Intro

Layer-2s (L2s) are growing and represent an immense potential for GAINS! There are promising L2 projects that we pinpointed.We’ve covered Optimism in the past. We discussed it briefly before announcing its native token OP in April.

Now is the time to go in-depth and extract all the valuable information we can find.

Optimism is a very popular L2 and desires to overtake its main competitor Arbitrum.

Can Optimism succeed? Let’s find out…

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions and only you are accountable for the results.

TLDR

- Optimism is growing very fast!

- Optimism can compete with the likes of Solana & Avalanche.

- Should you be optimistic about Optimism?

Origins

Optimism is a scaling solution built by Ethereum developers to make Ethereum faster & cheaper (scalable). By offering low-cost fees while using Ethereum-based protocols (i.e. Uniswap), Optimism improves the overall user experience (UX) when using decentralised finance (DeFi).If it works on Ethereum, it works on Optimism at a fraction of the cost.

Optimism was first introduced in June 2019 and went live on mainnet in July 2021.

Arbitrum, on the other hand, went live on mainnet in May 2021, which allowed it to capture more liquidity and users. This advantage for Arbitrum initiated and motivated Optimism to deliver more to compete for the throne.

Why Optimism? 🧐

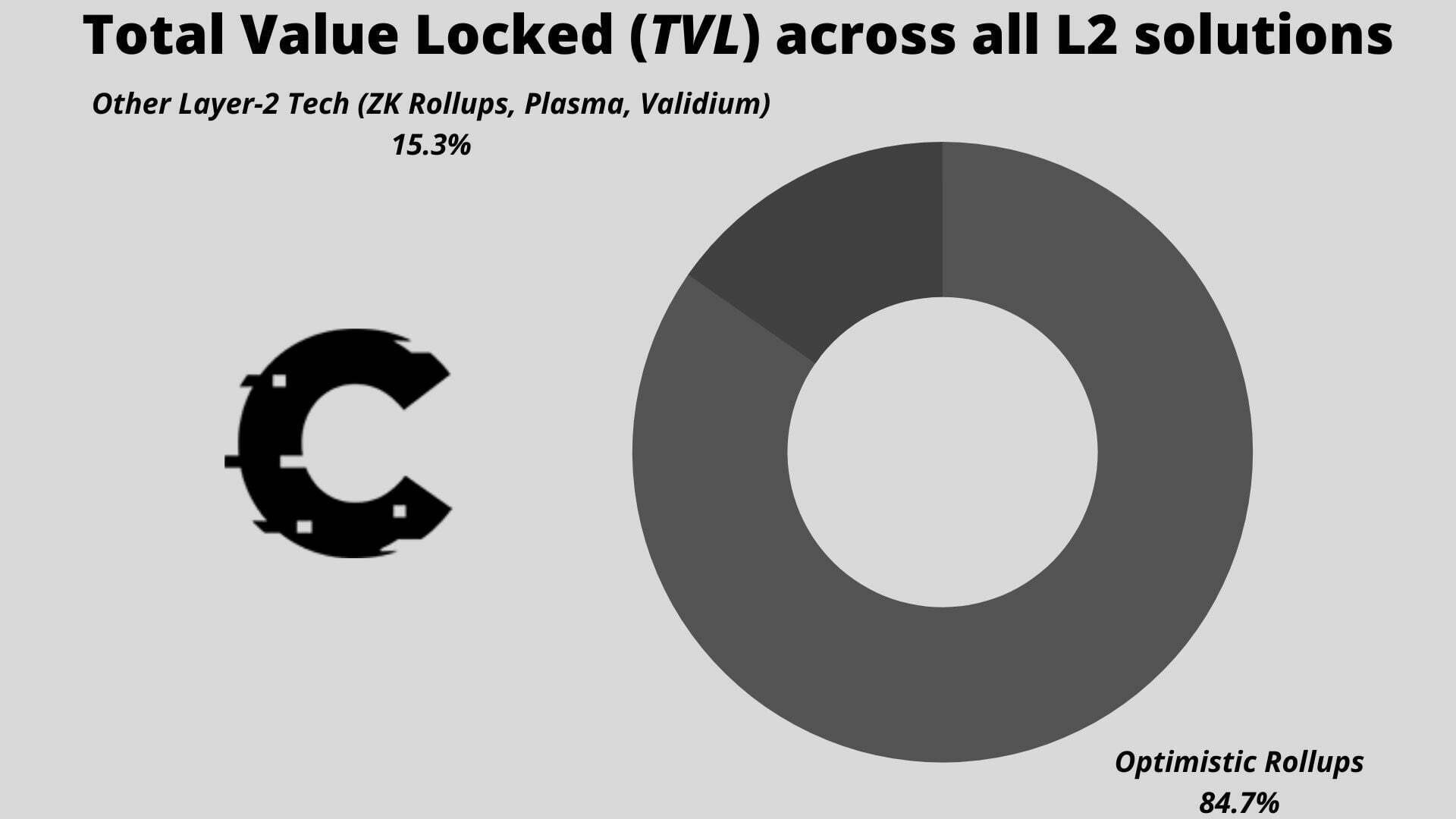

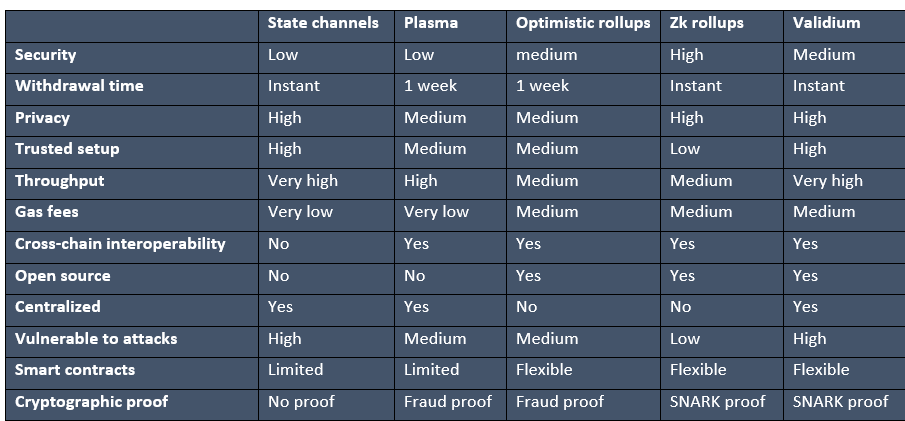

If you’re a Cryptonary member, you’ve probably heard “Optimistic Rollups” many times. Optimistic Rollups is the technology used by Optimism to scale Ethereum. Of course, there are other types of technology used by various scaling solutions, but it seems that Optimistic Rollups have caught the most traction in usage and development.

Optimistic Rollups acquire $4 billion in TVL to $720 million for other scaling solutions.

Rollups are scalable, secure & decentralised, as opposed to other scaling tech.

We’ve identified that Optimistic Rollups are the best L2 tech we have nowadays, so Optimistic Rollup projects will dominate the L2 Ecosystem. Optimism is one of those projects.

let’s understand why 👇

Note.

ZK-Rollups are strong competitors to Optimistic Rollups, but they are still being built. So in the short-term, Optimistic Rollups are the winners.

