Policy: What's the Plan?

At this point in the macro series, we’ve covered all the things in the last 50 years that have led to this inflationary environment economies around the world find themselves. However, what are governments doing about it? What economic policies are they bringing into place to combat inflation?

Fighting inflation is tough, and most people in high-inflation countries are witnessing their savings, their time, and their assets become worth less in real terms over time.

In this journal, we will cover exactly what policymakers are doing, why they’re doing it, and the expected repercussions of these actions.

Central banks have several tools at their disposal to fight high inflation. The baseline inflation rate that most developed countries aim for is around 2% year on year. Obviously, with inflation a lot higher than that in many countries, central banks are now finding themselves having to use those tools to tackle the problem. Since most countries now use a floating currency or fiat system, the tools that governments have at their disposal are roughly the same. Let’s take a look!

For some more context, check out the following journals:

Part 1 - Inflation, Fiat, & the Fed

Part 2 - Well Oiled Machine?

Part 3 - The Aftermath of COVID

Monetary Policy

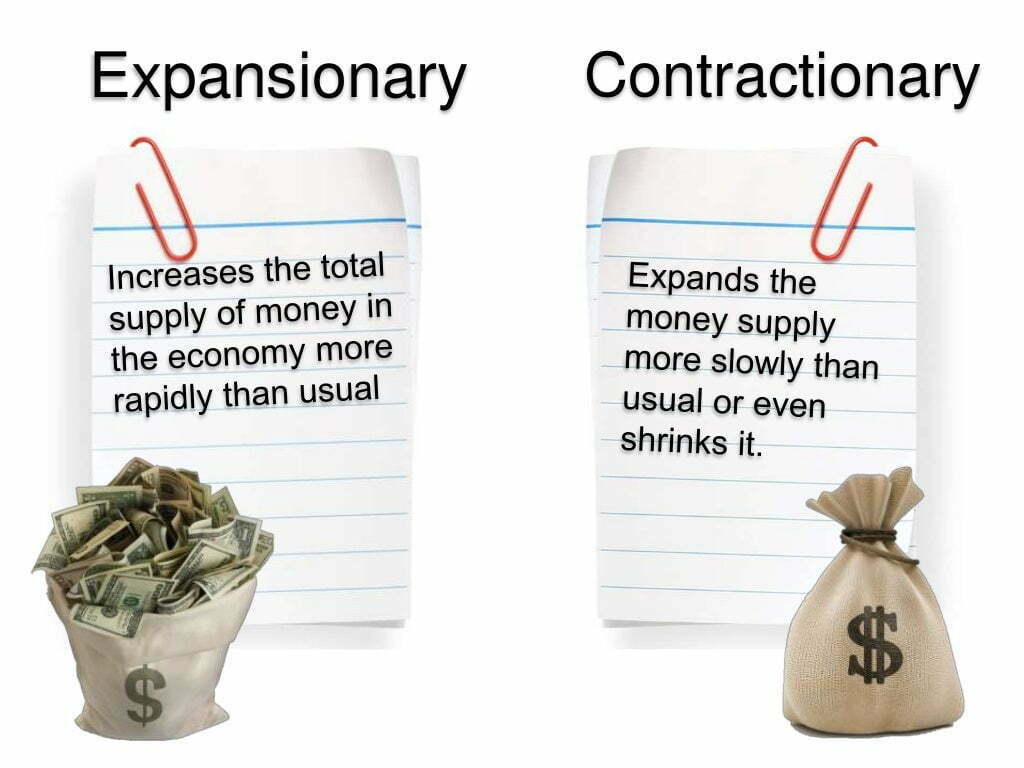

By far, the greatest and most used tool that central banks use to control inflation is monetary policy. Simply, monetary policies set by central banks control the amount of money that is available in the economy at any one time. The two forms of monetary policy are expansionary and contractionary.

