Welcome back to Skin in the Game where we take transparency to the next level!

This edition is just as good as the previous one, just as bullish, but with one "slight" difference. Instead of investing $10,000, we are investing $25,000!

Through this report, you will have access to:

- An update on last month's $10,000 investment (spoiler: it's up)

- Where we invested $25,000 this month

- Our exact reasoning behind each investment (including targets)

- On-Chain Proof of our investments

Our objective is simple: OUTPERFORM THE MARKET

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

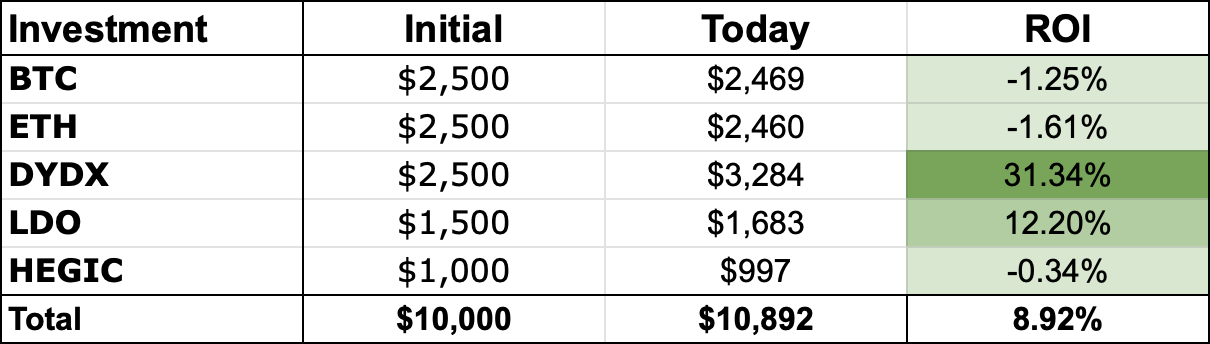

Jan 23 Investments | Update

- Market ROI: +0.49%

- SITG ROI: +8.92%

Overall, all assets remain on track to their short and long-term targets and our plans remain unchanged regarding the investments made in SITG 1. If you haven’t read it yet, click here.

Now let’s dive into where we’re investing this month’s $25,000 👇

Investments #1-5 | Re-Investing ($17,500)

We are very bullish on the investments we made in the previous version of SITG. As a result, we are reinvesting in them. However, if the assets had moved significantly from our initial entry points, we would not have done so.Note: This will also help prevent dilution of the initial positions in the portfolio allocation.

To summarise, we will be investing the $17,500 in the following way:

- BTC: $3,750

- ETH: $3,750

- DYDX: $3,500

- LDO: $5,000

- HEGIC: $1,500

Initially, we planned to allocate $15,000 towards reinvestments. However, we had to add an extra $2,500 for LDO due to two reasons:

- Fundamental Catalyst: Ethereum's Shanghai Upgrade is expected in March, finally enabling unstaking of ETH. Many people view this as bearish for LDO because large stETH withdrawals are expected. However, we see enabling unstaking/withdrawals as a positive development, as it will demonstrate a fully functional product. We actually expect an increase in ETH staked through Lido after the upgrade.

- Technical Catalyst: After 280 days of ranging under $2.68, LDO finally broke out, leading to a price target of $5.85. We will re-evaluate our position once that price is achieved. Chart below 👇

Investment #6 | Pendle ($5,000)

Conviction Level: 20%If you follow us, you know that derivatives are a massive market, and you know that we’re incredibly bullish on both DeFi Perps and Options. There is another one we haven’t really talked about yet, but today we will: Interest Rates.

Pendle offers a new way to trade interest rates within DeFi. It splits a yield-bearing token into two separate tokens:

- Principal

- Yield

Thesis

PENDLE currently has a market value of $14 million. When looking at a new project, it's important to check out the people behind it. Luckily for Pendle, it's easy to see what their team is made of. During the 2022 bear market, their market value and total value locked both fell by 90%, but they kept on building. That's a good sign.On another note, in traditional finance, the interest rate markets are really big, worth over $300 TRILLION BIG. That's why it's important for us to get a head start, especially now that Pendle is starting to become more popular (increased TVL).

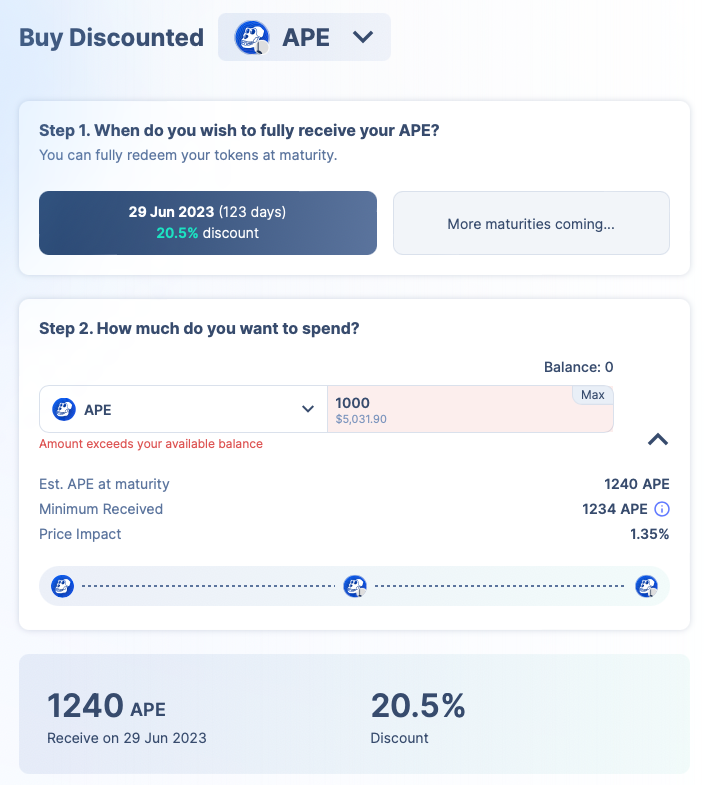

Another way to evaluate investments is to ask yourself if you would use the product, and Pendle has a compelling case. For example, you can buy APE on Pendle at a discount of -20.5% to the market price, who wouldn’t want that? Of course, the catch is that the contract only matures in four months.

