Memecoins comeback: Why now’s the time to pay attention

The crypto market is showing its hand, with Bitcoin's relief rallies sparking renewed interest in memecoins. Some select memecoins are already flashing bullish signals, hinting at where market participants are looking for gains. Here is our breakdown and game plan:

TLDR

- Bitcoin's bullish trend is essential for memecoin rallies, as it sets a risk-on market tone.

- BTC is the OG meme, and memecoins are the closest cousins to BTC

- BTC will continue to outperform the market, and memes that share similar qualities to BTC will explode

- Investors should wait for Bitcoin to break key resistance before going all-in on memecoins.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Bitcoin as a market driver

Before we jump into the state of the memecoins, it's critical to understand the market's biggest driver: Bitcoin. Memecoins thrive on hype and risk-on sentiment, but their explosive runs depend on Bitcoin paving the way. As the crypto market's bellwether, Bitcoin's price action sets the tone for whether memecoins (or even altcoins) will soar or stall. Let's break down why Bitcoin's trend is the key to unlocking the next memecoin wave.For memes, we need BTC to be in a bull trend, and at the moment, BTC is trying to change the trend, but it is still fighting its 50EMA (exponential moving average), which has been very good for determining risk-on/ risk-off. Since we are under it, we will still largely have a harder time pumping memecoins and alts as a whole because the market is in a risk-off environment.

What's next?

Bitcoin’s next move will make or break the memecoin rally. Find out which coins are poised to explode—and when.Macro conditions aren't helping either. Global economic uncertainty has investors hesitant to pile into risky assets, keeping capital on the sidelines. Meanwhile, BTC dominance is climbing on higher timeframes (HTF), signalling that Bitcoin is soaking up most of the market's attention and liquidity, leaving less fuel for memecoins and alts to rally.

However, whenever we see relief rallies in Bitcoin, it is the memecoin sector that is pumping the hardest. Risk capital is flowing into memes when there is even a slight improvement in the market.

This dynamic reflects a broader market truth: memecoins are an extremely high-beta play, amplifying BTC's movements. When BTC surges, retail investors and traders, emboldened by rising portfolio values, allocate capital to speculative assets like memecoins.

Conversely, when BTC stagnates or declines, memecoins face disproportionate selling pressure.

BTC is the biggest meme?

We expect the rest of this market cycle to remain firmly BTC-driven. As we mentioned, Bitcoin's performance dictates the crypto market's rhythm, and the next leg up will be no exception. As BTC breaks key levels, retail and institutional capital will flood back, setting the stage for a broader rally. But here's a twist: BTC itself might just be the biggest memecoin of all.Think about it - Bitcoin's price isn't tied to revenue, earnings, or traditional fundamentals. It's a pure play on belief, speculation, and market forces. Its value stems from a collective narrative: a decentralised dream, a hedge against fiat, a store of value born from code and conviction. Sound familiar?

That's the same DNA as memecoins like DOGE or FARTCOIN, where community hype and viral momentum drive prices. Therefore, we think BTC is the OG meme, a $1 trillion+ behemoth fueled by faith and common belief.

Given this, memecoins are BTC's closest cousins in the crypto family. While altcoins lean on utility promises or complex tokenomics (often riddled with insider dumps), memecoins thrive on the same raw, speculative energy that powers Bitcoin.

And since we expect the rest of the cycle to continue to be BTC-driven, memecoins will continue to be the outperformers in line with BTC because they are simple, relatable, and built for virality - qualities that mirror BTC's own allure.

Memecoins vs. Altcoins: Why memes win

Furthermore, in a BTC-driven market, capital flows to high-beta plays, and memecoins stand out as the purest expression of this speculative frenzy. Unlike altcoins, which often promise utility but deliver complexity, memecoins align closely with Bitcoin's speculative spirit, making them the go-to choice for retail investors chasing explosive gains. Let's break down why memecoins consistently outshine altcoins in this environment.First, retail investors have a clear edge in the memecoin space. Altcoins, despite their utility narratives, often suffer from predatory tokenomics - think team allocations gobbling up 50% or more of the supply, leading to months or even years of vesting-driven sell pressure.

Memecoins, by contrast, are frequently launched fairly, giving everyone an equal shot in the open market. This levels the playing field for retail, who can get in early without fighting insider dumps.

Second, memecoins start small and dream big. Take PEPE, which launched at a sub-$1 million market cap, versus altcoin token generation events (TGEs) debuting at $1 billion or more.

This low entry point gives memecoins massive upside potential, where retail investors can realistically chase 100x returns - something rarely achievable in the altcoin world unless you're an insider with pre-sale access.

Finally, memecoins dominate the attention economy. Memes like DOGE, PEPE, or FARTCOIN stick in your mind thanks to humour, community, and relatability. Altcoins? Beyond heavyweights like ETH, SOL or HYPE, most fade into obscurity, lacking the viral spark that drives prices.

Memecoins thrive on being cool, funny, or culturally relevant - think GOAT riding the AI-crypto wave or FARTCOIN soaring on its absurd, relatable humour. When you catch a memecoin early, its ability to capture attention translates directly into price action.

Meme chart radar: Spotting the trends

Some meme coins do look to have some light put on them, but it is less rather than more for now. So far, FARTCOIN and PEPE are on our watchlist for memes with strong cults. Almost everything else we looked at in the market looked at was still in a bearish daily trend or fighting to break above it. POPCAT's chart looks short-term constructive, though we still consider it high risk.The first chart we want to look at is the POPCAT chart on the daily time frame. Looking at this, we can see that we have finally broken over the daily downtrend that we have been in since late 2024. Now we are attempting to flip and hold the 50EMA.

