Premium Report: The Setup Everyone's Overlooking

We might've just found one of the cleanest trade setups in the market right now. A multi-billion dollar protocol quietly pivoted from passive yield to real-world utility, and the chart is finally catching up. Here's what you should know...

Everyone thought this protocol was just another restaking protocol. Then it rolled out a Visa card. Then it hit $11b in Total Value Locked (TVL). Then it started doing buybacks like a trader on tilt. Now it wants to become crypto's first neobank...

Is this the moment to front-run a potential supply squeeze before it is fully priced in? Let's dive in...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

How It Started And Why It's Winning Now

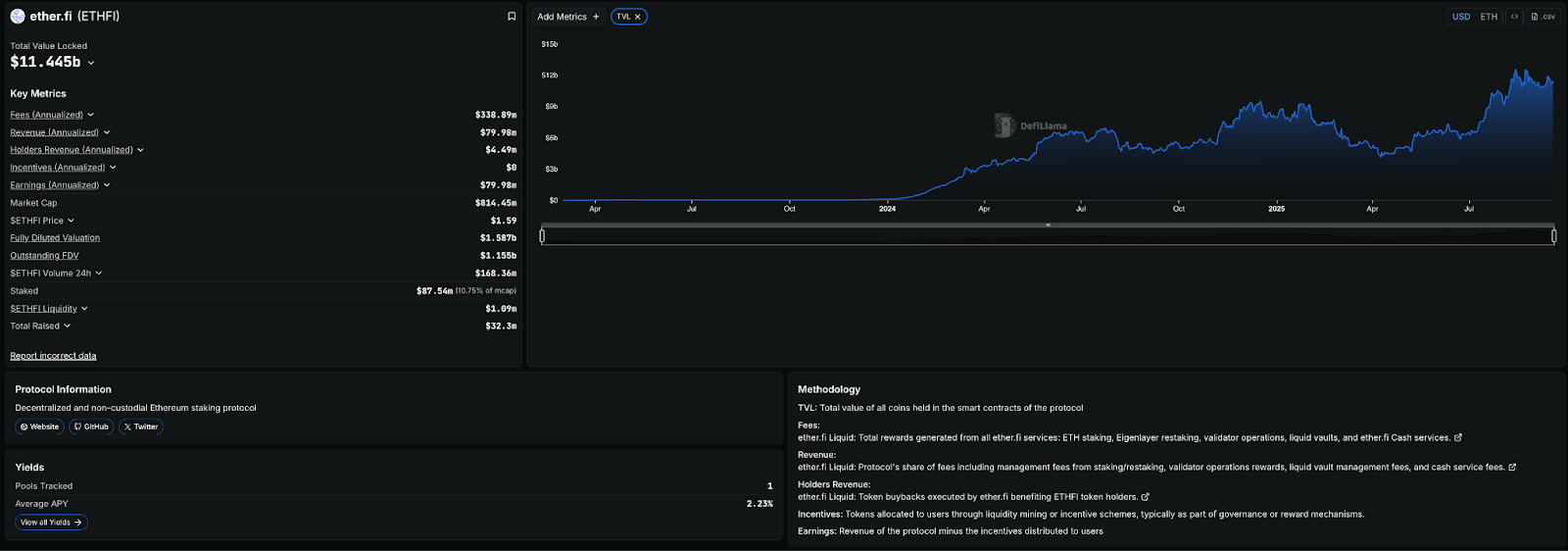

Ether.fi emerged in early 2023 at the inflection point of Ethereum's Shanghai upgrade, when withdrawals for staked ETH were first enabled and liquid staking protocols began to proliferate. Founded by Mike Silagadze, a Canadian entrepreneur and edtech veteran (previously CEO of Top Hat), Ether.fi has raised a total of $32.3 million from investors including CoinFund, Maelstrom, and North Island Ventures.

The protocol's first product was Ether.fan, an NFT collection backed by staked ETH that aimed to combine Ethereum decentralisation with a familiar collectible format. The launch was initially successful, minting out 3,000 NFTs and attracting more than 6,000 ETH in deposits. But momentum collapsed when OpenSea abruptly disabled listings in July 2023, citing concerns that wrapped staked ETH constituted a regulated financial product. Although Ether.fan remained tradable on smaller marketplaces, the episode cut off liquidity and stalled growth.