Targets

Short-Term ($0.30)

When it comes to lower conviction bets, we like securing our principal by selling half of our position at 2X and letting the rest run to the second target.

Our targets are purely derived from the charts and the first one for PENDLE sits at $0.30.

Medium-Term ($1.07)

The second target for us will be $1.07 where we expect heavy resistance for PENDLE. Note, that given the infancy of the interest rates markets we are simply after the “pump” until we see upcoming signs of adoption. Pendle will need to do a lot of work to turn this into a retail-friendly product (main DeFi participant) or institutions will need to enter DeFi pretty soon (unlikely for a few years) for Pendle to maintain its competitive advantage.

If we are correct, our $5,000 investment will net us $17,100 in profit. Awesome, but what if we’re wrong? Well, let’s dive into what may invalidate our thesis.

Invalidation

Our invalidation for PENDLE is a mixture of technical and fundamental factors:- Weekly Candle Closure Under $0.10

- Pendle Hack causing mistrust in their contracts

Investment #7 | Thales ($2,500)

Conviction Level: 10%You probably have many friends who bet on sports. We bet (no pun intended) that you have more friends who bet on sports than those who trade crypto.

Well, Thales is a platform that lets anyone create a betting market.

Thesis

Truth be told, we’re not betting on Thales just because it’s a gambling platform and there are many gamblers in the world. We’re betting on it because it’s also a bet on: Synthetix, Optimism and Arbitrum. Few assets have the same coverage. Let’s analyse “why” we’re interested in all three ecosystems:- Synthetix: Regardless of the memes about “Synthetix only having 12 users” and the fact that it has been underperforming the market for two years, Synthetix remains a backbone of DeFi. Given the fact that we believe DeFi makes a big come back; especially after FTX/Voyager/BlockFi, we also believe Synthetix makes a big come back. You can read more on our SNX thesis here.

- Optimism: Up until a few days ago, we would have continued to tell you that Optimism isn’t something we want to bet on. However, things can change and they have. Recently, Coinbase announced that they are launching their own L2 powered by Optimism. This is a significant step that pushes Optimism a few inches forward (though not enough to overtake Arbitrum).

- Arbitrum: “The Medium-Term L2 winner” that keeps making us wait on its token. Multiple assets have delivered exceptional returns in the Arbitrum ecosystem (GRAIL is one example) and the number of daily active users is at an ATH. So yes, we do want to bet on Arbitrum and we’ll bet some more once they finally launch their token.

Targets

Short-Term ($1.30)The technicals are the main reason behind our bet on THALES today.

THALES broke out from a resistance ($0.60) that held for 12-months and it did so with a lot of volume. This is a textbook breakout and exactly what you want to see.

We’ve set our short-term target at $1.30 which represents a ~100% increase from current prices. This is where we plan to exit 50% of our position and recover our principal.

Medium/Long-Term (N/A)

We won’t BS you with random numbers. The truth is that the crypto betting space is super young which means there’s very little data to base a mid/long-term target on.

It is so young that the total value locked inside ALL betting protocols is less than $18,000,000. To put things further into perspective, DEXs TVL is over 1,000x larger at $19,000,000,000.

Our plan today is to get a head start by longing THALES and then enjoying a risk-free ride should we decide to hold on. We’ll update you once this space grows further.

Note: we’re buying THALES on Optimism as the liquidity on Ethereum L1 is practically non-existant.

Invalidation

Our invalidation is a mixture of technicals and fundamentals:- Weekly Candle Closure under $0.60

- Active Users on Thales dropping by -90% for an entire month

- Inability to pay out profits to bettors

Investments Summary

- Invested $3,750 into BTC (0.162) and awaiting our 2030+ target of $650,000

- Entry: $23,150

- Invested $3,750 into ETH (2.36) and awaiting our 2030+ target of $115,000

- Entry: $1,590

- Invested $3,500 into DYDX (1,265), exiting half at $12.50 and letting the rest run until $65

- Entry: $2.76

- Invested $5,000 into LDO (1,810) exiting half at $10 and letting the rest run until $275

- Entry: $2.76

- Invested $1,500 into HEGIC (50,600) exiting half at $0.15 and letting the rest run until $27

- Entry: $0.03

- Invested $5,000 into PENDLE (34,000) exiting half at $0.2938 and letting the rest run until $1.07.

- Entry: $0.147

- Invested $2,500 into THALES (3,899) exiting half at $1.19 and letting the rest run until further notice.

- Entry: $0.641

Skin in the Game Addresses

Bitcoin: bc1qzpppmek8wh2vqymq06petmfwmhjj9k8vdxl389Ethereum: 0x8Be9987d18a10F770cADC94635CeDB2eF33B0f17

Thank you for reading 🙏

Looking forward to seeing you again on 25 Mar 23.