Parallel Finance | Deep Dive

Towards the end of 2021 and early 2022, we participated in the Polkadot Crowdloan Auctions through our Giga-Brain series. Of course, Parallel Finance was one of our picks, and we have since acquired our Crowdloan rewards.

However, the market is in a very different environment than it was at that time period. We are happy to hold our PARA allocation as it came at no cost to us. That begs the question, though – what is the risk/reward for PARA in the current climate?

In this journal, we will revisit Parallel Finance and provide a deeper understanding of exactly what Parallel is and the product it offers, as well as provide some insight into current and future valuations. It’s been a while since we’ve covered Parachain tokens, and so it’s a topic we’re always happy to cover. Let’s dive in!

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- Parallel Finance is a self-branded “super DApp”, with the vision of advancing the multi-chain economy.

- Features a DEX, Money Market, Liquid Staking, Cross-Chain Bridging, NFT Money Market, DAO Fi, and a Parachain Auction platform.

- The initial target is between $0.7-0.75 based on a $700-900 million MCap valuation (Q1/Q2 2023 based on our macro thesis).

Parallel Finance

Parallel Finance is a self-branded “super DApp” with the vision of advancing the multi-chain economy. Its main product is within financial utilities; here’s a brief overview:

- Decentralised Exchange (DEX) – Offering both AMM & Money Market based swaps.

- Money Market – lending and borrowing a variety of assets.

- Liquid Staking – offers DOT/KSM holders the opportunity to stake their tokens whilst also staying liquid using derivative tokens.

- Cross-Chain Bridging – Connection to other Parachains (on both Polkadot & Kusama), as well as Ethereum and Solana (more chains planned).

- NFT Money Market (Parallel Omni) – Similar to the traditional money market, Parallel Omni will allow users to lend their NFTs and ERC-20 tokens, earning interest.

- Parallel DAO Fi – allows DAOs and other users to provide a scheduled payment stream for expenditures etc., like a payroll service. Additionally, DAO Fi provides token & equity distribution services.

- Parachain Auctions – Parallel offers a crowdloan service where users can support their favourite projects and stay liquid with their DOT contribution yielding derivative tokens that can be used within Parallel.

PARA Tokenomics

PARA is the native token of Parallel Finance within the Polkadot ecosystem, used for several utilities:- Governance – along with HKO (Heiko, the Kusama canary chain) holders, PARA holders have a say in the management and decision-making process of Parallel.

- Transaction Fees – PARA is used for any tx fees on the network.

- Incentives – Parallel has a base inflation rate (minted tokens) which is used to pay validators/collators and offers a liquidity mining program (25% of supply) to incentivize new users.

- Security Module Staking – in the event of a staking slash, there is an insurance pool that validators/collators can use to recoup some of their losses. Those who add to this insurance pool are paid PARA tokens as compensation for taking on the risk.

