Q3 30x Update

Earlier this Summer our 30x investment suffered from a series of exploits that had a huge impact on both the operation of the protocol, and the public perception of the project. In the space of a 6-8 weeks the token suffered massive drawdown because of the wider market correction in May which was amplified by these security concerns.

We covered these exploits and the recovery plan that was implemented by the team in multiple journals, the latest of which can be found here.

The team never lost conviction in the project, and we made the decision to buy the fear at close to the lowest price point – the product that the protocol seeks to deliver far outweighs the chance of failure.

As stated in previous journals, investing early in a project comes with higher risk and teething issues will always be a problem at these stages.

But what’s been happening up to now? Where is the project at, and what can we expect for the rest of 2021 going into the New Year?

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

ImmuneFi Bug Bounties

With the recovery of THORChain well underway and nearing completion, bug bounties have been an integral part of that recovery. The exploits were primarily carried out through the Ethereum components of the THORChain network, mostly exploiting the Ethereum Bifrost (bridge). There were several signs that at least one of the hackers would have returned the funds had there been a bug bounty in place and so this was one of the very first things that the team worked on.

Initially bug bounties were handled by the devs themselves but this proved to be unworkable as a more structured approach was required. ImmuneFi is a DeFi bug bounty consultation service that links whitehat hackers with DeFi projects allowing those hackers to anonymously claim a reward for breaking or exploiting a protocol and return the funds they managed to take. The hacker benefits because they receive a lump sum legally awarded, and the projects benefit because they not only boost their security but also avoid a potentially devastating loss of funds. THORChain onboarded ImmuneFi to handle their bug bounties, and so far, the program has largely been a success.

Halborn

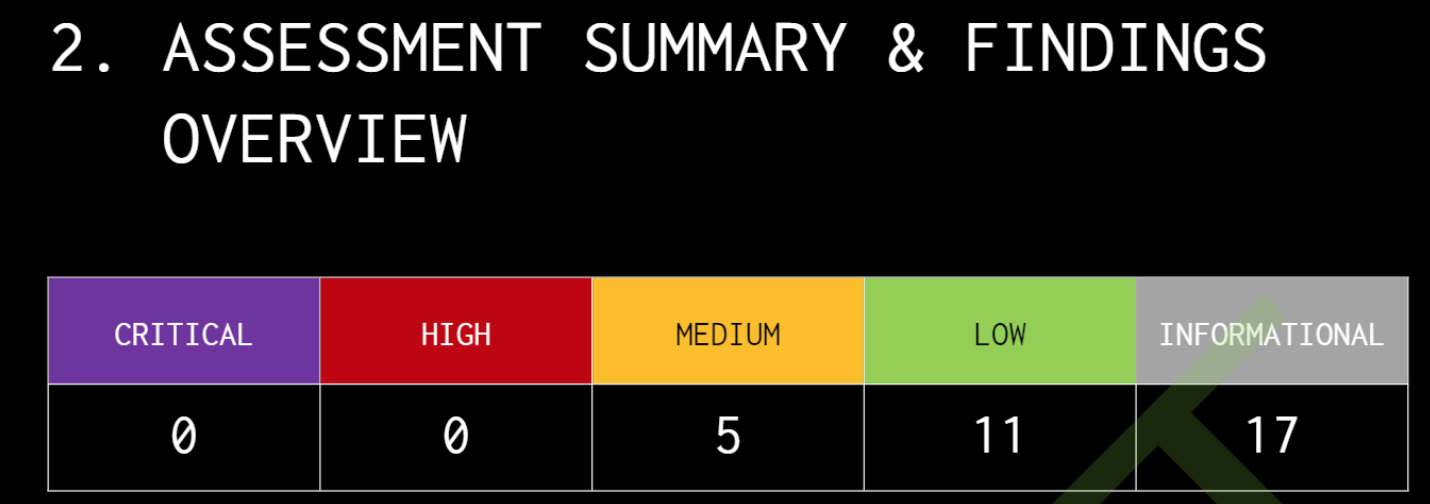

Halborn is an expert security firm specialising in blockchain security. THORChain on-boarded Halborn in July and since then they have been working with the THORChain core development team to audit the protocol before the eventual restart of the network.

We have been following developments and it appears at this stage there are only a few more problems that need to be resolved across all components of the network.

