Revisiting Synthetix: Updated price targets for 2024-2025

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

If you've been with Cryptonary for a few months, you would have heard about Synthetix (SNX) and why we are bullish on it. You can catch up on the research here, here, and here.

Activity is ramping up on the protocol, and SNX tokens are currently getting burned out of circulation. With the asset displaying deflationary traits, we expect the price dynamic to take a different turn in the 2024-2025 bull market.

Will Synthetix live up to its expectations during this bull run, or will investors need to wait much longer for the promised 20x to be delivered?

Let's find out.

TDLR

- Since we presented SNX as our 20x in 2020, the fundamentals of the project have changed significantly.

- Recently, it adopted deflationary mechanisms, with over 9500 SNX tokens burned in March 2024.

- The project is also going multichain with V3 perps to be deployed on Arbitrum, Solana and SUI networks.

- Annualised revenue is up 127% over the 30-day period.

- How does all this potentially impact SNX's performance during this bull run?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

A quick on-chain update

Since our last report in February, the new tokenomics for SNX has resulted in deflationary actions.

SNX's buyback and burn program has burned over 9,500 SNX tokens since March 8. The current burning rate is around 2200 SNX/per day, which is valued at over $10,000 at the current price.

Additionally, Synthetic Governance approved V3 deployment on Arbitrum with SIP-367 to increase activity and introduce further liquidity for Perps V3. Two proposals were also in motion with STP-17 and STP-18, which have been approved to bring Synthetix Perps to the Solana and SUI networks.

Perps V3 on Base currently supports a limited number of markets (BTC & ETH) with constrained open interest due to the limited amount of USDC LPing on Perps V3. However, recently, governance has moved to increase the limit up to $10m USDC in LP and open interest caps for ETH and BTC.

How has SNX performed so far?

Before we estimate a price target for SNX over the next few months, we need to be aware of certain dynamics that have changed over the past few years.When we first covered SNX in 2020, CPro predicted a 20X return for the asset. From its entry in October 2020 to the bull market in February 2021, SNX witnessed a 9x rally.

In 2024, SNX's tokenomics has changed; its expansion is taking place with a multichain approach, and we are at the beginning of another bull market.

So, expecting the same 20x prediction to pan out is not ideal because the fundamentals of the project have now had material changes.

Hence, we need to take a fresh approach to estimate new targets.

Let us consider a few datasets for clarity.

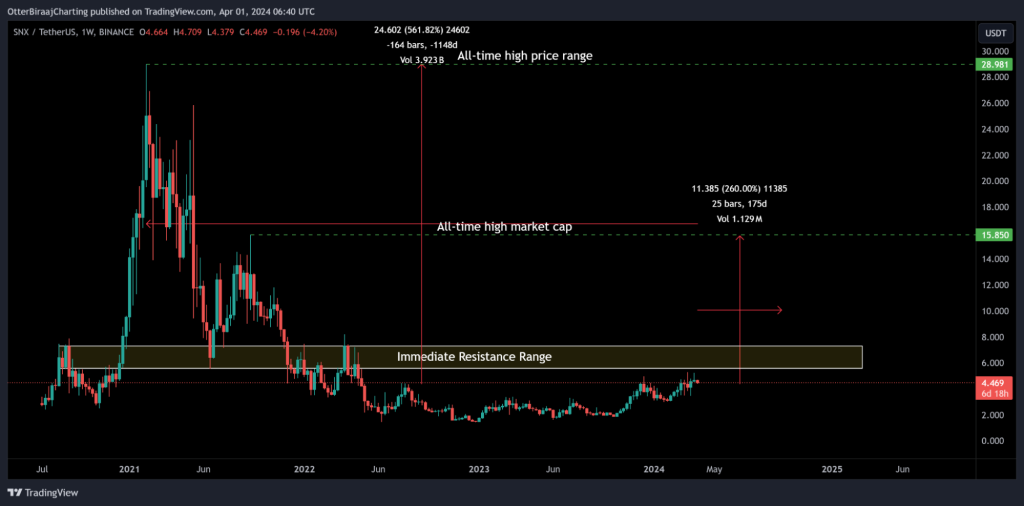

SNX's all-time high value stands at $28.53. It is currently down 83.7%, at $4.66. During a revived bull market, the common expectation is that the token will usurp its previous high and embark on a new rally.

