Policy updates: Is $9 Trillion of Wealth About to Flow into Crypto?

Huge news! For the first time ever, US citizens can now invest in cryptocurrencies directly through their 401(k) retirement plans. It's a historic milestone for crypto adoption, and the potential capital flows are enormous. To put this in perspective, 401(k) plans hold $9 trillion in assets, and even a modest 1% allocation to crypto could channel $100 billion into the market...

Picture telling your grandchildren in 2050, "Back in the 2020s, I put Bitcoin in my retirement plan, like planting a seed that grew into a towering oak." That future is taking root today.

The US has opened the door for cryptocurrencies to join 401(k) plans, a move as bold as when railroads first connected a nation.

With $9 trillion in these accounts, even a small shift could send billions flowing into digital assets.

Let's unpack what this monumental change means for the future of crypto...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is 401(k)?

A 401(k) plan is the primary retirement savings vehicle for millions of Americans. It allows workers to contribute a portion of their paycheck on a pre-tax basis, lowering their taxable income while building long-term savings. Many employers also offer matching contributions, effectively adding “free money” to employees’ accounts and accelerating growth. With favorable tax treatment and employer support, 401(k)s have become the backbone of retirement planning in the U.S.

Fig. Growth of U.S. 401(k) Assets (1990–2025)

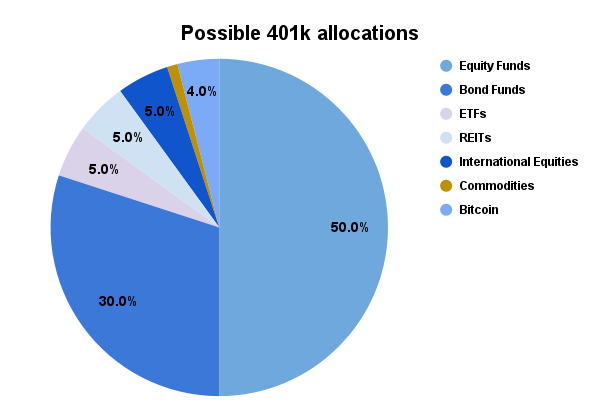

Typically, 401(k) funds are invested in assets like bonds, equities, ETFs and commodities which provide a hedge against market fluctuations protecting deposits while providing consistent gains. These funds have primarily been one of the largest investment pools in the world and are untouched over long periods of time.For more than ten years, US banks and funds were kept in the dark about cryptocurrencies like Bitcoin. People thought they were dangerous, maybe unlawful, and full of conjecture. There were accusations of scams made by politicians. Exchanges and regulators had disagreements. The headlines were filled with reports of exploits, hackers, and bubbles.

However, adoption kept going up, ever so slightly. Buyers were young adults with a strong affinity for technology. A lot of groups started to see what happened. Still, retirement funds? It appeared to be impossible. It seemed absurd to think that middle-class workers or grandparents' pension plans could hold crypto.

At least until 2025.

Trump's Big Move: Opening the Gates

Just recently, president Trump signed an executive order letting 401(k) plans buy Bitcoin, stablecoins, altcoins, basically, the whole crypto stack. This could shift trillions out of the old 60/40 boomer portfolio into hard money and high-conviction alternatives.The market reacted almost immediately, with Bitcoin surging past $124,000 in just a few days. The driver was not short-term speculation, but the entry of crypto into the world’s largest pool of long-term savings. Crypto, which had long been on the periphery, finally got admitted to the most exclusive club in banking.

The president's action was deliberate. It was the latest development in what seems to be a broader pro-crypto agenda in the works in Washington. The historic Genius Stablecoin Act, introduced by President Trump earlier in 2025, established a legislative framework for digital currencies known as stablecoins that are pegged to the US dollar.

For a long time, stablecoins were uncertain due to their importance and the absence of regulation. The Genius Act mandates that issuers maintain 100% reserves, undergo regular audits, and operate under a license similar to a national bank.

After receiving approval from financial institutions such as banks and payment processors, stablecoins have gone from "wild west" products to legitimate financial tools. By doing this, The United States preserved its position as the world's leading financial power and opened itself up to new ideas by laying the groundwork for digital dollars. Doing so was absolutely ‘Genius'.

Building on this momentum, the inclusion of crypto in 401(k) plans marks the next major step in mainstream adoption. Here is possible portfolio allocation after the inclusion of BTC in 401(k).

