Memecoin masterclass: Tips for successful memecoin investing

Meme coins have garnered significant attention for their potential to generate impressive returns. 10x, 100x, and 1000x returns are possible in this sector of the crypto market. At Cryptonary, one of our meme coin picks delivered a 9000+% return, and the second pick is on track for a 1000% upside.

However, meme coins are highly speculative and volatile, and the path to meme coin riches is fraught with risks—volatility, rug pulls, and outright scams lurking around every corner. Therefore, understanding a solid meme coin investment strategy is crucial for navigating this market successfully.

Therefore, it is unsurprising that many people who have dabbled in memecoins have fallen prey to scams and rug pulls. It is even more understandable that many people avoid meme coins because they find it hard to navigate the very thin line between legit memecoins, sh*tcoins and scam coins. But because you have the Cryptonary advantage, you shouldn't fall into these same pitfalls. But with the right tools, such as a proven meme coin investment strategy, you can avoid these pitfalls and achieve success. If you’re wondering how to invest in meme coins safely, you’re in the right place.

Today, we present a comprehensive to equip you with the necessary tools and strategies to separate the wheat from the chaff, spot the red flags, and ultimately position yourself for success with meme coins.

Let's dive in

TLDR

- The memecoin phenomenon has gripped the crypto world, fueled by the tantalising prospect of earning life-changing gains.

- However, this exhilarating journey is fraught with risks - extreme volatility, rug pulls, and scams lurking around every corner. The key lies in developing a robust meme coin investment strategy that includes opportunistic boldness tempered by prudent risk management.

- While the speculative nature of memecoins may draw comparisons to gambling, a key distinction lies in their position as an emerging asset class.

- Unlike casino games rigged in the house's favour, memecoins offer a level playing field where savvy investors can strategically position themselves for success.

- Learning how to invest in meme coins effectively can help you minimise risks and maximise potential gains.

- Identifying the next memecoin superstars hinges on evaluating three critical factors: attention, liquidity, and virality.

- Ultimately, memecoin investing demands an opportunistic boldness tempered by prudent risk management.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The unstoppable rise of memecoin mania

While cryptocurrencies have long been associated with financial speculation, the recent surge in memecoins has taken this phenomenon to unprecedented heights.The frenzy surrounding memecoins in the current market cycle is reminiscent of the ICO boom of 2017 and the NFT frenzy of 2021.

Understanding how to invest in meme coins effectively starts with recognising the unique drivers behind their success—viral attention, community engagement, and cultural relevance. For instance, the Solana ecosystem has emerged as a fertile ground for meme coin investments due to its low transaction fees and inclusive nature.

However, what sets meme coins apart is their ability to capture the attention and imagination of retail investors through viral memes and internet culture.

At the forefront of this memecoin revolution is the Solana ecosystem, which has emerged as the preferred playground for memecoin investors. The combination of low transaction fees and the inclusive nature of the Solana network has made it possible for even those with modest capital to participate in the memecoin frenzy.

Now, with the right meme coin investment strategy, even small-scale investors can participate in this space with confidence. This accessibility and the potential for life-changing returns have fueled a wave of meme coin investors. You probably remember WIF, our meme coin pick that delivered 9000+% in less than three months.

Now, the WIF community has raised over $650,000 to have the iconic meme displayed on the Las Vegas Sphere, showing how strong the community is behind a project that, for all intents and purposes, is a joke.

A new frontier for diversification

The rise of memecoins has coincided with the mainstream adoption of crypto, further solidifying their position as a legitimate asset class in the minds of many investors. But beyond retail investors, we posit that meme coins are on track to see some form of institutional adoption.While the largest proportion of global wealth is tied up in traditional assets like real estate, stocks, derivatives, and other investments, memecoins represent a new frontier for diversification.

How so?

For much of the last decade, it would have been sacrilegious for an asset manager to publicly announce they want to invest in crypto—especially not after JPMorgan's Jamie Dimon called crypto a fraud and money for drug dealers. Now, TradFi funds can't seem to get enough of crypto, and many HNIs are mounting pressure on their managers to provide exposure to this asset class.

