Mango Markets - Ready for harvest

Mango aims to capitalise on the derivatives market which is one of the key revenue drivers for any exchange - centralised or decentralised. Like most DEXs built on Solana, Mango Markets is powered by the Serum AMM (automated market maker) and will be the first leverage market in the ecosystem.

TLDR

- Mango will be launching their token on Tuesday the 10th of August at 1am BST, over 48 hours.

- 500,000,000 MNGO will be allocated to the launch. (Max supply 10 billion, initial circulating supply 1 billion).

- The launch will have 2 stages, each lasting 24 hours:

-

- During the first stage users will be able to deposit and withdraw USDC to a vault.

- During the second stage deposits will be restricted and users will only be able to withdraw their deposited USDC from the vault.

- At the end of the second stage MNGO tokens will be allocated to participants in proportion to their share of the USDC raised.

- We will not be participating in the launch.

Mango Markets

Mango Markets is a decentralised cross-margin trading platform offering up to 5x leverage. Built on Solana, Mango benefits from the performance of the Solana network – extremely fast, cheap, and secure transactions. Mango offers Limit and Market orders, leverage, a robust UI including charts, lending, and next to no fees.

Tokenomics

MNGO is an SPL (Solana Program Library) token and will be the governance token for the Mango Markets DEX allowing holders to contribute to the ecosystem by voting on proposals through the Mango DAO (decentralised autonomous organisation). The token will also be used to raise capital for the creation of an insurance fund that will cover some of the losses in the event of an account(s) going below the 100% collateralisation ratio, which is explained below. Finally, the token will be used to bootstrap liquidity and provide liquidity providers with incentives for their participation.Max supply is 10 billion MNGO with an initial circulating supply of 1 billion, of which 500,000,000 will be allocated to the launch.

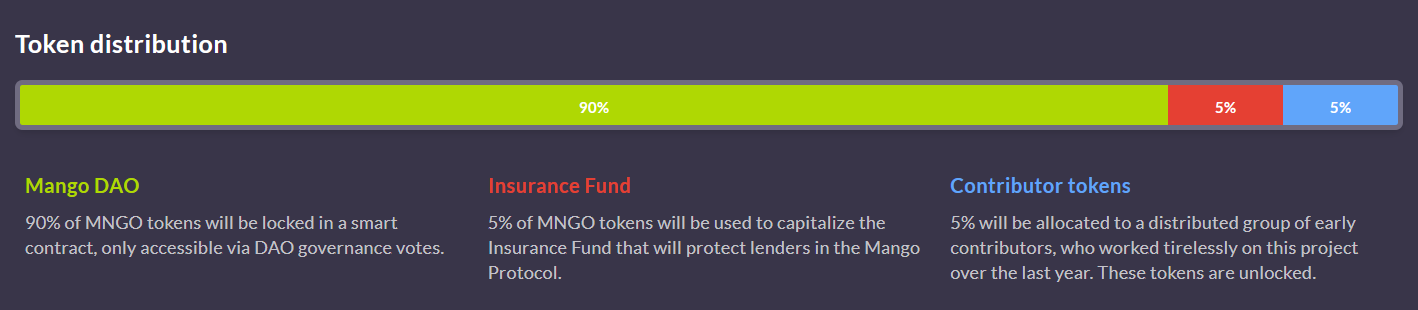

The token allocation is as follows:

- 90% of max supply will be locked in a smart contract to be emitted at the discretion of the DAO. As far as we’re aware the emissions schedule has still to be decided by a DAO vote. However, the Mango developers have suggested a halving model of emission like Bitcoin – 50% unlocked after 2 years, 75% after 4 years, 87.5% after 6 years, and so on.

- 5% will be used to inject capital into the insurance fund.

- 5% will go to the creators and contributors.

Launch

The launch will begin on Tuesday 10th August at 1am BST. Two vaults will open, one with 500,000,000 MNGO and one with 0 USDC (it is the ratio of the assets that will determine the price of MNGO). The launch will consist of two 24-hour stages:- Stage 1, Sale Period – investors will be able to both deposit and withdraw USDC into a vault from 1am BST on Tuesday the 10th of August, allowing users to change the amount of USDC they wish to allocate. It is likely that the price of MNGO will fluctuate during this period.

- Stage 2, Grace Period – at 1am BST on Wednesday the 11th of August, USDC deposits will be restricted and only withdrawals will be allowed. At this stage the price of MNGO can only go down, as funds can only be removed from the vault. The purpose of this is to allow participants to back out if they believe the price of the token to be too high.

Participants will require a Solana wallet, such as Sollet or Phantom, to participate in the launch. Additionally, SPL USDC will be required to enter the pool. There are no time constraints on the launch (other than the 24 hours for each stage). It is not first come first serve, meaning that there is no rush to deposit USDC as soon as the vault opens.

The vault will open here: https://token.mango.markets/

We will not personally be investing in MNGO as we are saving our capital for the DyDx launch further down the line – stay tuned for that! Read below for some more technical details on the protocol.

Liquidation

One unique feature of the DEX is the liquidation process:- Accounts must remain above a collateralisation ratio of 1.2 (120%) to open new positions. This is called the Initial Collateral Ratio, and below this ratio borrowing is restricted. Current positions will remain open.

- If the collateralisation ratio goes below 1.1 (110%), the account will be gradually liquidated. This is called the Maintenance Collateral Ratio, and below this ratio anyone can pay off any liabilities accrued by the account.

- In return for covering liability, the liquidator will receive back 105% of the amount loaned which is taken from the account being liquidated.

- This process is continued until either the account is back above the maintenance collateral ratio, or there are no more tokens in the liquidated account to return to liquidators.

- In the highly unlikely event that the account falls below a collateralisation ratio of 1 (meaning the account has accrued debt) any further losses are socialised across all lenders in the protocol or covered by the insurance fund.

Lending/Borrowing

Through Mango Lending depositors can earn interest on their capital. Depositor funds are used to provide the liquidity for leverage traders to borrow and trade with.The interest earned by the lender increases according to the utilisation rate - the ratio of borrowed funds to deposited funds. The system is designed so that the incentive is there to attract more capital and to ensure that the demand for liquidity is met, providing the necessary liquidity to support trading activity.

Lenders may not be able to withdraw if their funds are already borrowed, although this is a rare occurrence and should only be the case as the utilisation rate approaches 1. However, in this instance the protocol guarantees 100% APY whilst user funds are locked.