The Cross-Chain Future (Q3 Update)

As we’ve stated many times before, the cross-chain communications sector is one that we believe has significant advantages over other sectors. These protocols are creating products that will continue to be useful for years to come, and we are basically at ground level.

Q3 has seen some exciting developments for many of the cross-comms protocols we have been following. From enhanced token utility to improved user experience and even an entirely new ecosystem, there has been no shortage of development!

However, it is not all sunshine and rainbows, and there are some drawbacks to the models that some of these protocols use.

In this journal, we will outline some of the most important developments and outline our perspectives for the sector going forward into Q4 – this is a must-read!

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

THORChain Ecosystem

Overall, the THORChain ecosystem has been one of the hardest hit in this bear market. The demand for cross-chain swapping has declined significantly which affects volumes and revenue for both THORChain and THORSwap. In general, there are significantly fewer users of DeFi – they stop using the products and withdraw their assets from liquidity pools. For a liquidity-based protocol like THORChain where the token (RUNE) derives a lot of its value from participation in pools, this is obviously not great.

Volumes on THORChain have declined around 75-85% from the peak, and liquidity in the pools has declined around 80% from the peak. THORChain liquidity pools consist of 50% RUNE and 50% native asset. When users withdraw from these pools, they take their nominally “locked” RUNE with them, presumably to sell, which leads to significant downside for the RUNE token price – this is exactly what has happened.

We would expect demand to return relatively quickly once bullish conditions return, which will drive demand for cross-chain swaps, increasing revenue for liquidity providers and ultimately attracting demand for yield-generating LP positions. We expect that THORChain will perform as it has in the past once bullish momentum returns.

THORSwap

One major announcement is that THORSwap implemented the long-awaited Ethereum DEX aggregator. For those unfamiliar with what a DEX aggregator is, imagine there was a way to Google search through all decentralised exchanges and create a list of the cheapest price for every single possible asset swap on Ethereum. That’s what a DEX aggregator does; it checks the latest prices across DEXs on Ethereum and gives the user the best price for their swap.In addition to this, it also opens thousands of assets that are not actually supported by THORChain, meaning that THORSwap is essentially now a gateway to any asset on Ethereum. The result of this is a massive increase in the user experience and protocol usefulness, which long term, should drive volumes towards THORSwap and produce more yield for THOR stakers, directly impacting token price.

However, for the reasons stated above, it is unlikely this will play out before bullish conditions return. Despite market conditions, it is important to keep up to date with these developments, as ultimately, they add significant fundamental value that should shine through in a risk-on environment.

Synapse Protocol

Synapse recently released their Synapse 2.0 user interface update, refining the bridging experience and making the platform simpler to navigate. One of the more anticipated updates is Synapse Chain. Although the testnet has not been launched yet, we have been seeing Twitter accounts popping up for protocols that look like they are intending to build on Synapse.

With the launch of Synapse testnet sometime in the coming weeks, SYN will have huge utility added in the form of staking. We expect significant portions of the supply to be locked up in SYN staking, as well as an incentives program once the new chain comes online. This is one of the major developments we are excited about from an investment standpoint, and although there are no exact dates for this yet, we believe the announcement will be well received by both the community and those looking in from the outside.

LayerZero

LayerZero is one of those projects that we do not talk about enough. The significance of their product cannot be ignored, however, and we have seen some key developments both in terms of LayerZero Protocol itself and Stargate Finance, its flagship DApp.

We have seen LayerZero integrate with a few protocols recently. The advantage that this brings to those protocols is that they are no longer tied to the chain they were created on. Messages can be passed between chains through LayerZero, which means that theoretically, any action taken on a protocol integrated with LayerZero is valid on all the other chains.

One such integration is Angle, the creator of the agEUR stablecoin (pegged to the Euro). With this integration, the agEUR stablecoin can now be moved between Ethereum, Polygon, Optimism, and Arbitrum – without leaving the Angle interface. This provides deep liquidity for agEUR since all liquidity pools across these chains are now connected.

Angle is just one example of an integration with LayerZero (LZ) – another example is MugenFinance, a yield aggregator similar to Yearn. The infrastructure that LZ provides is attracting attention, and although the protocol doesn’t have a token itself, we believe that Stargate Finance will benefit from this attention.

