You want to execute a trade and only need to say, "Make it profitable"; voila, a genie sets up and executes the trade for you.

It sounds like something out of a sci-fi movie, but in crypto, innovation is the name of the game. Well, maybe the "Make it profitable" command is a stretch. But can you imagine how much faster crypto can unlock mass adoption (and more capital inflow) if people can participate in DeFi without all the current complexities?

The latest groundbreaking trend? Intents.

This report delves into the world of Intents, uncovering their transformative power in crypto applications. We'll demystify the concept of Intents and shine a spotlight on the projects leading this innovative charge.

Whether you're a seasoned investor or a crypto enthusiast, this emerging trend is something you won't want to overlook. LFG!!!!

TLDR

- Understanding Intents: Intents simplify user interactions, making crypto applications more user-friendly.

- Account abstraction: Account abstraction is driving the adoption of Intents in crypto by automating transactions.

- Benefits of Intents: Intents improve capital efficiency, execution quality, and user experience in DeFi applications.

- Show me the money: If you are not interested in the technical details, you can jump to the investment opportunities here.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

Intents: A simplified introduction

To understand how you can capitalise on innovation, it is essential to understand how it works. Otherwise, how will you discern genuine innovation from vaporware?For this reason, we will give you a quick rundown on intent, why it is essential now, and how it will reshape crypto applications.

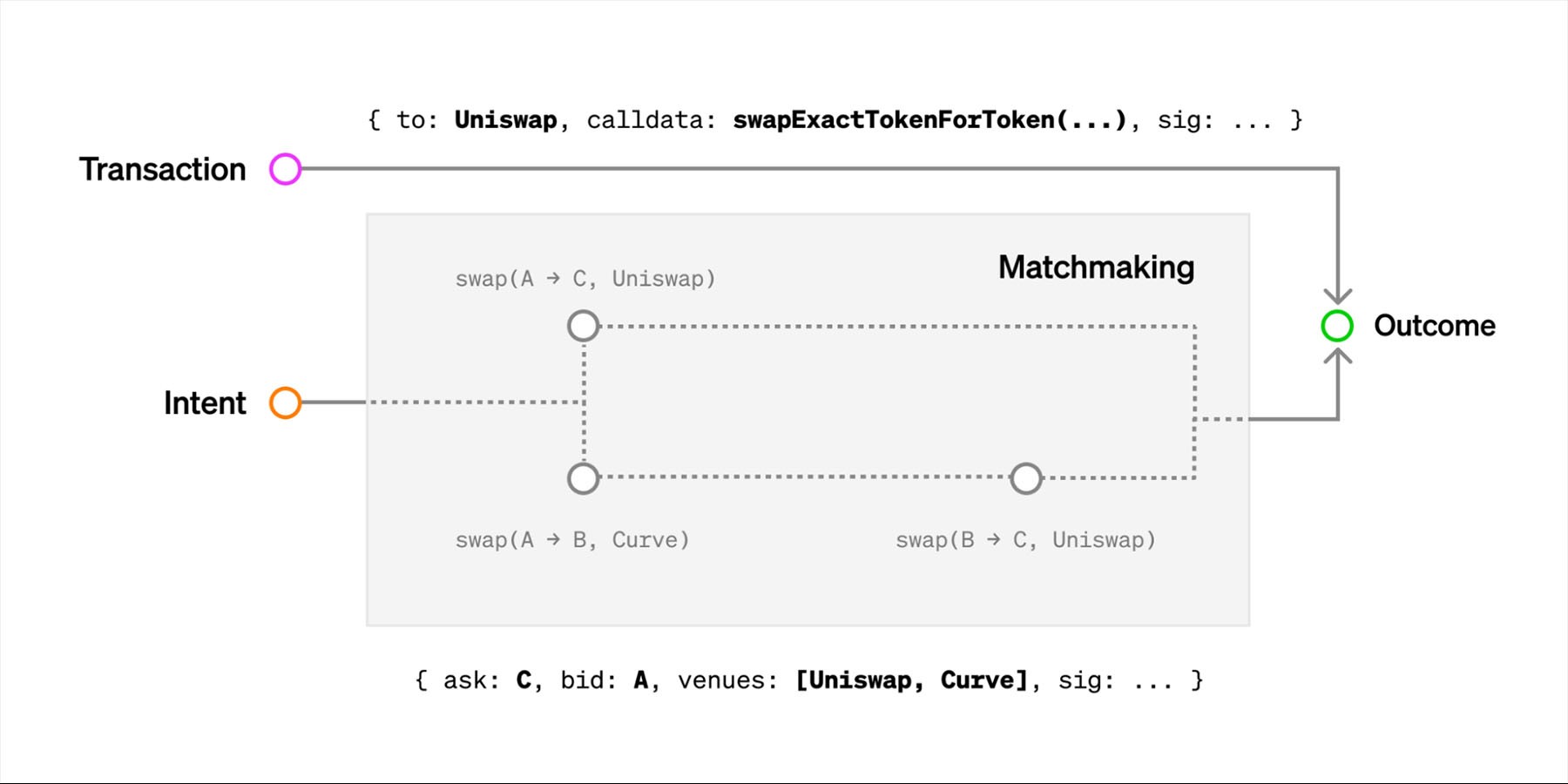

Intents vs transactions

Today, making a crypto transaction is like ordering a coffee by specifying:

"I want a 12 oz cappuccino, made with 2 shots of espresso pulled for 23 seconds; steam the milk to 110 degrees with 3% foam, and serve it in a ceramic mug."

You have to specify every single parameter and step involved. There's no room for flexibility at the café; you must follow the instructions, and it takes a lot of time to think about all these steps.

An intent-based order is simply:

"I want a cappuccino."

Now, the café can fulfil your intent in an ideal way. They can choose the coffee beans, pull time, milk type, temperature, mug, etc, dynamically based on what they think will achieve the perfect cappuccino.

