We said the 24/25 cycle is a memecoin supercycle, and that's valid, considering how well memecoins have outperformed every other sector in the market.

However, the memecoin market has also been plagued by an influx of low-quality scammy coins, distorting the true potential of this sector. So, is this how we would carry on? Most likely not!

Our latest analysis suggests that there's a shift in the tides.

Let's dive in.

TLDR

- The memecoin landscape has shifted dramatically - find out how recent trends have reshaped the market.

- Discover the surprising statistics behind memecoin launches and why the odds may be stacked against investors.

- Uncover the psychological factors driving the continued popularity of low-quality coins.

- Learn which blockchains see the highest "mortality rates" for memecoins and what it means for the ecosystem.

- Explore how sentiment is evolving and why a "flight to quality" could be on the horizon.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The explosion of sh*tcoins

Roughly between September 2023 and March 2024, the playbook for profitable memecoin investing was relatively straightforward.- Look for a memecoin related to a popular or potentially popular meme

- Double-check that it passes the rug test with the renounced ownership contract, liquidity locked, etc.

- Buy the coin and actively work towards building a thriving community around the meme.

The reason is that these token launch platforms allow users to easily create and launch memecoins with minimal effort. Virtually anyone can mint a new token with little more than a rudimentary understanding of blockchain technology and a few bucks.

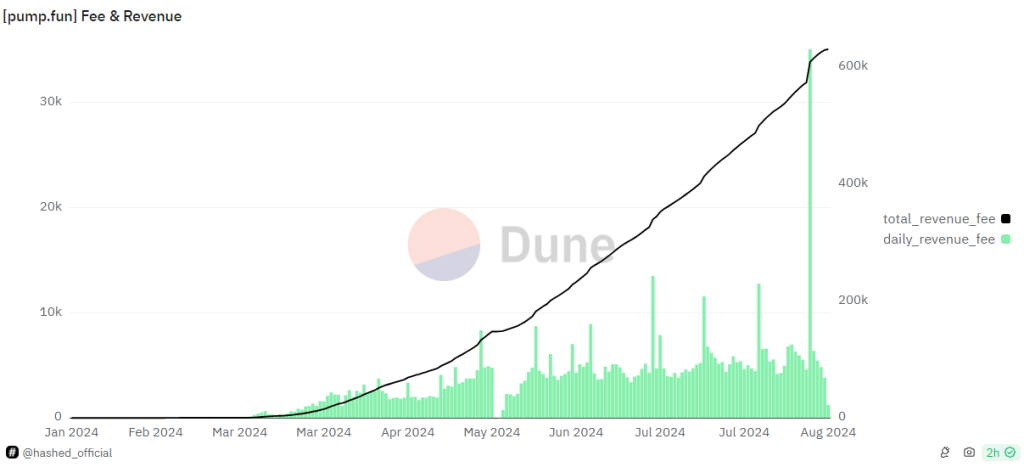

Pump.fun found a great product-market fit in the current market environment, often generating more fees than Solana and Ethereum.

And it wasn't long before many other platforms followed the trend, and we have multiple memecoin launching platforms, which further floods the market with memecoins.

The challenge, however, was that while these token launch platforms democratised coin creation by lowering technical and financial barriers, they've significantly increased the number of memecoins in circulation.

A race to the bottom

The dark underside of this proliferation of memes has also led to an explosion of "sh*tcoins"—low-quality memecoins intended to extract wealth from investors.Therefore, even when you buy a high-quality, potentially-viral memecoin with a committed community, the proliferation of memecoins means that liquidity and attention are fragmented.

TLDR, platforms like Pump.fun have turned the memecoin market into a casino of sorts; the house always wins; expect that, this time, your odds are much lower than in traditional casinos.

