And since blockchains are inherently decentralised networks and security needs to be guaranteed to protect users, scalability often becomes the tradeoff.

There are several approaches to addressing scalability – this led to the rise of Layer 2 networks.

L2s are growing really fast, with a combined market cap of almost $18b – but that’s only scratching the surface of what’s possible if they solve the scalability problem.

There is an inherent competition going on between multiple L2 chains right now. And in the last week, Manta Pacific started making waves in the market.

With an innovative new approach to scalability, it has gained consumer interest as more than 10 million transactions were processed, and it registered significant DeFi traction as TVL rose above $1 billion.

Is this shiny new L2 the game-changer, and is the MANTA token worth your attention?

Let’s find out!

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

What is Manta?

The Manta Network is the first to incorporate a modular ecosystem. A modular ecosystem, or blockchain, specialises in one particular functionality and outsources other tasks to separate blockchains.One of the protocols that has become popular with this approach is Celestia Network, and Manta has also embodied this approach.

It is classified into two layers:

- Manta Atlantic: A L1-chain on Polkadot, which includes programmable ZK-enable confidential on-chain identities

- Manta Pacific: A L2-ecosystem with a modular approach which provides scalability and a cheap gas-fees environment

Manta introduced Manta Pacific with a blog post last year, and the protocol might be banking heavily on the success of its L2 modular ecosystem.

How is Manta Pacific different from other L2s?

For most of 2023 and until now, the L2 narrative has become very competitive because most are trying to solve the same scalability and cost issues through different rollups.Projects like Arbitrum and Optimism take the Optimistic Rollup approach. OP-rollup scaling systems effectively reduce transaction costs but face delays of up to 1 week in transactional finality. They have good EVM compatibility, but security is based on crypto incentives for users, which can be shaky sometimes due to biased verification.

Polygon, on the other hand, utilises ZK-rollup, which carries no transaction delay but incurs a higher and more expensive hardware cost. Most ZK-rollups also lack EVM support and compatibility, but they are almost guaranteed protection due to cryptographic proof of security.

In comparison, Manta Pacific is the first EVM-native execution layer specifically designed for ZK adoption. However, its modular nature leverages the OP stack for scalability and the Celestia network for data availability (DA). The network claims this unique setup will allow for low transaction fees for ZK applications.

Theoretically, this approach puts Manta Pacific above the rest of the current competition, right?

But what do the numbers say?

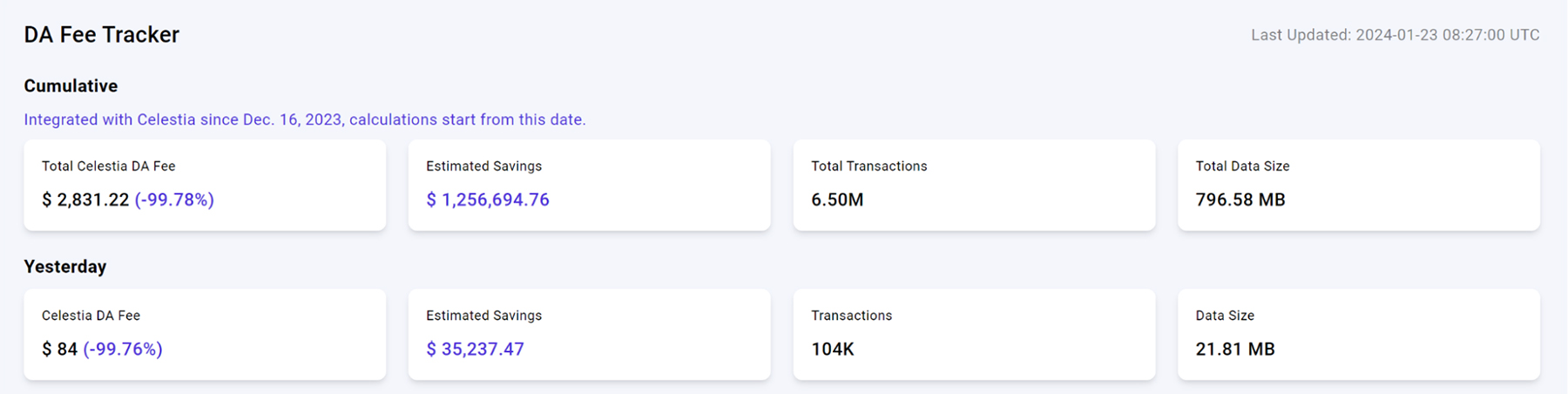

It seems like Manta’s modular approach to using Celestia DA is doing the trick.

