Ready, Layer One

If you’ve been around crypto for any length of time you will be aware of some of the fundamental issues that plague the two major cryptocurrencies. Transactions using Bitcoin take a while to be completed if the lightning network is not used, and its functionality is generally limited to being a store of value, as it does not have smart contracts. Ethereum, the most widely used layer one blockchain, suffers from relatively expensive fees, slow confirmation times, and limited transaction throughput and block space.

Of course, both Bitcoin and Ethereum have countless other positives, such as decentralisation, censorship resistance and years of successful use. Blockchains on which financial activities and DApps are built are referred to as Layer 1 (L1) blockchains.

You will notice that the above criticism of Bitcoin and Ethereum is focused on two key issues, speed of transaction confirmation and transaction fees. Bitcoin seems to have settled on being a store of value or ‘digital gold’ for the foreseeable future. On the other hand, Ethereum is actively addressing its current fundamental shortcomings by having successfully implemented EIP-1559; and with ETH2.0 approaching and becoming ever more tangible, solutions are upcoming. In turn, this has created a demand for alternative blockchains that address the problems of transaction speed and cost.

Ethereum, Cardano, Binance Smart Chain and Solana are all Layer 1 blockchains, with different capabilities and use cases. Binance Smart Chain (BSC) and Solana (SOL) have seen rapid growth in 2021, as there exists a clear need for Layer 1 chains that can adequately address the scalability problems as outlined above. BSC and SOL are characterised by the speed at which transactions are confirmed, combined with negligible transaction fees (aka gas). However, they are not the only Layer 1 networks that can deliver such a level of performance…. so what is the next one?

Disclaimer: THIS IS NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

TLDR

- Application layers have been garnering attention and traction in 2021 from Binance Smart Chain to Solana and Polygon, now it's Avalanche's time.

- Avalanche (token AVAX) is a Proof-of-Stake layer-1 blockchain that also happens to be EVM compatible which gives devs a "plug and play" system.

- Ecosystem growth kickstarted by the release of Avalanche Rush: an $180M liquidity mining incentives program.

- TVL has quadrupled over a short period of time which signals interest (from $0.5B to $2B+).

- There are numerous applications built on Avalanche that mimic different Ethereum dApps like Uniswap/Sushiswap/AAVE etc.

- The copies can be roughly summarised as such: Pangolin = Uniswap / TraderJoe = Sushiswap / Benqi = AAVE / Yield Yak = yEarn Finance

- A bridge is available to send funds through from Ethereum to Avalanche without using a centralised exchange.

Disclaimer: THIS IS NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

Avalanche: Blockchain Architecture

Avalanche is a Layer 1 chain which uses a Proof of Stake consensus mechanism, with full smart contract capability. The smart contract capability is implemented to be Solidity and Ethereum Virtual Machine (EVM) compatible. This is an extremely important feature, as for a Layer 1 blockchain to develop and grow, active development and core infrastructure such as wallets is imperative. Avalanche has clearly planned for such roadblocks, as MetaMask which everyone in the crypto space is familiar with can be used on the Avalanche network. In turn this makes it much easier to attract new users to the network. Outside of simple users, full compatibility with the EVM whilst also leveraging the existing Solidity docs and tutorials allow for accelerated code and protocol development. This ‘plug and play’ capability for developers has led to a thriving ecosystem with multiple protocols being built on Avalanche, which will be covered in detail below.Compared to other Layer 1 blockchains, Avalanche also has extremely competitive technical specifications and computational performance. The below comparison table is sourced from Avalanche’s website, and despite being biased, it is indicative of the superior performance AVAX offers. The throughput and transaction finality should be more than adequate for all but the most time sensitive application. The low latency combined with the low fees offer a better user experience than DeFi on Ethereum.

Members who have been with us for a while will notice that Solana is not on the comparison table as it would overshadow AVAX. However, a comparison between the two would be unfair, as AVAX is optimised for using CPUs as validators, whilst Solana uses high-performance computers. In turn, this should imply that AVAX should see significantly more validators as anyone who has a modern computer with fast enough internet, should theoretically be able to become a validator.

This is not the case, as digging into their actual validator numbers indicated that there are around 1,100 active validators on the network. This is slightly concerning, especially as the chain is optimised for CPUs. Validators are required to have 2,000 AVAX themselves to run a node in the network, and thus for most people delegating their stake is the best option.

