"Everybody has a plan till they get punched in the face."

That could describe the sentiment in the current market, not only in crypto but also in the TradFi markets.

But this is a philosophy you must always keep in the back of your head as an investor.

The market often throws a punch to force us to scrutinise our investments and confront reality, especially when an asset's performance doesn't align with our initial thesis.

The punch has been thrown, the market is down, and we're taking the time to assess the performance of some of our past thesis.

So, with that in mind, let's examine our thesis from September 2023 and see whether we have dodged that punch or have a nosebleed.

TLDR

- Today, we reevaluate our theses on two DeFi projects with huge upside targets.

- Thesis 1: A 12x-25x upside on the back of a DeFi money market project with hands deep in Ethereum staking.

- However, despite the soaring volumes, the expected revenue payoff was a paltry 0.08% cut, far below the 0.2% initially projected.

- Thesis 2: This altcoin should get a ~6x price increase for every $1B supply growth of an associated stablecoin.

- But that bullish equation was shattered with the stablecoin's supply dropping from $1B to $650M.

- Will both projects get back to winning ways or is it time to cut them loose?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

CVX

The play for Convex Finance (CVX) was an indirect bet on Curve Finance. To recap, Curve Finance is the largest stablecoin money market in crypto, with the deepest liquidity and highest volumes—meaning lots of fees. These fees are shared with CRV stakers through participation in governance. Therefore, it made sense to gain some kind of exposure to all those rewards generated.But there was a catch - CRV is highly inflationary, so any yield would be largely offset by the emission of CRV, diluting the supply and reducing the token value. Convex was taking all the risks associated with the volatility inherent in accruing yield via CRV staking (because it benefits them to influence governance). But, they share their CRV rewards with CVX holders.

In addition to CRV holdings, Convex's CVX has an intrinsic value associated with Frax (FXS), a liquid staking protocol (among other products), which also had to be considered.

Essentially, CVX represented a diversified index-fund-type bet on a range of core DeFi protocols through its control of governance tokens and distribution of associated fees to CVX holders.

