Passive income: The ultimate yield farming playbook for 2025

In any market -rain or shine - passive income is your ticket to building lasting wealth, and DeFi holds the key. This 2025 playbook reveals battle-tested yield farming strategies across stablecoins, Ethereum, and Solana, designed to grow your assets steadily, no matter the conditions. Ready to master passive wealth-building using DeFi? Let's get started…

Looking around, we can all see the markets are a bit of a mess right now-prices bouncing like a yo-yo, fresh launches nowhere in sight, and folks on X either freaking out or holding their breath. It's tempting to think there's nothing left to play for.

But hold up - all hope's not lost. Even with the chaos of the last couple of days, the wild world of DeFi still has some tricks up its sleeve. We've dropped a few yield-based reports lately, but we figured it's time to pull it all together and spruce up the best, most dependable yield strategies across stables, Ethereum, and Solana- plus a handful of shiny new plays to keep an eye on.

This is your one-stop shop for yield, and here is what we will be talking about:

- Why is getting yield important?

- Top Stablescoin yield strategies

- Top Ethereum yield strategies

- Top Solana yield strategies

- Things to be aware of when seeking yield.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Why does yield farming matter?

Yield farming is a rock-solid strategy we should all keep exploring because idle money just sits there, collecting dust. In TradFi, it's second nature for folks to chase high-interest savings accounts, money market funds, or bonds to make sure their cash outpaces inflation and grows over time. That's the exact same mindset we should bring to stablecoins and major crypto assets - whether it's most of them or every single one we hold.It also keeps us from getting trigger-happy. During downtrends and bear markets, impatience can creep in fast, tempting us to mash buttons and make reckless moves. That's the real killer - jumping the gun is what racks up the biggest losses. When our money's parked and stacking value through yield farming, it's like a chill pill for our nerves, helping us play it cool.

And here's the kicker: in crypto, especially DeFi, the yields blow TradFi's returns out of the water. That alone is a fat incentive to put our money to work harder and smarter

So now that you know why it is important, let's get into the meat and potatoes of this article and see the best places we can get yield on our coins.

What's next?

You won't believe the strategies we've uncovered to maximize your returns across stablecoins—it's not what you'd expect.Stablecoin yield strategies

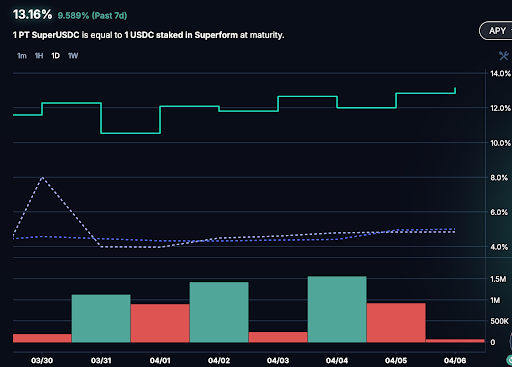

Let's kick things off with our top three protocols for farming yield on stablecoins-because who doesn't want their stables working harder? Here's where we're starting:Pendle

Pendle is a permissionless yield-trading protocol that allows you to manage and optimize your yields. It enables users to tokenise their yield-bearing assets and to trade the principal and yield components separately. It currently offers over 13% annual yield on stablecoins. For a more in-depth explanation, feel free to check out this report. In a nutshell, here are the benefits:

Benefits

- Simple process

- Deep liquidity

- High APY while having to just deposit stables

- Yield tends to drop over time

- Smart contract risk

- Unstacking period

- Temporary Depegs

- Go to the Pendle website

- Click on Markets

- Click on the green fixed APY button on the sUSDe row

- Select how much you want to put in

- Click swap (~13% APY)

Drift

The next product we want to talk about is called Drift. As a refresher, Drift is a decentralised exchange native to Solana but, over time, has branched out to other things, such as strategy vaults, which is the product we will be looking at today.Looking at the informational snippet below, we can see that the APY over the past 90 days has been significantly high at 27%, and on top of that, the TVL is also quite high at $28m, in USDC, supplied. This shows us that people trust this vault, and for now, the APY remains quite lucrative, but the capacity has almost been reached.

As another reminder, this vault does have a 3-day and twelve-hour lockup to be aware of.