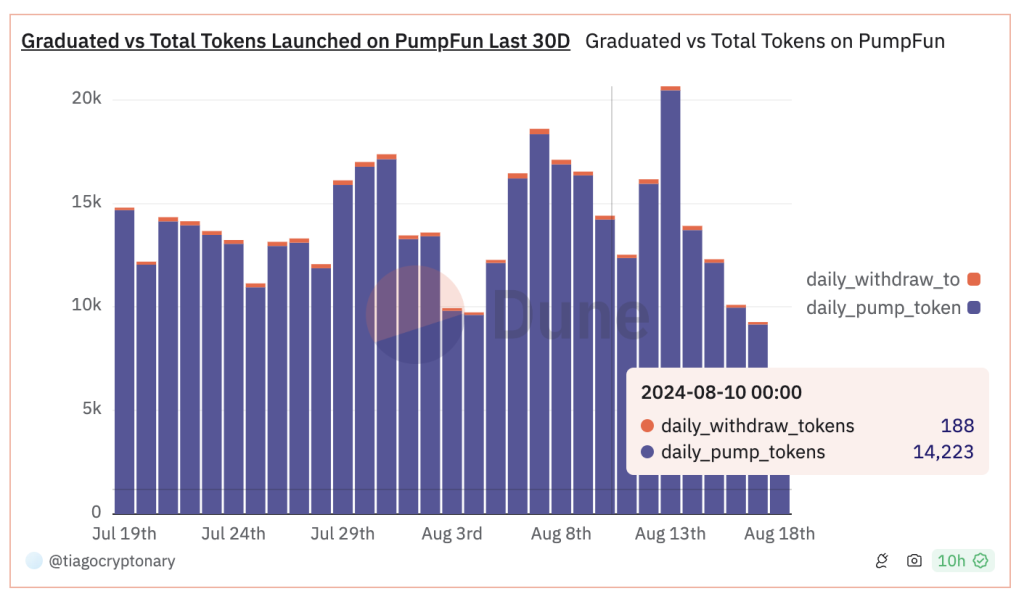

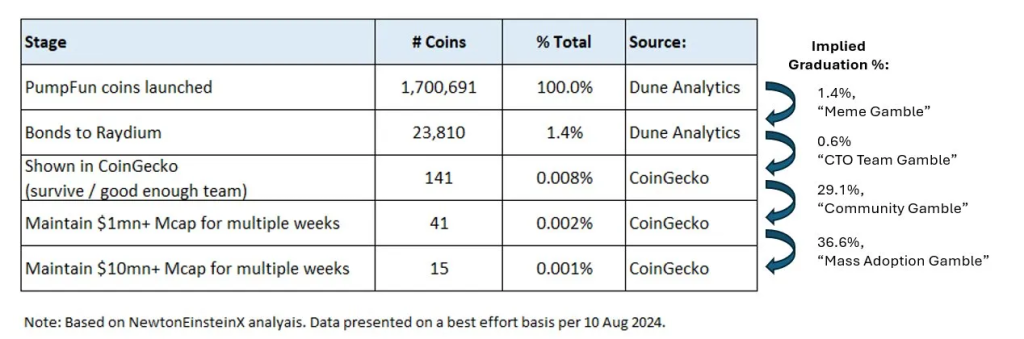

Analysing the last 25 days of data from Pump.fun:

- The median percentage of tokens that graduated from the platform to Raydium relative to the number of tokens created is 1.32%.

- The median percentage of cumulative tokens that graduated from the platform to Raydium relative to the cumulative number of tokens created is 1.34%.

More specifically, if you were to buy 100 tokens, based on the median daily graduation rate of 1.32%, you could expect that approximately 1 or 2 of those tokens would graduate to Raydium to then have a shot at competing with the rest of the memecoins in the already-saturated market.

But it gets worse!

