Portfolio Allocation: How to Grow from $0 to $1M+

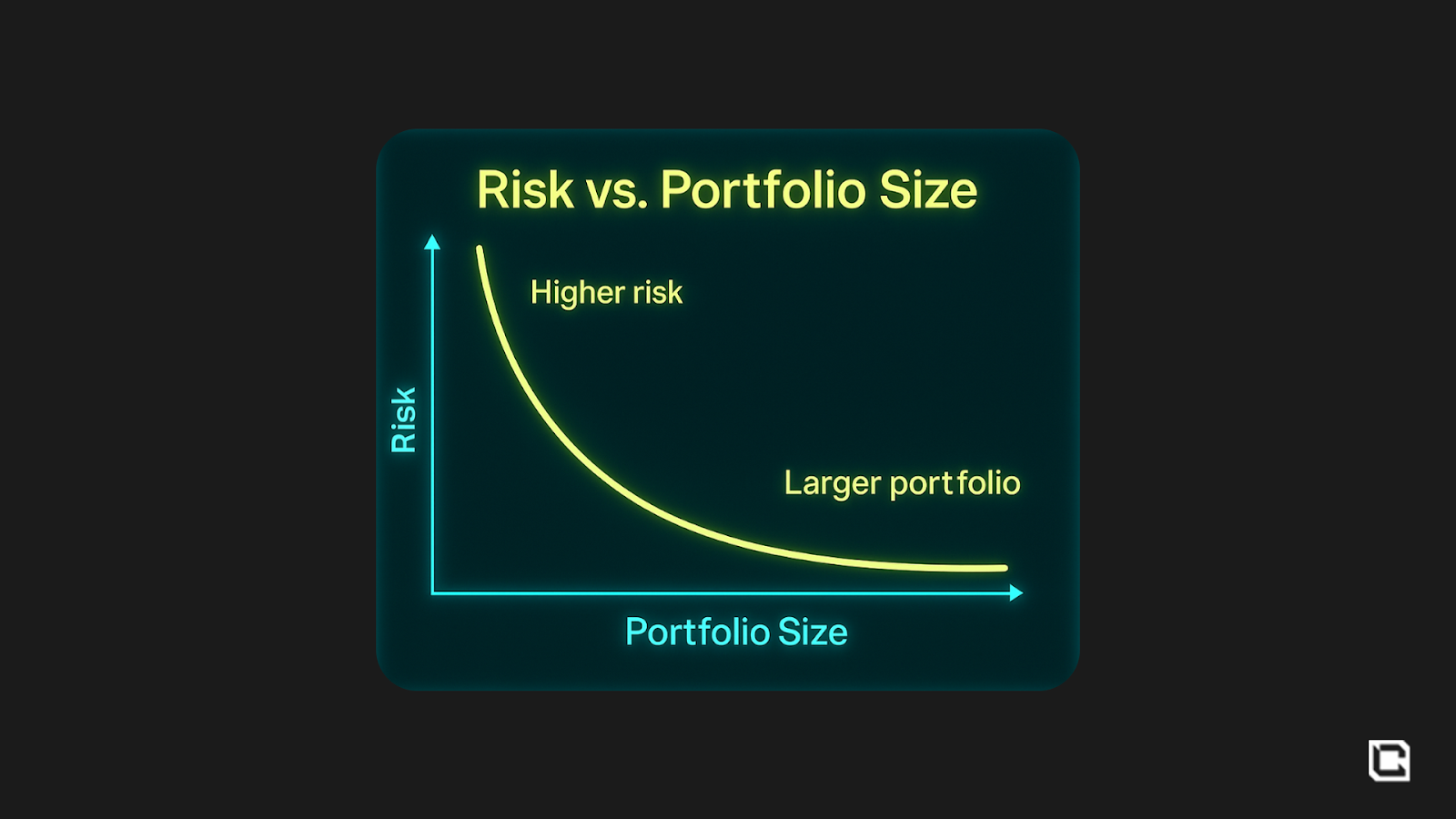

The structure of your portfolio should always reflect the size of your portfolio. Smaller accounts benefit from volatility and asymmetric bets, while larger accounts require stability, protection, and discipline. Making money and keeping money are two completely different skills, and each one demands a different approach. This guide breaks down when to take risk, when to pull back, and how your allocation should evolve as your capital grows. Let’s dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Background

A tiered approach to risk based on portfolio size

Crypto rewards different behaviors at different stages of the journey. Smaller accounts need volatility to grow, while larger accounts need protection to survive. Treating those stages the same is how portfolios blow up. The size of your capital should dictate the structure of your strategy, and the purpose of this framework is to make that distinction clear.

The recent price action has made this more obvious than ever. We moved from roughly $125k at the highs to the low $80k range in a matter of weeks. Drawdowns like this feel brutal in real time, but they serve a purpose. They reveal whether your approach is grounded in principles or driven by emotion.

This is the point in the cycle where fundamentals matter. Confidence is effortless when everything is trending up, but discipline becomes real when the market forces you to confront your decisions. Thinking in terms of risk management and long term structure is never the exciting part, but it is the only way to stay in the game long enough to benefit from future cycles.

