Passive income: Building cash flow with Liminal Money

Last week, we covered how to generate passive income with a basis trade setup. Now, we are taking it to the next level with a platform that simplifies and automates this concept, allowing anyone to earn 20% - 40% yield on stablecoins. Curious to know more? Let's dive in...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Basis Trade 101

What it is: A basis trade involves buying the spot asset and shorting the matching perpetual contract in equal notional size. This neutralises directional price exposure so that P&L comes primarily from funding payments rather than asset appreciation or depreciation.Why it pays: When perpetual funding is net positive, longs pay shorts. By shorting the perp while holding the spot, you collect these payments while staying market-neutral.

Overview

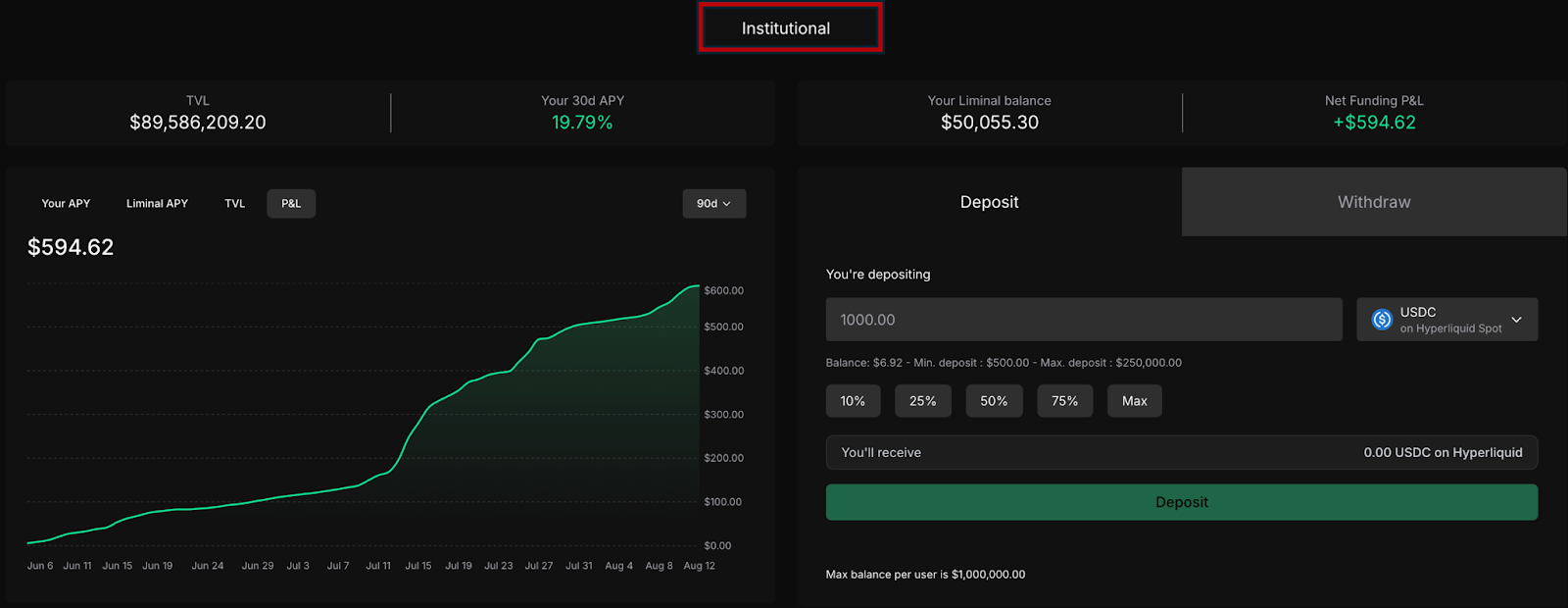

Liminal is a non-custodial automation platform that builds and maintains delta-neutral "basis trades" directly on Hyperliquid. In Institutional Mode, all execution happens from your own Hyperliquid (HL) sub-account, giving you full self-custody while ensuring every trade counts toward your HL volume, open interest, and funding history.This setup not only delivers market-neutral yield from perpetual funding but also positions you to capture potential future incentives from Hyperliquid, Liminal, and Unit. The strategy works best when periodically rotated into assets with strong, sustained positive funding.