Rather than letting this setback define them, the team pivoted by expanding the model. They introduced liquid staking tokens like eETH and weETH, which maintained staking yields while enabling seamless composability across DeFi. These tokens could function as collateral, trade on decentralised exchanges, and integrate into structured yield strategies. This evolution represented the true turning point in Ether.fi's trajectory, elevating it from a niche-staking-NFT hybrid to a scalable platform spanning the broader DeFi ecosystem.

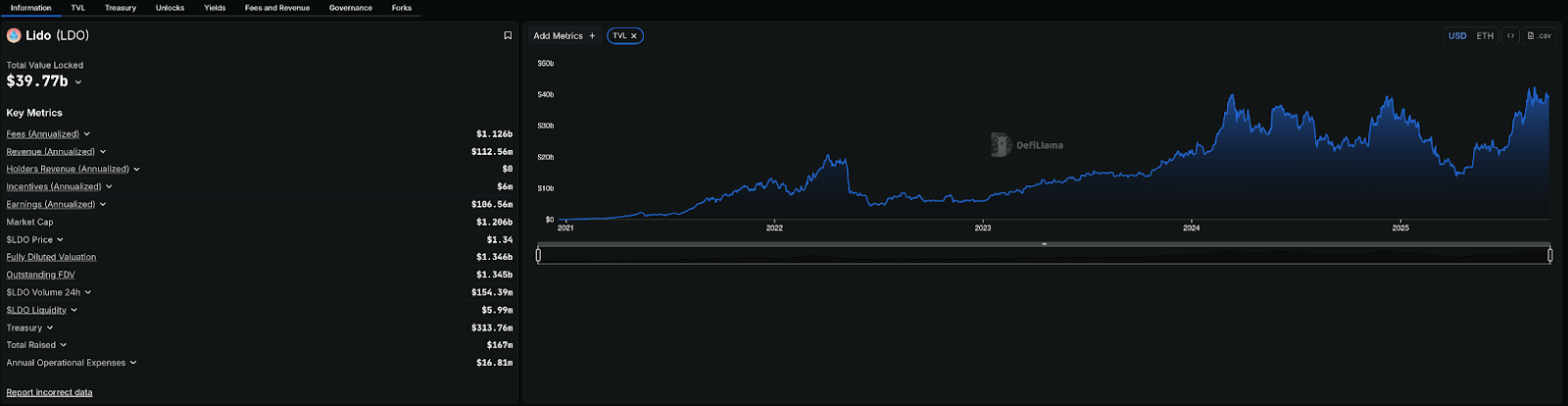

However, the competitive landscape has since intensified. Lido remains the incumbent, commanding more than $39 billion in staked ETH. Renzo has pursued a cross-chain strategy, introducing ezSOL on Solana with Jito and extending its footprint across multiple Ethereum layer 2s. Meanwhile, Swell has embedded itself in the Optimism Superchain to develop a restaking-focused Layer 2. Yet neither has achieved comparable levels of adoption, integrations, or product diversification.

Ether.fi today stands as the only credible challenger to Lido, with more than $11 billion in TVL, ranking second in the combined liquid staking and restaking sector. While direct comparisons are imperfect given Ether.fi's expansion into vaults and consumer-facing products, its breadth across assets, chains, and use cases explains why it has emerged as the breakout winner among restaking challengers.

Product Suite: From Staking to Spending

Ether.fi's offering is best understood as a three-layer stack: stake, grow, and spend.

