Macro Q3 Update

Q3 2022 has been a fairly interesting 3 months for macro & policy – not so much for the markets. The Fed is continuing its aggressive quantitative tightening policy, and Europe is still in turmoil.With no end in sight to the energy crisis in Europe and central banks tightening policy globally at the same time – is there any good news?

We believe there is!

This journal will outline some of the key developments within the macroeconomics environment and some projections for the rest of the year and beyond!

Disclaimer: This is not financial nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The Fed

The FOMC met on the 21st of September, raising interest rates by another 75bps in line with market expectations taking the base rate up to 300-325bps (3-3.25%). Powell (Fed Chairman) made some interesting statements during the meeting; the most important were:- Powell said that although the US housing market has been weakened, it has also been running hot for years and may have to go through a correction to get back to normal price growth.

- The Fed expects to maintain high interest rate levels throughout 2023, with a 4-5% (400-500bps) base rate expected in December 2023.

- The Fed understands that pain will be necessary to bring inflation down to the 2% target.

- Powell was unable to give odds on the chance of a recession

- The general consensus of the FOMC is that another 125bps of hikes is expected this year.

- FOMC believes that the Fed must stay in actively restrictive territory, and for a while, to tackle inflation head on.

- Powell believes that commodity prices may have peaked.

What are the results of the Fed’s policies?

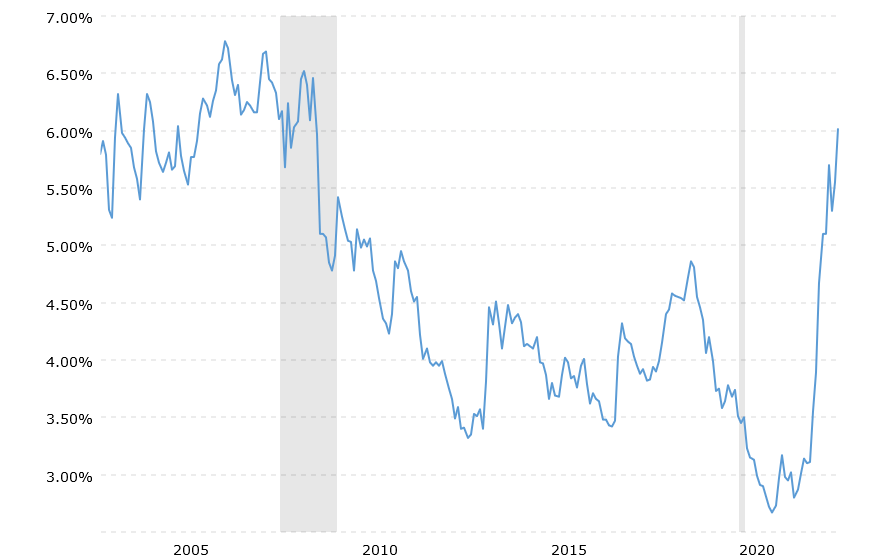

The 30-year mortgage rate is the typical loan term for most US mortgages – since November 2021 the rate has gone from 3.1%, to over 6%. This has led to a significant reduction in demand for new property purchases (cooling the market) and reduced rental demand and rental prices. Inflation from these sources tends to be lagging more than other indicators, such as energy, since the housing market is a lot less reactive than others. Fed policy is definitely having its intended effect – we can only hope that they do not overshoot with rate hikes.

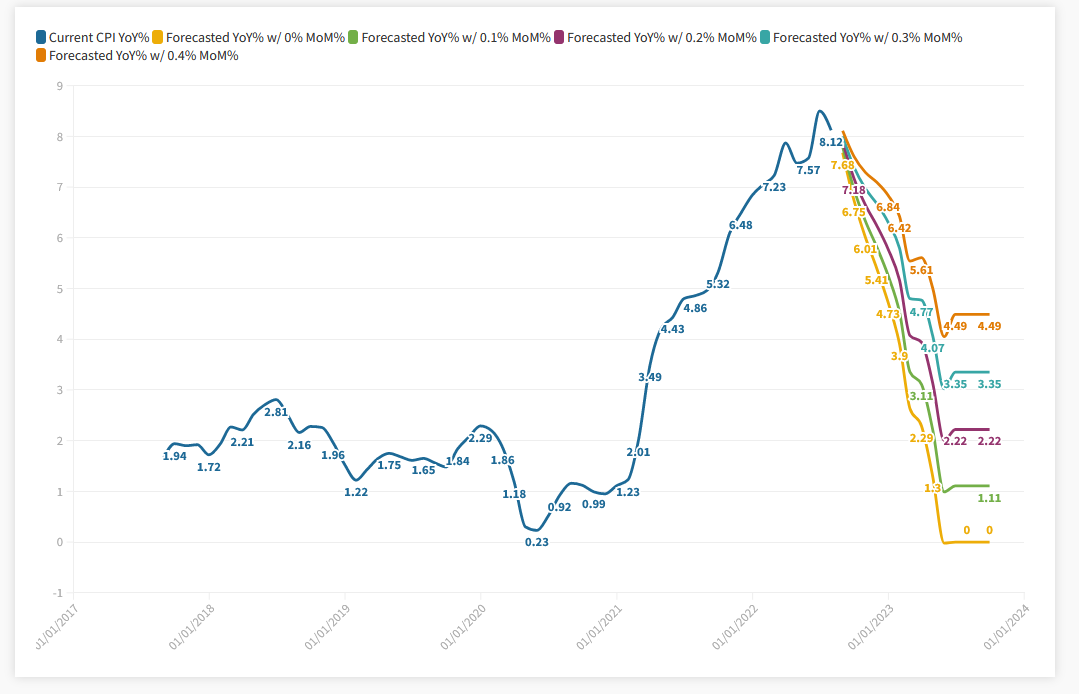

Leading on to this, we believe headline inflation, Year-on-Year CPI (YoY CPI), is no longer the main number we should be looking at – MoM (Month-on-Month) CPI is the more important figure. For the Fed to reach its 2% target for YoY inflation, typically they would be aiming for a MoM figure of around 0.2%.