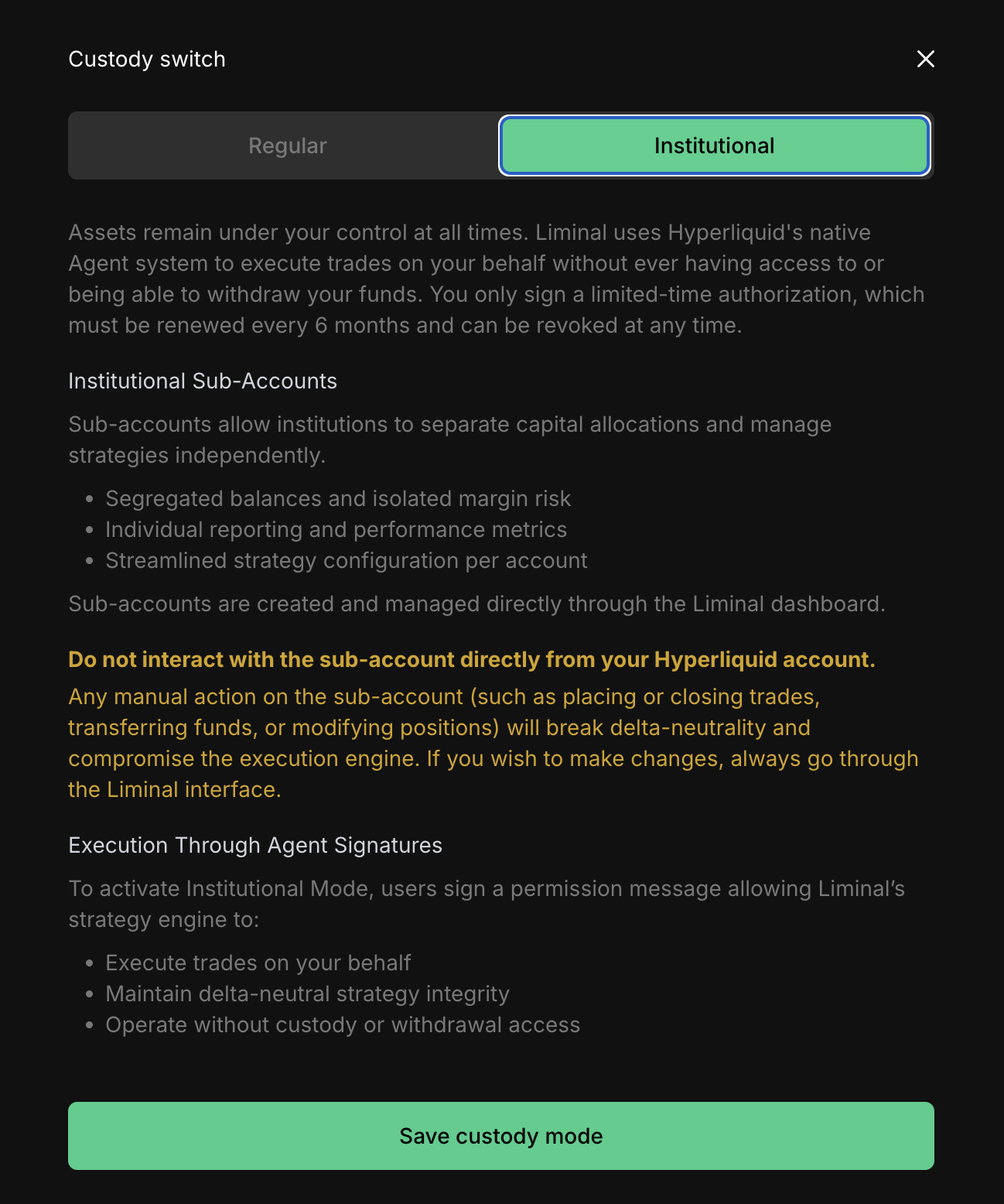

Why Institutional Mode Matters

Before you launch Liminal, upgrading to Institutional Mode is essential. Without it, all the trading volume from your strategy will be credited to Liminal's account, not yours.Here's why it's critical:

- Self-Custody Assurance – Liminal never holds your funds. Institutional Mode uses execution-only permissions, so your assets remain fully under your control.

- Direct Reward Eligibility – Any future Hyperliquid points, airdrops, or volume-based incentives will only be awarded to the account generating the trades. Without Institutional Mode, you risk missing out entirely.

- Transparency & Control – Your open positions appear directly in your HL sub-account, and you can revoke Liminal's permissions instantly from HL's API settings.

- Permanent Unlock – The $100k cumulative perp trading volume requirement only needs to be met once. After that, Institutional Mode remains available indefinitely.

Quick math

Gross APY ≈ Σ [ portfolio_weight × leverage × annualized_funding ]

Net APY = Gross APY − (exchange fees + protocol fees + slippage + negative funding periods)

Examples:

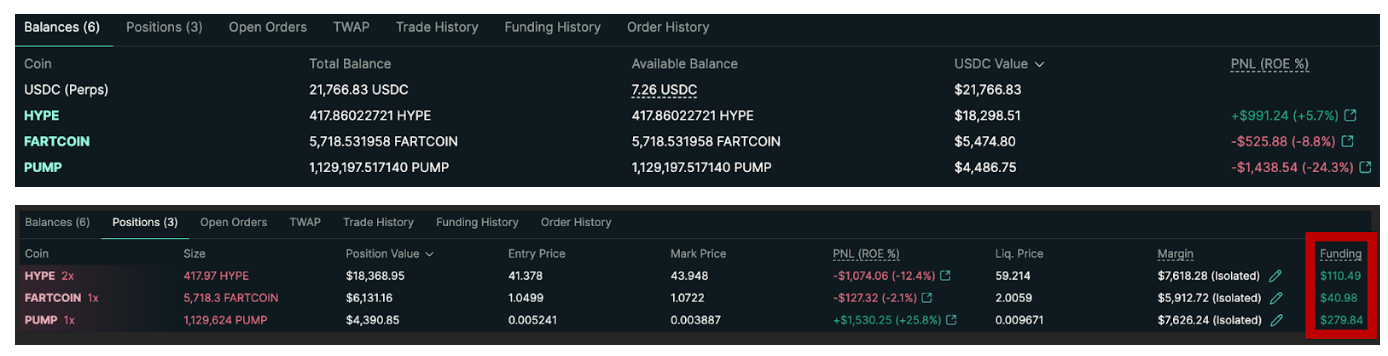

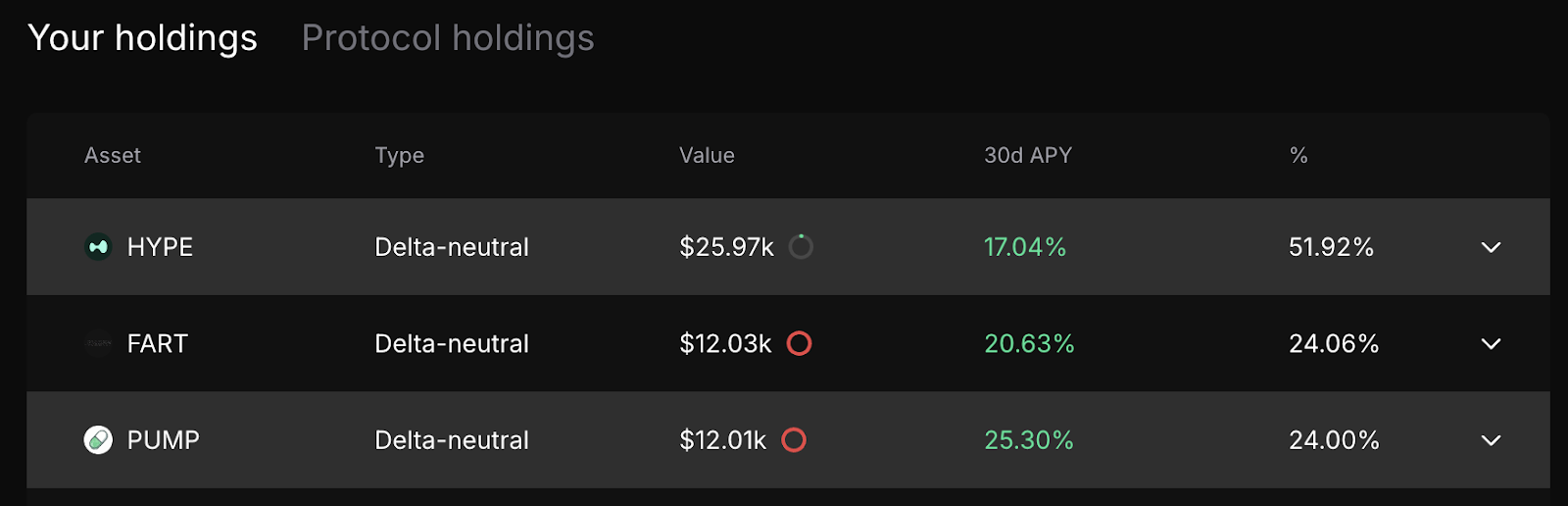

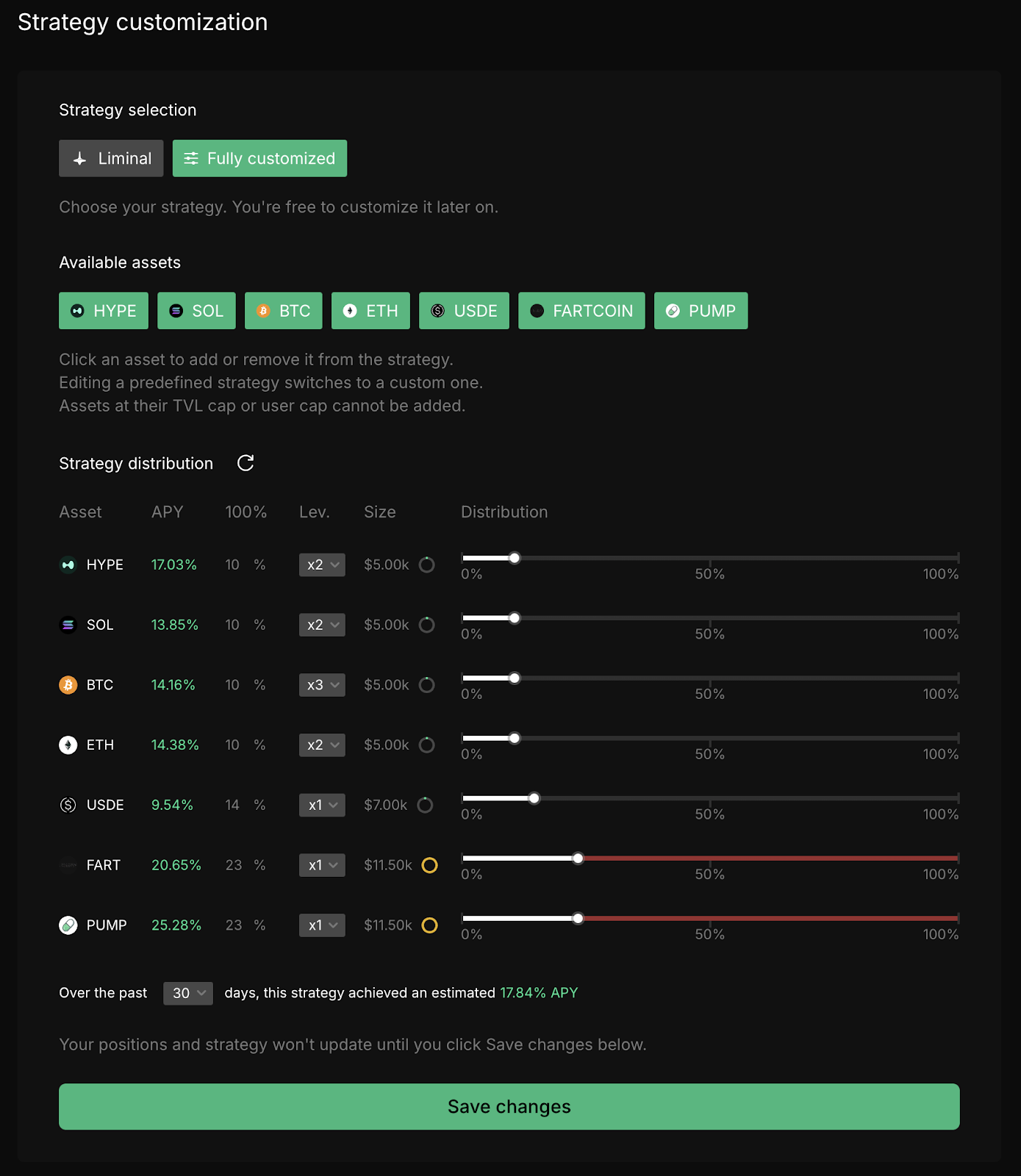

- HYPE — If HYPE's 30-day APY is 17.04% (at 2×) and you run a 51.92% portfolio weight contribution ≈ 0.5192 × 17.04% = 8.85% before costs.

- FART — If FART's 30-day APY is 20.63% (at 1×) and you run a 24.06% portfolio weight contribution ≈ 0.2406 × 20.63% = 4.96% before costs.

- PUMP — If PUMP's 30-day APY is 25.30% (at 1×) and you run a 24.00% portfolio weight contribution ≈ 0.24 × 25.30% = 6.07% before costs.

How Liminal Works

- Automation: You choose assets, portfolio weights, and leverage caps; Liminal opens and maintains matching HL Spot longs + HL Perp shorts.

- Settlement: Spot legs clear through Unit, Hyperliquid's tokenisation layer for native assets like BTC, ETH, and SOL.

- Institutional Mode: Execution occurs directly from your HL sub-account. You keep full custody, and all trading activity is credited to you.