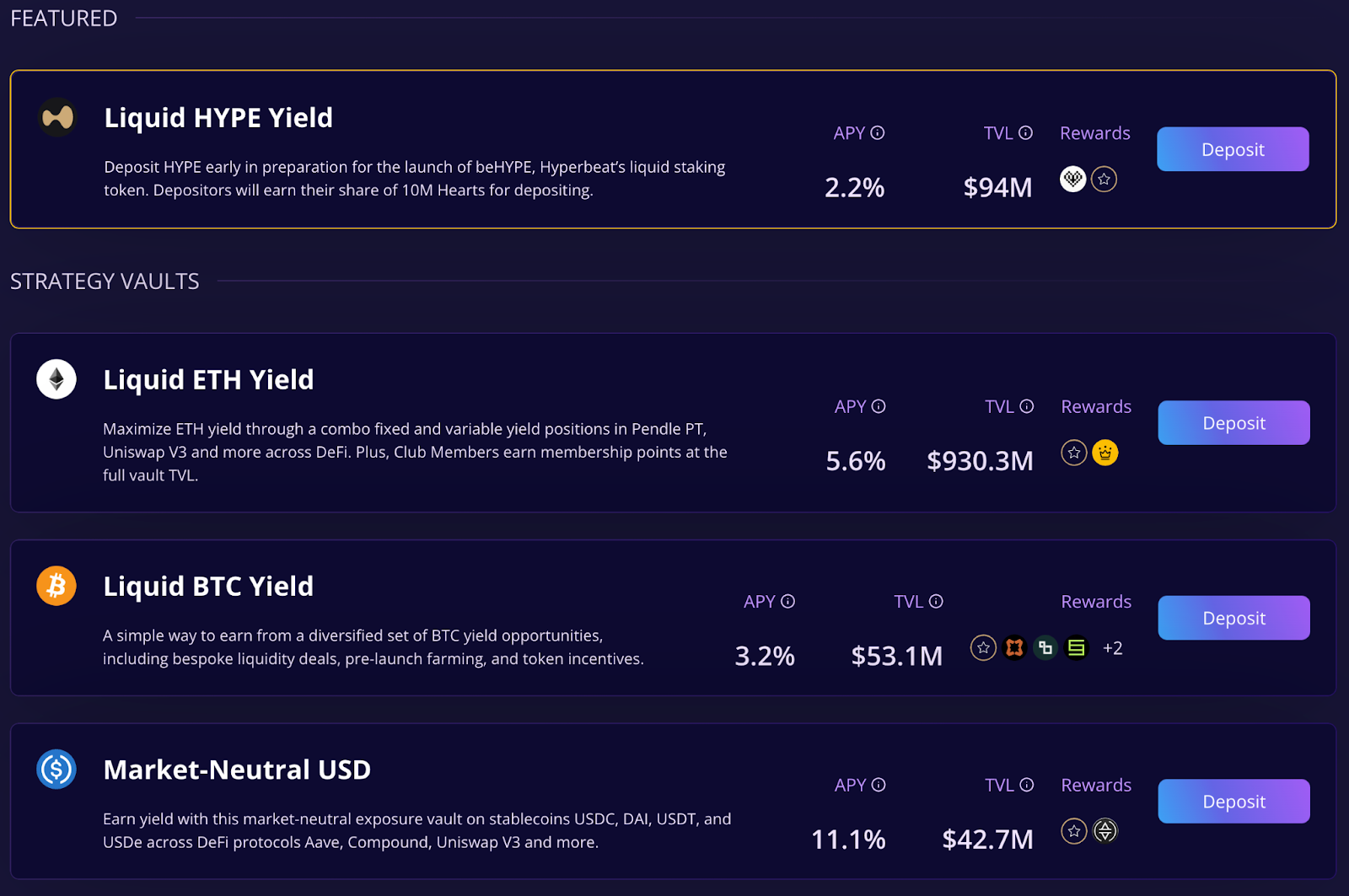

Staking and Restaking. Users can deposit ETH, BTC, or stablecoins to receive liquid tokens such as weETH, eBTC, or eUSD. These assets accrue staking rewards and, through EigenLayer, can be restaked to secure additional networks. This generates incremental yield while maintaining liquidity across DeFi protocols like Aave, Pendle, and Gearbox. Ether.fi's decision to support multiple chains has further broadened its reach, ensuring that eETH and its variants can circulate widely beyond Ethereum mainnet.

Vaults. Automated vault strategies deploy assets into yield opportunities across the ecosystem. They combine lending, liquidity provision, and structured products. One high-profile example is beHYPE, launched in partnership with Hyperbeat, which extends Ether.fi's model into liquid staking for HYPE. By layering these strategies on top of its ETH core, Ether.fi has positioned vaults as proof that restaking can scale into a genuinely multi-asset, cross-chain yield engine.