The above chart shows projections for YoY inflation rates for various sustained MoM rates. At consistent 0.2% MoM rates, YoY inflation will come down to 2% somewhere between Q2/Q3 2023. This is obviously not really feasible going into Winter, where energy usage etc tends to be highest (heating homes, etc). However, if the Fed can maintain a MoM figure of below 0.3% over the course of 2023, we likely see inflation around the 2% mark before 2024.

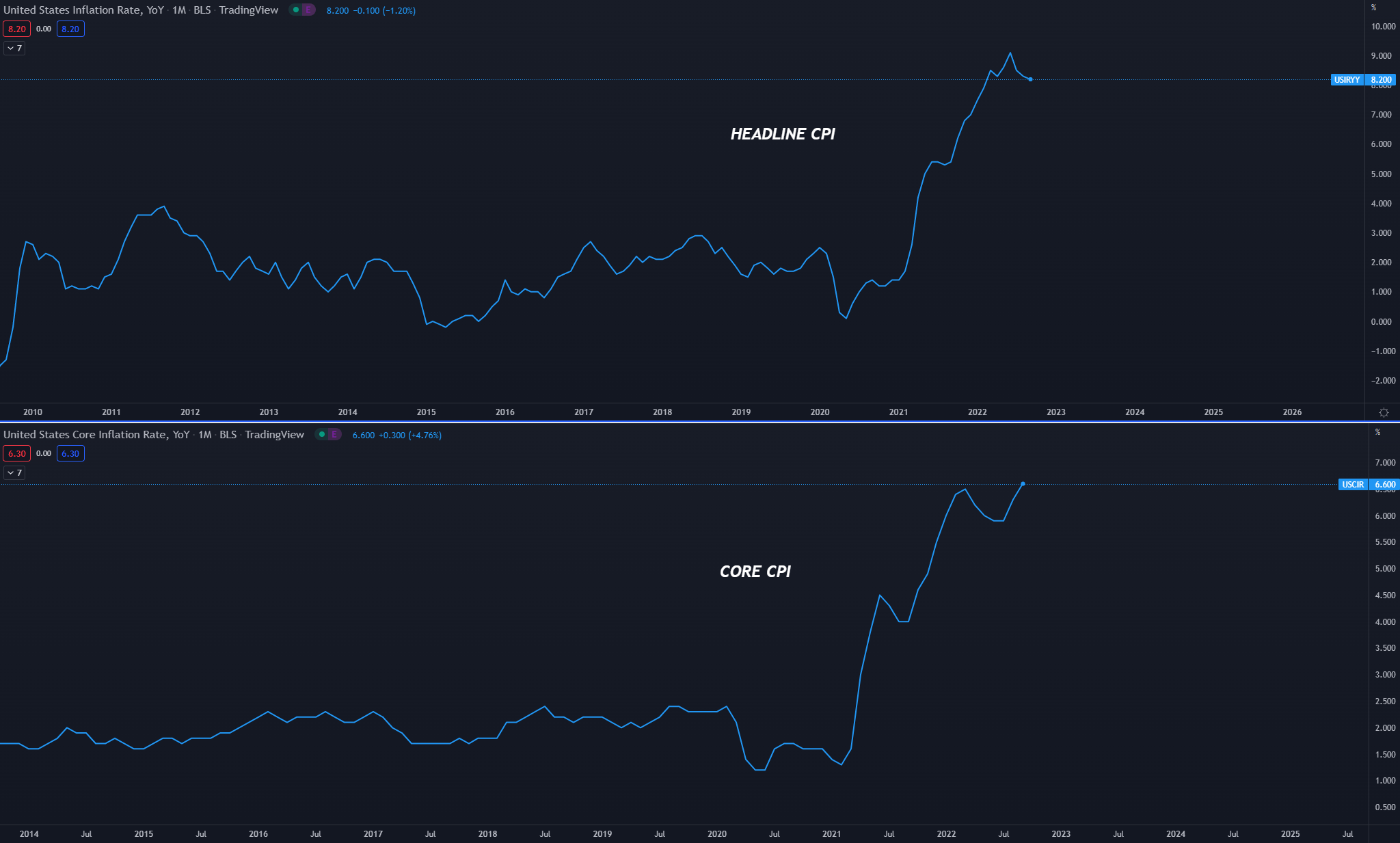

