This week only: 23% Off + a 1-on-1 call with our experts. ⏰ : 1d 23h 59m 43s

Conventional asset classes are usually yield-generating - no one wants to lose wealth to inflation.

Examples include treasury bonds and other fixed-income assets.

This gave rise to a secondary market - the Interest Rate Derivatives (IRDs) market.

Instead of having exposure to the underlying asset, IRDs allow speculators to bet on the future yield of almost anything.

Sounds simple, but the demand is HUGE.

The notional value for the interest rate derivatives market is upwards of $480 TRILLION.

Pendle Finance is bringing this huge market on-chain…

TLDR 📃

- Pendle Finance is a decentralized yield management protocol aiming to tap into the $480 trillion interest rate derivatives market, allowing users to optimize yield and hedge against risks.

- Pendle achieves flexibility by converting yield-bearing assets into distinct derivative tokens, including the Standard Yield Token (SY), Principle Token (PT), and Yield Token (YT).

- The protocol's Total Value Locked (TVL) has experienced explosive growth, reaching $166 million, a ~1000% increase since the start of 2023, mainly driven by Ethereum Liquid Staking (LST) derivatives; but that's barely scratching the surface of its addressable market.

- The PENDLE token serves as both a utility and governance token, offering benefits like revenue sharing, protocol fees, and boosted yield for liquidity providers. Our valuation exercise delivers exciting price targets on the token.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

What is Pendle?🔬

Pendle Finance is a decentralised yield management protocol designed to provide users more flexibility when using the various yield-generating assets in the market. Yield is volatile; it tends to react to bull market tailwinds and bear market tailwinds. In addition, other micro-factors can influence the yield on assets.Pendle provides the flexibility to make decisions that optimise your upside and hedge against downside risk. Until recently, this flexibility has mostly applied to ETH staking, LST derivatives and stablecoins; however, any asset that generates yield can be incorporated into Pendle’s infrastructure.

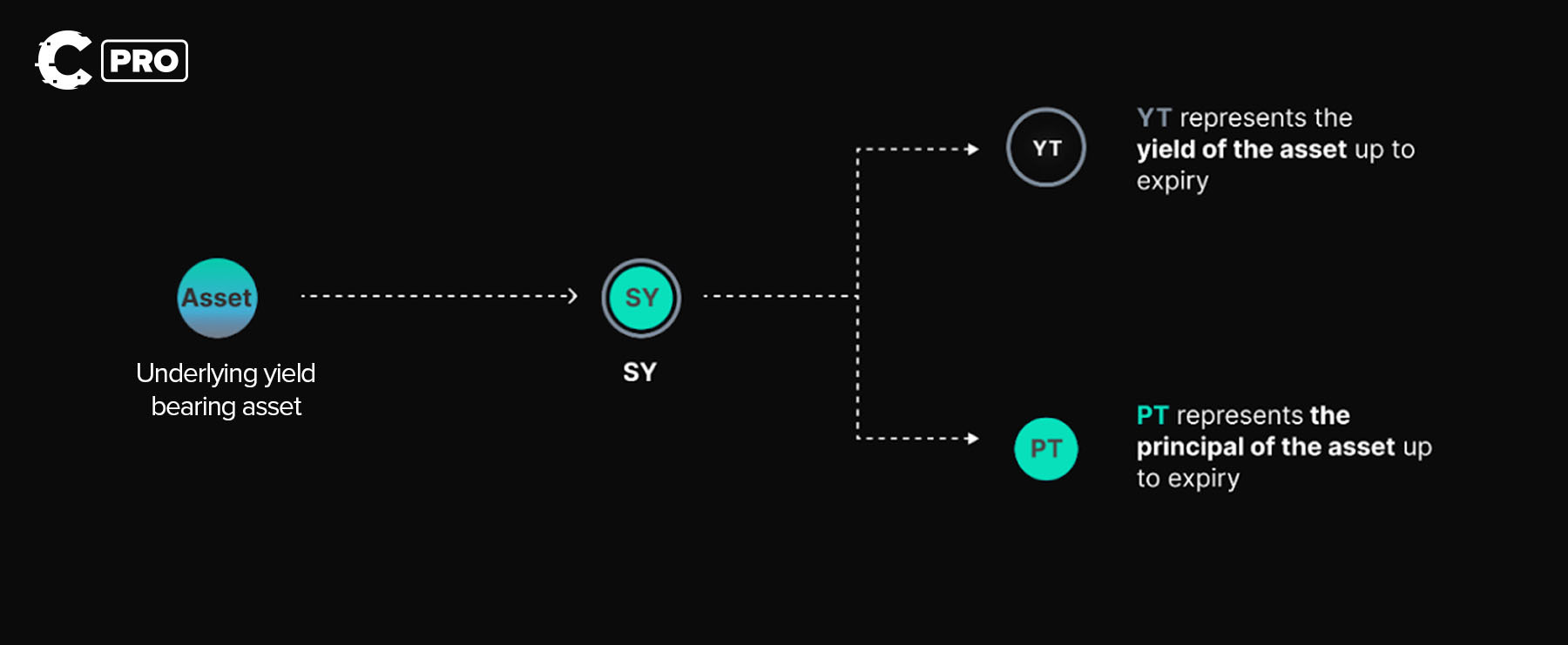

Pendle delivers this flexibility in yield management by converting yield-bearing assets into distinct derivative tokens:

