Since our last update, the project has introduced a new and improved tokenomics that will benefit all token holders.

Beyond this, it has some pending catalysts that will make this next phase exciting and game-changing.

Are you ready to dive into the details?

TLDR

- Synthetix has shown solid foundational growth.

- The introduction of Perps V3 Andromeda Release expands Synthetix to Base and aims to enhance trading efficiency.

- New tokenomics offers a better deal with no inflation and an SNX buy-and-burn model.

- And what's more. Synthetix is launching interfaces to improve usability.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

What is Synthetix?

Synthetix is a decentralised synthetic assets protocol built on the Ethereum and Optimism blockchains. It allows the creation of synthetic assets, which then can be traded and used in DeFi.We first covered Synthetix in 2020 and labelled this token as a potential 20x.

From our first report until now, many things have changed. For instance, Synthetic switched its business model from B2C to B2B to become a liquidity layer for Defi.

It now powers many successful dApps such as Kwenta, Polynomial, dHedge, Lyra (v1), and Thales.

Fundamental metrics

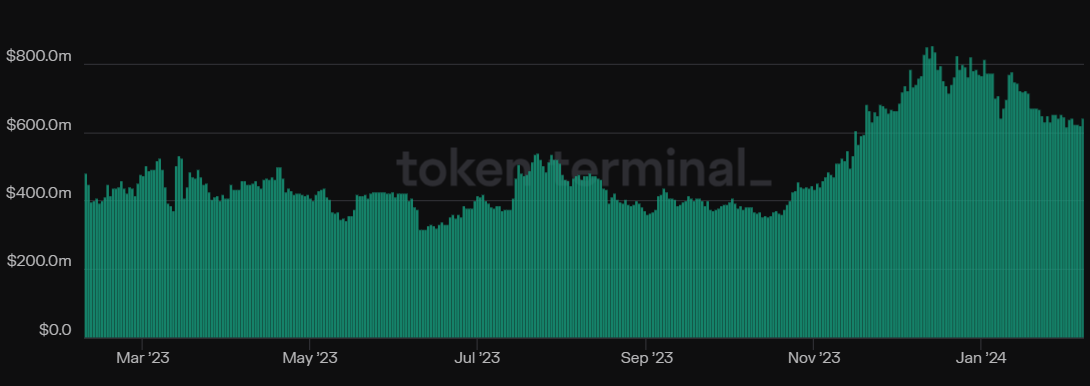

We saw the first hints of the bullish catalysts on the horizon in Synthetix's fundamentals.Its total value locked (TVL) has almost doubled since last year, with most of the increase coming since Oct 2023.

Why is TVL growth important?

Because it coincides with the recent market rally in a broader market, the last thing you want to see in any DeFi ecosystem is TVL not reacting to a broader rally.

We can observe similar price action when it comes to the token itself, which is, again, a good sign.

But can SNX decouple from the broader market and deliver superior performance?

The answer lies in upcoming catalysts.

So, what is next for Synthetix?

Perps V3: Andromeda Release

Perps V3, building on the success of V2, is a very important upgrade for the Synthetix protocol.This new version aims to boost Synthetix's trading efficiency, user-friendliness, and resilience.

Andromeda Release aims to be a testing ground for new developments such as using USDC as collateral, fee sharing and multichain vision for Synthetix.

The release will be launched on Base, the L2 built on OP stack by CoinBase.

Andromeda Release will be isolated, not connected to the existing V2 on Optimism or Ethereum Mainnet.

This isolation allows for independent testing and development, making it possible to compare it with the current Optimism Perps V2 deployment.

Technically speaking, Andromeda is already live on Base (alpha stage). However, it is not publicly available, so we haven't seen the effects of Andromeda yet.

The public version is expected to go live in February or early March. We expect this catalyst to be a significant leap forward for Synthetix and SNX tokenholders.

But there's more!

Superior tokenomics

Andromeda Release on Base will introduce superior tokenomics.40% of the revenue will be used to buy back and burn SNX from the market.

The Base ecosystem doesn't have a flagship perps market yet, so we believe there is a decent chance that Synthetix on Base will be a huge success.

That means Synthetix can find a new market on Base and generate a lot of fees, which, with new tokenomics, is huge for SNX tokenholders.

Ending inflation

On December 17, 2023, the Synthetix community voted to reduce SNX inflation to zero, effectively ending the token's inflationary period.

Before this change, the SNX token had been inflationary, with weekly issuance of new tokens. This was initially introduced to help bootstrap the network and incentivise participation.

However, the effectiveness of this approach had diminished over time, leading to the decision to end inflation.

What does it mean for SNX tokenholders?

With Andromeda Release, the SNX's demand side pressure will increase because of buyback/burn, while the supply side pressure of SNX will decrease dramatically.

That is a powerful combination that can drive a substantial rally. We believe the market hasn't priced it in yet.

Interfaces: more demand for SNX

Another positive catalyst for Synthetix is a new front-end, Infinex, which is set to launch soon.Infinex aims to provide a trading experience similar to centralised exchanges but with a decentralised approach.

It won't have a native token and will be governed by SNX debt holders (stakers). Infinex plans to use its revenue to buy SNX from the market and stake it, creating additional demand for the token.

Another front-end, Kwenta, which will expand to Base, also plans to use 20% of its revenue from Base to buy SNX from the market and stake it.

This adds another layer of demand-side pressure.

Overall, these developments suggest a potentially bullish outlook for SNX.

Cryptonary's take

Synthetix is about to open a new chapter in its journey.Bullish catalysts are piling up, and the token just needs that last push to deliver outsized returns.

The end of SNX inflation, the introduction of demand-stimulating tokenomics, expansion to Base, and new interfaces are all poised to bolster SNX's market position.

We are bullish on SNX and expect the public launch of Andromeda to be around February or March.

As long as the broader market plays our card, we believe SNX can outperform the market.