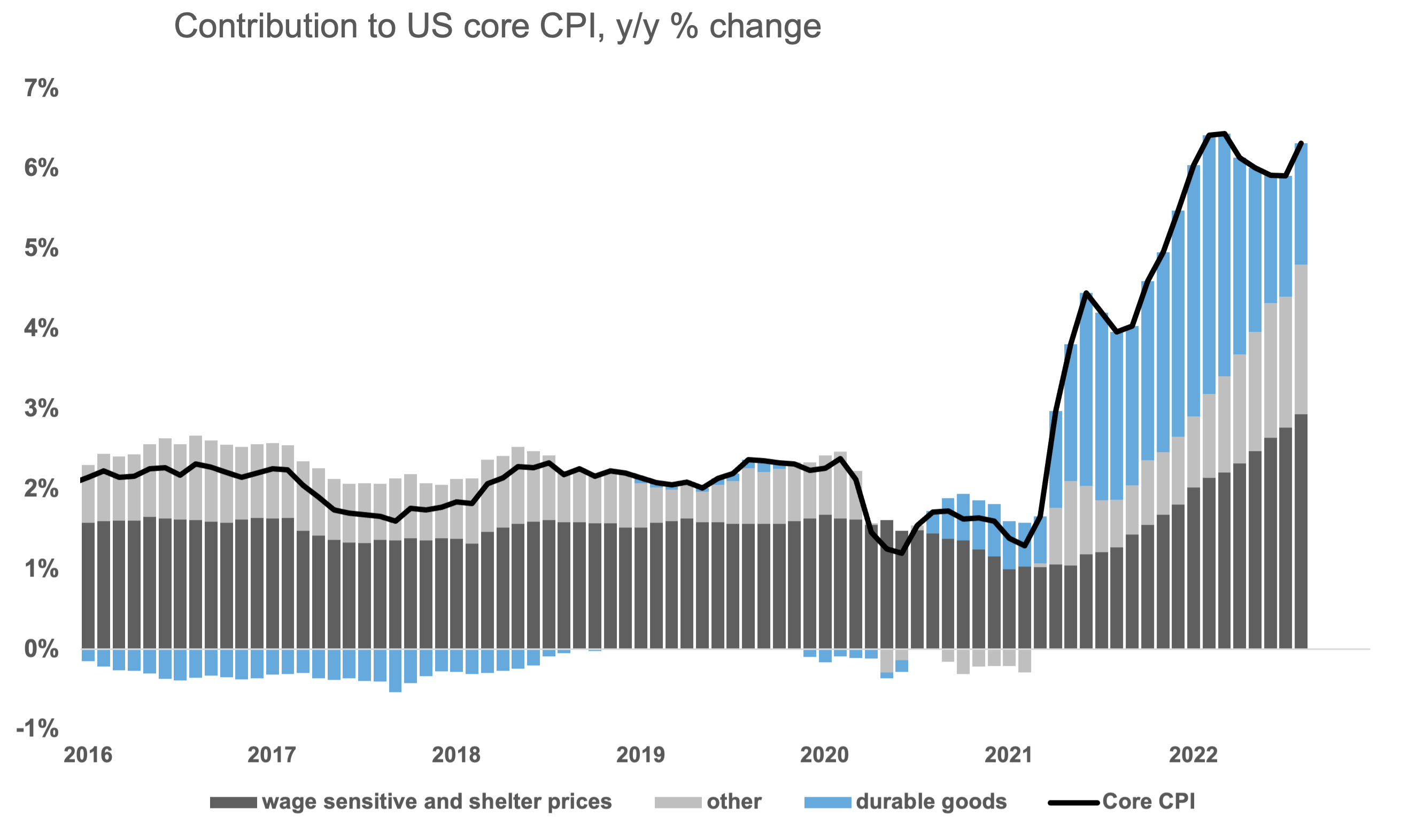

Latest CPI

On the 13th of October, the latest US CPI figures were released. Headline MoM CPI came in at 0.4%, and YoY CPI at 8.2%. This is down from 8.3% previous but significantly worse than expected. However, it was the core CPI figures that are concerning – 0.6% MoM, up to 6.6% YoY from 6.3% previous. Core CPI excludes Food & Energy, so the relatively large monthly core CPI increase suggests that inflation may be a long way away (multiple quarters) from reaching acceptable levels.

