This week only: 23% Off + a 1-on-1 call with our experts. ⏰ : 1d 15h 4m 44s

Ladies and gentlemen, the time has come.Over the coming weeks, we will be diving deep into the most promising DeFi derivative protocols, considering their potential, investability and future.

These reports are really exciting to us. We cover every aspect of the protocol, giving you an outline of what we’re excited about, any concerns we have, and whether we personally would invest. Then, perhaps most importantly, we’ll cover what we want to see going forward – what would make us change our view, or reinforce it and see us double down.

TLDR

- Premia has a LOAD of value-add events in the coming months.

- Serious alpha leaks contained in this report, gathered from talks with the community and team members, and in-depth research.

- Need I say more? Let’s dig in…

What is Premia?

Now, you’ve all read our 5-part series on derivatives in crypto – haven’t you?Well, if, for some reason, you haven’t…

Before going any further, read Is This Sector Going to the Moon in 2022?, Don’t Lose The Option, 80% APY!? Is It Sustainable? and The $1 Quadrillion Bet.

Now that we’ve dealt with the slackers, let’s get to the good stuff.

Premia, as you know, is a DeFi option protocol. It allows users to provide liquidity to, or buy options from, a liquidity pool. Essentially, the platform performs as a mix between Deribit and Ribbon, except we think it does it all better.

In The $1 Quadrillion Bet., we discuss the battle between Dopex and Premia. Now, I haven’t delved into the depths of Dopex yet (that is the next report), however, I can say with some confidence that we have a winner.

Pssst, it’s Premia.

This is not set in stone, as you never know what you will uncover when diving deep, but I’ve discovered masses of alpha on Premia, and see no way Dopex could steal the crown.

Premia Bull Case

Community governed and decentralisation focused. Community first approach.

-

- Community put forward proposals and vote on all aspects of the protocol.

- Fully upgradeable contracts mean the protocol can improve and adapt to anything that may be required.

- All of this means Premia can slot perfectly into the future of structured products, and much more, coming in DeFi.

- If you don’t know what this is such a massive deal, read our Why Is DeFi So Damn Impressive? crypto school article.

- From the governance process, to their impressively comprehensive and honest analytics page.

- They are going to open-source all code needed for others to build on Premia, opening the door for many more to use Premia as their base layer.

- Premia offers a range of strike prices and expiry dates (unlike competitors) in an impressive and simple dApp, with much more coming in V3.

- It will include huge upgrades, Premia team state that it will ‘bring Premia in line with centralised exchanges’ – I would argue it could make Premia better.

- Full details of what it will include have not yet been released, but stop, limit and take-profit orders are expected, alongside Premia vaults, and LPs being able to choose the strike price and duration they wish to underwrite (and much more).

HUGE things coming up:

- vePREMIA details now released - switch taking place soon!

- 2 DOVs buidling the bear - expecting news on launch dates soon.

- V3 coming soon, date yet to be released.

- Launched on Fantom - Other chains to follow where there is demand.

vePREMIA

First on the list of upgrades to Premia is vePREMIA, due to come out in the next couple of months.Some of you may be familiar with ve-tokenomics, but for those that aren’t, here is a super-simplified explanation of how it will work:

- vePREMIA is the staked version of PREMIA. vePREMIA is locked for a period of time, decided by the staker. The longer they lock their PREMIA, the more fees, voting rights and other rewards they earn.

- vePREMIA gives the holder voting rights. These will allow holders to vote on which pools the PREMIA token emissions will go to. You can vote to have the pool you are in receive additional PREMIA rewards. This hopes to inspire a Curve wars type situation.

- TL:DR – Premia tokens locked up, bullish for price action.

I don’t want anyone turning up at my house saying “that’s not how it worked” or “you missed this out”. I will update you guys when they have released the details, and include a link here.

Got it? Good. Let’s be friends again…

Side note – Dopex are also doing a ve-tokenomics model. It will be interesting to see how these play out between both platforms.

Coming Soon to V2

In preparation for V3, Premia are upgrading aspects of V2 where possible.There will be yield-bearing pools that will use the collateral deposited to the pool to earn additional yield (it normally sits there until options are exercised). Starting by integrating yearn vaults for stablecoin collateral (used to underwrite puts) and a couple of different versions of staked ETH. The team are working on the contracts for this at the moment, and they are expected to be ready very soon.

The user experience will be improved throughout, including a dashboard detailing all updates since you last visited the platform (tied to your wallet). This is expected in the next few weeks.

