Real-world assets: Is this sector the next hot thing?

A quiet revolution is unfolding in finance, and it's happening on-chain. While the spotlight remains on speculation, institutional money is moving into tokenized real-world assets (RWAs), unlocking new opportunities for investors and institutions alike. In this deep dive, we'll explore why RWAs are gaining momentum, who's leading the charge, and what this shift means for the future of finance. Let's dive in…

While the crypto space is fixated on speculative narratives, real money is quietly moving into tokenized real-world assets (RWAs). Organisations that previously disregarded blockchain are now firmly and strategically entering the market.

Instead of betting on the next big trend, BlackRock, Bank of America, Franklin Templeton etc are putting themselves in a position that has the potential to completely transform the global banking industry.

Despite the lack of huge mainstream attention, the numbers don't lie. Over $17.67 billion worth of RWAs are now on-chain (excluding stablecoins), with the sector growing 17.58% in the past 30 days alone. The momentum is clear-private credit, treasuries, and stablecoins are seeing sustained capital inflows, and institutional adoption is definitely on the rise.

This pattern is not new to us. Smart money moves first. The potential will be priced in by the time the entire market catches up.

In this deep dive, we'll analyze how RWAs are reshaping financial markets, which sectors are leading the charge, and why institutions are quietly going all-in on tokenization.

So let's dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The on-chain RWA landscape: Breaking down the market

While tokenized RWAs still fly under the radar, the sector has grown into a multi-billion-dollar market across several asset classes. From U.S. Treasuries to private credit, commodities, and equities, the range of tokenized assets continues to expand, bringing traditional finance (TradFi) into the blockchain.As of today, over $17.67 billion worth of RWAs are on-chain. The largest inflows are being directed toward private credit and U.S. Treasuries, highlighting a clear trend-investors are looking for yield-bearing, institutional-grade assets in DeFi.