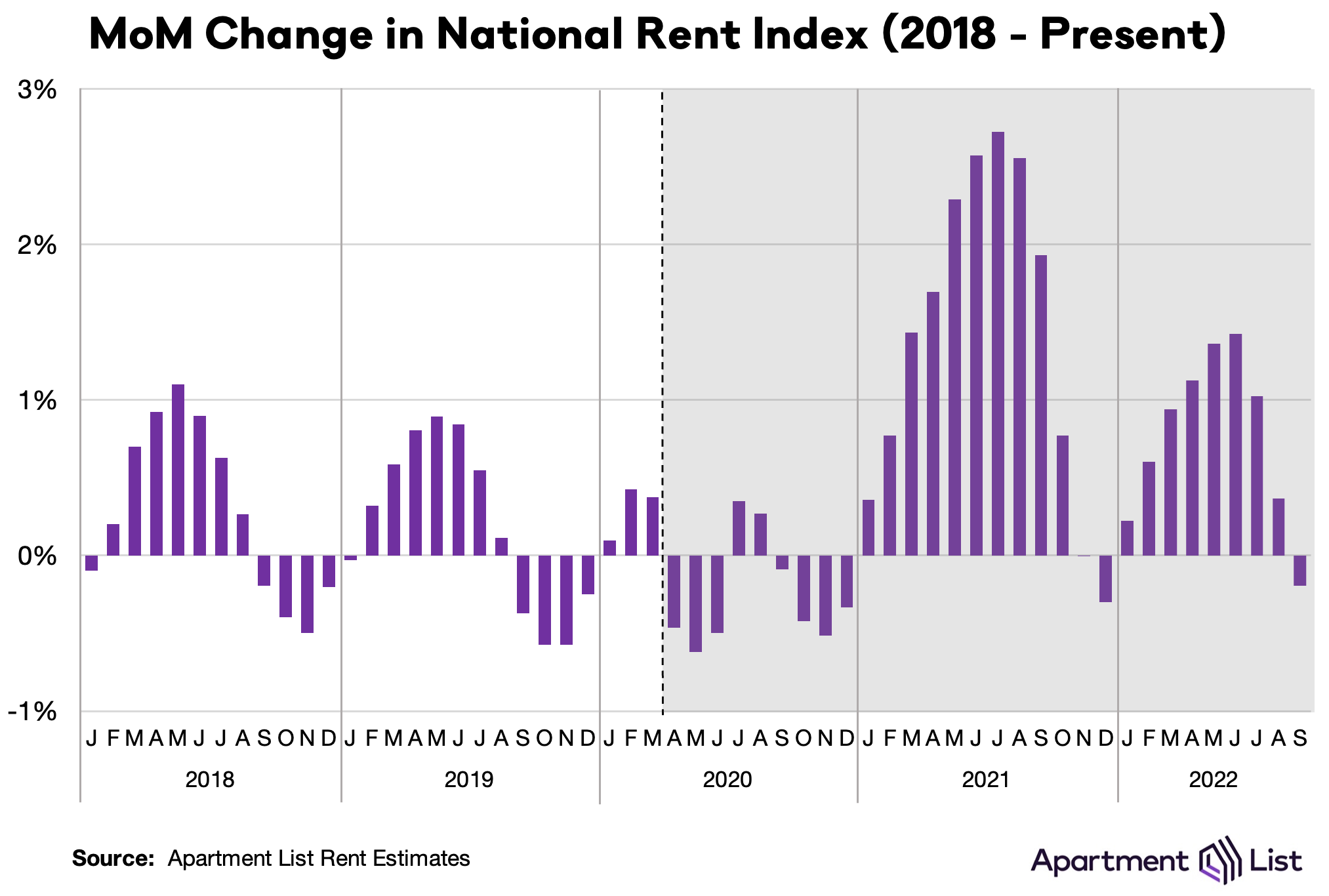

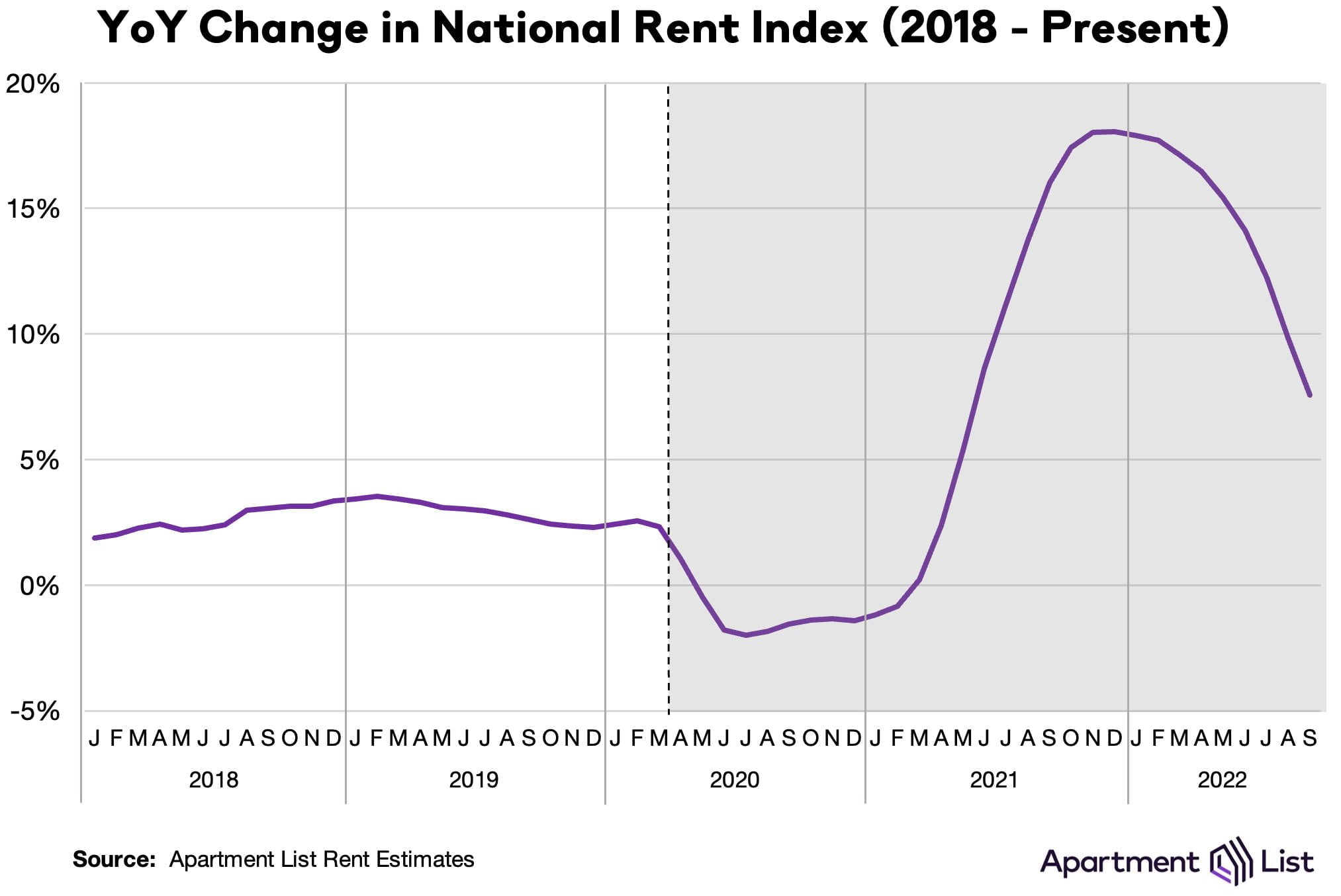

However, there is some evidence that interest rate hikes are working as intended. The Month-on-Month change on the (US) National Rent Index actually fell 0.2% MoM in September – the first negative print since December 2021.