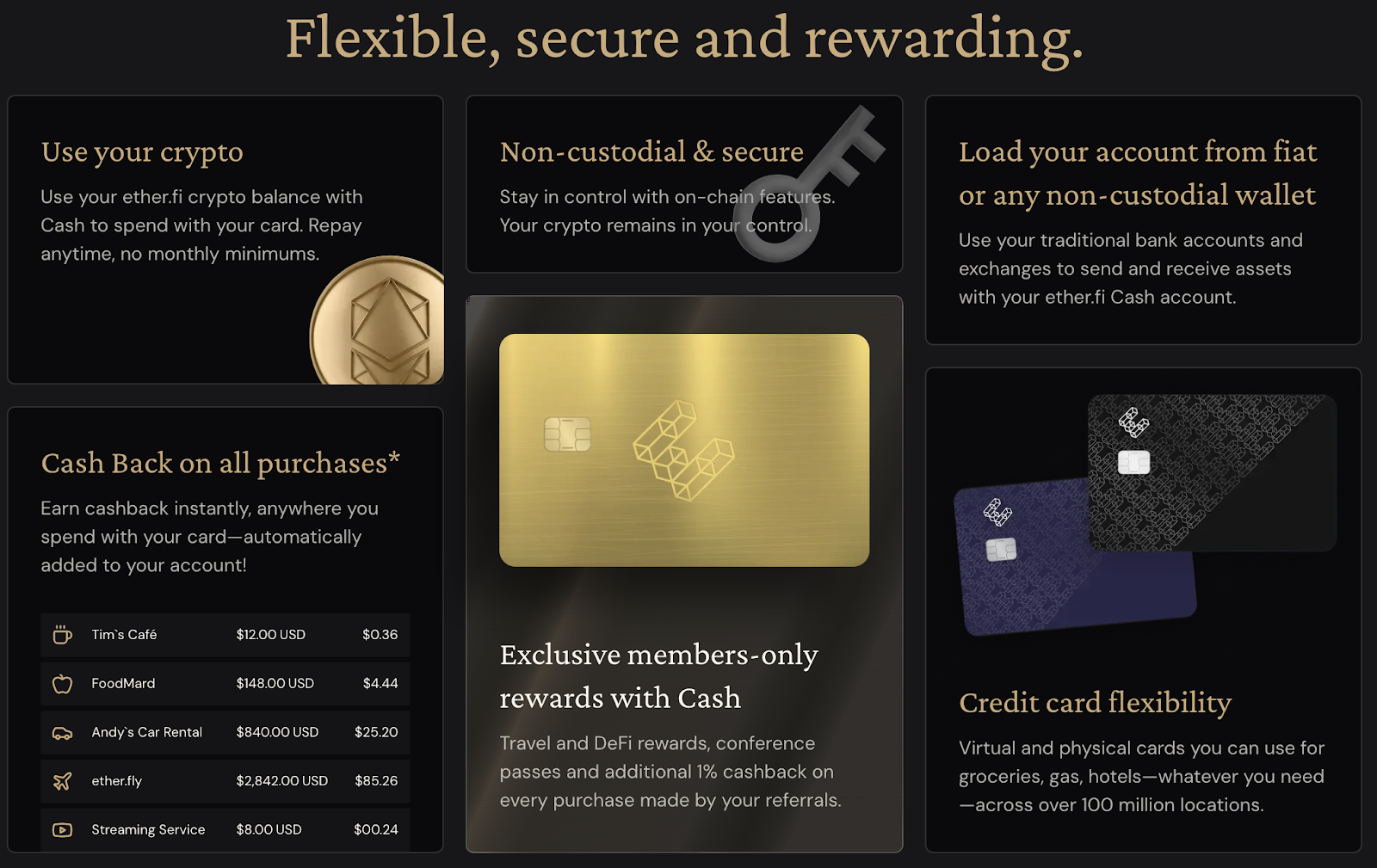

Cash and Visa Card. The Cash program is Ether.fi's defining leap from DeFi protocol to consumer-facing neobank. Users can link a Visa card directly to their vaults, spending against collateral without triggering a taxable event, or simply deposit stablecoins and continue to earn yield while transacting.