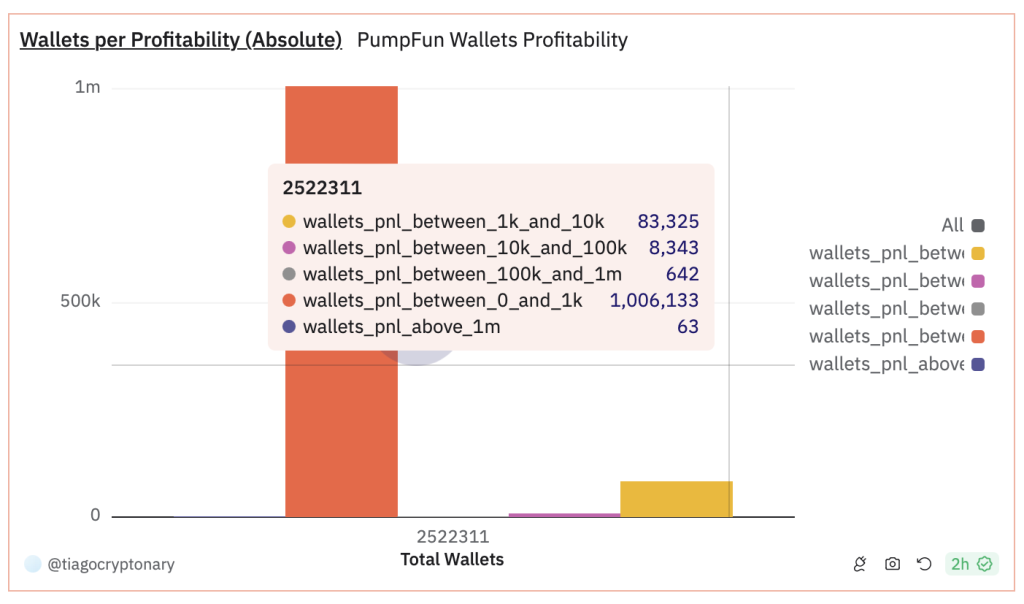

Take the 2.52 million wallets that have interacted with Pump.fun; 55% are at a loss, and only ~1.13 million (45%) are profitable.

But that profitability number is misleading.

When we broke out the actual level of profitability, and the numbers are damning.

- More than 93% of wallets only have profits between $0 and $1,000.

- Only 5.9% of wallets have between $1000 and $10k profits.

- Only 0.04% of wallets have managed to score more than $100k in profits.

Long story short, the majority of Pump.fun users are in the red, and the most profitable ones are either barely breaking even or making negligible gains.

From sh*tcoins to deadcoins

Due to the massive number of memecoins that flooded this segment, it has become one of the most challenging high-quality memes to achieve sustained success.Out of the over 1.7 million meme coins introduced by Pump. Fun, only a handful, 15, to be precise, have achieved and maintained a market capitalisation exceeding $10 million for multiple weeks. This equates to a minuscule success rate of only 0.0001%.

The rarity of achieving lasting value in this sector is further underscored by the fact that only 41 meme coins have managed to sustain a market capitalisation of over $1 million for an extended period. This represents just 0.0002% of all meme coins launched on Pump.fun. These figures highlight the exceptional difficulty of reaching significant financial milestones within this market, where most projects quickly fade into obscurity after their initial hype.

As we've already established, it's much harder for your high-quality memecoin to build the momentum necessary to break into the big leagues.

Why do people buy sh*tcoins?

The popularity of these sh*tcoins can be attributed to several factors, but the central theme is that scammers are taking advantage of inexperienced retail traders and investors.- Misleading unit economics

- The allure of a 1000x instead of a modest returns

A significant driver of this trend is the prevalence of "success stories" and wallet screenshots circulated across social media.

These narratives frequently showcase individuals who have purportedly transformed their financial lives through quick, substantial returns from memecoins. Such stories seed a pervasive sense of FOMO among potential investors.

- FOMO for the next big thing

This FOMO is not just a byproduct of these stories and screenshots but a critical component of the marketing strategy for many sh*tcoins. It taps into the emotional psyche of inexperienced investors, compelling them to believe that they, too, could be on the brink of a similar financial windfall.

Sh*tcoins aren't limited to Solana

It is common to see memecoin sceptics claim that Solana memecoins are the poster child of everything wrong with memecoins. However, our analysis suggests that the sh*tcoin epidemic is not limited to Solana.A look into scam activity within the memecoin market shows that more than half (55.24%) of all meme coins analysed in 2023 were classified as "malicious."

Further, each month, an average of over 2,000 memecoins vanish from the crypto scene. This "death rate" is determined by several indicators, like a website being taken down, an inactive Twitter account, or a market cap dipping below $1,000. Here's how different blockchains stack up:

- Base has the highest death rate at 67%, meaning two-thirds of all memecoins created on this platform have ceased to exist.