Here's a little-known fact about asset managers—they don't care about decentralisation and all the other sociopolitical and philosophical underpinnings of crypto. They only care about profit, and if the meme coin sector of crypto offers the highest return, you can be rest assured that they'll allocate positions to that segment.

Funds and institutions have seen multiple examples of successful memecoins. After seeing this, many of them will start allocating some portion of their capital to memecoins as part of their diversified portfolio.

What's different between memecoins and gambling?

Gambling has existed for centuries, with millions risking money or valuables to win material goods, for entertainment, or for social interaction. Similarly, memecoins have emerged as instruments for entertainment, social commentary, and money-making.Now, let's face the facts - memecoins don't have "fundamentals" in the traditional ways that other crypto projects do. There's no revenue, fees, TVL, or price-to-sales ratio to evaluate. That's why many people believe you should mentally write off any money you allocate to memecoins immediately after making the investment. This lack of traditional fundamentals is also a prime reason to be responsible and only invest what you can afford to lose.

Based on this absence of typical investment metrics, many perceive memecoin investing as nothing more than gambling. However, we disagree—while the house always wins in gambling, when you choose the right memecoins, there's no house, and all participants have fair odds for profit.

In contrast, while memecoins may share some surface similarities with gambling, such as an element of speculation and risk, there are distinct advantages that set memecoin investing apart and make it a more appealing proposition than traditional casino gambling.

Social acceptability

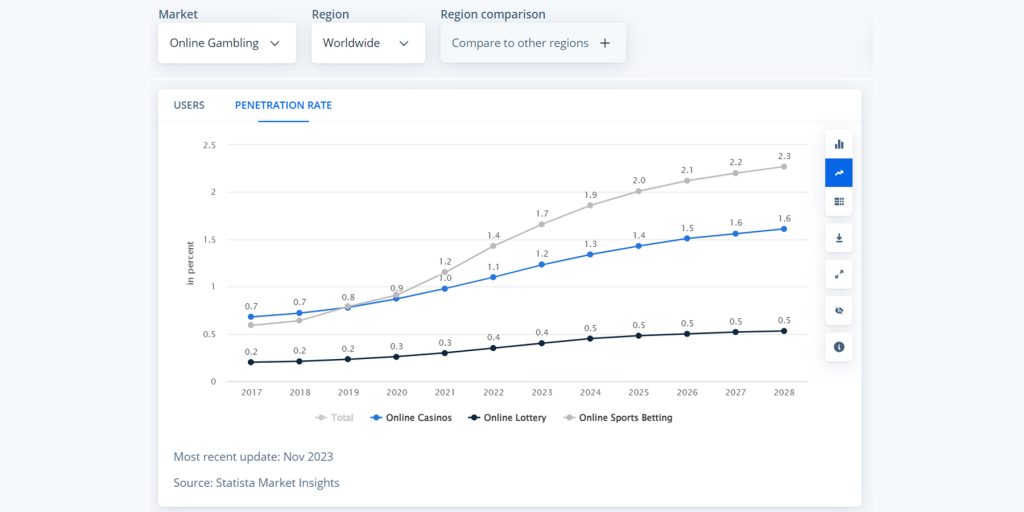

Crucially, though, unlike gambling, which is often stigmatised, memecoin investing is seen as a legitimate, if high-risk, asset class. Investors can openly share insights, strategise on entry/exit plans, and celebrate wins without moral apprehension.That said, while many people investing in meme coins may never jump on a plane to play slots in Vegas, it is much easier for people already visiting casinos (offline and online) to dabble in memecoin investing. The penetration rate of online gambling is approximately 2% worldwide and is expected to grow.

Some of that growth will also spill over to memecoins, further fueling the adoption of memecoins by retail and institutions.

And since meme coins are perceived as assets that can be traded and invested as part of a portfolio where risks and returns can be managed. Therefore, people are more willing to allocate significant amounts to memecoins as part of their broader portfolio than they'd spend on a few nights out at the casino.