Looking at the YoY chart, we can see that there is some significant progress being made in tackling inflation from shelter:

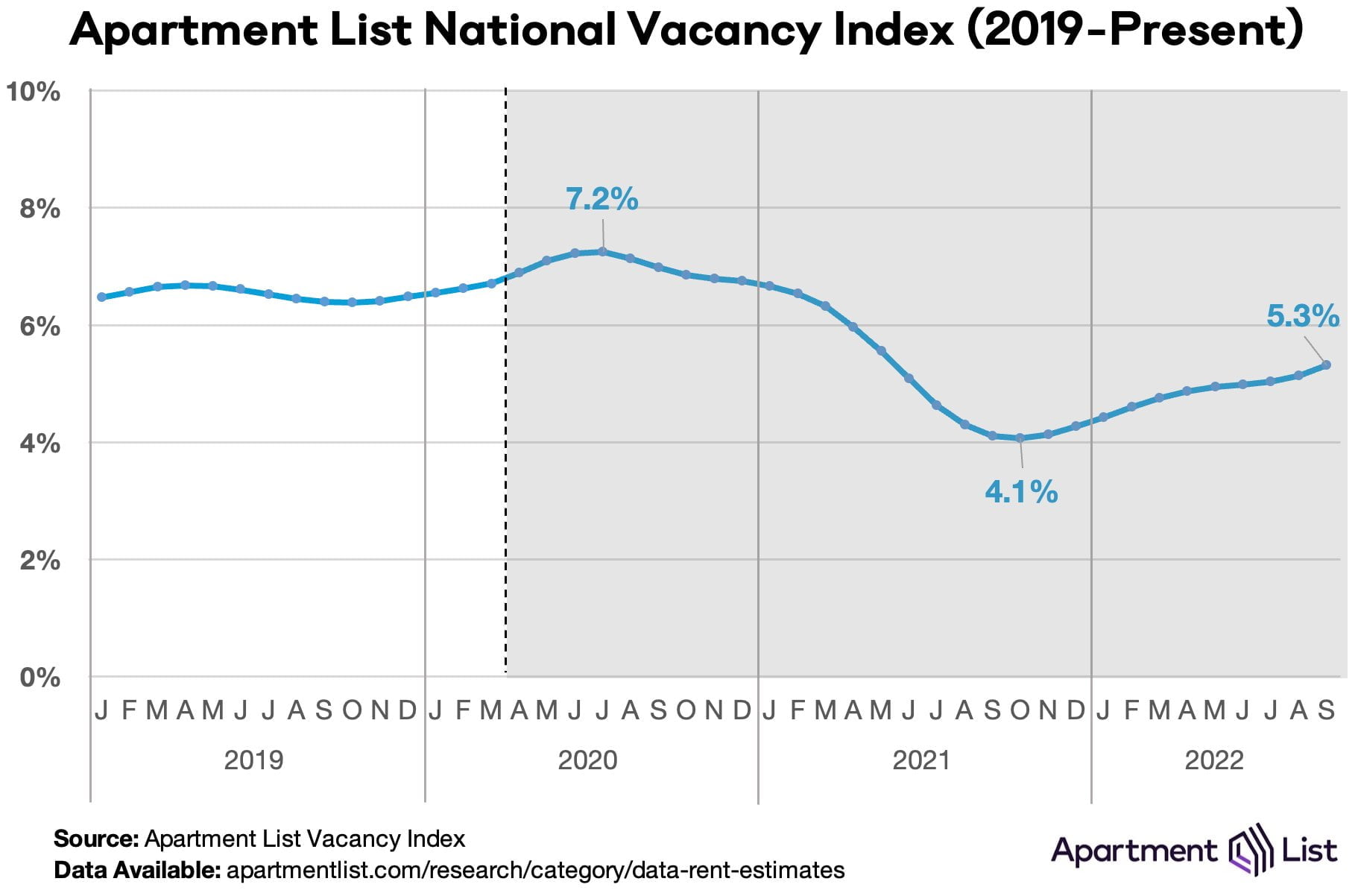

These figures suggest that the supply side of the rental market is gradually trending towards relatively normal (pre-pandemic) levels, as can be seen from the National Vacancy Index (a measure of empty properties/apartments):

If this trend continues it’s likely we see a significant reduction in shelter inflation in the US as we head into Q1 2023. Shelter makes up a large proportion of core CPI and so the numbers reflected above will hopefully be the first signs of this source of inflation easing up.

However, most rental agreements are usually 6 or 12 months, so changes in rental market circumstances are usually slow to reflect in CPI prints.

Currencies – WTF?