Benefits

- Easy to understand

- High APY

- Proven Hedge Fund running it

- Lockup period of 3 days and 12 hours

- Smart contract risk

- Yields can be variable over

- Go to the Drift website

- Click on Strategy Vaults

- Click on the "View Vault" button on the Hedged JLP+ row

- Deposit into the vault (~33% APY)

Beefy

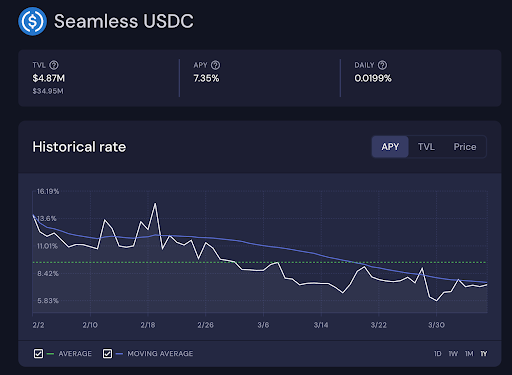

Beefy's a multi-chain yield optimizer that's all about juicing up your returns without you lifting a finger- think auto-compounding on autopilot. It works its magic through vaults where you deposit your tokens, and Beefy takes it from there, compounding the yield for you. How? By plugging into liquidity pools, farms, or lending protocols across EVM chains, doing the heavy lifting so you don't have to.Inside Beefy, we're doubling down on recommending the Seamless USDC vault. Right now, it's sitting pretty with a 7.35% APY and a hefty $40m deposited. That's a solid yield paired with some serious market trust.

Benefits

- Automated and easy

- No slippage

- Noncustodial and decentralised

Risks

- Smart Contract risk (on Beef's side)

- Smart Contract risk (on Seamless side)

- Go to Beefy

- Select the WETH Stargate Vault

- Deposit your ETH/WETH (~6.45% APY)

ETH, SOL, HYPE yield opportunities

As we know, there are many places to get yield on our majors, so we've compiled some of the best places here. In this section, we have a bit of everything for your ETH, SOL, and even for HYPE. Let's start off with ETH. For ETH, we have 3 platforms we wanna look at, Beefy, Derive, and Morpho.Beefy (Seamless Vault)

As we mentioned, Beefy is a multi-chain yield optimiser that gives us higher returns while doing all the hard work for us. When it comes to majors, we like the "Seamless WETH" vault here. Right now, it's rocking a 4.75% APY with around $20m deposited, which means it's delivering solid yield on ETH and has plenty of market trust behind it.Not a huge APY, but it is on ETH and the price of it can go up in value in more risk-on environments, which will boost the total ROI. So if you have some spare ETH lying around, it is a good idea to put it to work.

Benefits

- Automated and easy

- No slippage

- Noncustodial and decentralised

Risks

- Smart contract risk (on the Beefy side)

- Smart contract risk (on Seamless side)

- ETH price is subject to market fluctuations

- Launch the Beefy website

- Select the WETH Stargate Vault

- Deposit your ETH/WETH (~6.45% APY)