Optimism’s Architecture

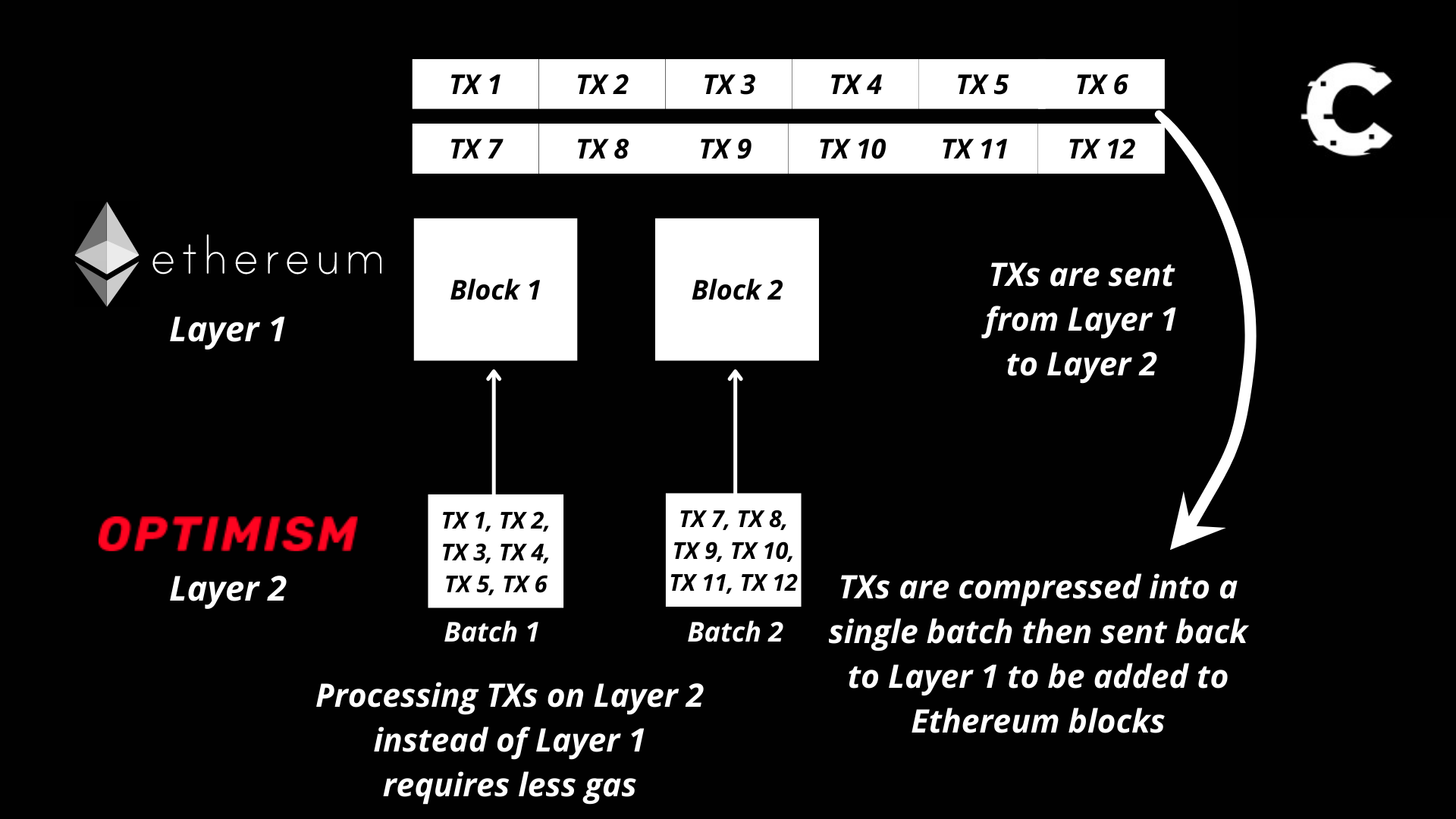

When transactions are sent to Ethereum, they are processed by Optimism using advanced compression techniques before sending the final transaction data back to Ethereum to be stored. This mechanism allows for reduced costs, which result in cheaper gas fees and more transactions processed, achieving scalability.

In short, Ethereum transfers transaction data to another layer to be executed (processed), hence the term Layer-2, and finally sends this data back to Ethereum blocks to achieve consensus (security).

Since transactions are returned and stored on Ethereum, Optimism inherits the complete security of Ethereum. This aspect favours Optimism over Alternative Layer-1s (L1s).

Alternative L1s (i.e. Solana, Avalanche) are smaller networks than Ethereum. Ethereum is the largest chain representing the highest demand. Therefore, Ethereum has the most validators & stake securing the network, making it more resilient to attacks.

Also, Ethereum has been battle tested since 2017, making it the most reliable for users because the probability transactions would be reverted or double spent is lower than other L1s.

We’re not saying that other L1s are not secure, but Ethereum is the most secure based on the above premise.

The Solana network has been facing outage issues in 2022. If this issue keeps on arising with no immediate solution in the short-term, people will resort to using a competitor-like Optimism.

Many blockchain experts as Vitalik Buterin (the founder of Ethereum), believe that Rollups are the ultimate scaling solution for Ethereum. Rollups are complex and have many additional features that make them the most favourable solution.

Our previous L2 report describes these significant features.

The Optimism Bridge

In 2022, over $1.8 billion in user funds were lost due to exploits mainly from bridges.This could be a driving factor to onboard people to Optimism (alongside being the only prominent L2 with a token) because users’ trust in some networks has depreciated.

The Optimism bridge connected to Ethereum strives to protect users’ funds by having the same security as Ethereum.

Security of funds in most bridges relies upon the bridge & not the underlying network, making it more centralised and vulnerable to exploits.

Optimism is a trustless bridge, therefore, carries fewer risks than a trusted bridge outlined in the picture.

The Optimistic Virtual Machine (OVM)

Hang in there, dear Cryptonary member, this is the last part we cover technicalities and move on to more interesting points.The Optimistic Virtual Machine (OVM) is what allows developers to build on top of Optimism - think of it as the Ethereum Virtual Machine (EVM) for Optimism.

Optimism is designed to mimic Ethereum’s code as much as possible. Therefore, Optimism is fully aligned with EVM. This is known as EVM-Equivalence.

An EVM-Compatible L2 replicates specific properties from Ethereum, making it a custom L2. To build a dApp on this type of L2, a developer builds custom code, which is a lengthy process.

An EVM-Equivalent L2 inherits all identical properties of Ethereum. To build a dApp on this type of L2, a developer can use the same tools they would use on Ethereum, obsoleting the need for custom code.

This is how other L2s go around their infrastructure to support Ethereum smart contracts by creating many lines of custom-built code.

The whole point is that one system requires excessive customization, and the other provides a seamless alternative that makes building and migrating dApps easier than ever.

Optimism is currently the only live L2 that has successfully achieved full EVM-Equivalence.

By going down this path, Optimism has made their protocol more appealing to developers by making dApp migration and building faster than any other live L2.

Back in the day, it was just compatibility, but now equivalence is being popularised more.

Optimism used to be EVM-Compatible until upgrading to EVM-Equivalence back in October 2021.

Examples of EVM-Compatible L2s:

- Arbitrum.

- ZkSync.

- StarkNet.

- Optimism.

- Polygon Hermez.

- Scroll.

Growth

Optimism has achieved impressive growth over time since its mainnet launch, and despite the current bearish sentiment in the past year, there is demand for blockspace.Let’s take a look at the figures!

