Passive income: 2 single-sided yields on SOL with up to 70% APY

We came across two yield setups on Solana that just make sense: easy to run, strong returns, and fully on-chain. Together, they show how effortless passive income can be when the market’s right. These are no-brainers. Curious to know more? Let’s dive in…

In this report, we break down two high-performing Solana yield setups currently active on-chain.

- The first: HYPE → SOL → INF loop, earns steady yield by borrowing cheap SOL on HypurrFI and staking it on Sanctum for real validator returns.

- The second: SOL → xSOL → RateX lock, amplifies that yield through Hylo’s non-liquidating leverage and RateX’s one-month pools offering up to 70% APY.

Disclaimer: This analysis is for informational purposes only and not financial advice.

Strategy A: The HYPE-SOL Carry Loop (Low-Risk Real Yield)

Platform OverviewHypurrFI is a lending dApp built on Hyperliquid’s HyperEVM, enabling “clean leverage loops.” Users supply tokens such as HYPE as collateral and borrow assets like SOL at low variable rates.

The borrowed SOL is bridged back to Solana through the Hyperliquid App, then staked on Sanctum, whose INF liquid-staking token earns roughly 9.17 % APY.

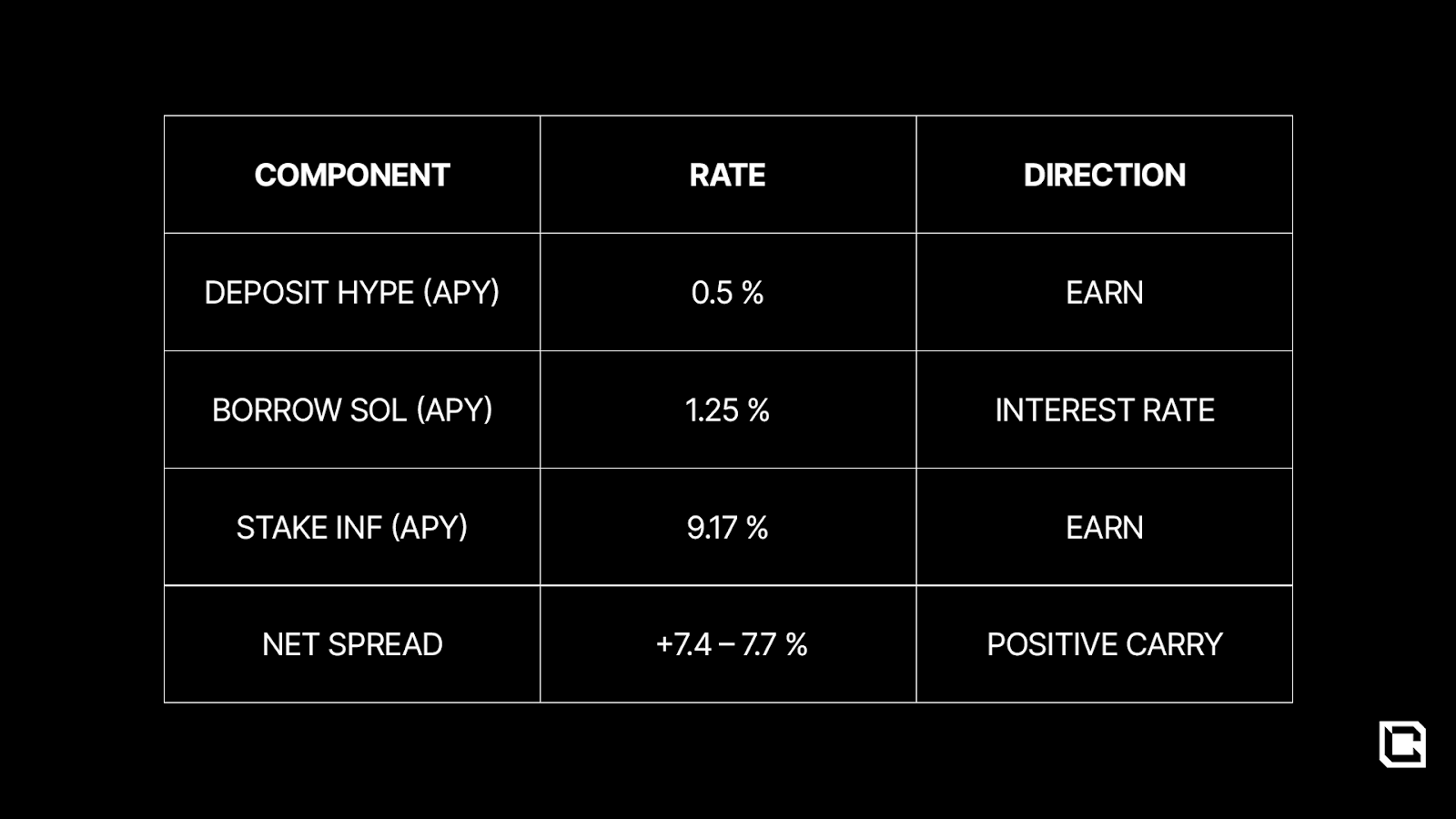

Because the borrow rate (1.25 %) is far lower than the staking yield, the loop creates a positive-carry position.

