Disclaimer: Not financial nor investment advice. Any capital-related decisions you make is your full responsibility.

Crypto’s Growth Path

If you haven’t found out what “The Sauce” is in crypto yet then start off with this thread first 👇The Crypto Sauce 🥫

“Understand how this market is built and you will understand where it’s going”This recipe is the base to all of our research

A thread 🧵

— Cryptonary 💎🙌🏻 (@cryptonary) February 12, 2022

If you prefer delving into the details without a primer via a Tweet Thread then read the full research report here.

Now that you’ve read and understood the path crypto is on, then you logically see why Layer-1s such as Solana and Terra really boomed in 2021. What’s next?

Sector Hype | 2022

Maybe calling it “hype” is uncalled for because some of these sectors are due for outperformance given the natural state of growth of this market. In other words, they are the solution to the most prominent problems faced today (not 5 years from now) in crypto.- Alternative L1s: This narrative is still ongoing, mainly because the money tap is wide open with incentives flooding some of these new ecosystems. For example, Near Protocol has $800M lined up in incentives and Binance Smart Chain has $1B ready. This is a sector we foresee continuing to rise but we don’t think it would be as easy as last year, mainly because of this next sector.

- Ethereum L2s: Most new chains deal with security/throughput problems along the way (think Solana outages), there’s one though that has been consistent: Ethereum. The problem is that it is incredibly expensive with some transactions costing as much as a fancy dinner in the heart of London. This is where Layer-2s come into play with better UX and significantly lower fees. With exchanges opening up withdrawals directly to L2s such as FTX/Binance with Arbitrum and mobile wallets doing 100x improvements with zkSync (try Argent) we see this becoming a prominent narrative in 2022 onwards. One may call it “L222” 👀

- Cross-Chain Communication: Tens of L1s and many new L2s on the rise, it is clear that these chains are becoming silos and that’s a major problem - perhaps the biggest problem of 2022. These chains will need to communicate and aggregate liquidity in some form or manner. Whether that is done via an L0, bridge or liquidity pools, a solution is needed and it can’t come soon enough.

- DeFi Derivatives: Some people like to degen gamble while others like to use complex products to hedge/limit their risk and we shouldn’t stop them. Derivatives are the most traded products worldwide across asset classes (crypto incl) with a particular emphasis on Futures & Options. These products are now in DeFi and prime candidates for a narrative, especially with regional bans on derivs like we saw in China last year - people flock to DeFi.

- Infrastructure/Storage Solutions: With NFTs rising in popularity throughout 2021, we saw a problem become more prominent: storage - which needs to become decentralised.

- Metaverse: This is an area many are trying to compete in to gain market share but how the metaverse will end up looking like is yet to be seen. Catching early winners here will be rewarding in our opinion and gaming is the first step.

There are quite a few options out there but the ones that stand out to us are: MetaMask. Phantom, Argent & XDeFi.

The Two Pumps

If you’ve paid attention in the “Want the Sauce?” report then you’re thinking that some of these are in the Application Layer sector so why would they be rising now if you’ve said the logical path puts this sector as the very last one to pump?Great question sers (I see the irony in posing the question and answering it myself lol).

The answer is simple, each sector/vertical has TWO PUMPS:

- Novelty Pump: New to the market, hyped and flavour of the day which is non-sustained.

- Fundamental Pump: This is where the numbers start backing the pump.