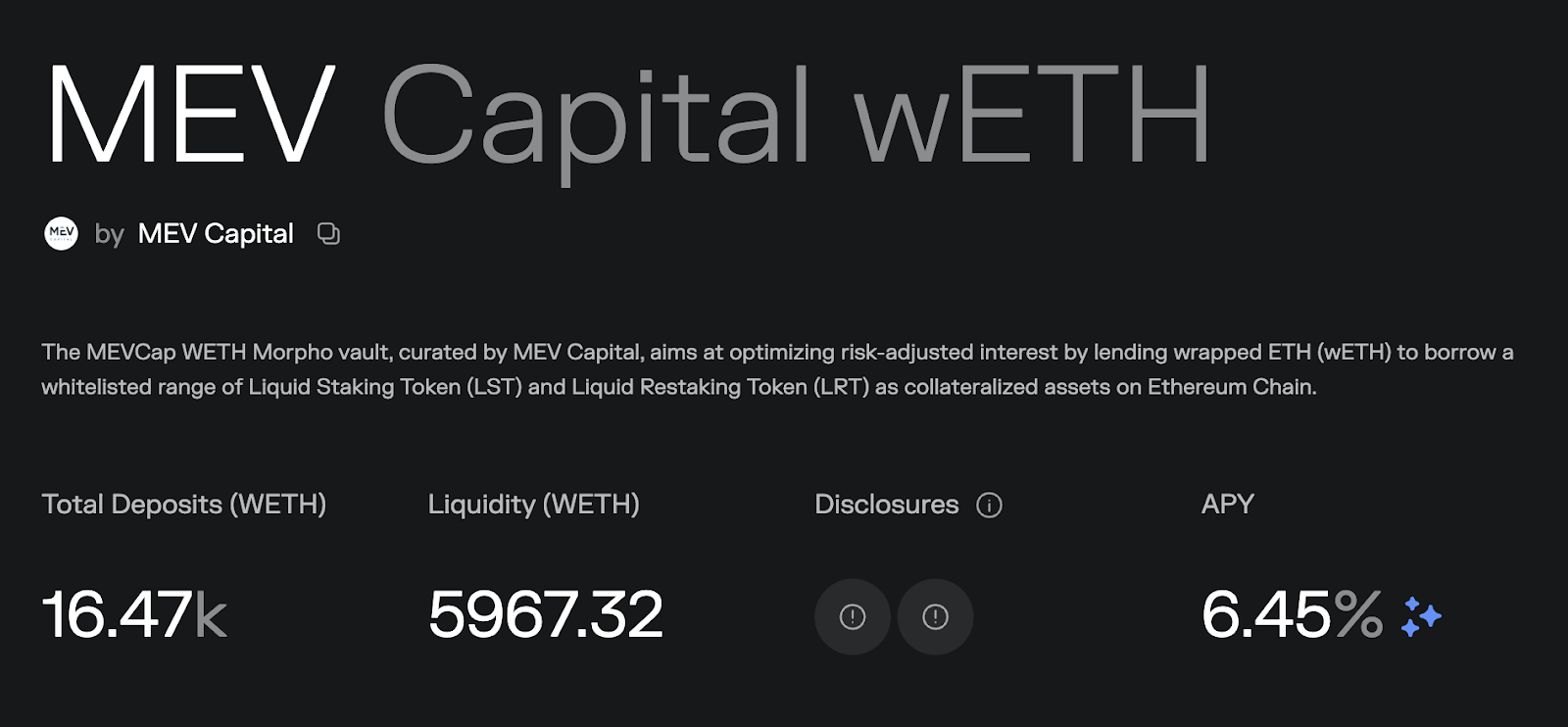

Morpho (MEV Capital wETH Vault)

The second non-lockup option is Morpho, an open infrastructure for on-chain loans built to be secure, efficient, and flexible. Running on EVM, Morpho boasts an impressive $4.8b deposited across its vaults, proving it's a heavyweight in the space.On Morpho, we're spotlighting the MEV Capital wETH vault. Managed by the MEV Capital team, this vault optimises risk-adjusted returns by lending wrapped ETH (wETH) and borrowing against a curated whitelist of Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) as collateral on the Ethereum chain.

As shown below, it's currently sitting on $20m in liquidity and delivering a steady 6.45% APR- pretty solid numbers all around.

Benefits

- Deep liquidity

- Low risk of liquidation

- Simple to use

- APY does tend to drop slightly over time

- Smart contract risk

- 3D lockup

- Go to Morpho

- Click on the MEV Capital wETH vault

- Click deposit (6.16% APY)

- You can use the vault both on Ethereum and on Base

Derive

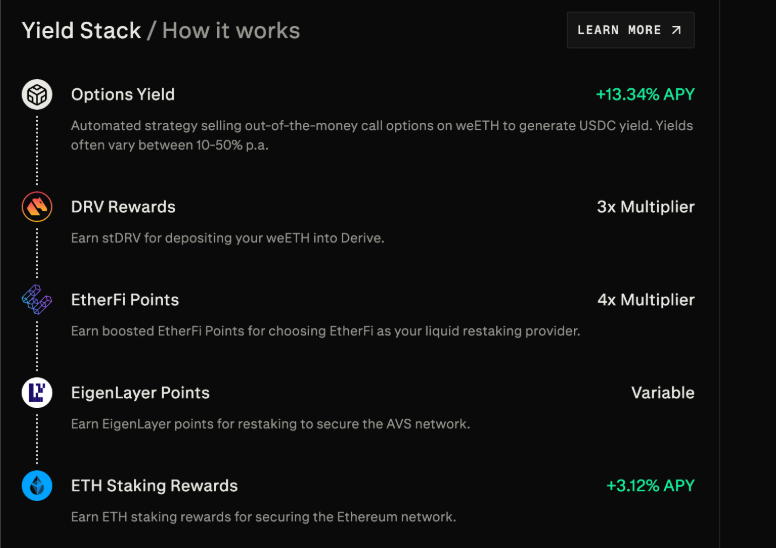

This is a platform where users can trade options & perps. On top of that, they can also earn yield on restaked collateral. For simplicity, we can say that platform-wise, it is quite similar to Drift.On Derive, we want to look at the weETH Harvest Vault. As we can see below, the APY at the time is projected to be about 16.4% per year, and it is achieved in a couple of different ways, mostly through options yield.