Similarly, crypto transactions today require manually specifying all the details, like the first order. With intent, users simply declare the outcome they want, and the system handles optimising the parameters and steps involved behind the scenes.

So, the key difference between a transaction and an intent is that, with a transaction, you lock yourself into specific instructions. In contrast, Intents focus on goals, and the 'solvers' within the system have the freedom to find the optimal transaction process to achieve that goal, such as your desire to trade your ETH at a specific price.

This aligns with how most of our current systems operate. However, many applications in crypto have not adopted this approach yet, which is one of the reasons why crypto is often perceived as not user-friendly.

Understanding the significance of account abstraction

So, why have Intents suddenly become a hot topic today? This is driven by another innovation in crypto called 'account abstraction,' which serves as the gateway for Intents.What is account abstraction?

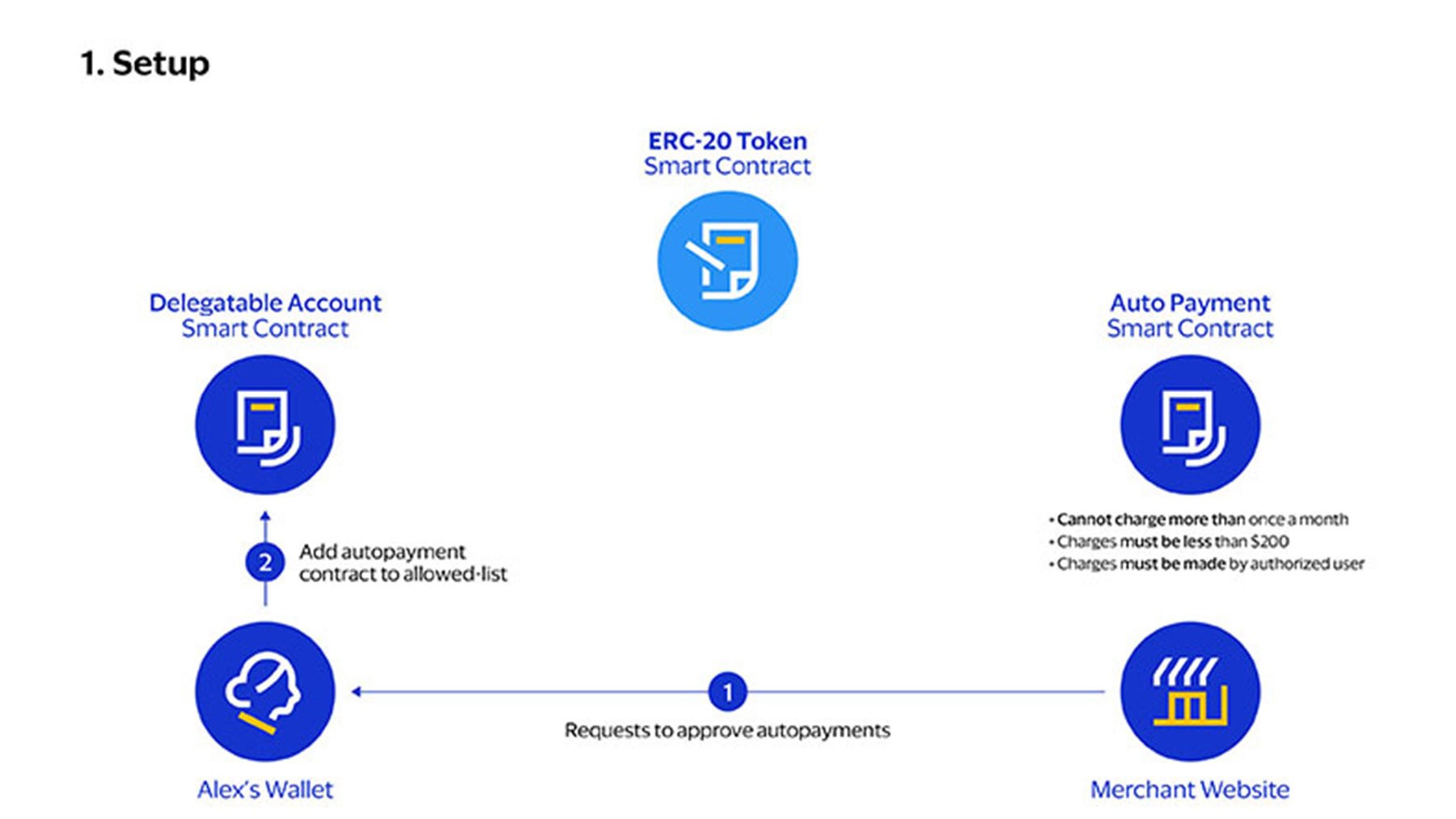

Account abstraction is a concept that empowers smart contract wallets to handle transactions on behalf of users. This functionality is made possible by innovations in the Ethereum ecosystem, such as ERC-4337.To illustrate, one practical application of account abstraction is the facilitation of recurring payments. With account abstraction in place, users no longer need to sign transactions every month for crypto payments manually. It automates the process, making it simpler and more user-friendly.

In the picture, you can see that in this setup, Alex doesn't have to send a transaction every month. Instead, a smart contract can handle transactions directly without depending solely on users with private keys to control externally owned accounts.