Setup Guide

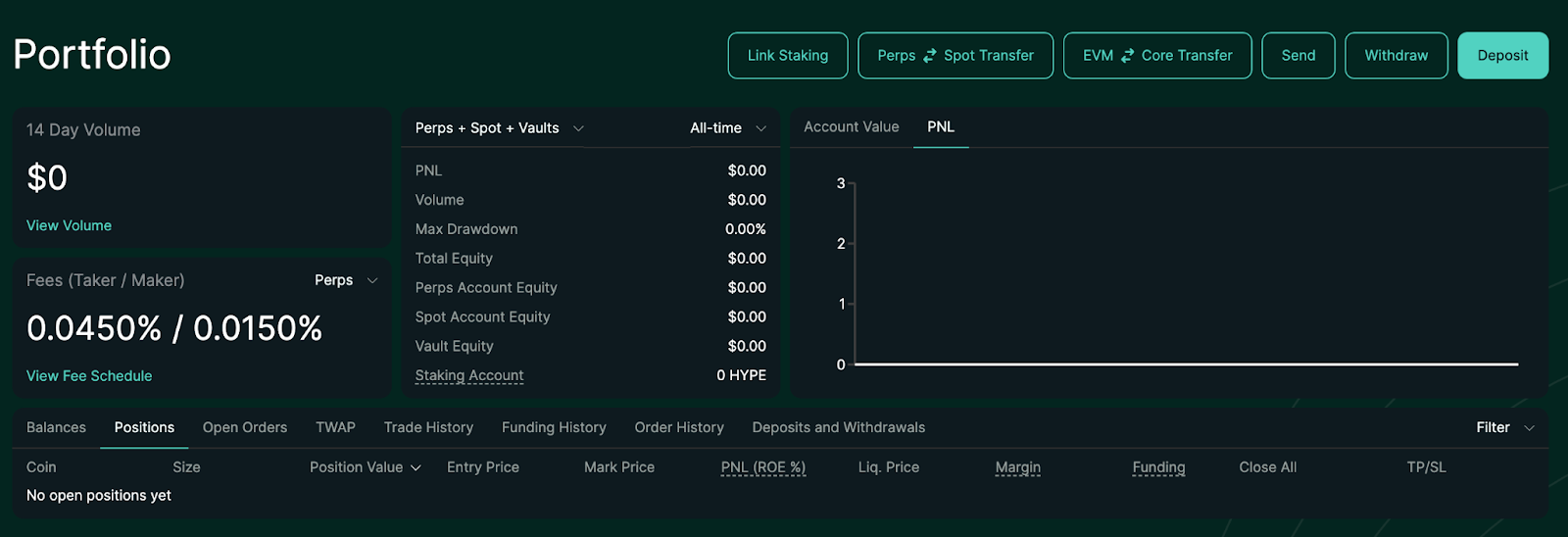

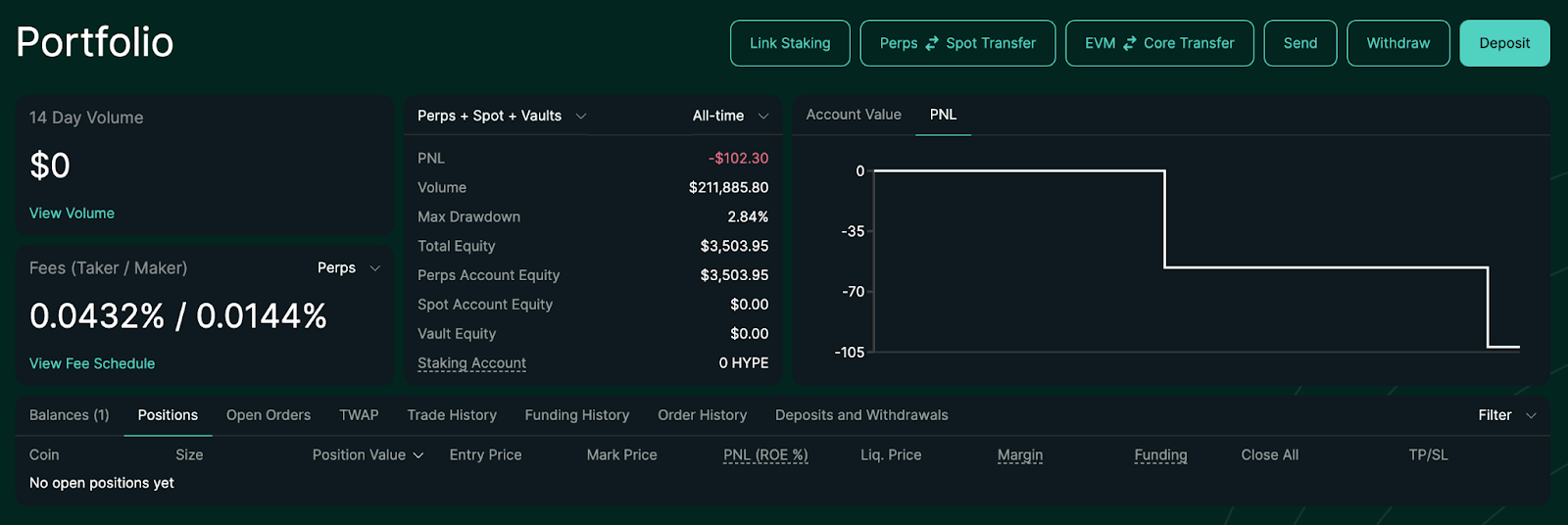

Step 1 — Meet Institutional Mode Eligibility- Log in to your Hyperliquid account.

- Go to Perpetuals and trade until you've reached $100k cumulative perp volume.

- Open and close small positions repeatedly if needed.

- Any asset works, and both sides of a round trip count.

- Once your account has hit the threshold, you're ready to switch Liminal to Institutional mode.

