Ever wondered why you’ll be scrolling Instagram and suddenly you get spammed with adverts for something you Googled yesterday? That’s the “algorithm” (we’ll call it that to simplify things) blasting you with targeted ads based on your specific traits, interests, preferences, and search history.

There is really no privacy on the internet anymore – your data is not your data.

However, there are sectors within crypto that are trying to give us back custody of our data and reduce/eliminate the monopoly that big tech has on our data – how it's stored, how/where it's used, etc.

Blockchain is not just a new financial system – it’s a new everything.

In this journal, we will dive into some of the more technical features of decentralised infrastructure and discuss what it means for the average person.

Disclaimer: This is not investment nor investment advice. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

RPC?

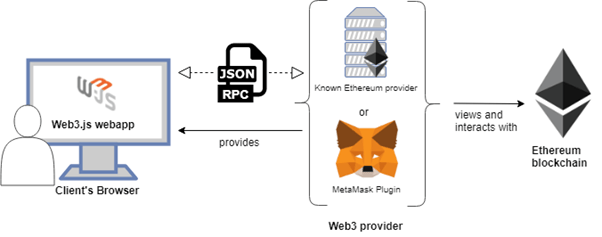

RPC stands for Remote Procedure Call and is a type of API. An RPC is a set of protocols that allow communication with remote servers, allowing protocols/DApps to execute programs in a separate location – the remote server, in this case, is the blockchain. Using Ethereum as an example, MetaMask would use an RPC to communicate with Ethereum nodes to request information or to send a transaction. The node, in this case, would be known as the RPC endpoint.

Simple operations such as viewing a balance, creating a transaction, or interacting with smart contracts are all facilitated using RPCs. Basically, if you’ve ever used a wallet, you’ve used an RPC. A simple example of an RPC service in use would be as follows:

- You use your browser to access MetaMask wallet and send an Ethereum transaction.

- The transaction instructions are processed to an RPC server.

- The RPC server sends those instructions to the Ethereum node to validate.

- Once the transaction has been validated by the nodes, the RPC server sends this information back to your MetaMask, and the balance is updated on-screen.

Decentralised Storage

The shift from Web2 to Web3 will require decentralised alternatives to the current centralised system. As we have seen on multiple occasions in the past, decentralised protocols/DApps are often at the mercy of the centralised parts of their infrastructure when it comes to things like Web-hosting services. The Tornado Cash sanction earlier this year showed that even if a protocol claims to be fully decentralised, often they are unable to do anything other than comply with regulations due to their centralised components complying.An example of this is Uniswap DEX. Uniswap began blocking suspect wallets from its front end in August 2022, with suspect wallets determined by TRM blockchain analytics. However, other than Ethereum validators censoring certain blocks, these wallets are still able to access and use Uniswap DEX through other frontends. This is the beauty of blockchain – it is almost impossible to stop wallets from using a protocol even if they can’t use it through the standard means. In this instance, users are still able to use other routes through alternative hosted websites.

Decentralising the internet is a huge undertaking – one major component of this is decentralised storage. Data sovereignty and data security are the cornerstones of Web3. Large data companies like Google and Meta (Facebook) collect, store, process, and sell your data – like how banks collect, store, process and distribute/lend out your capital (for profit). Decentralised data storage aims to give back custody of our data to us rather than have it held at ransom in centralised data centres.

When it comes to data storage, there are only really 2 options:

- Physical storage – Disk Drives, USB drives, etc.

- Centralised Cloud Storage – data is hosted on a central cloud (think iCloud, Google Drive).