This guide is designed to prevent that outcome. It gives you a framework that evolves with your capital, helping you capture upside when you are small and protect wealth when you are large. It is the playbook for navigating the journey from $0 to $1M and beyond

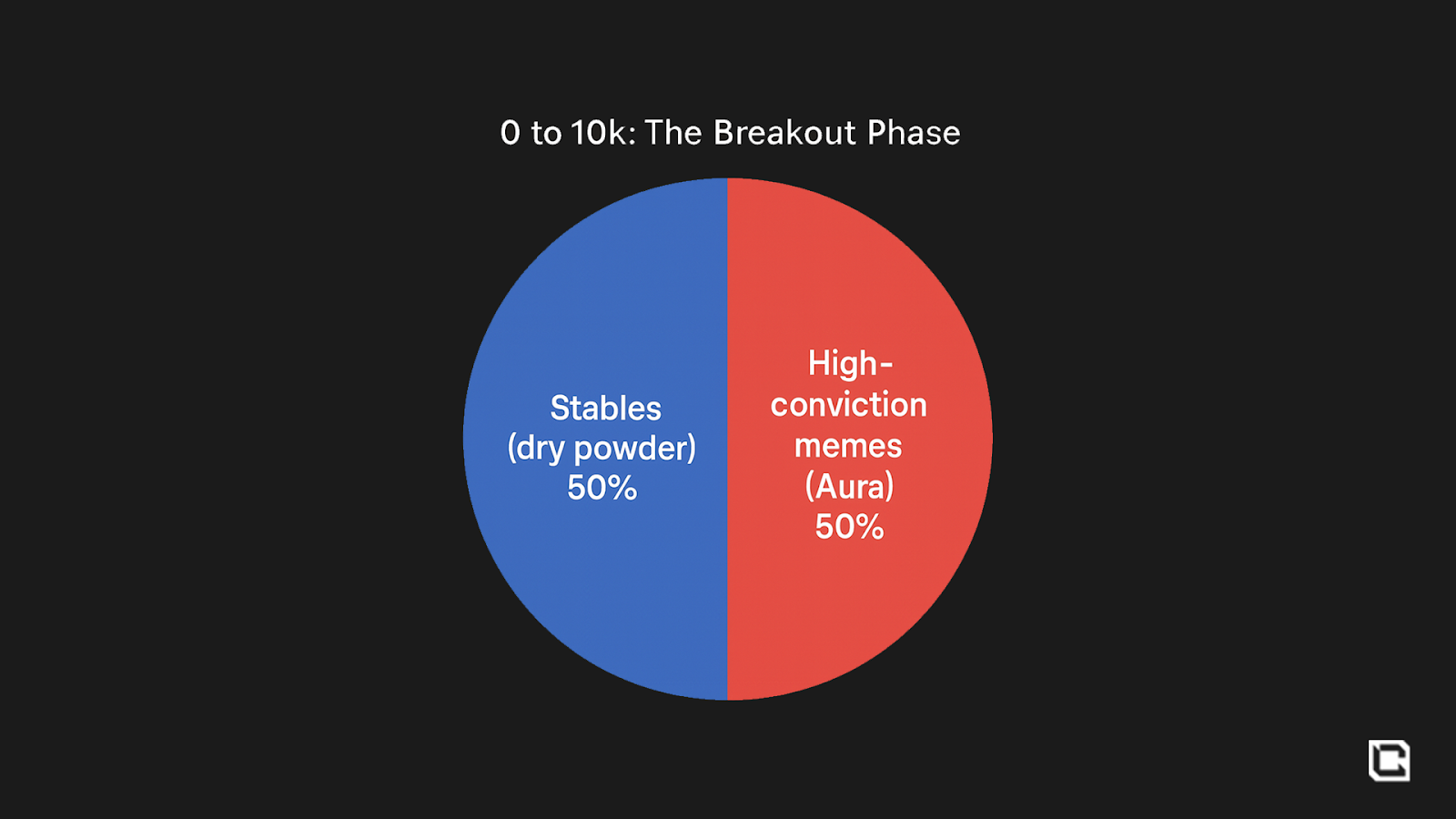

$0 to $10k: The Breakout Phase

This is the hardest stage in all of crypto. The $0–$10k range is where most people stay trapped for years because they either take the wrong kind of risk or avoid taking any real risk at all. The mission at this level is straightforward. You need to escape this bracket as quickly as possible, because nothing meaningful happens until you do. Playing safe at this size is a guaranteed way to stall out.

A BTC allocation will not move your life forward from here, and the same applies to SOL and even HYPE. A 2–3x return on a small account barely shifts your position, and you simply do not have enough capital for slow compounding to matter. This stage is defined by asymmetric upside. The only bets worth taking are the ones that can actually change your trajectory. You are operating with a growth mindset, not a preservation mindset.

You also need to stay grounded in reality. Even with perfect discipline, you will always face a very real chance of getting wiped out on a timing mistake or a narrative rotation. This is why having a real-world income stream is absolutely essential. A recurring paycheck gives you durability and allows you to recover from losses without resetting your entire journey. If a position fails, fresh capital gives you new attempts, new flexibility, and new ways to re-enter the market. Without a reliable income source, one misstep can end everything. With one, mistakes become lessons you can recover from rather than failures that take you out of the game.

At this stage, your portfolio should not be diversified. It should be focused and conviction-driven. Half of your capital should be allocated to high-conviction memes or other high-risk, high-reward plays.

The remaining half belongs in stablecoins, not for comfort but for flexibility. Stables let you average down when your thesis is right but your timing is off. They let you rotate into new opportunities the moment they appear instead of watching them pass by.

