Bitcoin transactions can take a while to complete if you don't use the lightning network, and its functionality is generally limited to being a store of value, a "digital gold."

On the other hand, Ethereum suffers from relatively expensive fees, with slow confirmation times and limited transaction throughput and block space.

Of course, both Bitcoin and Ethereum have countless other positives, such as decentralisation, censorship resistance, and being battle-tested by years of successful use.

Bitcoin stands clear! But there have been attempts by many other blockchains to supplant Ethereum – crypto media branded them the "Ethereum killers".

Today, we deep dive into one of the more successful OG "Ethereum killers" – truth be told, the Avalanche network has made a name for itself.

But does the AVAX token deserve a spot in your portfolio?

Let's dive in!

A quick primer on L1s

You will notice that the above criticism of Bitcoin and Ethereum is focused on two key issues:- Speed of transaction confirmation

- Transaction fees

On the other hand, Ethereum is actively addressing its current fundamental shortcomings by implementing EIP-1559 and ETH2.0.

However, anyone who has tried to use Ethereum during the recent market surges knows it is far from fixing its scalability issues.

Thus, the demand for alternative blockchains that address the problems of transaction speed and cost will always be there. These alternatives, including Avalanche, Binance Smart Chain, Cardano, and Solana, have taken different approaches to solving the scalability challenge.

Binance Smart Chain (BSC) and Solana (SOL), in particular, witnessed rapid growth throughout 2021/22 because their approaches have delivered some results in increasing transaction speeds and offering negligible transaction fees (aka gas)– to certain extents.

However, they are not the only Layer 1 networks that can deliver such a level of performance - Avalanche also belongs on that list.

What is Avalanche?

Avalanche (AVAX) is a Layer 1 chain that uses a Proof of Stake consensus mechanism with full smart contract capability.The smart contract capability is implemented to be compatible with Solidity and the Ethereum Virtual Machine (EVM) - this is an essential feature. For a Layer 1 blockchain to develop and grow, active development and core infrastructure like wallets is imperative. AVAX was proactively designed to be usable; therefore, it is unsurprising that popular wallets such as MetaMask, which almost everyone in crypto knows, can be used on the Avalanche network. This usability, in turn, makes it much easier to attract new users to the network.

Outside of simple users, full compatibility with the EVM while leveraging the existing Solidity docs and tutorials allows for accelerated code and protocol development. This 'plug-and-play capability for developers has led to a thriving ecosystem with multiple protocols built on Avalanche, which are covered in detail below.

Avalanche also has extremely competitive technical specifications when compared to other Layer 1 blockchains. The below comparison is sourced from Avalanche's website, and despite being biased, it indicates the superior performance AVAX offers.

The throughput and transaction finality should be adequate for all but the most time-sensitive applications. Combined with the low fees, it offers a better user experience than DeFi on Ethereum.