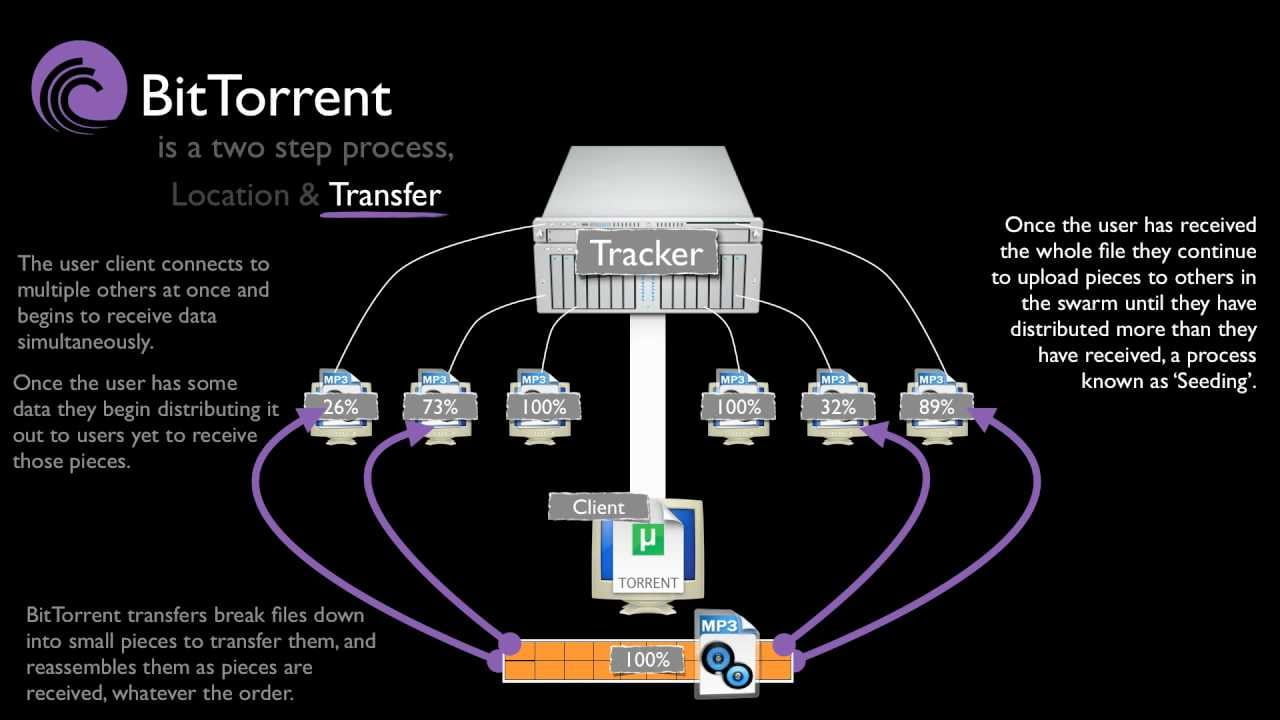

Users would download files (leechers) from multiple other users who already had the file (seeders), creating a storage network that did not have a single point of failure and was owned by no one. Bits and pieces of the file(s) would be scraped from multiple sources, and then once the download was complete, these pieces would be constructed to create the whole file. Since the user now had the full file, they could become a seeder, allowing other users to download the file from their system.

This is essentially the same idea as decentralised blockchain technology, and indeed, BitTorrent was one of the inspirations for Bitcoin. However, this architecture better fits the current infrastructure for decentralised storage. With decentralised storage protocols, users essentially sell storage space on their computer/system to users who need storage.

Obviously, there can’t be a single point of failure – not all personal computers can be left on all the time, and there are power outages, etc. The files, or pieces of the files, are stored on multiple systems around the world. Users are incentivised to sell their storage and bandwidth, usually through some form of reward, such as tokens acquired through fees, as well as protocol incentives/emissions.

We have covered some storage and RPC content in the past, the most notable being GenesysGo (SHDW). For even more detail for tokenomics, please click here.