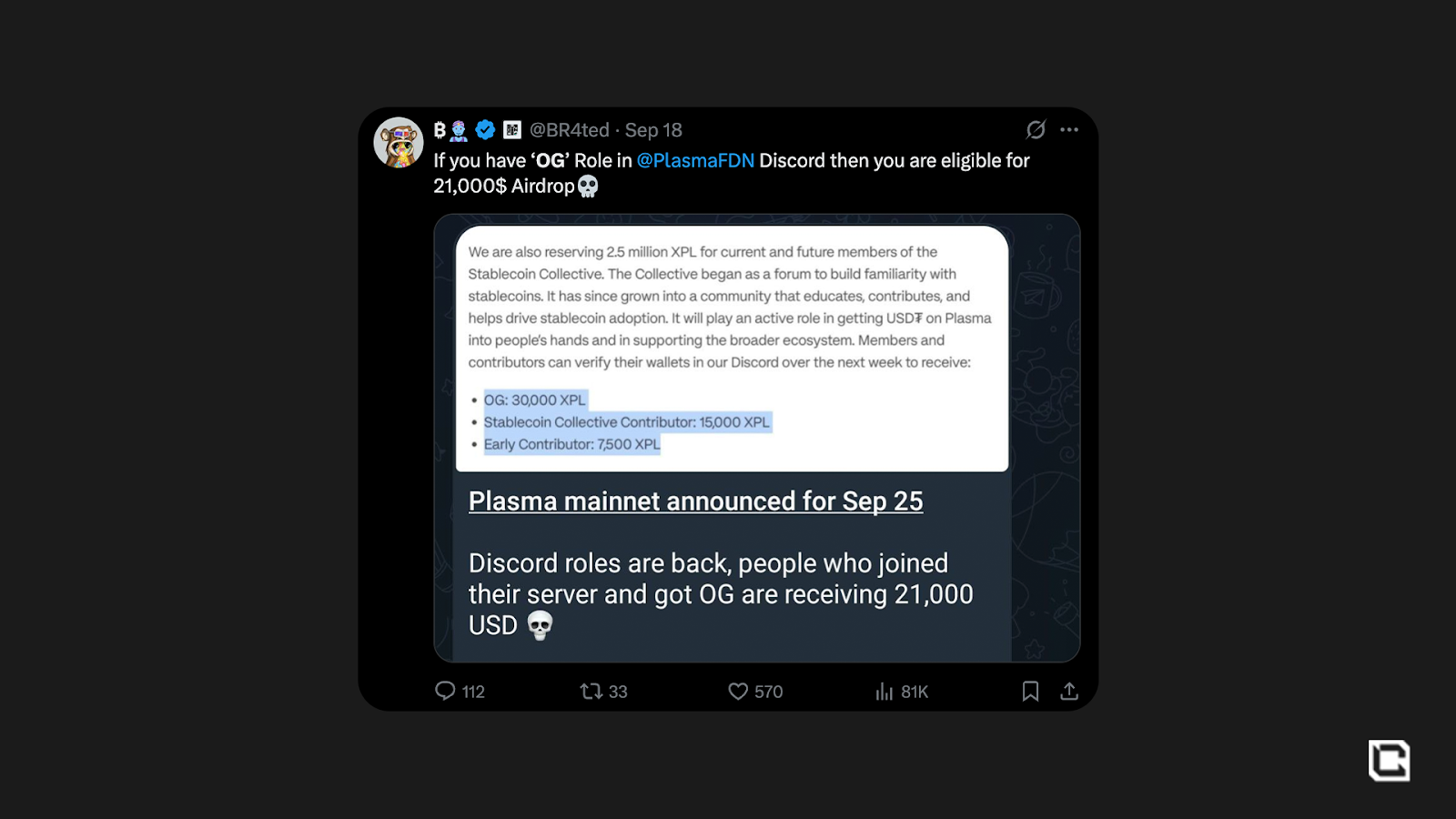

If you want the fastest possible route out of the $0–$10k range, you should be taking advantage of every zero-cost opportunity available. Discord roles have been one of the most reliable free money sources this cycle. Plasma paid $20k to holders of the OG role, and both Eclipse and Succinct issued meaningful allocations to early community members. These roles require nothing besides your time, yet they can push you to 5 figures before you ever place a serious trade. Skipping them is a costly mistake.

If you want to take it even further, start talking about high-quality pre-TGE projects. Many ecosystems, especially those indexed by Kaito, reward early content creators with token allocations at launch. Most newcomers ignore this because they assume you need followers. You do not. You just need to show up early, engage, and contribute.

The reality is simple. There are dozens of ways to make money in crypto if you put in the effort. This is not the phase where you pretend you are managing institutional capital. This is the phase where you claw your way out of the $0–$10k bracket by any means available. Once you break through it, everything changes. This is one of the most difficult parts of the entire journey, but if you can get out of it, the path to $100k and eventually $1M becomes significantly more achievable.

