If you've been with us since January, you've seen us raise the stakes each month. Now, with the market growling like an angry grizzly, we're embracing a daring $10,000 challenge. Can we still outperform the market? There's only one way to find out!

In this month's thrilling update, we'll review our performance to date, delve into the financial world's current state, and reveal our investment strategy for April 2023. Plus, we're making gutsy moves by cutting out underperforming positions.

But that's not all! For the first time, we're capping off the report with a captivating SITG quiz to test your knowledge.

Don't miss this action-packed adventure! Join us and witness firsthand how we prove that a billion-dollar hedge fund isn't necessary to beat the market!

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

Investment update 🗞️

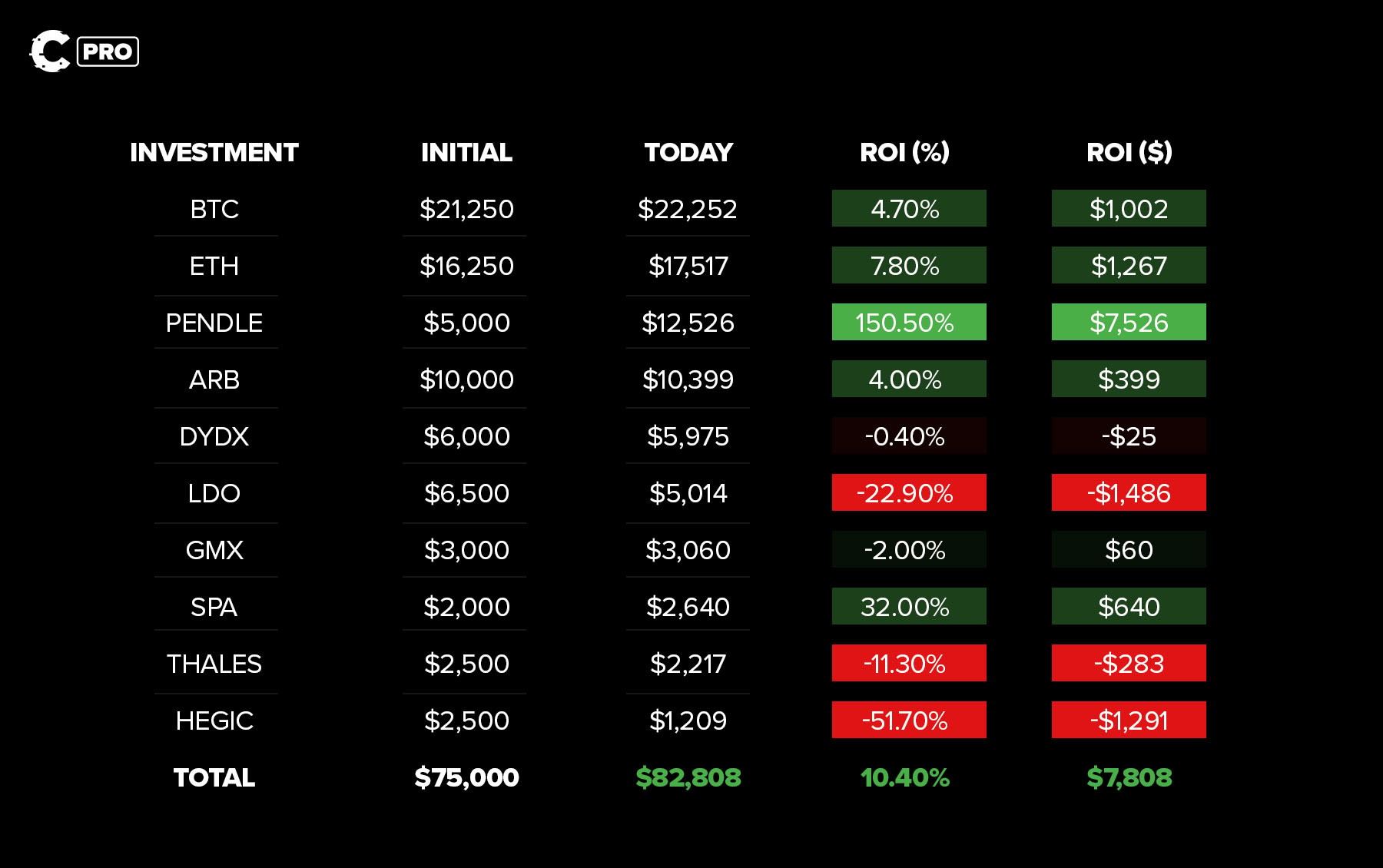

- Market: +2.1%

- Cryptonary: +10.4%

State of the market 📉

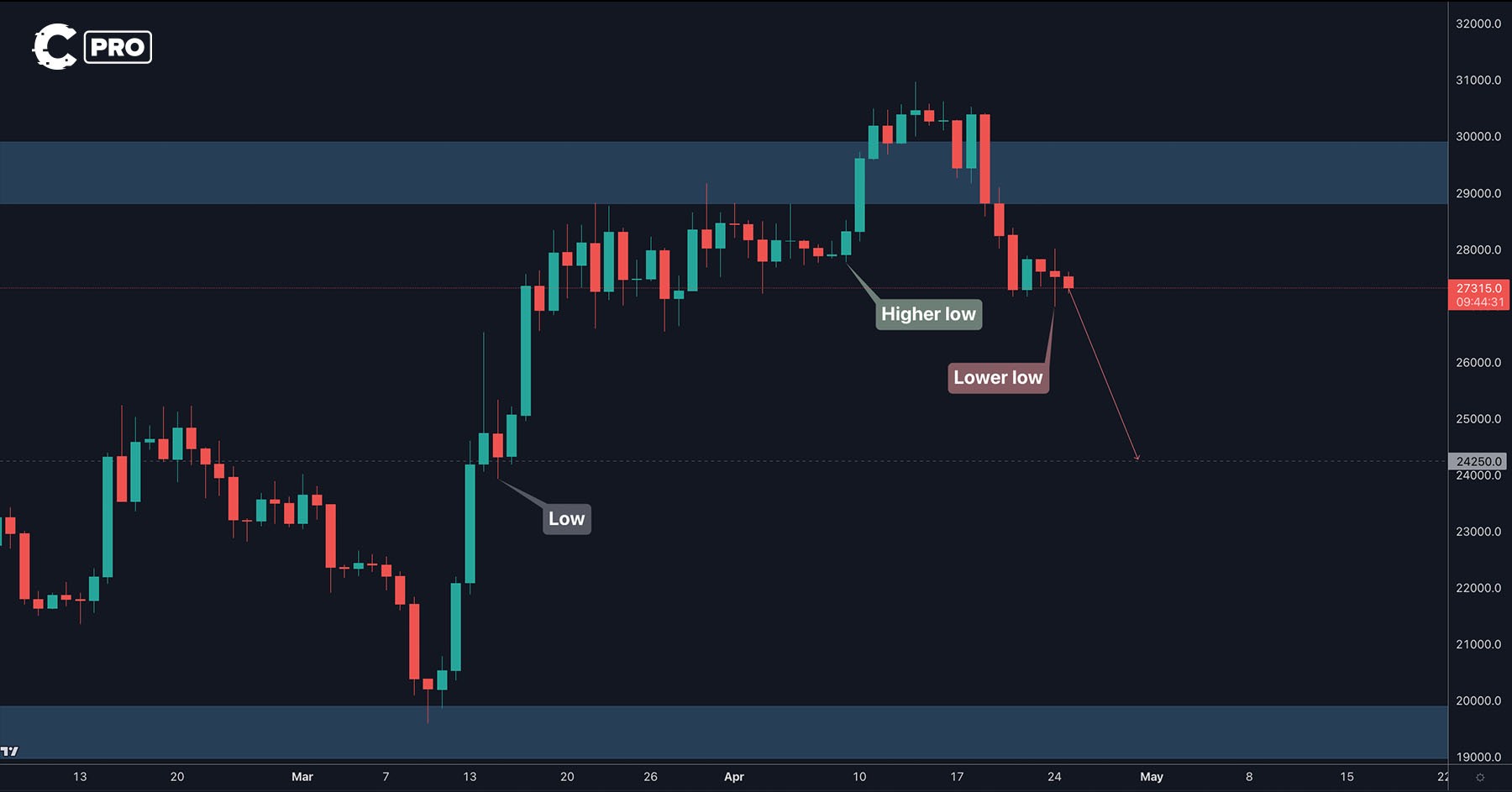

Before revealing our $10,000 investment strategy for the month, let's see where we stand. After a strong rally, the market's now shaky, with broken bullish structures all around.