V3

This is the big daddy of what’s coming up for Premia. Version 3 of the platform.

LPs will be able to select the strike price and duration of options they would like to sell (there will still be an option to have this done automatically for you), which will allow the DOVs building on top of Premia to directly connect with Premia’s pool liquidity (providing extra liquidity) and purchase options on the platform (as some DOV strategies may require purchasing options).

Options buyers will have a range of tools, likely including stop, limit and take profit orders. This is something that we haven’t seen in DeFi options before.

Premia vaults will be released, one of which we expect to have some form of delta-hedging, the other will look to take advantage of arbitrage opportunities. The form the vaults will take is unknown, as they have yet to share details, but we are very excited. Delta-hedging is an issue we are yet to see addressed in DeFi, and we think it’s a vital part of the puzzle.

Full details of what is coming in V3 will be covered in an article Premia are posting in the coming weeks! We will link it here when released.

But Max, What Does This Mean?

The Premia team state that V3 will bring DeFi options on par with their centralised counterparts. The user experience on Premia is already vastly better than Deribit and DeFi competitors, now think about what is possible with these extra features…In my opinion, this won’t bring Premia on par. This will make Premia better! For more details on why, check out our crypto school article Why Is DeFi So Damn Impressive?, and our article on DeFi Options Vaults.

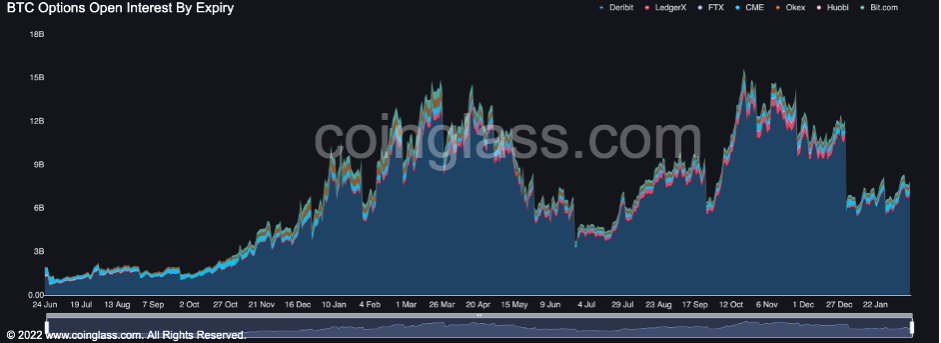

Remember this from ‘Don’t Lose The Option’?

Currently, Deribit accounts for around 88% of BTC options volume (above, dark blue = Deribit), and 96% of ETH.

Now, imagine Premia taking even a small % of that market share! MEGA BULLISH. This without considering the general shift we are seeing from CeFi to DeFi.

Expanding Chain and Asset Offering

Current Chains:

- Ethereum

- Arbitrum

- Fantom very soon…

Current Assets:

- Ethereum & Arbitrum:

- ETH

- BTC

- YFI

- LINK

- Ethereum only:

- LUNA

- ALCX

- alETH

As a side note, Neon Labs are working on making Solana Ethereum Virtual Machine (EVM) compatible. If there is demand, and Neon Labs succeed, Premia wouldn’t have any issue adding Solana to their arsenal.

There is an incentive for protocols to approach Premia for listings, as their POOL (Protocol Owned Options Liquidity) can form part of the protocol’s treasury management, without them having to pay the fees that other vaults charge for the service.

- Details on POOL at the end of this article.

DOV Funding and Integration

Liquidity is an issue that plagues DeFi option protocols, Hegic’s has been steadily dropping, Dopex has masses but can’t find demand to put it to use. Premia has kept relatively stable, but I couldn’t see how they were going to attract more liquidity, which will be needed when buyer demand comes knocking.

That was until I dug into V3 vaults, and found out they were funding not 1, but 2 DOV/structured product protocols, both building directly on top of Premia!

I strongly recommend clicking the links below and reading the proposals!

Vaults.Pro were granted 235,000 Euros to build an actively managed vault protocol, where anyone can design a strategy for others to deposit into. This democratises access to complicated and often high yielding strategies. It’s something others are working on, but it’s yet to be seen in practice.