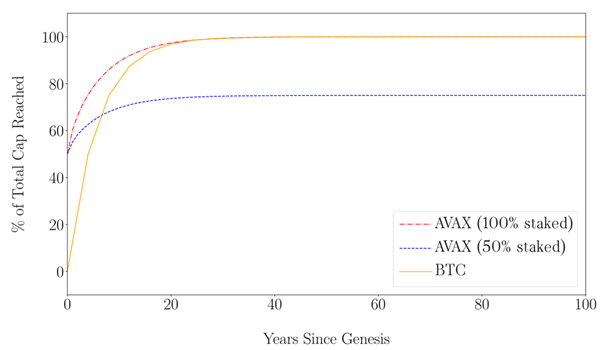

People who simply wish to take advantage of staking, can delegate their stake to validators, who charge a percentage of the staking returns. Staking with an APY of 10% is extremely attractive, especially when the stake can be delegated to obtain a smaller return of around 4% or so. This has led to 57% of the supply being currently staked. The percentage of tokens staked is important as it governs the rate at which new AVAX tokens are minted. The staking percentage effectively determines the inflation rate. The emissions formula they use is extremely complicated however it can be simplified down to the following key points:

- AVAX has a capped-supply of 720,000,000 (720M) tokens

- The genesis block will have 360M AVAX tokens (50% of total supply).

Currently, there is a circulating supply of 173M AVAX, with approximately 214M AVAX locked away in staking. Additionally, the fees which are paid for transactions are burned further decreasing the circulating supply of Avalache tokens.

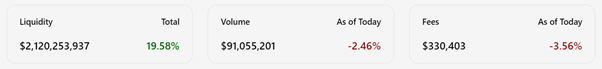

The strong and simple tokenomics model, the superior performance compared to most Layer 1 blockchains, and the sharing of core resources and easy interoperability with other blockchains has led to its rapid growth. Looking past the rapid increase in the price of AVAX, the Total Value Locked (TVL) in the network has also been rapidly increasing. The most recent figures are shown below:

Avalanche has around $2 billion in Total Value Locked (Liquidity), with a market capitalisation of $9 billion. With 147K transactions in the last 24hours, this is indicative that the network is being actively used by people leveraging the cheap fees and quick transaction speed. Value follows users inherently, and the numbers indicate that Avalanche is attracting more and more users. And this seems to be only the start of Avalanches' growth.

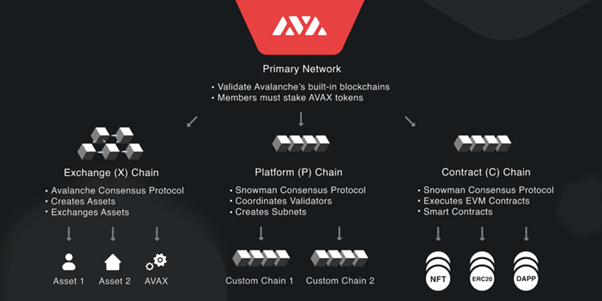

Avalanche Blockchains

Avalanche utilises three separate blockchains in addition to the primary network, which validates all transactions on the sub-chains. Here is a breakdown of each chain:

- X Chain – the Exchange Chain API is used for setting the conditions and rules for the creation and trading of digital assets on the Avalanche ecosystem. Parameters such as time or location restrictions on an asset are set from this chain. The X Chain runs as an instance of the Avalanche Virtual Machine (AVM).

- P Chain – the Platform Chain API is used for setting the conditions and parameters for the creation of new blockchains/protocols to be built on Avalanche. Clients can select various options for their protocol and blockchains.

- C Chain – the Contract Chain runs as an instance of the Ethereum Virtual Machine (EVM). To find out more about the EVM, click here. The C Chain handles smart contract executions and is compatible with both native Avalanche and ERC-20 contracts.

Avalanche Rush: $180M Incentive

Avalanche Rush is a $180M liquidity mining incentive program that aims to expand the presence of AVAX by integrating with more protocols and applications outside of its native ecosystem to grow the Avalanche ecosystem and expand its user base. Avalanche Rush follows the launch of the Avalanche Bridge, a cross-chain bridging technology that allows for transfers of assets between blockchains, enabling the aforementioned integration with protocols on other chains.No precise date has been provided for the launch of the Rush however the first phase will be the deployments of Aave and Curve on the platform. This will initially take the form of liquidity mining incentives for Aave and Curve users over a 3 month period, with rewards of up to $20 million AVAX for Aave users and $7 million AVAX for Curve users. Additional partnerships are planned for Phase 2 in the coming months, but the details of those have not yet been disclosed.

Ecosystem

DeFi on the Avalanche ecosystem mirrors that of the Ethereum DeFi with many comparable protocols. This section will briefly cover a few of those protocols – note that providing liquidity and yield farming comes with risks, such as impermanent loss.BENQI

BENQI is to Avalanche what Aave is to Ethereum – a decentralised liquidity market platform. Users of the protocol can lend assets to earn passive income and borrow assets through over-collateralised loans. BENQI has a Total Value Locked (TVL) of over $1 billion, which is extremely impressive for a protocol that only launched on the 19th of August (5 days ago at the time of writing).