How account abstraction enables Intents in crypto

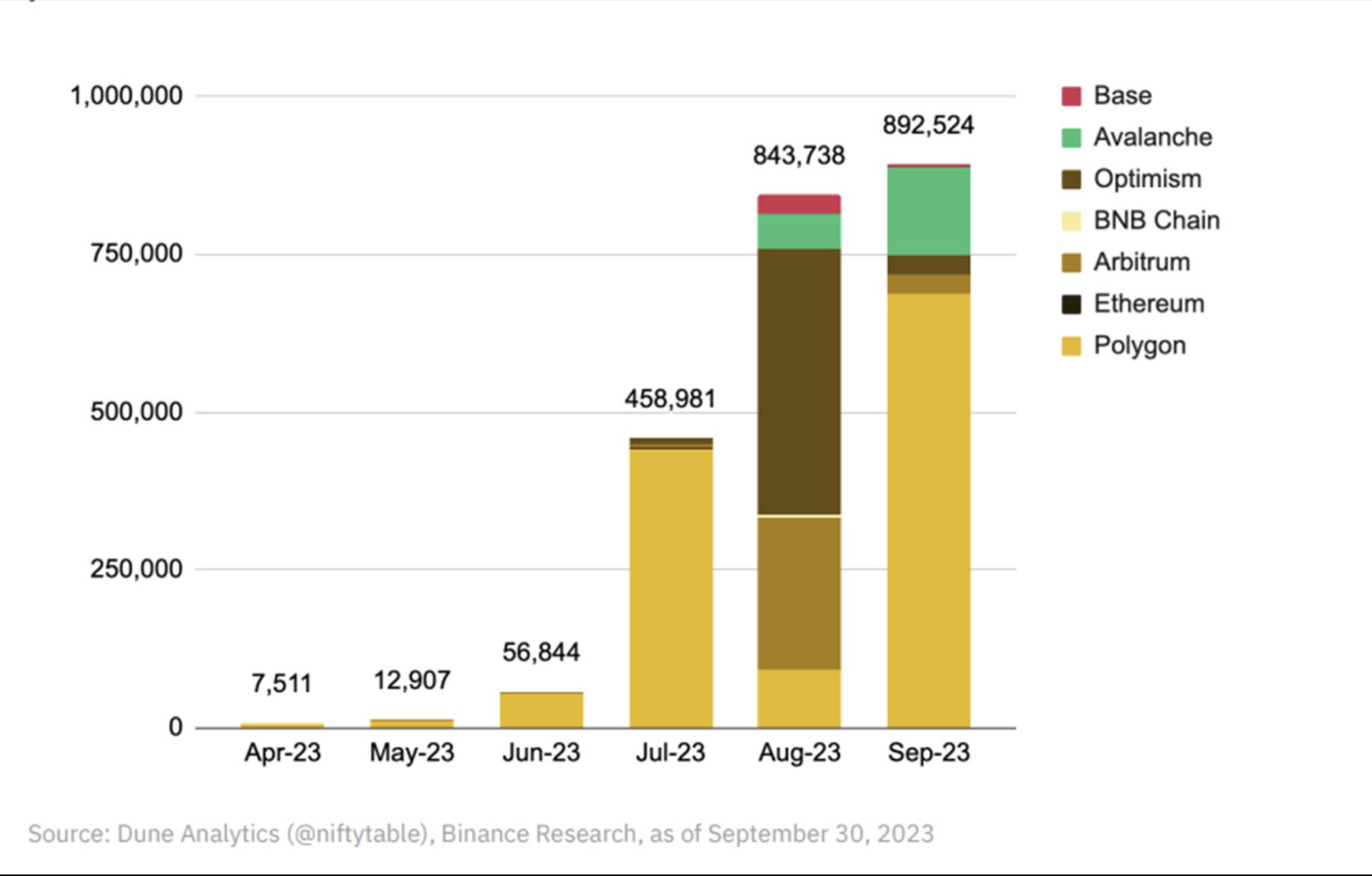

Numerous use cases can be imagined for this, and it is a massive innovation for crypto that we are finally witnessing the adoption of account abstraction. The month-on-month increase in ERC-4337 smart account transactions shows that users have adopted this new token standard, enabling innovation.

So, returning to Intents, account abstraction is essentially the innovation that crypto needed to shift from transactions to Intents.

Intents simplify what users want to achieve, while account abstraction streamlines how it’s accomplished. And now, we can streamline the user experience and empower protocols to handle these Intents on behalf of users.

This is why, despite having been around for a while, we believe that we are now witnessing the ideal conditions for Intents to get on the fast track to adoption in Web3.

How Intents will reshape crypto

We anticipate that Intents will significantly impact crypto as both existing and new applications will begin to adopt them.Especially in DeFi applications, transitioning from transactions to Intents will bring benefits such as:

- Improved capital efficiency - Intents enable the aggregation of transactions, reducing wasted gas costs. Some estimates suggest this can lead to 20-60% gas savings.

- Enhanced execution quality: Intents can be programmatically routed to identify optimal pricing and slippage parameters across liquidity venues, resulting in improved execution quality. For instance, this can be particularly beneficial when setting limit orders.

- Streamlined UX: Abstracting away transaction details enhances the user experience. With intent, users can schedule actions, such as regular investments or portfolio rebalancing, and pledge funds only when a project meets certain milestones, making using crypto more. similar to other apps on your phone.

Innovations bring new narratives and opportunities

If you're not in crypto for the tech, everything we’ve said about Intents up until now might have sounded boring to you. And that’s okay. If you are in crypto for the money, here’s where Intents get interesting.

Innovations in Web3 often birth new narratives, and new narratives often mean new opportunities to get a first-mover advantage.

At Cryptonary, we bring you the most exciting opportunities in Web3. The primary goal here is to make money, and the reason we're educating you on Intents is because we believe it can shape a new narrative.

What do we mean by a new narrative?

In the current market environment, there isn't a significant influx of new money into crypto since we are not yet fully in a bull market. What primarily occurs is the reshuffling of existing funds from one place to another.The allocation of these funds is typically influenced by where attention is focused, and attention tends to gravitate toward innovations.

The recent popularity of AI is an evident example of this trend – both in crypto and the stock market. The recent advancements in AI are, no doubt, a massive innovation. Still, they have also caused capital to be directed towards companies associated with AI, even when the use case is tenuous at best –all due to the power of a captivating narrative.