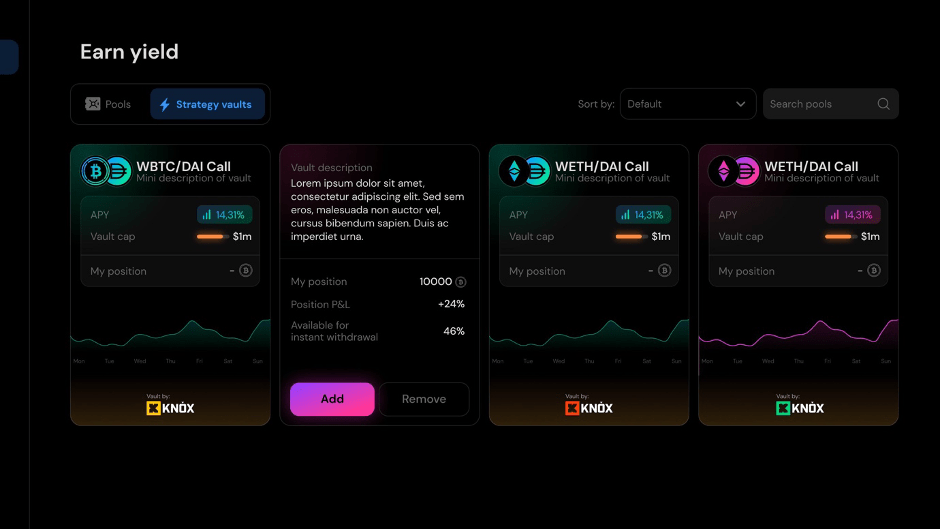

Fort Knox Vaults will receive $250,000 and 50,000 PREMIA to build a passive vault DOV protocol, similar to traditional DOVs such as Ribbon and Friktion. We expect to see the first version of Fort Knox Vaults live in around 2 months, and as far as I’m aware, it will be the 1st DOV protocol on Arbitrum.

Fort Knox Vaults will also distribute 20% of revenue back to Premia treasury (and there is discussion of having this go directly to PREMIA stakers).

As part of the agreement, both teams will be open-sourcing code needed for other protocols to easily build on top of Premia.

This is an absolute game-changer in my opinion, it unlocks massive potential, and secures Premia a spot in the future of DeFi, provided all goes to plan.Oh, and of course, these protocols built on top of Premia could one day decide to release tokens. If they do, there could be an opportunity there…

It Not All Sunshine and Rainbows

Yes, alas, I have to be a Debbie Downer (or Negative Nelly) for a moment.

Until V3 is released, these protocols won’t be able to add liquidity or buy options from Premia.

This is solved by V3, but I must add a cautionary note before we get too excited.

Fort Knox Vaults gives Premia exclusivity for 3 months, after which ‘strategies will become more complex and thus additional protocols will need to be utilised’. Vaults.Pro does not have an exclusivity clause.

I know the teams of both protocols are in close contact with Premia, and fully expect them to utilise Premia when V3 is released. However, we have yet to see Premia’s unique options pricing model used on a large scale, or with DOVs involved.

We will be keeping a close eye on Premia post Fort Knox and Vaults.Pro launch. Should the pricing model stand the test, this would give other protocols the green light to build atop Premia, and could open the flood gates.

If this goes pear-shaped, and issues arise (for example excess DOV liquidity isn’t matched by buy-side demand, and LPs on the protocols earn minimal returns for a sustained period of time), we will have to see how Premia address the issues.

If there are sustained issues, it is likely Vaults.Pro and Fort Knox would look to provide liquidity and buy options elsewhere.

The Premia team is a strong unit, and we often see teething issues in protocol growth. If issues arise, I’m confident they will iterate and address them, but this is something we will be keeping an eye on.

Upgradeability

Below is a quote from the Premia docs:“Option markets are hard to predict — indeed, the future is hard to predict. For this reason, the Premia contracts, including the liquidity pools, are fully upgradeable. New third-party integrations, gas optimizations resulting from new EVM features, and other unforeseen opportunities are all on the table. The upgrade process will be subject to extensive audit and approval by the Premia DAO.”

Updated Fee Structure

The 3% fee on options purchase remains, but the 3% exercise fee on profits has been scrapped. This was a sticking point for us, as it made the platform more expensive than others. We’re crying no tears for its loss.

Instead, they have introduced a 2.5% annualised utilisation fee, which will be paid by liquidity providers (LPs). This works out at around 0.2% per month the capital is being used, FAR less than the LP earns, and considerably lower than competing vaults charge.

Options Trading

Sell Back to Pool

An innovative addition, options buyers can now sell their options back to the pool, this allows them to benefit from the time value (extrinsic value – options worth more if expiry is further in the future), rather than just receiving the intrinsic value (asset current price -option strike price).LPs can opt-in to this, which will allow them to buy back options from the pool, freeing their capital for use or reinvestment. Essentially, LPs will act as market makers if they opt-in.