The findings and lack of high/critical threats bodes well for the timeline that THORChain has set for the recovery of the network. The Halborn audit is set for completion at some point in October, after which all security teams and the devs will review the data and decide on how to proceed. We expect the network to be fully operational by the end of the year, including the Ethereum chain.

THORSec

THORSec (THORChain Security) is a team of whitehat hackers who are perpetually trying to exploit all components of THORChain. Led by NineRealms and funded by the THORChain treasury, the team will not only try to “break” the protocol and report any issues to the core devs, but they will also participate in code reviews of any future updates. Overall, this should massively increase the security of the protocol and provide additional peace of mind to the community.

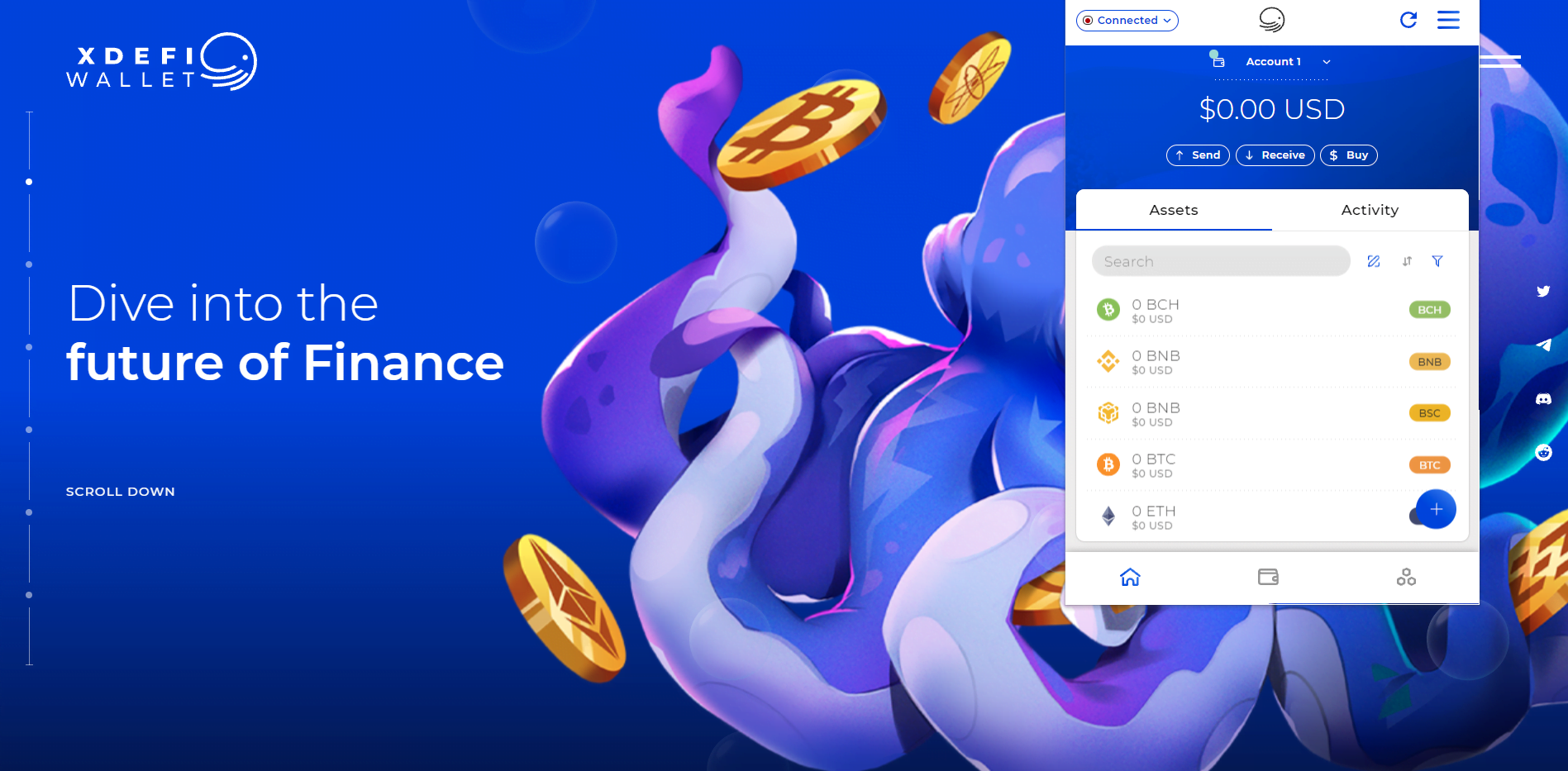

XDEFI

XDEFI is a cross-chain wallet extension for Chrome that leverages THORChain to allow users to manage their native assets across multiple chains, all from one wallet. We have already released a journal about the integration before XDEFI was launched, here. The wallet uses THORChain to allow direct L1 to L1 swaps and has recently been updated to support NFTs. We had Emile from XDEFI on a podcast earlier this month, which you can find here.

THORStarter

THORStarter is the IDO launchpad for the THORChain ecosystem. xRUNE is the utility token for THORStarter and is used to bootstrap liquidity for the IDOs that will be launching on THORChain; for example, if a project token called $TEST was launching then the pool would be TEST-XRUNE.This allows for THORStarter to provide in-house liquidity without relying on wrapped tokens or stablecoins, and projects will also be able to apply for grants from THORStarter. Holding 100 xRUNE also provides early access to launches on the platform.