Private credit

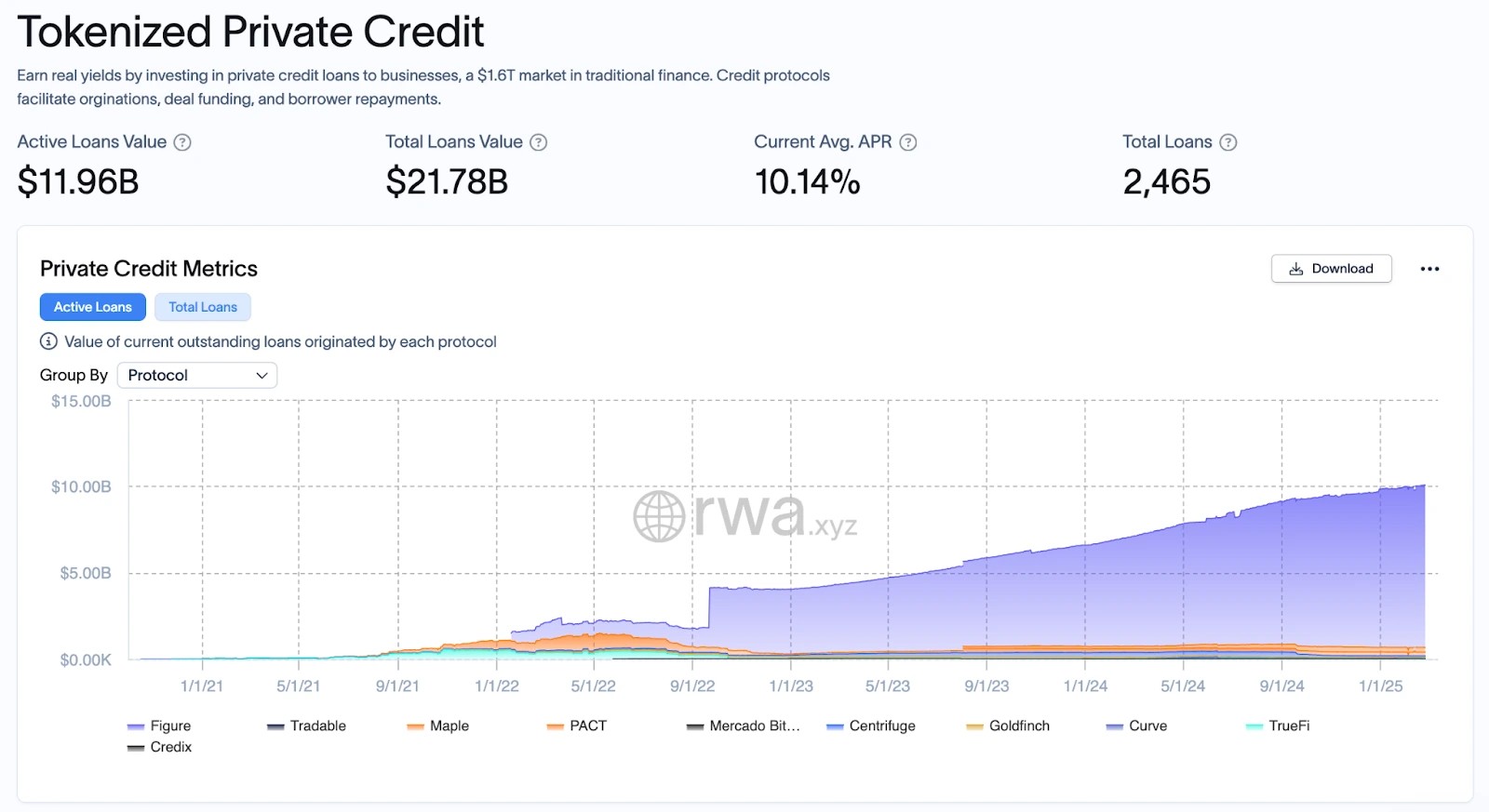

For example, tokenized private credit is the largest and fastest-growing sector in RWAs, accounting for over 67% of the total market cap with $12 billion in total value locked (TVL) and $11.96 billion in active loans. Institutions and high-net-worth investors are moving capital into this space, drawn by higher yields, faster execution, and fewer intermediaries compared to traditional credit markets.In TradFi, private credit is dominated by banks and institutional lenders, with slow approvals and limited accessibility. On-chain, the process is streamlined-capital moves faster, smart contracts automate execution, and borrowers can access liquidity without the friction of traditional financial infrastructure. The average APY in tokenized private credit is 10.14%, similar to corporate bonds or traditional fixed-income instruments.

Key players in tokenized private credit

- Figure is the largest player in the space, focusing on institutional-grade lending for hedge funds and asset managers ($11.08B in Total Loans Issued, $9.39B in Active Loans).

- Maple Finance ($2.55B in Total Loans Issued, $273.8M Active Loans) - A DeFi-native platform allowing under-collateralized lending, enabling borrowers to access capital without the strict collateral requirements of traditional finance.

- Centrifuge ($573.4M in Total Loans Issued, $74.8M Active Loans) - Specializes in bringing real-world assets like invoices and supply chain debt on-chain, bridging traditional businesses with DeFi lenders.

But the risks are real. Unlike tokenized U.S. Treasuries, private credit often involves uncollateralized or partially collateralized loans, making counterparty risk a major factor. Liquidity is also lower investors need to lock up funds for fixed terms, unlike in DeFi's fully liquid lending pools.

Despite these risks, the growth trajectory is undeniable. Institutions are allocating billions to tokenized private credit, positioning it as a key pillar of the evolving RWA market.

Tokenized U.S. treasuries ($3.90B TVL)