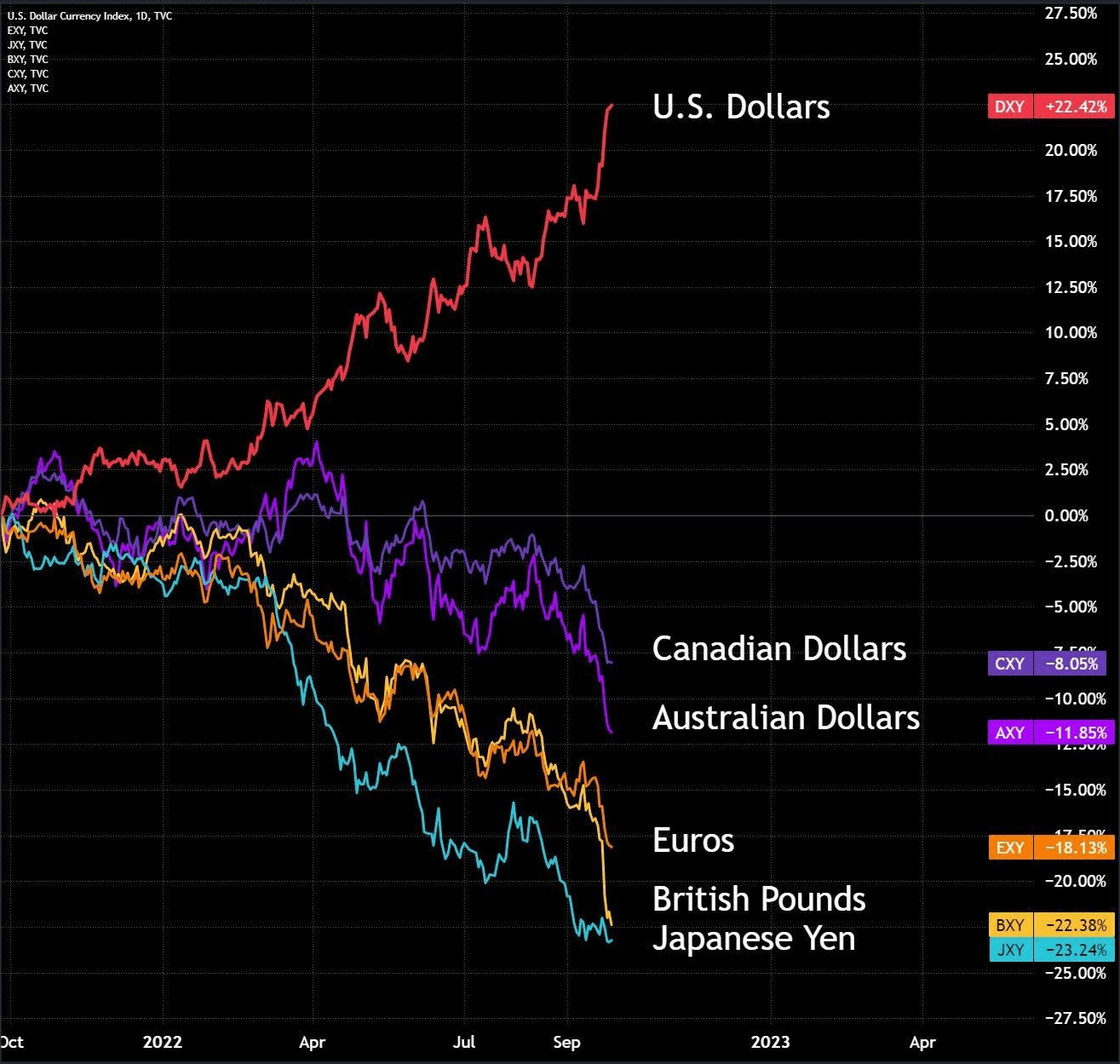

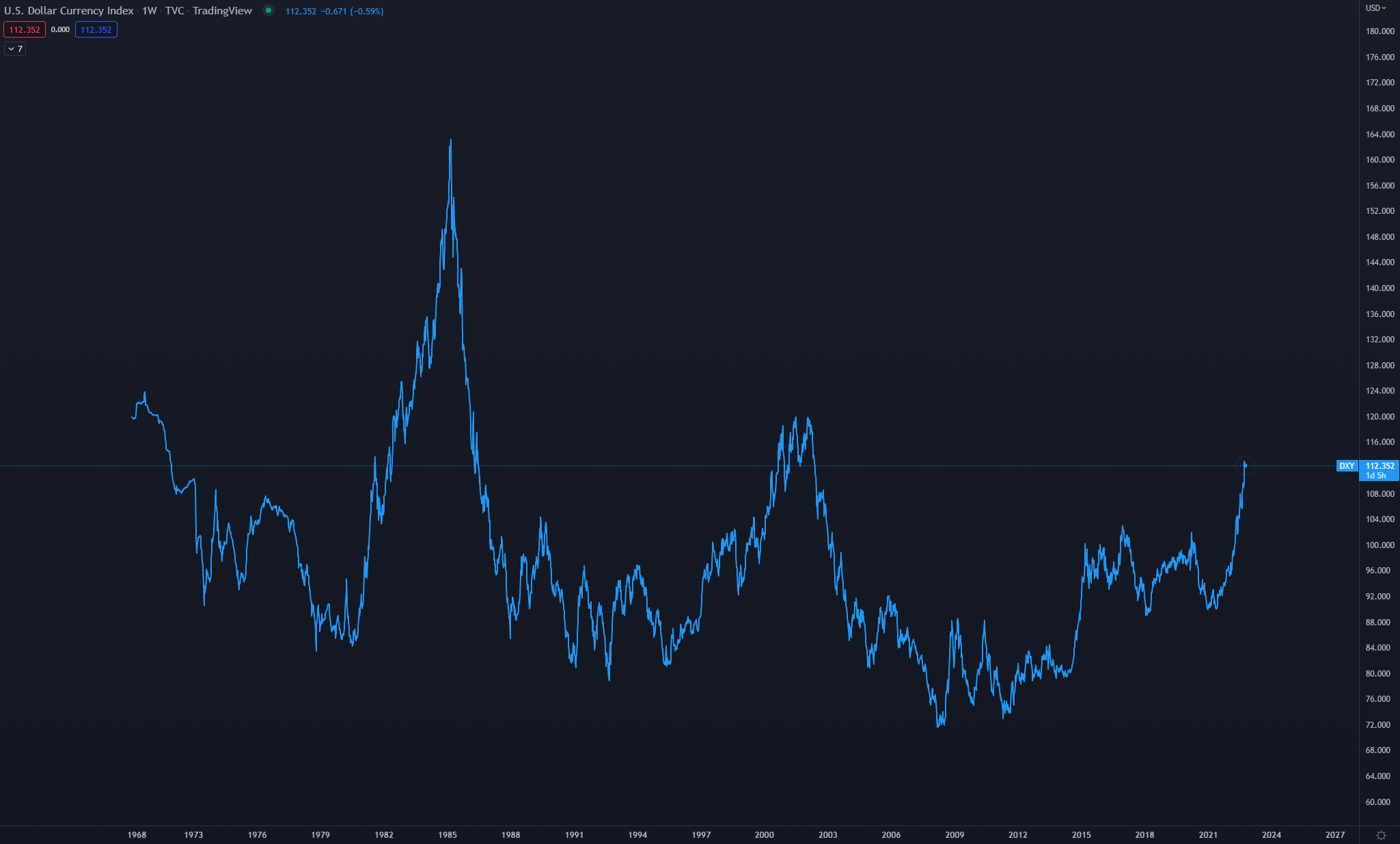

With the continuation of the Fed’s aggressive hiking policy, we are seeing extreme strength in the dollar that has been highly detrimental to most other currencies. The DXY is the dollar strength index and is a measure of the relative strength of the $USD compared to 6 other currencies. Those currencies are weighted as follows:- Euro: 57.6%.