As the buyback price is calculated with 70% of the extrinsic value, this allows LPs to earn a spread every time, generating additional yield.

Auto Exercising – Protects LP Capital Efficiency

Options on Premia are automatically exercised 24 hours after expiry. This ensures options buyers get their returns, and LPs get their capital back so they can keep earning with it. A massive selling point vs Hegic, as if your options expire on Hegic without you exercising them, you lose any potential gains!Any Asset Purchasing

Users are able to purchase options or provide liquidity with any asset, directly on the Premia dApp (as long as there is DEX liquidity). The protocol swaps assets for them, and purchases the option or deposits liquidity, bundling all transactions into 1, saving on gas fees and removing layers of complexity.Pricing, Volatility Surface Oracles and Pool Utilisation

Premia options pricing is calculated fully on-chain (removing centralisation that we see among many competitors), using the ‘C-value’, a supply and demand-based pricing model, alongside Premia’s Volatility Surface Oracle. These get quite complex and are out of the scope of this report, but if you’d like to find out more check out Premia’s docs:- https://docs.premia.finance/pricing/option-pricing/the-pricing-model

- https://docs.premia.finance/pricing/implied-volatility/volatility-surface-oracle

- https://docs.premia.finance/pricing/capital-pricing-initial-liquidity-not-an-issue

If you’d like more details on how this works, feel free to DM me or the Cryptonary account on Discord!

Potential Issues

Oh look, Debbie Downer is back…

Like it or not, when assessing a protocol we have to play devil’s advocate and think about every possible situation. This is not a concern currently, but something to keep in mind.

As discussed earlier, we haven’t yet seen this pricing model tested on a large scale. We don’t know how it will behave when DOVs are integrated, or if a sustained spike in demand would drive customers elsewhere (due to high prices).

We also don’t know how this model will affect pool utilisation (the % of capital in the pools that is being used to underwrite options), as whilst independent to a certain extent, when utilisation holds above 50-60%, it is likely that Premia’s options will be priced higher than the rest of the market. In many markets, this won’t be an issue, as Premia is the only protocol selling those options, but in BTC and ETH markets, high pool utilisation may drive buyers elsewhere.

This gives us a bit of a catch 22 situation, where we want high pool utilisation as that benefits LPs (as the capital is used efficiently) which will bring more capital to the platform. But, having high utilisation would likely bring the C-value up, increasing option prices and potentially driving buyers elsewhere.

To an extent, this is by design, as it means there shouldn’t be excess demand the platform can’t cope with (disincentivising purchasing options when liquidity is low by increasing price), or excess liquidity sitting idle in the pools (incentivising purchasing options when liquidity is high by lowering prices).

Also, it allows buyers to get below-market priced options. With the new order styles in V3, users will be able to place orders that will be triggered when the option is priced below market. This is a great tool for buyers, allowing them to snatch up cheap options when available, and ensuring balanced supply and demand.

As this pricing model hasn’t been battle-tested, it is vital we keep a close eye on how it affects supply and demand on the protocol. For example, one thing we will be looking at is where pool utilisation naturally settles (the point at which buyers and sellers are matched). If that happens to be around 70% (for argument’s sake), how would that affect LPs capital efficiency? Is Premia a better option than competitors for LP returns? Are buyers happy with price at this level? That all needs to be taken into account.

Note, this is not a concern for us as it stands, and there are many tools that could be used to address issues if they arise, but it is important I run you through my logic.

Tokenomics / Vesting

- 30% Cross-Chain Liquidity Mining Fund

- 20% Development Fund

- 10% Safety / Insurance Module

- 10% Initial Distribution

- 10% Founder Allocation

- 10% Future Incentives Program

- 5% Marketing and Education Fund

- 5% Ecosystem Grants Fund

One thing for us to bear in mind in team vesting, 10% of the total supply, equal to the entire circulating supply at the moment, is set aside for the team. This is due to be released in around 1 year, which, if sold, could flood the market.

This is not a concern at the moment, firstly the team are interested in the success of the protocol, not a payday. However, in crypto, we should never rely on trust!

The team are expected to delay their token unlock, which we will be keeping an eye out for. If this doesn’t happen, we’ll consider what implications this could have closer to the time, and potentially hedge against potential downside should there be selling pressure.