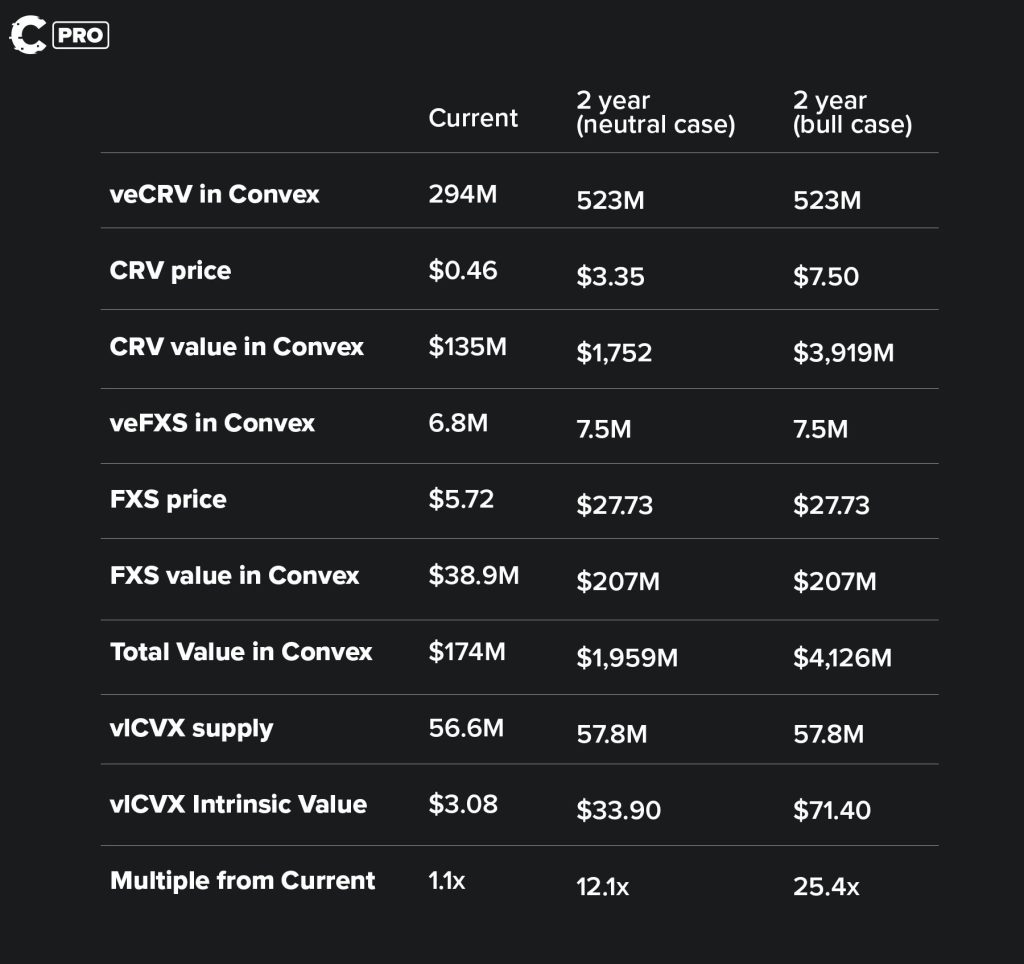

The above shows a summary of our calculations to get the CVX price targets:

- Neutral case: $33.90, or a 12.1x.

- Bull case: $71.40, or a 25.4x.

Where is it now?

$2.44.

Without even considering the consequential figures outlined in the original thesis, we've just had a major bullish phase in Q1 2024, so the price through speculation alone should be higher.

What has gone wrong?

Key issues with the CVX thesis

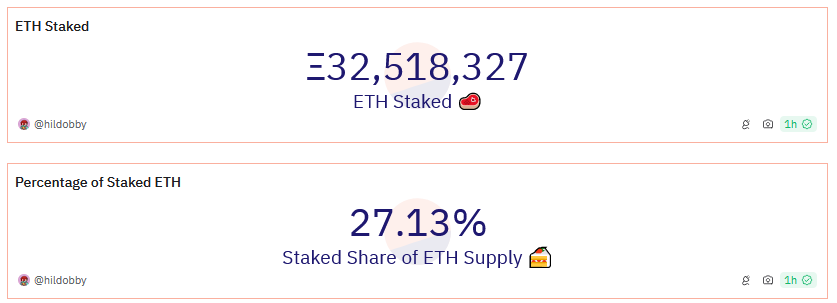

Much of the CVX bet was based on increased Ethereum staking participation and the subsequent growth of protocols like Frax, which supports liquid staking infrastructure. Ethereum staking participation has increased, but it has not had the intended effect on CRV/FXS that we had initially theorised.

In September, staking participation was around 20%. Yet, we have seen negative CVX price action despite a ~7% increase in overall ETH staked (relative to supply).

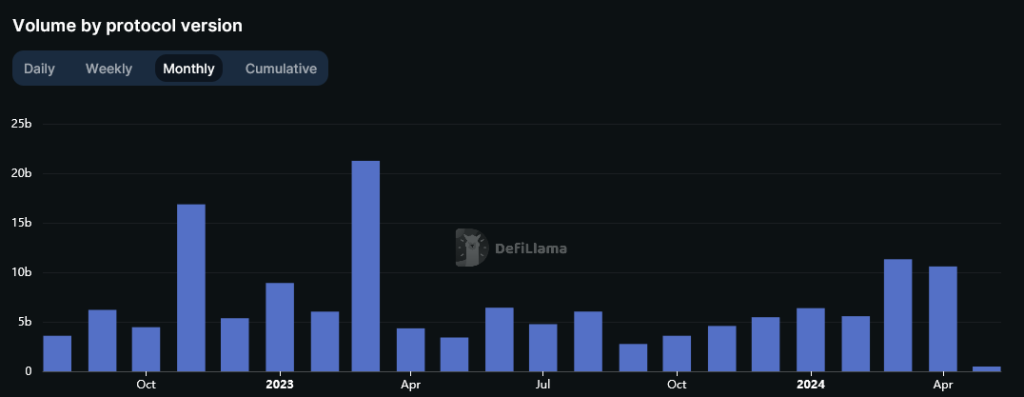

The other half of the thesis considered Curve's volume and the resulting fees generated. Again, when we look at the figures, Curve has increased its volume by ~200% since Sept 23:

Yet, there is no positive price action on CVX.

This would be enough for us to throw in the towel and work on fixing that nosebleed.