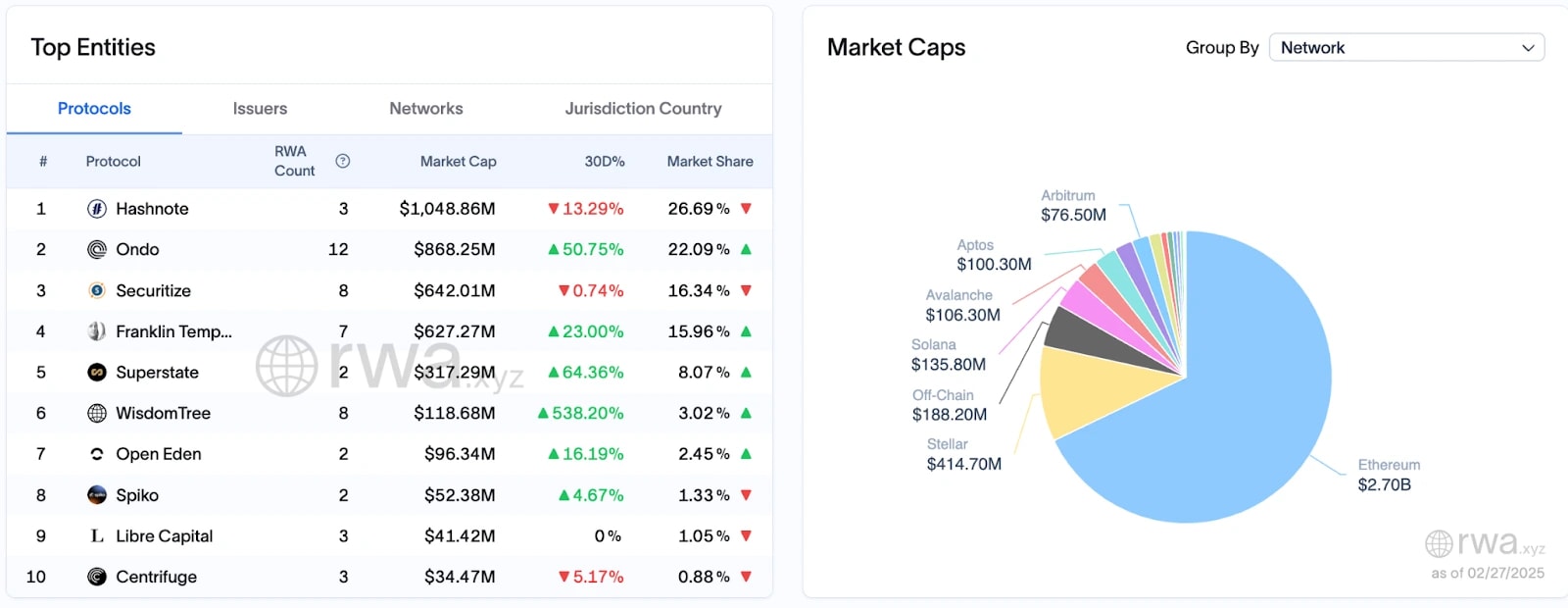

After private credit, U.S. Treasuries have become one of the most sought-after tokenized assets, growing 3.89% in the last 7 days alone. With $3.90 billion in TVL, they now represent the second-largest segment in the RWA market. The reason is simple: they offer low-risk, yield-bearing exposure in a fully transparent, on-chain format.Institutions that once dismissed blockchain are now actively embracing tokenized treasuries, drawn by instant settlement, automated yield distribution, and unrestricted global access. With yields on U.S. government bonds sitting at 5%+, tokenizing these assets on-chain allows investors to bypass banking restrictions and access real-world yield directly.

Ethereum Network leads in almost all the asset classes including this for being the choice of chain for tokenization.

Key players in tokenized treasuries

- Hashnote ($1B+ TVL)- The largest issuer of tokenized U.S. Treasuries, providing institutional-grade, fully compliant exposure to short-term T-bills on-chain (requires a minimum deposit of $100k).

- Ondo Finance ($868M TVL) - A leading issuer of tokenized U.S. Treasuries, offering products like OUSG, which provides yield-bearing exposure to short-term T-bill (requires a minimum deposit of 1k-5k for both its current products).

- Franklin Templeton ($627 TVL) - One of the first major TradFi firms to enter the space, integrating tokenized government securities into its investment offerings.

Why tokenized treasuries are gaining traction

- Instant access to yield - No need for brokerage accounts or lengthy approvals.

- Lower barriers to entry - Retail investors can access fractional ownership in Treasuries with minimal capital.

- No banking restrictions - Tokenized treasuries enable permissionless global participation.

