What changed?

Optimism, Arbitrum, and Mantle registered new all-time highs ahead of the anticipated Dencun upgrade.

The Dencun upgrade went live in March, and while it was supposed to be the game-changer upgrade for the L2 networks, the L2 narrative has struggled to retain the market's interest.

In this report, we try to determine whether these L2 tokens still have more fuel left in the tank or have already reached their bull market peak.

Let's find out!

TDLR

- The Dencun upgrade: Post-Dencun, Ethereum Layer 2 networks improved transaction efficiency but saw declining token prices.

- Network usage: Despite lower token values, on-chain activity and total value locked (TVL) in Layer 2 networks remain high.

- Market valuation vs performance: Despite strong network performance metrics, significant price corrections occurred.

- Shifting market sentiment: Current interest has moved to newer trends, but Layer 2 networks are poised for a potential rebound in the next phase of the bull market.

- Updated price targets: Despite market challenges, we still think some Layer 2 projects have promising upside potential.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Ethereum's Dencun upgrade

The largest altcoin network has faced scalability issues for the longest time. Layer 2 networks have aimed to alleviate network congestion issues and high transaction costs. Hence, Ethereum Improvement Proposal-4844 was touted by some developers as a technical milestone that would change the ether ecosystem.What is EIP-4844?

It is a part of the Dencun upgrade introduced to reduce costs associated with transactions on layer 2 solutions.

Remember that L2s batch and compress transactions before sending them to the mainnet. The Dencun upgrade introduced Binary Large Binary Large Objects (blobs), which attach large data chunks to regular transactions. Blobs store data off-chain, unlike call data, which is stored permanently. Therefore, L2s could not store data in blobs instead of expensive call data, processing transactions at a lower cost.

The Dencun upgrade took place as planned on March 13, 2024, and overall, it delivered on the promise. Between March 13 and 19, the number of active addresses and transaction volume for Layer 2 networks increased to their all-time high range.

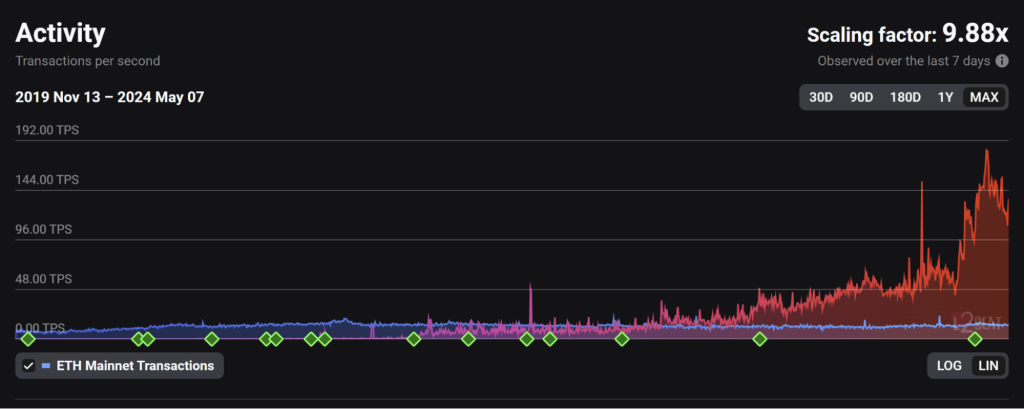

The combined daily throughput reached around 136.5 TPS on March 16, the previous high being around 149.5 TPS.

