Pump.fun has been one of the most controversial projects on Solana. Our first two reports highlighted structural issues, insider-heavy tokenomics, collapsing market share, and extraction-like behaviour that left retail holding the bag.

But, over the past few weeks, fundamentals, sentiment, and technicals have all shifted , enough for us to flip our stance. On September 3rd, during our livestream, we called out this shift in real time.

This report marks our third coverage of Pump.fun.

Unlike our previous bearish takes, this time we are revising our stance. We'll recap our past calls, explain why the fundamentals have shifted, break down the new revenue-fueled flywheel, and outline where we think the opportunities (and risks) lie going forward.

So let's dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Quick Primer

Pump.fun is Solana's leading memecoin launchpad, a platform where anyone can instantly mint and trade meme tokens using automated bonding curves. At its core, it lowers the barrier for meme creation by gamifying token launches. All it takes is a few clicks to spin up a new token, throw it into the markets, , and spark a frenzy of speculation.Our March 2025 analysis positioned Pump.fun as Solana's juggernaut of memecoin season, minting 8.1 million tokens and peaking at $15.4 million in daily revenue. However, in the same report we outlined some worrying stats:

- Front-running bots exploited retail regularly.

- Rug pulls like TRUMP and LIBRA shattered confidence in the memecoin space.

- And volumes on PumpFun have been dropping drastically.

After a couple of quieter months, memes made a comeback, and so did Pump.fun's extraction habits. The team launched an Initial Coin Offering (ICO) and created their own token: $PUMP. In July 2025, $PUMP went live with a $4 billion valuation, raising around $500 million from the ICO.

We labeled the launch extractive due to both the distribution and mechanics. Despite already profiting heavily from fees, the trenches were being extracted once again. The token distribution, 67% to insiders, 18% privately pre-sold, and just 15% public, set the stage for dumps and slow bleeding. Furthermore, it was losing its market share to other launchpads like Letsbonk.fun

We recommended complete avoidance, and as expected, the token dumped hard post-ICO, leaving launch-day buyers deeply in the red (around 45% loss for ICO buyers).

Sentiment worsened, and reputation took an even bigger hit. There was no airdrop for early users, and no meaningful effort to give back to the trenches who fueled the platform's rise.

Our call to be bull

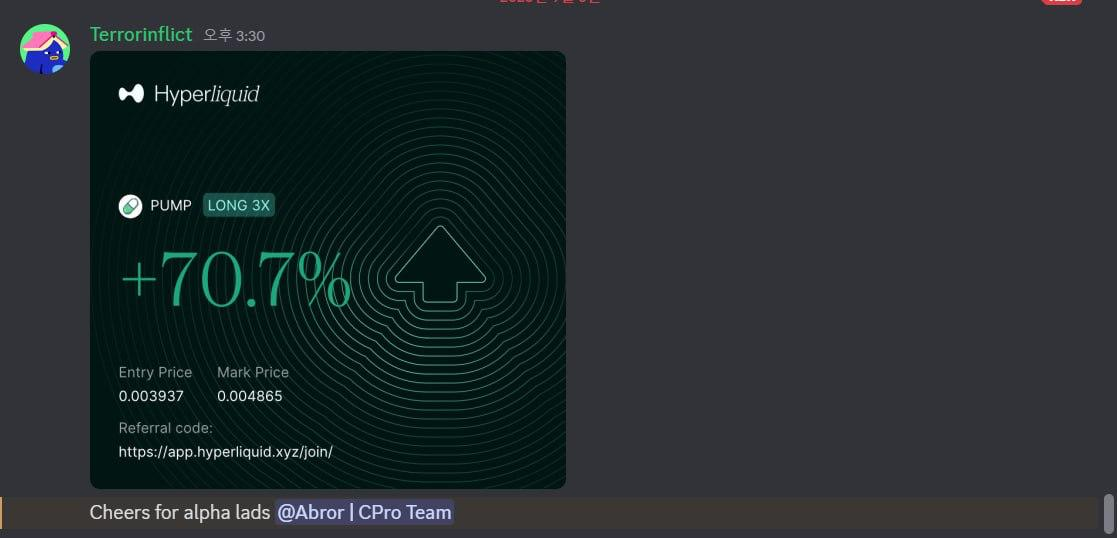

However, in our latest livestream, we shared with our community that we've now pivoted our stance. The $PUMP chart has put a bottom, consolidated and was breaking out at the time of our livestream. We discussed all the reasons why things have changed for $PUMP and gave green to be long on it. The result: a breakout and a 60% gain in the following days.