- Depositors receive interest on their assets according to the APY of the pool. The yield is determined by the supply/demand for that particular asset.

- Borrowers can deposit collateral and then use that collateral to take out a loan. The protocol uses a “health” system to determine the status of the borrower’s loan. If “health” goes below 1 then some of the user’s collateral will be liquidated to pay off the borrowed funds.

- Liquidators carry out liquidations and receive a part of the borrower’s collateral for ensuring that the protocol remains solvent during the process.

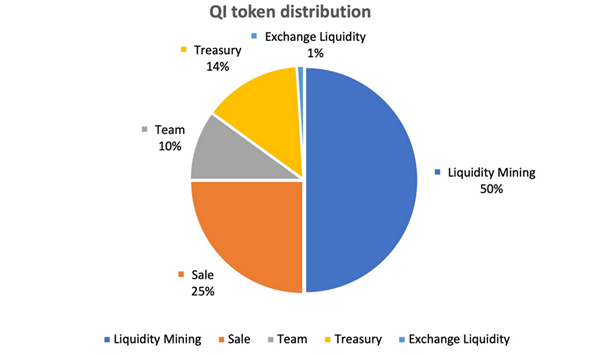

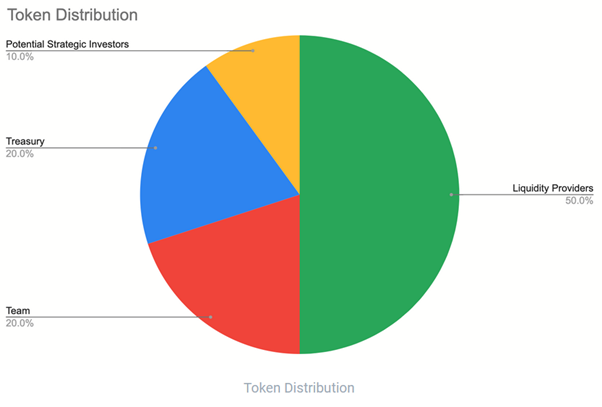

QI is the governance token for the BENQI protocol providing users with voting rights in the DAO (to be implemented in the future). QI has a maximum supply of 7.2 billion, with a circulating supply of ~325 million. The BENQI market capitalisation is ~$117,000,000 at the time of writing.

The developers have placed an emphasis on developing a healthy economy and paramount to this is attracting liquidity. As such, 45% of the total supply of QI will be emitted to liquidity providers as an incentive to provide capital - over and above the rewards earned through interest paid by borrowers. The remaining 5% of the liquidity mining allocation will be used to provide liquidity on Avalanche DEXs, as well as utilised for listings on centralised exchanges.

There are certain incentives in place for the first 90 days from the launch of the protocol to attract capital which can be claimed for both borrowing and lending on the protocol, paid in QI.