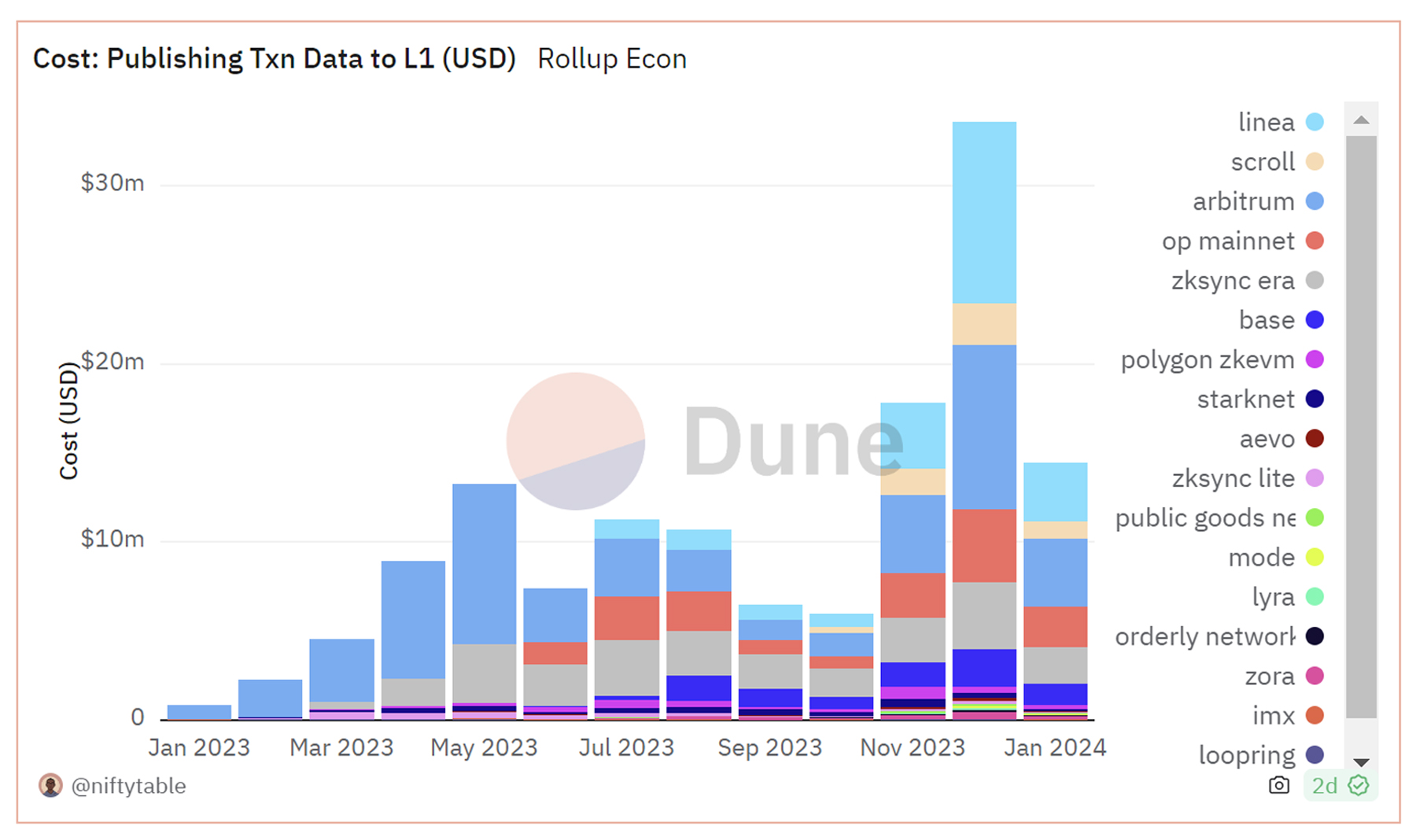

We compared the storage cost of Ethereum DA to the likes of Arbitrum, Optimism, and Manta’s expenditure through Celestia DA. There was a huge difference.

In December 2023, Arbitrum and Optimism users paid $9.22 million and $4.09 million as DA fees or as the cost of publishing transaction data to the L1.

Manta Pacific users have paid an amount of $2831, which is 99.78% below the market average, since December 16, 2023. The estimated Celestia DA fee was $84 recently, while the estimated L1 data fee on Ethereum was $35,321.