Step-by-Step Execution

- Acquire HYPE Tokens

- if you already hold HYPE, skip ahead.

- Otherwise, load USDC on Arbitrum in your EVM Wallet (example Rabby) → open Hyperliquid App → deposit USDC →transfer from perps to spot → trade HYPE/USDC on Spot Markets → you now hold HYPE in Hyperliquid Spot.

- Bridge to HyperEVM

- In Hyperliquid App → Balances → Transfer → Spot to EVM, choose HYPE amount → confirm.

- Tokens appear in your HyperEVM wallet.

- Deposit & Borrow on HypurrFI

- Go to app.hypurrfi.xyz and connect the same wallet.

- Under Quick Borrow, select HYPE as deposit asset and uSOL as borrow asset.

- Pick an LTV slider in the green or yellow zone (conservative = lower risk).

- Deposit HYPE → confirm transaction → Borrow uSOL → uSOL appears in wallet.

- Bridge uSOL to Solana

- Return to Hyperliquid App → Balances → Transfer EVM → Spot (SOL).

- Withdraw SOL to your Solana address (Phantom Wallet, for example).

- Within ≈ 4 minutes, SOL arrives on-chain.

- Stake on Sanctum (Receive INF)

- Visit app.sanctum.so → connect your Solana wallet.

- Navigate to Stake → SOL → INF, input amount → confirm.

- You now hold INF tokens, instantly unstakeable and auto-accruing yield (9.17 % APY).

Example Position: 12.5 HYPE ($600) deposited → borrow 0.7 SOL ($140). Health factor = “very green,” low risk, can scale further with active monitoring.

Risk & Management

- Collateral Volatility: If HYPE drops faster than SOL rises, LTV tightens. Add collateral or repay borrow.

- Bridge Risk: Monitor transaction finality when moving SOL across chains.

- Staking Performance: INF relies on validator returns and pool balance stability. On average, it yields around 9% APY

- Borrow Rate Spikes: If SOL demand rises sharply, rebalance or repay.

- Monitoring Routine: Daily check health factor + rates and weekly verify INF APY

Here is a step-by-step tutorial on how to farm this opportunity:

Strategy B: xSOL on RateX (High-Yield, No-Liquidation Leverage)

Platform OverviewHylo and RateX together create one of the most efficient leveraged yield stacks live on Solana.