- An expansionary monetary policy increases the overall money supply. Interest rates are reduced, which conditions consumers and businesses to spend money rather than save/hoard it. For the most part, this increases economic activity and leads to the economy “heating up”. This is beneficial in times of recession to get the economy moving again.

- A contractionary monetary policy reduces the money supply. Interest rates are increased, which makes saving more attractive for consumers and businesses and increases the cost of borrowing. This reduction in spending “cools” a heated economy, reducing inflation but also slowing down economic growth.

So, we’ve identified the problem (inflation) and the solution to that problem – what’s the issue?

Breaking Things

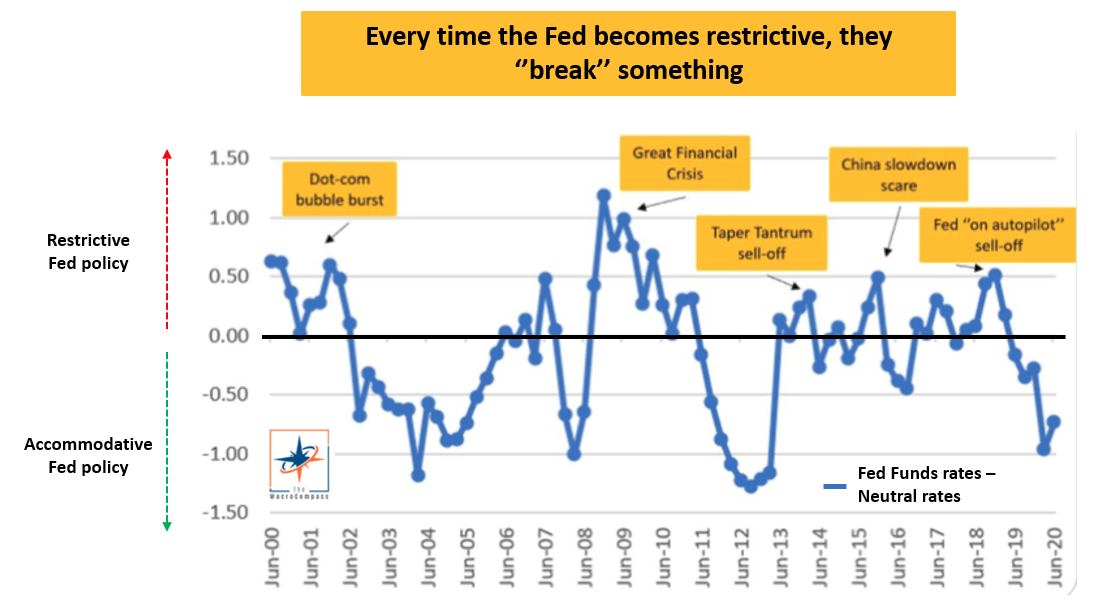

Since the mass expansionary policy implemented by most governments in response to the Great Recession of 2008, there has been no period of sustained, significant, quantitative tightening from any major central bank. Any time QT has been implemented historically, something in the economy has broken, and central banks have had to backtrack.Let’s use the United States as an example since it’s the world’s largest economy. The Federal Reserve (Fed) is the central bank of the United States in charge of maintaining 2% inflation, a strong jobs market, and stable prices for goods and services across the board. Throughout 2022 the Fed has been implementing a quantitative tightening program in the form of raising base interest rates and reducing its balance sheet.

However, every time in recent history the Fed has tried to do this, something has broken. Let’s look at some examples:

- At the start of the millennia, US tech stocks were booming because of the rise of the internet, and speculation was rife. Absurd valuations for most of these companies were fuelled by the availability of money because interest rates were so low. The Fed acted to slow down what was perceived as an overheated economy and entered a restrictive phase. The capital available dried up, and the bubble popped.

- By 2006, it was becoming clear that the US housing market was becoming overheated. This was largely caused for much the same reason as the dot com bubble – cheap interest rates with extremely high rates of borrowing. Concerns about liquidity were growing because banks were becoming insolvent due to this bad debt, forcing the Fed to cut rates in 2008 to prevent economic collapse.