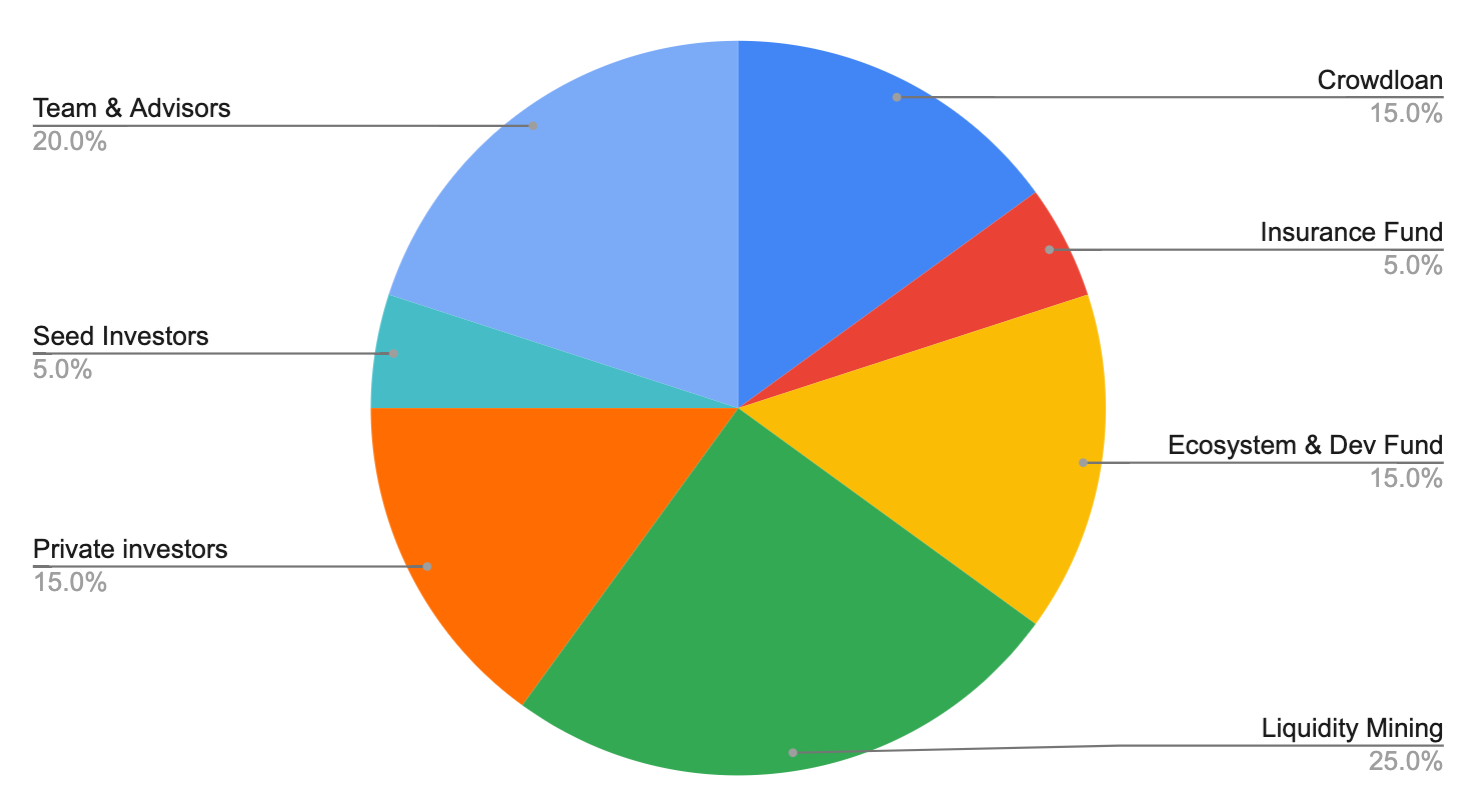

As can be seen from the chart above, there’s a relatively heavy distribution towards the team, early investors, and advisors (40%). Although it’s not the worst distribution we have ever seen, it’s something to keep in mind for future unlocks.

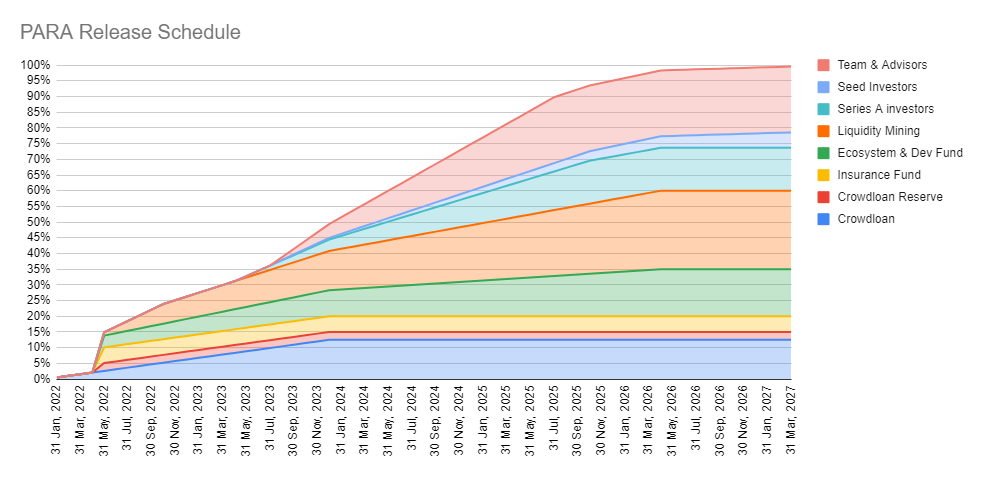

The release schedule tells us that the majority of the team/early investor tokens are not due to be unlocked until after July 2023, and, even then, they are not immediately unlocked but rather released over a 24-48 month period up to Q2 2026.

Overall, despite the relatively large allocation toward early investors/team, we believe that the release schedule is fair and distributes potential selling pressure from unlocks over a lengthy period. In our opinion, the release schedule tells us that till mid-2023, there are no causes for concern in terms of supply dump or unexpected unlocks. The saying goes that a month in crypto is equivalent to a year in the stock market, and so this leaves us with an opportunity before there’s any significant sell pressure on PARA.