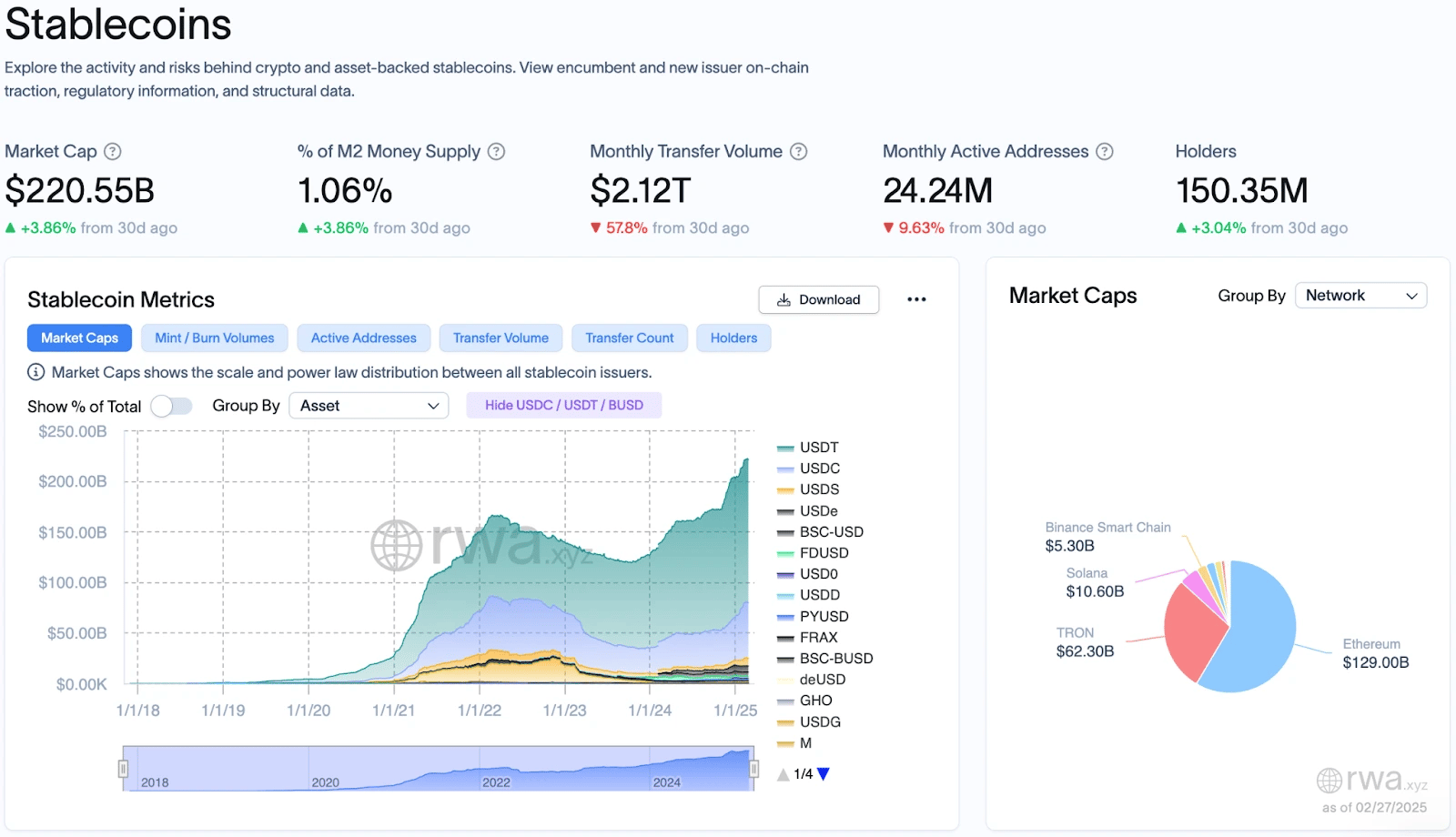

Stablecoins ($220.55B market cap)

With unparalleled liquidity, stablecoins have solidified their position as the foundation of on-chain finance by enabling settlements, DeFi transactions, and cross-border payments. They are the most used and systemically essential sector among RWAs, with the highest amount of tokenized assets (market capitalization of $220.55 billion).The way stablecoins are developing beyond their initial function is becoming more and more visible. Income-bearing stablecoins are bringing about a fundamental shift by combining the stability of fiat-pegged assets with actual income generating, even though USDT and USDC still hold a dominant position.

By combining U.S. Treasuries and other RWAs, these stablecoins are starting to serve as real-world yield generation tools rather than only being a medium of exchange.

The market breakdown

Despite competition from algorithmic models and non-USD stablecoins, the U.S. dollar still dominates on-chain finance, with over 90% of stablecoin liquidity pegged to USD.- Tether (USDT) - $141B Market Cap - The largest and most liquid stablecoin, leading in trading volume and cross-border settlements.