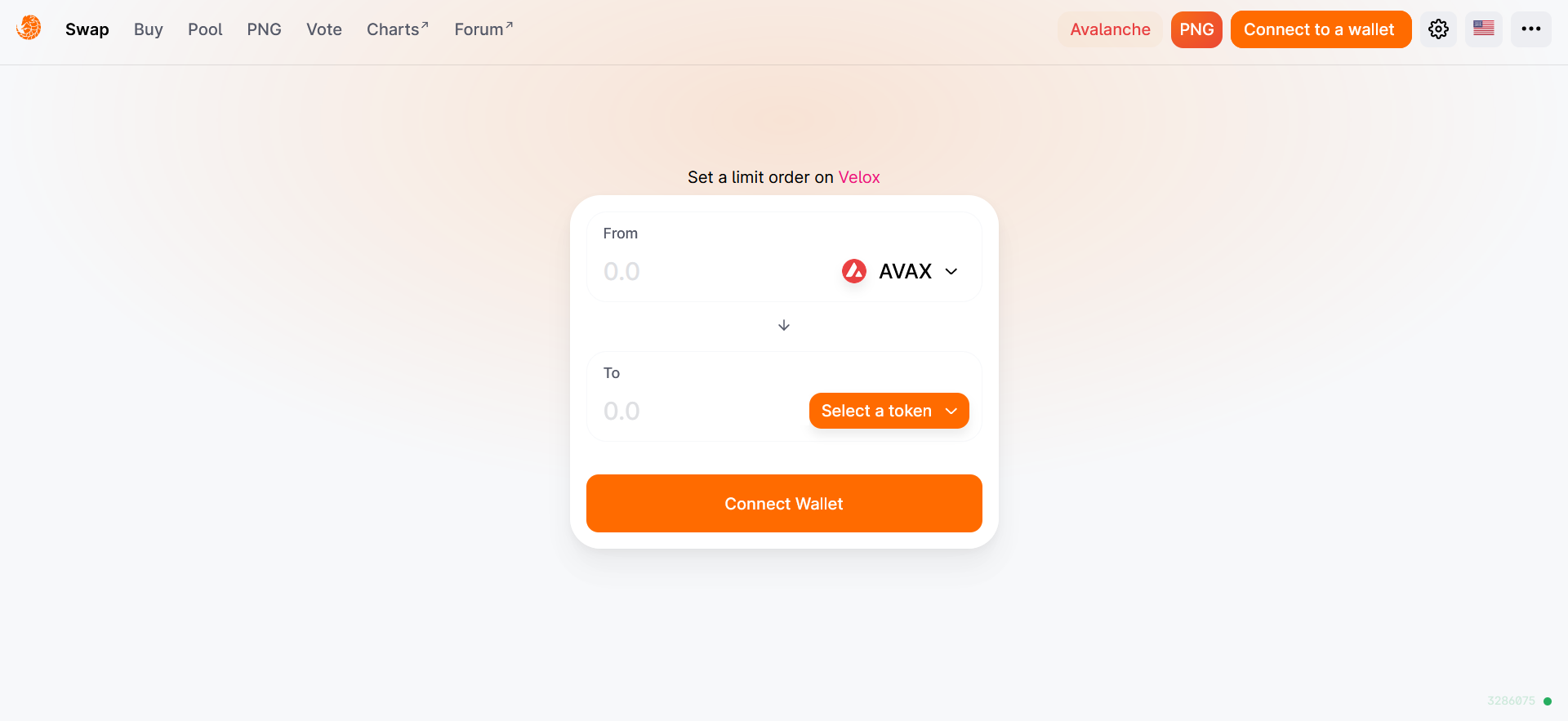

Pangolin

Pangolin is a decentralised exchange (DEX) built on Avalanche that functions in much the same way as most other DEXs built on Ethereum. In fact, it shares the same automated market-making (AMM) model as UniSwap. The main difference is that the Pangolin DEX benefits from the speed and transaction costs of the Avalanche blockchain. Pangolin currently has around $255 million worth of value locked in the protocol.

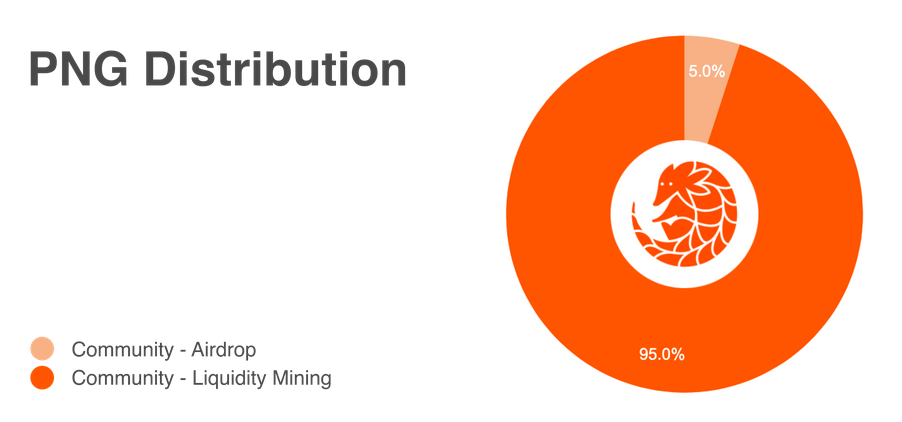

PNG is the governance token of the Pangolin DEX entitling holder’s to voting rights in the DAO which is currently the governance model. Again, there is a strong emphasis on the community and as such 0 (zero) PNG has been allocated to the developers or any other early investors.

PNG has a circulating supply of ~43,500,000, with a maximum supply of 538 million tokens. The emissions schedule halves every 4 years, starting with 256 million distributed in the first 4 years (64 million per year), then 128 million (32 million per year), and so on. Rewards for providing liquidity are paid earned through trading fees (fixed at 0.3%) and are also subsidised in PNG to provide further incentive.