- Yen: 13.6%.

- Pound Sterling: 11.9%.

- Canadian Dollar: 9.1%.

- Swedish Krona: 4.2%.

- Swiss Franc: 3.6%.

As can be seen in the chart above, there is basically an inverse relationship between the strength of the dollar and the weakness of other currencies. The dominance of the USD within global markets is significant, and as the Fed continues to tighten policy, other currencies will continue to decline relative to it. Really the only action other central banks can take is to raise rates more aggressively than the Fed, which is unlikely to happen because the Fed front-ran most other central banks.

The DXY is heading for highs not seen since the early 2000s. This is good for American consumers since their imports will be cheaper and should impact inflation, but bad overall for American exports because they become more expensive and, therefore, less attractive on the global markets. We believe that the DXY will likely top out at around 120, if not before, which should provide some relief – BTC (generally) has an inverse relationship with DXY.

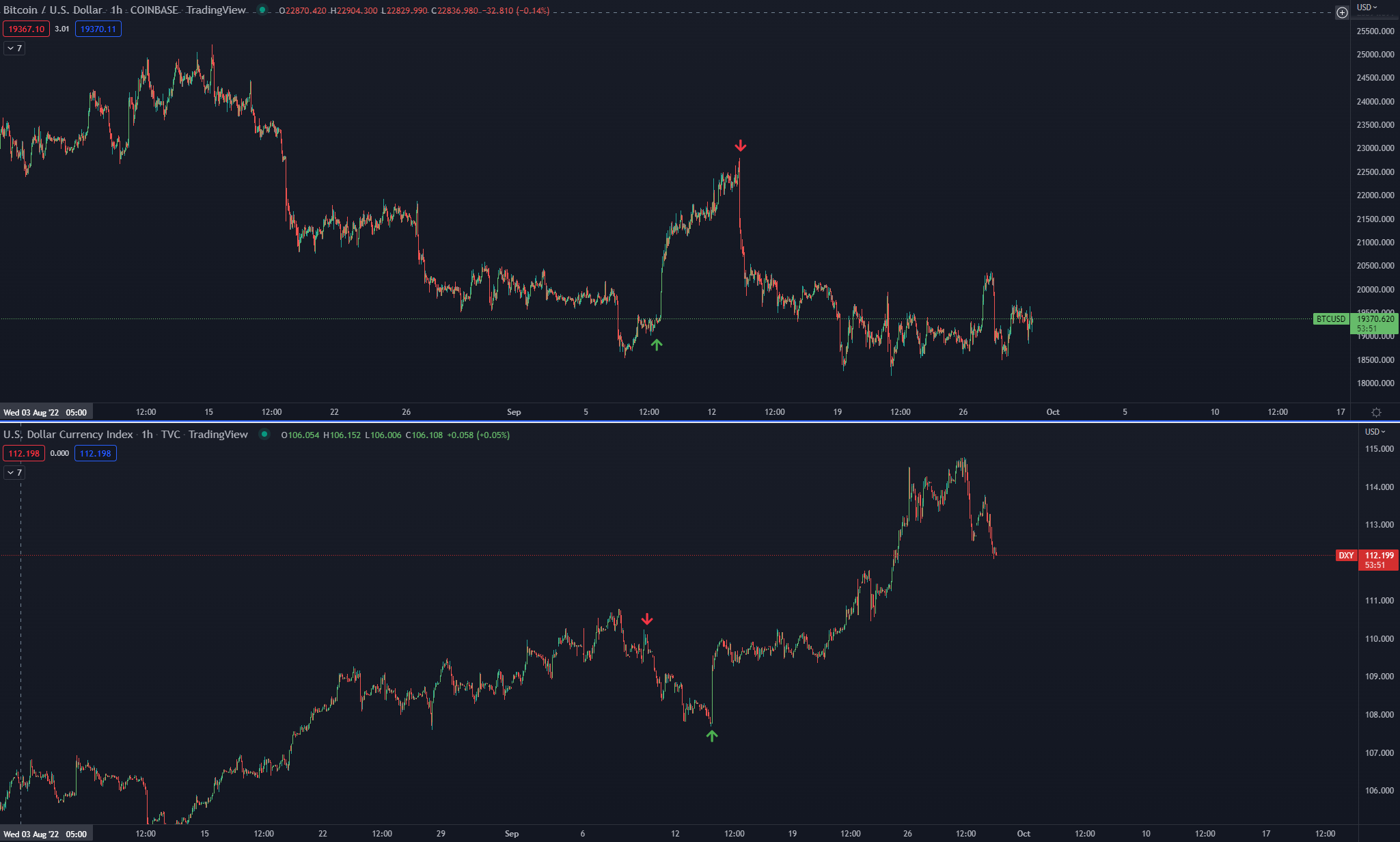

The interesting point we’ve been seeing is that as the dollar strengthens and other currencies weaken, more recently, BTC has become less correlated with the DXY. This could suggest that rather than moving assets into USD, people are choosing BTC – despite a 15% gain in DXY earlier in September, BTC has remained steady around the $20k mark with only minor variances. This is something we will be keeping our eyes on as it could be the beginning of the “decoupling”.