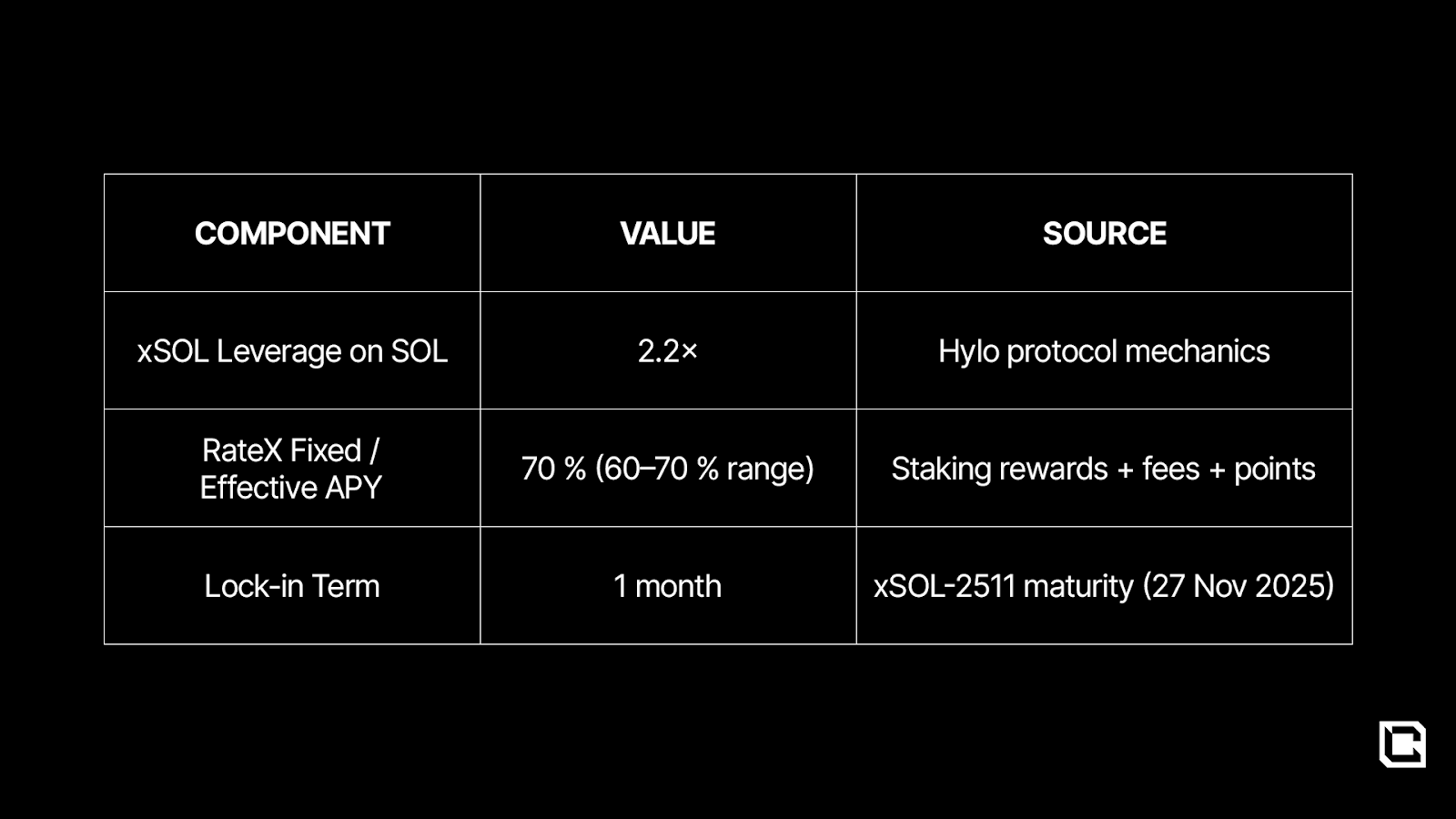

Hylo’s xSOL token represents a 2.2× leveraged exposure to SOL, but without liquidations. When SOL’s price rises, xSOL’s price accelerates, when SOL falls, the drawdown is absorbed through price, not forced sales. That design makes xSOL a safer alternative to margin leverage for directional SOL bulls.

RateX builds on top of that by turning xSOL into a yield-bearing instrument. Through its Earn → Fixed Yield section, users can lock xSOL into monthly maturity pools (e.g., xSOL-2511) to earn exceptionally high effective yields, currently 70 % APY, from a mix of staking rewards, AMM fees, and points programs across both ecosystems.

Step-by-Step Execution

- Mint xSOL on Hylo

- Connect your Solana wallet (Phantom or similar) to hylo.so.

- Deposit SOL → Mint xSOL. The system converts your SOL into a leveraged token at roughly 2.2× exposure (current), delivering amplified upside with no liquidation thresholds.

- The freshly minted xSOL appears in your wallet.

- Deposit xSOL on RateX

- Go to RateX → Earn → Fixed Yield.

- Select the available maturity pool (for example, xSOL-2511, maturing 27 Nov 2025, 1 month).

- Connect your wallet, slide the bar to the desired amount (usually max), and approve the transaction.

- Your xSOL is now locked for the term, returns accrue automatically.

- Track and Redeem

- Check progress under Dashboard → Earn Positions.

- At maturity, redeem your xSOL plus yield directly back to your wallet; the position closes automatically.

This combination of Hylo’s internal leverage and RateX’s boosted pool compounds yield dramatically. A 2× leveraged SOL with 70 % APY on top effectively outpaces most structured-product returns available in crypto today, though the volatility risk is just as real.

Risk Profile & Considerations

- Leverage Drawdown: If SOL drops 20 %, xSOL falls around 40 %. No liquidation, but temporary P&L pain is magnified.

- Pool Capacity & Liquidity: RateX pools can fill (> 90 % utilization seen), late deposits may face slippage or lower yields.

- Points Speculation: A large portion of the headline APY (30–40 %) derives from Hylo XP and RateX point multipliers whose future value depends on airdrops.

- Short Maturity Risk: Exiting early requires splitting PT/YT tokens and selling through AMMs, introducing price risk and fees.

It’s the cleaner, smarter version of leveraged staking, one month of controlled risk for outsized upside. For traders confident in Solana’s medium-term strength, xSOL + RateX is currently one of the most capital-efficient yield engines in crypto.

