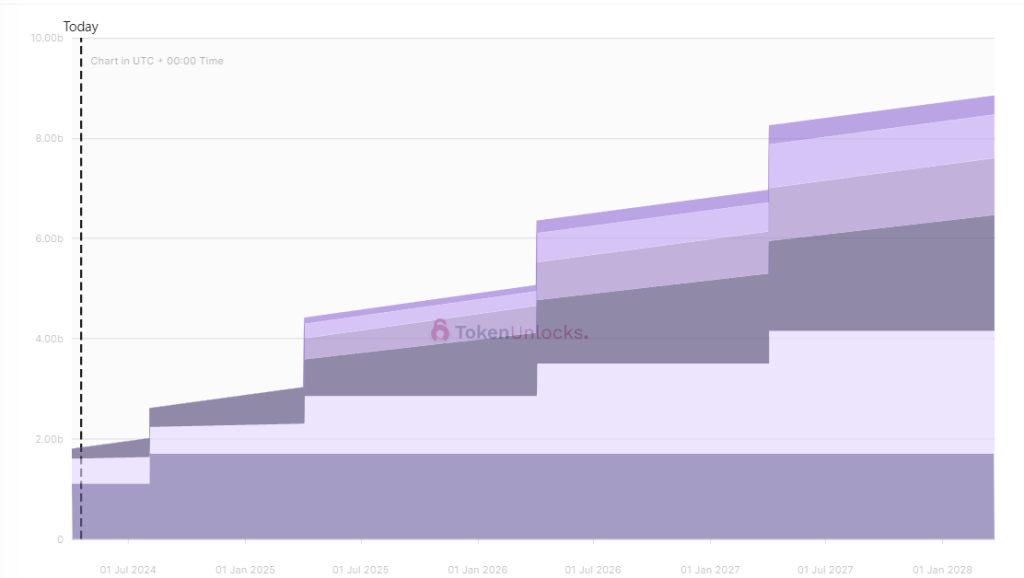

Tokenomics

- Ticker: $W

- Market cap (circulating): $1b

- VC valuation: $2.5b

- Circulating supply: 18%

- Market cap (fully diluted): $5.9b

Potential play and price targets

We are not very excited about Wormhole. The tokenomics aren't exciting; it is a governance token with frequent unlocks. Moreover, we can see that most of the volume and messages came from Terra, which remains the top destination and source chain.That stat tells us that adoption hasn't picked up since Terra collapsed almost two years ago, and the volume from those years remains the biggest in Wormhole's history.

This weakness in gaining traction beyond Terra makes us generally conservative about the prospects of $W. This might still deliver a decent ROI relative to its mid-risk positioning.

Based on all of the above, we have the following targets:

- The base case scenario: in this scenario, Wormhole will perform decently in line with a broader market and can reach a $5b market cap (5x from current prices)

- The bull case scenario: in this scenario, we believe Wormhole can reach a $7b market cap (7x from current prices) due to its strong partnerships and backers. We cannot ignore the fact Wormhole raised $225m at a $2.5b valuation from VCs

- The best-case scenario: We believe Wormhole can potentially have something under its sleeves to gain significant traction (Volume) finally. We can expect a $9b market cap (8x from current prices) in this scenario.

A 5x to 8x upside isn't exciting, but based on its strong partnerships, there may be icing on the cake.

As we mentioned previously, Wormhole has a very close relationship with Monad. Quick background -- Monad is a high-performance Ethereum-compatible Layer 1 blockchain that significantly improves the decentralisation-scalability tradeoff. Monad claims it can process 10,000 transactions per second -- it could be a very successful project if it delivers on its promise. And since Wormhole airdropped $W to the Monad community, we believe there is a decent chance Monad will airdrop its tokens to $W holders/stakers when it launches.So, beyond the 5x to 8x upside in $W, you may also be positioned to receive Monad tokens.

Technical analysis

This market has seen a huge surge followed by a well-needed correction. What is attractive about this price action is that we had a generous retracement but still held up within a relatively solid pullback percentage of the overall move.

The market has now started to poke its head above two significant diagonal bearish levels of resistance, which suggests a shift in sentiment from bullish to bearish.

Overall, we have signs of strength and promise from a TA perspective.

Cryptonary's take

Wormhole is one of the main players in the Solana ecosystem. Almost all major dApps have integrated it into their platform for smooth onboarding from other competing chains.However, there are still security and centralisation concerns related to a bridge, and history shows us that bridges tend to be vulnerable to hacks.

Additionally, the token is not attractive from an investment standpoint and has no use cases except for governance.

Even though Monad's airdrop might end up not being very significant, the mere speculation related to the airdrop can potentially drive up the price of $W in the short term. But in the long-term, we aren't particularly excited about the prospects of $W as an investment.

Cryptonary, Out!