An argument in favour of other L2s is that they are reliant on and optimistic about the massive upgrade coming to Ethereum. With EIP-4844, separate blockspace will be introduced for L2 call-data, which will reduce blockspace demand on Ethereum, hence reducing transaction costs.

However, the best estimate expected by the market after EIP-4844 is live is that call data costs could go down by a magnitude of 5 to 10x, at most. This means Celestia DA will still be at least 50x cheaper than ETH-based alternatives.

So, Manta is indeed solving a problem right now, but other things need to be considered before arriving at a potential investment decision.

Manta Pacific vs Metis

We recently released a report on Metis, in which we were bullish about its development and potential.Now, we have another L2 on our hands. Hence, it is only fair to conduct a side-by-side analysis to understand if we need to be more bullish on Metis or Manata. We have classified the talking points below:

-

Approach to Scalability

Manta Pacific doesn’t have this advantage over Metis because it also uses a hybrid rollup scaling system (i.e., using both OP Stack and ZK-rollup), which allows it to have a faster transaction finality time, dropping from 7 days to 4 hours.

Metis is one of those projects awaiting Ethereum’s EIP-4844 upgrade to reduce transaction costs and improve scalability in real-time.

However, as highlighted in the previous section, Manta Pacific is currently ahead with its modular DA approach to reducing gas fees.

Manta Pacific has a clear upper hand right now.

-

TVL

The total value locked under various dApps had a wider discrepancy. Manta Pacific boasted over 31 protocols on Defillama, amassing $445 million, while Metis DAO facilitated 36 protocols, aggregating only $65 million in TVL.

Hence, activity and growth-wise, the numbers also favour Manta Pacific here.

Important note: The TVL mentioned below is retrieved from both L2beats and Defillama. L2beats calculates all values locked on Ethereum. Defillama only calculates the value locked on various dApps across chains.

-

Tokenomics

But not so fast; let’s talk about tokenomics.

This is where we started spotting a few glaring holes and concerns around the modular L2 chain.

One of the major reasons why we were bullish on Metis DAO was that its circulating supply was hard capped at 10 million.

Out of this 10 million, 4.6 million tokens were dedicated towards its Metis Ecosystem Development Fund, which would be used to incentivise developers, liquidity providers, etc., to build on the network.