If it holds this, we can assume POPCAT can see a pump up to its next resistance zone, which in our eyes happens to be around the $0.7 level. However, due to the broader risk-off environment, we would recommend caution. The chart is for illustration purposes only.

The next chart we want to look at is the Fartcoin. Looking at this chart, we can see some interesting things in the mix. First, we are smack dab in a resistance level at the moment, and we are kind of elevated above the EMA's. Because of these two factors, it wouldn't be wrong to anticipate a move lower to potentially look to get long targeting higher.

For us, we would look to get involved around the $0.62 and then target about $1.3, which lines up with a daily swing high. From there, we would look for potential shorts outlined in our latest Market Direction report.

Thus, the technical setups for some memes are showing early promise, with bullish chart patterns signalling potential breakouts. However, their ability to deliver explosive returns depends on a critical market catalyst: liquidity. Let's critically evaluate the liquidity landscape and why it points to a concentrated memecoin rally.

Liquidity reload

A few months ago, the memecoin market reached a fever pitch, driven by an unprecedented wave of token launches and dispersion. Influencers, celebrities, and even political figures - such as the U.S. president with $TRUMP and the first lady with $MELANIA - flooded the market with new coins. Countries like Argentina also joined the frenzy, launching their own tokens.This wasn't just a retail-driven phenomenon; key opinion leaders (KOLs) and venture-backed projects amplified the hype, creating a new coin every few hours. The result was a liquidity crunch: capital was spread thin across countless speculative assets, leading to unsustainable valuations and sharp corrections. This frenzy stretched liquidity thin, leading to a sharp correction - $TRUMP is down 90% from its highs, $MELANIA 97%, and influencer coins like Hailey Welch's are down 99.7%.

So, where are we now? In a much stronger position. The mania has cooled, and liquidity is no longer spread across countless speculative launches. Instead, capital is consolidating, sitting on the sidelines, and waiting for the next big opportunity.

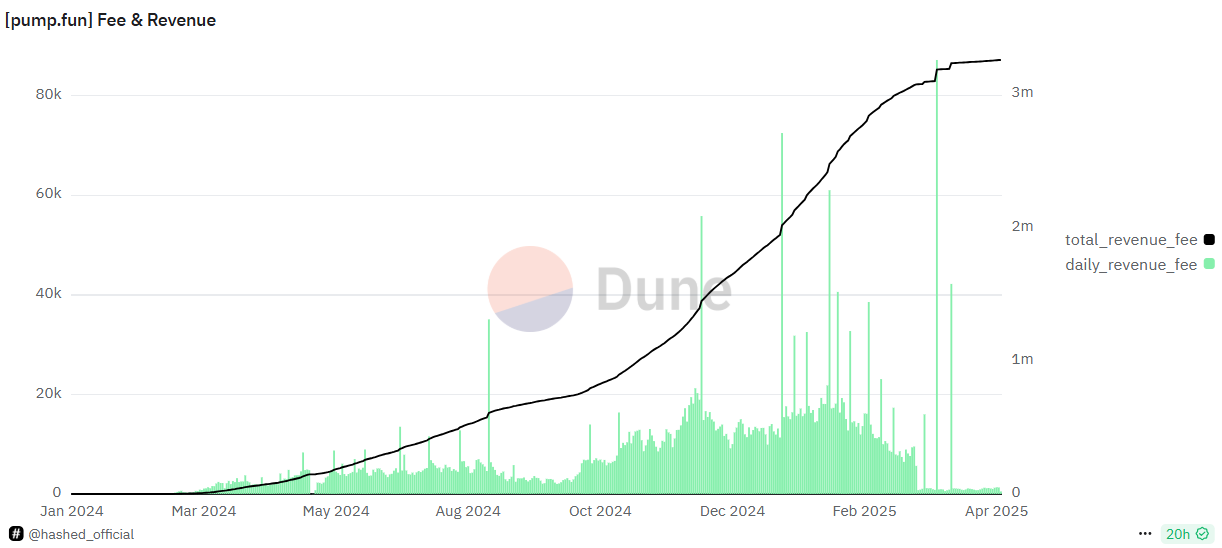

The frenetic pace of launches and memecoin gambling has slowed dramatically. Unlike the peak mania, where new tokens emerged every 12 hours, the market now sees fewer, more selective projects. PumpFun's (once a fee-generating king) revenue has collapsed.

This reduction in supply-side noise allows capital to consolidate and focus on high-quality memecoins with genuine community traction in a risk-on environment. For example, FARTCOIN and PEPE have sustained attention due to their humorous appeal and cultural relevance, unlike the ephemeral celebrity coins that diluted the market.

All in all, this cleansing and market-wide correction was needed to clear the froth. Trenches are finally healing, and almost all cabals and extractive actors have been flashed out. We are almost there.

Cryptonary's take

We're very bullish on memecoins, and it's obvious they're what retail and crypto fans will keep chasing. They're attention magnets, pack a huge upside, and are way friendlier to retail than altcoins with their shady launch tactics. Every Bitcoin relief rally pumps our excitement because each time we see memes pumping the most during these rallies. When BTC breaks key levels and risk-on will kick in, we are likely to see multiple 100x memecoins emerging again.For now, BTC's still calling the shots, though. It's gotta clear resistance before we can go all-in. The trenches need to heal as well after massive rugs by bad actors. Macro vibes are cautious, but each BTC rally we see, memecoins are heating up. We're holding off on big moves until BTC confirms the trend, but our thesis is rock-solid: memecoins are the play for retail outperformance.

Stay tuned.

Cryptonary, OUT!