We were happy to see our members capitalising on the move and staying ahead of the curve.

This case is a reminder that when the market presents new information, it is important to adjust your thesis. Now, here is why we have shifted our stance...

Fundamental Shifts

The main reason we flipped our stance on $PUMP is that the fundamentals have changed in ways that were not present during our earlier reports. Pump.fun has gone from extraction-heavy tokenomics to implementing mechanisms that actively support price and participation. Three pillars stand out: buybacks, creator rewards, and market share recovery.Buybacks have been the clearest driver. Since July, Pump.fun has directed the majority of its revenue into repurchasing and burning $PUMP. To date, over $62-$84 million has been used, retiring around 16.5% of supply. At times, up to 100% of daily revenue has been allocated, with August alone seeing $58.7 million burned. This consistent buyback pressure has created a direct link between platform usage and token demand, a shift from the one-sided extraction we criticised in July.

- $62$ - $84m used for buybacks since July

- 16.5% of supply already retired

- 100% of revenue allocated at times

In its first 24 hours, over $2 million was distributed, with weekly rewards exceeding $15 million by early September. The effect is twofold, creators have stronger incentives to keep launching, and volumes flow back into Pump.fun's ecosystem, reinforcing buybacks and reducing sell pressure.

- Dynamic fees tied to token market caps

- $2M distributed in the first 24 hours

- Weekly creator rewards reached $15M

- Market share recovery: 41% → 77%-90%

- Daily buyback: $0 → $1.7–2m

- War chest: $1.3B treasury backing

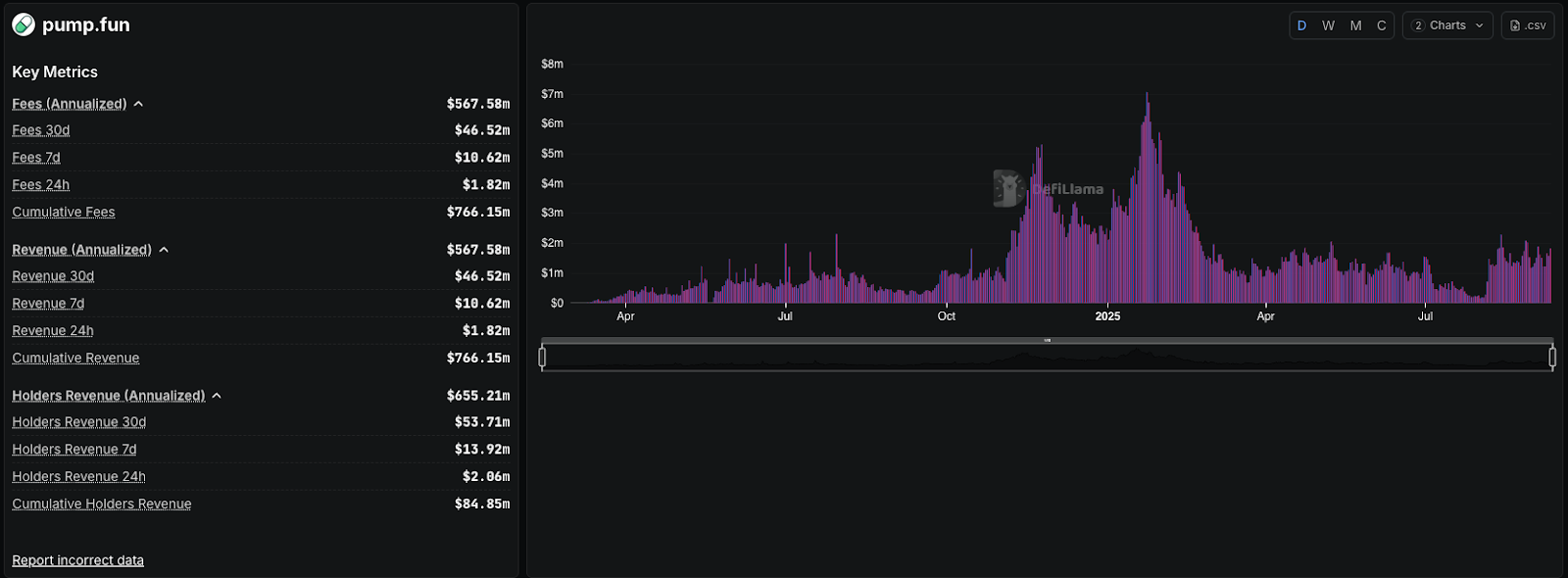

The fourth pillar is valuation strength relative to revenue. By August 2025, Pump.fun's lifetime revenue had surpassed $800 million, while the last 30 days generated about $49.8M (~$600M annualised). At a $1.99B market cap and $5.63B FDV, $PUMP trades at roughly 3.3× market cap-to-revenue and 9.4× FDV-to-revenue, well below many peers.