Here is a step-by-step tutorial on how to farm this opportunity:

Comparison & Suitability: Choosing the Right Yield Path

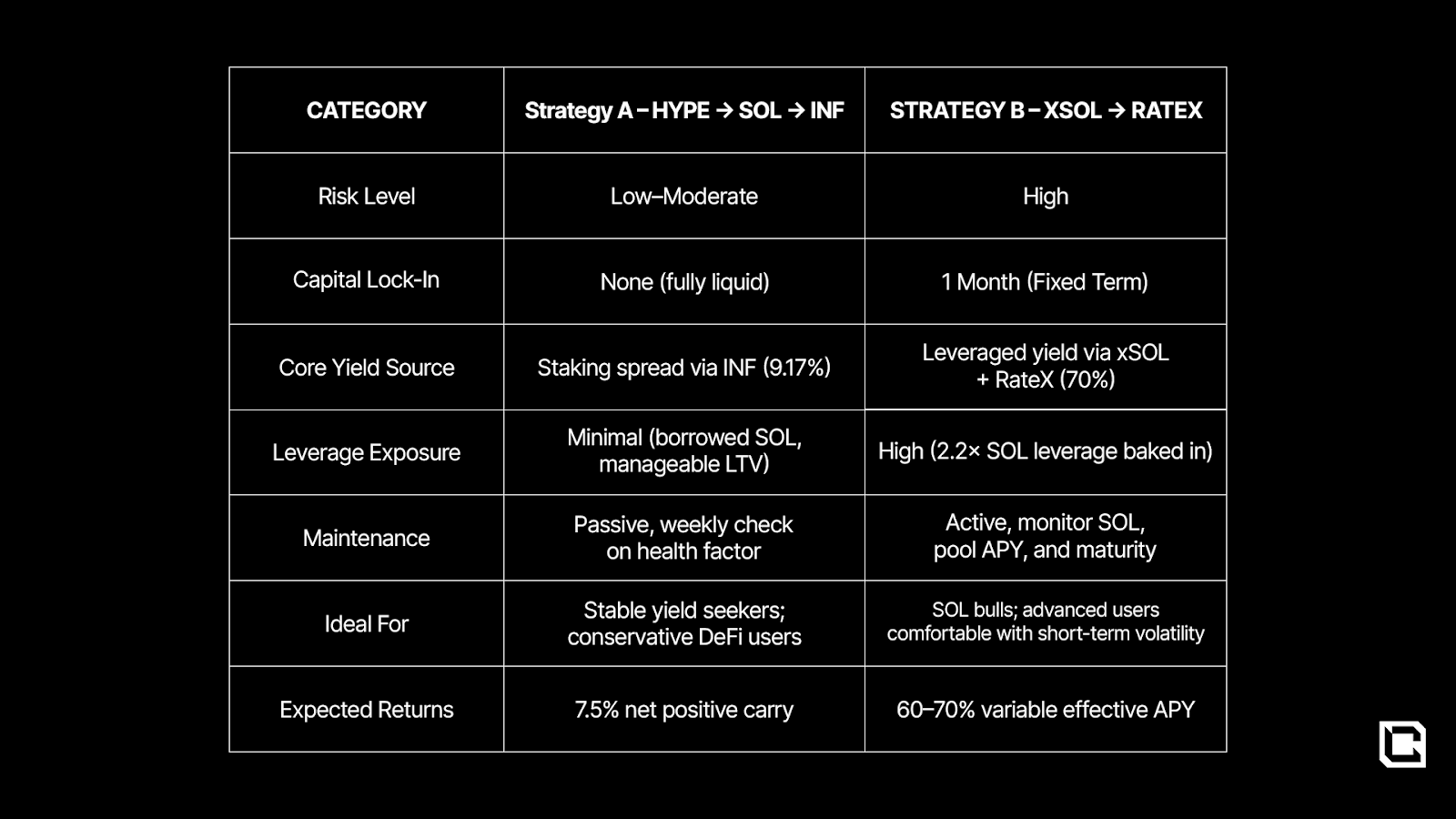

Both strategies start with SOL as the base asset, but they sit on opposite ends of the risk spectrum.- Strategy A (HYPE → SOL → INF) is the carry trade, built for steady yield and delta-neutral yield.

- Strategy B (xSOL → RateX) is the leverage trade, built for acceleration and amplified rewards. If you mid-to-long term bullish on SOL, it is a very clean and cheap leverage play.

- Strategy A works best as a base-layer yield play, predictable, easy to manage, and with a healthy spread between borrow and stake rates. It fits portfolios seeking consistent, low-maintenance income from existing holdings.

- Strategy B, on the other hand, is a high-conviction play on mid-to-longer timeframe. Its one-month lock and leveraged structure make it ideal for bullish SOL environments where momentum is clear and volatility is manageable.

Cryptonary’s Take

With SOL staked ETF approved by SEC, earning passive income on SOL can be one of the smartest exposures to the market.Here in today's case, Strategy A earns from market inefficiency, and Strategy B from conviction and being early.

HYPE → SOL → INF is the safer foundation, quiet, predictable, and compounding (though operationally more challenging). xSOL → RateX is the accelerant, volatile, tactical, and built for moments when Solana runs hot.

Happy Farming!

Cryptonary, OUT.