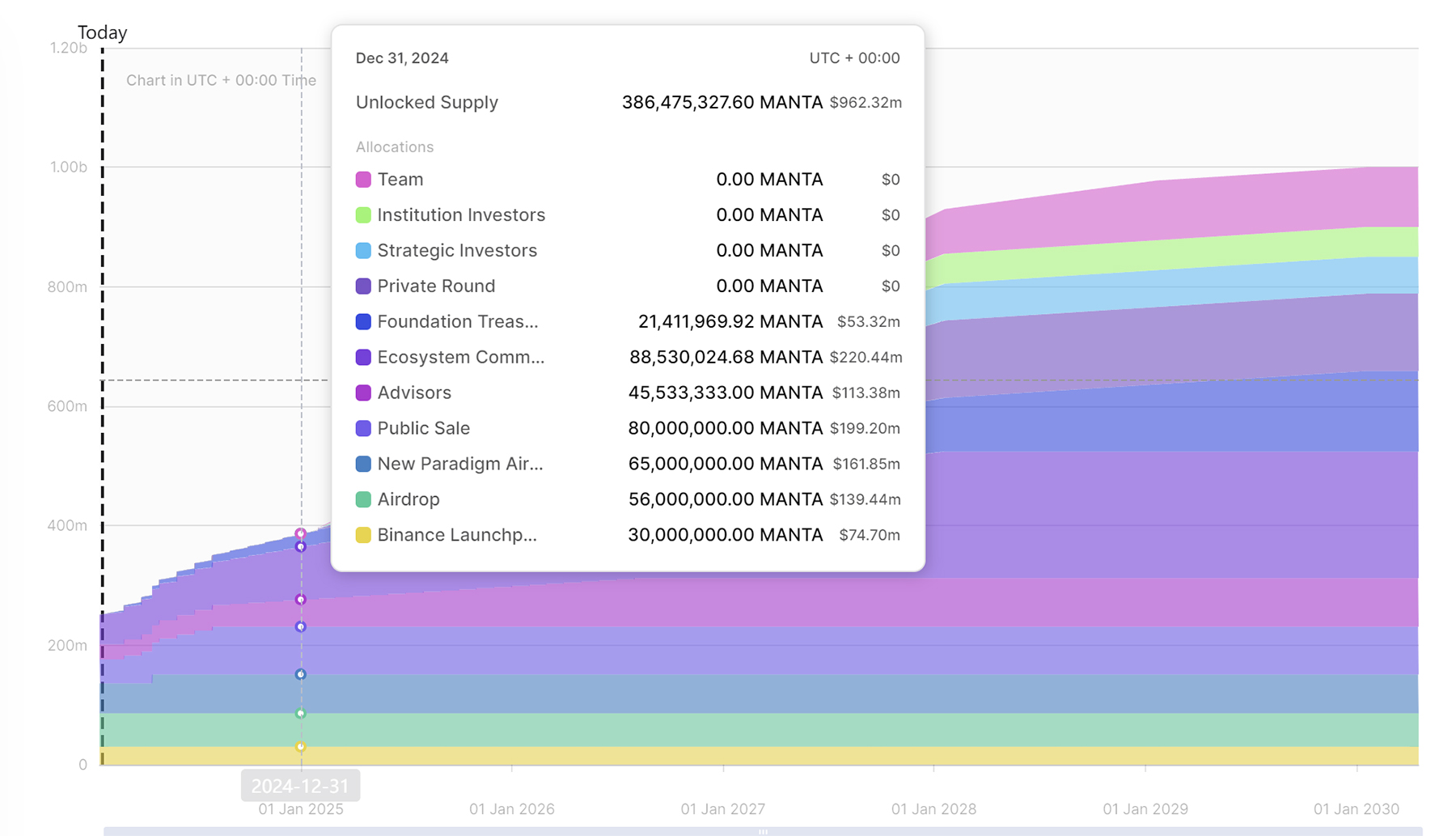

With Manta Network, the total circulating supply is 1 billion, with 250 million currently in circulation.

That leads to a very low float and high FDV metric, which paints a poor investment proposition.

Hence, the tokenomics are better for Metis than Manta Pacific.

But it gets worse for Manta.