If BTC doesn't reclaim $29,000 soon, we will see it drop to $24,250 and even $20,000.

We won't ignore these changes, and we will protect our capital. The bearish scenario is the most likely.

Now for some secret sauce. 🤫

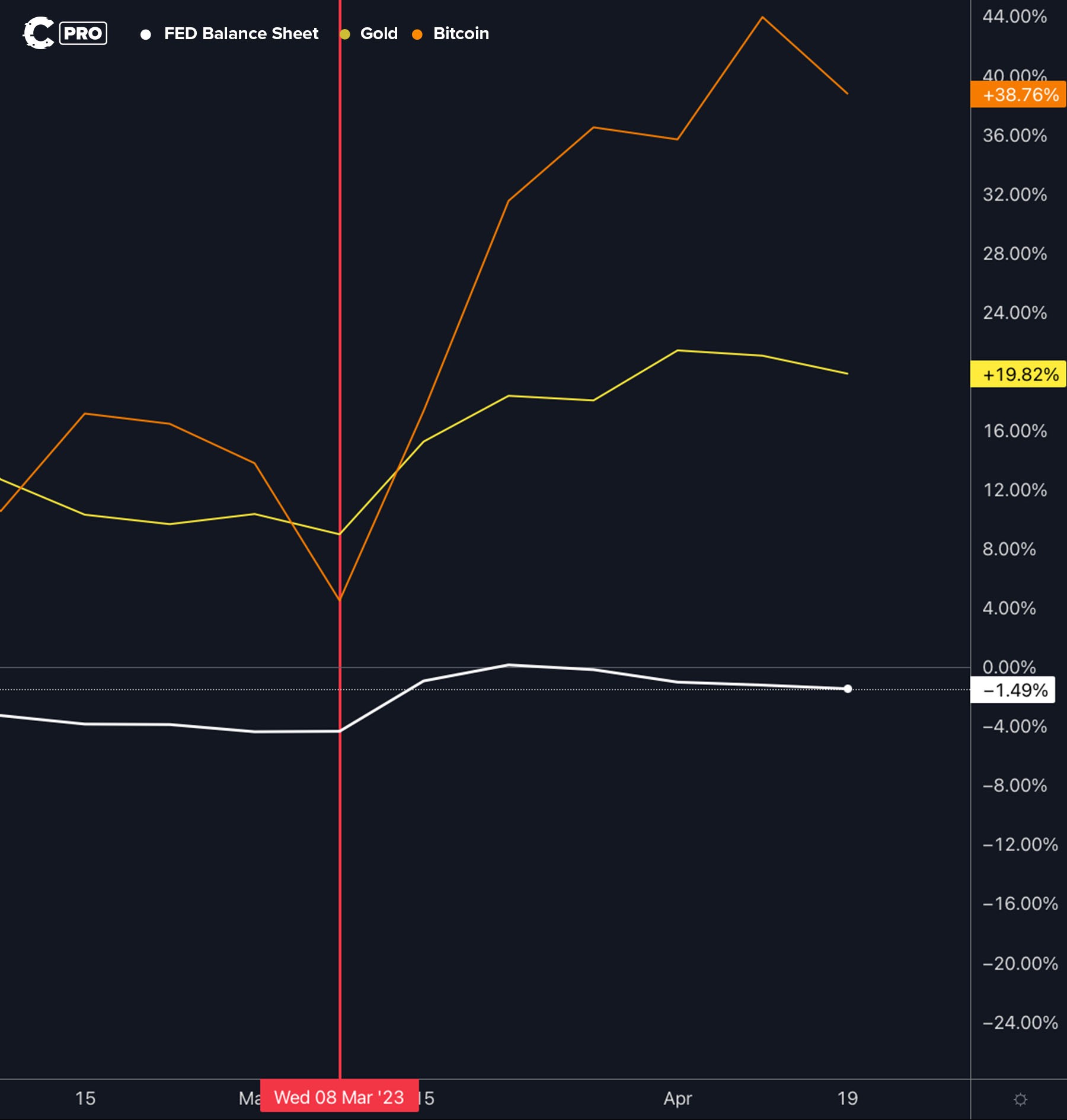

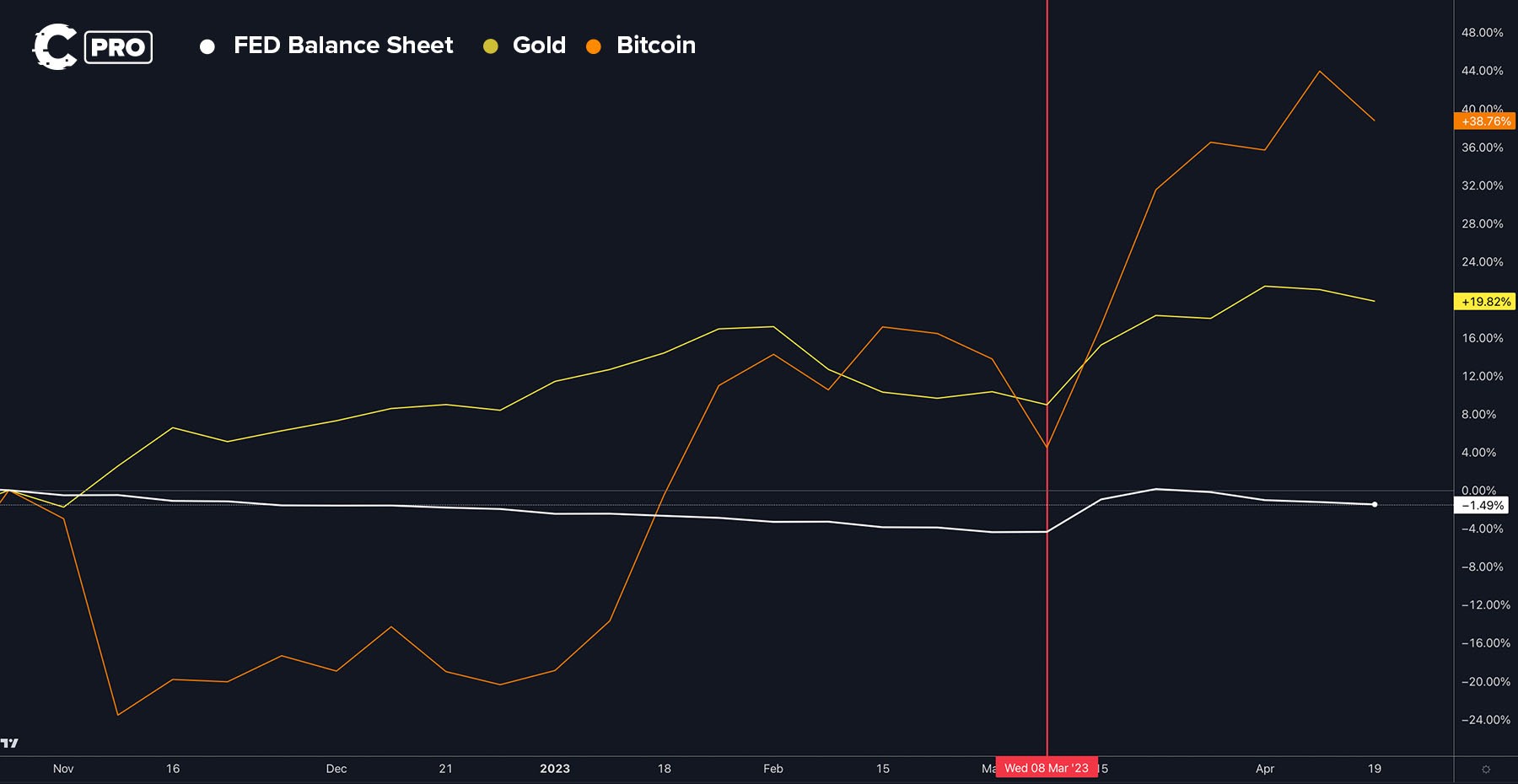

All of crypto is correlated to Bitcoin, and Bitcoin itself is now perfectly correlating with two things:

- Gold

- The Fed's balance sheet

Both Bitcoin and gold bottomed where the Fed’s balance sheet did, and they topped out soon after the balance sheet started shrinking. This is the number one indicator we’ll follow in coming weeks - especially for determining whether a price bottom is here or not.