- Solana follows with a 54% death rate of its memecoins.

- Ethereum fares better but still sees 37% of its memecoins fizzle out

In investing, failure is not fatal. A memecoin that performs poorly today may yet get a fresh breath of life to regain its lost momentum. We've seen this with CTO (community takeover) projects. But when a memecoin is dead, it's gone for good, and the losses are permanent.

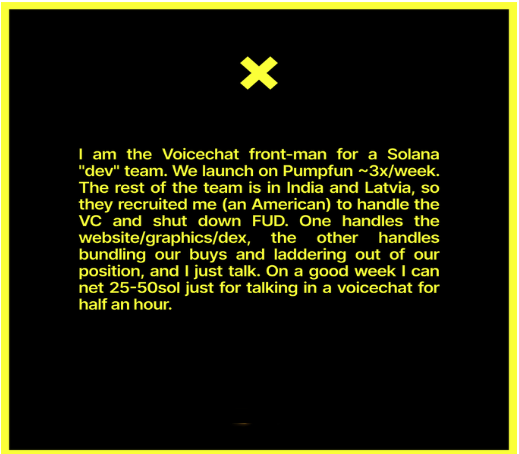

Don't fall prey to scammers

Warren Buffet is credited with saying, "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.

As seen on Coinfession.

As a result of the memecoin mania that has happened in the last six months, scammers can extract substantial amounts of money by creating sh*tcoins and selling them to retail investors.

That is unsurprising since the odds of making substantial money are very low. At this point, it is self-evident that these Pump.fun memes are an enormous wealth extraction machine for celebrities, KOLs, influencers, and scammers, and many people have lost money.

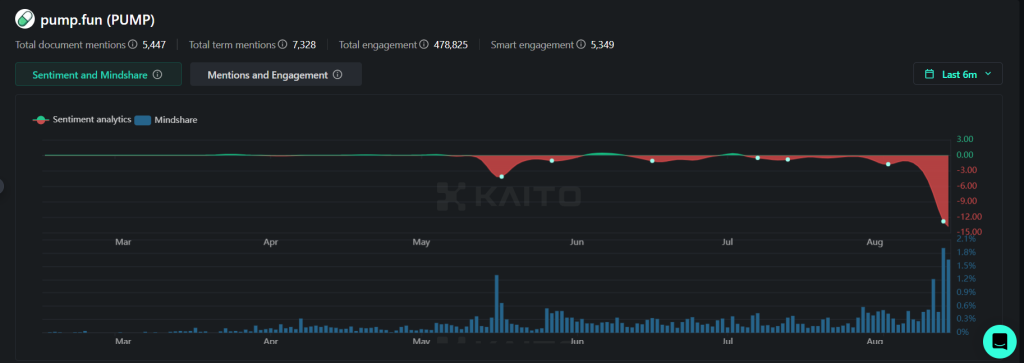

The flight to quality memes is back

Initially, platforms like Pump.fun were celebrated for democratising token creation, allowing anyone to launch a coin with minimal technical know-how. However, as the novelty wore off, the market began to witness the darker side of this coin-creation frenzy.The crypto community has become increasingly critical. Users have started vocalising their disillusionment, pointing out that the only consistent winners in this game are the platforms themselves and those who manage the bots or engage in "rug pulling"—where creators abandon the project after dumping hidden tokens on retail, leaving investors with worthless tokens.

The lack of transparency, the prevalence of bots, and the sheer volume of new coins daily have led to what some describe as a "race to the bottom," where the odds of making money are increasingly stacked against the average investor.

Thus, the sentiment around Pump.fun has been at historical lows. This sentiment reflects a broader realisation: the ecosystem of sh*tcoins, especially on platforms like Pump.fun, has become saturated with projects that rarely see the light of day beyond their initial hype.

This shift in sentiment isn't just about the significant financial losses but also about realising how these platforms operate.

This shift underscores a maturing market with an awareness of risk, an embrace of due diligence, and a demand for fewer sh*tcoins to promote quality over quantity.