- The “Standard Yield Token” (SY) which is simply the Pendle representation of the asset, identical to the underlying.This SY token is further split into the following:

- The “Principle Token” (PT) which represents the price (simplification) of the underlying asset.

- The “Yield Token” (YT) which represents the yield of the underlying asset.

By splitting the yield-bearing asset into different parts, Pendle allows users to gain exposure to the volatility of the components that make up the asset - yield or price.

These tokens can be redeemed for the price (PT), yield accrued (YT), or both price and yield accrued (SY) of the underlying asset. PT and YT tokens have expiry dates attached, meaning you can lock in a certain yield over the duration of maturity.

Pendle users know exactly how much ETH, USDC, USDT, or any other yield-bearing token they will receive at maturity.

How does Pendle work?🤔

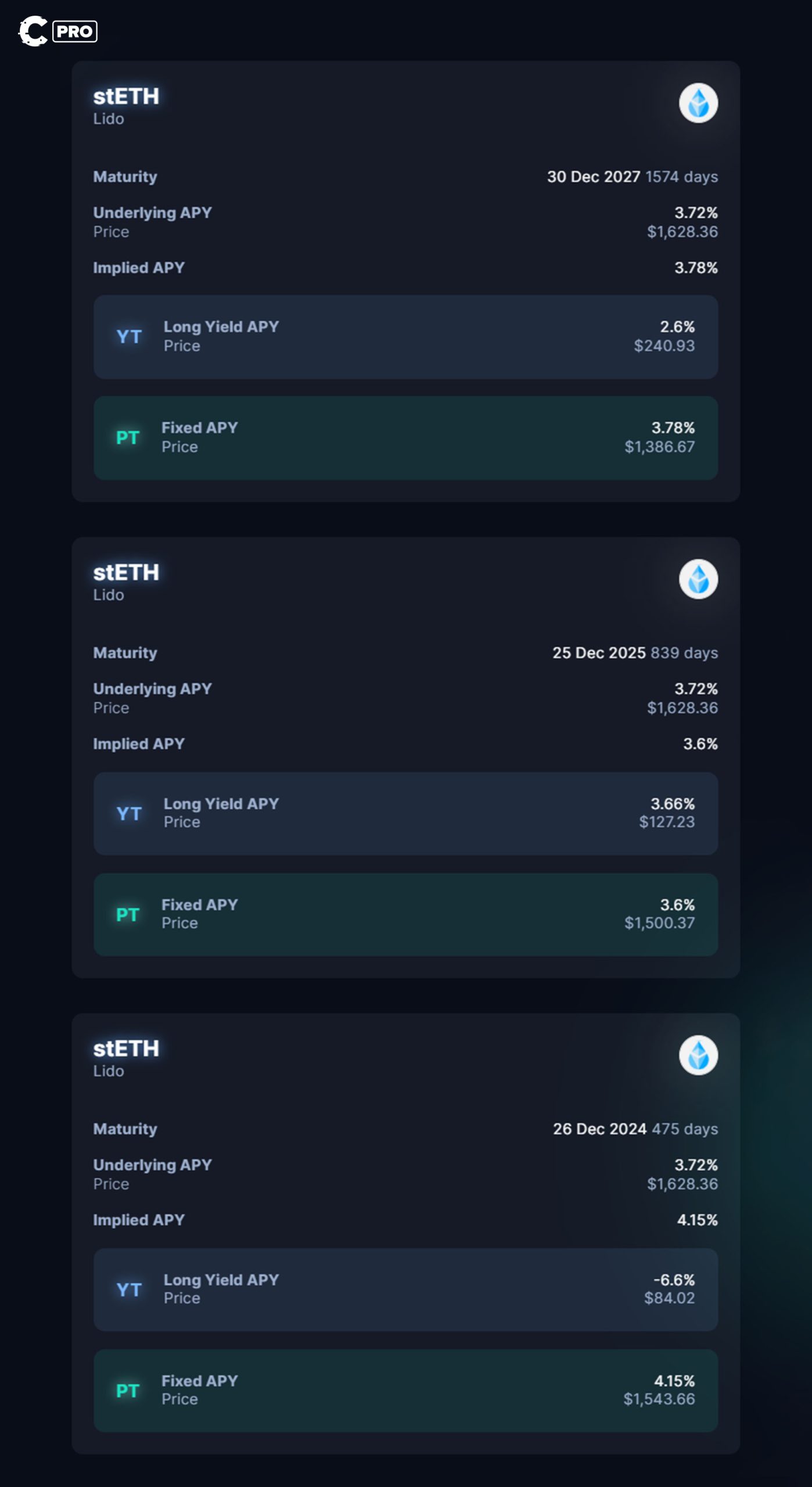

Pendle started with LSD-Fi - comprising ETH liquid staking tokens like stETH (Lido) and rETH (RocketPool). However, they have since expanded the product to include RWAs - which we’ll get to later.For example:

- Buying 10 PT-ETH for 9 ETH (at a discount) means after a year, the PT-ETH can be redeemed for 10 ETH at full value.

- Buying 10 YT-ETH entitles the buyer to the yield generated by 10 ETH over a year.

- Mary has $10,000 worth of USDT.

- The current USDT APY is 5%, which means theoretically, in a year, Mary will have $500 worth of yield from her original $10,000.

- Instead of waiting a year for the yield, Mary deposits the 10,000 USDT into Pendle.

- The USDT is broken down into PT-USDT and YT-USDT and given to Mary.

- Mary sells her YT-USDT for 500 USDT, retaining the PT-USDT.

- After a year, Mary’s PT-USDT matures, and she redeems her PT-USDT for the full 10,000 USDT.

But who is Mary selling her YT-USDT to?

John, who sees an opportunity:-

- John has 10,000 USDT and speculates that the USDT interest rate will increase to 6%.

- John buys 10,000 USDT worth of YT-USDT.

- Let’s say the price of YT-USDT is 5% of the price of USDT, with his 10,000 USDT, John can buy 200,000 YT-USDT, which entitles him to the equivalent yield of $200,000 worth of USDT.

- The yield increases to 6% the next day until maturity. This means $200,000 worth of USDT will generate $12,000 in interest over that year.

John has made a 20% return on his 10,000 USDT.

However, if the yield had decreased by1% down to 4% instead of increasing, John would have lost $2000.

This means he has overpaid for the future yield.

This ability to place trades on current and future yield opens up a huge number of potential strategies for yield generation, hedging positions, and other plays that were previously unavailable in DeFi:

This specific offer of unlocking more opportunities with yield generation is one of the key selling features of Pendle.