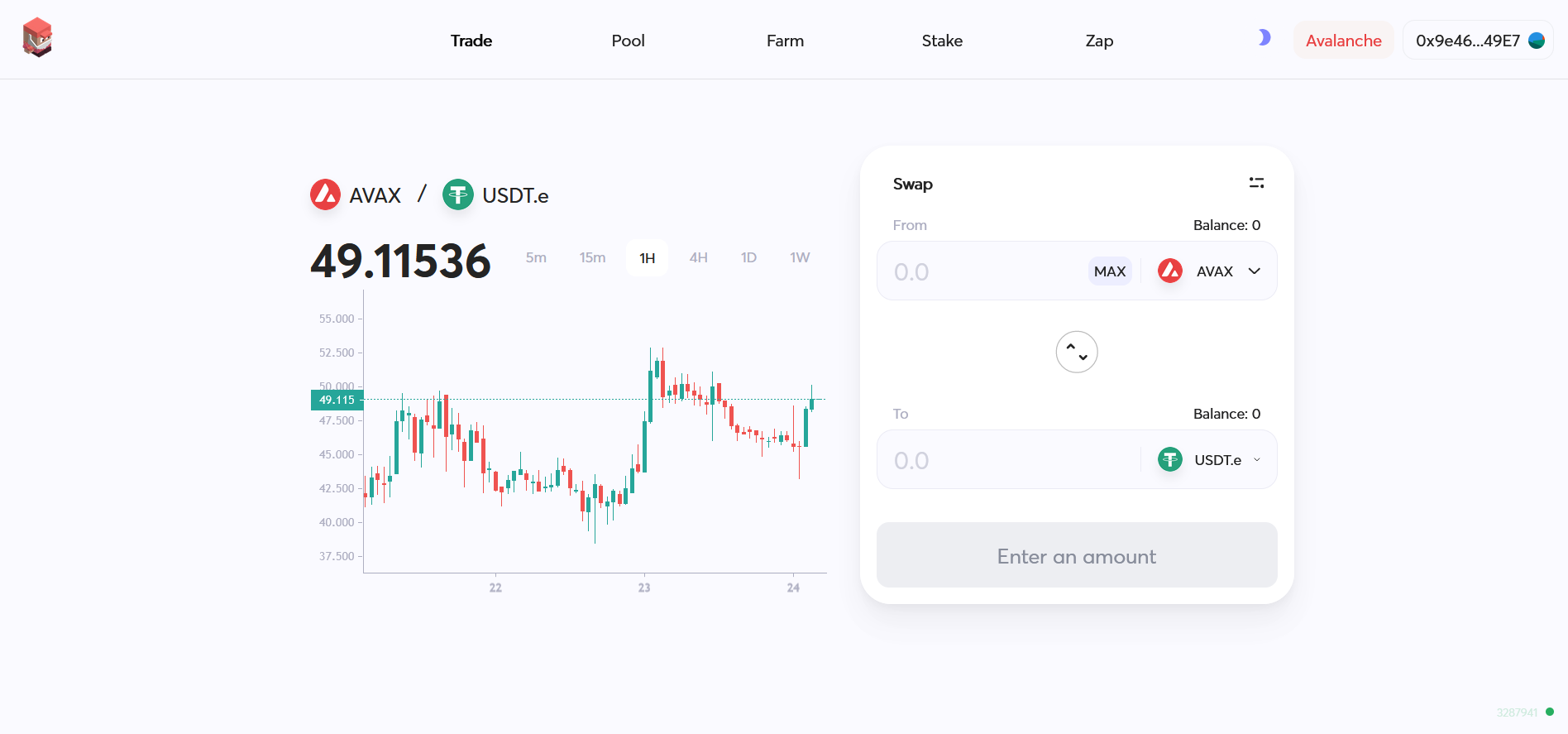

Trader Joe

Trader Joe is an Avalanche based DEX that facilitates swaps, farming, staking, and leverage trading (soon) through a lending system similar to that offered by Mango Markets. The exchange works in much the same way as Pangolin but with the added feature of farming for liquidity providers, who receive LP tokens for depositing to a pool which can be staked in a yield farm for extra rewards. Trader Joe is comparable to the SushiSwap DEX on the Ethereum ecosystem.

JOE is the governance token of the protocol with a circulating supply of ~110 million and a maximum supply of 500 million. JOE holders can stake their JOE tokens and receive xJOE, which entitles them to a share of staking rewards accrued through trading fees. Trading fees are set at 0.3% per swap, of which 0.25% goes to liquidity providers and 0.05% goes to the xJOE staking pool. This 0.05% is used to buy back JOE tokens which are then distributed to JOE stakers, with the returns re-staked automatically for compounding returns.