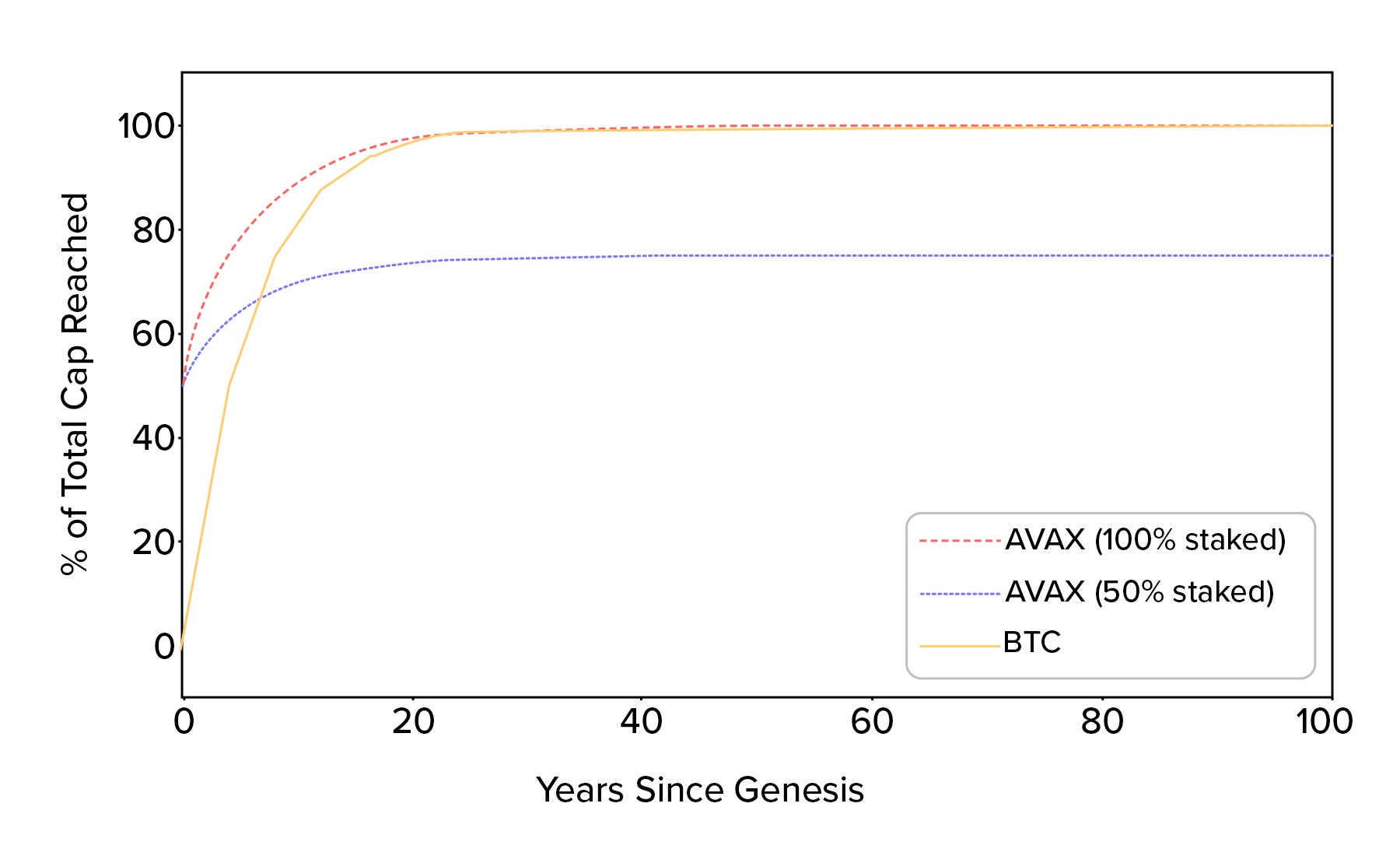

The emissions of new AVAX tokens halve every four years, like Bitcoin. However, the emissions are adjusted based on the % of the supply that is staked. The maximum supply (720M) may never be reached if there is not enough AVAX staked. The emission rate and supply cap dependent on the amount of AVAX staked is best illustrated by the figure below:

Currently, there is a circulating supply of 366M AVAX. Burning some transaction fees also counters token emissions, further decreasing the circulating supply.

The project's strong and simple tokenomics model and its performance compared to other blockchains led to rapid growth throughout 2021/22.

However, Avalanche has since struggled to recover meaningful TVL since 2022. The most recent figures are shown below:

Avalanche has around $1.6 billion in non-staking Total Value Locked (Liquidity), with a market capitalisation of $14.2 billion.