We don't perceive Intents as groundbreaking as AI, but we anticipate a similar response when they become more widely adopted.

In this scenario, projects involved with Intents will likely attract more capital than those that don’t use Intents – and that is where the upside potentials will be found.

4 projects to watch when the narrative shifts to Intents

Given that we anticipate Intents to be a significant innovation drawing attention from Q4 onwards, we can now explore projects with the first-mover advantage. These four projects, two with tokens and two without (yet), will likely outperform the market as this narrative garners more attention.IntentX (High Risk)

What is IntentX?

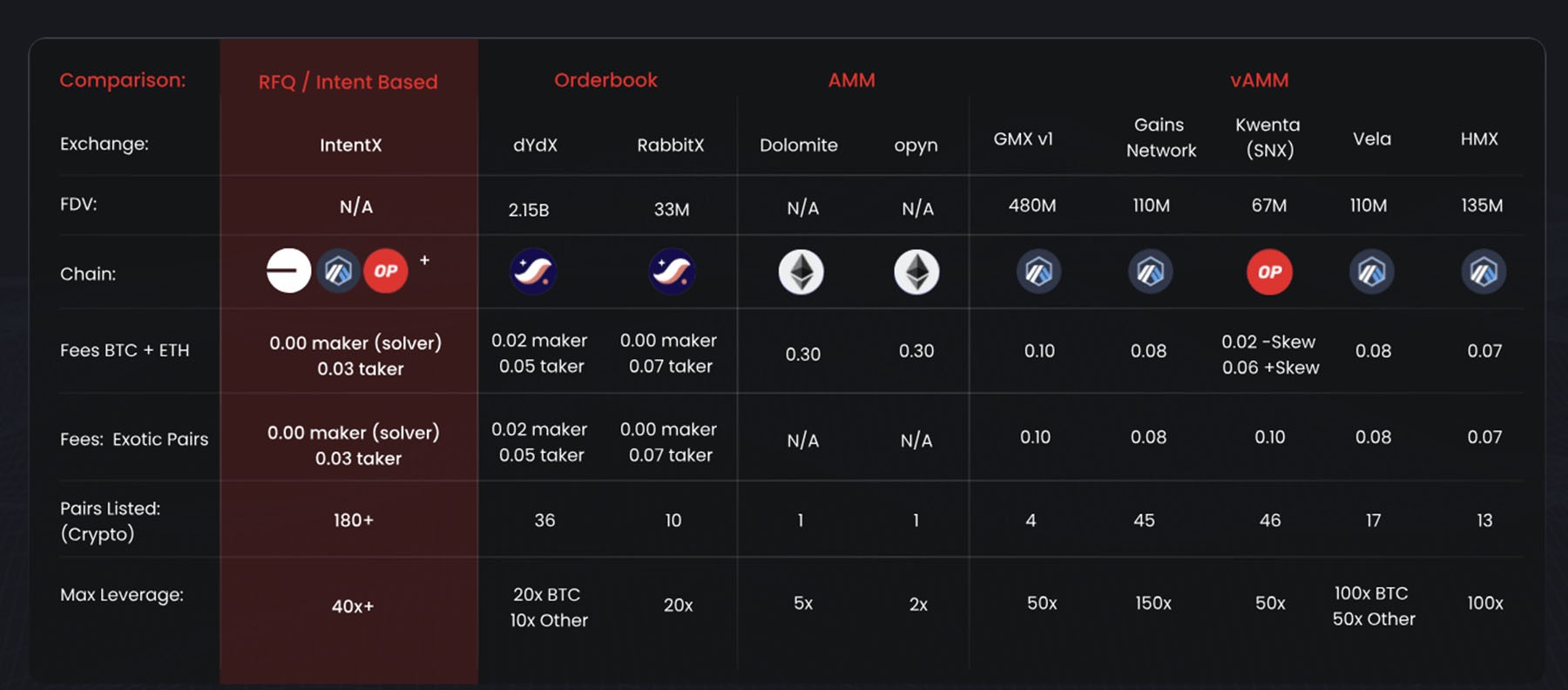

IntentX is a decentralised derivatives exchange built on Base, distinguished by its innovative approach. Instead of using conventional liquidity pools, it operates through "solvers," incentivised nodes responsible for handling trades.By focusing on Intents rather than transactions, it aims to provide users with an enhanced trading experience. This approach enables it to offer lower fees than most other decentralised perpetual exchanges and supports a wider range of assets.

Additionally, users benefit from more efficient execution since they only need to state their intention, and the solvers will determine the optimal way to execute the trade.