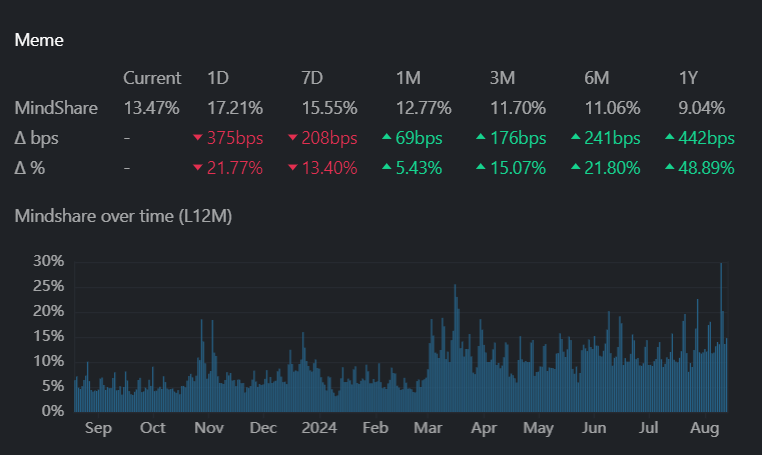

Quality memes are consolidating

Now that a sense of sanity is being restored to the memecoins market, we think the time is near for quality memes to return to winning ways.For one, the mindshare for memecoins as a sector has increased over the last year. Thus, the current consolidation is constructive because it clears the froth and allows quality memes to shine.

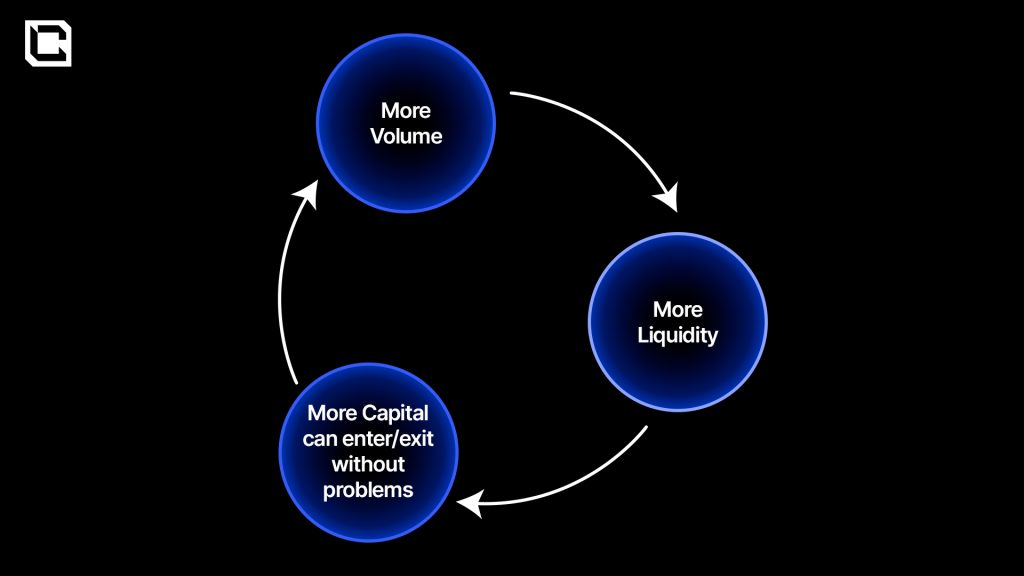

Consolidation is crucial in building the liquidity needed for the next significant price movement. Despite prices staying within a range or trending down, liquidity is steadily increasing, driven by the volumes generated by leading memecoins.

Since one of the features of organic memes is the locked liquidity, all fees and slippage generated from the volume will be retained in pools. Thus, liquidity is gradually growing over time despite prices being rangebound.

Therefore, meme market leaders will continue to absorb volume and attract more capital, setting the stage for explosive growth in the next leg up. This will make it increasingly difficult for lagging memecoins to gain traction, as liquidity naturally gravitates towards where the volume is concentrated.

Thus, unlike many sh*tcoins that don't last more than a month, market leaders will suck all the volume, further sucking liquidity, and attracting more and more capital, thus leading to explosive growth in the next leg up.