Arweave (AR)

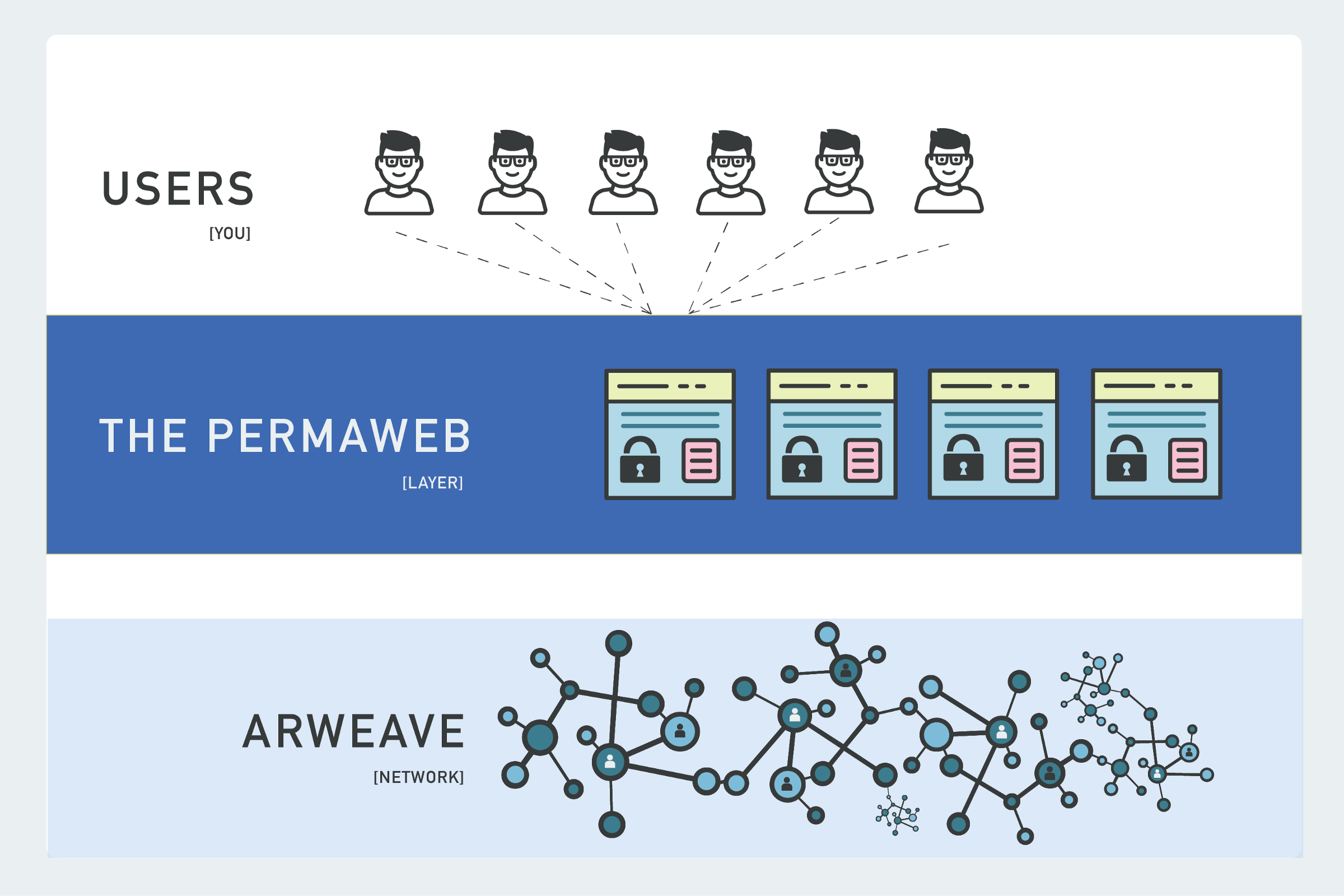

Founded in 2017, Arweave is a network utilising blockchain technology to create a decentralised storage alternative to data giants like Google. Technically, blockchains like Ethereum can store anything. However, the gas costs of processing and storing TB of data would be astronomical, and so in practice, this is not feasible. Arweave is a Peer-to-Peer protocol that allows various users to rent out their storage space and get paid for it.