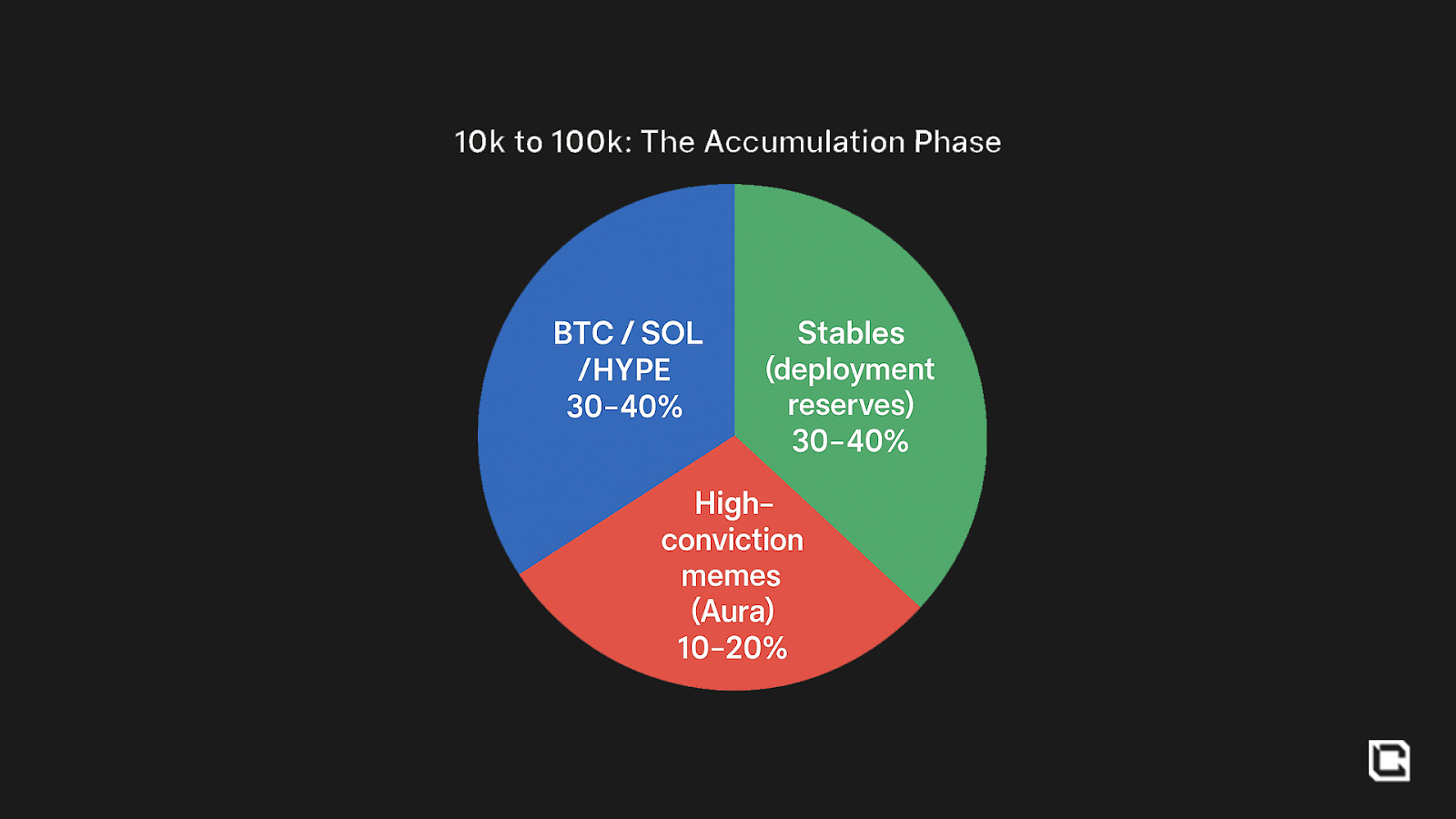

$10k to $100k: The Accumulation Phase

Crossing the $10k mark changes the entire game. You are no longer clawing your way out of the bottom with desperation, but you are still far from the safety of real wealth.

At this stage, your portfolio needs to blend stability with controlled aggression. You’re not abandoning volatility, but you aren’t treating every narrative like a lottery ticket anymore. This is where you introduce your first real core, the part of your allocation that can survive a correction without derailing the entire journey. Around 30 to 40 percent across BTC, SOL, and HYPE gives you durability while still keeping you exposed to long-term appreciation. These are the assets that support everything else you do.

A smaller 10 to 20 percent belongs in high-conviction memes with real culture, community, and upside. At this bracket, you can finally size into these plays in a way that matters without letting them dominate your risk profile.

Your stablecoin allocation should sit around 20 to 40 percent, but not for the sake of safety. These are your deployment reserves. This is the capital you rotate into dips, LP with, farm points, position into new incentives, or use to secure allocations in pre-TGE opportunities. Stables ensure you never miss an opportunity because you were fully deployed at the wrong moment.