- USD Coin (USDC) - $54.9B Market Cap - The preferred choice for institutional transactions and regulated financial applications.

- Frax, Ethena, and New Entrants - Yield-bearing and synthetic models are gaining traction, with protocols like Ondo Finance integrating RWAs into stablecoin mechanics.

This shift is becoming more visible as major U.S. banks and asset managers start advocating for stablecoin regulation. Bank of America's CEO's recent statement on stablecoins, "If they make that legal, we will go into that business." was an open statement that U.S. institutions want control over the future of digital money.

For institutions, the logic is simple: if stablecoins are going to power on-chain finance, they want the dollar to remain the dominant currency.

Another major development is the rise of yield-bearing stablecoins, backed by real-world assets like U.S. Treasuries. Traditional stablecoins like USDT and USDC offer no inherent yield, but products like Ondo Finance's OUSG are changing allowing stablecoin holders to earn passive appreciation by holding tokenized T-bills.

This shift could be a game-changer. Stablecoins are no longer just a settlement tool-they are becoming an asset class of their own. If institutions weren't paying attention before, they are now.

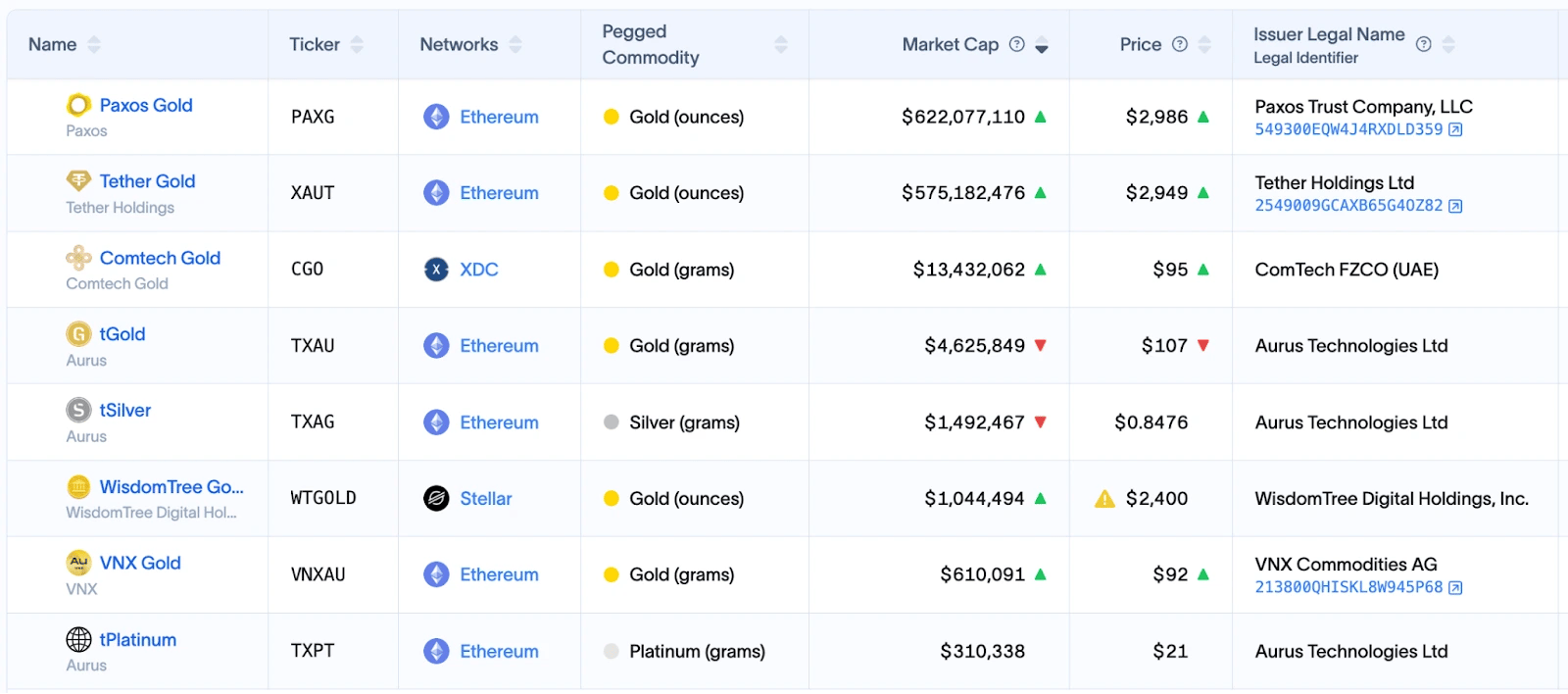

Tokenized commodities - Gold and beyond ($1.22B Market Cap)