This vault essentially makes money the more ETH goes sideways, you are essentially going "neutral" in return for sacrificing the upside on ETH, which in a bear/ sideways market, this is exactly what we are looking for.

Right now, the Vault has about $3m worth of capital, making it quite small; however, as we can see from below, the performance is quite good.

Benefits

- Automated

- Betting on sideways / down

- No lockup

Risks

- If the price goes up sharply, you lose the upside exposure to ETH

- Smart contract risk

- If the calls expire OTM, you get USDC instead of ETH

- 7-day withdrawal wait time

- Go to Derive Earn

- Click on the weETH harvest row

- Click on the get weETH button (follow the instructions if you don't already have it)

- Deposit (~16% APY)

Solana yield opportunities

Finally, we have our top two picks for getting yield on Solana. Sollana is very well known for its DeFi, so after extensively looking through different opportunities, these are the top two we are looking at.Kamino

We've covered Kamino extensively in the past in one of our last write-ups, but as a quick refresh, it is a lending and borrowing platform on Solana that is in the top ranks in terms of TVL on the Solana chain.Today, we are going to look at one of the many products it offers on the platform called Multiply, which is a way to boost your yield exposure by multiples in a simple way. This is done through a method called looping, which essentially means you stake an asset, use it as collateral and borrow from your stake, and stake it again to gain more yield. With the strategy, you essentially stake more money than your original stake, allowing you to get more rewards.

Benefits

- Deep liquidity

- Low Risk of liquidation

- Easy to use

- Ways to increase our returns

- Overleveraging

- Smart contract risks

- Small slippage is possible

- Go to Kamino's Multiply

- Click on the JUPSOL Multiply

- Select SOL to deposit (it will swap it for JUPSOL)

- Select Multiply Leverage (we recommended up to 3.5x)

- Deposit (~15% APY)