André Dragosch of Bitwise summed it up best:

"Even small allocations to Bitcoin in 401(k)s represent hundreds of billions of dollars in potential inflows. That kind of demand can reshape the market."

For comparison, this is similar to how REITs and ETFs were integrated into 401(k)s decades ago. Initially, there was skepticism, but over time, these assets became mainstream and contributed meaningfully to long-term returns. The initial investments will be made through ETFs (Bitcoin and ETH) with new financial products already being worked on by portfolio managers to give the retirees a much broader access to the world of cryptocurrency, who knows your favourite meme coin may also make the cut!

Learning from the Past: How Asset Classes "Exploded" in 401(k) Portfolios

At the launch of the 401(k), relatively stable assets like bonds and commodities were the first to be included as they provide nominal gains of 3% - 5% and secure the assets of the working class. As time progressed, these assets were not able to keep up with the rising inflation. To combat this, newer financial products like ETFs (Exchange traded funds) and REITs (Real estate investment trusts) were incorporated and the results of how these asset classes grew with the injection of heavy capital from this massive pool will astound you.Evidence of REIT "Explosion" Post-401(k) inclusion

What are REITs? REITs (Real Estate Investment Trusts) are companies that own or finance income-producing real estate such as apartments, office buildings, and shopping centers. They trade like stocks, providing liquidity, dividends, and diversification.Growth After 401(k) Inclusion:

- 1990s: REIT market cap was under $100B.

- 2000: After early 401(k) adoption and Target-Date Funds (TDFs), REITs hit $300B.

- 2010: REIT market cap surpasses $400B.

- 2025: US-listed REITs reach $1.4T, with 401(k) funds among the largest steady buyers.