Fair playground

Unlike casinos, where the house has a built-in edge, the memecoin ecosystem operates on a decentralised, trustless basis. No centralised authority takes a cut or manipulates the odds in their favour. All participants have a fair and equal opportunity to profit from their investments.In addition, memecoin success is driven by powerful market forces like viral interest, community engagement, and capturing the zeitgeist of internet culture. While luck plays a role, skilful investors can analyse trends, gauge public sentiment, and strategically position themselves in potential winners. This introduces an element of research and strategy largely absent from casino gambling.

Furthermore, memecoins represent a new frontier of investing and wealth generation. While casino gambling is intrinsically zero-sum, the memecoin market has the potential for sustained growth and value creation as adoption increases. Early investors are not just taking from a finite pool but riding the wave of an expanding economic ecosystem.

A sense of community

The rise of memecoins has also democratised opportunities. With low cost of entry and 24/7 trading, anyone with an internet connection can participate, not just geographic elites. This has sparked dreams of financial independence in a way lottery tickets or casino nights cannot match.Moreover, the social elements of meme coin communities provide entertainment value beyond just monetary speculation. The creativity, in-jokes, and sense of belonging associated with being part of a memecoin's rise generates its rewards.

How to separate memecoins from sh*tcoins

Every week, thousands of memecoins are created. 99% of them will go to zero. But can you spot a winner and ride it to the moon?Memecoins' success relies on Attention, Liquidity, and Virality.

Attention

Memecoins rely heavily on the power of social media and online communities to gain traction. The more attention a meme coin receives, the more likely it is to attract new investors and increase its value. Therefore, it is important to at least check the social media presence and account following (Twitter, Telegram)It is also important to check whether there is some supporting narrative: politics, events, or story; otherwise, it can be hard to get attention.

Additionally, it is a huge plus if legit people with a huge following tweet, tease, or hint about the token (we covered Messari's founder hinting about $WIF multiple times before it took off).

Liquidity

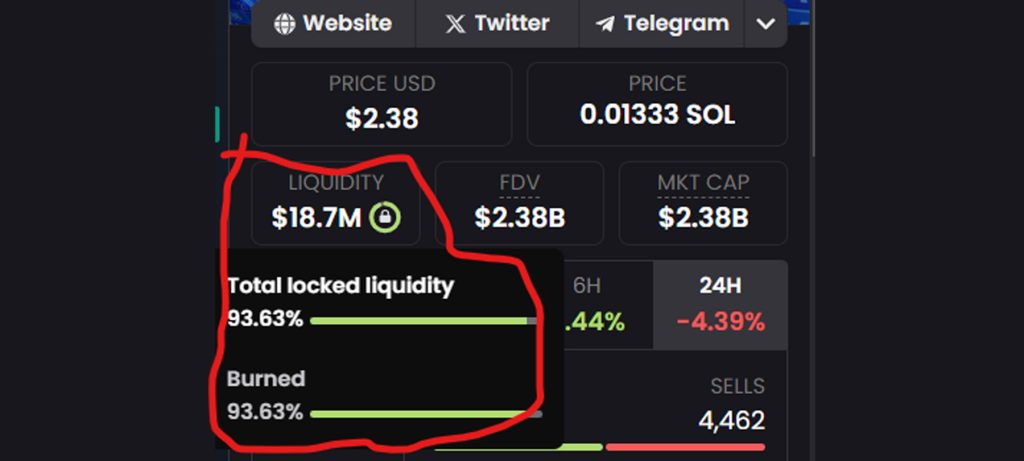

Liquidity refers to the ease with which a meme coin can be bought and sold in the market. High liquidity is essential for the success of a memecoin, as it allows investors to enter quickly and exit positions without significantly impacting the price. High liquidity can help to stabilise the price of a memecoin, as large buy or sell orders are less likely to cause significant price fluctuations.Big money won't enter into an asset with insufficient liquidity. Therefore, checking whether LP tokens have been burnt and the asset has enough trading volume is important.

More volume will create more liquidity, and more liquidity can facilitate more volume.

Virality

Memecoins often rely on virality to generate buzz and attract new holders. Therefore, the meme coin should be "meme-able".Funny slogans, cute photos, memes, etc; anything that can help to grab attention will create a community around that memecoin. A strong and supportive community is essential for the success of a memecoin.