But it’s not the only selling point…

Demand for Real World Assets (RWAs)🏦

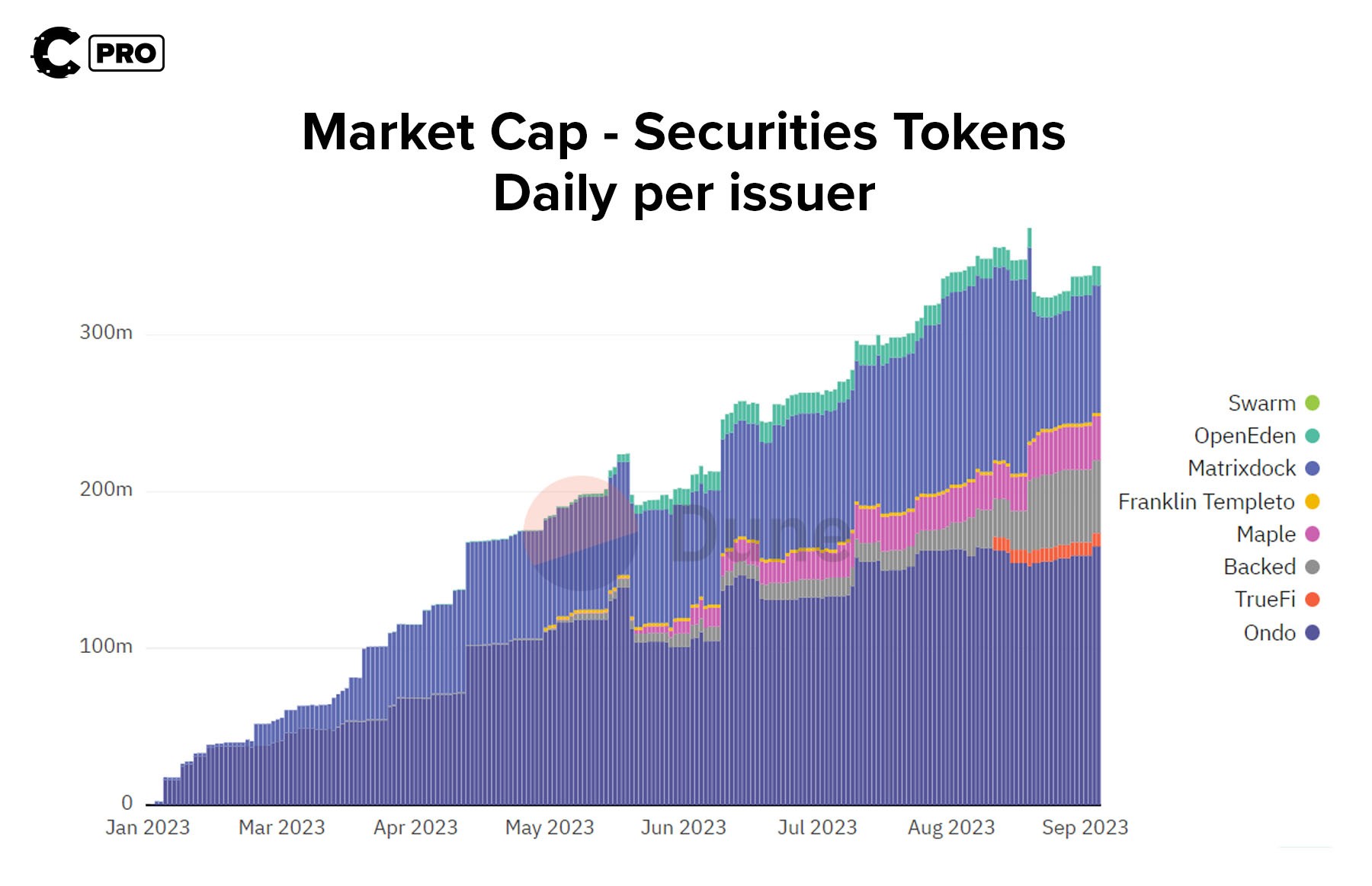

Remember the fixed-income TradFi assets we were talking about earlier? Treasury bonds and such? Well, they are gradually moving on-chain – thanks to Real World Assets (RWAs). RWAs are digital representations of tangible assets that are tradable on blockchain networks.RWAs have been a big narrative throughout 2023.

The tokenised securities market has grown from practically zero at the start of the year to well over $350 million.