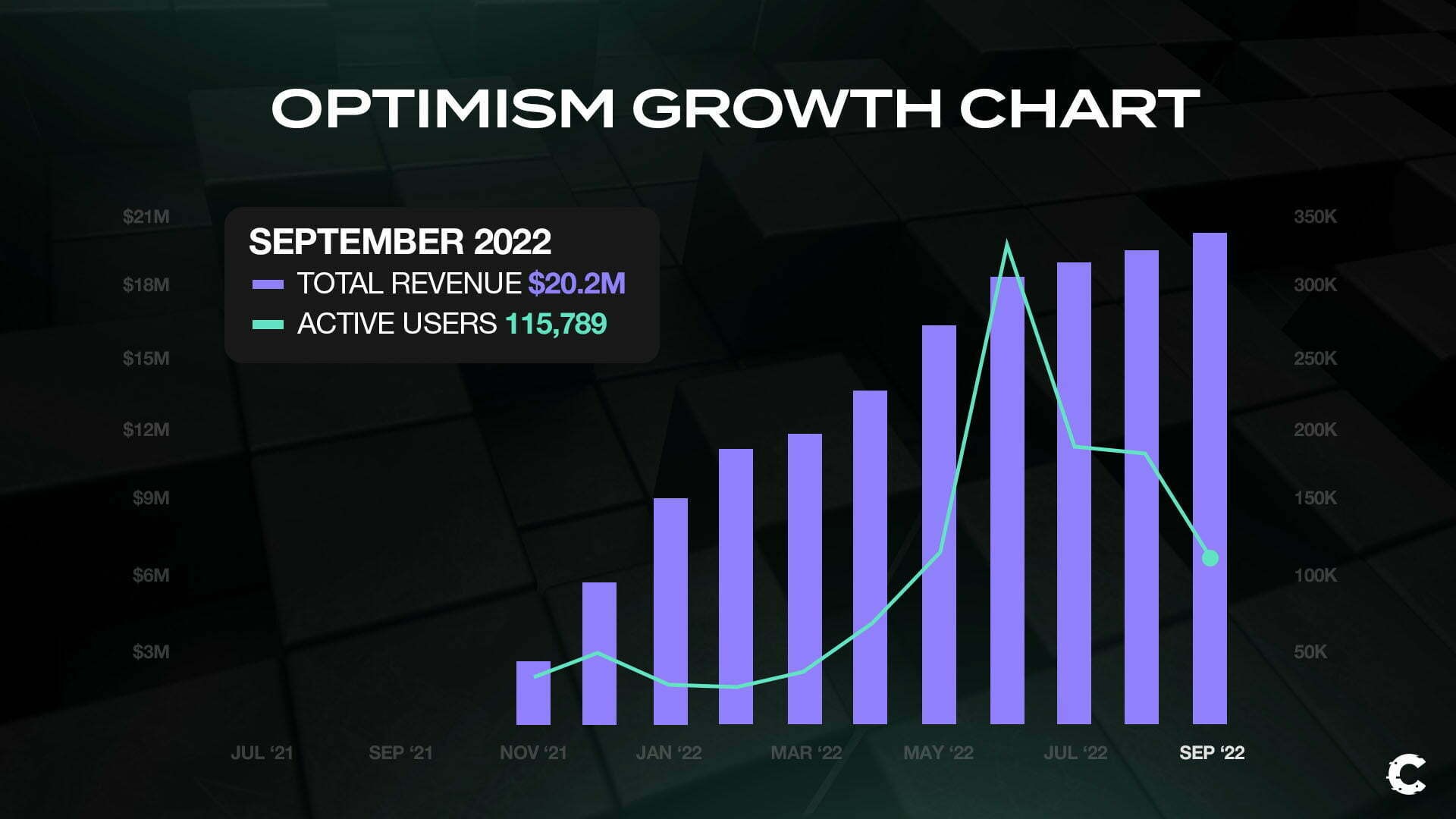

Optimism has generated over $20 million in fees and more than 115,000 monthly active users.

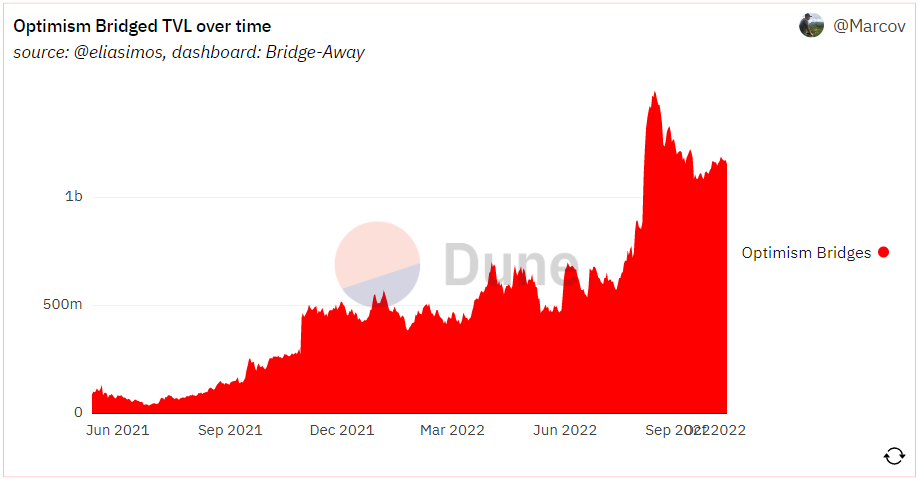

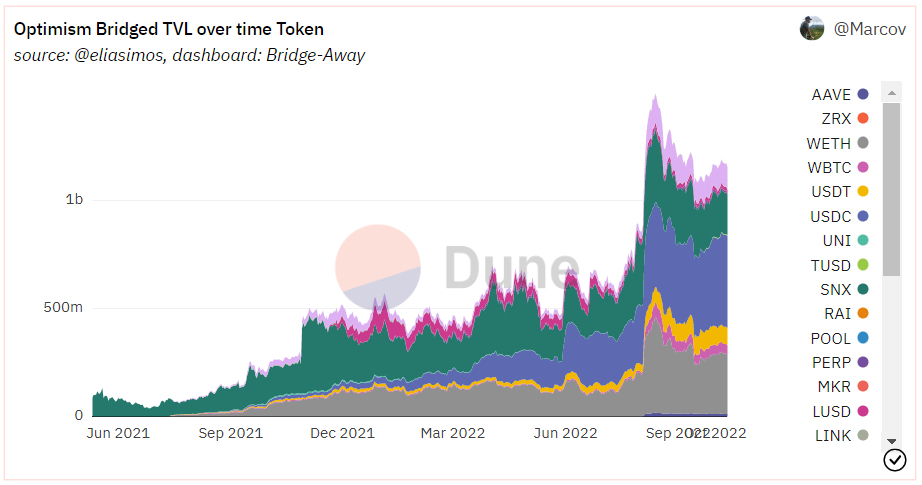

Optimism is among the top 10 chains in DeFi that have the highest Total Value Locked (TVL). Optimism’s peak TVL is over $1.15 billion.

TVL represents tokens being locked up in smart contracts. High TVL is a sign that shows users have trust in the chain to lock up their funds and perform activities like staking or lending.