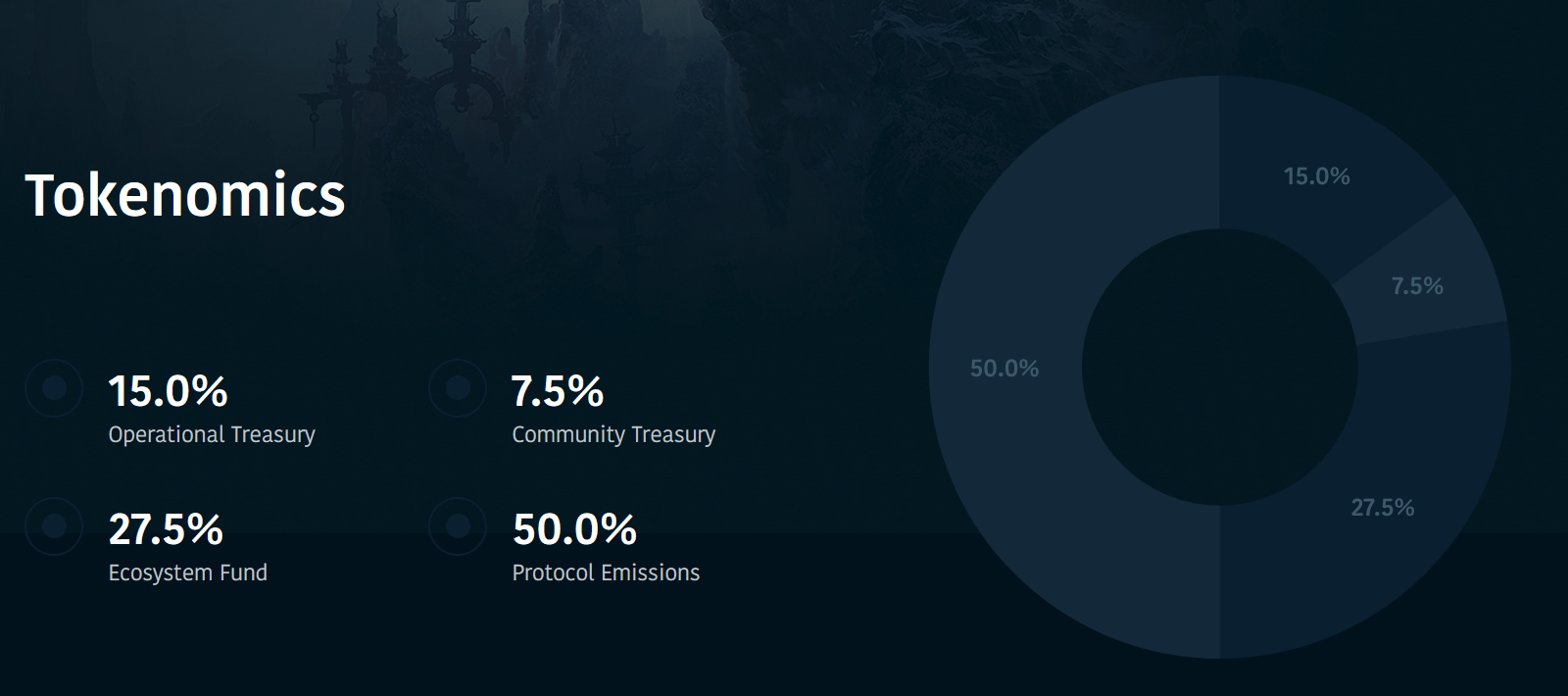

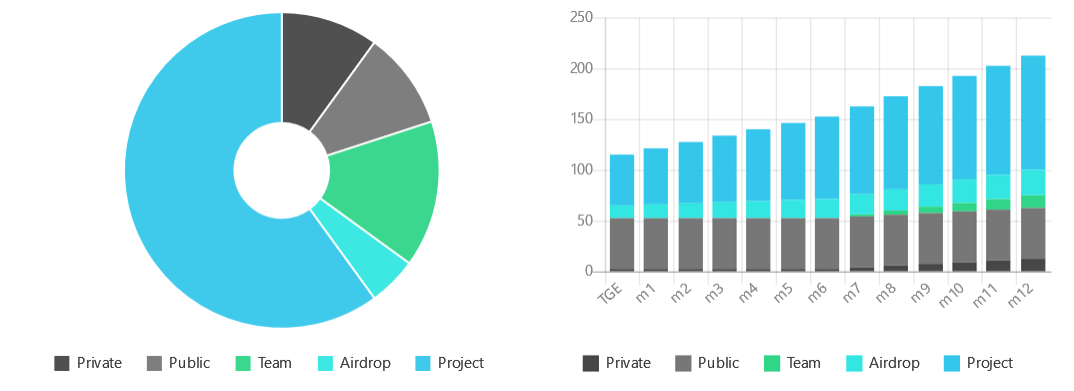

xRUNE has a maximum supply of 1 billion tokens, allocated as follows:

As xRUNE is primarily a utility token for providing deep liquidity to THORStarter it is not a particularly attractive investment from a tokenomics standpoint. However, we will likely purchase some to take advantage of future IDOs and incentives on the THORStarter launchpad.

