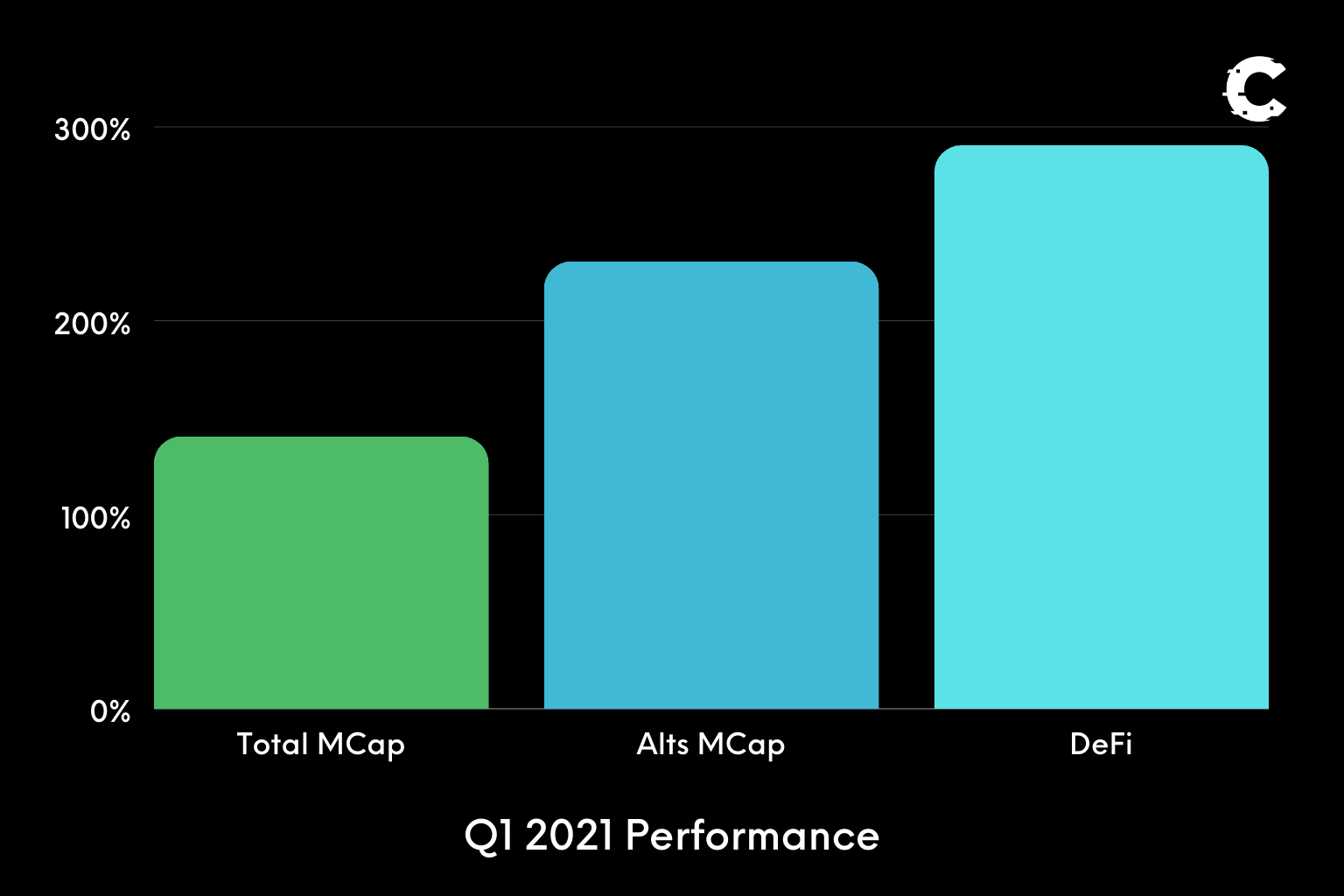

The year opened at a mere $750 Billion in MCap and ended Q1 over $1.8 Trillion.

Altcoins pulled a better performance and grew by 230%.

The sector that outperformed them all was DeFi, with a 290% rise.

Where do we go from here?

Based on a statistical analysis we've conducted last week, it is clear that the upcoming quarter is likely to be a very interesting one to say the least.Cryptonary's Predictions

👇

Based on the narratives being pushed that we continuously monitor, in addition to the trends, here are our predictions.The quarter will be bullish for both Bitcoin and Altcoins, however Alts are likely to outperform on a percentage basis.

Bitcoin

Given the stimulus bills being passed by the US Government, the latest one being the $1.9 Trillion COVID Relief Package, dollar devaluation is hard to overturn at this point. The FED would need to pull a miracle and investors know it.These worries about inflation are only increasing Bitcoin's attractiveness to those investors. Given the stats and fundamentals, we cannot rule out Bitcoin growing by 50% this quarter and reaching a price of $90,000 per BTC.

Ether

ETH investors see what others don't at the moment. Many are focusing on the delays while others are using them as opportunities to scale in before the remainder of market participants see Ether's value and economic model (with EIP1559 & ETH2.0). We already saw a company put ETH on its balance sheet, we are expecting more of these announcements.From a technical perspective, ETH has just broken out from the 2017 high of $1,420 and is in retest-mode. The limiting factor right now is $2,000, coinciding with BTC sellers at $60,000.

The market structure is hinting towards a huge advance in prices. If we had to make one, our ETH price prediction for Q2 2021 would be $4,000 per ETH.

DeFi

The smaller the market cap, the higher the volatility (beta) compared to the market average. Add this to the tremendous value that many DeFi tokens hold and you get a multiple Xs possibility for the quarter.Our prediction is we will see DeFi Alts rise anywhere between 3X & 5X in price - in addition to the major advances seen already.

The Big Long

Every so often a new specific ecosystem gains a lot of momentum. The most recent one was DeFi based on Binance Chain. Valuations went through the roof and prices rode rocketships. The next one?

SOLANA-based DeFi

Decentralised Finance is truly revolutionary, just trying it out proves it. The issue has been that Ethereum gas fees have priced out a lot of market participants. So when they are given the chance to interact with DeFi protocols at quasi-zero network fees, they immediately jump onboard.We have a reasonable Solana long (spot) that we will be holding throughout this quarter. In addition to that, we will be investing in many new to-be-launched DeFi protocols on Solana. Unfair to call it investing because our target holding period will range between 1 and 6 weeks.

We've allocated capital we can afford to lose to this endeavour as the risks are high. As we all know, with high risks come high potential rewards and this is what we are shooting for.

We will be releasing a journal where we talk about our watchlist for Solana-based DeFi protocols very soon.