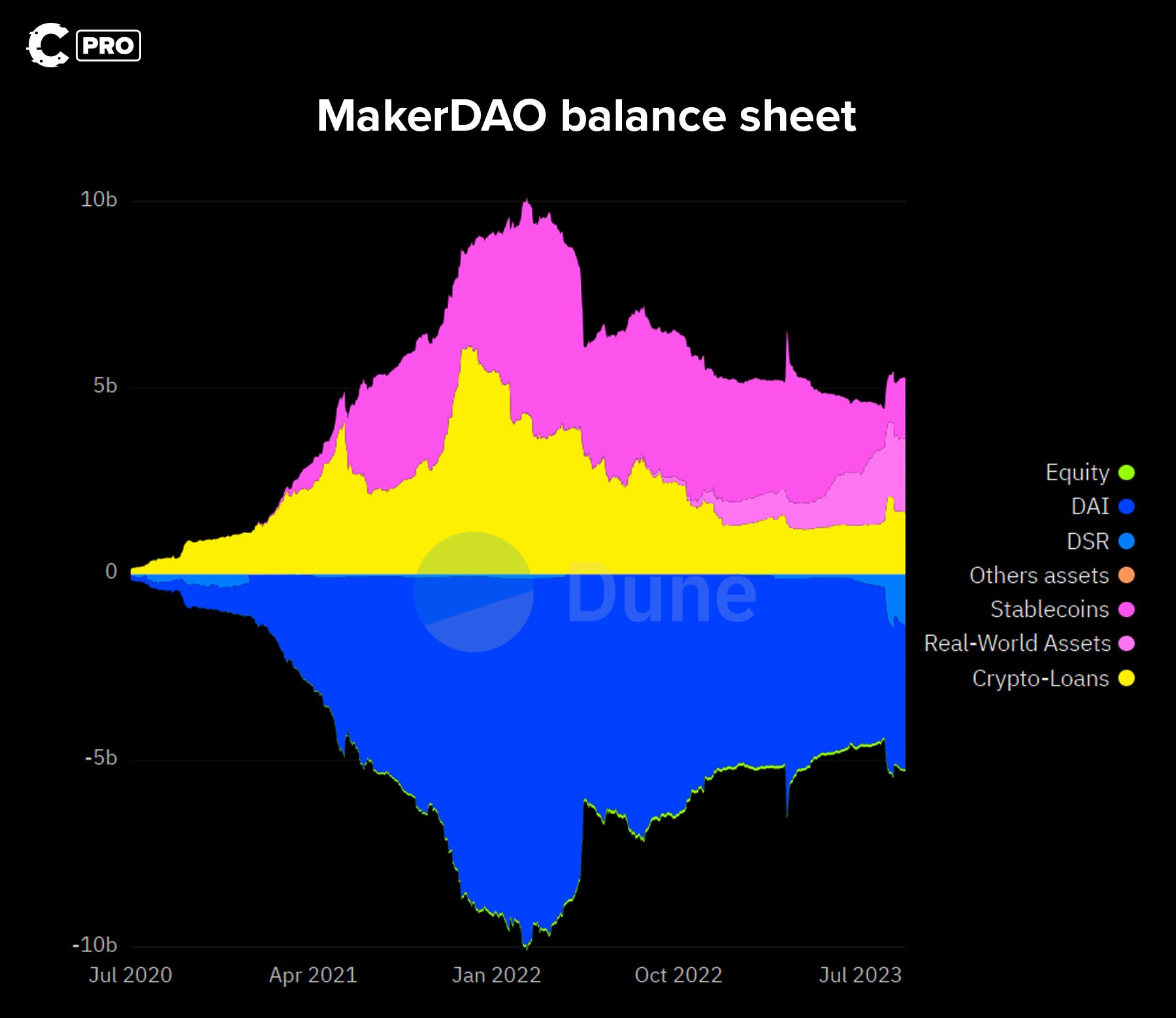

Additionally, MakerDAO, the issuer of one of the largest decentralised stablecoins, DAI, has been hard at work diversifying the assets that back DAI into RWAs.

DAI is now backed by nearly $2 billion worth of RWAs out of a total collateral pool of just over $5 billion. Most of MakerDAO's revenue now comes from RWAs like short-dated US Treasuries. Ultimately, this has allowed DAI to benefit from a base interest rate of 5%.

In essence, the demand for RWAs and tokenised RWAs is growing.

Protocol statistics 📊

We’ve talked about interest rate derivatives, yield management, and RWAs, but how do all these benefit Pendle? 👇Of course, where there’s yield and an underlying asset, Pendle can step in and break them up!

Through stablecoins backed by RWAs, Pendle has seen and acted on this demand to offer pools for users to enhance their stablecoin yield-generating activities.

You can see the tangible benefits to Pendle in the stats below.

Pendle has a TVL of $166 million at the time of writing. From the start of 2023, this represents an incredible ~1000% TVL growth.

Explosive growth.

