Rollbit (RLB): Is it time to cut losses or hold the line

Assets in the crypto market are vulnerable to different levels of volatility. Volatility alone can cause massive drawdowns, and sometimes, the odds of underperformance creep up. Rollbit’s RLB token is in such a situation right now.

We have extensively covered Rollbit (RLB) as a GambleFi play over the past six months, but since peaking in value in November 2023, it is currently down 57%. In this market update, we examine RLB’s ecosystem and fundamentals to determine whether we need to keep the faith or move on from it. Let’s dive in!

TDLR

- Today, we cover the timeline of previous RLB reports highlighting bullish projections.

- Rollbit's RLB token has declined 57% from its peak despite strong revenue numbers.

- Rollbit’s recent AMA suggests the team is focused on longevity over short-term token price.

- Key initiatives like the RevShare model and new sportsbook have been shelved.

- On-chain data still looks good, but RLB's bearish market structure persists.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

A brief timeline of our coverage

Let us quickly recap each of our reports on RLB and what aspects of each report kept us involved with the project.1st report

An RLB deep dive on October 20th, 2023.- Exciting project building during the bear market.

- It generated more revenue than its market cap.

- Tokenomics looks okay; its buy-and-burn mechanism has burned 37.5% of the total supply.

- Close to 1M RLB burn/daily.

- The expected annualised revenue is $472 million, and the 2-year target was $1.2B.

Price movement

If you had entered a position on October 20th, you would have been briefly up by 68% at RLB’s peak on November 11th, at $0.26. However, if those positions were not exited at net flow and are currently held, you would have a 28% drawdown at the moment.

2nd report

A Smart Money update on November 24th, 2023.- Whale 1 bought $660K worth of RLB after ATH.

- Whale 2 added 318K to a RLB allocation of $3.5M.

- Buy and Burn continued to increase linearly.

- A market rally was expected.

Price movement

RLB did not register a relief rally after the whale purchases, and any position entered on or after November 24th would currently sit at around a 36% decline.

3rd report

A market update on whale movements, December 8th, 2023.- Two whales dumped about $18M in RLB tokens.

- They were assumed to be early investors, with one whale wallet dumping $6.2M of RLB.

- The exit looked like a profit-taking move, and it presented the silver lining touted as a buying opportunity.

- Of course, there was short-term uncertainty, but the long-term thesis remained intact.

Price movement

A quick turnaround for the December 8th investors, with a sharp 32% jump in less than a week.

This would have been a good exit for prior holders to exit the trade at a minor profit, but if investors are holding positions from this date, their current drawdown would be 24%.

4th report

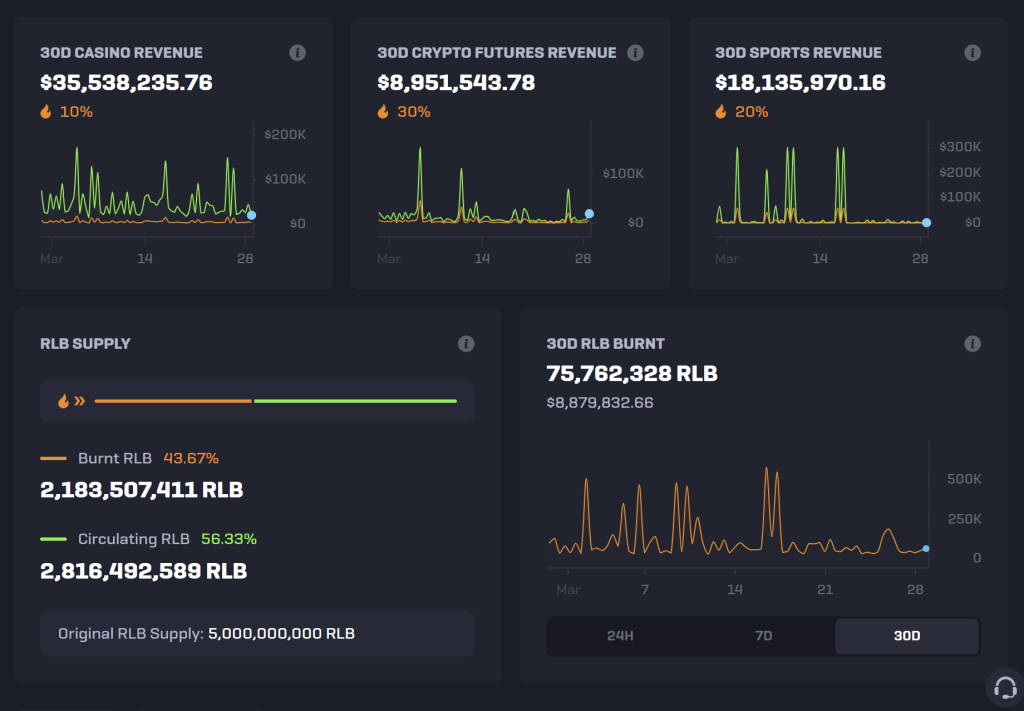

A deep dive covering new initiatives on January 26th, 2024.- Casino, Futures and Sports Revenue continued to be high

- $7.7M RLB tokens were burnt in 30 days

- Rollbit’s newly released Duel Arena was underwhelming

- FaZe Clan partnership was a massive milestone

- Introduction of new tokenomics, RLB rev-share model

- Assumed to improve RLB holding and earning incentive

- Potential in-house sportsbook and a dedicated app in the pipeline

Price movement

After this report, RLB’s price action witnessed two bullish spikes with 37% and 44% gains. However, a prolonged bearish market structure did not break, and current holders would be at a minor drawdown of 5.69%.