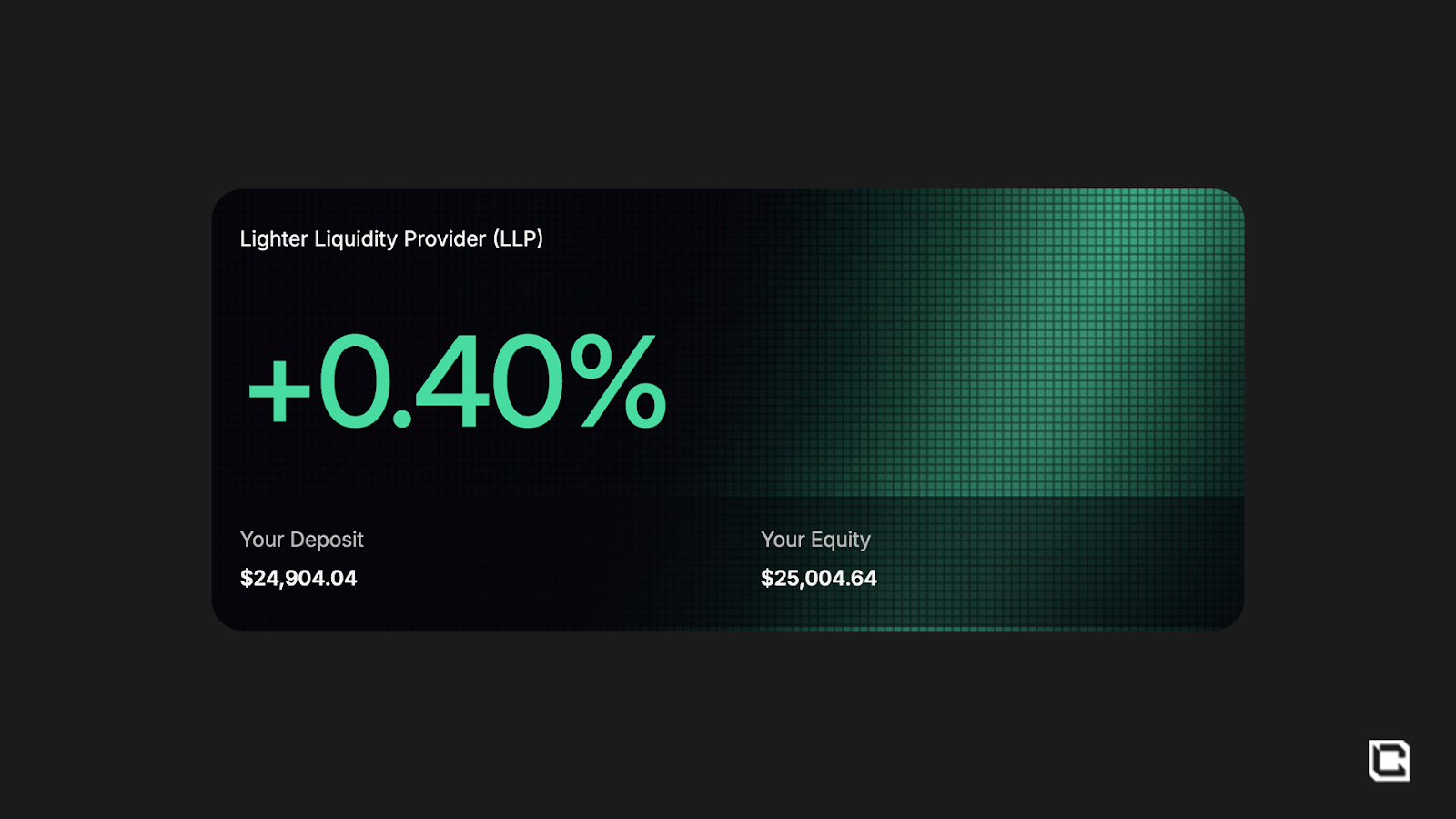

Here is what productive capital actually looks like: your SOL sits in Kamino earning yield while staying liquid. Your stables rotate between Hyperliquid, Lighter, Extended, Paradex, and Backpack farming perp incentives. Your BTC, SOL, and HYPE deploy across Hyperliquid EVM in vaults or liquidity pairs that generate points. Your meme exposure catches asymmetric upside.

This is also the first bracket where high-quality early-stage opportunities make sense. MegaETH’s ICO has already played out, but many are still ahead, and this is the first level where you can participate without risking your entire net worth. Allocations here can be genuinely portfolio altering.

Everything you earn, points, yield, tokens, incentives, should flow straight back into your core buckets. And the one rule you cannot break here is lifestyle discipline. Nothing destroys momentum between $10k and $100k faster than lifestyle drift. People get a little traction, feel smarter than they are, take undisciplined size, or start spending money they haven’t earned yet. The $10k–$60k zone is where most blowups happen because people start believing they’ve already made it. Keep your burn rate exactly where it was. Do not sabotage your own runway.

The path from $10k to $100k is built on controlled aggression and purposeful allocation. You build a core that gives your portfolio stability, expand into narratives with catalysts, farm airdrops with size, deploy stables with intention, and recycle rewards into the parts of your stack that actually scale. By the time you reach the upper end of this bracket, you’ll have the structure, flow, and momentum required to push into the next level, where real wealth building finally begins.