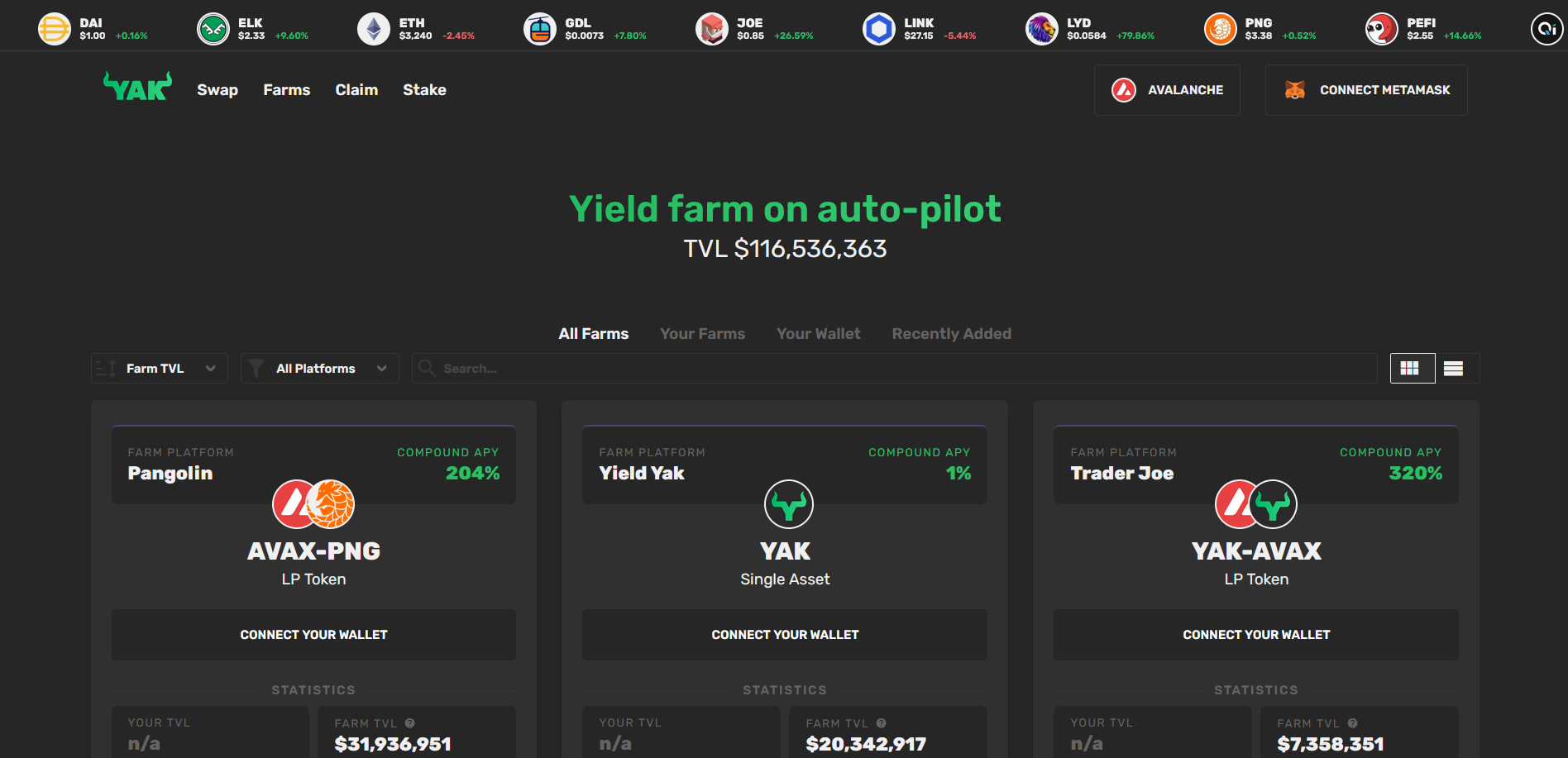

Yield Yak

Yield Yak is the Yearn Finance of the Avalanche ecosystem – a DeFi yield aggregator that automates farming strategies for users across many of the protocols on Avalanche. The main benefit of Yield Yak is that it allows for the costs of executing transactions to be spread out amongst all participants, which allows each individual to benefit from higher frequency reward claiming and subsequently greater compounding returns. Yield Yak currently has around $155 million in TVL.

YAK is the native token of the protocol. It has a small maximum supply of 10,000 YAK which means that at the time of writing 1 YAK is equal to ~$9300 – this is likely a nod towards Yearn Finance and their token, YFI. The token provides holders with governance rights, and YAK can be single-sided staked for AVAX rewards. Additionally, YAK-AVAX LP tokens can be staked to farm even greater returns.

