Pendle took the market by storm with interest rate swaps. In hindsight, that was a no-brainer offering because interest rate swaps are huge in TradFi, a multi-trillion-dollar market.

Do you know what else is huge in TradFi and every market that has ever existed? Arbitrage.

Now, we have found a protocol that taps into the arbitrage market…

Could this be another PENDLE in the making?

Let's find out!

TLDR

- After our massive Pendle call last year, we may have uncovered the next big DeFi protocol—this one aims to tap into a multi-trillion-dollar market.

- It allows regular investors to profit from a perpetual money-making strategy usually reserved for elite traders - arbitrage across markets.

- It takes a novel approach to pooling capital and distributing arbitrage profits, unlocking access to an endless stream of arbitrage opportunities.

- The platform's deflationary token has a capped supply that is continuously burned, making it an extremely attractive investment opportunity.

- Currently trading at a small fraction of its potential, this token could deliver a 40x upside from here by tapping into its massive target market.

- Our verdict? After our successful PENDLE win, this could very well be our next 40x - the protocol that unlocks the infinite arbitrage gold mine.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is arbitrage?

Put simply, arbitrage is the act of taking advantage of asset price discrepancies in different markets/exchanges. Here's an example:- ETH is $3400 on Uniswap but $3350 on Binance.

- An arbitrage trader notices this difference and buys 10 ETH for $33,500 on Binance, which he withdraws to his MetaMask wallet.

- He then sells the 10 ETH for $34,000 on Uniswap, walking away with a $500 profit.

Arbitrage trades tend to become more profitable during periods of heightened market volatility. This is because when a high volume of trades comes through, liquidity often becomes squeezed on smaller exchanges to the point that the price of a given asset deviates significantly from the mean across all platforms.

Either demand for an asset outpaces supply (due to large buy-side volume), or supply outpaces demand (due to large sell-side volume).

We already know that arbitrage trades occur in a neverending cycle. The market never sleeps, and arbitrage opportunities are endless.

What if a protocol was built for us to benefit from this never-ending cycle?

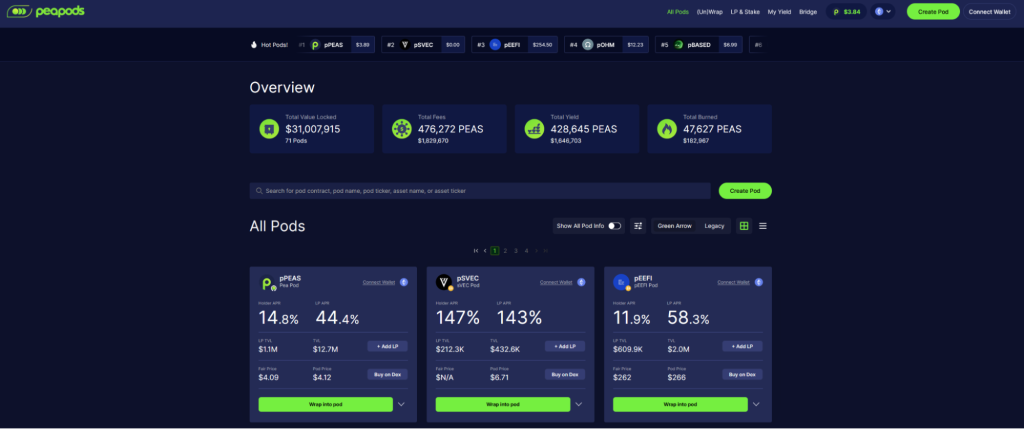

Peapods Finance

That's precisely what Peapods Finance is aiming to achieve. Remember when we said that generally, the more capitalised an arbitrage trader is, the more profit they are likely to make with each execution?

By decentralising capital for trades into pools (called pods) and distributing the profit to LPs who provide the capital for the trades, Peapods can effectively kill two birds with one stone:

- The average person has no idea how and when to arbitrage trade. Peapods allow retail investors to profit from arbitrage while helping improve the efficiency of the markets they use daily.

- Arbitrage traders help markets run efficiently by rotating capital from over-capitalised markets to the markets where it is required.

Peapods

The crown jewels of Peapods Finance are the peapods themselves.