The resurgence of quality memecoins

There are over 1.7m coins in the Solana ecosystem; 99,9% of the memes among them will go to zero. So, how do you distinguish signal from noise?

As we mentioned earlier, volume is the precedent for building deep liquidity. The deep liquidity, in turn, brings more volume and triggers the memecoin flywheel liquidity described above.

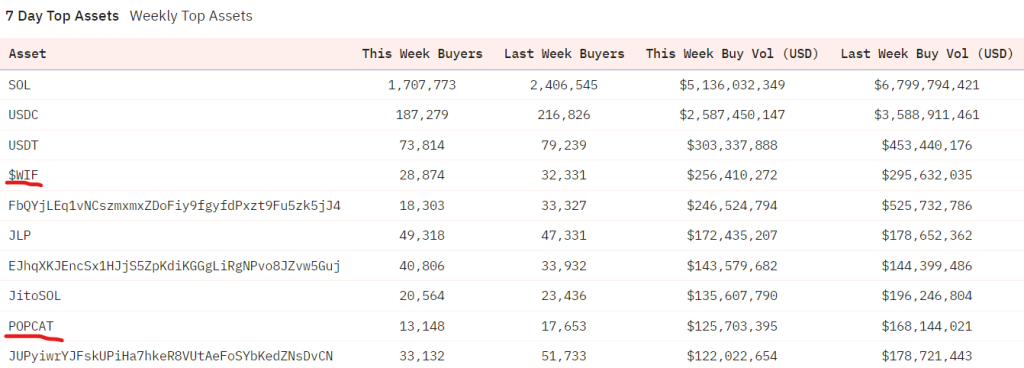

Looking at the top assets by volume, we can see that among the top 10 coins by volume, the only memecoins are WIF and POPCAT.

Despite WIF and POPCAT's prices being down from their ATHs, they have been consistently at the top in terms of volume.

What does it mean?

Even though the prices have come down, WIF and POPCAT are leading in building up liquidity because they have the largest volumes and, thus, are likely to attract more capital in the next leg up.

So what happens next?

WIF and POPCAT are set to win and win BIG.

Why? Many people are now realising that they'll most likely lose money chasing low-quality memes, and their best odds of success are in high-quality memes like WIF and POPCAT.

Cryptonary's take

The memecoin sector has been a chaotic battleground, with platforms like Pump.fun flooding the market with low-quality coins, fragmenting liquidity, and diluting attention. This has made it increasingly difficult for even the most promising memes to maintain sustained momentum.However, the tide is turning. Current sentiment around platforms like Pump.fun indicates a growing disillusionment. Retail investors are beginning to realise that cheap doesn't always equate to valuable and that a low price tag often comes at a steep cost.

The market is reaching a critical inflection point, where the memecoin "sh*tfest" is likely ending. The result? It's a flight to quality memes.

When backed by strong communities, organic growth, and fun culture, memecoins are not bad investments. In fact, as a sector, they will still outperform. The key, however, is discerning the winners from the losers. As the market matures, only the memes with true staying power—those with real communities and strong liquidity—will rise to the top.

WIF and POPCAT are already leading the charge, attracting the highest volumes and building up liquidity in anticipation of their next leg up. These coins are positioned to capitalise on the eventual breakout of BTC and SOL to new all-time highs, which will likely serve as the catalyst for these winners to truly moon.

In this cycle, it's no longer enough to be in memes; you must be in the right ones. The market's evolution from quantity to quality will separate the wheat from the chaff, and those who position themselves wisely will stand to gain the most.

While we are confident that the winners will continue winning, in our next memecoin report, we will spotlight some emerging opportunities in the memecoin market. You definitely don't want to miss the next one. Stay tuned!

Cryptonary, OUT!

The Future of Memecoins: Quality Over Quantity

The memecoin market is evolving fast. Scams and low-quality projects are fading, and only the strongest will survive. If you want to navigate this space successfully, you need solid research and a winning strategy.At Cryptonary, we help investors identify the real opportunities—before they explode.

🚀 Get exclusive insights, expert analysis, and high-quality crypto picks.

Join Cryptonary today—your edge in the memecoin supercycle!