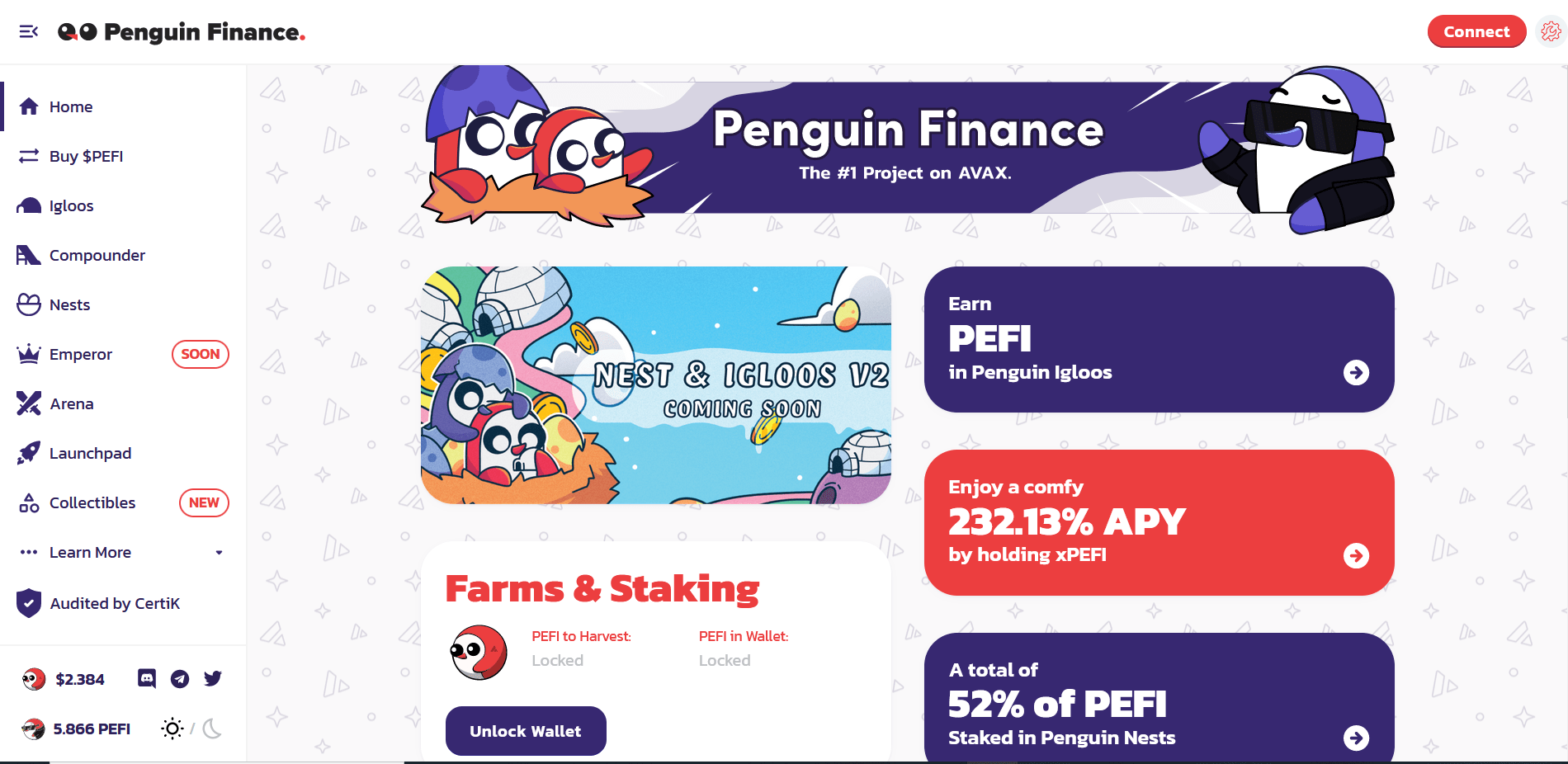

Penguin Finance

Penguin Finance is a multi-purpose DeFi protocol with an emphasis on passive income through staking and yield farming, and a rather unique component of Penguin Finance – the Penguin Emperor game, complete with customisable characters and, in the future, Penguin NFTs.

PEFI is the governance token of Penguin Finance with a maximum supply of 21 million tokens. The token will provide voting rights in the future DAO. The tokenomics of PEFI are particularly strong with decent value accrual:

- “Nests” provide users with the opportunity to stake their PEFI tokens and receive xPEFI tokens which entitles holders to earn rewards and auto-compound returns. Single-sided staking removes the possibility of impermanent loss at the cost of lower yield, and rewards are generated from fees acquired from users of the protocol.

- xPEFI is also required to participate in the LaunchPad, as well as play the Penguin Emperor game. There will likely be other benefits in the future for staking PEFI.

- The “Igloos” provide yield farming opportunities through staking Pangolin LP tokens.