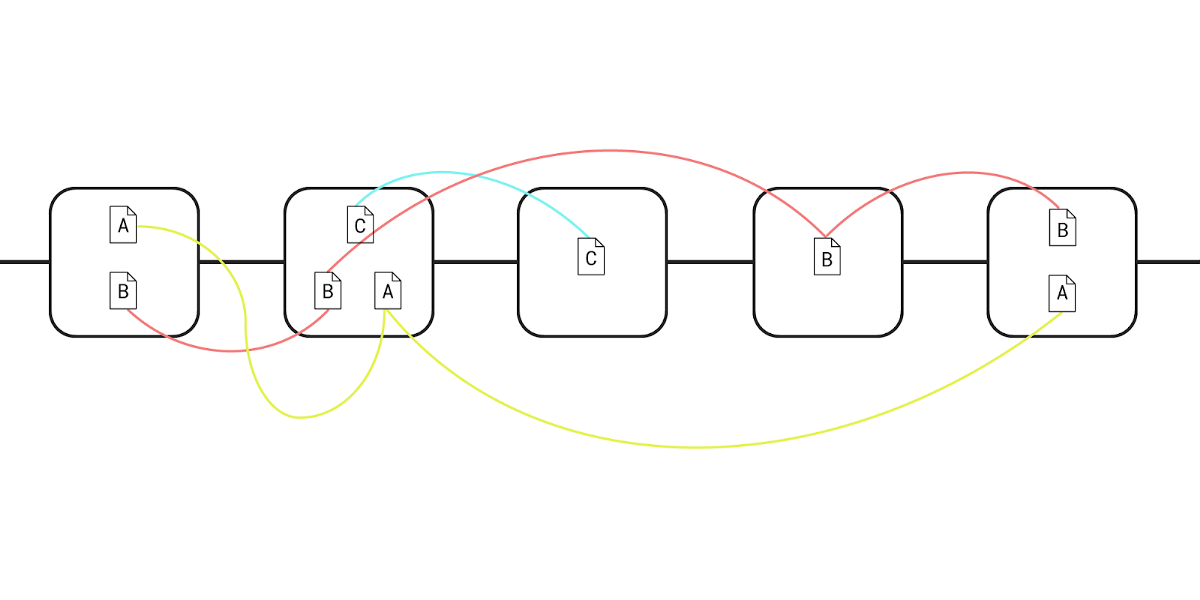

Data stored on Arweave is added to the “Permaweb”, which is the exact same as the WWW (world wide web) except that anything stored there is kept forever. This is done utilising blockweave technology, which is a modification of the standard blockchain secured by a Proof-of-Access (PoA) consensus. Here’s a rundown of how PoA works:

- Storage providers act as nodes (miner nodes).

- For a new block to be verified, a miner node must replicate a randomly chosen, valid, older block (the recall block).

- This system incentivises miners to provide more storage, and for longer, since miners with access to more of the previously verified blocks have a higher chance of verifying the next block.

- Each new block is linked to the previous block, as well as the recall block used to verify it. (Structure below).

In this way, blockweave allows data to be stored indefinitely since a literal web is created between blocks. This means that even if a significant number of miners go offline, there is always a link to recall previous data somewhere in the network.