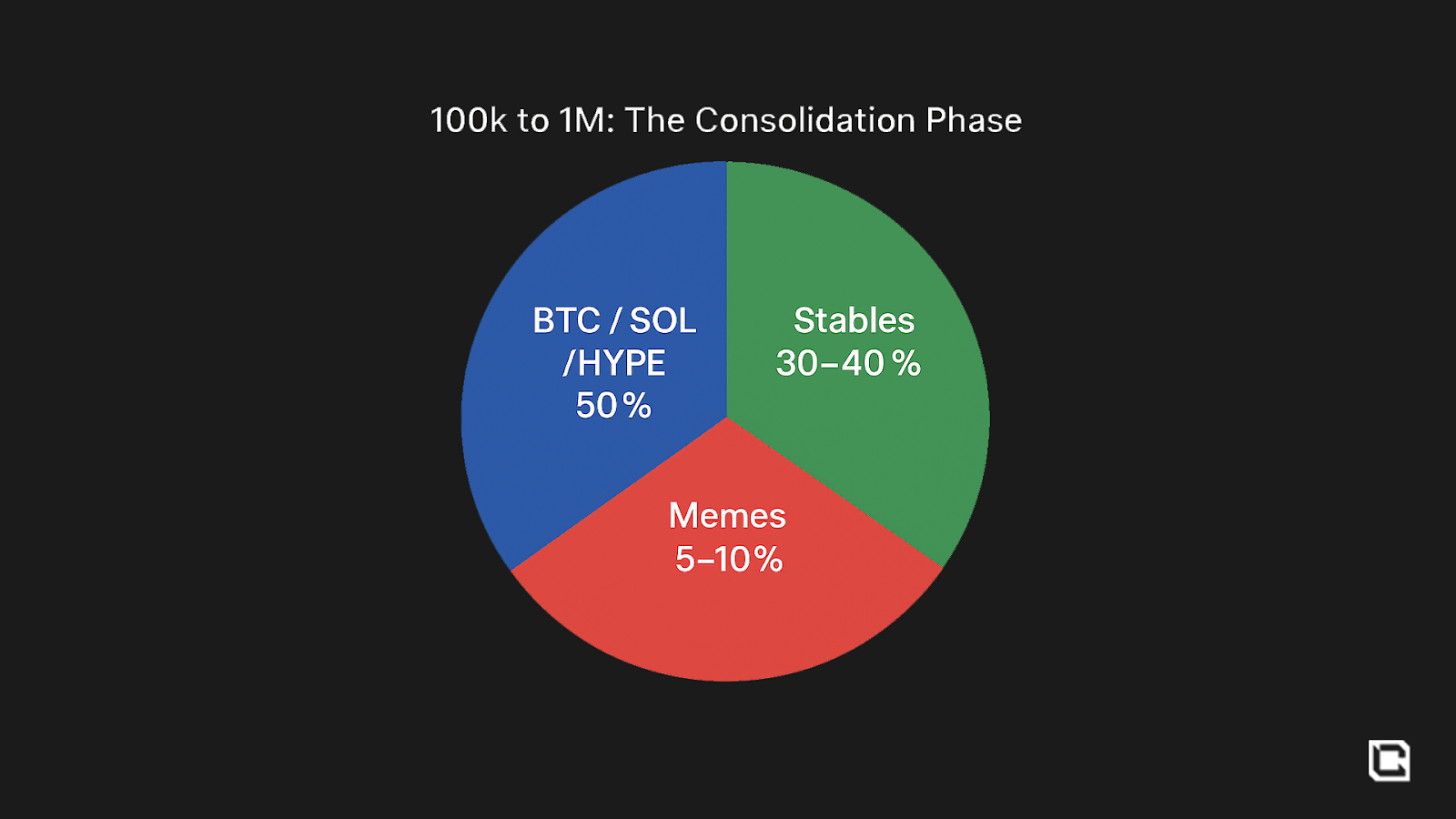

$100k to $1M: The Consolidation Phase

Once your portfolio crosses into the $100k–$1M range, the game changes again. You are no longer in survival mode, and you are no longer trying to escape the bottom. You have real capital now, and real capital behaves differently. Every decision carries more weight, every mistake hits harder, and every bit of complacency compounds against you. This bracket is where people either set themselves up for generational wealth or derail their progress entirely. They call it six-figure hell for a reason.

Six figures feels like money, and that illusion is exactly why most traders never reach 7. This is the stage where people start celebrating too early, loosening their discipline. The reality is that $100k is not wealth yet. But it is an opportunity.

Most people at $100k start acting like they have $1M. They loosen their position sizing. They start taking lower-conviction plays because “it is only $5k.” They increase their lifestyle spend because they finally feel ahead. This is how you stay at $150k for two years instead of reaching $500k in one. The only thing that changes between $100k and $1M is discipline.

Your allocation now needs to shift toward structure without abandoning the asymmetry that got you here. Roughly half of your portfolio should sit in assets designed to hold value through volatility. BTC, SOL, and HYPE form the core here. This doesn’t mean you abandon growth. These assets give you durability without eliminating upside, and their strength compounds quietly in the background while you deploy the rest of your capital with intent.

Your structure now becomes more intentional. Roughly 50% of your allocation should be in your core: BTC, SOL, and HYPE. They anchor your stability, but they are also the assets you will deploy across Hyperliquid EVM, Solana DeFi, liquid staking protocols, and ecosystem rotations that reward real participation. This is the bracket where your size finally amplifies the rewards for being active.

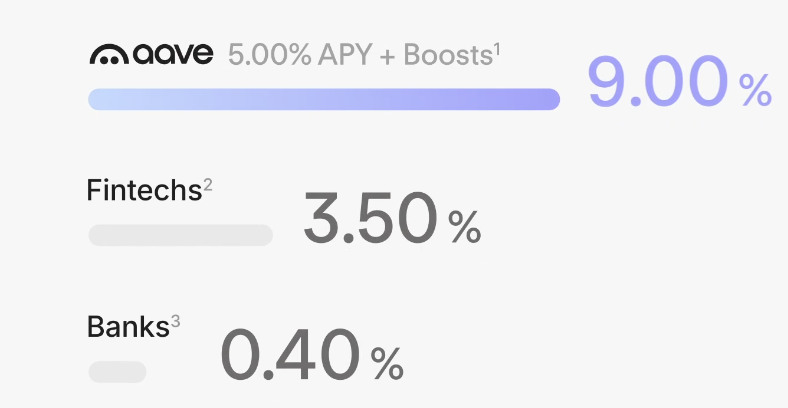

A 30–40% allocation to stablecoins becomes one of the most important levers in this phase. Earlier in your journey, stables existed purely for mobility. Now they serve a second purpose: protection. This is the capital that keeps you safe while still working for you. It should be earning passive income in places like Kamino, AAVE, stable LPs, or conservative DeFi strategies, always positioned to be deployed if a cleaner, higher-reward setup appears. Your goal is to let stables compound quietly in the background while still being able to strike fast when the market hands you an asymmetric entry.