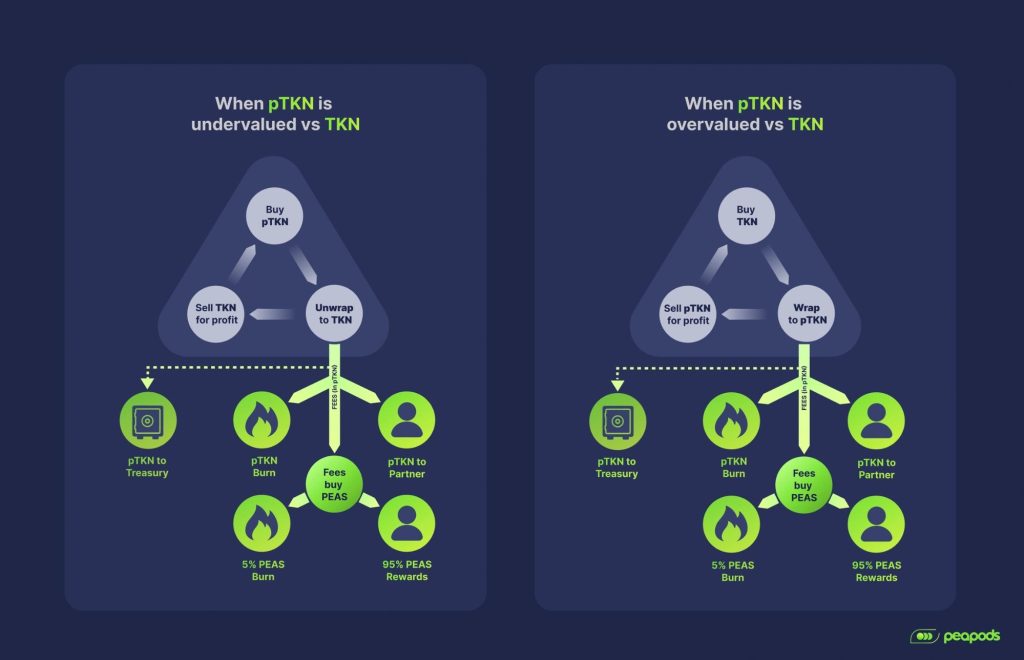

Pods are made up of TKNs (the underlying asset, like WBTC, for example) and pTKNs (the token that represents a share of that pool, like an LP token).

The difference in price between a TKN and a pTKN determines whether there is a profitable arbitrage trade. In this way, Peapods creates its own opportunities, over and above the opportunities presented by the market.

PEAS tokenomics

PEAS is the utility, governance, and yield token for the platform. Here's a breakdown of usage:The project launched with a max supply of 10,000,000 PEAS; new PEAS cannot be minted— but PEAS could be burned. This makes the token deflationary and a solid base for investment.

Protocol fees are used to buy PEAS on the open market (see process outlined above). 5% of those PEAS are burned, with the remaining 95% going to pods as rewards.

The initial distribution was as follows:

- 44% to Uniswap PEAS/DAI pool ($100k-$300k market cap concentration; this essentially means initial liquidity for public sale).

- 44% to PEAS/DAI position, $100k-infinity market cap (the rest of the token liquidity).

- 12% to team.

Valuation

In terms of valuation, PEAS currently has a market cap of ~$38 million, and all tokens are circulating.

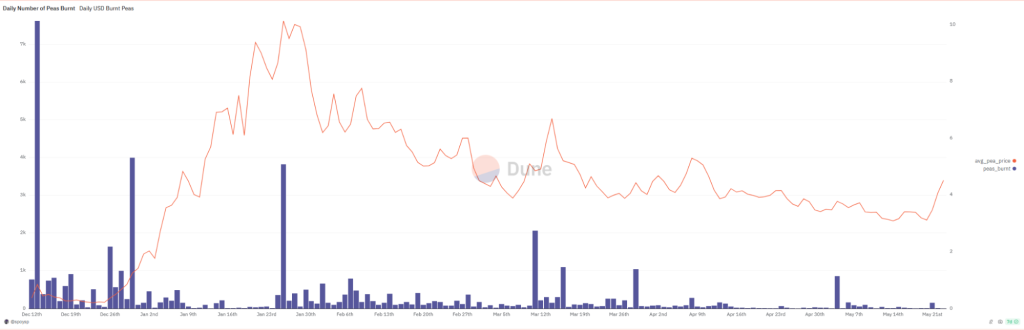

Of the initial 10,000,000 minted, ~48,000 have already been burned.

Obviously, as PEAS increase in scarcity over time, the number of PEAS burned for the same amount of revenue will decrease.

However, as can be seen, the price of PEAS is directly correlated to the number burned in a given day.

Now, if fees increase due to volatility, we can expect that when the market moves up, PEAS will very likely follow in price. In addition, as the underlying assets increase in value, the fees to wrap/unwrap the pTKNs will also be a larger portion.

Thus, based on this flywheel effect (and assuming its continued operation as intended), PEAS is currently undervalued.

So here are our targets from the current token price of $3.80 and circulating supply of 9,950,000:

- 24/25 target: $500 million market cap, or ~$50.25 per token, a 13x upside from here.

- As a base case, we would be surprised if a $500 million market cap was not reached based purely on the current trajectory and PEAS deflation.

- Longer-term target: a $1.5 billion market cap, or ~$150.75 per PEAS, a 40x increase from here.

-

- This is based on PENDLE's recent FDV. If we compare PEAS to PENDLE, given the size of their respective markets, we think this is a reasonable medium-term target.

Technical analysis

Since peaking in market value in January, $PEAS has witnessed a slow correction over the past few months. One key observation is that $PEAS has tried to maintain consolidation between the $3.30-$5.35 zone (green box) during this drawdown period.

The majority of the trading activity has remained in this range, and the current price is also oscillating between it.

At the moment, price action is very neutral in the short term, but the long-term structure is bearish. To undergo a bullish shift, $PEAS ideally needs to break above the said range and potentially close a daily candle above the resistance of $5.65-$5.70.

Conversely, further bearish pressure may lead to a re-test of the long-term orderblock at $1.11-$2.36 (red box), which will strengthen its bearish structure and continue the present trend.

We recommend waiting for $PEAS to break out above the $5.65-$5.70 resistance before taking a position here.

Cryptonary's take

Peapod offers a unique selling point.Its target market is essentially limitless. Crypto markets are extremely volatile, and even when that volatility diminishes over time, Peapods will still have a source of value extraction.

It's like selling shovels, a practical money printer in a gold rush.

Obviously, the same risks are inherent when dealing with DeFi—protocol exploits, bugs, etc. But another key point is that Peapod has been audited by yAudit and Sourcehat.

So, based on the current market cap, the target market, and the potentially endless arbitrage opportunities - with or without outside investment – we're looking at the next PENDLE here.

Where PENDLE operates a market for yield volatility, Peapods operates a market for price volatility.

LFG!!!

Cryptonary, Out!