- After the massive easing program in the wake of the Great Recession, by 2013, the Fed announced it was ready to reduce the support it had been providing the economy. This created a panic in markets as investors began selling as fears that the market would crumble as a result became widespread. The Fed backtracked and continued buying as it had before.

- In 2015/2016, there were fears that the Chinese economy was slowing down as Chinese quantitative easing was cut. This led to a panic in markets as China produces a significant portion of consumer goods around the world. Since the Federal Reserve was in the process of raising interest rates (again), a stronger dollar would hurt developing economies that were dependent on the US dollar. The Fed backtracked (again) and kept rates relatively flat rather than reducing them.

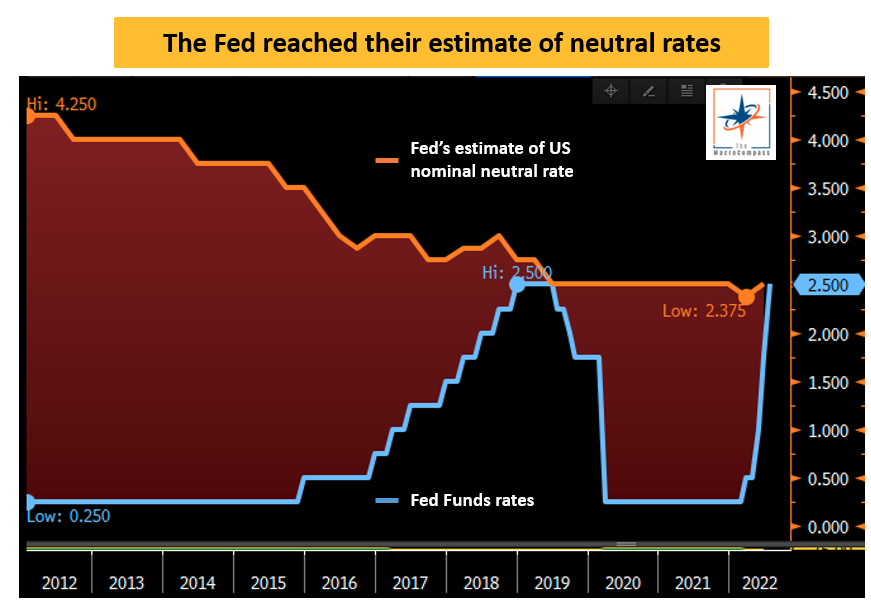

At the last FOMC meeting in July 2022, the Fed announced that they had likely reached the neutral rate, at which point the Federal Reserve was no longer contributing to economic growth, and the economy was delivering its potential with no help. What this means is that any interest rate hikes going forward will put the Fed in an actively restrictive territory, where they will be limiting the growth potential of the economy.

This is good for combating inflation – not so good for preventing recession.

We believe that it is highly unlikely that the Fed will manage to restrict the economy without something breaking – it could be the stock market, the housing market, or even the economy itself through the recession.