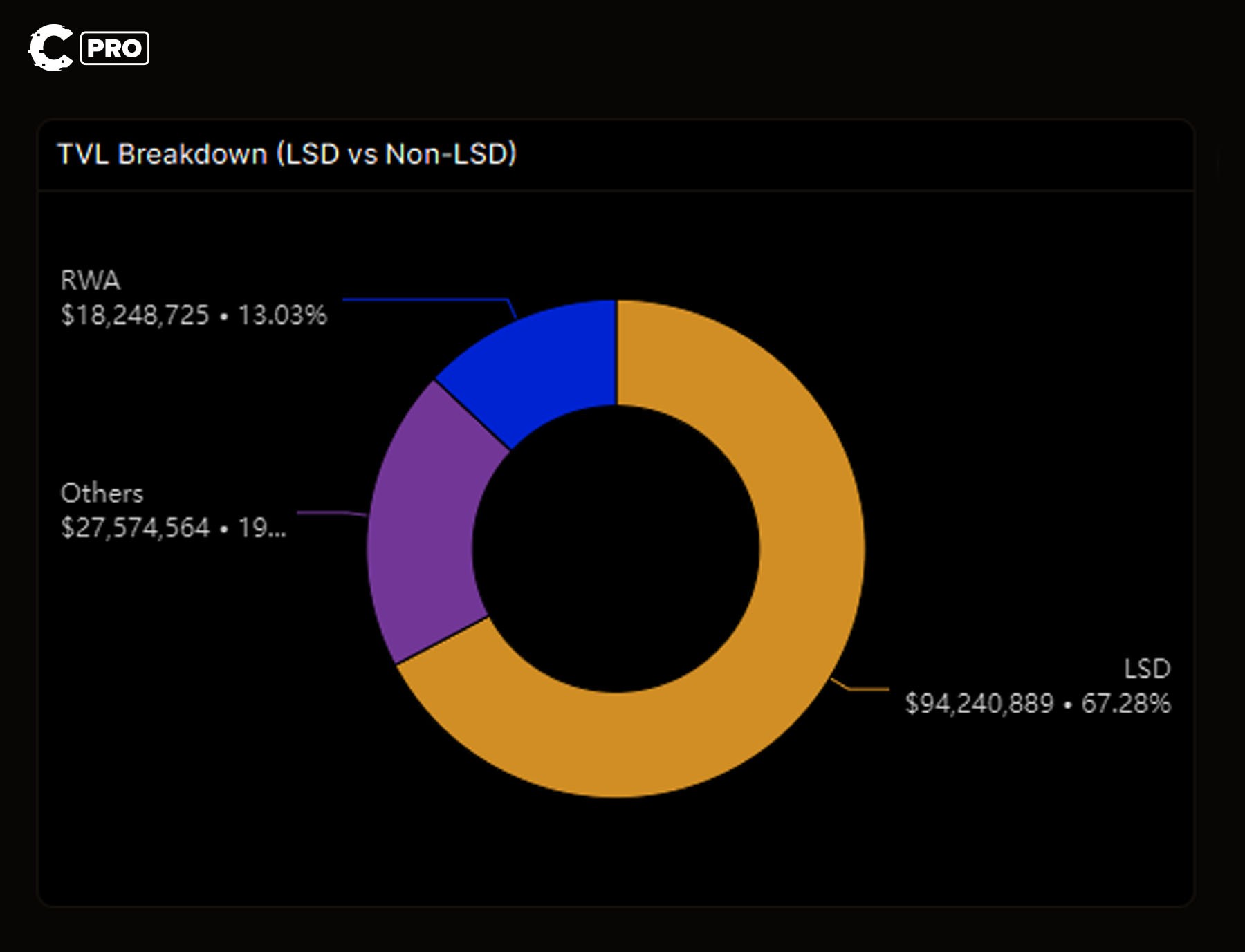

This is distributed between the following products (see chart below).

Ethereum LST derivatives are the flagship product, with ⅔ of TVL made up of LSTs (mostly stETH from Lido).

RWA TVL comprises stablecoins (and their yield, for instance, sDAI vaults).

Interestingly, all of these TVL sources have barely scratched the surface of the addressable market for LSDs and RWAs.

But we’ll touch on that later…

We know Pendle has a solid product, but does this translate to a solid token? Let’s find out! 👇

