We didn't provide a price target when we first wrote a report on this next-gen decentralised storage provider in December. However, over the past three months, tokens in the DePIN and AI narratives have built momentum. So, now we have a clearer understanding of SHDW's upside potential based on its current market position.

In our last discussion on Shadow, we drew parallels with Filecoin and Arweave. While both projects are strong contenders in the fiercely competitive DePIN and AI narratives, it is important to remember that SHDW's value proposition remains unique because of its DAGGER technology.

Let us dive in!

TDLR

- SHDW is the native token of GenesysGo, a decentralised storage protocol aiming to be the "Filecoin on Solana."

- The ongoing SHDWDrive testnet has over 1 PB storage space, 600+ participants, and 27M+ SHDW staked so far.

- SHDW offers cheaper immutable data storage ($0.05 per GB) compared to Filecoin ($0.30-$0.60) and Arweave ($3-$8)

- SHDW currently trades at $1.82 after a 36% monthly gain, but we've identified a golden buy zone

- SHDW's potential growth within the DePIN and AI narratives on Solana forms the basis for our conservative, base, and bull targets in 2024/2025

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

A quick primer on GenesysGo

GenesysGo is a DePin protocol that aims to completely redefine the standards of decentralised data storage and cloud computing services. The DAGGER technology is at the heart of the protocol—it allows decentralised storage systems like SHDWDrive to efficiently handle large amounts of data, users, and transactions. This unique tooling will, in turn, enable developers to build fast, scalable, decentralised apps.(Please check out our first report to brush up on the technical side of things.)

From a business and marketing perspective, GenesysGo is basically aiming to be 'Filecoin on Solana'. For context, Filecoin and Arweave are projects built on Ethereum, and Solana is the main L1 play in the 2024/25 bull market. Now, $SHDW is the native or utility token on GenesysGo.

Additionally, the key vision for Genesys Go is that data can be stored both in a mutable and immutable manner, where it is not reliant on a centralised server like AWS or Google BigQuery.

But can GenesysGo deliver on its promise?

Let's take a look at recent developments.

SHDWDrive Testnet 2 updates

One of the major developments on Genesys Go is the ShdwDrive testnet 2. The release of the SHDWDrive network is expected to be a game changer because it would allow users to sell their access storage on their system to earn SHDW tokens.Here are some key facts from the ongoing SHDWDrive testnet:

- The testnet has node operators from over 15 countries.

- Over 1 PB of storage space is currently available

- More than 600 participants are involved in various protocols

- The staking pool has over 27.3 million SHDW staked at the moment; the total claimable reward is 62,258 SHDW tokens

Genesys Go also revealed a detailed report on their ongoing testnet. They transparently revealed the positives, areas of improvement, and fixes. While we will not dive into the technicals, openly discussing such topics with the community is often a positive sign, as it builds the community's confidence and protocol trust.

Network statistics

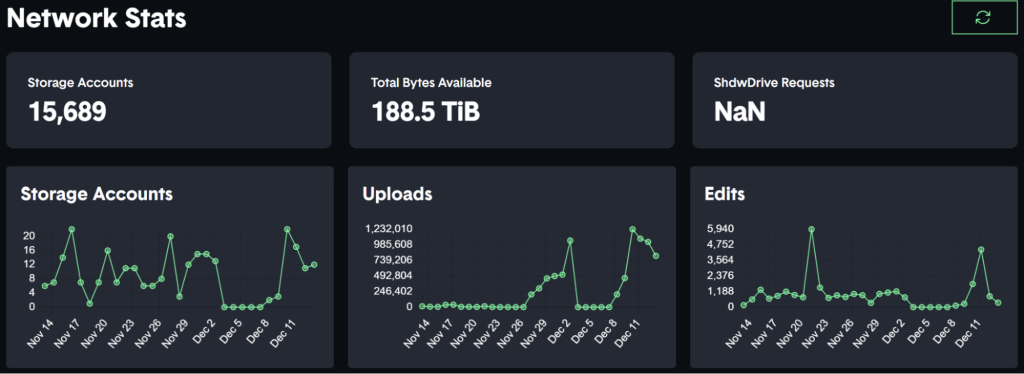

From an adoption standpoint, SHDW has yet to take off, which is understandable. The protocol has not realised its true potential in the data storage or cloud computing environment, but early signs are decent.

ShdwDrive currently hosts 15,689 storage accounts, and 188.5 TB of data storage is available.

The project has about 91,799 holders, and the top 100 holders have a 62.55% allocation. That is a fairly decent distribution for a project that has yet to break out. Shadow hasn't popped off on social media yet, registering a rise of 2000 followers over the past 30-days.

Price targets for 2024-2025

Now, to estimate a price target for SHDW in this bull market, we decided to draw a product and market comparison between it, Filecoin and Arweave.As mentioned earlier, Filecoin and Arweave are similar data storage projects built on Ethereum but have a significantly larger market cap.

Filecoin has a current market cap of $4.3B.

Arweave has a market cap of $2B.

Shadow's market cap comes at $226 million.

Now, the idea is to build a position with a project with the largest ROI potential, and with SHDW, we are on a clear path in 2024.

First of all, Shadow is developed on Solana, which is a huge advantage this year. Secondly, the cost of data storage on each project is listed below:

- 1 GB storage on Filecoin: $0.30-$0.60

- 1 GB storage on Arweave: $3-$8 (this data storage is immutable and permanently stored)

- 1 GB immutable storage on Shadow: $0.05 or 0.25 SHDW in dynamic pricing

Now, Filecoin peaked at around $12B market cap in 2021, and Arweave peaked at $4B. Keeping these figures in mind, for the SHDW token,

- Conservative target: $1B MC at $6.27 per token, i.e. 3.8x

- Base Target: $2B MC at $13 i.e. 8x

- Bullish Target: $4B MC at $25 per token, i.e. 15x (33% of Filecoins' previous ATH).

Technical analysis

SDHW's bullish rally began last year in November, when the token increased by 16x, reaching a new yearly high of $1.78. However, on March 18, SHDW registered a new yearly high of $1.82 before undergoing the current collective market correction.

While SHDW has maintained a strong consolidated range in 2024, a golden buy zone between $1.21-$1.08 will be ideal for long-term positions.

We expect SHDW to re-take its all-time high of $2 over the next few weeks.

Cryptonary's take

We are optimistic about DePIN protocols in general, and SHDW, in particular, is a strong DePIN project in the Solana ecosystem right now.Our bullish target is based on the fact that GenesysGo has progressed towards its development and adoption goals. The testnet data is promising. The team behind the protocol is very engineering-centric, with serious tech builders involved.

There is little doubt that if DePin continues to carry momentum, SHDW is a fairly reasonable bullish bet over the next couple of years.

We will continue evaluating the project, but as of today, we are confident that SHDW can deliver on its potential.

Until next time,

Cryptonary Out!