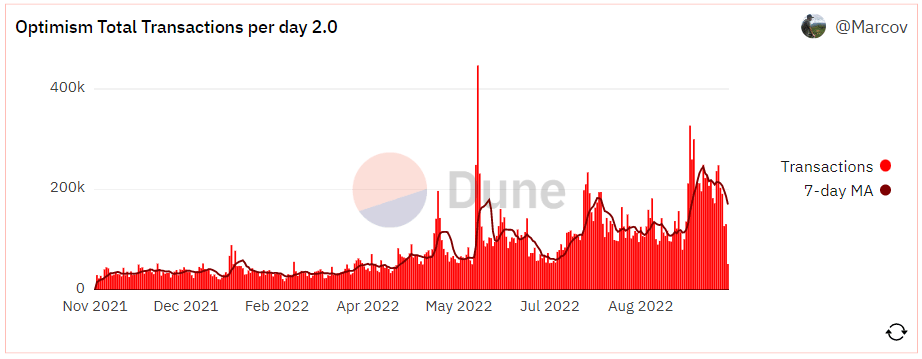

Optimism processes over 100,000 transactions per day.

Over $ 1 billion in funds have been bridged to Optimism, and transactions are rapidly going up over time.

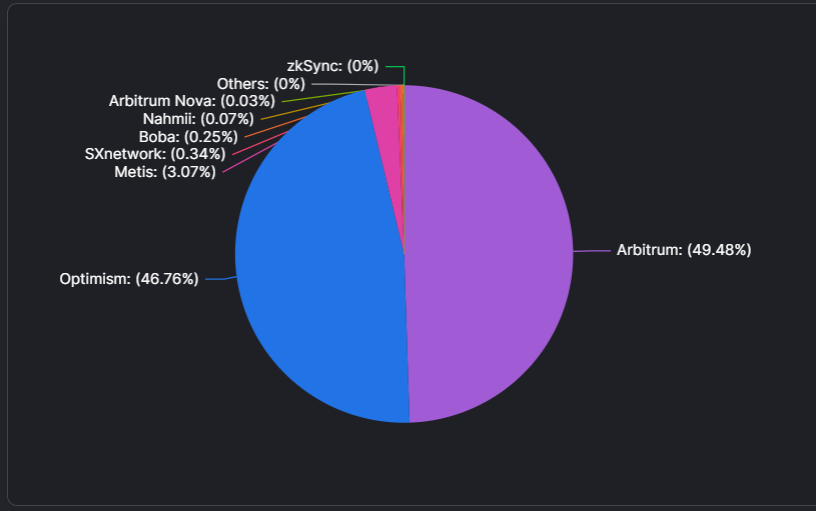

Optimism is one of the go-to L2s. Optimism is a popular scaling solution and captures the 2nd most liquidity after Arbitrum.

Optimism captures 46.76% of the entire TVL across all L2s.

In line with our broad view of the market, we presume activity to continue to increase, especially in bullish market conditions, as the demand for L2s is showing continuous growth.

Ecosystem Overview

The Optimism Ecosystem has more than 70 protocols, including major ones like Aave, Synthetix, Uniswap and Curve.

We refer to these protocols as “major” because they are integrated by many chains and acquire the most liquidity across DeFi.

Curve, Aave, Uniswap and Lido are among the top 10 protocols by TVL on all chains. They are also part of Optimism’s ecosystem.

The more Optimism integrates protocols, the more liquidity it can capture from Ethereum, specifically because Optimism is cheaper.

$1.3 billion approximate on-chain value is live on Optimism. This is distributed as follows:

- 35% USDC.

- 21% ETH.

- 9.5% DAI.

- 7% USDT.

- 5% sUSD.

- 5% SNX.

- 4.5% WBTC.

From the above charts, ecosystem activity heavily relies on USDC, ETH, SNX, USDT, DAI, sUSD and WBTC for liquidity.

The more these assets keep on being deposited over time, the more the ecosystem can thrive and grow.

Decentralised Exchanges (DEXs)

DEXs, or Automated Market Makers (AMMs), are a substantial element of DeFi. Swapping assets and providing liquidity have become popular since 2020, by driving liquidity across many chains.

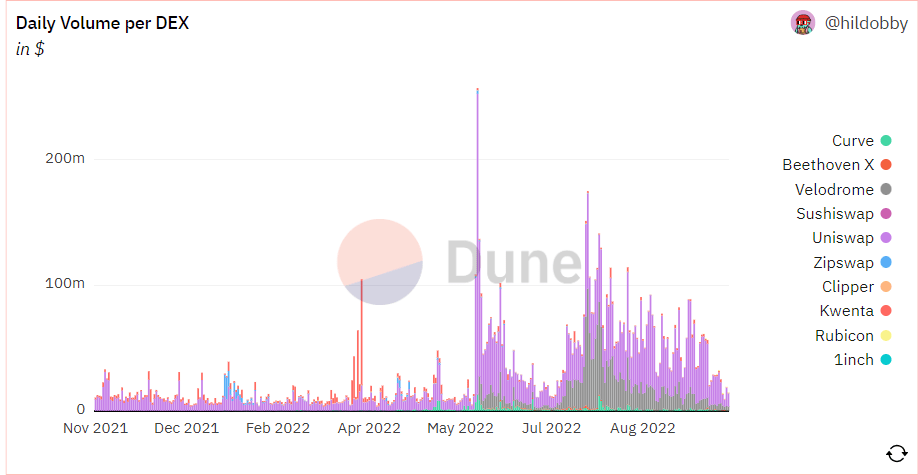

Daily volume per DEX has been rapidly increasing massively across 2022. Again, a great sign to show demand for asset swapping and providing liquidity.

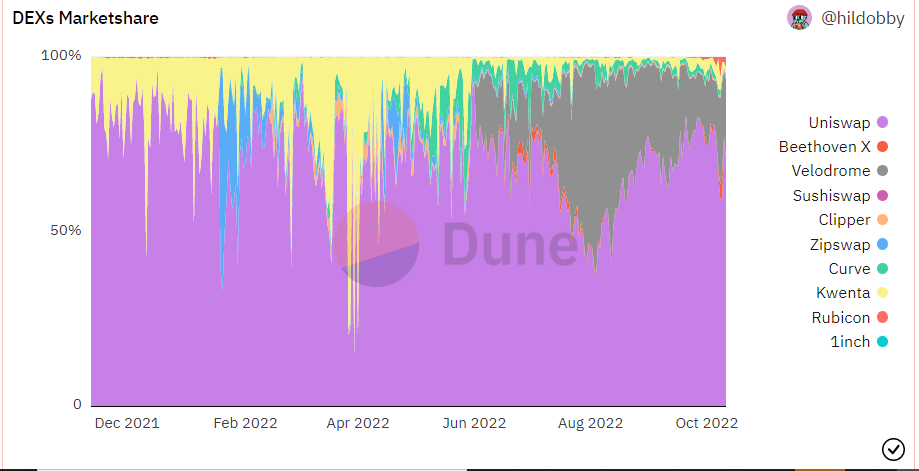

Uniswap and Velodrome are the biggest DEXs per volume. The greater the volume, the more fees earned by protocols are distributed to liquidity providers.

Uniswap used to acquire 90% of the DEXs market share in 2021. Today, Uniswap captures 60%, Velodrome 26%, Beethoven X 7.4% and Kwenta 4%.

It is great to see market share expand across other DEXs to enable a robust flow of liquidity and more incentives for users to other DEXs to contribute growth towards Optimism.