Step 2 — Connect Liminal to Your HL Sub-Account

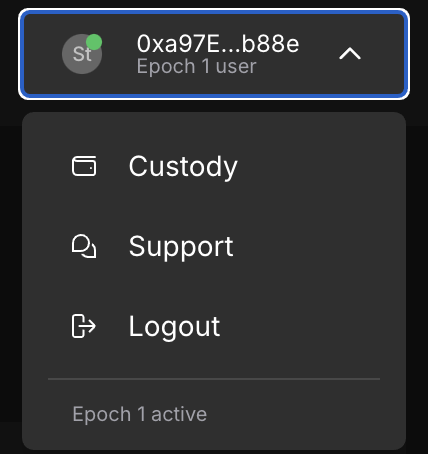

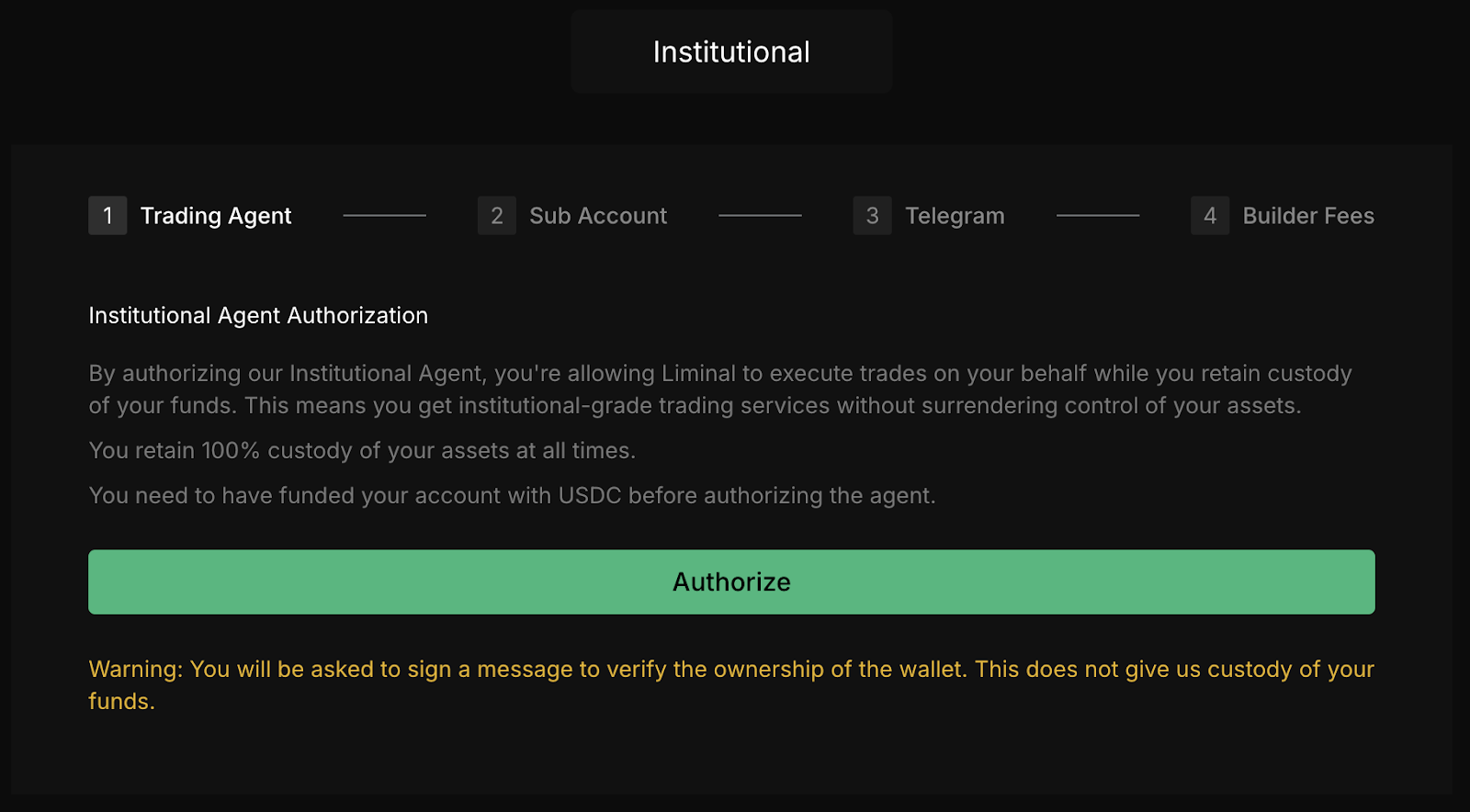

- In the Account or Settings menu, open Custody and switch to Institutional Mode.

- When prompted, authorize the Institutional Agent. This allows Liminal to execute trades directly from your HL sub-account while you retain full custody.

- Confirm the connection. All execution will now be HL-native and credited toward your own account's volume, OI, and funding.

Step 3 — Choose & Configure Your Strategy

- Scroll down to strategy customization.

- Select Fully Customized

- Adjust asset weights and leverage within caps. The percentages must add up to 100.

- Click Save Changes.