Commodities have started making their way on-chain, offering investors direct exposure to physical assets without traditional market inefficiencies. While still a relatively small segment, tokenized commodities have grown to a $1.22 billion market, led by gold-backed stablecoins.Gold has historically been a safe-haven asset, and tokenization is making it easier to trade, fractionalize, and settle globally without relying on banks or vault storage. As trust in fiat currencies wavers and inflation concerns persist, investors are increasingly looking at tokenized gold as a hedge.

Gold-backed tokens:

- Paxos Gold (PAXG) - $622M Market Cap → A regulated gold-backed token, providing institutional-grade exposure to gold markets.

- Tether Gold (XAUT) - $574M Market Cap → Backed 1:1 by physical gold, offering stable value storage with easy on-chain transfers.

- Other Emerging Tokens: A few smaller projects are experimenting with tokenized silver, platinum, and oil-backed assets, though adoption is still limited for now.

Tokenized stocks & ETFs ($14.38M TVL)

Tokenized equities might emerge as one of the most disruptive sectors in RWAs, offering 24/7 trading, fractional ownership, and unrestricted access to global stock markets. While adoption is still in its very early stages, the concept is gaining traction, with $14.38 million in total value locked (TVL) across various platforms.Traditional equity markets are highly restricted, and limited by trading hours, geographic barriers, and brokerage requirements. Tokenization removes these inefficiencies, enabling investors to own, trade, and transfer stocks on-chain without relying on intermediaries.