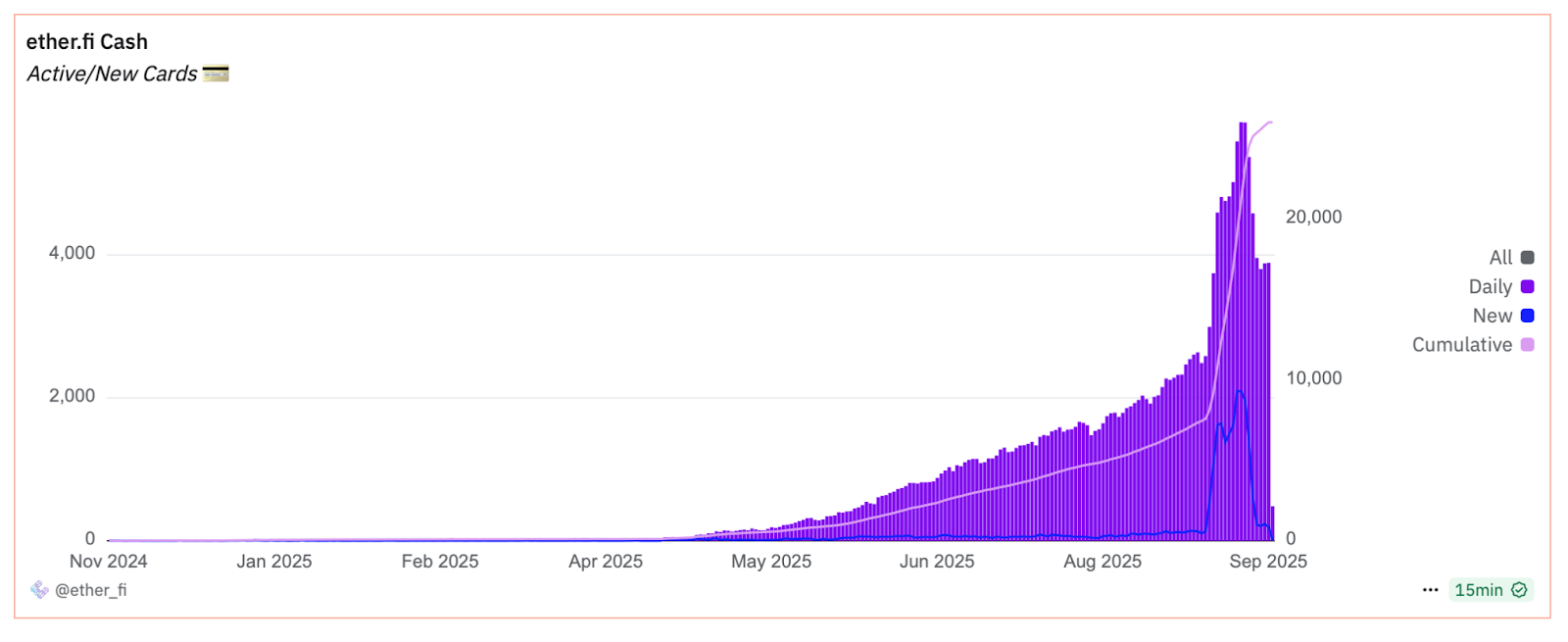

Adoption has been rapid and measurable: more than 26,000 cards issued, over half a million transactions processed, nearly $48 million in cumulative volume, and more than $2 million distributed in cashback rewards. Daily spend peaked near $10 million earlier this year, underscoring real-world traction rarely seen in DeFi. The card integrates seamlessly with Apple Pay and Google Pay, while loyalty is reinforced through "The Club," a tiered rewards system offering boosted yields, event access, travel perks, and luxury discounts.