$PENDLE tokenomics 🪙

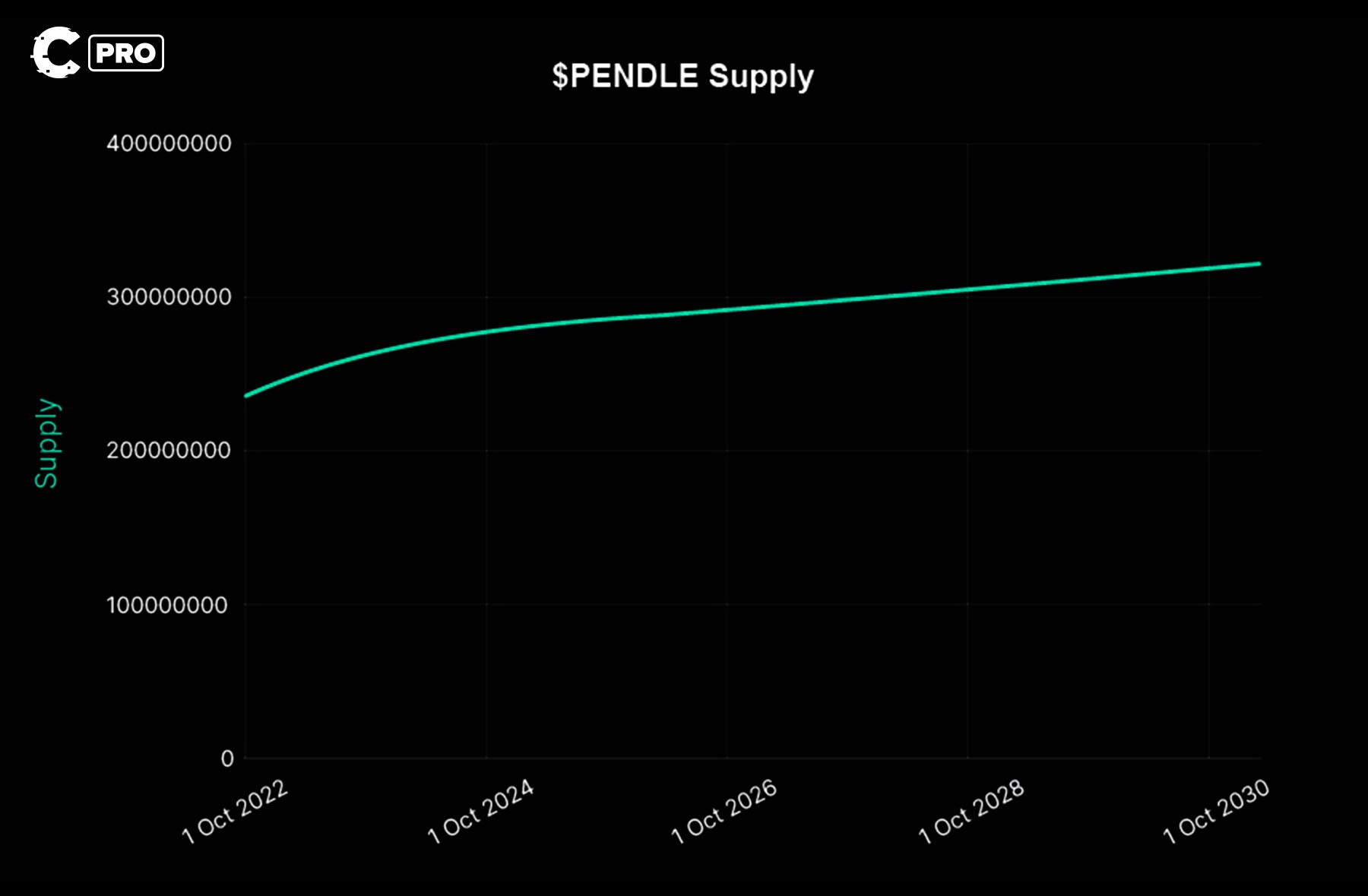

PENDLE is the utility and governance token for Pendle Finance.Supply information:

- Total Supply: ~258 million tokens

- Max Supply: Uncapped

After this date, PENDLE will inflate by 2% perpetually, with the emitted tokens being used for incentives.

The vesting schedule was complete by April 2023, so no new additional inflation will come from allocations.

PENDLE has the following utility:

- Governance: vePENDLE holders are entitled to a share of the revenue generated by the protocol, based on which pools successfully received incentives through voting.

- Protocol Fees: Over and above the governance incentives, vePENDLE holders (regardless of participation) receive a portion of overall protocol fees.