But what does that opportunity look like? What’s the risk/reward?

Perspective

There are few DApps that offer all these services in one place, and even fewer that are multi-chain oriented. Although Parallel has still to fully implement all the above services, one thing that we have seen is swift implementation from the team. When we first looked at Parallel back in Q4 2021, many of these offerings were just a single paragraph in the whitepaper - or weren’t in it at all.The rate of delivery and the activity of the team is excellent, and they appear to be moving quickly with the times. The only significant criticism that we have is that there are different tokens for a lot of the different products. For instance, Parallel Omni uses the OMNI token.

From a practical perspective – this makes sense, they’re DApps built on top of the Parallel Parachain. Additionally, Parallel Omni will be used mainly for ERC-20 and ERC-721 (NFT) assets, so of course, it makes sense that OMNI be an ERC-20 token to incentivize users from that ecosystem.

However, from an investment perspective, we feel that it takes away the attention and usage of the base PARA token. That’s not to say that PARA is a terrible investment – there are still several attractive value propositions:

- Parallel Finance is not listed on any major exchanges or DEXs. This means it will still largely be under the radar – the only way to acquire PARA is by swapping DOT (or its derivatives on the Parallel DEX). Parallel is in negotiations with major exchanges for a listing.

- Polkadot ecosystem tokens appear to be performing well during market rallies. With the plethora of products that Parallel is developing, we see no reason why PARA should be any different – the main difference is that PARA can only be acquired on the Parallel DEX.

- The User Experience (UX) of Parallel Finance is excellent – simplistic, and the number of clicks to get to where you need to go is minimal.

Valuation

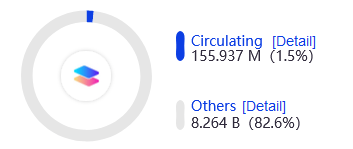

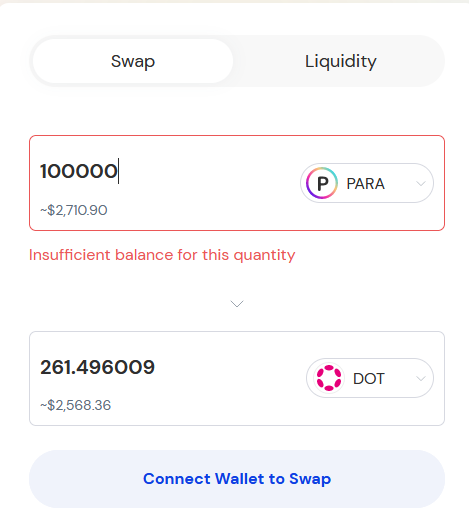

Taken from the Parallel Subscan we can see that there are around 156 million PARA tokens circulating. Since the only market that is trading PARA is the Parallel DEX itself, we must look at the value of PARA compared to DOT to estimate a market cap:

Using 100,000 PARA to provide price accuracy gives us a range of between $0.025-0.027 per PARA token (fees and slippage on the Parallel DEX play a part in the price discrepancy). Multiplying by the circulating supply, we get around $3.9 million for the Parallel Finance market cap with an FDV of $250 million.

Considering the plethora of products that Parallel offers currently and those that are in development, it’s clear that right now Parallel is undervalued. Unlocks and inflation over the next 4 years will obviously affect the price.

However, the question then becomes a macro question – how far from the bottom are we? Will the market turn around before PARA inflation begins to become detrimental to the circulating supply?

Firstly, we must come up with a realistic MCap valuation for Parallel. A valuation of between $700-900 million is an achievable MCap target in the mid-term, depending on market conditions, based on the performance of ACA, ASTR, and GLMR at the beginning of this year. We believe the first batch of Parachains will perform well in any rallies.

Accounting for inflation around that period, we expect anywhere between 10-12% of supply to be circulating at that time point. Thus, the first target for PARA would be between $0.7-$0.75, representing a 28-30x – this is dependent on PARA being listed on either Polkadot DEXs, or centralized exchanges.

This would represent our first target for taking profit. It wouldn’t be wise for us to set further targets until the macro picture changes; however, we will keep members posted on any updates in this regard and we will revisit these assets once we see evidence of a change in momentum!

We received our PARA allocation for “free” through the Crowdloan Auctions, so this must be considered. It is important to set personal targets and consider what it is we want to achieve here. We are quite happy sitting on our hands until the first target is met.