The platform has outlined its roadmap to launch the application in Q1 2024

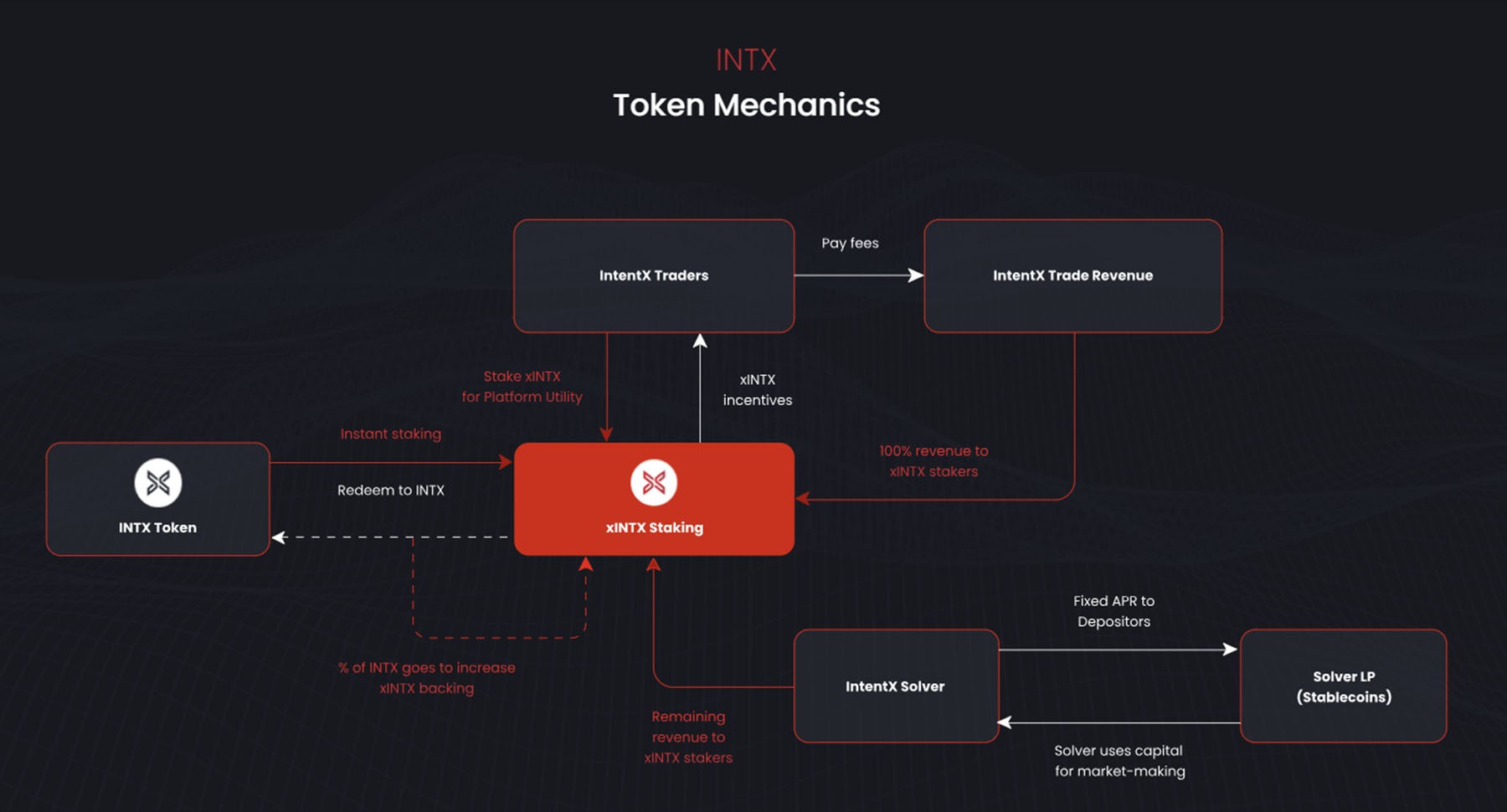

There will be an INTX token, and holders can earn trading revenue by staking once the platform goes live. This direct link between revenue and token success makes it appealing.

Why is this important?

IntentX will be among the pioneering decentralised perpetual exchanges, utilising an intent-based architecture that aligns seamlessly with the Intents narrative.Furthermore, its launch on Base, an emerging network, enhances its appeal. However, it's vital to recognise that IntentX is very early, so exercise caution, as new protocols inherently carry a higher risk.

SYMMIO (High risk)

SYMMIO is a decentralised exchange infrastructure designed to enhance the user experience for traders. It empowers protocols to build decentralised exchanges using an intent-based infrastructure, capitalising on SYMMIO's expertise.Due to its design, SYMMIO is expected to offer improved capital efficiency.

SYMMIO is a B2B provider handling the backend work for protocols, enabling them to offer Intent-based trading. Protocols can then construct a front-end on top of SYMMIO's infrastructure. SYMMIO charges a fee to the protocol for the use of their infrastructure