And as you approach the upper end of this bracket, the purpose of your stables becomes even more strategic. This is the stage where you begin thinking about risk reduction and profit preservation. If the market is extended, if narratives are overheated, or if your core positions have rallied far above your average, this is where trimming becomes rational. The goal is not to “sell the top,” but to protect yourself from giving back months of progress in a single correction.

Most of the principles from the $10k–$100k phase still apply, but with greater seriousness. You should continue farming airdrops, working ecosystems, rotating between incentives, and using your core assets to generate yield, points, or unlocks. The difference is that at this level, the returns finally scale. Airdrops go from a few thousand to 5 figures. Catalyst rotations start to matter. Your size creates momentum if deployed correctly.

Your only real enemy here is lifestyle creep. This is the bracket where people start spending, relaxing, and letting emotions seep into decisions. Keep your expenses the same. Keep your hunger the same. Treat $100k exactly like $10k and you will reach $1M far sooner than you expect.

If you execute this phase properly, your portfolio will start to feel different. You will still experience setbacks, but they will no longer feel terminal. You will feel momentum building. And once you reach the upper end of this bracket, you will have the structure, the consistency, and the flow required to push into the final stage, where wealth transitions from something you chase to something you defend.

This is the bracket where allocation decisions become more nuanced, when to rotate, when to protect, when to deploy. We have been tracking crypto markets for 8 years across three full cycles and developed proprietary intelligence frameworks that analyze these patterns.

We are now offering Portfolio Intelligence to select clients: comprehensive research, market context, and strategic analysis tailored to your portfolio size and risk profile. This is not investment advice, it is institutional-grade intelligence to inform your own decisions. Reach out if this stage applies to you.

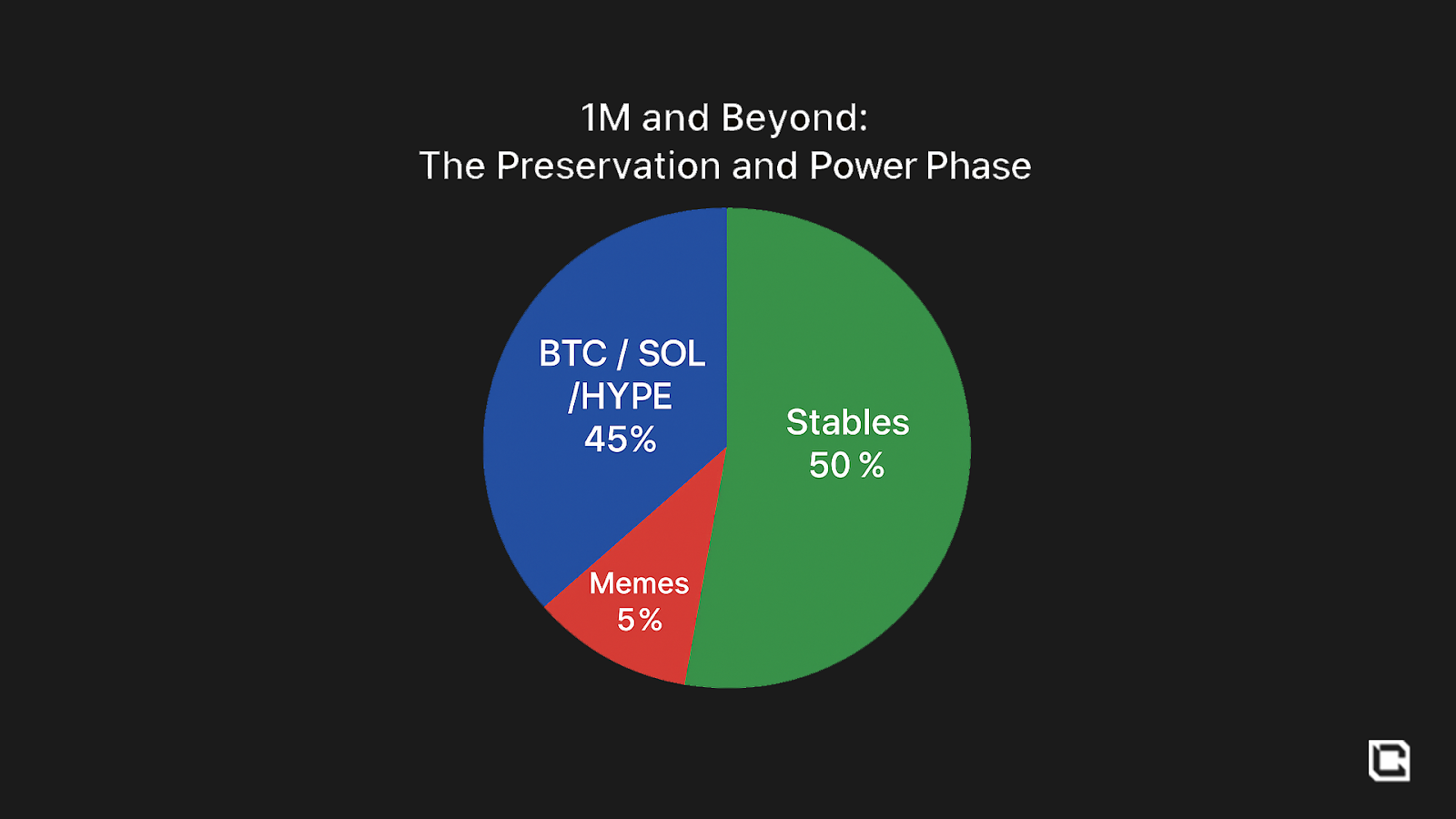

$1M and Beyond: The Preservation and Power Phase

Crossing into the seven-figure bracket changes everything. You have entered the stage where capital preservation becomes more important than raw upside. This is where most traders fail because the rules shift and the old playbook stops working. You are not rewarded for aggression anymore but you are rewarded for control.