THORSwap

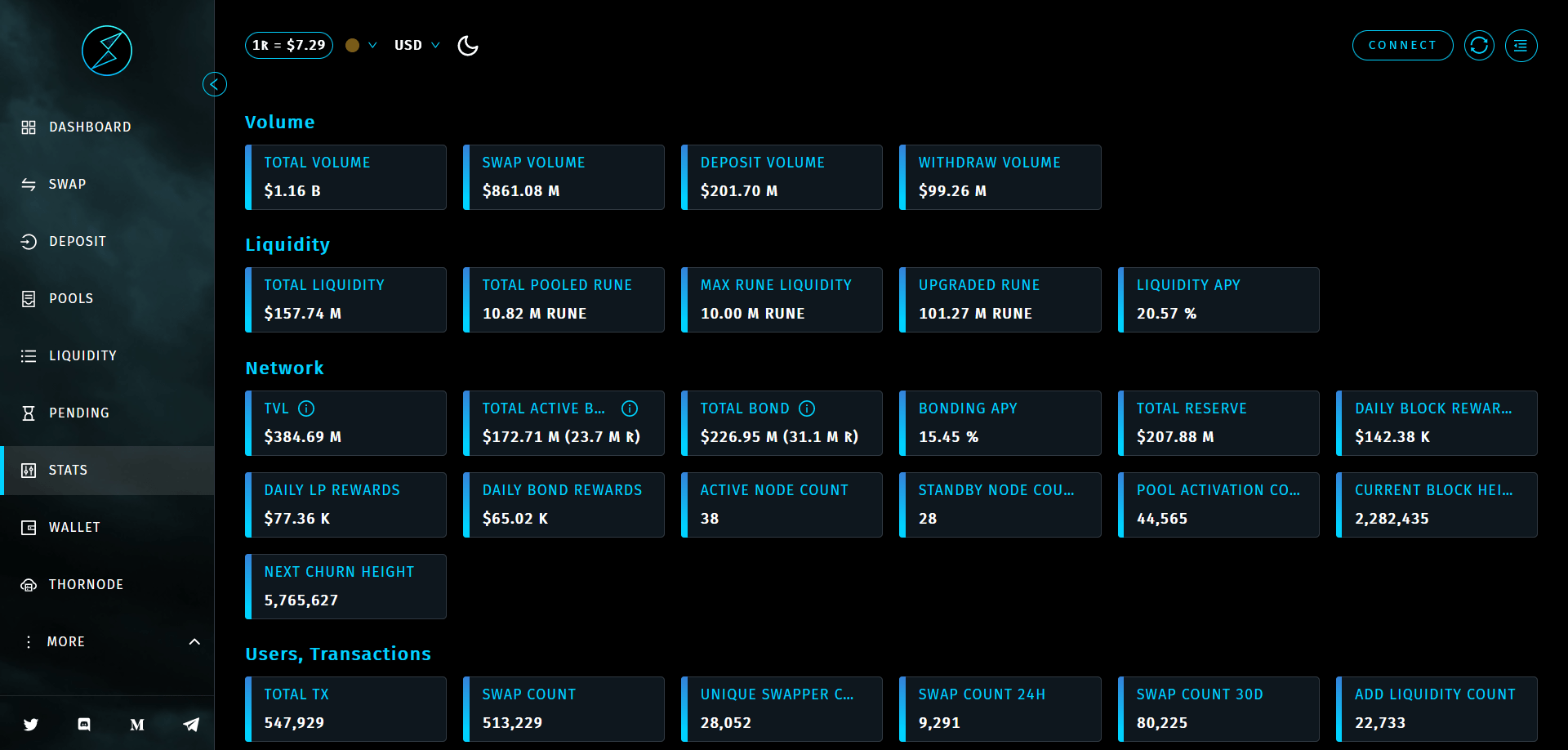

THORSwap is the front-end for cross-chain swaps powered by THORChain. The overall user experience has come on leaps and bounds since the first iteration earlier this year. THORSwap now supports over 20 different tokens across 5 blockchains (Bitcoin, Binance Chain, Ethereum, Bitcoin Cash, and Litecoin) with more tokens and chains planned before the end of the year – subject to the return of network functionality.

TVL has been increasing steadily with over $150million locked in the various liquidity pools - this number would be a lot higher had the exploits not occurred. For more information on providing liquidity, check out this journal. Another point to take into consideration is that most of the network is still offline or working under reduced capacity and so the statistics are not a good representation of the interest and value of the project.

THORChads DAO

THORChads is the home of THORSwap/THORChain’s metaverse and acts as a community organisation (DAO). The purpose is to provide a medium where the creative aspects of the community can launch various initiatives whether it be NFTs, games, webapps etc.

THORChads comes with various novelties; for example, you can check “degen” and “chad” scores which are calculated by analysing wallet activity to see what events you were involved in and how active you are on THORSwap and THORChain in general. Additionally, users will be able to manage their THORSwap membership from here and participate in community events.