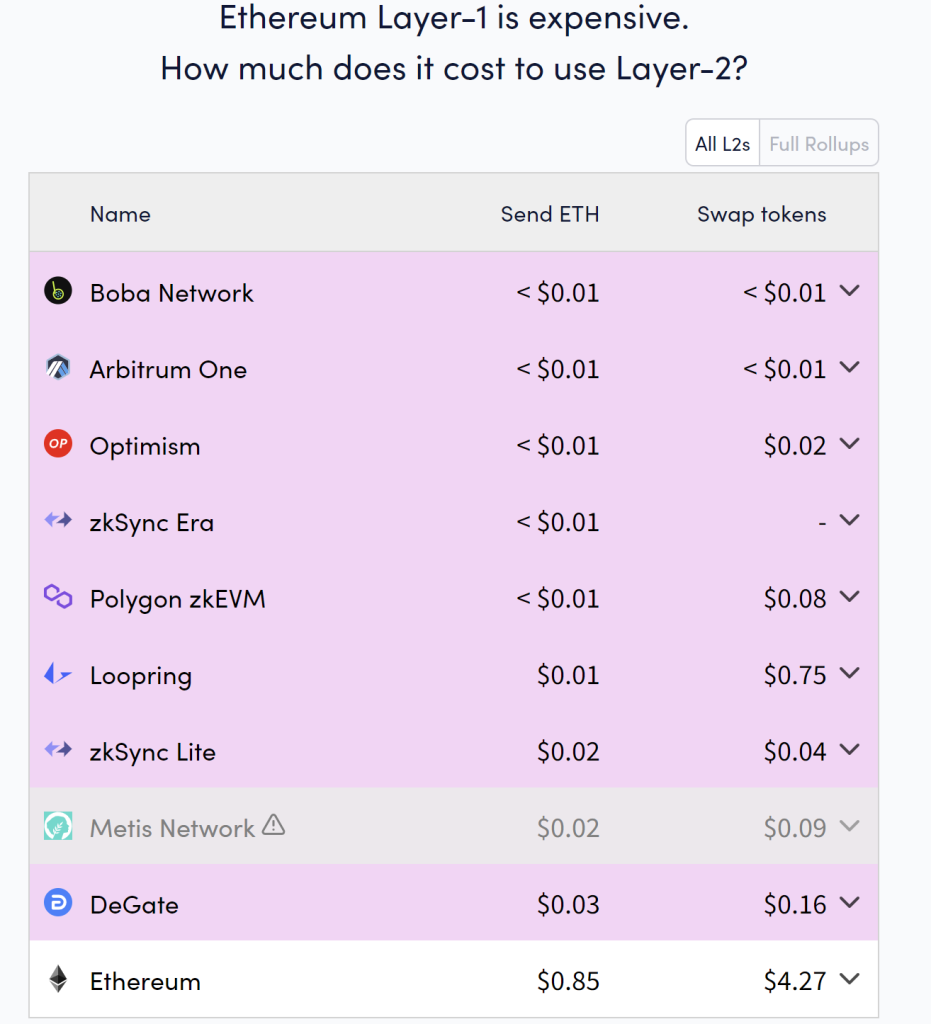

Currently, the median transaction fees on major L2s like Arbitrum, Optimism, Metis, etc., are below $0.01, almost 85-90% below previous quotations.

However, the Dencun upgrade's success did not exactly have the right type of impact on L2 token valuations.

Falling fees and falling prices

In the chart above, we have taken the price performance of four L2 tokens that Cryptonary has extensively covered. As observed, each of these assets has witnessed massive corrections since March 13. While ARB and OP faced a -55% and -42% decline, MANTA and METIS have dropped by 59%.

This contrasts with how the tokens performed in Q1 2024 when ARB and OP reached new ATHs.

On-chain activity

Earlier, we identified that transaction costs for L2s had significantly decreased. Many people seem to think that declining transaction costs may have triggered low activity. However, that was far from the truth. This slowdown in transaction fees doesn't necessarily imply lower network usage.