Step 4 — Deposit Funds to Activate

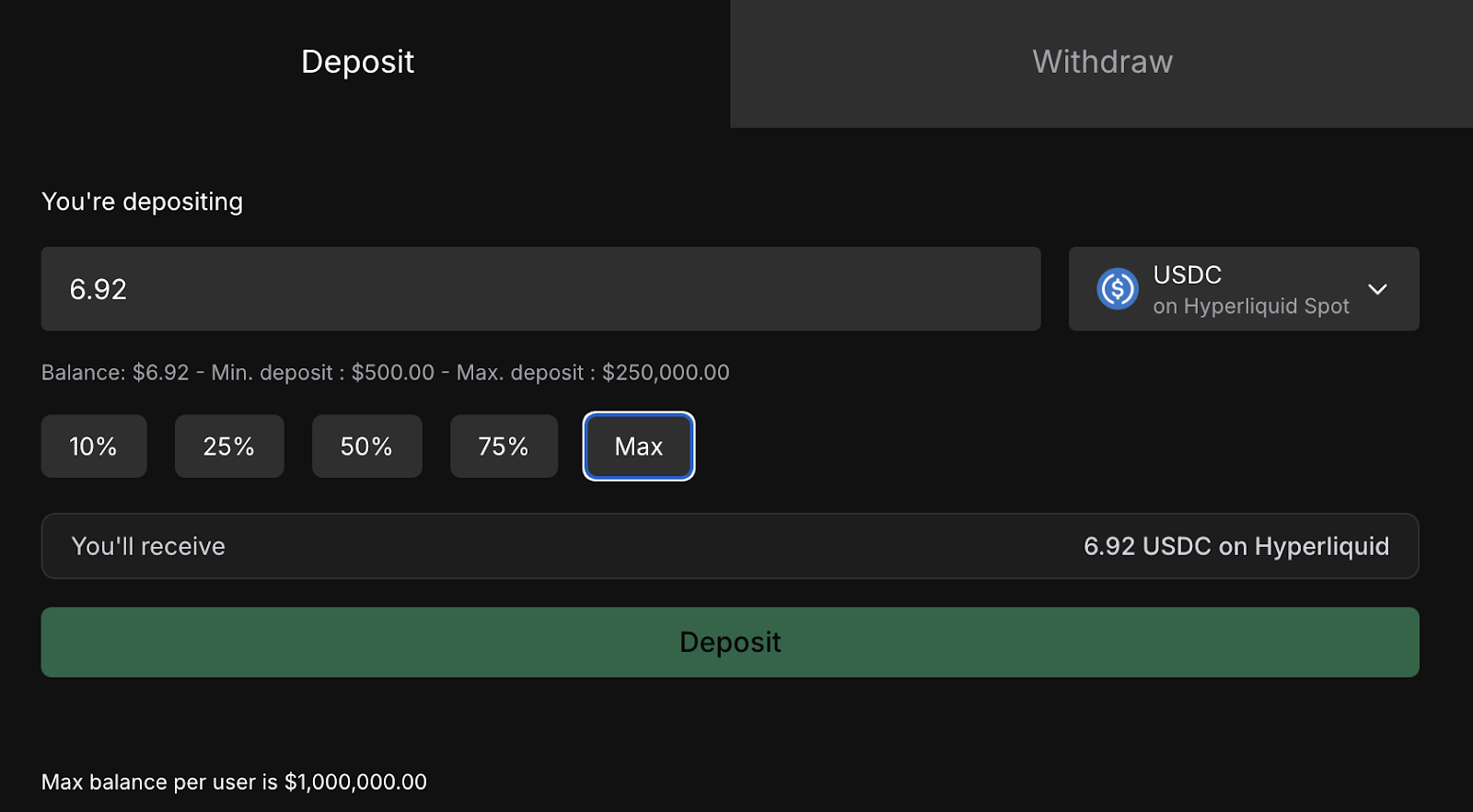

- Click Deposit in Liminal.

- Select USDC and deposit directly from your HL account (mandatory in Institutional Mode).

- Upon deposit, Liminal will immediately execute your configured spot/perp hedges.

Operational Considerations & Risk Management

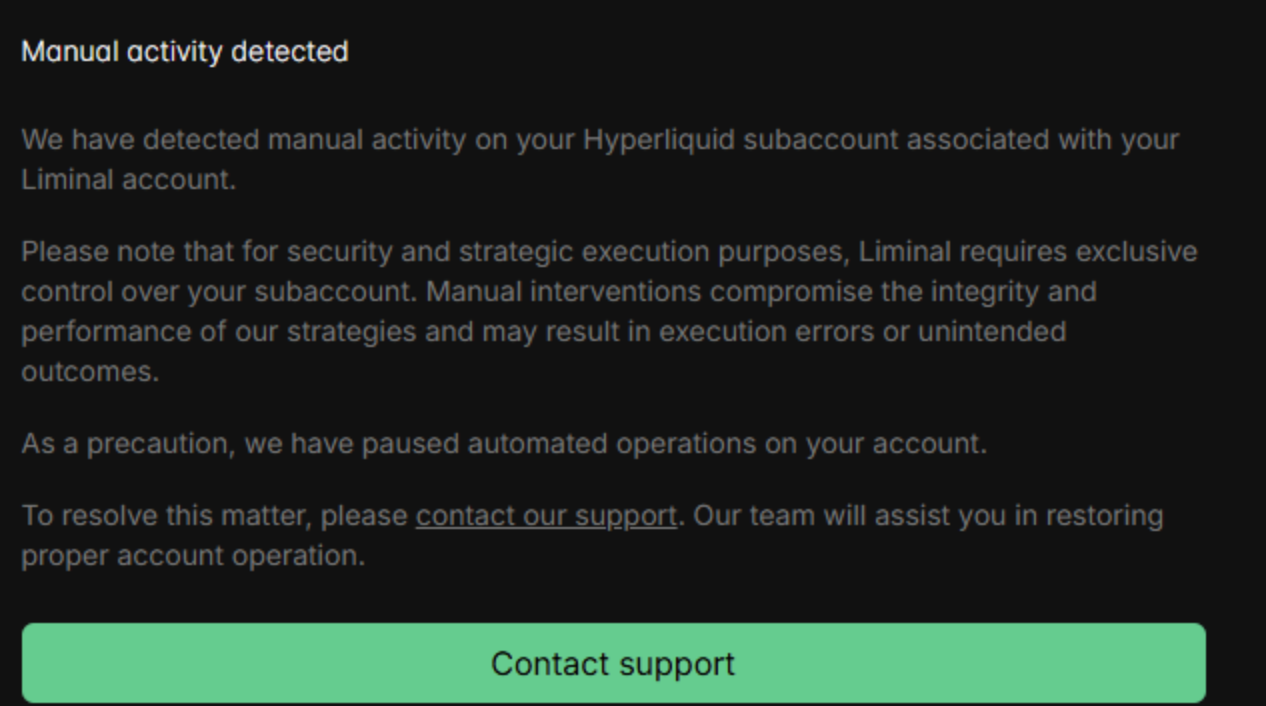

Automation & InterventionLiminal continuously maintains your hedge, but in certain cases manual approval may be required (e.g., re-hedging after volatility). You will be notified when action is needed, and positions remain hedged until approved. If you make manual changes to positions directly in Hyperliquid, automation may pause until positions are realigned.