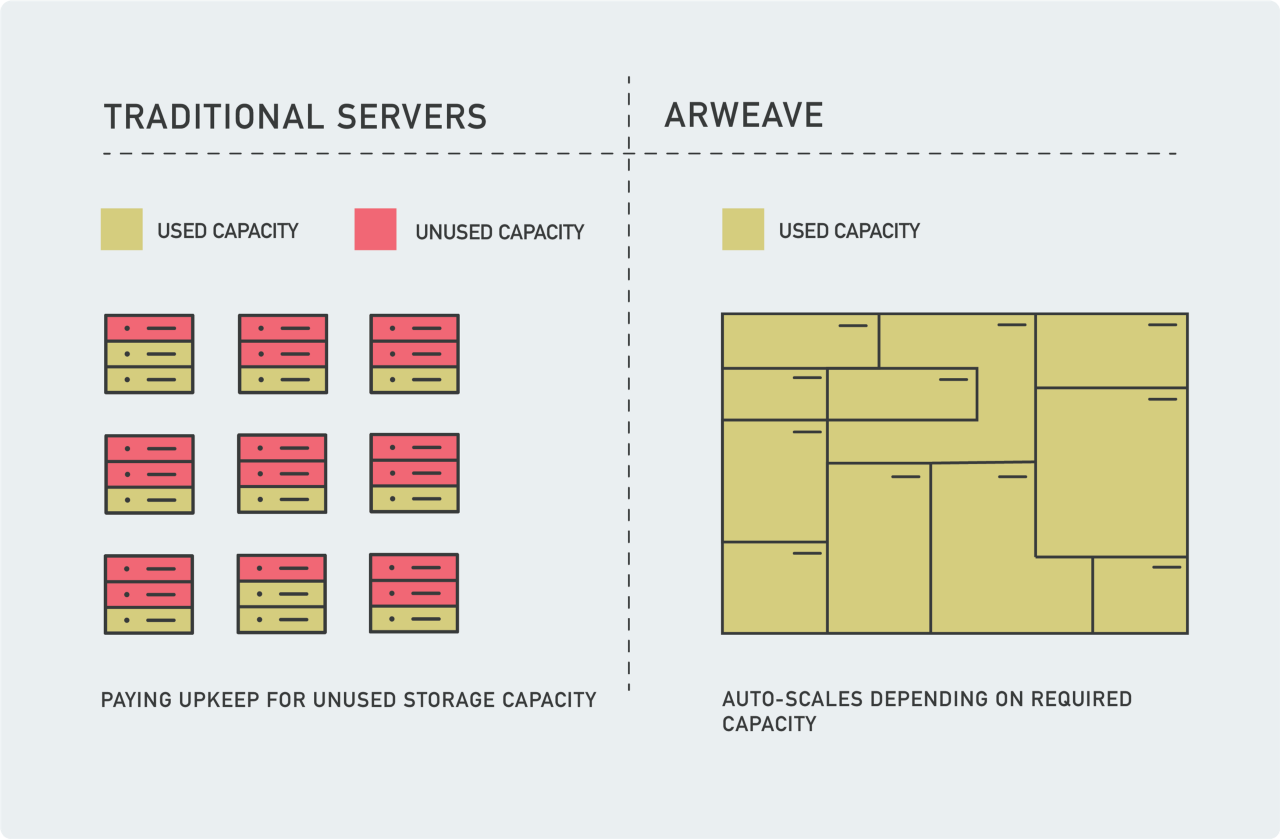

Additionally, the use of storage space is magnitudes more efficient than regular servers since the network is always at 100% capacity. Over and above the storage capabilities, the Arweave network also supports smart contract functionality and decentralised applications, creating the permaweb. DApps are accessed using multiple gateways in the exact same way as accessing regular websites. Arweave uses HTTP (the standard for communication between client computers and web servers), which means that interaction between Arweave-based sites and the regular web is possible.

Token

AR is the native token of the Arweave network, used for transaction fees (including storing and retrieving data), and incentivising miners. Users pay for storage user AR tokens, and once their data is valid, it's stored forever. AR has a circulating supply of 50.1 million, with a max supply of 66 million. Market Cap at the time of writing is ~$492 million with an FDV of ~$649 million.