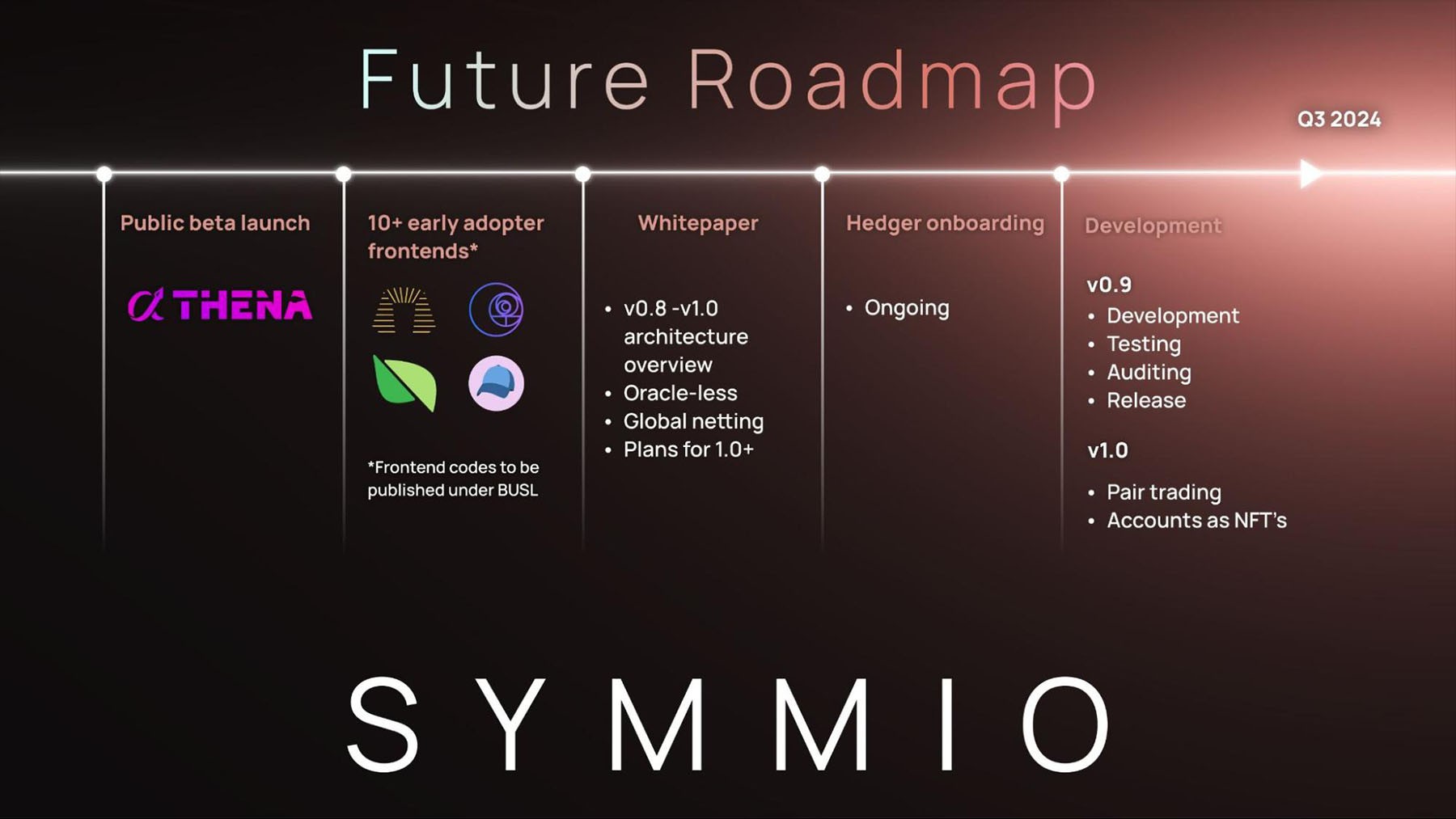

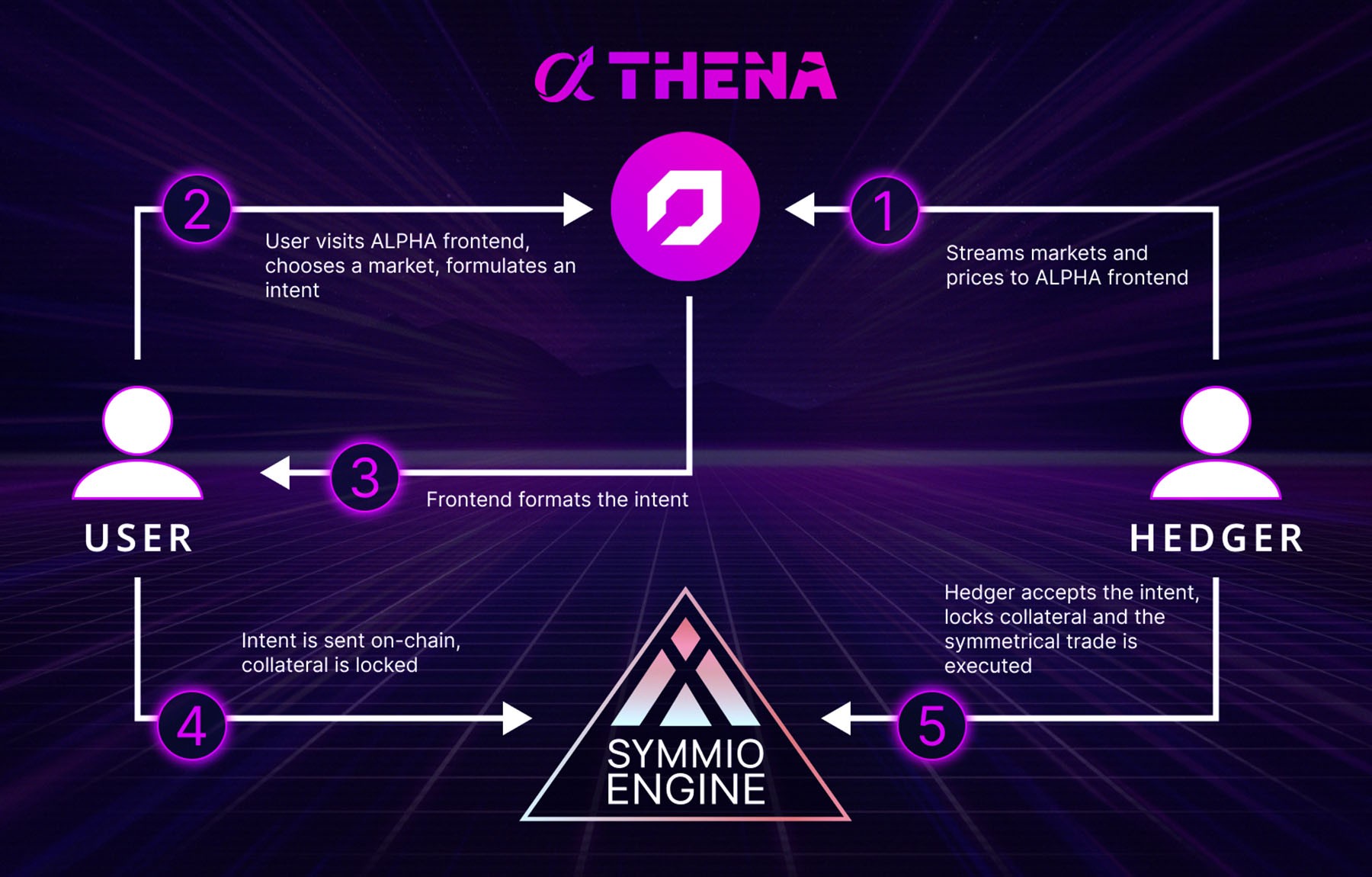

The beta version of the product is currently live, and several protocols, including THENA, have already adopted SYMMIO's trading infrastructure to provide intent-based trading to their users.