But before investing in any memecoin, it is important to undergo a basic rug-pull test to ensure that only the market decides the fate of the meme coin and not the developers.

How to spot rugpulls and scams

Checking for signs of a rug pull can help you avoid scams and deceitful projects.

Here are some key aspects to consider when conducting a rug test:

LP tokens are burnt

Liquidity Pool (LP) tokens are used in DeFi platforms to facilitate trading and provide liquidity. When the dev burns its LP tokens, the tokens are permanently removed from circulation, making it impossible for the project developers to withdraw the liquidity and run away with the funds (a.k.a. "rug pull").By burning LP tokens, the devs ensure that the liquidity remains locked in the DEX, always providing liquidity for investors to exit the asset.

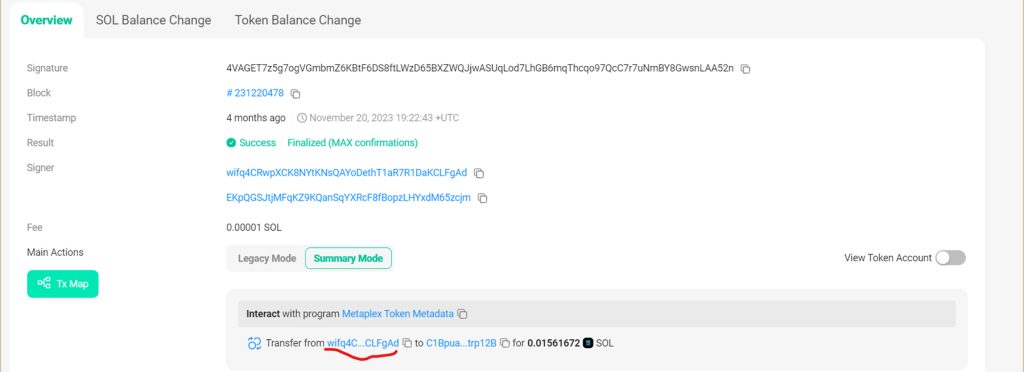

Here is how to check whether LP tokens have been burnt -> example of our beloved $WIF

- Go to Birdeye and choose the Solana network.

- Search the token using its contract address (For $WIF: EKpQGSJtjMFqKZ9KQanSqYXRcF8fBopzLHYxdM65zcjm)

- Go to "First mint tx"; it will take you to the Solana Explorer

- Click on "Transfer from" address

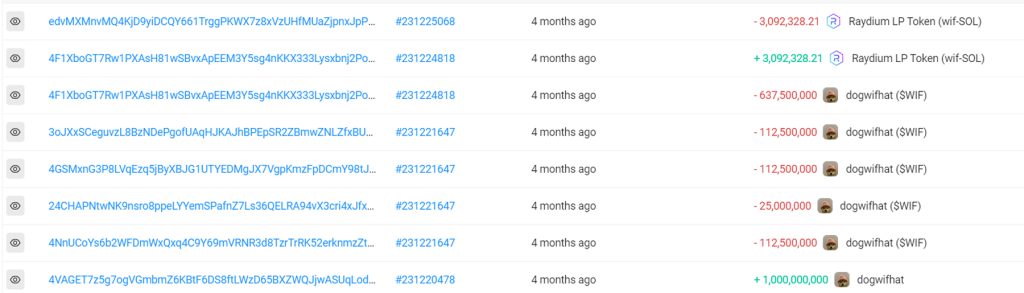

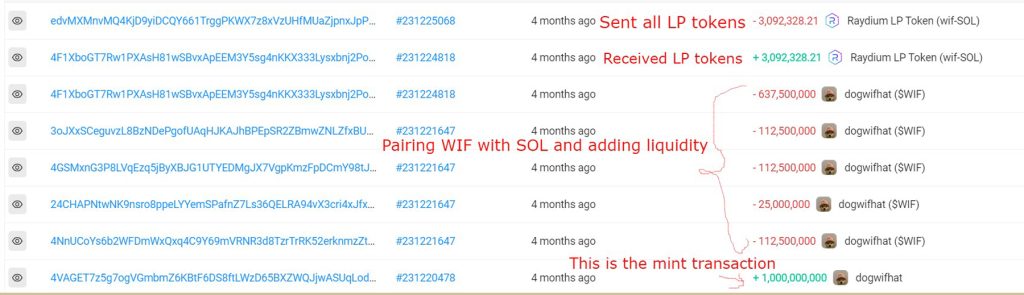

- Go to "SPL Transfers" and go back to find the first mint transaction. It should look like this.