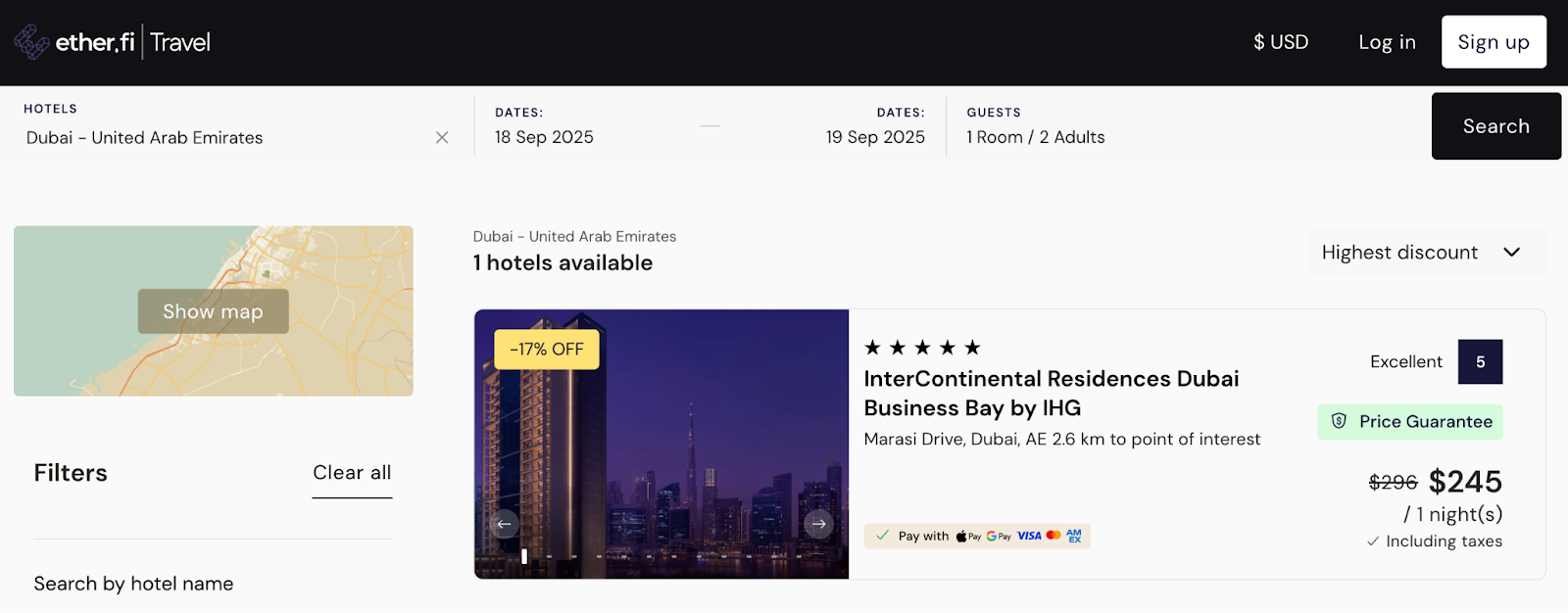

Travel and Loyalty. Ether.fi's partnership with Entravel extends the Cash card into the high-end travel market. Cardholders can book more than 100,000 hotels worldwide with discounts of up to 65 percent and an additional 5 percent cashback, directly linking on-chain yield to real-world spending. Loyalty is reinforced by ETHFI staking, which unlocks tiered benefits through "The Club," including reward multipliers, partner perks, and priority access to exclusive events.

Airdrops. Season 1 of the Ether.fi airdrop was a watershed moment in community alignment. Roughly 7.5 percent of total supply was distributed to early stakers, Ether.fan NFT holders, referrers, and badge earners, with vesting restrictions on whales to avoid concentration. Its scale and fairness distinguished it as one of the most successful token distributions of the cycle, cementing trust and deepening long-term user engagement.

The Flywheel. Staking generates yield, vaults optimise it, and the Cash card with travel integrations channels that yield into everyday spending. This creates a self-reinforcing loop of adoption and utility that few protocols in DeFi have ever managed to achieve.

Real-World Utility: Ether.fi Visa Access: As part of our coverage of Ether.fi's consumer adoption, readers can apply for the Ether.fi Cash Visa card. The card enables spending against collateral without triggering a taxable sale, integrates directly with DeFi vaults, and offers 3 percent cashback through December 2025. It is one of the clearest examples of DeFi translating into real-world utility.

Tokenomics and Financial Health

The ETHFI token has a fixed supply of one billion units. Allocations are distributed across:

- Investors (33.7%)

- The DAO treasury (21.6%)

- Core contributors (21.5%)

- User airdrops (17.3%), and

- Partnerships (3.9%)

What distinguishes Ether.fi is its transparency. Through its Token Terminal integration, the protocol publishes real-time data on revenue, fees, TVL, and token unlocks. Investors can see exactly how much revenue is generated, where it comes from, and how much is recycled into buybacks. Few DeFi projects provide this level of visibility into their financials, and even fewer can back it up with consistent growth.