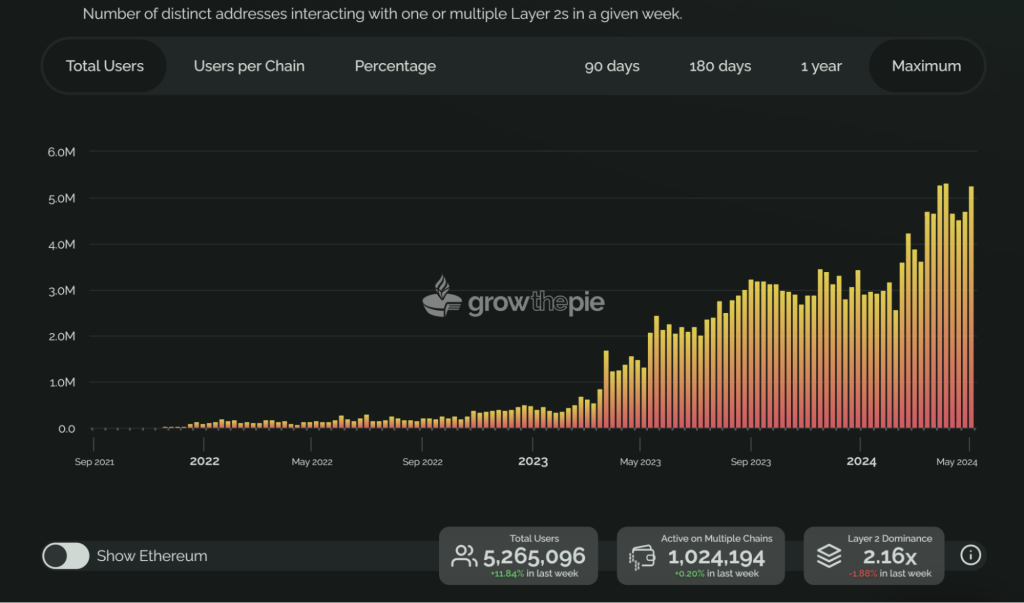

Since the beginning of 2024 and also after the Dencun upgrade, the number of addresses on L2 networks has progressively increased. On May 5, the number of unique addresses was above 5 million.

The total value locked or TVL in these networks also remained high. On April 9, the collective TVL value reached an all-time high of $45 billion. Since then, a minor decline has occurred, currently clocking at around $38.5 billion.

The number of transactions per second also reached a new all-time high on March 31, with 180 TPS collectively on all L2 chains. As mentioned earlier, the previous TPS peak was around 149.5, which is, ironically, the current TPS after activity has fallen a little over the last couple of weeks.

Lastly, the L2s network also saw the largest asset inflows from L1 networks over the past week, indicating that the value transfer on these scaling solutions remained high despite the drop in market valuation.

So, are L2s dead yet?

Far from it.One of the issues with this industry is that newer narratives always take away the shine. That is the nature of the beast, as crypto innovations are undeniably a constant process. However, Ethereum L2s are far more yesterday's news.

Despite the current weakness in price action, these L2 projects are delivering on their promise of scaling Ethereum in terms of adoption, community and brand recognition. We are only at the beginning, and when DeFi gets back in the limelight, these L2s will shine.

Take the case of Arbitrum. It currently holds the largest TVL market share, with 41.15%. There are over 500 DeFi apps on Arbitrum, and the network has processed $3.32 billion in volumes over the past week alone.

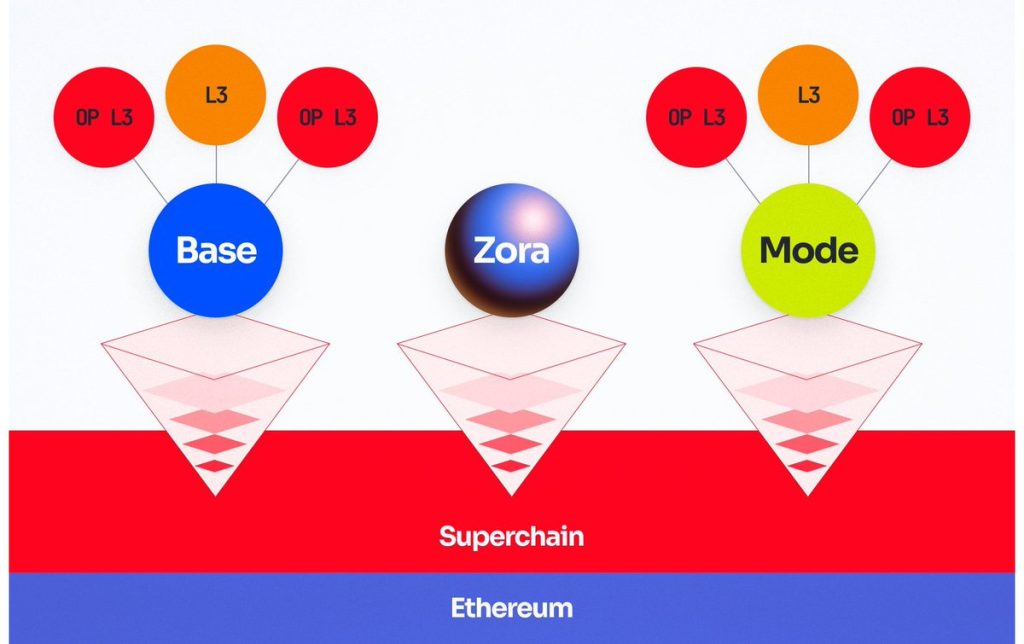

Its competitor, Optimism, leads in distribution. One notable addition to its "superchain" consortium has been Coinbase's Base, which uses the OP stack. Now, building with the OP stack allows Optimism DAO to receive a fee, and it is safe to say that Base has been extremely successful.