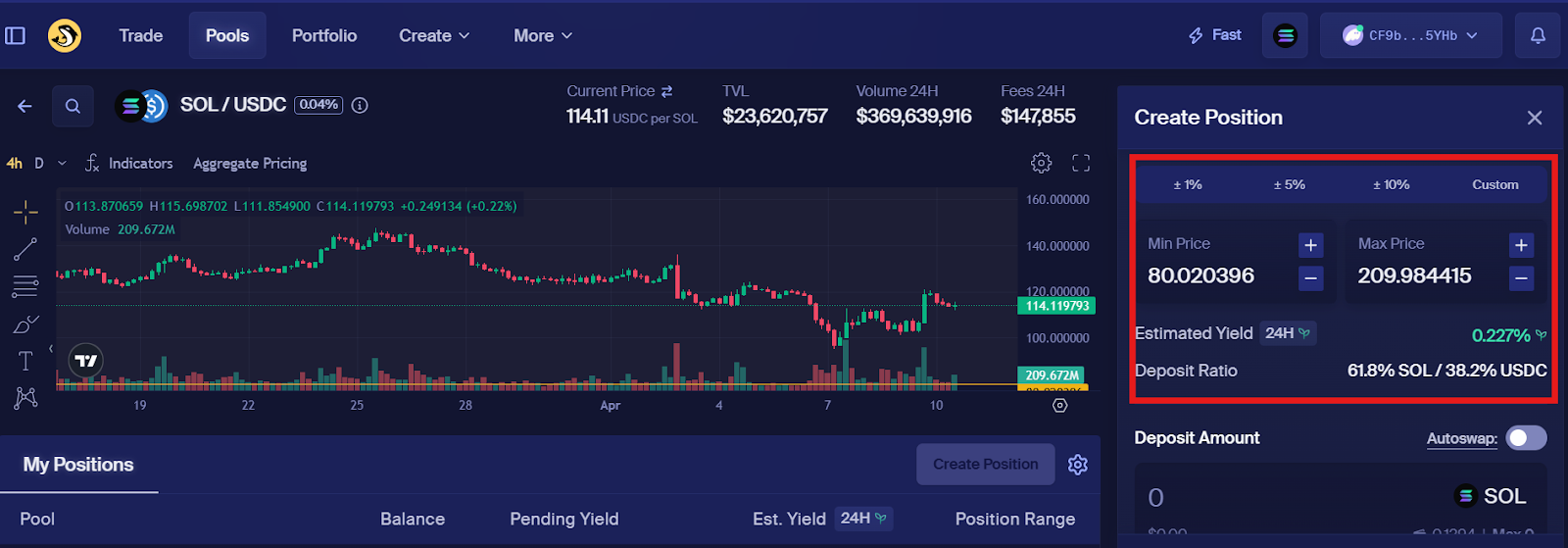

SOL-USDC pool on Orca (Bonus)

Orca is a decentralised exchange on Solana that allows people to swap, provide liquidity, and earn yield. One of its most popular features is the liquidity pools, which essentially allow users to deposit a pair of tokens, in our case SOL & USDC, and with those tokens, they will be used to market make automatically, resulting in a very lucrative yield over time.There are two options for providing liquidity: Full and Custom. For the general audience and newbies, using the full range is likely the safest option, because you don't have to manually choose ranges. However, since we do the research for you, based on our analysis, we believe a custom range of between 80$ and $210 is the most optimal range with a solid yield.

Below we can see the yield is 0.22% PER DAY on this range. However, it is important to note that the market is dynamic and sometimes the ranges might need to be adjusted based on SOL's price. Follow our Market Direction reports for SOL's price action

Benefits

- Liquid/ No lockup

- Balanced Exposure

- Exposure to trading fees

- Impermanent Loss

- Smart Contract Risk

If SOL goes from $120 to $210, the pool automatically sells your SOL for USDC to keep things balanced. On the other hand, If you had just held onto your SOL instead of putting it in the pool, you would've made more money from the pump. That difference between what you could've made by holding and what you actually made in the pool is called impermanent loss. It's called "impermanent" because it only becomes a real loss if you withdraw while the price is still far from where you started the position.

- If you are bullish on SOL, you can choose a higher max price that fits your targets. However, the narrower the range, the higher the yield. Typically, if you get the range right, the yield from the position can be greater than impermanent loss.

- The yield isn't guaranteed; it can vary based on market conditions and volumes. But again, typically, the yield is high.

- Narrower ranges can result in even juicier yields; however, there is a higher chance of getting out of range.

- Go to the Orca pools

- Click on the SOL/USDC pool

- Click "Concentrated" on the position range

- Make the range $80 to $210

- Deposit SOL/USDC (~0.271% Daily)