The Optimistic Experience

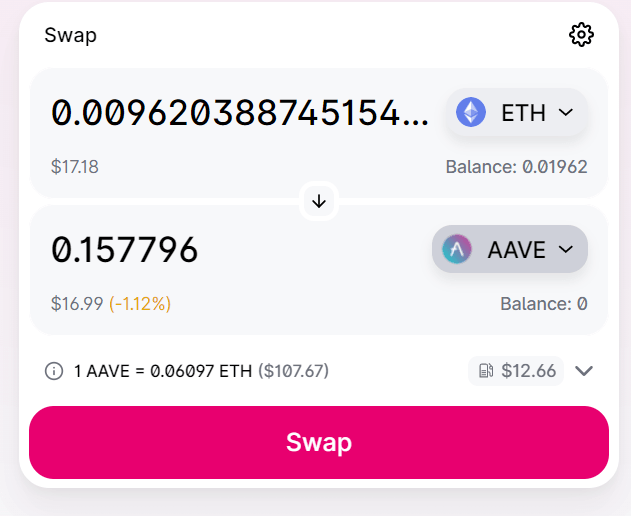

The user experience on Optimism is similar to using Ethereum mainnet but much cheaper.For a tutorial on how to use Optimism, read here.

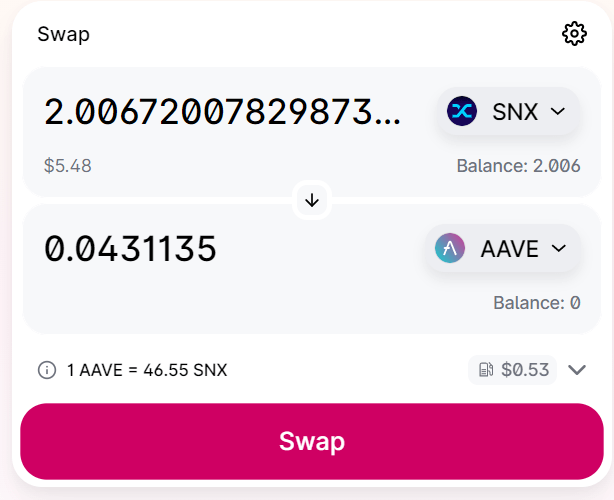

The need for L2s is evidenced in both pictures. A transaction on Optimism usually costs $0.5, while on Ethereum costs $10 and sometimes even more.

The shift in fees drastically improves the overall user experience (UX).

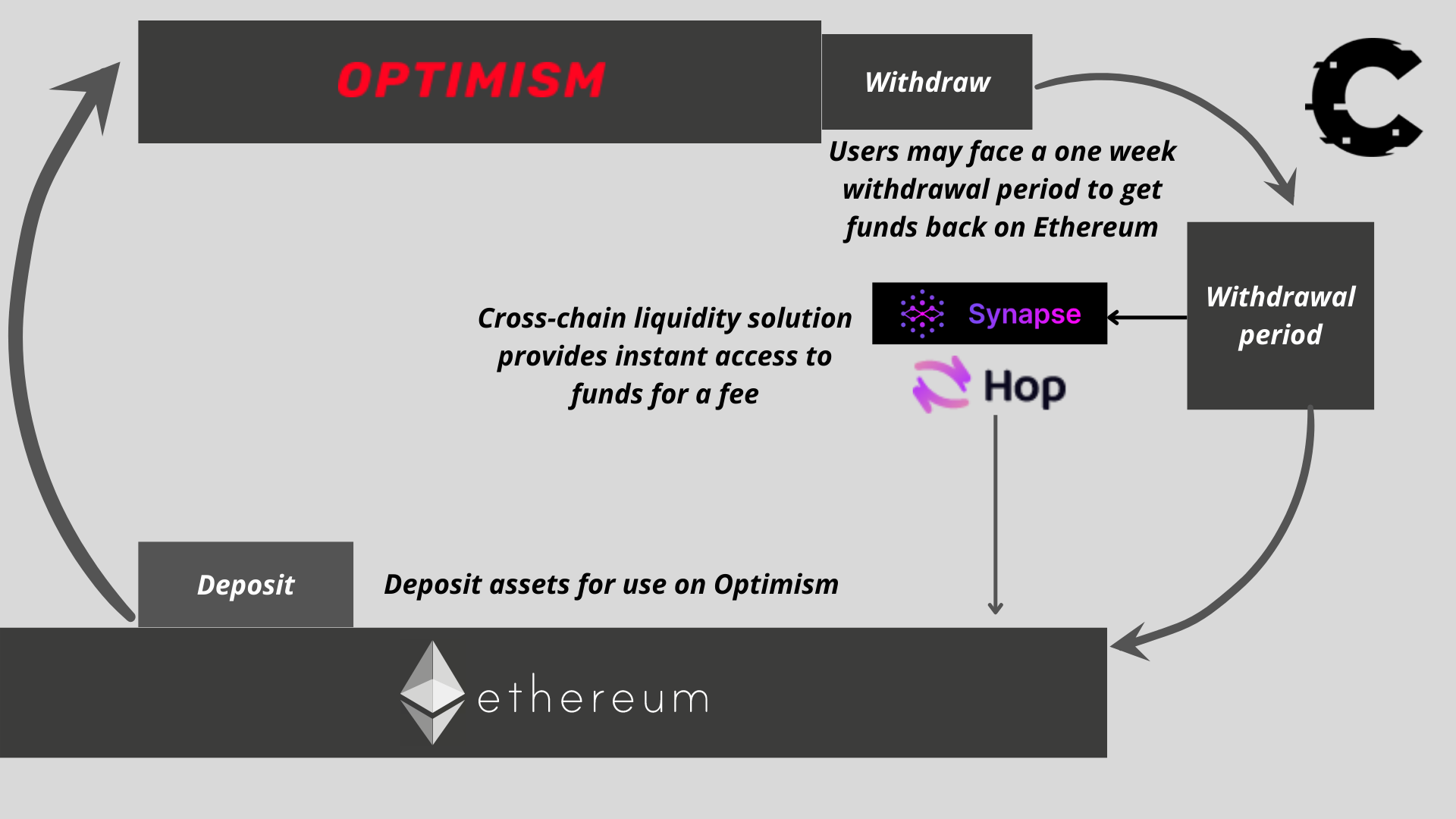

As good as the Optimism user experience is, there is a pain in the donkey. Withdrawals from Optimism to Ethereum take around 1 week to go through. This tradeoff is due to Optimism’s architecture.

However, there is a solution to this issue. Users can access their funds instantly when withdrawing back to Ethereum by using a cross-chain liquidity solution that requires a premium to release the funds.

This a great alternative for users, but reduces the revenue generated to Optimism from withdrawals.

The Optimistic Experience in a Nutshell

- Deposit funds by bridging from Ethereum L1 to Optimism L2.

- Use protocols on Optimism for DeFi purposes.

- Withdraw funds back from Optimism L2 to Ethereum L1 using the Optimism bridge or a cross-chain liquidity solution like Synapse or Hop Protocol.

Governance

Optimism governance is a collaborative effort between the Optimism foundation and the Optimism collective.

Optimism collective is a band of companies, communities, and citizens working together to reward public goods (projects) and build a sustainable future for Ethereum.

The Optimism collective will be governed by a DAO that consists of two houses: the Token house and the Citizens’ house.

Token house members are responsible for governing project incentives, protocol upgrades, and treasury funds - governed by OP holders.

Citizens’ house members are responsible for Retroactive Public Goods Funding (RPGF) - responsible for retroactively distributing protocol-generated revenue to projects serving the Optimism ecosystem. The Citizens’ house has yet to be launched but will initially comprise top contributors in the Optimism ecosystem.

OP Tokenomics

OP is a governance token. So how does OP accrue value?

The more revenue Optimism generates from bridging, the more RPGF rewards are available to reward projects, creates ecosystem value and drives user demand for blockspace.

Also, value accrues to users through airdrops (will be discussed further below). Users will be incentivised to use Optimism to receive OP tokens in the form of airdrops, which generates more revenue and drives demand for blockspace.