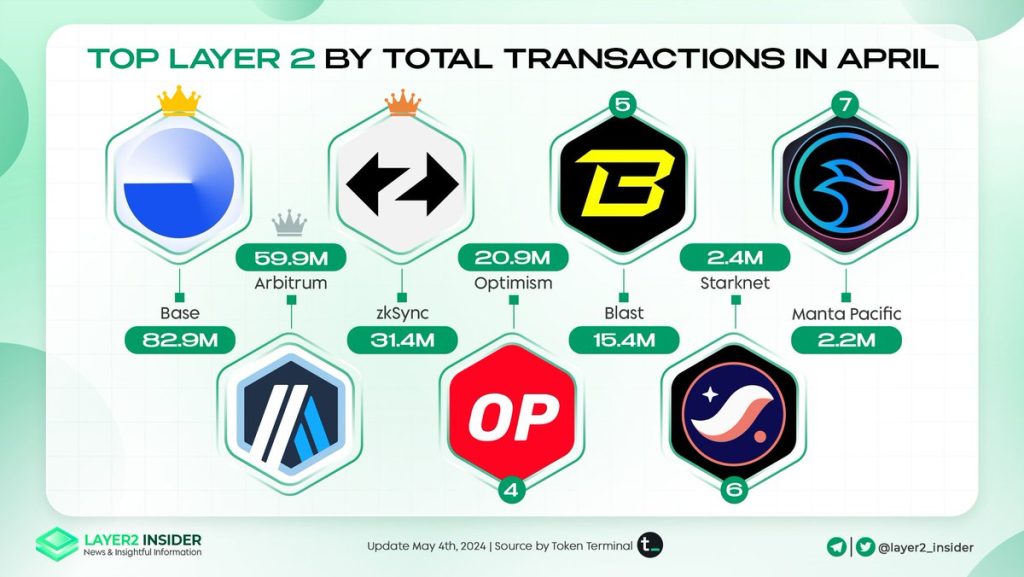

In April 2024, the Base L2 network processed the highest number of transactions, leading both Arbitrum and Optimism.

Therefore, collectively, L2s are far from becoming a lost cause.

But we are not in it only for the tech, right? We also want to make money.

So, examining whether these projects are on track to reach their 2024/2025 bull targets is important.

Estimating 2024/2025 targets

Arbitrum

We have already assessed the bullish target for Arbitrum and Optimism for the 2024/25 bull run. Check out Cryptonary's picks for our price targets and potential multipliers from current prices.With Arbitrum, the major headwind was its token unlock, which increased the circulating supply by 87%. While we initially expected the token release to have a lesser impact, the correction has been pretty severe. However, we must look at the current statistics and ecosystem as well.

With ARB, we currently have Layer 3 implementation, expansion to multi-VM through Stylus, and chain clusters. Stylus is basically a more efficient execution environment than EVM, which provides better computational results.

So, the current bull case for ARB relies on dApps built through stylus and L3 orbit chains. We highlighted the key narratives in our report earlier last month.

We believe that ARB is still on track to reach its $8.75 target for 2024/2025.

Optimism

Earlier in February, we made a case for Optimism's bullish target based on OP Stack and Superchains. That narrative is starting to unfold now. Aerodrome and Velodrome Finance are some projects with direct and indirect associations with Optimism.Velodrome is one of the largest decentralised exchange protocols on OP, while Aerodrome is the largest protocol on Base by TVL.

All these chains are built across the superchain, which shares a common roll-up architecture in the OP stack. Base, the newly launched Mode network, and Zora were all developed with Optimism's OP stack.

Optimism's bullish narrative remains in play for its 2024/2025 target of $30.

In our previous report, we mentioned that investors can DCA into $2.72, $2.34, and $1.95 if they want to build a position in Optimism. Currently, OP is consolidating in the above range.

Metis and Manta

When we released our deep dive on Metis earlier this year, the project was one of the leading narratives in the L2 ecosystem. Since then, the trading price has declined by 59%.From a technical development perspective, the project has continued to build, and recently, its decentralised sequencer upgrade went live. On March 14, 2024, Phase 1 was completed, and on April 23, 2024, Phase 2 commenced. This is a key milestone in Metis' 2024 roadmap, where market participants and incentives will be properly aligned.

For a detailed technical breakdown, please check their report. Following this upgrade, Metis users will be eligible for two-second confirmation time and revenue streams like sequencer mining rewards.