Speaking of Stargate, we have also seen substantial development on that protocol. Up until a couple of weeks ago, the only assets that could be bridged using Stargate were stablecoins. ETH is now available for bridging through the Stargate interface, and we expect the rest of the native tokens of the blockchains supported by Stargate (BNB, AVAX, MATIC, OP, FTM) to be added by the end of the year.

Over and above this, SushiSwap has launched a product on top of Stargate called SushiXSwap. SushiXSwap is an omnichain (exists on multiple chains) DEX that leverages the LayerZero and Stargate infrastructure to create a DEX that supports asset swaps on many chains. Again, this is similar to the Angle integration above in that all liquidity pools on SushiXSwap are combined across chains, which is a huge step towards solving the liquidity fragmentation problem we outlined in the cross-chain comms sector coverage. Since the plan is to share revenue and fees with STG stakers in the future, protocols building on top of and using Stargate should add significant unrealized value to the token.

Cosmos

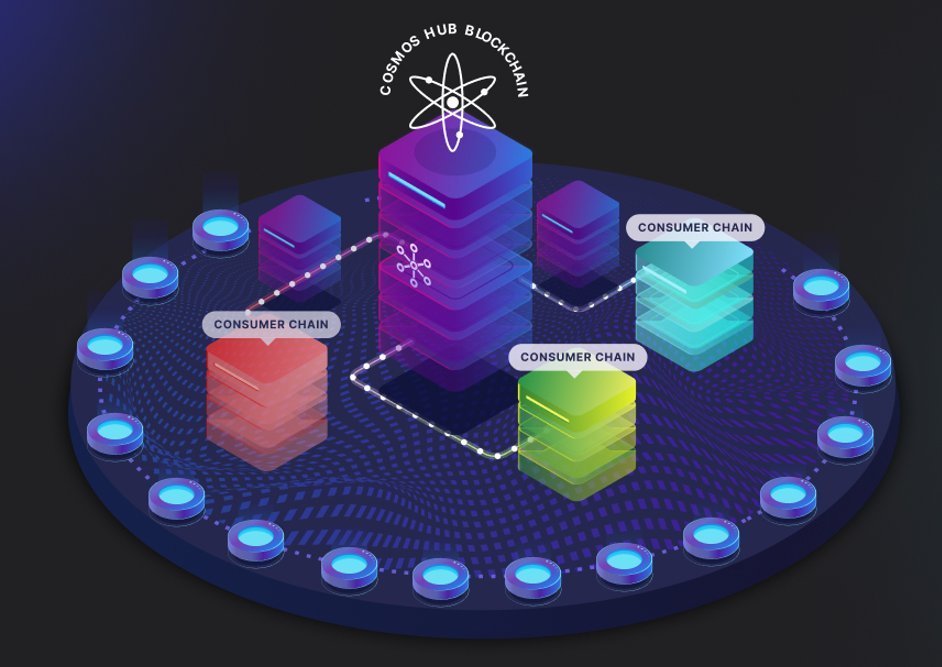

The Cosmos Inter-Blockchain Communication (IBC) infrastructure was a huge step for the cross-chain comms sector when it launched back in March 2021. Unfortunately, the ATOM token itself was relatively uninvolved when it came down to the tokenomics department since protocols built using the Cosmos architecture have their own validators and are secured using their own native tokens.However, very recently, Cosmos announced a huge improvement to the ATOM tokenomics – ATOM 2.0. Although not launched yet, ATOM 2.0 brings massive utility to the token itself and the wider ecosystem – we will definitely be changing our views on the ATOM token going forward. The major component of this upgrade is Interchain Security.

Interchain Security implements a security model similar to that used by Polkadot and its Parachains. Developers will be able to launch a chain (consumer chain) that is secured by the validators already present in the Cosmos Hub, saving them time and engineering resources that would otherwise be used to maintain their own validator set.

This should not only provide significantly more traffic on Cosmos (meaning more fees for validators and their delegators) but also allow new chains and DApps to expedite their launch without having to worry about decentralizing validators and boosting their token value to outpace TVL.

There are a couple of other changes happening to the ATOM tokenomics:

- Lower inflation rate.

- Liquid staking on the Cosmos Hub.

Conclusions

As stated previously, cross-chain communications are essential, and we believe the protocols building that infrastructure will be big winners. The projects outlined above have significant funding and backing and we are about as certain as we can be that they will continue to develop and build no matter the market conditions.That’s it from us! You can expect a quarterly update for each sector going forward, and as always, if there’s anything major happening, we will always keep members updated as soon as we can.