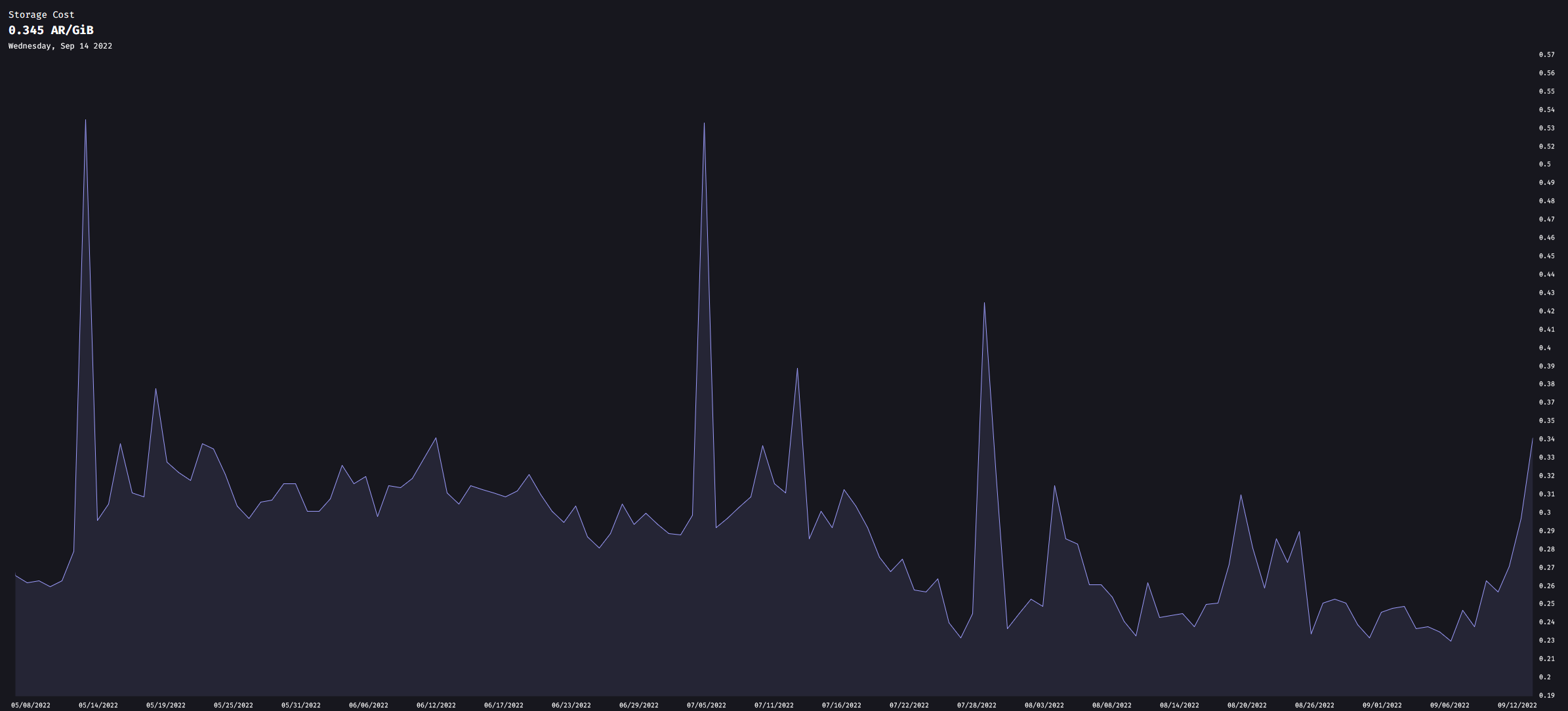

Currently, to store 1 GB of data costs around 0.345 AR (~$3.40). This is relatively expensive compared to using centralised cloud storage, which is an issue. The cost is dynamic and depends on a number of factors, such as available storage and network congestion. The current weave size (total data stored) is 90.65 TB.

Conclusions

There is a clear need for decentralised and censorship-resistant web services. Time and time again, we have seen huge data leaks affecting millions of people, which is essentially down to the centralisation of the big players like Google and Apple. Projects like Arweave and GenesysGo are leading the way in this sector, and although not perfect, we believe they are well on their way to truly decentralising the internet. These two projects just scratch the surface of this sector – similar projects are being built on Polkadot, Ethereum, and all the major ecosystems.However, the decentralised infrastructure sector is not something we expect to take over anytime soon – especially storage and RPCs. The decentralised alternatives to storage and web hosting need further development to compete with the big boys like Amazon Web Services and other well-established tech giants. Whilst we are seeing huge developments, there is a way to go.

Having said that, the early stages like this are the best time to get involved in potential winners. They are high risk and very high reward. That's why we have storage and RPCs firmly on our radar, and we will be keeping our community up to date with any important developments in the sector.

Thanks for reading!

If you have any questions, reach out to the Cryptonary account in the Discord server.