- We should check whether the dev added all tokens as liquidity and burnt all the LP tokens. The image below shows that the dev added all $WIF that he minted as liquidity to the Raydium, received LP tokens, and sent LP tokens.

- We still need to check whether the dev burnt the LP tokens and didn't send them to 3rd third-party wallet he controls.

- For that, we go to DexScreener, input the WIF's contract address, and choose the same assets and DEX on which the initial liquidity was created.

For the small-cap, 100% of the liquidity should be locked and burnt.

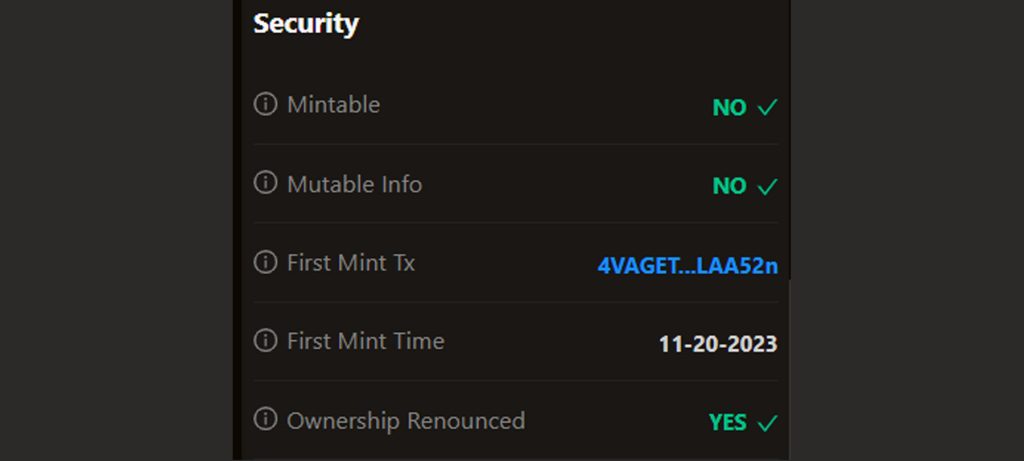

Ownership is renounced

Ownership is renounced when the meme coin developers transfer the ownership of the smart contract to a null address.This means that the developers can no longer change the contract, such as modifying the token's supply or manipulating the code.

By renouncing ownership, the project reduces the risk of the developers making malicious changes that could harm investors.

Here is how to check whether the contract ownership has been renounced:

- Go to Birdeye and choose the Solana network

- Search the token using its contract address (For $WIF: EKpQGSJtjMFqKZ9KQanSqYXRcF8fBopzLHYxdM65zcjm)

- Check whether ownership has been renounced

- It is extremely important to have a non-mintable status as well. It is preferable to have non-mutable info as well.