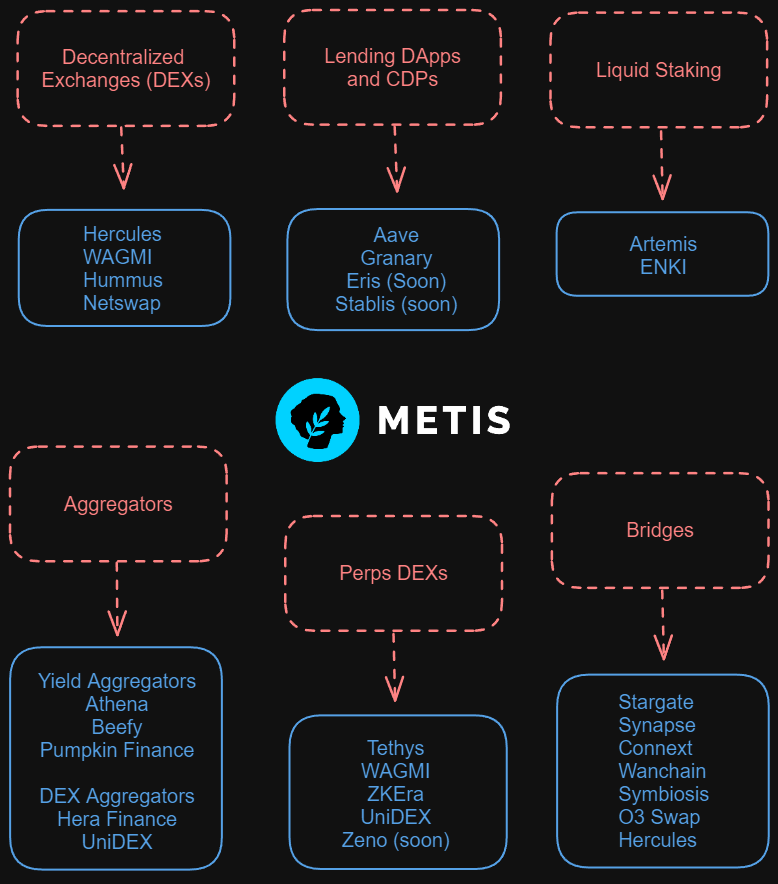

Metis is also steadily building a DeFi ecosystem, with multiple dApps preparing for launch. On one particular dApp named Hercules DEX, one of the incentivised pools had over 500% APR.

In January 2024, we estimated METIS's current price range as an accumulation zone. Our bullish case for Metis peaked at $700, and for 2024/2025, the same target is potentially achievable—giving METIS an 11x ROI from current prices.

We must mention that we are giving METIS a higher target because it hasn't yet rallied in a full-blown altcoin season. Based on our current analysis, Metis is on track, but we must keep track of its on-chain activity, which has dipped since Q2, 2024. With Manta, our position hasn't changed. Metis remains a technologically superior yet undervalued L2 option.

When to expect the next L2 rally

According to VanEck, the Ethereum L2 market might reach a base case valuation of $1 trillion by 2030. The prediction was based on anticipated cash flows from transaction revenues and maximal extractable value, assuming a 60% market share of Ethereum ecosystem smart contracts.Their analysis covered 46 Layer 2 networks, assessing factors such as transaction costs, developer and user experiences, trust assumptions, and ecosystem size. Despite the optimistic outlook for some networks, VanEck is bearish on the long-term value of most Layer 2 tokens, expecting only a few to dominate amid fierce competition and speculative trading.

So, the question arises: have we chosen the correct projects to rally in 2024/2025?

We believe so.

These projects have been considered with respect to tokenomics, fundamentals, and potential opportunity costs. With Base L2, we believe that the protocol has also proven its mettle, but it does not have a native token.

Most of these L2s were already up 50% YTD before their recent decline, so technically, the pump from here should be exciting. However, based on our market evaluation, we don't expect the rally to realistically kick off until Q3 2024.

Cryptonary's take

Right now, L2s are not the most attractive narrative. Investor's interest has shifted strongly towards memes, AI, DePin and RWAs. However, there is no denying that L2 narratives will come back, and the ecosystem will grow during the next phase of the bull market.Despite its current market struggles, we remain confident that L2 narratives will thrive in the ongoing bull market for 2024/2025. There is enough on-chain data, expansion, and innovation to infer that the current price correction will eventually be followed by recovery.

As always, we are tracking the narratives and will update you if a fundamental shift demands that we revisit or reject our theses on L2s.

Until next time,

Cryptonary Out!