Pump.fun (PUMP):

- Valuation metrics: ~3.3× MC/rev, ~9.4× FDV/rev

- Activity surge: 73.6-90% market share, 1.3m monthly users (keeps changing)

With a $1.3 billion treasury backing these moves, the risk of collapse looks materially lower than it did just months ago.

Our thesis is simple: Pump.fun has moved from extraction to a model defined by revenue share, buybacks, and ecosystem incentives. The combination of supply reduction, recurring revenue, and community alignment has created a feedback loop that now supports a bullish bias on $PUMP.

While risks remain, the foundation for a sustainable cycle is far stronger than in our previous coverage, and that changes the outlook.

Technical Analysis

PUMP/USD (Daily Timeframe)

Price History: Volatile Launch and Early Cycle$PUMP launched around $0.0050 before flushing to $0.0035. From there it staged a sharp pump to $0.0068, only to reverse just as quickly. By the second day, price had entered a steep decline, ultimately falling nearly 70% to $0.0022.

Accumulation and Breakout

From late July into mid-August, $PUMP consolidated in a tightening pennant structure. In late August, this aligned with our livestream update where we pivoted bullish. Price broke out of the pennant around the $0.0030 area, climbed through multiple resistance levels, and reached a local high of $0.0064 before rejecting at the $0.0062–0.0068 zone.

Current Setup: Wide Range

Since then, price has pulled back into a broader range between $0.0046–0.0062. Beneath that, $0.0041 stands out as the next key level. Together, the $0.0041–0.0046 zone forms a critical accumulation area. On the upside, $0.00629 is the immediate resistance, followed by the $0.0068 ATH. The 20 EMA on the daily (currently $0.0042) provides additional dynamic support in case of pullbacks.

RSI is stretched at 75, with its average trend near 63. This suggests overheated momentum, leaving room for either a cooldown in price or time-based consolidation. A healthy base above support would help sustain continuation.

Our Take

$PUMP has shown heavy volatility in its first weeks but is now beginning to form structure. The $0.0041–0.0046 range is the key support, while $0.0062–0.0068 remains the resistance zone to watch. With RSI overheated, the next move depends on whether price consolidates at support before attempting a continuation.

PUMP/BTC (12H Timeframe)

Price Structure: Similar to USD PairThe PUMP/BTC chart closely mirrors PUMP/USD. This relative strength against Bitcoin is an encouraging sign for any altcoin, suggesting it is not underperforming the benchmark.

The structure is similar: an initial pump and dump, followed by consolidation, and then a wedge-like formation that broke out to the upside in late August. Since then, price has rallied and reclaimed levels.

Current Setup: Supply Zone in Play

Price is currently rejecting from a supply zone (lines 5–6). This is heavy resistance, as it marked the origin of the last major breakdown. For PUMP to confirm further upside, this zone must be broken and flipped into support. On the downside, lines 3–4 form the nearest support, with the 20 EMA running through this area, making it a key zone to monitor.

RSI has been overheated for several days, currently near 80 with an average around 75. This lines up with rejection at the supply zone. A pullback here is expected and would be healthy if support holds.

Key Levels to Watch

- Support: Line 3 & 4 zone (with 20 EMA confluence).

- Resistance: Line 5 & 6 (supply zone, heavy overhead pressure).

PUMP/BTC is holding up well relative to Bitcoin but remains capped at resistance. A retest of the 3–4 support zone with EMA confluence would be constructive for continuation.

PUMP/USD & PUMP/BTC: Combined View

Both the USD and BTC pairs tell the same story: PUMP has rallied strongly out of its August breakout but is now stalling at a heavy supply zone. On USD, this sits between 0.0062–0.0068, while on BTC it aligns with the line 5–6 zone.RSI overheating on both charts confirm the need for a cooldown or pullback. The critical supports to watch are 0.0041–0.0046 on USD and the line 3–4 zone with 20 EMA confluence on BTC.