Current Market Cap vs Fully Diluted Value – Should We Worry?

PREMIA circulating supply sits at just over 10.5m at the time of writing (4th April 2022), out of a total supply of 100m.I know that sounds scary, but don’t panic!

Inflation is relatively high at the moment, at around 1.5 PREMIA per Ethereum block, which works out at around 9,969 PREMIA per day, or 3,638,769 PREMIA per year. The tokens will be released over more than 10 years, so we won’t see a flood of tokens. Worth noting is that over the years, as more PREMIA is in circulation, the inflation rate will be reduced dramatically, as it is fixed (so the % would reduce relative to circulating supply).

At just over 3.5m PREMIA per year, that does give us an inflation rate of around 35%, not including team tokens or development grants/funds.

Whilst this is a high inflation rate, the current market cap and growth potential leave us feeling pretty zen.

In fact, there is a discussion amongst the community at the moment, considering the benefits of a token burn for excess supply. The team fully support this idea and will go with whatever the community decides.

48m tokens are set aside for development purposes, split in the following way:

- ~8M liquidity mining fund

- 20M development/growth fund

- 5M Marketing / Education fund

- 5M Ecosystem Grants fund

- 10M Future incentives program

If this doesn’t happen, we know those funds will go to good use improving the protocol, so it’s a win-win.

TL:DR of above – circulating supply vs fully diluted value (FDV) is not any major concern (despite FDV being around 10x current circulating supply). Low relative inflation rate and community decision making put our minds at ease.

What We’d Like To See

- Word is starting to spread about the protocol. Over the coming months, we want to see Premia marketing step up and generate some serious hype to match the impressive offering Premia is crafting. We’d like to see V3 hit the ground running, and Premia grow consistently from there.

- vePREMIA details, and performance in practice. We know the theory behind it, tokens get locked up for additional rewards and voting power, meaning more PREMIA is locked and number goes up. But as with any big change, we would need to monitor how this works in practice.

- Pricing model battle testing.

- DOV successful integration.

- Monitoring the impact the DOVs have will also be vital.

- V3 – we are yet to find out what will be involved, and the same as vePREMIA, we would want to see how this goes in practice

Technical Analysis

Before diving into the TA, note that we have looked at Premia’s fundamentals, and they are impressive. With a mid-long investment horizon, short term price action shouldn’t hold much weight.PREMIA, 1D time frame

Same as many other altcoins, PREMIA has experienced buying pressure due to BTC's recent run (from 37k up to 48k) but is now testing the $2.10 resistance level. The closest support is around $1, which can be considered a huge demand area for PREMIA. If PREMIA manages to break its previous high ($2.5) by a daily closure above it, then we would be looking at a possible reversal in market structure, from bearish to bullish. If that happens, then the next resistance area to look out for is around $3.5. Volume has been average for now, we want to see a strong break out above the $2.5 resistance, backed by high buying volume.

Conclusion

I’ve gone into a lot of detail above, so I’m going to keep this short and sweet…There is a succession of value-adding events, and the market hasn’t priced them in yet in my opinion. Premia is relatively under the radar at the moment, and I believe vePREMIA, DOV integration (and open-sourcing code for future integrations) and V3 are a superpowered catalyst. Should these changes be successfully implemented, PREMIA is primed and loaded for a stratospheric run.

Update Since Deep Dive Was Published (10/08/22)

Premia have recently launched on Optimism, adding to their arsenal of blockchains. They’re now live on Ethereum, Optimism, Arbitrum and Fantom.Premia DOV Funding

Premia funded 2 proposals for around $250k each, to build out DOVs that will directly integrate.Fort Knox is coming along nicely, we have seen the mock-up of their vaults which will be on Premia.

The Knox team told me they’re doing internal audits and integrations in preparation for an audit by veSoon.

Vaults.Pro progress is slower, with little publicly released. However, having spoken to the team, there seems to be a lot cooking up behind the scenes. We will check back in when more information becomes available.

V3

Premia held a community call on 17th June which had some interesting information on V3 – check it out here.The release has taken longer than anticipated, due to some unforeseen issues which are currently being resolved. We expect V3 live soon.

vePREMIA

Full details for vePREMIA have recently been released. It replaces the old staking model (xPREMIA), and means holders can now stake their PREMIA tokens and earn platform rewards on any chain (previously, only available on Ethereum mainnet).vePREMIA is used in governance voting, and, as with all ve-tokenomic models, the longer you lock the tokens for, the more rewards and voting power you receive. For full details, check out this article.