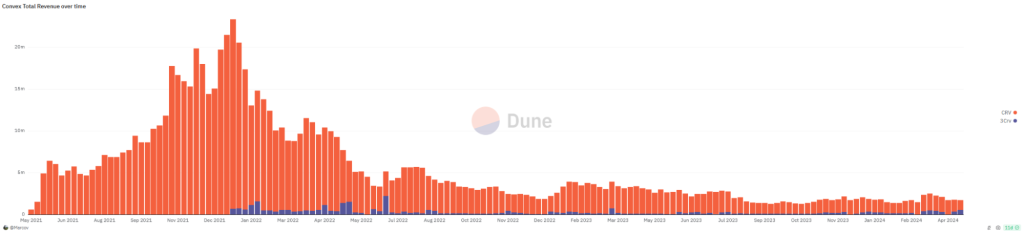

But the real killer is that, despite this increase in volumes on Curve, we can see that they have failed to funnel revenues to CVX at the anticipated rate:

The period we're interested in on the above chart is Sept 2023-Present. In September 2023, CVX revenue was ~$5.5 million. In March, that revenue was $9.3 million.

Granted, CVX peaked at around $5.30 in March, so there is some relationship between CVX revenue and price. But, the killer is by comparing the CVX revenue/Curve volume ratio (metric for Convex's share of fees) from September and the current March:

- September: $5.5 million/$2.758 billion = ~0.2%.

- March: $9.3 million/$11.318 billion = ~0.08%

Therefore, the CVX valuation is now invalid.

Is CVX still a valid investment? Sure, but not under this thesis.

Bottom line - we're out.

But what about Frax?

Frax (FXS) - still worthwhile?

The TLDR thesis for Frax (FXS) was that for every billion that FRAX added to the supply, FXS price should increase about 5.9x.For context, FXS is the governance and utility token of Frax Finance, and FRAX is the stablecoin managed by Frax Finance.

To figure out if this ratio holds, let's look at the numbers and calculate the proportional ratio of FXS/FRAX:

- In May 2023, approximately 1 billion FRAX were circulating, and FXS had a market cap of $552 million. This gives a ratio of 0.552.

- Current figures are 650 million FRAX circulating, and FXS has a market cap of $330 million. This gives a ratio of 0.51.

Additionally, and even more worryingly, despite significantly better market conditions between May 2023 and now, there is actually less FRAX circulating than there was back then (1 billion v 650 million).

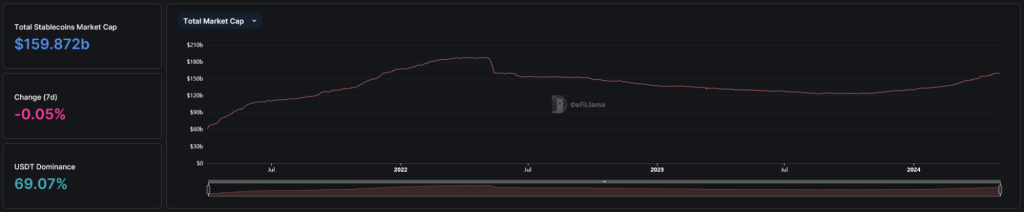

Quite clearly, the demand for stablecoins has not dropped. The value of stablecoins circulating has increased ~23% since May 2023.

Any projections comparing FRAX to DAI are invalid—DAI increased supply by ~$500 million in the same period.

Therefore, we can also exclude FXS - we're out.

Cryptonary's take

CVX is not worth holding when looking at the investment objectively and comparing expectations against performance. However, there is still merit in holding CVX as a less volatile bet on Ethereum DeFi, and we believe that previous CVX revenues above are still achievable. Thus, CVX can still reach its all-time high of ~$50.In the case of FXS, the stablecoin simply hasn't gathered momentum as expected. This also impacted our thesis on CVX owing to Convex's significant FXS holdings, which were included in the CVX valuation methodology.

Sometimes, things don't play out the way you expect. It's part of investing.

But being aware of why you originally bought an asset and keeping up to date with developments helps you understand when things have changed and it's time to sell.

This could be a fundamental shift, overall market sentiment, or other reasons.

But you must have as much conviction in selling when the tide turns as you did when you bought in.

In moments of uncertainty, capital preservation is more important than capital appreciation.

Cryptonary, OUT!