You can get the balance sheet on TradingView by typing “WALCL”.

Investment strategy | April 2023 💵

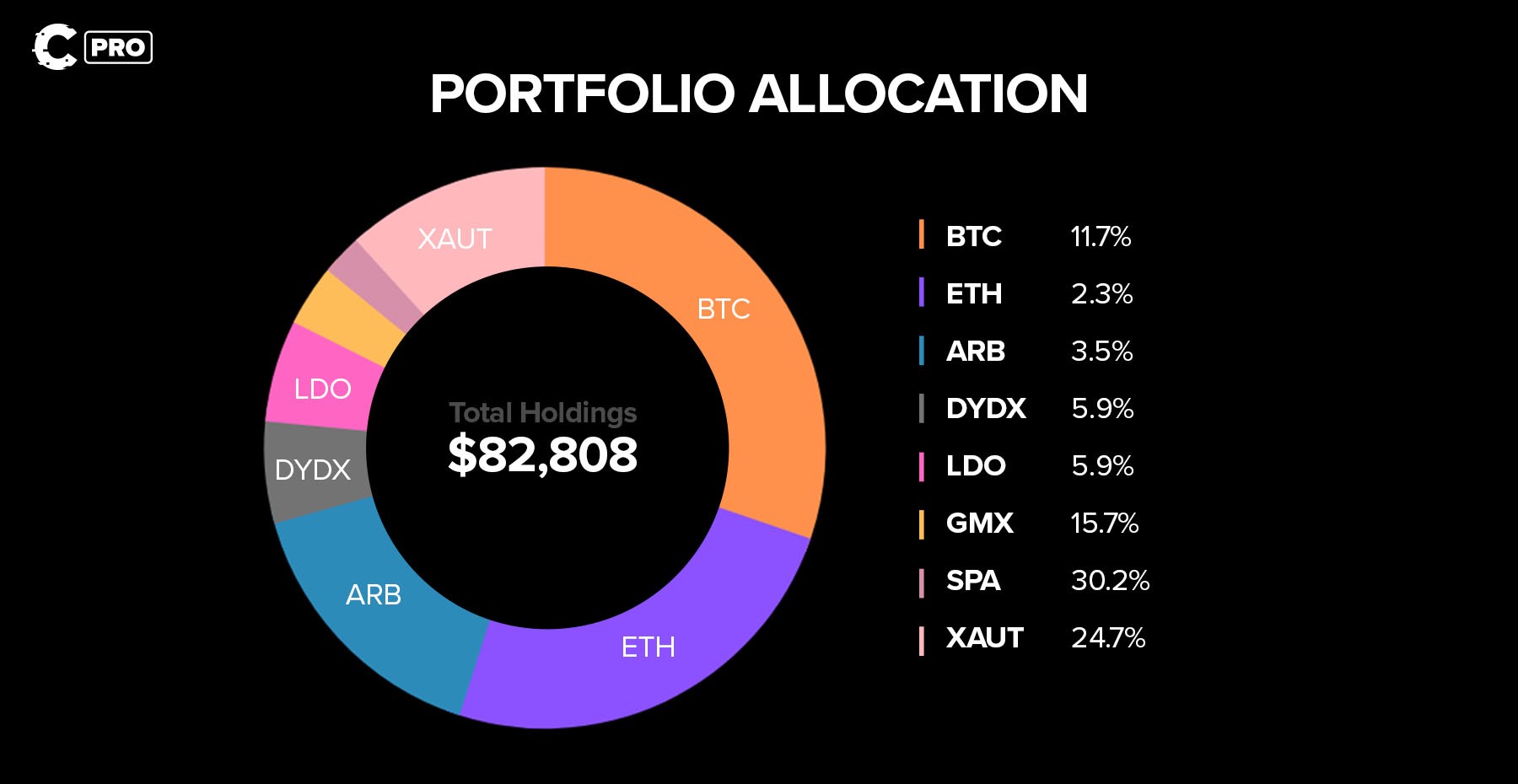

Current market conditions have persuaded us to shift into capital-protection mode. This means selling underperformers, trimming and downsizing positions, holding more XAUT, and DCA-ing into our high-conviction assets: BTC, ETH, and ARB (the next SOL?).Here are the five specific moves we're making:

1. Investing $10,000

Investment #1 | Bitcoin ($3,500)

Conviction: 60%We're all-in on Bitcoin as the digital gold 2.0 for the future! Why? With the digitisation of capital and the dollar's likely downfall, our target is a whopping $650,000 per BTC by 2030+. We're putting our money where our mouth is with a monthly DCA bet.