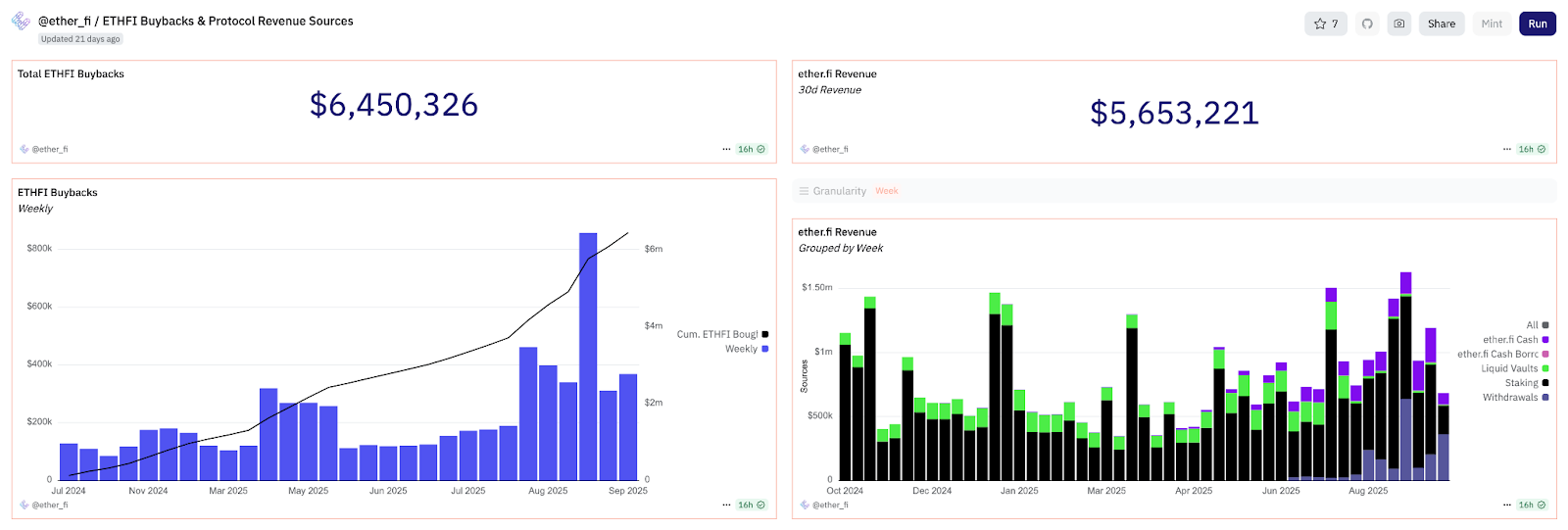

Financially, Ether.fi has become one of the rare protocols with sustainable and expanding revenues. Annualised recurring revenue now exceeds $80 million, up from $18 million in April. Over the past 30 days, the protocol generated more than $6.5 million in revenue, with $28.7 million in cumulative fees. Around 20 percent of revenue is directed toward ETHFI buybacks, creating direct value capture for tokenholders. Cumulative buybacks have already surpassed $6.4 million and continue weekly. The model echoes Hyperliquid's playbook of using protocol revenue to create deflationary pressure on the native token, a proven strategy that strengthens long-term price dynamics.

Ether.fi's scale is already placing it among the top 20 revenue-generating protocols in crypto, alongside giants like Lido, Aave, and PancakeSwap. Unlike many incumbents, however, its revenues are diversified across staking, vaults, and consumer products rather than concentrated in a single stream. This breadth makes its cash flows more resilient and reinforces the sustainability of its buyback program.