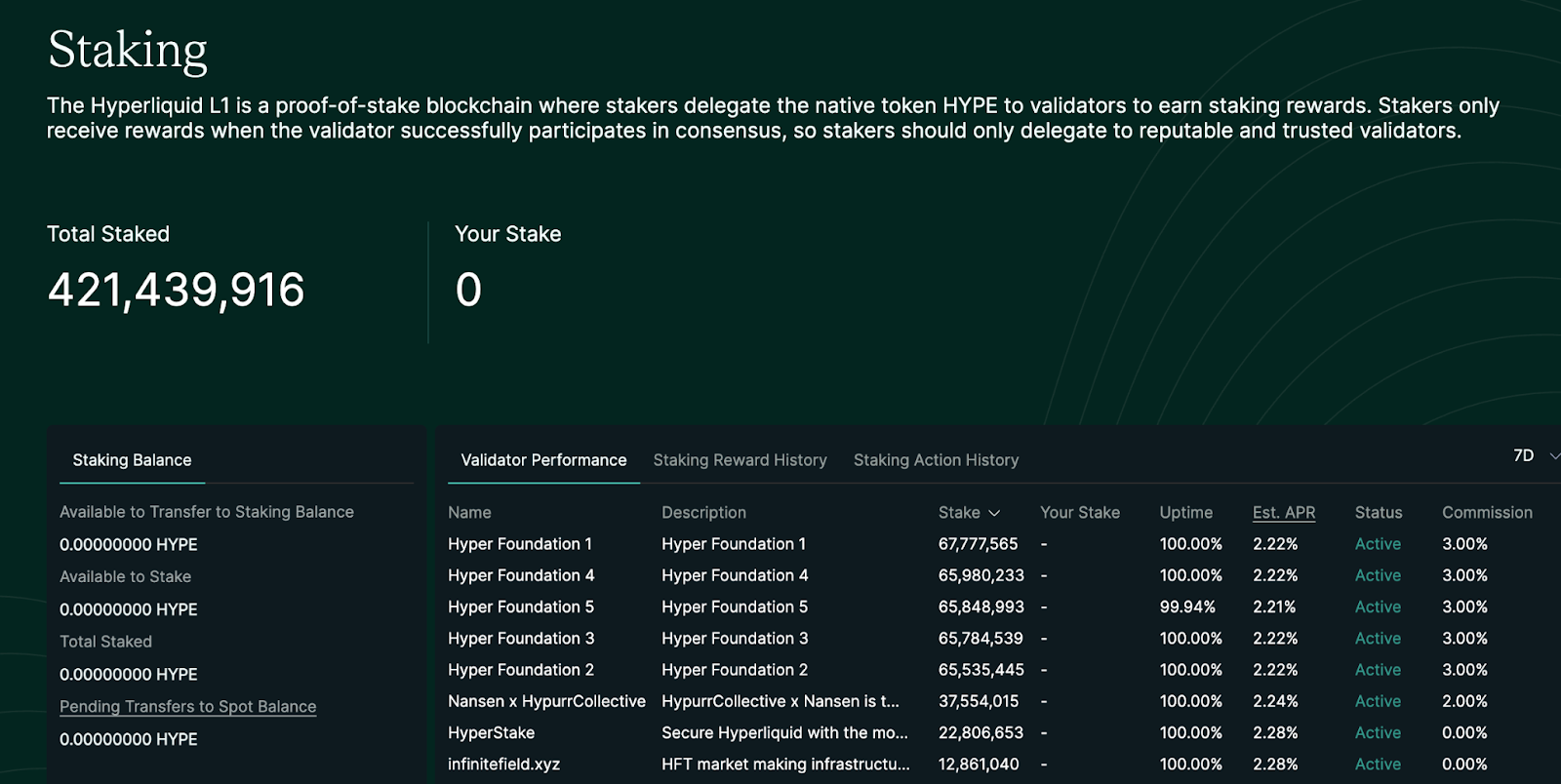

Hype yield opportunity

Hype StakingHyperliquid is most well-known as a DEX, which is okay as it is the highest DEX in market cap in the crypto space. However, today we want to take a peek at something that is less talked about - HYPE staking. On the surface, we can see that quite a bit of HYPE is being staked, and while the APR is only ~2%, there is more upside than what meets the eye.

Through staking hype, you also get more airdrop exposure from hypeEVM apps, and you can also be rewarded for season two of the HYPE airdrop.

On top of that, since it's a spot token you are already holding (if you are staking), it never hurts to get a bit more return even if it's just a couple of percentages per year.

Benefits

- Easy to understand and execute

- Potential for Airdrops for season 2 and from the HyperEVM ecosystem

- Low yield compared to other ways

- Smart contract risk

- Go to the Hyperliquid

- Click on Staking

- Click on the Validator you want

- Deposit into the Validator (~2.2% APY)

Yield isn't risk-free

Check out the table below where we break down the risks we've flagged throughout this guide, what they mean, who's in the crosshairs, and how to dodge the worst of it.

Cryptonary's take

Let's wrap this up with our two cents on nailing yield farming in 2025. The past couple of days have been a wild ride-market meltdowns triggered by new tariffs, with investor sentiment taking a nosedive and coming back after Trump announced a pause on tariffs.But here's the thing: DeFi's still your ace in the hole. While the broader market's been shaky, the strategies we've laid out, like parking your stables in Pendle's vault or leveraging Kamino's JUPSOL Multiply on Solana, can keep your portfolio stacking gains, even when the vibes are off. Our take? Don't let the noise scare you off.

Yield farming's a long game, and the protocols we've highlighted are vetted, with solid TVL and APYs to back them up. Just play it smart-diversify across stables and majors, keep an eye on those risks we flagged, and follow Cryptonary for updates to stay ahead of the curve. You've got the playbook; now go make your money work harder than the market's drama.

That is it from us.

Cryptonary, OUT!!