Red flags and concerns for Manta Pacific

-

The tokenomics is not investor-friendly

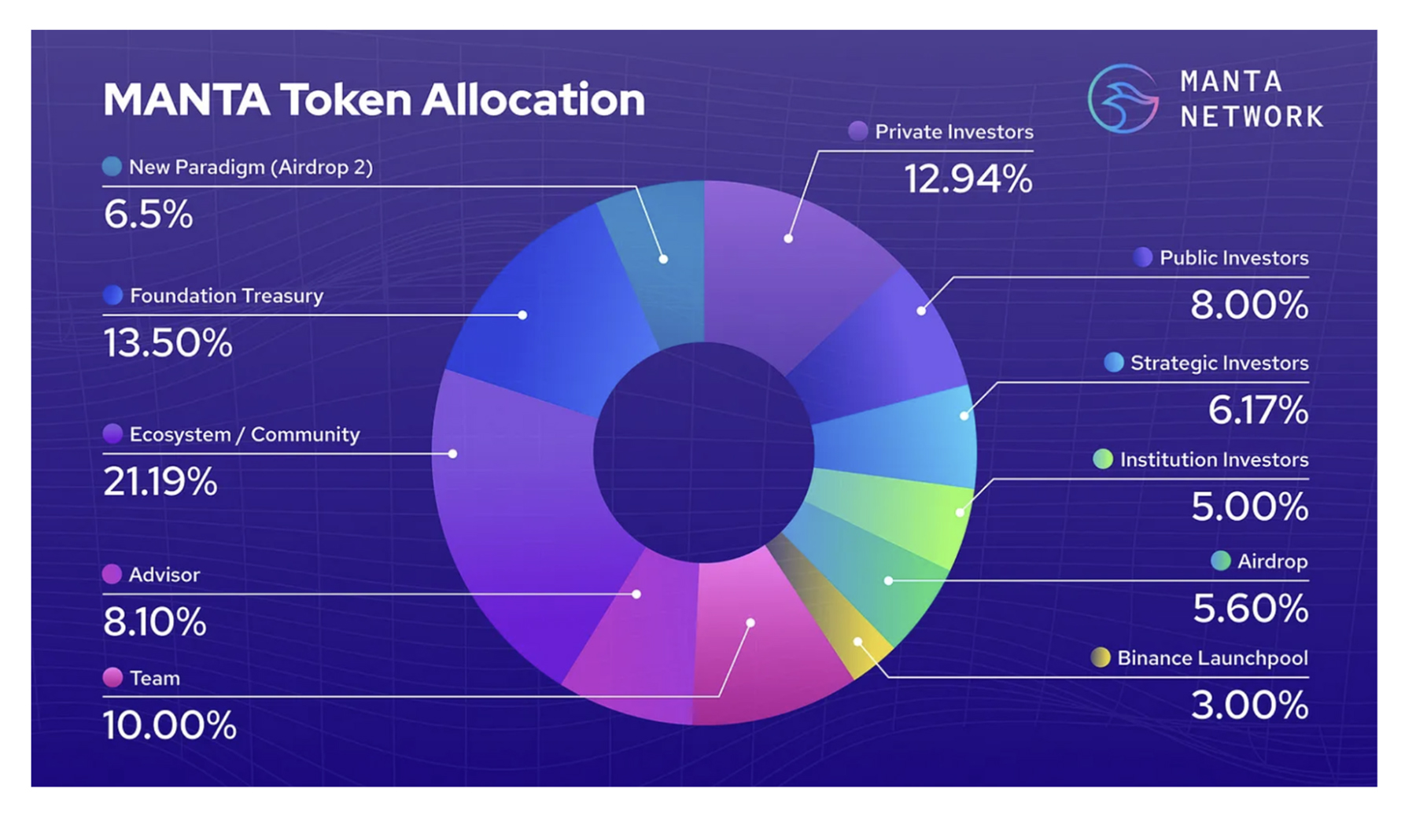

By the end of 2024, the circulating supply will rise to 384 million, an increase of 54.4% from the current mark. From an inflationary perspective, that isn’t ideal for the token price. The protocol also released its complete Manta token allocation, highlighting more issues.

If the allocations for advisors (8.10%), teams (10%), private investors (12.94%), public investors (8.00%), strategic investors (6.17%), and institutional investors (5%) are added up, it looks like a 50% allocation. This means almost 500 million tokens are concentrated in a very small group of people in comparison to the larger community. It raises concerns like mass dumping on the network over time.

-

DDOS attack and underwhelming airdrop

One particular event that the community was hyped about was Manta’s New Paradigm campaign. It promised early participants rewards in the form of airdrops, which played a massive role in its TVL rising above $1 billion.

However, the results were underwhelming, with multiple users indicating their disappointment.