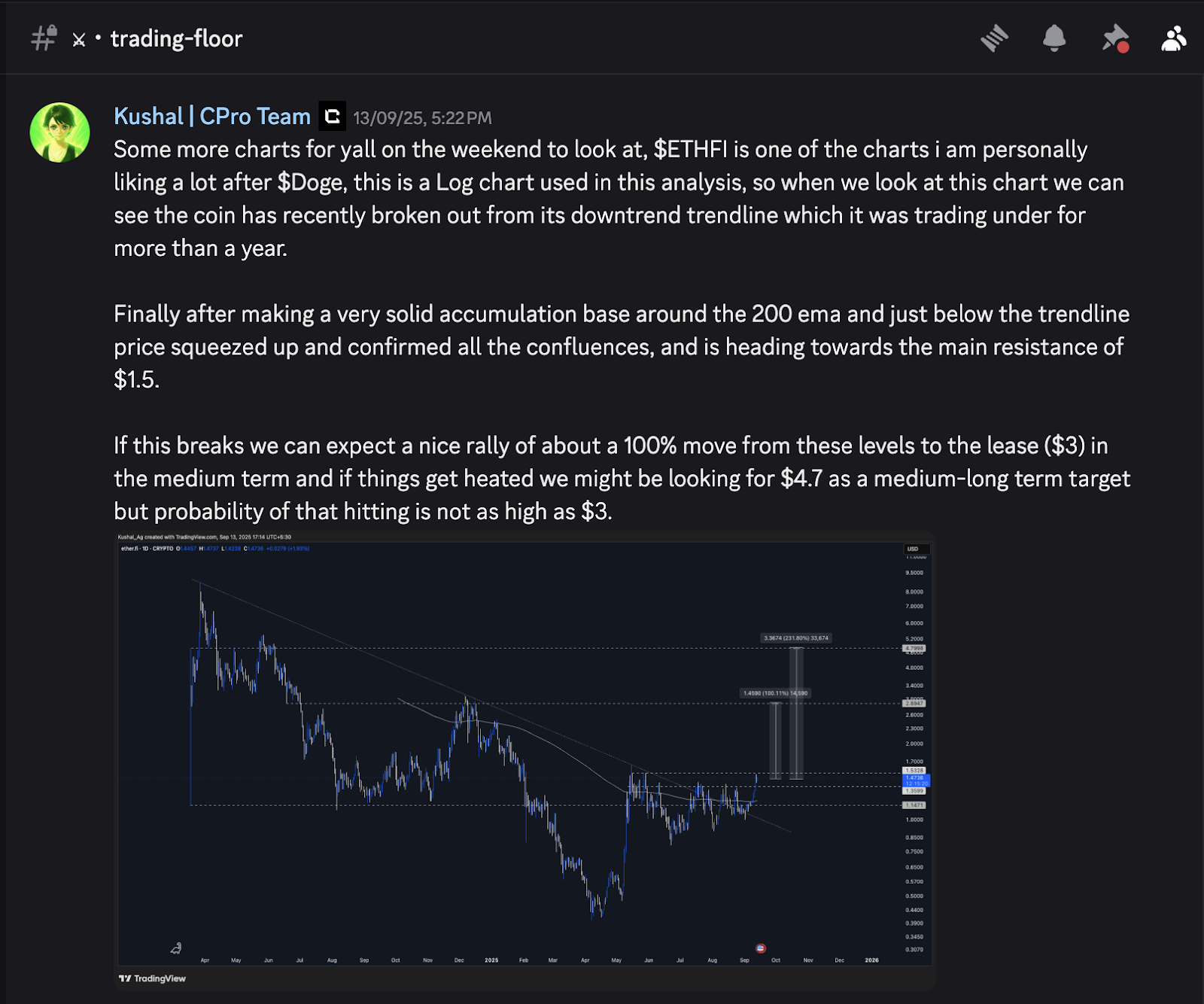

The Trade Setup: The Chart Finally Caught Up

We first highlighted EtherFi ($ETHFI) a few days ago, noting how the coin had finally broken out of a year-long downtrend that had capped price action since early 2024.Using the logarithmic chart on the daily timeframe, it was clear that EtherFi had been in an extended accumulation phase, building a strong base around the 200 EMA. This consolidation created a foundation for price to challenge major resistance levels, with $1.53 standing out as the critical zone to reclaim.

At that time, EtherFi was trading just below $1.53, consolidating between $1.35 and $1.53. The immediate question was whether price could secure a daily close above this resistance to confirm the breakout.

Since then, EtherFi has pushed higher, breaking through $1.53 and now attempting to sustain above it. This breakout has shifted the short-term structure firmly bullish, with the next area of interest set higher on the chart.

Trading Setup

Supports:

- $1.53: Now flipped into immediate support, holding above validates the breakout.

- $1.35: Secondary support if price slips back into the prior range.

- $1.21 (200 EMA daily): Final major support; a breakdown here would invalidate the bullish structure.

- $2.89: First major upside target. This represents a near-doubling from where we first flagged EtherFi and remains the key medium-term objective.

- $4.79: Full bull-case target, achievable only with strong catalysts or wider market momentum. This should be treated as an extended scenario rather than the base case.

Our View

EtherFi is now attempting to confirm strength above $1.53, a level that has acted as a pivot throughout this structure. If price can build a base here, continuation toward $2.89 becomes increasingly likely. Beyond that, $4.79 is technically mapped out, but traders should monitor how EtherFi reacts at $2.89 before positioning for any higher targets.

Cryptonary's Take

Ether.fi has executed one of the most significant pivots of this cycle. From an NFT experiment to liquid staking, from vaults to a full neobank vision, the protocol has consistently adapted to market conditions while scaling adoption. The competitive field remains crowded, but Ether.fi has emerged as the clear leader among challengers. Its TVL is second only to Lido, yet its diversified product stack sets it apart from single-focus protocols.The Cash card and travel program represent genuine product-market fit. Few protocols have managed to bridge on-chain yield to everyday spending, and Ether.fi's early traction shows this model has legs. The original airdrop reinforced community alignment, while ongoing buybacks provide a credible framework for value accrual. Risks remain, particularly around token unlock schedules and Ethereum's broader market cycle, but the trajectory is clear.

For users, the message is simple: Ether.fi is no longer just a staking protocol. It is positioning itself as the first true crypto-native neobank. The combination of yield, spending, and loyalty mechanics puts it at the frontier of DeFi adoption.

With TOTAL3 heating up and ETHFI confirming breakout, this is one of those setups where price may soon catch up to the product.

Cryptonary's OUT!