Risk becomes real at this level. A 10% drawdown is a six-figure loss. Market volatility that barely registered when your account was small now affects you in ways that can take months to recover from. A position that would have been harmless with a smaller bankroll can create genuine setbacks. Every decision carries more weight because of the financial impact of being wrong.

Your allocation has to evolve to match this reality. A large percentage of your portfolio should sit in durable, liquidity-rich assets and protocols that have proven themselves across multiple cycles. BTC, SOL, and HYPE still anchor your core, but the weighting becomes dynamic and dictated by the current market environment.

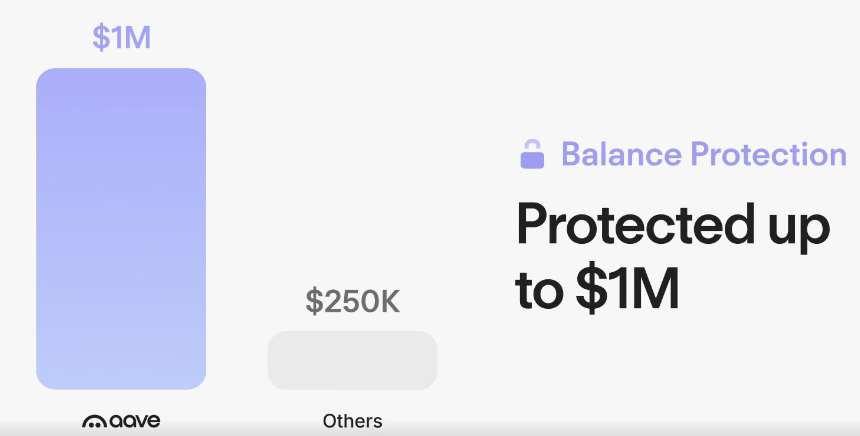

This is where battle-tested infrastructure becomes essential. Exposure to proven systems like Aave, Maker, Lido, and conservative liquid staking products gives your portfolio structural strength. These positions are built for durability rather than excitement, and they ensure that your base remains intact regardless of what the market throws at you.

Stablecoins now serve a deeper purpose. They are now a protective layer around your wealth. A significant portion should be allocated to high-quality yield strategies such as insured lending markets, conservative LP positions, and unlevered stablecoin protocols that have shown resilience through volatility. Your stables should reduce variance, generate predictable income, and give you the breathing room to make decisions from a position of logic instead of pressure.

The exact ratio between core assets and stables becomes cycle-dependent. A neutral posture sits around 45% in BTC, SOL, HYPE, and related core assets, and 45% in stablecoins earning conservative yield. In highly favorable market conditions, this can lean more aggressive. Up to 70% in core assets and 30% in stables allows you to capture upside while still retaining a meaningful buffer. In hostile or uncertain environments, that ratio flips. You reduce core exposure and operate closer to 20% in BTC and ecosystem positions with 80% in stablecoins. Preservation becomes the focus when the market is unstable.

Your highest-risk bucket shrinks to the smallest it has ever been. The absolute maximum exposure to early projects, emerging narratives, or high-conviction memes should be around 5%–7%. At this scale, even a small allocation can still produce meaningful results. You maintain optionality without putting the foundation of your wealth at risk.

Diversification beyond crypto also becomes a rational next step. Real estate, equities, private credit, or structured yield all begin to make sense when handled intelligently. This is also the point where changing your country of residence for tax optimization becomes a real, practical strategy. Jurisdiction becomes part of your allocation because tax efficiency compounds faster at seven figures than most trades ever will.

Security becomes a core part of your strategy: cold storage, hardware keys, multisig setups, and proper compartmentalization are no longer optional. One operational mistake can cost you everything you have ever worked for.

At this stage, yield also transforms from a bonus to a meaningful source of income. When deployed correctly, a large portion of your lifestyle can be funded from passive yield alone. Five to eight percent APY on seven figures provides freedom, stability, and emotional distance from the market. You no longer need to force trades. You no longer need to chase narratives. You can wait for the market to present clean opportunities because you already have momentum working in your favor.

Reaching $1M is proof that you have reached a level many never touch. Very few people make it this far, and even fewer keep it. Capital at this scale gives you leverage, opportunity, and time, but it exposes you to an entirely different category of risk. Wealth disappears quickly when it is handled without intention. This stage is about discipline, protection, and understanding that you are managing something rare and difficult to recreate. Treat it with the respect it deserves and the path beyond seven figures opens naturally.

Cryptonary’s Take

The biggest mistake investors make is treating every phase of their journey the same. The truth is that your strategy must evolve as your capital evolves. Aggression matters when you are small. Discipline matters when you are mid-sized. Preservation becomes everything when you are large. Most market participants never understand this. They keep swinging like they are still at $3k, or they play safe like they already made it.What separates the traders who survive from the traders who get erased is not intelligence or luck. It is the ability to adjust as they progress with their portfolios. It is the willingness to build structure when it is required and take risk when it is justified. Good markets reward courage. Bad markets reward patience. The people who last learn to master both.

Respect the stage you are in. Build the structure that stage demands. And when the opportunity comes, because it always does, you’ll be in the position to act while everyone else is still recovering from their last mistake.

Cryptonary, OUT!