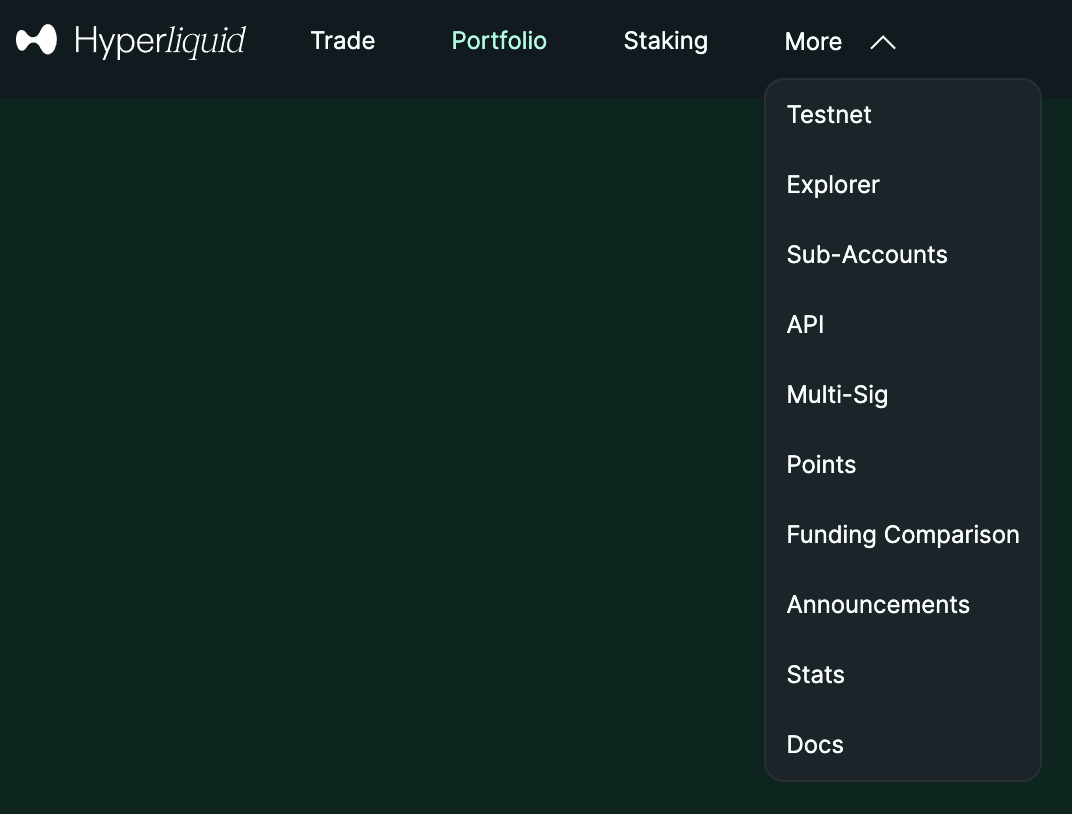

To revoke permissions, go to the API settings under the "More" tab in your Hyperliquid account.

Balancing Volume and Yield

Since all trades in Institutional Mode are credited to your HL account, generating consistent trading volume can improve your eligibility for potential future rewards from Hyperliquid and other protocols.

Typically, higher volume increases the chance and scale of rewards. However, it's essential to balance this with sustainable yield. Simply chasing volume at the expense of funding profitability can lower overall returns.

Key Risks & Mitigations

- Funding Risk – Funding can turn negative; monitor rates and rotate into stronger assets when needed.

- Execution & Cost Risk – Spreads, fees, and slippage can erode returns; limit unnecessary rebalances.

- Leverage & Liquidation Risk – Misaligned positions can be liquidated; allow Liminal to rebalance automatically.

- Platform & Automation Risk – Changes to HL or Liminal may affect execution; stay updated and be ready to approve manual rebalances.

Cryptonary's take

In crypto, truly sustainable yield is hard to find. Most protocols rely on inflationary emissions or short-lived incentives that fade over time. Liminal takes a different approach by anchoring returns to a real market mechanism: perpetual funding. Because this yield comes from actual market activity rather than token giveaways, it has the potential to last much longer.Hyperliquid's rapid growth shows the value of being positioned close to its liquidity flows. Protocols with that alignment are best placed to benefit as adoption increases. Liminal integrates directly with Hyperliquid, executing trades from your own self-custodied account. Every trade adds to your personal volume, open interest, and funding history, which could play a role in future reward distributions from Hyperliquid, Liminal, or Unit.

As cycles progress, shifting some capital into low-risk, market-neutral yield strategies becomes a smart portfolio consideration. This is not about leaving high-beta opportunities behind, but about adding stable, compounding strategies that can work alongside them. Liminal offers exactly that, while also keeping the door open for upside from ecosystem incentives.

Cryptonary, out!