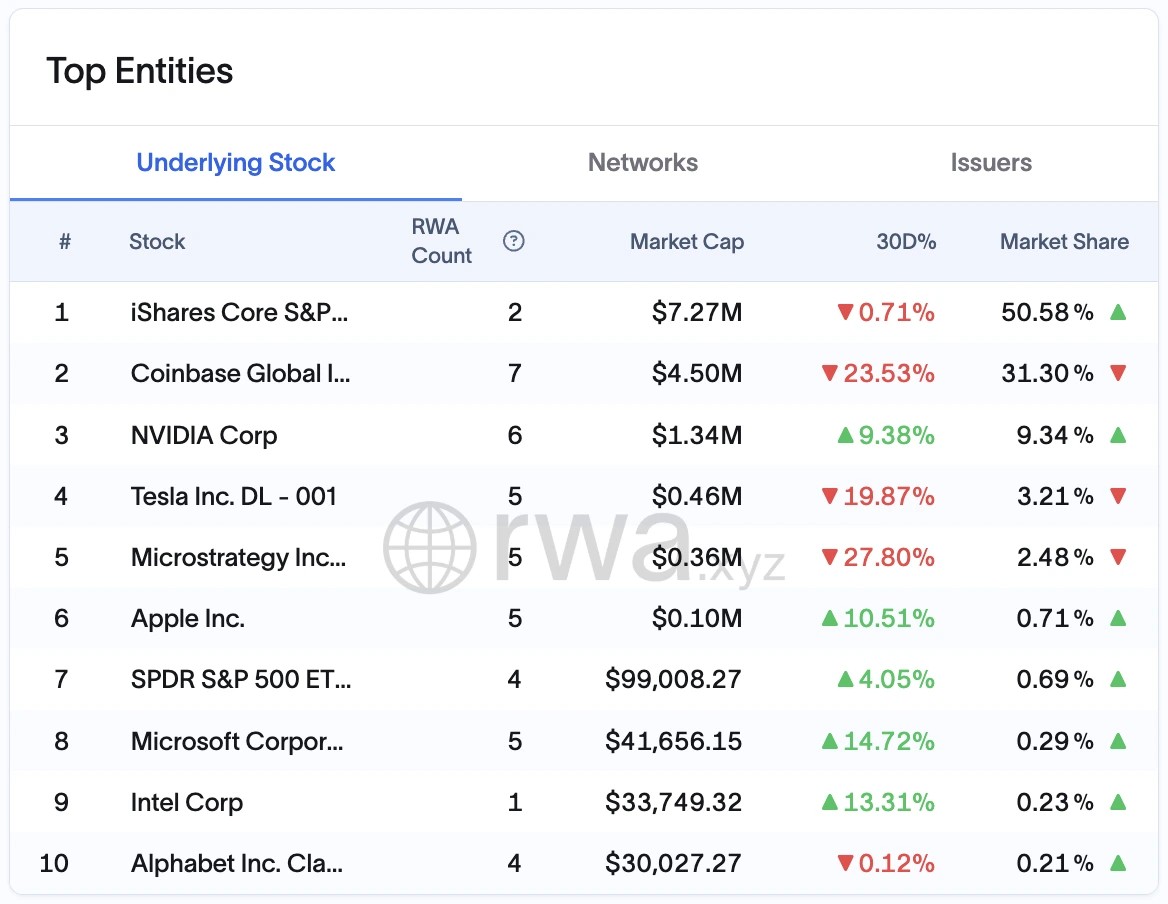

Which stocks & ETFs are being tokenized?

- Tesla (TSLA), NVIDIA (NVDA), Coinbase (COIN) → Some of the most widely traded tokenized stocks.

- S&P 500 ETFs → Index funds are being brought on-chain, allowing permissionless exposure to traditional markets.

- Other emerging assets → Experiments with tokenized mutual funds, bonds, and real estate ETFs are underway, but liquidity remains low.

One of the biggest catalysts for tokenized stocks and ETFs could be Ondo Finance's upcoming Global Markets (GM) product. Unlike current tokenized equities, which often rely on synthetic assets, Ondo GM aims to offer real, fully backed securities on-chain, giving investors direct exposure to stocks, ETFs, and bonds.

Unlocking global liquidity

The real power of tokenization isn't just putting TradFi assets on-chain-it's about removing financial barriers entirely. Traditional markets are slow, fragmented, and heavily restricted. Tokenization flips this system on its head, creating 24/7 markets, enabling borderless access, and automating ownership transfers.For decades, financial markets have catered to those with deep pockets and institutional access. Tokenization is changing that. High-value assets are now being fractionalized, giving retail investors access to opportunities that were once out of reach.

- Real Estate - Instead of requiring hundreds of thousands of dollars to buy property, investors can now own fractional shares of tokenized real estate and benefit from appreciation and rental income.

- Stocks & ETFs - High-priced stocks like Berkshire Hathaway, Amazon, and Tesla can be bought in small increments, making equity markets truly accessible.

24/7 markets & instant settlement

Traditional finance operates on its own schedule-markets close on weekends, transactions take days to settle, and intermediaries slow everything down. We think tokenized RWAs are about to render that system obsolete.- Markets never close → Unlike TradFi, tokenized RWAs trade 24/7, across any time zone.

- No middlemen, lower costs → No brokers, no banks, no clearing houses-just direct ownership and on-chain transfers.

- Instant settlement → Stocks, bonds, and real estate transactions that take days in TradFi now settle in seconds with smart contracts.

Cryptonary's take

Billions are being moved on-chain silently while institutions are setting themselves up for long-term success, while the majority are preoccupied with short-term narratives. This is a structural change that is actually taking place, not speculation.The appeal is evident. Institutional-grade yields are being introduced to DeFi, U.S. via private credit. Access to treasuries has become available globally, and entrance barriers are being eliminated via tokenized stocks and funds. Capital is now moving freely, right away and without intermediaries, unlocking liquidity from outdated financial institutions.

Institutions aren't just watching from the sidelines-they're adapting, creating, investing, and integrating. The financial system as it currently exists is undergoing a transformation, and the difference between those who get this now and those who do not will be immense.

This is no longer about speculation. RWAs are here, they're scaling, and they're set to reshape global finance. We will continue to monitor this sector and give out updates, till then enjoy these discounted prices the market is presenting right now. There likely be some more pain, but we are almost there. And when we get there, be ready to shoot cause the discount won't last for long.

Cryptonary, OUT!