-

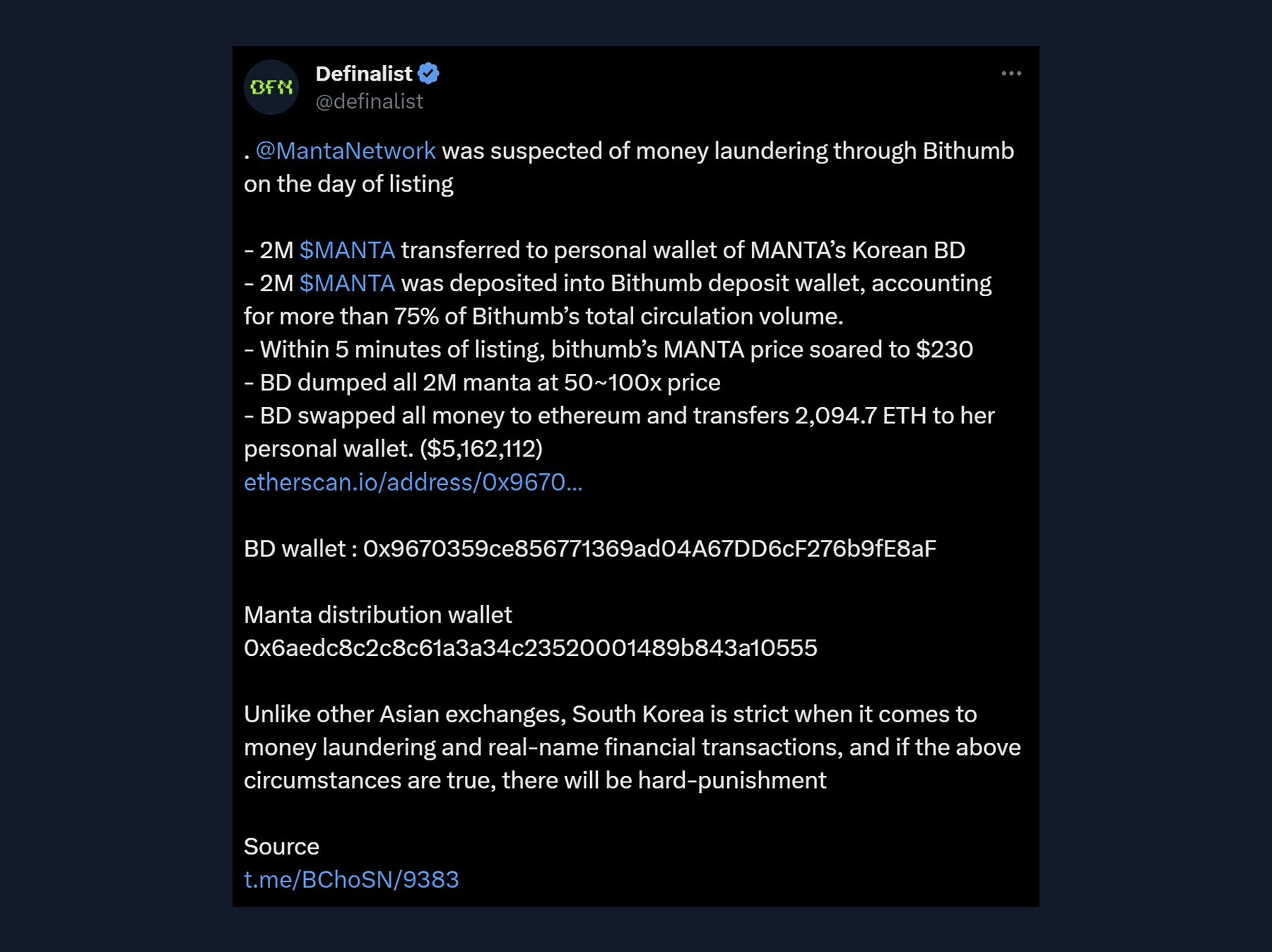

Money laundering allegations

The Manta team responded swiftly to these allegations and stated that the funds in question were allocated to expand the project’s footprint in South Korea. However, it is a little suspicious that they limited user interactions on that post and disabled the comment section.

Manta’s valuation

From an on-chain and activity perspective, Manta Pacific has been proving its mettle. According to data, it has already processed over 10.6 million transactions, and the network possesses over 720,000 wallet addresses.Like most L2 networks, the business model of Manta Pacific revolves around revenue generation and fees collected. The $MANTA token has utility on both the Atlantic and Pacific.

For Atlantic, it processes utility in:

- Demand for $MANTA blockspace generates revenue.

- Initial funding from the sequencer accrues to the Manta Foundation for redistribution.

- Future funding may accrue directly to the protocol through the sale of participation rights in Manta’s decentralised sequencing network.

- Transactions and contract/pallet executions incur a usage fee.

- 72% of network usage fees are allocated to ecosystem projects, enhancing incentives for apps built on Manta.

- 18% goes to the Treasury, which is governed to incentivise network development and future parachain auctions.

- 10% is distributed to collators producing blocks containing transactions.