Want to read the full thesis? Check out the whole story in the first edition of Skin in the Game.

Investment #2 | Ether ($3,500)

Conviction: 60%Imagine owning a piece of the new Wall Street. That's what ETH offers! As the DeFi motherboard and powerhouse, Ethereum is poised to dominate the financial internet. With a target of $115,000 per ETH by 2030+, we're not betting against this game-changer. Staking ETH makes you a digital landlord in the world's financial districts! Curious about the details? Find the full thesis in our first Skin in the Game report.

Just remember, we're in this for the long haul. We’re focused on 2030+.

Investment #3 | ARB ($3,000)

Conviction: 50%Arbitrum is the new hotspot for Layer 2s, and we're all in!

Picture SOL back in 2021 - that's how we view ARB's potential. With a target of $7.5 in the medium term and $30+ long term, we're grabbing ARB tokens and DCA-ing monthly throughout 2023. We believe ARB will join the top 10 cryptos by market cap in 12 - 24 months, just like SOL did. But remember, we will reconsider our position if conditions change. Want the full lowdown? Check out our full thesis.

2. Cutting losers (THALES & HEGIC)

It's time to say goodbye to THALES and HEGIC, folks. They've been dragging our portfolio down, and we don't tolerate underperformers. Sure, the loss is minor (-$1,500), but we're all about the winners. So we're cutting these two loose. The sale will net us a tidy $3,322.3. Reducing positions (DYDX & SPA)

Reading current market tea leaves has convinced us to dial down our altcoin exposure. We've picked DYDX, which has been pretty average, and SPA, a small cap with wild volatility. We still believe in them, but we're trimming our positions to $5,000 for DYDX and $2,000 for SPA. This move will add $1,531 to our coffers.4. Selling PENDLE

Yes, our shining star PENDLE has done wonders for our portfolio. And we are selling it.It’s our only risk-free investment since we recouped the principal, but we have to remain agile. It's over-extended now, and we don't fancy a downhill ride.

The weekly chart's bearish engulfing candle hints that the party might be over. We got in at $0.147 and we're cashing out the last bit at $0.44 – a whopping 200% gain. A massive win for the SITG team.

So we’re selling PENDLE and pocketing $7,161 (on top of the initial $5,000).

5. Buying XAUT with all fiat

Of course, we don’t want to hold this sh*tcoin called the “US Dollar”. So we’re converting the stablecoins we have gotten into XAUT (on-chain gold).Portfolio allocation 📊

SITG summary 📝

- BTC: Invested $3,500 and awaiting our 2030+ target of $650,000.

- Entry Price: $27,473

- Size: 0.1274 BTC

- ETH: Invested $3,500 and awaiting our 2030+ target of $115,000.

- Entry Price: $1,830

- Size: 1.91 ETH

- ARB: Invested $3,000, selling 50% at $7.50 and the remainder at $30.

- Entry Price: $1.31

- Size: 2,289 ARB

- PENDLE: Sold 17,020 PENDLE for 7,161 USDT.

- THALES: Sold 3,900 THALES for 2,207 USDT.

- HEGIC: Sold 87,020 HEGIC for 1,115 USDT.

- DYDX (reduce-only): Sold 370 DYDX for 889 USDT.

- SPA (reduce-only): Sold 77,500 SPA for 642 USDT.

- Bought 6 XAUT with the above 12,000 USDT.

SITG quiz 🧠

Loading...Skin in the game addresses ⛓️

Bitcoin: bc1qzpppmek8wh2vqymq06petmfwmhjj9k8vdxl389Ethereum: 0x8Be9987d18a10F770cADC94635CeDB2eF33B0f17

Thank you for reading! 🙏🏼

Join us next month for more thrilling crypto adventures!