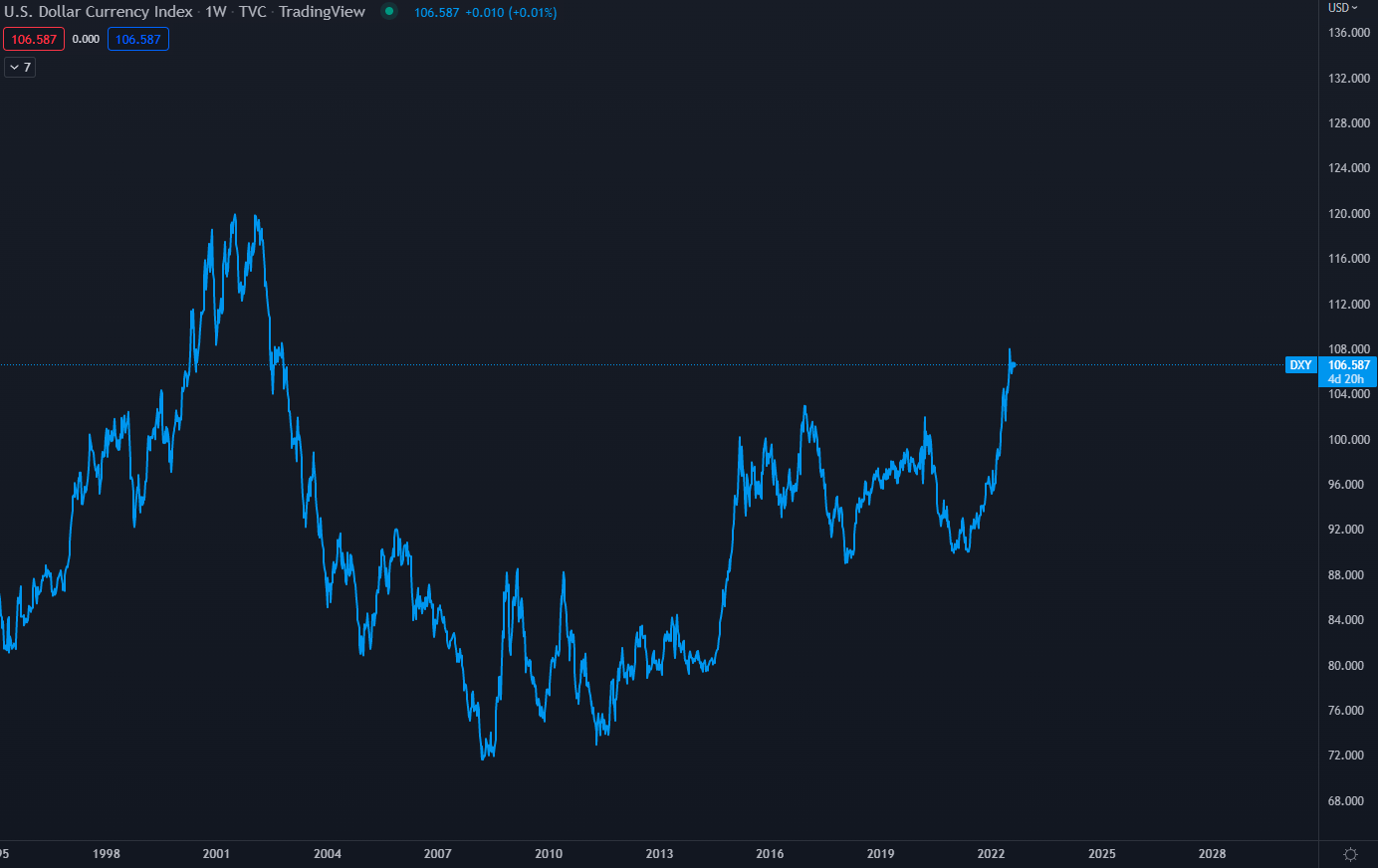

The US dollar has been growing in strength exponentially since the 2020 lows. What this means for American consumers is cheaper imports and less expensive foreign travel. On the flip side, however, American companies that rely on exports and global markets for sales are hurt because they get a worse exchange rate for the products they sell – with the same overheads. This means American-produced goods are less competitive (bad for the economy).

Additionally, developing economies that rely on the US dollar as a reserve company end up paying more for those dollars in relation to their economic output. If the dollar becomes too strong, then the role as a reliable reserve currency will come into question as dollar obligations could become unpayable.

We will be closely monitoring developments and FOMC meetings as always. It is a really difficult situation to make any predictions on because, as stated above, quantitative tightening has never really happened without something going significantly wrong. The main difference between the previous QT cycles is that inflation is rapidly becoming a huge problem, and the Fed has stated on many occasions that fighting inflation is its number one priority.

The world will soon find out the repercussions of this policy. Stay tuned.