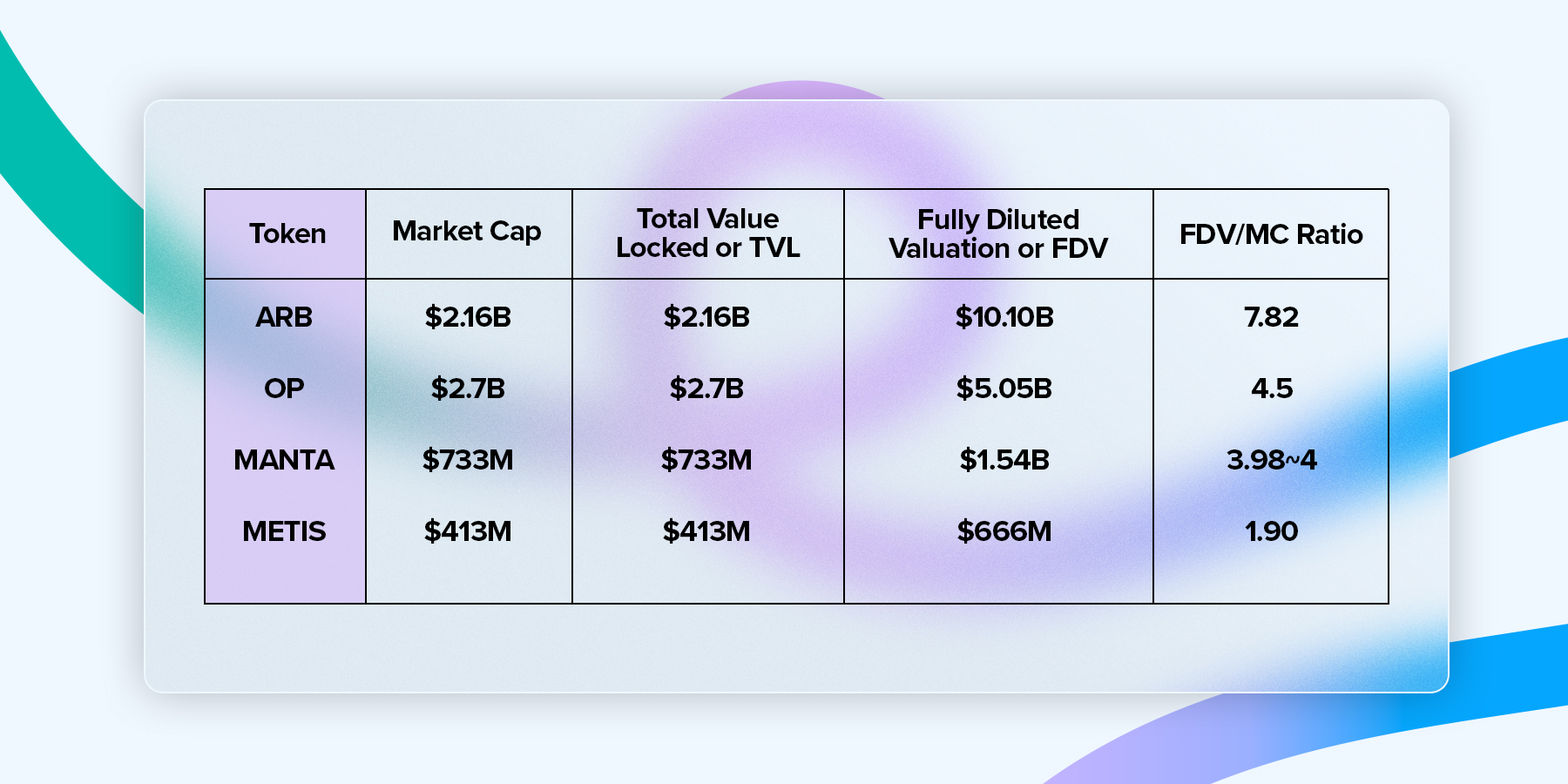

Listing out the important data:

When the FDV/MC ratio of a token is below 1, it is deemed undervalued. Between 1 and 2, it is termed fairly valued, and over 4, it is considered overvalued.

Currently, the valuation for ARB, OP, and MANTA is overvalued.

For METIS, with a 1.90 rating, it is fairly valued.