The intrinsic value is in the network itself (through demand for blockspace) rather than the token. This is a poor value accrual model for OP, as investors are less incentivised to hold OP because there isn’t any benefit to them as receiving rewards from staking or revenue sharing.

With ETH, you pay for transaction fees, smart contracts and receive yield. With OP, you can’t do any of that.

Investors would be mainly buying OP to speculate on prices going up.

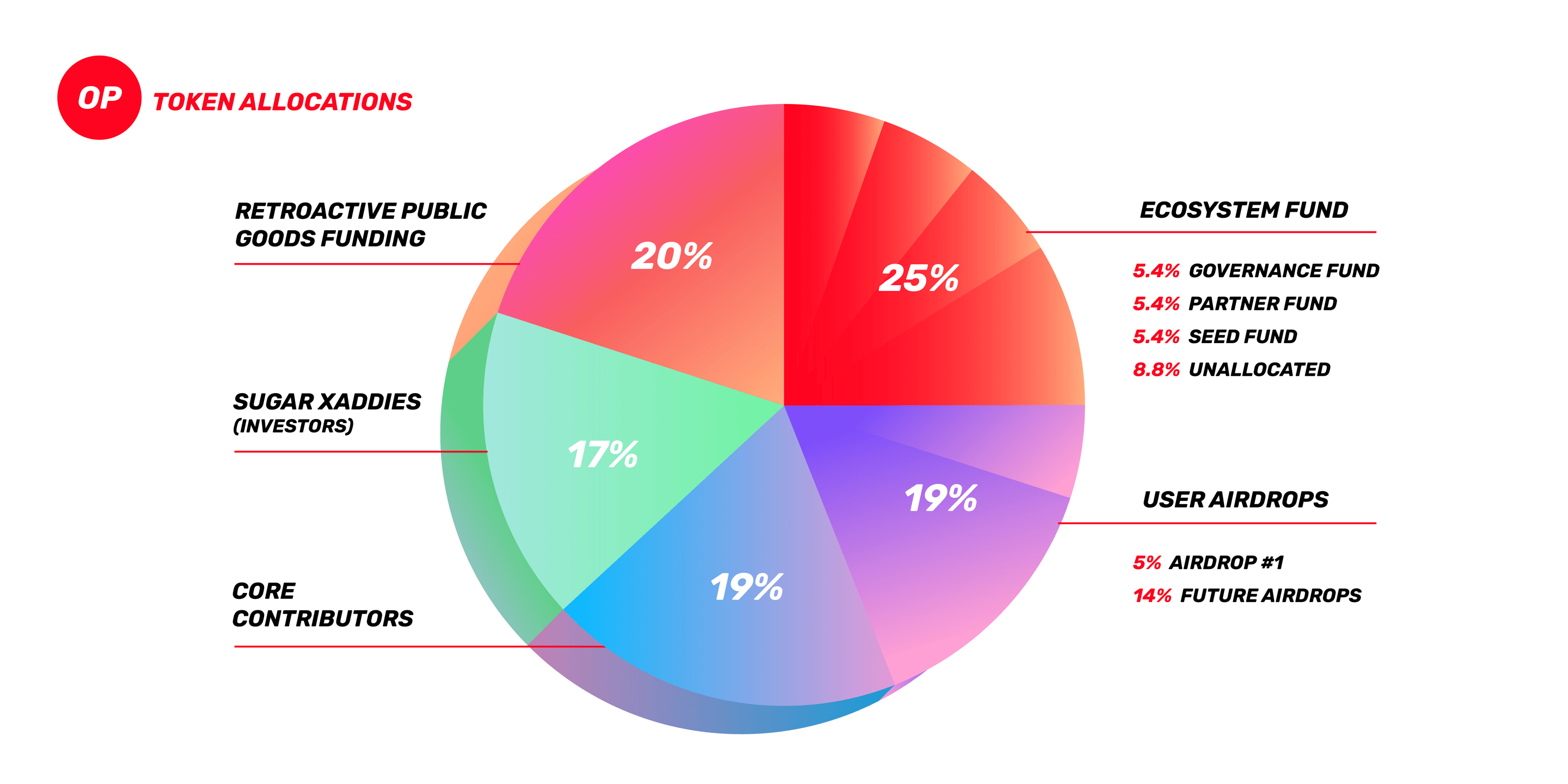

OP Allocations

- Ecosystem Fund 25%: an incentive program to stimulate development in the ecosystem by providing funding to projects and communities in their early days.

- Retroactive Public Goods Funding (RPGF) 20%: the Optimism Collective’s primary mechanism to adequately and reliably reward projects for the impact they provide.

- User Airdrops 19%: a series of airdrops to reward users, beginning with airdrop #1. An allocation of 14% for the OP token supply will be held in reserve for future airdrops - the 2nd airdrop is discussed in the last part.

- Core Contributors 19%: contributors who worked to bring the Optimism Collective into existence.

- Sugar Xaddies 17%: investors.

Also, the ecosystem fund is intended to be a kick-starting mechanism that will be phased out entirely once the OP in the fund has been depleted.

The Optimism foundation expects the function served by the ecosystem fund (proactive funding) to eventually be replaced by possible exit liquidity for projects paid out by the RPGF.

Only 19% of the total supply is issued to the community. We always prefer community distribution to be at 40% at least so the team and investors can have less influence on price and give the community more democracy.

