One of the biggest frustrations many people have with crypto investments is the volatility. 30% to 70% drawdowns within minutes or hours are frequent occurrences.

In TradiFi, index investing has been a cornerstone strategy for people who want a low-volatility and low-risk exposure to the market. Index funds offer a strategic path to wealth accumulation through reliable returns. The crypto market has lacked similar tools that provide consistent, safe returns through index investing. However, the landscape is changing.

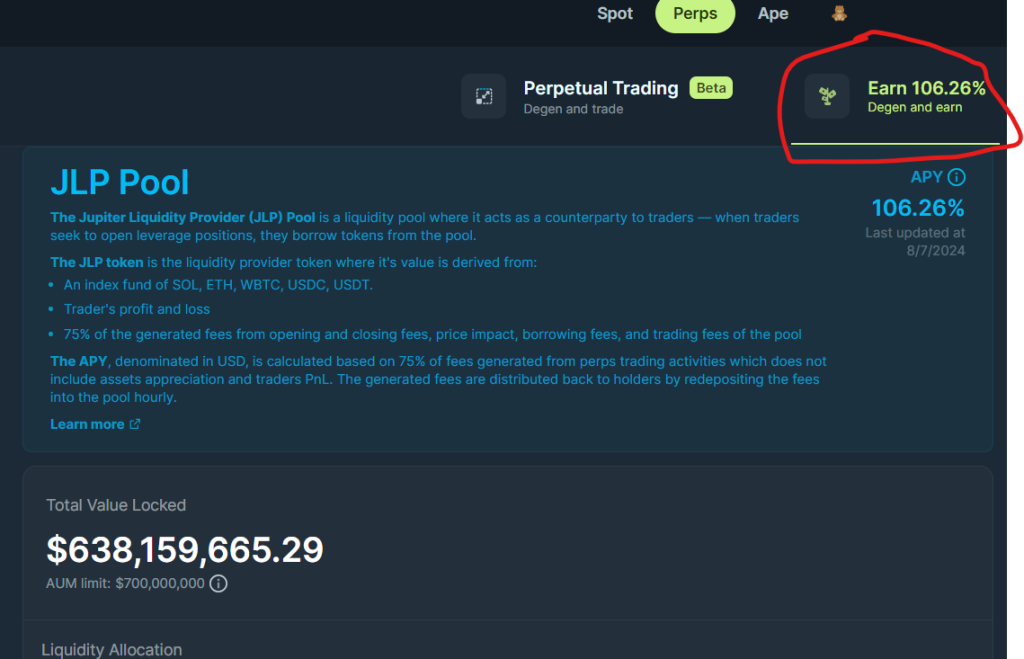

Today, we reveal the ultimate crypto index; it offers over 100% APY and has seen an 84% price increase year-to-date.

Curious to know more?

Let's get started…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Why index investing?

Let's start with the basics of why you should consider index investing.Diversification: Investing in an index fund gives you exposure to a broad range of assets; the performance you record is a function of all the assets tracked in the index. This diversification significantly mitigates the risks associated with investing in individual investments.

Simplicity: Index funds epitomise passive investing. Once you commit your funds to an index, there's little need for ongoing market monitoring or frequent trading decisions. This hands-off approach is ideal for investors who prefer a "set it and forget it" strategy. It is a stress-free way to participate in the market.

Consistent performance: Index funds have historically demonstrated consistent performance. Active investors—including professional traders and institutional funds—often struggle to surpass the returns achieved through passive index investing.

Let's look at the historical performance of the S&P 500 index from the stock market.

Examining over 70 years of market history, the performance of the S&P 500 presents a compelling narrative. When viewed from a long-term perspective, the returns from this index resemble a nearly linear upward trend. This demonstrates the power of index investing and a simple dollar-cost averaging (DCA) strategy, where regular, disciplined investments lead to wealth accumulation over time.

Our perspective on index investing in crypto

At Cryptonary, while we specialise in active crypto investing strategies, we also recognise the potential of exceptional index-based opportunities when they emerge.Our mission is to ensure that our users are well-positioned to capitalise on these opportunities when they arise, providing a balanced approach to portfolio management.

Although few crypto indexes stand out in terms of consistency and performance, we found an excellent opportunity within the Solana ecosystem.