Avalanche's infrastructure

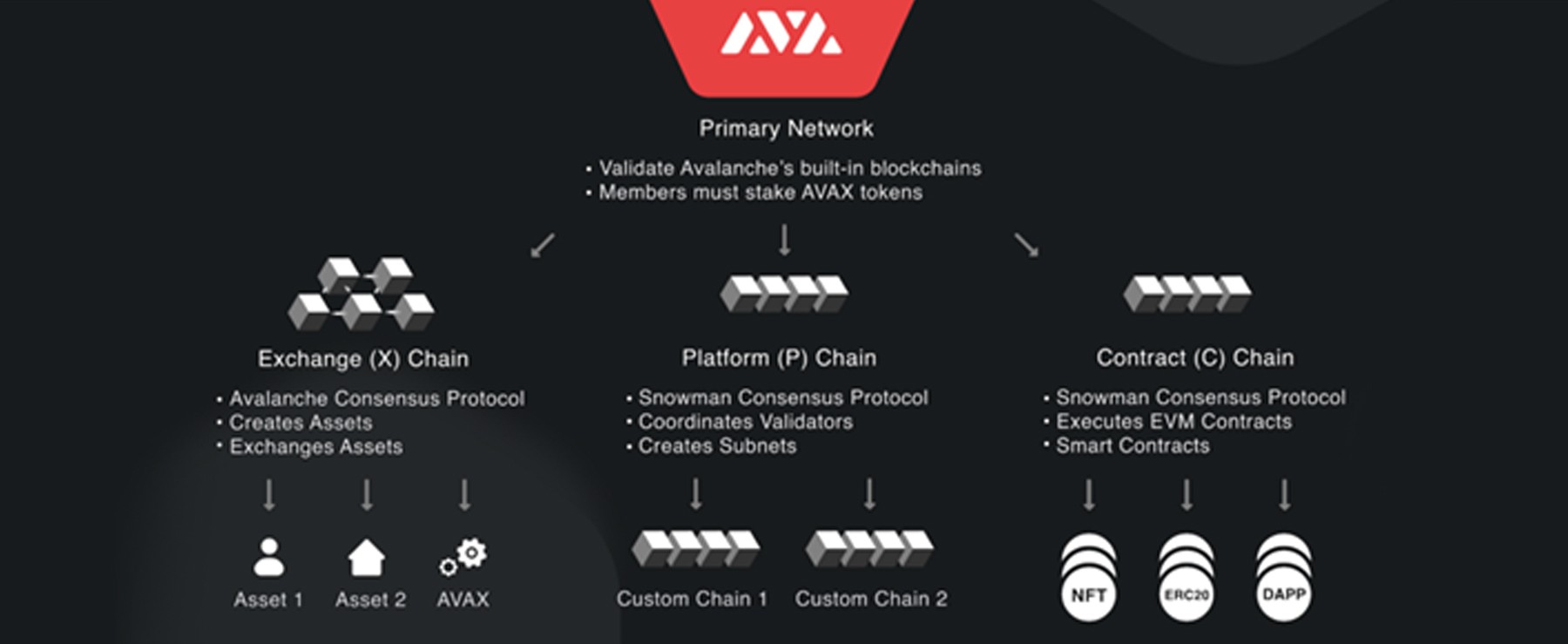

Avalanche uses three separate blockchains in addition to its primary network, validating all sub-chain transactions. Here is a breakdown of each chain:- X Chain – the Exchange Chain API is used to set the conditions and rules for creating and trading digital assets on the Avalanche ecosystem. Parameters such as time or location restrictions on an asset are set from this chain. The X Chain runs as an instance of the Avalanche Virtual Machine (AVM).

- P Chain – the Platform Chain API is used to set the conditions and parameters for creating new blockchains/protocols to be built on Avalanche. Clients can select various options for their protocol and blockchains.

- C Chain – the Contract Chain runs as an Ethereum Virtual Machine (EVM) instance. To find out more about the EVM, click here. The C Chain handles smart contract executions and is compatible with both native Avalanche and ERC-20 contracts.

Where's the value?

With a market cap of $14.6 billion, AVAX is the 10th largest crypto by rank - highly correlated to the wider market.As such, we believe it is more appropriate to attach price targets based on technicals rather than the ecosystem's potential for growth.

AVAX lost its local uptrend line and has battled with the next uptrend line but has managed to find support at that line along with the first yellow box - a buying zone.

However, price has now moved into the $39 horizontal resistance and is potentially rejecting there.

If it rejects, the uptrend line will need to hold as support; otherwise, the bottom yellow box will likely be tested. If that bottom yellow box is tested, that'll likely be a good long-term buying opportunity.

We are confident that AVAX can achieve its all-time high figure of $130.

However, further growth will depend on continued ecosystem adoption, an uptick in on-chain activity, and a recovery of TVL.

Cryptonary's take

Avalanche is one of the more developed ecosystems within the crypto market. As such, we feel the risk/reward ratio no longer makes AVAX an attractive investment for those looking for higher returns. We believe it is on the same risk level as Ethereum/Solana.Still, as one of the more established ecosystems, it is worth watching for Avalanche-related trends and narratives.

Sure, risk is also limited, which is why we've added AVAX to our list of "low" risk assets.

Want to know which assets we're eyeing up for the bull?

If you haven't already, check out our new tool here!