Crypto Corrections

Crypto is one of, if not the, most volatile asset class out there. Let's go over a few of the sharpest and quickest market corrections seen to date.[caption id="attachment_101401" align="aligncenter" width="2554"] BTC Jan '17[/caption]

BTC Jan '17[/caption]

[caption id="attachment_101399" align="aligncenter" width="2554"] BTC Sept '17[/caption]

BTC Sept '17[/caption]

[caption id="attachment_101403" align="aligncenter" width="2554"] ETH Jul '17[/caption]

ETH Jul '17[/caption]

Obviously this cannot be said about sh*tcoins, only fundamentally-sound assets which both BTC & ETH qualify as, but in hindsight, every single dip bought on fundamentally-sound assets over the last few years has led to profit. Though this is not only true for crypto, it is true for any asset class and here is an example of one of the highest valued companies in the world: Amazon.

-32% dip on Amazon right after it broke the high set during the .com bubble. Once again, in hindsight that dip would have been highly profitable if bought. Why? Fundamentally-sound assets are always in demand and it is very difficult to outperform them in the long-run.

Causes & Opportunities

At this magnitude, this fall in prices qualifies as a correction and not a dip. To be fair, we had it coming (explained here during the latest podcast) given the number of vapourware that new retail kept pumping. As we stated over and over again, sh*tcoins are overvalued and fundamentally-sound assets are undervalued. The best part? This correction caused by retail making too much money on vapourware caused those same undervalued fundamentally-sound assets to become even more undervalued.What qualifies as "fundamentally-sound"?

- BTC

- ETH

- DeFi tokens with revenue & usage

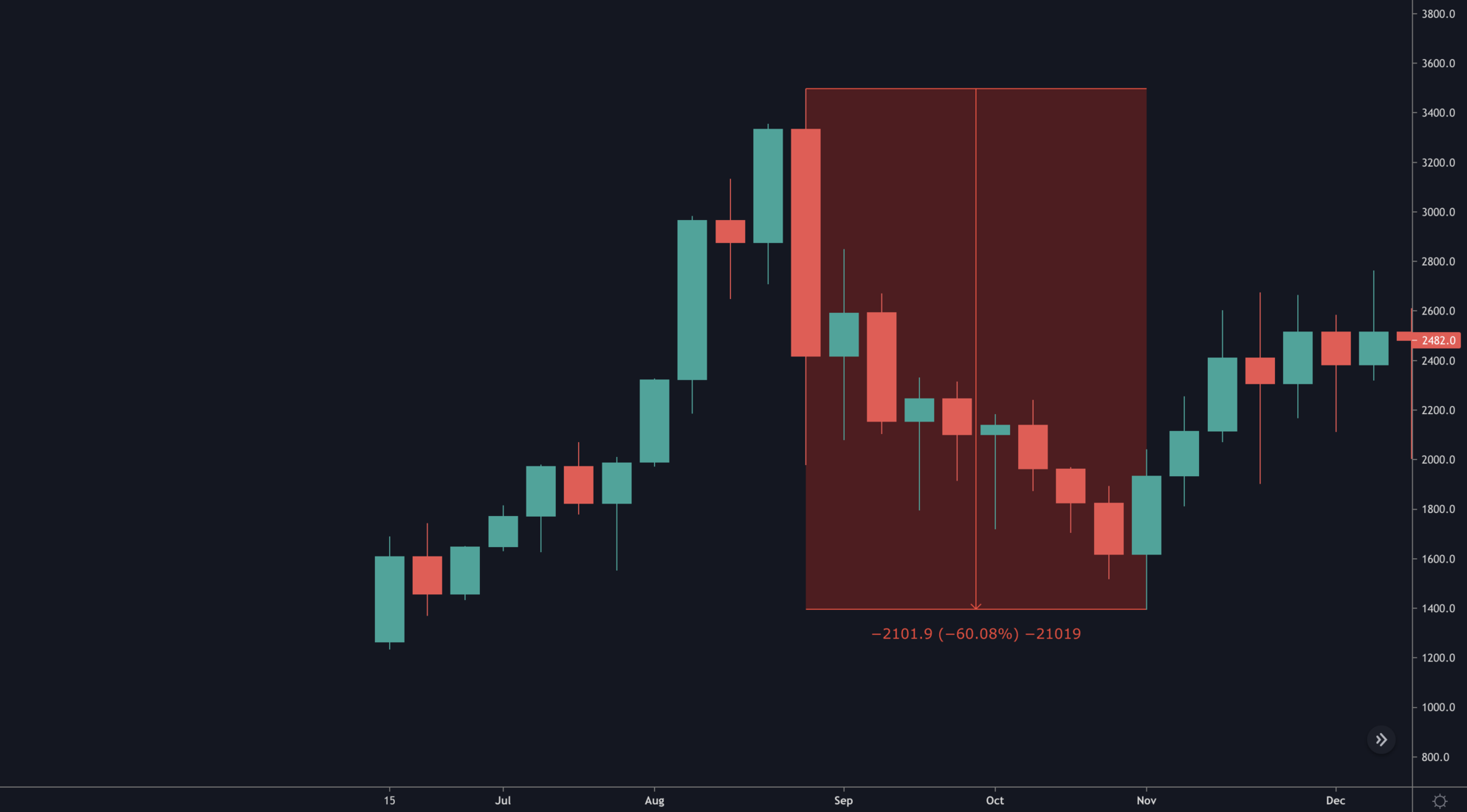

Example: DeFi Winter - September/October 2020

At the start of September 2020, DeFi was running very hot and entered a correction which averaged around -60%.

Similar to how dog-coins were pumping recently (AKITA, SHIB, etc.) there was food coins pumping (YAM, PASTA, HOTDOG...) and the market was in euphoria.

All of the sh*tcoins never recovered but fundamentally-sound assets reclaimed all-time highs and entered price discovery. One example is SNX:

So yes, we are sticking to our 💎 🙌

NGMI or AGMI?

NGMI = Not Gonna Make ItAGMI = All Gonna Make It

Depends on two factors:

- Interest in crypto must remain despite prices so you can focus on innovation and catch market mispricings

- Not be holding majority in shitcoins