- Incentives: LPs holding vePENDLE are entitled to boosted yield from participating in liquidity pools.

But to put a valuation on Pendle, we require some context…

Valuation 🏷️

Since LSDs make up around 66% of Pendle’s TVL, we can get a conservative valuation for PENDLE by focusing on the potential of LSDs.RWA should also factor into the valuation, but the product is not yet quantifiable - do we count the $480 trillion TradFi market? Obviously not.

So, we are keeping this valuation exercise lean with LSDs.

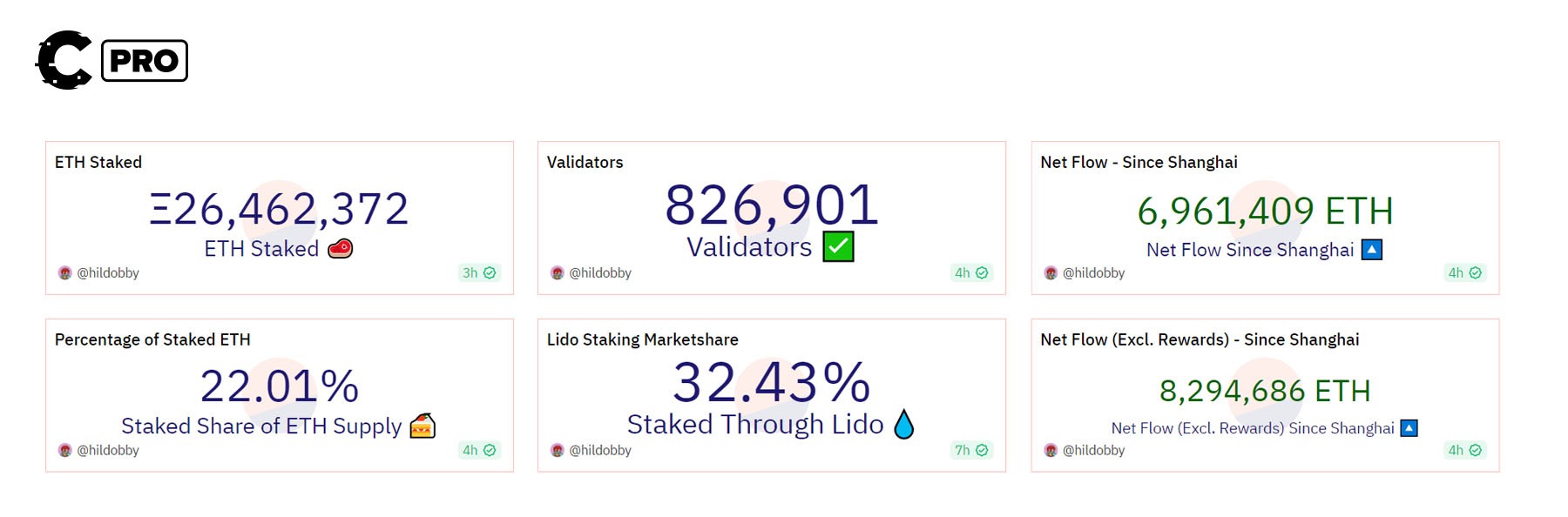

Looking at the Ethereum landscape, we see that 22% of the ETH supply is staked. This is unlikely to go significantly higher.