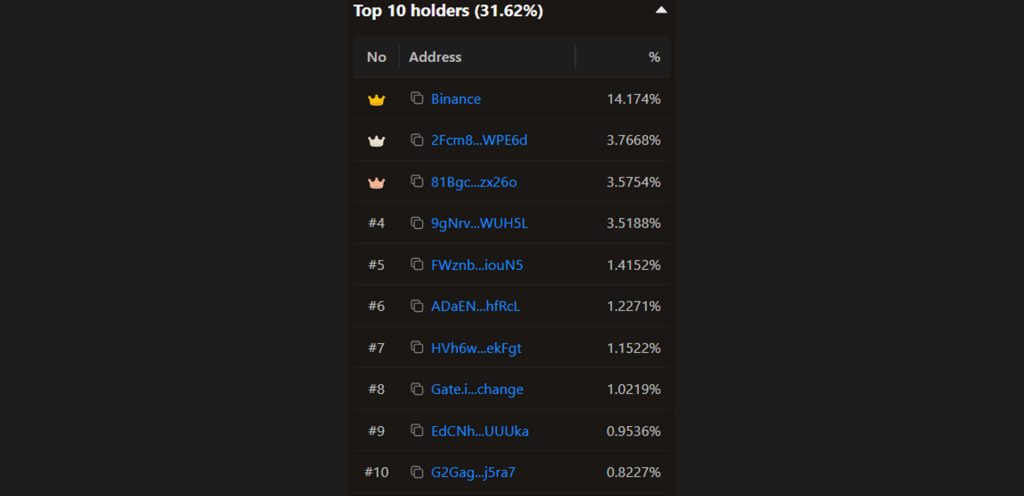

Devs don't control the supply

Ideally, token distribution should be as wide as possible, but at minimum, it shouldn't be concentrated in the hands of a few.When creating memecoins, devs have the power to allocate themselves as many tokens as possible.

This makes the memecoin susceptible to dumps from the devs. Therefore, it is important to check whether devs have allocated themselves tokens

Here is how to check:

- Go to Birdeye and choose the Solana network

- Search the token using its contract address (For WIF: EKpQGSJtjMFqKZ9KQanSqYXRcF8fBopzLHYxdM65zcjm)

- Check top tokenholders

Ideally, the number should be as low as possible.

What allocation should meme coins have in your portfolio?

The investment spectrum of those can look something like this:- 1-5% for those cautious about risk, protecting their capital.

- 10-50% for the risk-takers, willing to gamble on potential high returns.

- 100%+ for those using optimal betting strategies, fully committing to memecoins.

Cryptonary's take

The memecoin phenomenon is undeniably one of the most captivating and polarising sectors in the crypto space. While the potential for life-changing gains is tantalising, the risks of capital obliteration loom large. By approaching meme coins strategically and understanding how to invest in meme coins effectively, you can position yourself for success in this volatile market.As we've outlined, navigating this landscape requires a potent combination of opportunistic thinking and stringent risk management. Memecoins are not assets to be trifled with—they require opportunistic boldness, diligence, and strategic risk management. But you should have an allocation (matched to your risk appetite) in your portfolio.

It is important to approach memecoins with a mindset akin to gambling, where any invested capital carries a high probability of being lost. Nevertheless, the rewards can be life-changing if you are willing to embrace the inherent volatility and take strategic action rather than going in blindly.

Cryptonary, out.