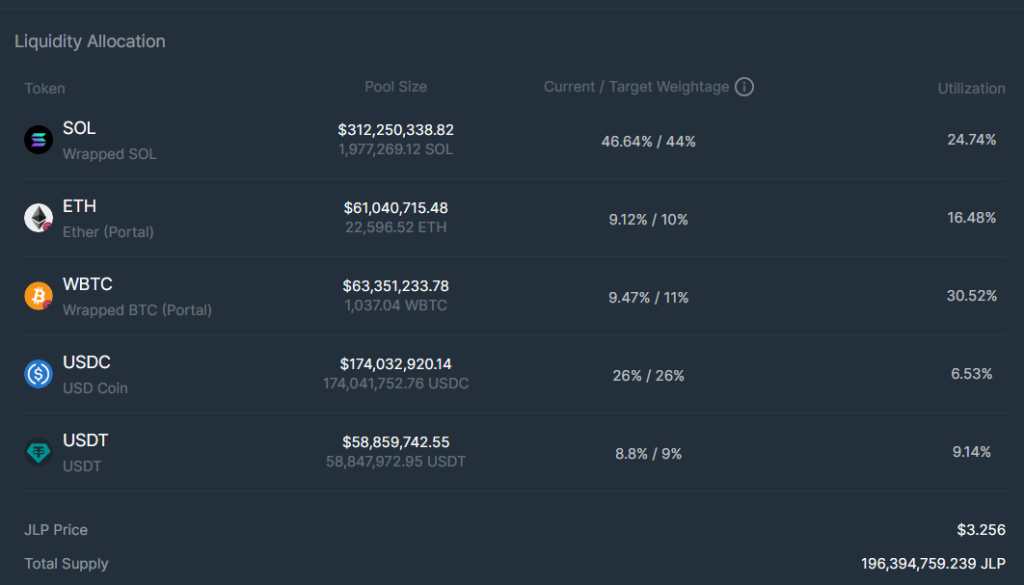

Introducing JLP

The JLP token is a liquidity provider on the Solana blockchain. It plays a key role in the Jupiter Perps DEX by allowing traders to borrow tokens for leveraged positions. JLP offers a unique index-like exposure to the market because it tracks a basket of major blue-chip assets like SOL, ETH, BTC, and stablecoins (USDT/USDC), giving you diversified exposure to the market. The best part is that it also offers additional yield on top of stress-free exposure to a diversified, low-risk, and balanced portfolio.

The best part is that it also offers additional yield on top of stress-free exposure to a diversified, low-risk, and balanced portfolio.

However, JLP offers more than just asset diversification. Its value is also influenced by the profits and losses of traders on the platform and by 75% of the fees generated from trading activities. Since Jupiter Futures is one of the largest perpetual DEXs on Solana, these fees help boost JLP's performance.

Jupiter Futures is the largest perp dex on the Solana ecosystem with considerable volume, behind only dYdX and Hyperliquid.

Why is that important? Because fees generated from volume generate yield that boosts the value of JLP.

Currently, JLP is yielding over 100% APY and has seen an 84% price increase year-to-date, with very little volatility compared to other DeFi tokens and even BTC, ETH and SOL.

This makes JLP a strong option for investors looking for a low-stress, passive investment with the potential for solid returns.

This makes JLP a strong option for investors looking for a low-stress, passive investment with the potential for solid returns.

The JLP performance fortifies the narrative that the JLP token is like an index; many won't outperform it, and it is an excellent choice for passive investing for retail investors.

Some risks to consider

While JLP offers a promising investment opportunity, it's important to consider the associated risks:- Bridged assets: The BTC and ETH in the JLP pool are not the native versions of these assets but rather bridged versions. Generally, bridged assets are considered less secure than their native counterparts. Although the technology behind bridges is improving and becoming more secure, there is still an inherent risk associated with using bridged assets. Investors should be aware of this potential vulnerability.

- Traders PnL: The yield generated by JLP depends on the profitability of traders on the platform and the fees collected. The yield could decrease if a trader becomes significantly profitable or attempts to manipulate the market.

- However, over the long term, the general wisdom is that "the house always wins," meaning that you can benefit from the platform's overall activity as a liquidity provider.

- Opportunity cost: JLP's conservative approach may not align with your investment strategy if you believe you can outperform the market by investing in more hot and volatile assets, like memecoins.

However, you can always adjust your broader portfolio by investing in memecoins separately if you want to chase those potential gains.

Technical analysis

We don't think technical analysis is necessary since the price of JLP tends to experience little volatility. Trying to catch a 5%- 10% move down isn't worth the risk, stress, and time in the grand scheme of things.The best approach would be DCAing, just like with traditional index investing.

How to buy JLP

- Go to Jupiter

- Swap USDC/SOL to JLP (Contract address: 27G8MtK7VtTcCHkpASjSDdkWWYfoqT6ggEuKidVJidD4 )

- Use DCA or VA (Value-average) featuring to set up a long-term plan

- Done

Cryptonary's take

JLP has proven itself an outstanding investment choice, boasting an over 80% increase year-to-date with minimal volatility. Anchored by an index of blue-chip assets, including BTC, ETH, SOL, and stablecoins, JLP mirrors the stability and performance of the S&P 500, making it the epitome of reliability in the crypto market.At Cryptonary, we recommend JLP as a stellar asset for those seeking a low-stress, passive investment approach while still achieving superior market performance this cycle. In the current investment climate, dominated by memecoins, a strategic portfolio blend could be the key to optimising returns.

For a balanced approach, consider a portfolio composition of 75% JLP and 25% blue-chip memecoins, such as POPCAT and WIF. For those willing to embrace higher risk for greater rewards, a 50/50 allocation between JLP and selected memecoins could significantly outperform the market for the rest of the cycle.

You can also allocate 5%- 10% for some exciting yield farming plays to generate yield and take advantage of corrections and pullbacks.

It is a stress-free investment strategy — where less hassle means more potential.

Cryptonary, OUT!