United Kingdom (GBP)

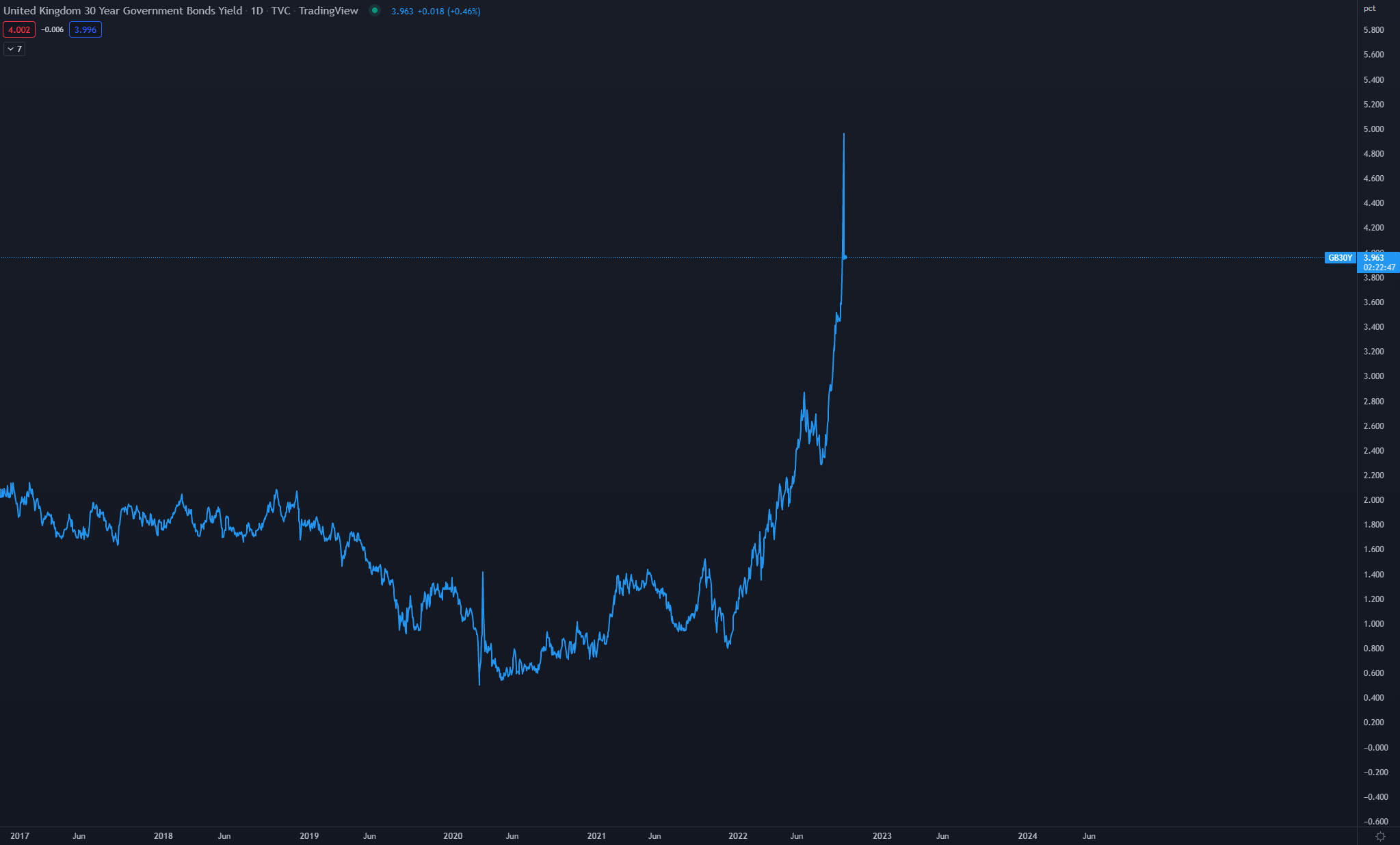

One of the major updates for Q3 was the collapse of the £ (GBP) at the end of September. The new government announced a new budget, with tax cuts and stimulus that will be funded with debt. This was the complete opposite to the Bank of England’s quantitative tightening program – investors did not warm to the budget at all. The bond market took a hit (the chart below shows the spike in yield on 30-year bonds):

Essentially, the interest rate at which the UK Government can borrow (the yield demanded by lenders to the UK Government) jumped multiple percentage points as the value of bonds collapsed. UK pension funds were being margin called (they have big bags of “leveraged” gilts), which led to a cyclical selloff of gilts (UK bonds), at which point the Bank of England (BoE, UK Central Bank) had to step in and start purchasing these bonds to maintain market stability (prevent panic selling). Obviously, this is detrimental to the ongoing quantitative tightening program – raising rates whilst purchasing bonds? Tightening whilst easing? Doesn’t make sense, and the market knows this.

These measures implemented by the BoE are meant to be temporary to allow pension funds to stay liquid – essentially, the BoE has become a “last resort” line of credit for the funds because no one else would take on that risk quick enough to prevent a complete collapse of the bond market.

Although this is not really printing cash directly because the BoE is using reserves for these purchases; nevertheless, the Sterling (GBP) has taken a beating as a result and confidence in the UK economy has dropped significantly in the short term. The situation appears to have stabilized for now. however, it remains precarious and will no doubt prolong the battle against high inflation in the UK since imports will become more expensive as the GBP loses value.

Subsequently, Chancellor Kwasi Kwarteng was sacked on the 14th of October. However, there are calls for PM Truss to resign as well – it takes two to tango, and it appears as if Truss has made the Chancellor her “fall guy”. With the BoE stopping its purchases on Friday the 14th, it is unclear how the situation will develop moving forward. The main question is whether pension funds have used the BoE’s lifeline and now have sufficient capital to avoid further margin calls.

Outlook

The general outlook is still quite grim and will likely remain grim for the rest of 2022. Key point is that BTC has held up pretty well despite the turmoil in other markets, which lends some credibility to the entire crypto market generally. For Q4, expect much of the same. We believe that the majority of the Fed’s hikes have been priced in at this point, and it’s just a waiting game for either something major to break in a G7 economy or some favourable news at a future FOMC meeting or government policy.We do believe that inflation has likely peaked, albeit with core inflation still way too high. We expect Q1 2023 to provide some better conditions, especially going into Spring time. If there are any major updates, we will post them in Discord - but you can expect more of these macro reports every few weeks!