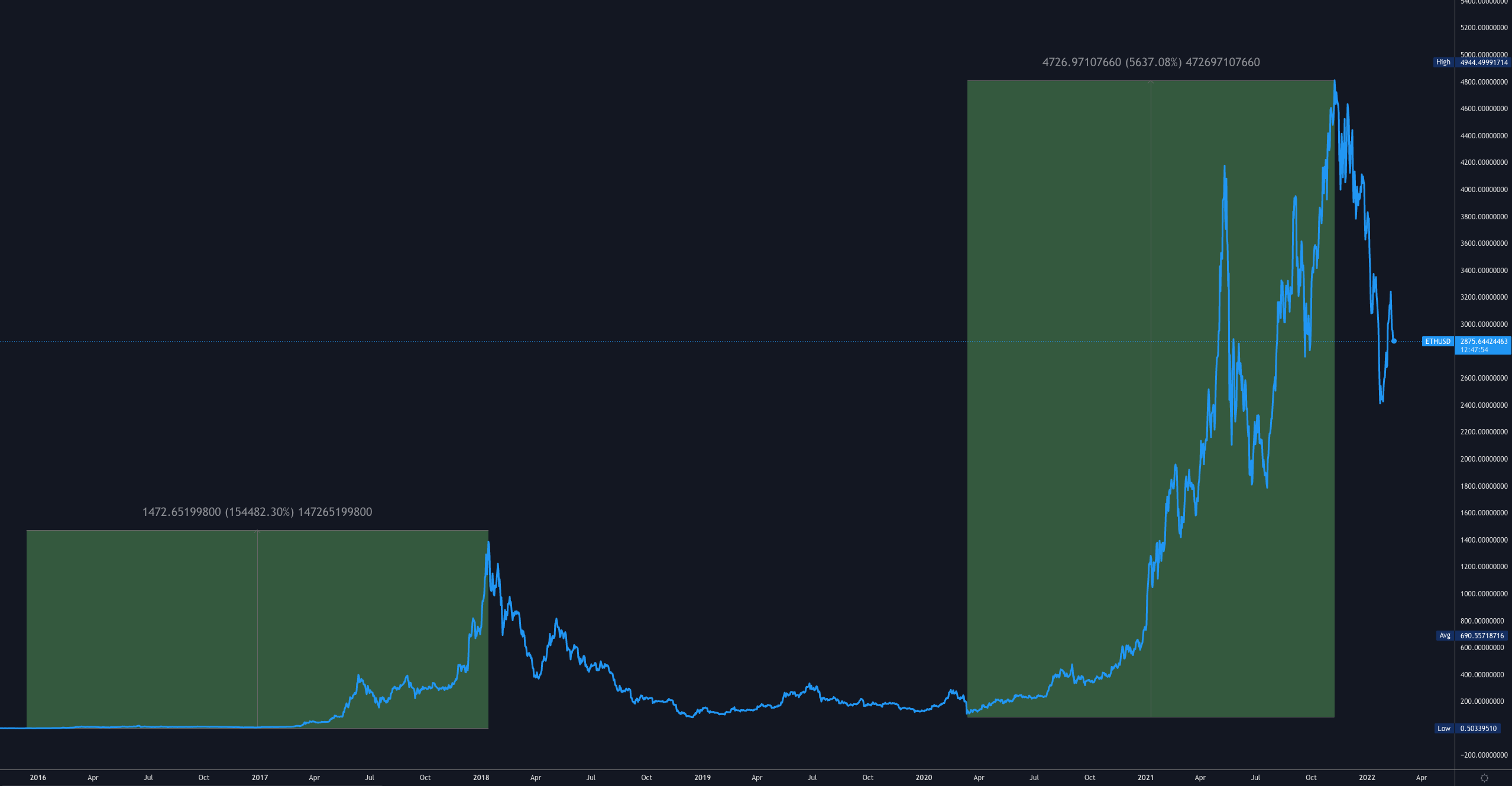

When Ethereum launched in 2015 it started pumping all the way until 2017 and ran up by a massive 150,000%+ simply because it was “new” and smart contracts seemed “cool” - basically flavour of the day. At the time though, nothing fundamentally backed that pump since there was nothing built on top of it except for ERC tokens (no dApps, no TVL). Then in 2020, a new pump began but that was after many dApps began building and setting up shop on Ethereum, with rising TVL, that was the start of ETH’s Fundamental Pump.

What to expect from CPro?

Over the next 6-months+ you will see a new level of research emerge.We will be starting with a thesis on the sector as a whole, explaining its different components in the simplest manner and finally honing in on a few assets we’re personally looking to long as a bet on said sector.

Of course, NOT FINANCIAL ADVICE & NOT TO BE REPLICATED. This will walk you through our thought process.

Base Assumption

Now that we’re coming to the end of this report, I guess it seemed like a base assumption throughout everything written is that crypto would pump in 2022 - as if it was a given. Well let me clarify that it is not a given and the year will heavily depend on what the FED decides in March about Quantitative Tightening. If they do go ahead with it, markets would dump more which means more pain but also more undervaluations for fundamentally-sound assets but also a pump-delay. If they don’t, and even better print, then game on for 2022. For a full breakdown of the FED situation, read this.Will we be sitting on our hands until then?

Cash ready to deploy certainly from March onwards but not sitting on our hands.Until then we will be playing the lowest risk and highest reward game in crypto: AIRDROPS. Which? Arbitrum, Optimism, zkSync, MetaMask, Phantom, Opyn, 01 Exchange, Wormhole and Rainbow Bridge.

Thank you for reading fellow degens.