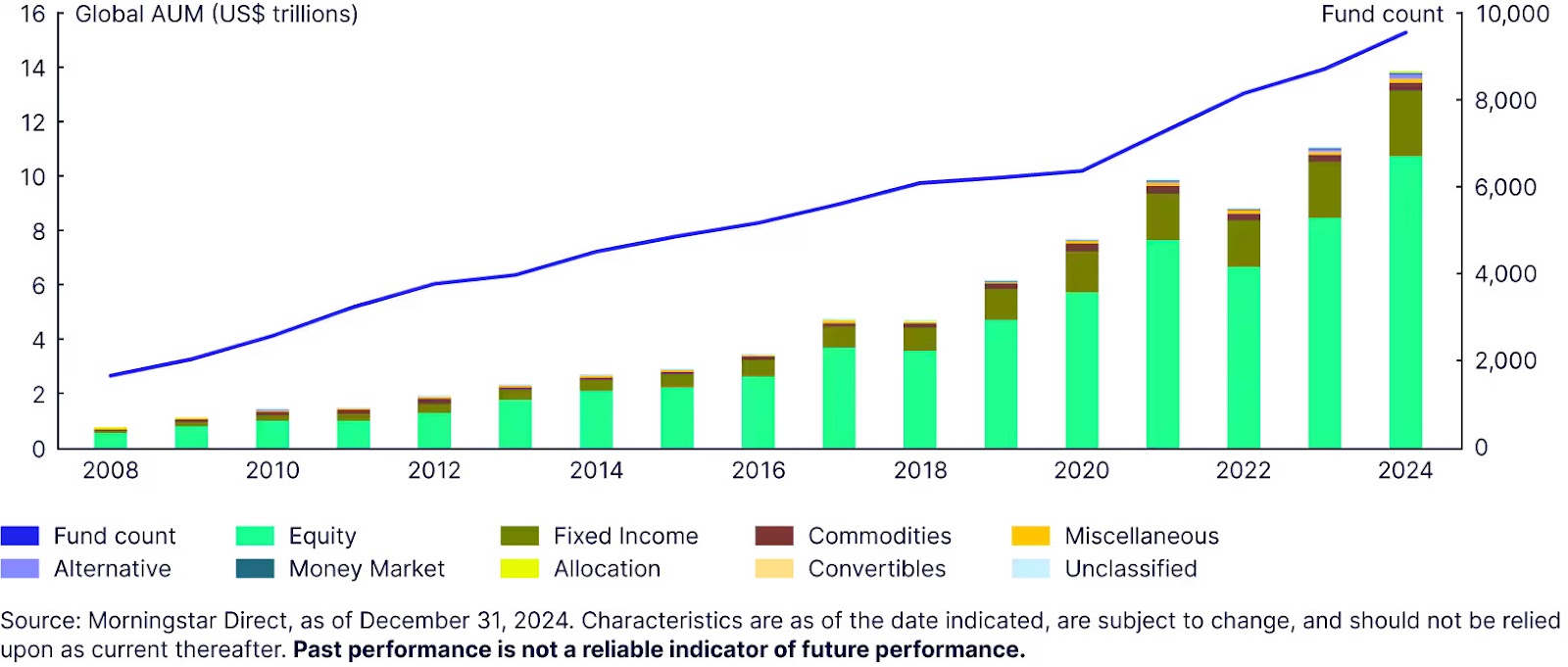

Evidence of ETF "Explosion" Post-401(k)Inclusion.

What are ETFs? ETFs (Exchange-Traded Funds) are investment vehicles that trade on stock exchanges and hold baskets of assets like stocks, bonds, or commodities. They offer low cost, transparency, and diversification, making them highly attractive in retirement portfolios.Growth After 401(k) Inclusion:

- Early 2000s: ETFs had less than $500B Assets Under Management (AUM) globally (still niche).

- 2014: ETFs represented a large 16% of retirement plan allocations.

- 2023: Global ETF assets hit $11T, growing nearly 20% CAGR since 2008.

- 2025: ETF AUM crosses $15T, with retirement accounts among the largest and most consistent buyers.

Overall Growth: From just shy of $500B in early 2000s to $15T in 2025 is a mammoth 30x growth (15–20% CAGR) post-401(k) inclusion.

Commodities, Foreign Equities, and Bonds

To improve diversification, 401(k) portfolios expanded into bonds, international stocks, and commodities alongside U.S. equities. Bonds became the anchor of conservative allocations, delivering steady 3–5% returns with low volatility. International stocks offered 6–9% returns and reduced reliance on U.S. markets, while commodities, though smaller, provided 4–7% returns and protection against inflation.By 2025, U.S. bond funds grew from under $1 trillion in the 1990s to over $5 trillion, international equities expanded past $2.5 trillion, and commodities rose from under $100 billion to $500 billion. Together, they added stability, diversification, and inflation protection to 401(k) portfolios, complementing the growth engines of equities, REITs, and ETFs.

How Bitcoin Exposure Works for 401(k)

Most 401(k) plans initially will offer Bitcoin and Ethereum through spot ETFs, such as BlackRock's iShares Bitcoin Trust (IBIT). These ETFs hold Bitcoin directly and aim to track its market price, allowing participants to gain exposure without managing private keys or wallets.

Why 401(k) Adoption Matters

When new investments are added to 401(k) plans, demand usually rises, often pushing the asset class valuations way higher in the following years and decades. With Bitcoin now part of 401(k)s:- More passive investors buying will lead to higher prices (around $9t).

- Higher prices means more institutional interest.

- More interest leads to even more buying and the inevitable supply shock.

- Less volatility and selling pressure because retirement funds typically invest very long-term.

Cryptonary's Take: The Bigger Picture

This is a historic moment for crypto adoption. Like REITs and ETFs before it, cryptocurrencies are entering mainstream portfolios. Institutional flows from passive investors will likely push the industry higher and stabilise the market over time.The crypto sector had a long period of isolation from mainstream finance, but now it is being integrated into the American retirement system. Like ETFs and real estate investment trusts (REITs), Bitcoin (some other crypto assets as well) has evolved from a fledgling concept to a fully fledged financial institution.

The inclusion of BTC and other crypto assets in 401(k) plans is the clearest sign that the US is starting to embrace digital assets. Everyone from traders and techies to firefighters, nurses, and manufacturing workers are now part of it. It affects every pay cheque, every savings account, and every retirement plan.

Significant consequences follow:

- It's inevitable that institutional injections will alter market dynamics. This cryptocurrency's volatility may go down as its user base grows. The concept of "internet money" is now widely accepted.

- This is the biggest on-ramp Bitcoin's ever had. For the first time, crypto could sit next to S&P index funds in grandma's retirement account. Wall Street giants like BlackRock and Apollo will be drooling over the inflows, and crypto asset managers just got handed a direct pipeline to sticky, long-term capital.

Peace!