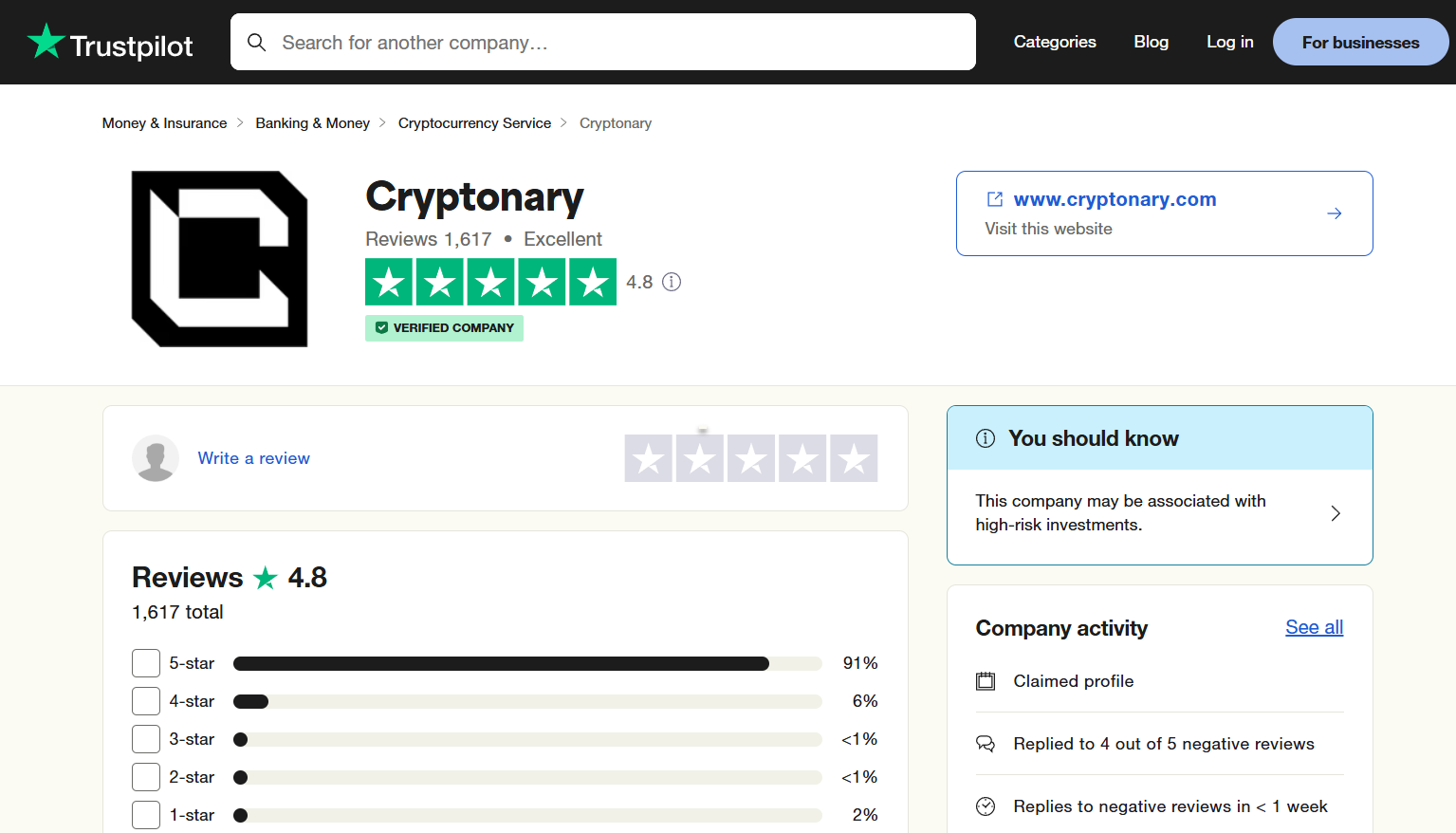

Missed DOGE? Catch the next big thing with Cryptonary

Did you know we reported WIF at $0.003 (+62,308%), POPCAT at $0.004 (+48,233.33%), and SPX at $0.01 (+6,200%)? Imagine what our research could uncover next.

With a 7-day free trial and a 4.8/5 rating from over 1,600 reviews, there’s no reason not to give it a try.

With a 7-day free trial and a 4.8/5 rating from over 1,600 reviews, there’s no reason not to give it a try.

FAQs

Here are some memecoin masterclass FAQs.1. What is a meme coin investment strategy?

A meme coin investment strategy involves understanding and applying specific methods to assess and invest in meme coins effectively. It helps you navigate the high-risk, speculative nature of meme coins, reducing exposure to scams and maximising potential returns through prudent risk management.2. What makes meme coins different from gambling?

While both involve speculation and risk, meme coins offer a fairer playing field since no central authority manipulates outcomes. Successful meme coin investments rely on market trends, virality, and strategic positioning, unlike gambling, where the house always has an edge.3. Are meme coins safe to invest in?

Investing in meme coins involves high risk. They are often highly volatile and susceptible to scams such as rug pulls. However, by employing a solid investment strategy—like assessing attention, liquidity, and virality—and conducting thorough due diligence, investors can mitigate some risks and make more informed decisions.4. How do I identify promising meme coins?

To spot potential meme coin winners, focus on these three factors:- Attention: Strong social media presence and community engagement.

- Liquidity: High trading volume and burned LP tokens to ensure stability.

- Virality: Memeability, catchy slogans, and a robust narrative.

5. What percentage of my portfolio should I allocate to meme coins?

The allocation depends on your risk tolerance:- Cautious investors: 1-5% of their portfolio.

- Moderate risk-takers: 10-50%.

- High-risk enthusiasts: Up to 100% or more with optimal strategies.