Of this, 32.4% is staked through Lido Finance, which equates to 8.563 million ETH.

Of the 8.563 million stETH created by Lido, only 109,000 is locked in LSD-Fi, corresponding to 1.27% of the supply. In dollar terms, at current prices, this is $177.67 million worth of stETH locked in LSD-Fi.

This is a tiny portion - the overall value of all stETH in existence is ~$14 billion.

Where are we going with this?

Important point:

- Pendle has held an FDV/TVL ratio of around 1.13, and with no new tokens to be released from vesting, we will base the projected value of PENDLE on this ratio.

- This is under the assumption that as TVL/Revenue increases, the rewards shared with PENDLE stakers will inherently keep PENDLE price in line with those statistics. (Increased rewards > increased APY on vePENDLE > investors buy/stake PENDLE).

Now, here come the predictions:

- Conservatively, we expect LSD-Fi to grow to between 10-15% of the Ethereum Liquid Staking sector.

- If the ratios stay the same, this accounts for an inflow of between $1.4 billion-$2.3 billion stETH tokens entering LSD-Fi.

- With a 27% market share, Pendle would have an stETH TVL between $378 million and $621 million.

- LSDs currently make up 66.5% of Pendle’s TVL; therefore, Pendle’s overall TVL would be between $502.4-827.8 million.

- At an FDV/TVL ratio of 1.13, this places PENDLE at an FDV of between $567.7-935.4 million.

(Projected FDV * MCap/FDV ratio) / circulating supply = target

Price targets🤑

- Lower bound: (567.7 million x 0.375) / 96.95 million = $2.20.

- Higher bound: (935.4 million x 0.375) / 96.95 million = $3.62.

But Cryptonary, a $50 investment will only net a $250 gain - is it worth it?

IMPORTANT:

- These calculations do not consider any price appreciation of ETH, which we’re sure will happen. The numbers above were calculated with an ETH price of $1,630.

- They also don’t consider the growth of RWA deposits, which we’re sure will also increases

- Finally, they do not consider more deposits into Ethereum liquid staking protocols, which would mint more LSTs for LSD-Fi to consume.

Invalidation criteria ❌

There are a few key events that would invalidate the thesis:- Market share: Pendle loses significant market share to other LSD-Fi protocols, dropping below 10%. This would signify very low demand for the product.

- ETH staking participation drops: Since LSTs are crucial to Pendle’s product, a significant drop in ETH staking participation (below 16%) would invalidate the above valuation, which depends on stability/continued growth.

-

-

- Note: this will likely be mitigated by the expansion of the RWA product and the launch of more diversified pools.

-

- Competition: Although there are no clear competitors at the moment, Pendle’s success might spark the launch of competing product offerings and services.

Price analysis 📈

PENDLE remains one of our best plays of the year. We managed to scoop up a whopping 200% gain on our investment by exiting our position in April.But unfortunately, the time for PENDLE to rest is nearing. Since marking the peak in July, the asset saw continuous selling pressure, bringing its price to the $0.50 level. But that's only interesting in the short term.

PENDLE's price might've formed a range between $1 and $0.375, and we believe it will move between the two levels for the rest of the year. Why?

We've identified a bearish divergence on the RSI (Relative Strength Index). As you can see, the price of PENDLE formed higher highs, whilst the RSI formed lower highs. Given the strength of the timeframe (weekly), this is a good enough indicator that signals a potential bearish outlook for the coming months.

Plus, our views on September are quite bearish, so this month will likely see downside/boredom. Interested in more on that? Check our latest monthly analysis here.

Cryptonary’s take🧠

Pendle is a solid project with solid utility and a viable business model - what else can we say?Without any further price action from ETH and no deposits by would-be ETH stakers, Pendle already has a HUGE addressable market.

The conservative targets we have set out will likely be reevaluated in the future - most probably to the upside.

But for now, in the depths of a bear market, caution is the name of the game.

Action points 📝

- Accumulate PENDLE between $0.375 and $1.

- 25% of the position will be sold at $2.20.

- 25% of the position will be sold at $3.62.

- The rest will be held for re-evaluation at a later date.

As always, thanks for reading. 🙏

Cryptonary, out!