$THOR Token

THOR is the utility and governance token for THORSwap. THOR holders will be able to stake their THOR and receive vTHOR tokens which entitles them to a share in THORSwap revenue, voting rights in the DAO, THORSwap trading fee discounts, and a THORSwap membership that will likely entitle them to future airdrops and other perks.The maximum supply will be 500 million tokens, with an initial circulating supply of 115 million THOR. Let’s have a look at the token allocation and emissions schedule:

- 60% for Community Incentives – mining, LP rewards etc.

- 20% for Private/Public Sale, divided 10% public sale and 10% private – early investors do not receive a discount so there will not be a supply spike when the token launches.

- 15% for the THORSwap Team, with a heavy vesting schedule laid out over a 36-month period.

- 5% will be Airdropped.

- Follow THORSwap and THORChads on Twitter.

- Join both the THORSwap and THORChads

- Connect a wallet here to verify or check eligibility.

Major developments on THORChain have been at a practical standstill due to the exploits, with many planned implementations pushed back until the network has been fully audited and restarted. Synths, additional chains, additional assets on THORSwap, IDOs on THORStarter - all of this has been delayed. However, there is likely to be a revival of activity in the near future and all of the infrastructure for this ecosystem to flourish is now in place.

We will be updating with more details as they become available so stay tuned!