Should You Buy Coinbase Stock?

If you’ve contemplated buying $COIN, you're not alone. Coinbase is one of the top crypto exchanges on the scene. Following rival FTX’s demise last year, Coinbase is now the second-largest centralised exchange in the crypto space. Plus, in these bear market conditions, its stock is at a discount.

Does this mean Coinbase stock is a good buy?

We’ve done a deep dive into Coinbase’s financials, market conditions, and competition, so you don't have to.

Read below to find out whether we’re investing in Coinbase. If we’re not, we’ll certainly share an alternative…

Let's go!

TLDR: Too long, didn't read (I’m lazy)

- Coinbase’s financials are questionable. Revenue is down, and operating costs are in the billions.

- With so much damage caused by centralised authorities in the last year, users are turning to DeFi. (Spoiler: this is where the real opportunity lies)

- Cryptonary will not invest in Coinbase. The cons simply outweigh the pros.

- We’ve found an alternative investment we believe will deliver a 7X return in 2023.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Is Coinbase financially sound?

Being the only crypto exchange on the stock market and having 100 million users certainly has its pros, but the cornerstone of every business is its financials. The first step in evaluating Coinbase is to open up its books!What do the books say?

Firstly, it’s important to note that Coinbase has three main revenue streams. Trading fees, Interest Income, and staking services.According to Coinbase’s Q3 financial reports, total revenue from trading fees dropped from $1.3 billion in 2021 to $590 million in 2022. This was mainly due to market volatility and the decline in crypto trading.

On a brighter note, revenue from the interest earned on cash and stablecoins sat on the platform did increase to over $100 Million from 2021 to 2022!

When it came to staking services, the company saw mixed results. Despite an influx of customers staking their ETH through the exchange, the decrease in ETH’s price led to lower revenue.

Coinbase did try to address this issue by launching cbETH— Coinbase’s liquid staking token of ETH. But with no integration with DeFi protocols, it was uncompetitive at best.

Not good at all!

That aside. There’s one big word that matters most here. A word that sends shivers down the spine of many a public company CEO….

Profitability

So, is the big blue whale making money?Drumroll, please… No. No, it’s not.

Coinbase reported a net loss of over $2 billion over the past nine months. The biggest factor here was overheads, which increased from $3.18 billion in Q3 2021 to $4.7 billion in Q3 2022.

The company did recently cut 25% of its staff, but more changes need to be made to keep the ship afloat.

That said, Coinbase does have a strong balance sheet with around $5 billion on the table, but with operating costs in the billions, this financial cushion doesn’t look so comfy.

Regulations, competition and market sentiment

How has the recent collapse of FTX affected Coinbase? On the surface, it seems like a good thing right? A major competitor wiped out of the space leaving Coinbase to sweep up market share…However, we believe the fallout may have brought more problems than benefits.

With so much damage caused by centralised authorities in the last year, everyone and their mother, has lost faith.

Where do they turn? DeFi. We’ve seen an increase of over 150% in users of well-known decentralised exchange Uniswap.

Coinbase may be the most regulated option available, but this has also led to a slow and steady approach to business. They simply lack a lot of the features users are looking for — futures trading, NFT minting, and ICOs, to name a few.

It’s also worth keeping in mind the high cost of regulation and compliance. Coinbase was recently fined $100 million by US regulators for failures in its compliance programme. With FTX’s collapse, we expect even more expensive compliance measures to keep regulators happy.

Cryptonary’s Take

Friends, we’ve analysed three core determining factors to help us answer our question. Financials, market conditions, and competition.So will we be buying $COIN?

No.

Coinbase is losing money. Customer trust is damaged. And, we believe DeFi is primed to swallow up the majority of the market share left by FTX’s fallout.

We’re bullish on crypto, so of course, when we look into our crystal ball we see a “bright” future for $COIN. However, in comparison to other opportunities, it still looks pretty dim.

So Cryptonary, what will you buy instead?

With crypto users turning their backs on centralised exchanges, it’s DeFi’s time to shine.

There’s a DeFi exchange that we believe will 7X this year! It offers a range of unique features and has the potential to become the leading decentralised exchange on the market.

Meet dYdX

dYdX is a decentralised exchange with a focus on perpetual futures trading. It's built on an Ethereum Layer 2 and traders pay zero network fees.The platform offers perpetuals (contracts with no expiry date) on 36 different markets with up to 20X leverage.

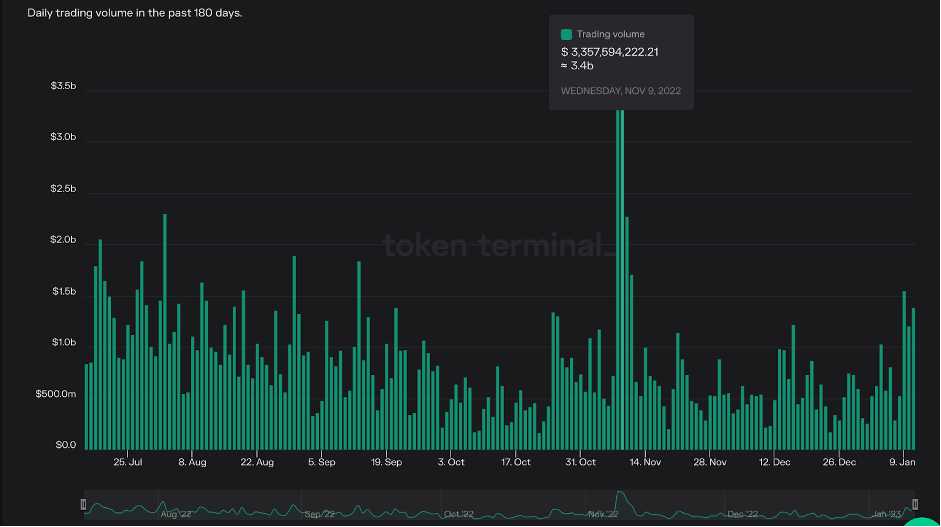

Trading volumes already exceed Coinbase(If you include leverage), and with a further inflow of capital to DeFi, we expect this gap to widen.

*dYdX trading volume, notice the huge spike in November when FTX fell*

Action Points

- If this is the first you’re hearing of dYdX, take 5 minutes to read our Simply Explained to get caught up.

- As for investing, the Cryptonary team is planning to DCA into DYDX between late January and early March. An important note: dYdX will begin a rather big token unlock on February 2nd, which could cause a drop in value. While this news falls short for holders, it gives us an opportunity to enter at a discounted price.

- We’re expecting DYDX to reach $7 in 2023, at which point we will take some profits.

- The plan is to hold onto the rest of our DYDX through 2024/2025 at which we expect a new all time high.

What about you? Do you hold any $COIN? If so, check out our community tab and let us know why.

Thanks for reading!