This quarter, the $SYMM token will be launched, and the project is actively working to provide early community members with the opportunity to acquire $SYMM tokens before the official launch, hinting at potential advantages for early adopters.

Upon the token's launch, holders can stake their $SYMM, which offers several advantages, notably the ability to consistently receive 100% of the protocol revenue from all frontends.

Why is this important?

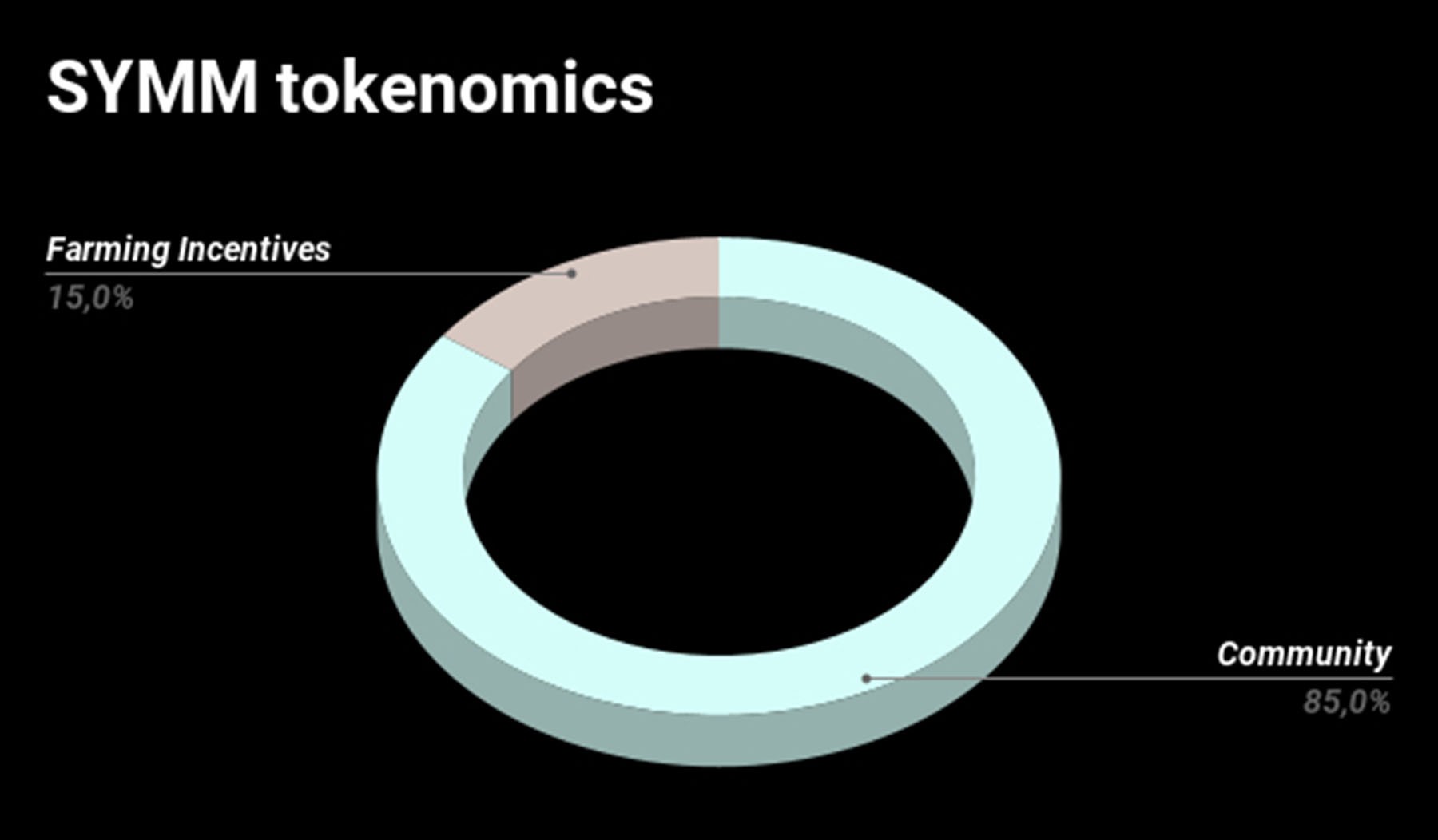

SYMMIO stands out as a pivotal player in the realm of intent-based protocols. It's more than just a DEX; it's a foundational infrastructure that empowers other DEXs to offer intent-based trading, which adds to its allure.The tokenomics appear reasonable, with a significant portion allocated to the community. However, it's crucial to acknowledge that this project is still in its very early stages, so approach it with caution.

CoW Swap (Medium Risk)

What is CoW Swap?