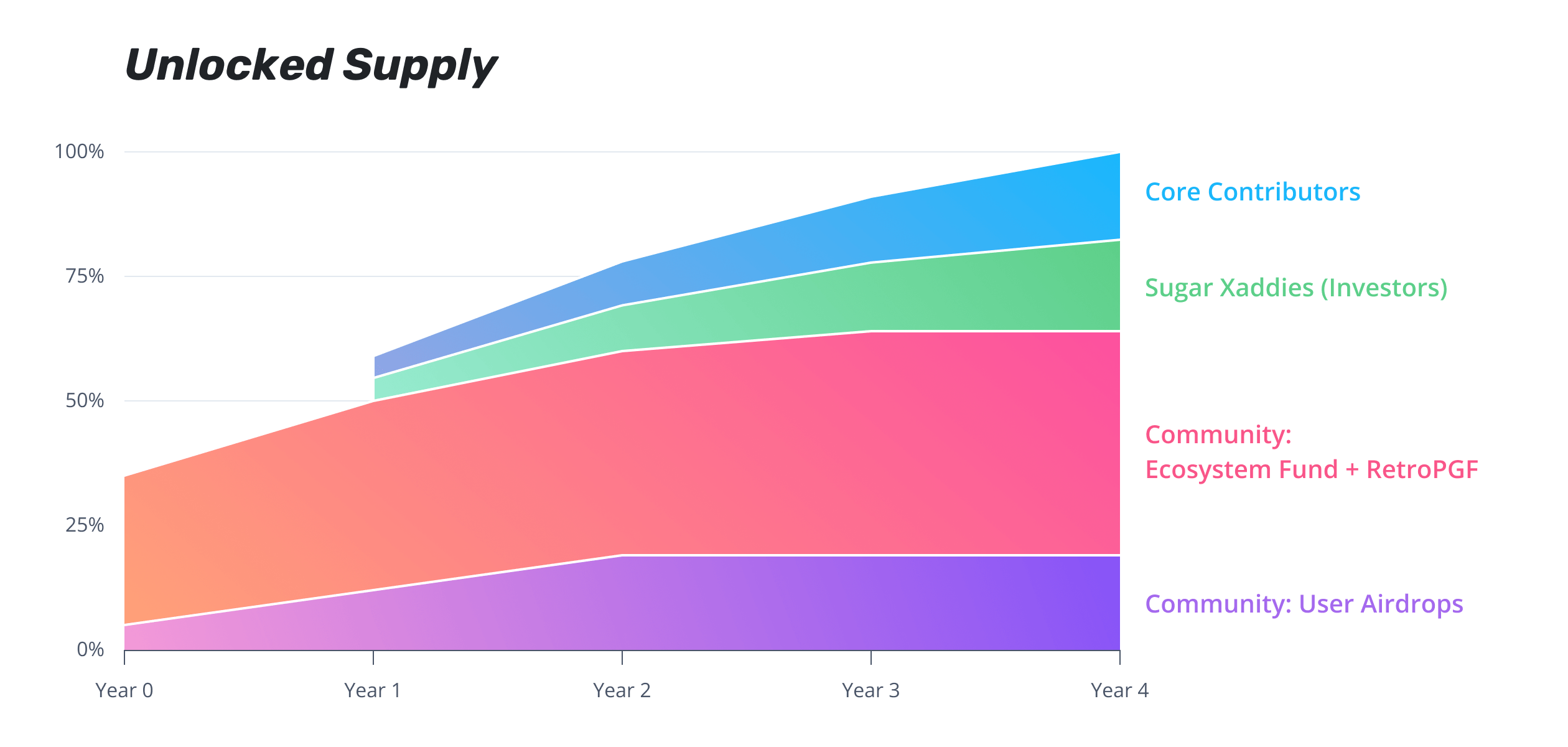

OP Distribution

At genesis, there will be an initial total supply of 4,294,967,296 OP tokens. The total token supply will inflate at 2% per year.64% of the initial token supply (excluding OP reserved for core contributors & sugar xaddies) will be distributed below. These distributions will be administered over time by the Optimism Foundation.

In year 1, 30% of the initial token supply will be made available to the foundation for distribution. After the first year, token holders will vote to determine the foundation’s annual OP distribution budget. The foundation expects to seek the following annual allocations:

- Year 2: 15% of the initial token supply

- Year 3: 10% of the initial token supply

- Year 4: 4% of the initial token supply

The foundation expects the total supply of unlocked OP tokens to approximate the graph below:

OP launched on the 31st of May in 2021. The total supply of OP will be fully unlocked 4 years from launch. Sugar xaddies (investors) and core contributors tokens unlock after 1 year (around 10% of the total supply) and will continue to unlock to year 4 until they receive 36% of the total supply.

When tokens are unlocked, selling pressure is created by venture capitalists (VCs) and private sales. Therefore, if emissions exceed demand, OP could suffer as a result.

Since VCs purchase tokens at a low price, it is likely during rallies they will be selling to realise their profits.

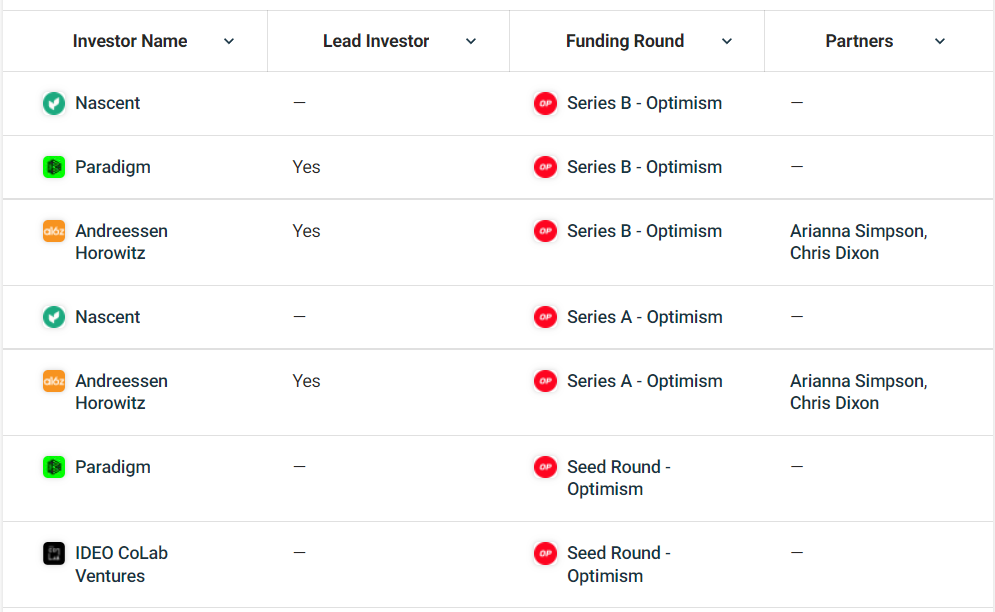

Investors

Andreessen Horowitz (a16z) and Paradigm - one of crypto’s prominent VCs are leading investors, alongside Nascent & IDEO CoLab Ventures.

Full Decentralisation

Despite tokenizing and issuing OP, there are still certain areas where Optimism operates in a centralised manner. There are future plans to move towards full decentralisation in 2023.Decentralising the Sequencer

Currently, Optimism runs the sole sequencer node (block production) on Optimism. It is still desirable to decentralize the sequencer over time, eliminating Optimism's role entirely so that anyone can participate in the network as a block producer.The long-term goal is to support multiple concurrent sequencers. This can be simply achieved by adopting a standard BFT consensus protocol, as used by other L1s like the Cosmos Hub.

So, until Optimism is fully decentralised, Optimism will be donating all profits from running a centralized sequencer towards scaling and sustaining projects.

Next Gen Fault Proofs

Fault proofs are part of Optimistic Rollups architecture which increases security and decentralisation by eliminating malicious transactions published to Ethereum.Optimism's fault proof mechanism is temporarily disabled. Users need to trust the Sequencer node to publish honest transactions to Ethereum. This mechanism is being worked on and is expected to roll out in 2023.