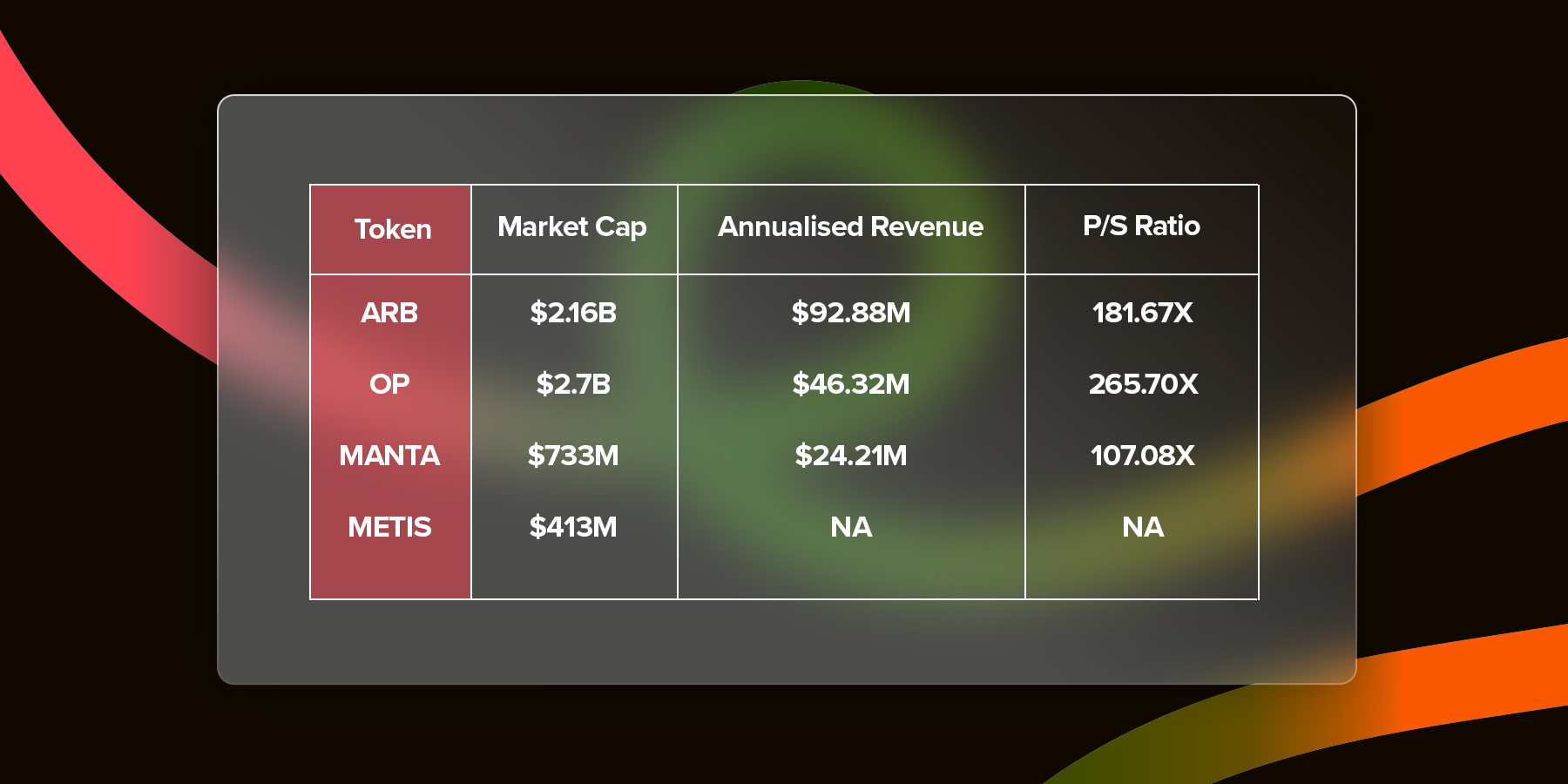

Now, we will assess the revenue generation of each protocol using a price-to-sales ratio metric. The price-to-sales ratio is calculated based on the token's market cap divided by the token's annualised revenue.Based on data from the token terminal:

Now, comparing the P/S ratios of ARB, OP, and MANTA, it is very clear that Manta is just slightly less overvalued than the two largest L2 chains.

Manta’s market cap is also fairly high at $733 million, so the possibility of 10X its current value seems like a long shot.

Manta Pacific might have the best narrative right now regarding solving the scalability issues as visualised by the reduction in gas fees. Still, token emission concerns and a concentration of 50% amongst early members are not great anchors to follow up with.

So, how high do we think MANTA can get?

- As a base case scenario, we can see MANTA match ARB’s market cap, i.e. 2.8x

- As a bull case scenario, we can see MANTA match OP’s market cap, i.e. 3.68X

Of course, from a technical and narrative perspective, MANTA is impressive, but when it comes to getting the best value out of your investment – MANTA drops the ball.

Cryptonary’s take

Manta Pacific has made its presence felt in the crypto market this month.It has a different approach to solving an underlying scalability issue for L1-L2 chains. It registered a strong start in saving gas fees and has the third-largest TVL of all L2 chains.

Yet, this is where the buck stops for them.

Manta Pacific does not have the complete package right now because the investment proposition is terrible. There is an alarming token emission schedule. The market size of the protocol is screaming overvaluation, and the battle for dominance among L2s is far from over.

When we covered the Metis protocol, the roadmap was more credible. There is better transparency with token distribution, the project is fairly valued, and there is far more upside potential from an investment point of view.

Manta Pacific is the new shiny protocol on the block, but Metis remains a better bet to take on for the near future.

After reviewing both projects, we maintain our bullish outlook on Metis.

But don’t just take our word for it; take a moment to read our Metis deep dive again to reevaluate both projects and gain clarity.

Cryptonary, OUT!