The takeaway is clear: PUMP has shown strong upside and relative strength against Bitcoin, but it now needs a healthy pullback and consolidation at support before any sustained continuation can unfold.

While the technicals show near-term caution, the bigger picture depends on how Pump.fun manages external risks. The lawsuit, concentrated holdings, and competitive threats remain overhangs that cannot be ignored.

Risks Still on the Table

Even with the improvements in fundamentals and structure, $PUMP still carries meaningful risks that investors need to account for. These are not small considerations, they are material overhangs that could cap upside or trigger volatility.Lawsuit Exposure

Pump.fun faces a $5.5 billion class-action lawsuit in New York federal court, with claims ranging from securities fraud to unlicensed casino operations. The case has expanded to include Solana Labs and other entities. While the outcome is still uncertain, the scale of potential liability is large enough to unsettle long-term holders.Concentrated Holdings

Supply remains heavily skewed, with the top 10 wallets controlling around 75% of circulating tokens. This creates the possibility of sudden supply shocks if large holders decide to reduce exposure, and it raises questions about how decentralized $PUMP really is.Regulatory and Platform Risk

As a Solana-native meme launchpad, Pump.fun is tied closely to Solana's performance. A downturn in Solana price or ecosystem activity could flow directly into Pump.fun's volumes and revenue. Regulatory scrutiny of memecoins more broadly, including delistings on certain platforms, adds another layer of uncertainty.Competitive Pressure

Rivals like LetsBonk, Bonk.fun, and Moonshot have shown that Pump.fun's model can be replicated and improved. Market share recovery has been impressive, but it is not guaranteed to hold. If competitors re-emerge with stronger incentives or lower fees, Pump.fun's dominance could be tested again.These risks do not erase the progress that has been made, but they keep $PUMP firmly in the high-risk, high-reward category. With that in mind, it's worth asking where the opportunities lie and how investors can think about positioning.

Opportunities Ahead

Despite the risks, Pump.fun now presents opportunities that were not available in earlier stages. The shift in fundamentals has opened the door for traders and investors to consider exposure, though timing and strategy remain critical.Swing Trade Potential

With buybacks steadily reducing supply and sentiment turning positive, $PUMP has the potential to offer strong short- to medium-term swing opportunities. The key lies in entering during pullbacks to the $0.0041 - 0.0046 support range, where both technical structure and fundamentals converge. Above $0.0062–0.0068, the chart opens up space for continuation, but chasing breakouts without a base carries higher risk.

Revenue-to-Buyback Flywheel

The direct link between platform revenue and token demand creates a self-reinforcing cycle. As long as daily revenue remains consistent and buybacks continue, supply pressure will decline over time. This dynamic could become one of the more sustainable flywheels in the sector if maintained, offering compounding benefits to long-term holders.Alternative Exposure

For those who want exposure without holding $PUMP directly, liquidity pools and ecosystem strategies may offer a way to participate while spreading risk.Here is how to get exposure to $PUMP via PUMP-SOL liquidity pool on ORCA:

- Go to ORCA

- Select PUMP-SOL pool and choose "Custom" range

- Choose ranges (below the one we recommend)

- Min. price: 0.000021

- Max. price: 0.000031You will be earning 0.9% per day paid in SOL and PUMP

- And still retain upside potential of SOL and PUMP

- For full ABCs of concentrated liquidity check out our comprehensive breakdown here

Cryptonary's Take

Our first two reports on Pump.fun were bearish. The launch and dump confirmed it, revenue was falling, market share collapsed, and the tokenomics looked like pure extraction.Now the setup is different. Buybacks are consistent, Project Ascend has flipped incentives, and market share has rebounded. Usage, revenue, and token value are finally linked. That's the foundation we needed to see.

Risks remain. The lawsuit is still active, top wallets control most of the supply, and competition could re-emerge. This is still high-risk, but the balance of risk and reward has shifted.

Our stance: $PUMP has moved from being an extraction play to a high-beta swing opportunity on Solana. It isn't a long-term conviction yet, but it's one we're actively watching.

We flipped on September 3 at $0.0036-0.0038, and the structure has validated that call. Members already made money, but now it might not be the best time for entry. However, for the first time, we hold a bullish bias and the best entry is $0.0041-0.0046.

Let the flywheel spin.

Cryptonary, OUT!