Invest-ability

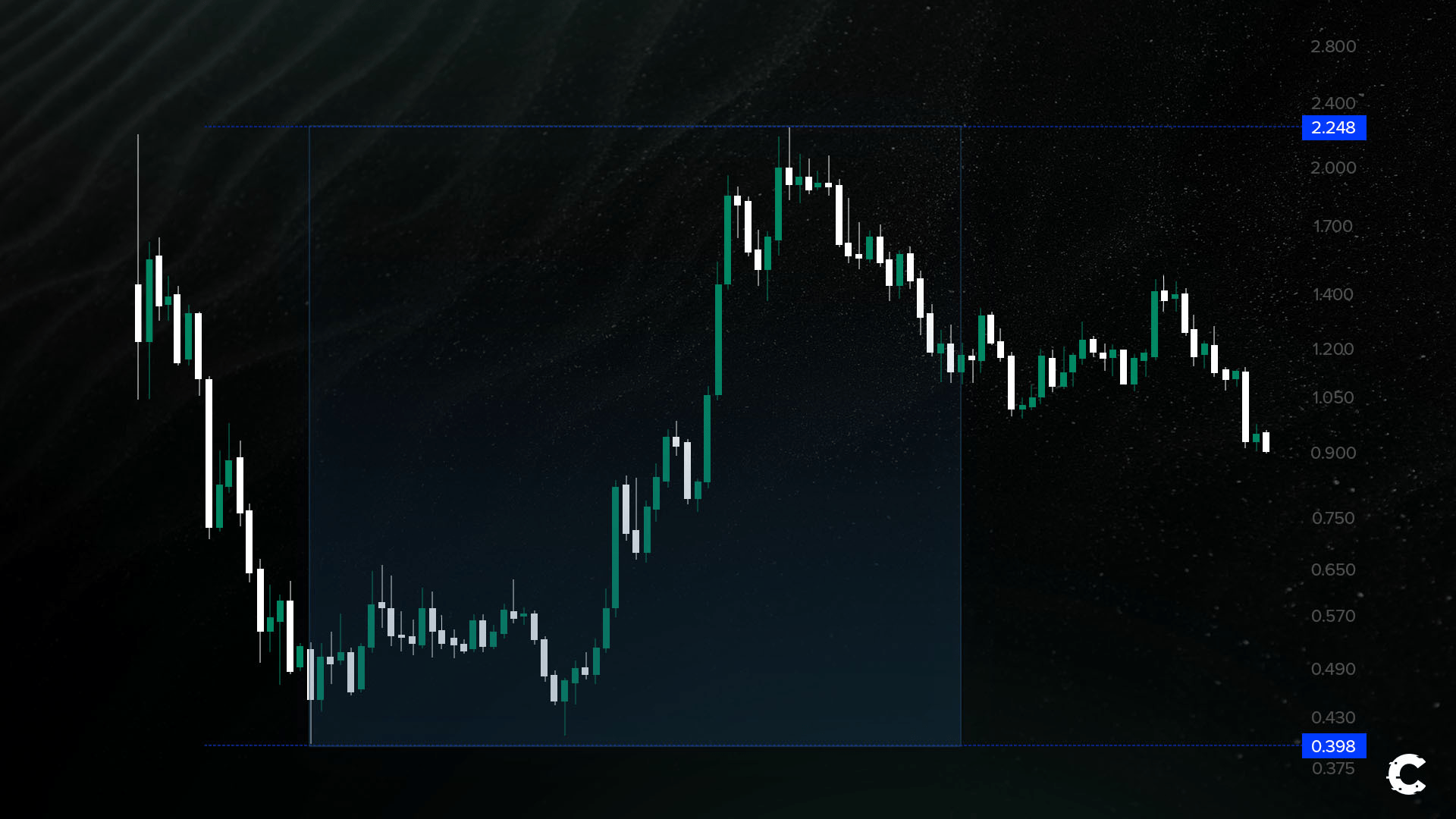

The market has a long way to go before recovering into bull mode. As long as macroeconomic and geopolitical conditions remain unstable, the market will probably be bearish. The market is currently in a risk-off environment, so investing in altcoins is riskier.However, here is our perspective of OP moving forward.

At the time of writing this report, the current circulating supply is 214,748,364, and the market capitalisation (Mcap) is $160,248,841.

The maximum supply is 4,294,967,296. If total supply were to circulate, then OP’s fully-diluted valuation (FDV) is $3.2 billion.

The difference between the Mcap and FDV is significantly high!

During this first airdrop, only 5% of the total supply was released, meaning that 95% of the tokens have yet to hit the market!

Unlocks will cause high-pressure selling because around 25% of the total supply will be unlocked by next year, coupled with presumably bearish macro news.

These factors are expected to negatively affect OP’s performance.

The fact that full decentralisation is expected by the end of next year appears to be conveniently timed with the supply to be unlocked.

Additionally, if inflation begins to fall sharply and the FED begins to change course with rate hikes, the best opportunity to invest in OP will be somewhere in 2023 after these events have passed.

Dollar-cost average (DCA) is the solution for individuals who prefer to avoid timing or take more risk in exchange for a greater reward if they have enough conviction in OP.

The Layer-2 narrative has high growth potential and will drive capital because of the solution and the value L2s are offering.

Regardless of fundamental soundness (poor value accrual model), there is a high speculative element tied to OP.

The value of Optimism comes from the L2 network rather than its tokenomics. As long as more protocols are being built, more TVL gets filled, and more revenue is generated. This will be the main factor to push the price of OP higher - demand for blockspace.

When OP pulled a 500% return in August, this is what precisely caused it. The OP pump was influenced by the explosion in network activity - TVL skyrocketed from $270 million to $1.16 billion.

Considerations and Drawbacks

Arbitrum will always be the number one contender for Optimism. This competition will pursue one side to capture marketshare more than the other.ZK Rollups propose the biggest threat to Optimistic Rollup solutions like Optimism over the long term. ZK Rollups offer instant finality, unlike Optimistic (1 week). This shift in design is massively superior. Also, ZK’s architecture prefers security & withdrawal periods over faster transactions like Optimism.

Optimism is not fully decentralised yet. The sequencer can freeze user funds - this is unlikely but still a potential.

26% of airdrop holders have not claimed their tokens yet. 56 million OP is yet to be claimed - this represents 1.3% of the total supply, which could create selling pressure on rallies.

Bridging to L2 and withdrawing from L2 is still considered expensive for some users - bridging costs sometimes $5 and even more, depending on gas fees on L1, which can cause users to use cheaper alternative chains.

Airdrop #1 was carried out poorly and showed a lack of competence from the team. If more issues arise, then this will arouse more suspicion regarding the degree of professionality.

Gas fees could spike high even on L2s ($10+) like what happened to Arbitrum - this has not been faced by Optimism but could happen if adoption were to increase. The key will be to monitor how the team will resolve this issue and prevents users from leaving the chain.

Optimism is currently managed by a multi-sig and will be removed after decentralisation. Another source of central power.

Conclusion

The progress in development since 2019 has been immaculate. Optimism started as a singular Rollup to now being supported by prominent exchanges (Binance, FTX, Crypto.com) and DeFi protocols to start the onboarding stage of L2s.There’s a lot of value currently sitting on Ethereum and alternative L1s to be extracted. Optimism’s value, witnessed throughout this report, is increasing and is the first sign of high potential growth for the blockchain.

As the founder of Synthetix, Kain Warwick said:

Once people have confidence to move from L1 to Rollups, then we’re gonna see a massive influx of TVL and will probably see both Optimism & Arbitrum with $100 billion+ TVL by the end of the years.Optimism’s main advantage remains against other L2s is its OP token. A token pumping in price is a source of marketing that contributes to more growth.

How long will the other L2s (Arbitrum, StarkNet and zkSync) remain token-less?

Arbitrum has not confirmed any news regarding a token, but speculation hints its coming soon.

We don’t know what Arbitrum’s model will look like, but since it already is the L2 leading by little difference, a token drop will arguably steal more market share from Optimism.

After deep research, we believe that the tech offered by ZK Rollup projects is superior to Optimistic Rollups.

While StarkNet & zkSync are yet to go live on mainnet, their potential and development activity throughout the bear has been astonishing and hints at a great future.

StarkNet is releasing its token (STARK) soon, governed by a proof of stake (PoS) model. ZkSync confirmed their token will be community-owned (airdropped!) and used for staking to secure the network.

Value accrual of both zkSync & StarkNet’s token is better than Optimism. This is one factor contributing to potential marketshare capture from Optimism, coupled with how better ZK Rollups' user experience will be.

However, Optimism was the underdog for a long time and proved its competence to compete for the throne. We know that the team has great potential and their main goal moving forward is to keep developers incentivised to build to benefit the community and become the number one scaling solution today.

For those less heavy on the risk side, we are presenting you a low-risk/high-reward opportunity that speculates at the next OP airdrop #2.

The event will be recorded to benefit all those participating

More details will be shared soon, so keep an eye on our Discord!