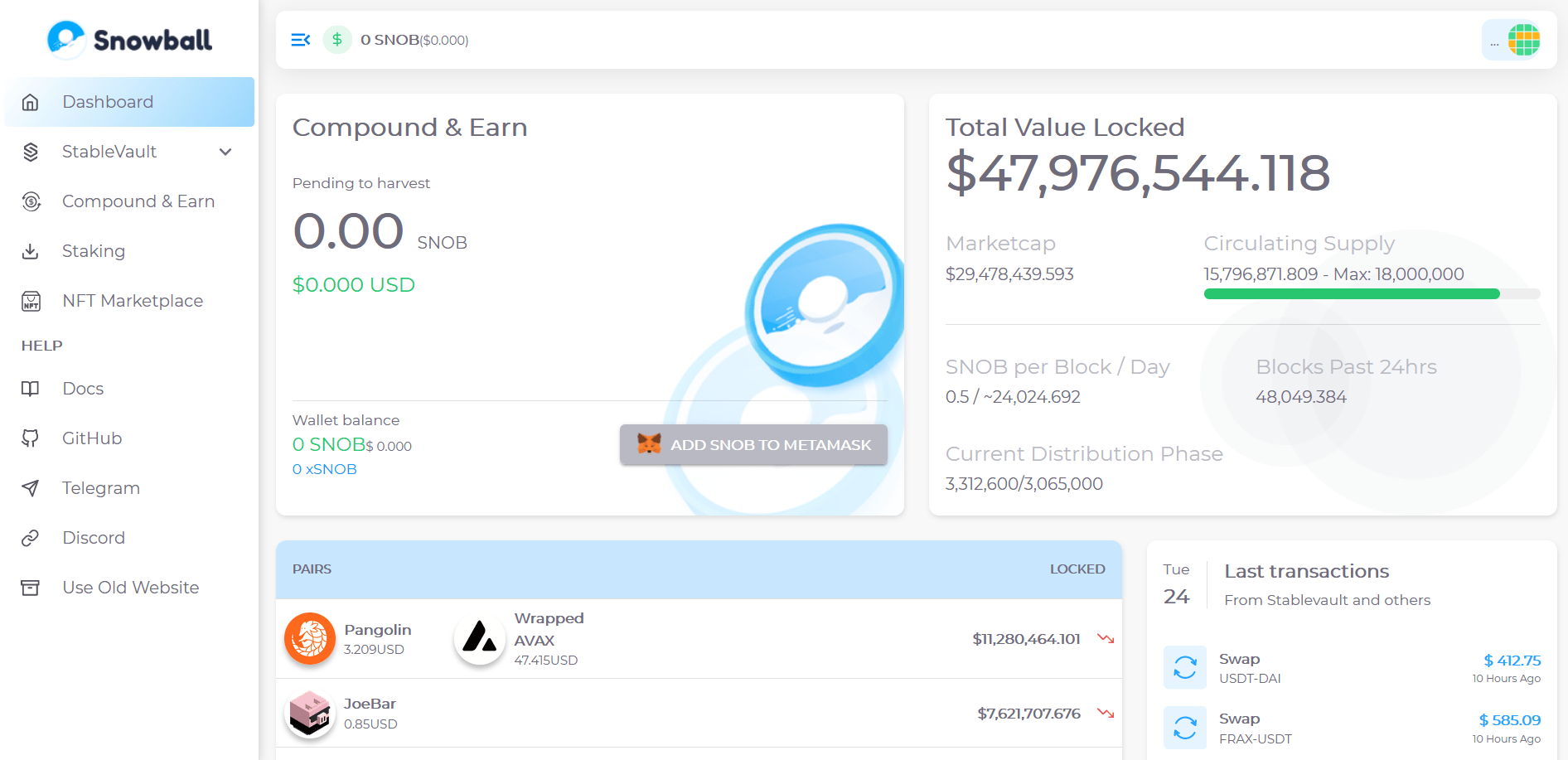

Snowball

Snowball is a stablecoin exchange and auto-compounder. Snowball provides an avenue for Avalanche DeFi participants to earn interest and yield on stableassets. The protocol has 2 key products:

- Compounding – offers a service that users can use to auto-compound their earnings from other exchanges and yield farms. Snowball pays the fees to allow the user to increase their profitability through more frequent compounding, which is possible because costs are socialised amongst all participants.

- StableVault – an automated market maker that facilitates stablecoin and pegged token swaps, with low slippage and minimal fees.

Bridging from Ethereum & Using Avalanche

Assume you want to try out that ecosystem and buy yourself one of these tokens, how would you go about it if you just had an Ethereum MetaMask wallet? Well, you're in luck because here are the steps.- You need to have a MetaMask account with at least some funds on it.

- You need to connect to the Avalanche network via a custom RPC on MetaMask and Avalanche themselves have a very simple guide - click here.

- Once you've created the custom RPC and connected to the new network, switch back to the Ethereum network from the network drop down menu at the top and go here - the bridge.

- Connect your Ethereum wallet

- You can now transfer many different assets from Ethereum over to Avalanche - we prefer using WETH (wrapped ETH) which you can get by simply swapping ETH or any other ERC-20 token for WETH straight from MetaMask swap or any other DEX.

- Once all network confirmations are done, the assets should arrive to the Avalanche wallet which you can check by re-changing the network back to "Avalanche" from the drop down menu.