5th report

A Smart Money report on February 6th, 2024.- The situation looked positive, with smart money wallets accumulating $2.5M RLB.

- Revenue numbers remained strong; $ 1.9M worth of RLB burnt in 7 days.

- Super Bowl possibly increase sports betting revenue.

Price movement

There was no change in the bearish trend, and any new position taken then would have resulted in a 14.20% decline today.

Rollbit's latest updates

On March 20th, 2024, Rollbit’s anonymous co-founder Razer held a community update and AMA, where he answered some of the communities’ queries.Razer believed that Rollbit as an ecosystem ‘is in a very strong position’. The other important highlights from the AMA are listed below:

Solana supply cutoff

Razer announced that RLB’s SOL cutoff will occur on May 1st, 2024. For context, Rollbit recently migrated from the Solana to the Ethereum ecosystem. RLB’s SOL supply is slowly being removed, and any SOL after the cutoff will be burnt on Ethereum. The community is split on this decision, as some in the industry believe Solana is the superior chain for volumes and adoption right now.RevShare model shutdown

One of the initiatives considered a major catalyst in our 4th report has been shut down by Rollbit, citing regulatory concerns. The founder emphasised continued faith in the protocol's buy-and-burn model.No immediate roadmap

Yeah, this wasn’t the best AMA for Rollbit. Razer mentioned they do not believe in a predetermined roadmap and develop as they move forward. The current sportsbook is a third-party service, which is not a popular feature. Now, they have mentioned an in-home sportsbook is not on their agenda, and they are happy with their current setup. Lastly, Razer did not pay much attention to other emerging narratives as he believed in ‘setting realistic expectations’.Revenue data

Rollbit’s financials continue to be attractive in terms of annualised revenue generated. It has slowed down a bit over the past 30-days, but the burnt supply is currently up to 43.67%. When we initially covered RLB, the total burnt supply was around 31%.

But despite the success of the buy-and-burn mechanism, the price has continued to disappoint investors.

Technical analysis

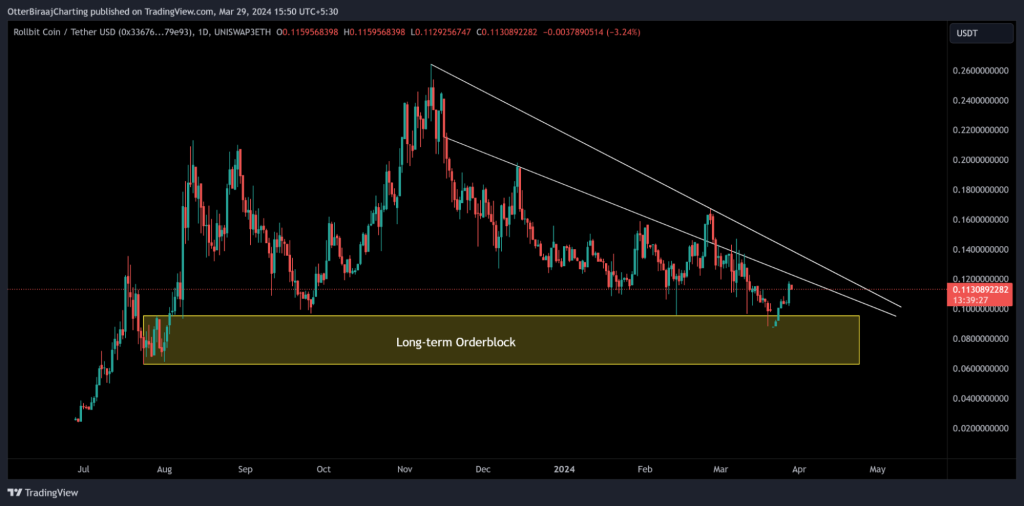

As our timeline shows, RLB has followed a bearish market structure since its peak on November 11th, 2023.

The token has re-tested its final long-term orderblock, and we’ve identified a bounce. However, this coin is slowly losing market interest unless the descending trend lines are broken and RLB generates a trend shift.

Cryptonary’s take

Rollbit continues to defy good on-chain fundamentals and strong buy-burn statistics with underwhelming price action.The project has yet to hit any of the original invalidation criteria highlighted in the 1st deep dive, but it may become irrelevant.

Razer’s recent AMA inferred one thing: they are betting everything on the project’s longevity and are not really worried about RLB’s current price. That is a diplomatic way to go about it, as expected, but considering the opportunities flowing in other crypto narratives, it might be time to move on from Rollbit.

We want to highlight that the price structure looks like a bullish bounce is possible, but the probability is slim, and unless GambleFi becomes a hot topic again, RLB does not look like an ideal trade.

If your allocations are minor, as in less than 5-10%, and your drawdowns are below 20%, this is a good time to exit the market. A higher allocation above 10% is a tricky situation, as ideally, you would want to be at least near breakeven. But even then, this is where we need to be able to move on from losses and allocate capital to other opportunities.

Accordingly, we have removed Rollbit (RLB) from Cryptonary’s picks and are closing the chapter on the project for now.

Until next time,

Cryptonary Out!