The current drawdown highlights that there is still a fair bit of difference between present and ATH values, but hold on one moment – the market cap paints a different picture.

- The current market cap of SNX is $1.5B.

- The all-time high market cap of SNX is $3.9B.

- The difference in valuation is a mere 2.6X jump.

Another factor to consider is the improvement in fee generation.

For any derivatives exchange, revenue generated is a positive sign of activity, and at present, the year-on-year annualised revenue is on an incline.

Annualised revenue is currently at $52.61M, up 127.1% over the 30-day period. SNX's Price to Sales ratio is also decent at 29.1X, up 50%.

The bullish catalysts are definitely present for SNX right now, and price is definitely lagging concerning on-chain and ecosystem development.

Technical analysis and price targets

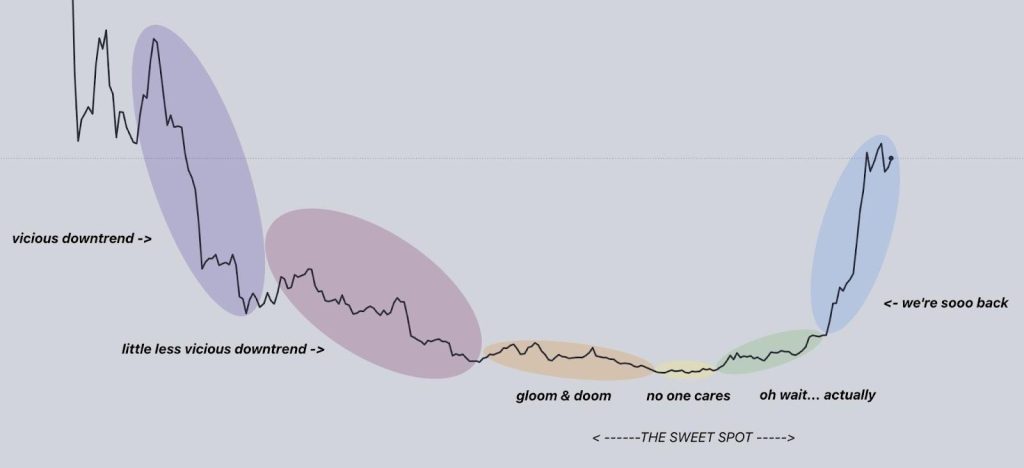

In February 2024, we released a report where we jotted down the blueprint to identify overlooked assets with 10x to 100x potential. (Please go through that report once more for better understanding.)In that study, we highlighted the following price chart.

Now, let us look at SNX's present market structure.

SNX's price market is uncannily similar, and considering the number of bullish catalysts currently present with the protocol, it is a matter of time before SNX undergoes its "we are sooo back" bullish leg.

Now, based on its current market price and historical and present market cap, these are the current price targets for SNX in 2024-2025, illustrated in the chart below.

- Base target: $15.85

We expect the base target of $15.85 to be reached once the SNX breaches its historical resistance range of $5.56-$7.30. At $15.85, SNX will re-test its all-time high market cap.

- Bullish target: $28.98

The bullish target at its previous all-time high of $28.98 should be an easier target post its base price point. After $15.85, SNX will undergo a market cap discovery range, allowing the token to ascend in momentum. The new market cap at $28.98 will be $8.4 billion.

- Moonshot target: $47.55

The moonshot target is $47.55, calculated based on a 3X rise from its previous all-time high market cap. At $47.55, SNX protocol will be valued at $11.7 billion. It is also important to note that the moonshot target would mark a 16x upside from our initial report in 2020, when SNX was valued at $3.

Cryptonary's take

So, how should you play SNX from here?Well, it mostly depends on your entry price and how much of your portfolio is currently allocated to SNX relative to other low, mid-risk, and high-risk assets.

If you are not currently exposed, your move also depends on what kind of risk and upside you are most comfortable with.

The base and bull targets represent the realistic upside potential for this project in the 2024/2025 bull market. The moonshot target is also possible, but it depends on the stars aligning – we would consider this to be more of a longer-term target.

Based on renewed projections, we believe SNX should be able to reach its base and bullish target for the 2024-2025 bull market.

We are a little conservative on the moonshot target for this bull market because it is difficult to say that SNX will reach a new all-time high on both price and market cap.

Therefore, we believe 2.6x and 5.6x are SNX's immediate targets for the 2024-2025 bull market.

Until next time,

Cryptonary out!