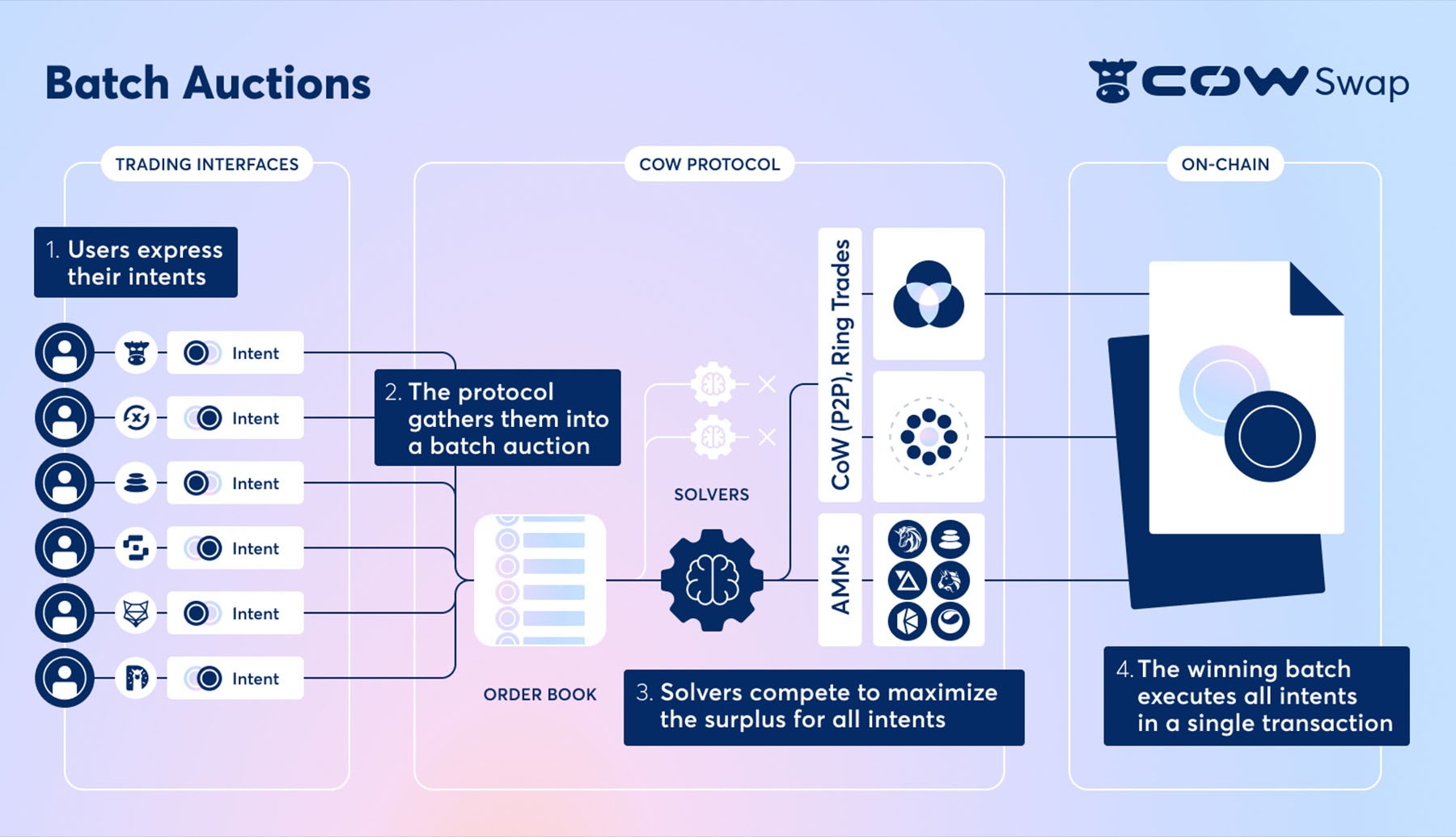

CoWswap, at its core, is a decentralised exchange (DEX) on the CoW protocol, a unique system that offers two key features: batch auctions and Coincidence of Wants (CoWs).

Batch Auctions: CoWswap leverages batch auctions, where trade orders are gathered off-chain and settled on-chain. This approach simplifies direct exchanges between users.

Coincidence of Wants (CoWs): CoWs occur when two parties possess assets the other desires. CoWswap enables direct, intermediary-free trades in such cases. Notably, it doesn't require direct on-chain liquidity access, enhancing security and reducing Miner Extractable Value (MEV) risks.

In addition, CoWswap operates as a 'meta' DEX aggregator, striving to offer users the best prices and execution across various Automated Market Makers (AMMs) and DEX aggregators on the Ethereum network.

Why is this important?

CoW Swap has pioneered Intent-based architecture, using Intents and solvers for its decentralised exchange. It was one of the first protocols to adopt this approach.The primary limitation of Cowswap lies in its current tokenomics, where the $COW token serves solely as a governance token. However, there's hope on the horizon, as the team recently announced plans for a tokenomics revision in their public Discord channel.

This upcoming change holds the potential to transform the COW token into a revenue-generating asset.

THENA (High Risk)

What is THENA?

THENA is a decentralised exchange ecosystem on BNB Chain. It is trying to position itself as the native liquidity layer, directly competing with protocols such as Pancakeswap and UniswapRecently, THENA expanded its horizons by introducing a cutting-edge "Intent-Based" perpetual DEX powered by SYMMIO. This DEX, hosted by THENA, provides users access to high-leverage trading, reaching up to 60x, across a diverse range of over 150 crypto assets.

ALPHA's generated fees will be used to buy back THE tokens, incentivising various revenue-generating pools.

Why is this important?

THENA may become the inaugural protocol on the BNB Chain to embrace intent architecture, aligning it with the growing narrative around Intents. This positions THENA as a player to watchHowever, the only downside we identify with THENA, which makes it less appealing than other opportunities, is its connection to the BNB Chain. We have reservations about the BNB Chain's prospects due to the challenges faced by Binance and the increasing shift of capital towards layer 2 solutions.

Cryptonary’s take

The rise of Intents in crypto will bring a new wave of innovation and investment opportunities. With Intents simplifying user interactions and enabling more user-friendly applications, we anticipate a growing narrative around this technology.As investors and traders shift their focus towards projects adopting Intents, newcomers like IntentX and SYMMIO stand out as promising prospects, albeit with higher risk due to their early stages.

Out of all the projects we've discussed, we consider CowSwap to have the best risk-reward ratio. Given its established presence and early adoption of Intents, the potential revision of CowSwap's tokenomics could offer a compelling investment opportunity. We view it as a more attractive option than THENA for gaining exposure to Intents.

If we decide to invest in any of the discussed projects, we will provide a full deep dive into the project. However, due to the limitations of this report, we couldn't delve into all of the details here. You can expect an update if we invest, which will provide a comprehensive overview of the project we choose to invest in.

As always, thanks for reading.

Cryptonary, Out!